XTZUSDT Fibonacci Retest and Rebound Potential: Is Tezos Ready?Detailed Analysis of XTZ/USDT Chart (Daily Timeframe):

The XTZUSDT pair (Tezos vs USDT) has shown strong momentum following a breakout above previous support zones, with a sharp rally toward $1.17 before retracing.

Currently, the price is testing the Fibonacci Retracement levels, specifically the 0.5 ($0.8877) and 0.618 ($0.7998) zones — which also align with a key previous demand zone. This zone is critical for determining the next directional move.

---

🟢 Bullish Scenario:

If the price holds above the $0.80–$0.88 zone (Fibonacci support area), this could confirm a valid breakout retest.

Potential upside targets include:

$1.0379 (minor resistance)

$1.1721 (recent local high)

Further targets: $1.5090 – $1.7942, and potentially the major high at $1.9081.

This structure may form a bullish continuation pattern, especially if supported by volume.

---

🔴 Bearish Scenario:

A breakdown below $0.7998 may trigger further selling pressure toward $0.70 – $0.65.

A deeper retracement could take price back into the previous accumulation zone between $0.55 – $0.50.

Failure to hold the Fibonacci levels may confirm a bull trap, invalidating the recent breakout.

---

📌 Pattern Insights:

The current price action resembles a Bullish Flag / Retest Structure.

The 0.5–0.618 Fibonacci levels serve as a key confluence area for potential trend continuation.

This is a common setup before a major upside move — if the support holds.

---

Conclusion: XTZ is at a decisive moment. As long as the price stays above $0.80, the bullish trend remains intact. However, a drop below could shift momentum back to the bears. Traders should watch this zone closely for confirmation.

#XTZUSDT #Tezos #CryptoAnalysis #AltcoinSeason #FibonacciRetracement #BreakoutRetest #TechnicalAnalysis #CryptoTrading #BullishScenario #BearishScenario

XTZUSD

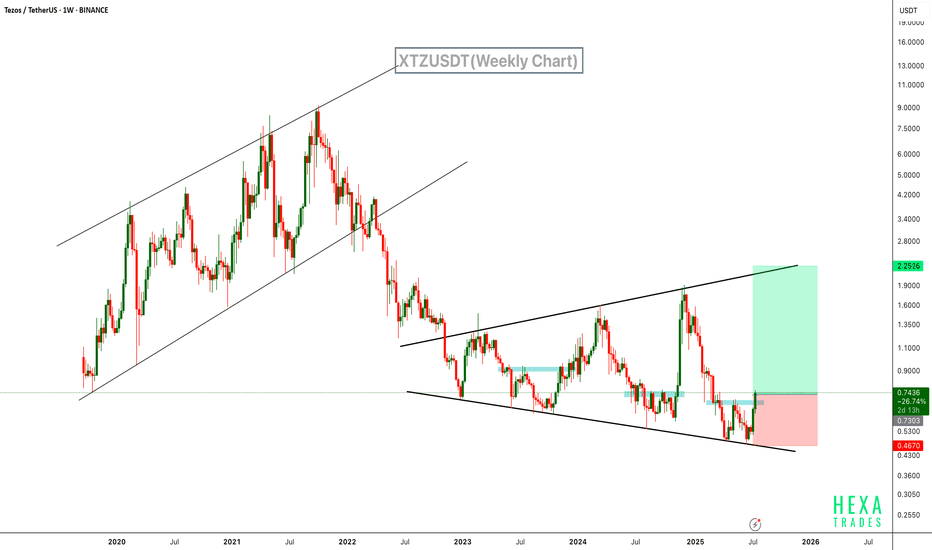

XTZ Is Waking Up – Next Stop $2.25?SEED_DONKEYDAN_MARKET_CAP:XTZ is currently bouncing from the lower boundary of a broadening wedge pattern on the weekly chart, signaling a potential trend reversal. This structure, characterized by widening price swings, has been developing since mid-2022.

The recent bullish move has pushed the price above a key resistance zone, with rising volume supporting the momentum. The upper boundary of the wedge aligns with the next major target zone near $2.25.

Resistance 1: $1.00

Resistance 2: $1.45

Resistance 3: $2.25

Cheers

Hexa

BINANCE:XTZUSDT

XTZ/USDT Ready for a Massive Breakout After Prolonged Downtrend!Technical Analysis (1D Timeframe):

The XTZ/USDT pair is forming a well-defined descending triangle pattern, with sustained selling pressure since late 2024. However, the price action is now signaling a potential breakout as it approaches the apex of the triangle, supported by a strong accumulation zone around $0.4720–$0.5247.

🔍 Analysis Details:

Descending Trendline Resistance: Price has repeatedly failed to break above the descending resistance line since December 2024. It is now testing the edge of the triangle, which typically precedes a significant breakout.

Strong Support Zone: The consolidation zone between $0.4720 and $0.5247 has acted as a key accumulation area, successfully holding off bearish momentum.

Potential Breakout: A breakout above the triangle resistance, especially with confirmation above $0.5797, could trigger a strong bullish rally toward the next resistance levels.

🎯 Target Resistances (Upon Confirmed Breakout):

1. $0.5797 – Initial breakout confirmation

2. $0.6326 – Minor resistance

3. $0.7281 – Significant resistance from previous structure

4. $0.9145 – Medium-term bullish target

5. $1.0445 – Strong resistance zone

6. $1.2022 – Final breakout target

⚠️ Note:

A valid breakout requires a daily candle close above the descending trendline, ideally supported by volume confirmation. A pullback to the breakout zone may occur and could offer a second entry opportunity.

#XTZ #Tezos #XTZUSDT #CryptoBreakout #DescendingTriangle #AltcoinAnalysis #TechnicalAnalysis #CryptoSignals #TrendReversal #BullishSetup

Is #XTZ Ready For a Major Breakout or Another Trap Ahead?Yello Paradisers! Are you prepared for what might be one of the sneakiest reversals brewing quietly on #XTZUSDT? Let's see the current setup of #Tezos:

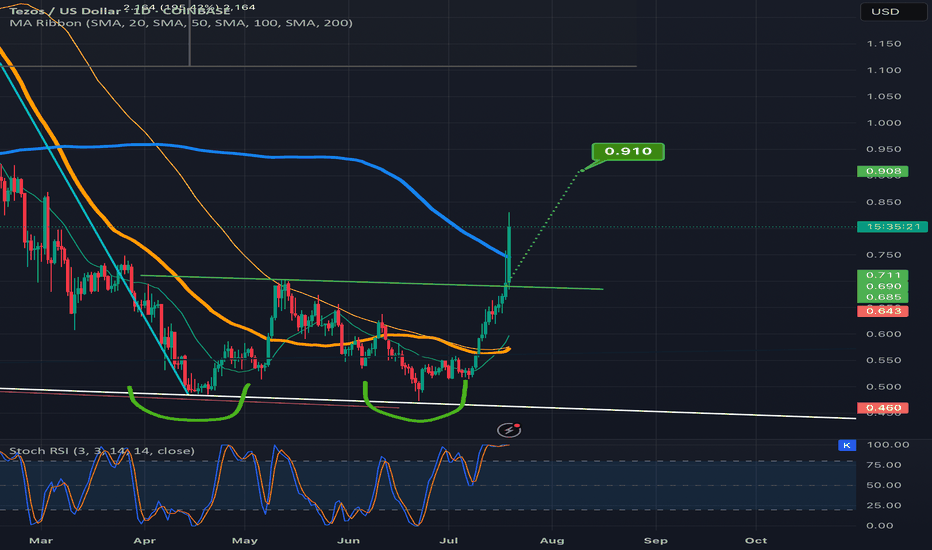

💎#XTZ is trying to break out of a descending broadening wedge formation, a setup that typically signals the end of a corrective structure and the potential beginning of a major impulsive move. We’re likely witnessing the very first wave of this new impulse, and what happens next will depend entirely on how the price reacts to the overhead dynamic resistance.

💎The 1st impulsive wave appears to be nearing completion, and based on structure and current momentum, a minor pullback is both expected and healthy. This retracement will likely serve as a reset before the next leg higher begins, offering a potential entry for those who missed the breakout. However, we do not expect this correction to break below the origin of the first wave — doing so would undermine the integrity of the new trend.

💎Currently, the #XTZUSD is facing strong resistance from the EMA, which it must convincingly break and reclaim. This EMA level has repeatedly acted as a lid on price action, and until it’s cleared, any upside move remains tentative. However, if buyers step in with real volume, we could see a rapid acceleration toward the mid-term resistance at $0.916. That level has historically marked a shift in market control. And beyond it, the next major resistance lies at $1.134, a key supply zone that could trigger heavy distribution.

💎On the downside, the structure remains clean. The $0.491 – $0.516 zone is now our major support, and it must hold. If the price falls below this support and closes with weakness, it will invalidate the current bullish thesis and likely lead to a deeper correction.

Play it safe, respect the structure, and let the market come to you!

MyCryptoParadise

iFeel the success🌴

XTZ/USD Main trend. Downward channelLogarithm. Time frame 1 week. Main trend.

Idea for understanding the local work zone for traders in the main trend. It will also be useful for investors to understand the cheap/expensive zones for investing.

Linear price chart.

Secondary trend. Downward channel. Area to work. Time frame 3 days.

XTZ/USD Secondary trend. Downward channel.

XTZ Secondary Trend. Channel. Wedge. Capitulation Zone. 07 05 20Logarithm. Time frame 1 week (less is not necessary).

The secondary trend has formed a horizontal channel for several years, with repeating wedge-shaped formations, the third time we entered under the support of this channel not by squeezes to collect long stop-loss, but by full candles and the structure of a descending wedge. It looks more vertical. The corrective movement to this semi-vertical wedge, quite possibly, will similarly have an aggressive character. The wedge is almost in the final phase of its formation. I showed percentages for clarity to the key reversal zones, for orientation for your money management and setting the first medium-term, and possibly local targets.

The main trend of this previously hyped cryptocurrency since 2017

XTZ/USD Main Trend. Descending Channel 01 2023

XTZ Tezos 7x? SeekingPips First Look! TIME & PRICE MEET?ℹ️As noted in the title Tezos XTZ is NOT something SeekingPips has had on his RADAR BUT....

You know by now that for 🟢SeekingPips🟢 PRICE is ALWAYS SECOND to TIME.

Our TIME FILTER BELLS are ringing HARD VERY HARD.

✅️Those of you who have been around SeekingPips for sometime KNOW WELL that I care not about any news or fundermental analysis, we are strictly MATH based TIME TRADERS in here so when the stars align and our TIME filters TRIGGER we sit up.

✅️You will know too that when 🟢SeekingPips🟢 decides to use a TRENDLINE that SeekingPips SEES SOMETHING COOKING.

✅️Also I just want to remind you that we only LONG CRYPTO. Any selling we do is strictly to bank something. Therefore the majority of our CRYPTO CHARTS will have a BULLISH BIAS.

⚠️However it DOES NOT MEAN that we necessarily have a valid trigger to enter the market at that moment a chart is shared.

⭐️We have our alerts ready and very clear key levels on the chart NOW WE SIT & WAIT and see how the LOWER TIMEFRAMES STRUCTURE develops around our TRENDLINE TO START.⭐️

No doubt we will have more to talk on this in the NEAR FUTURE.

✅️ SUBSCRIBE TO SeekingPips NOW SO YOU GET OUR ANALYSIS FIRST✅️

XTZUSDT: Buyers Could Step In Here! XTZUSDT: Buyers Could Step In Here! 🔥

This blue box marks a critical level where buyers might become active from multiple perspectives.

Key Confirmation Factors:

CDV spikes, lower timeframe upward structure breaks, buyer dominance on volume profile, and liquidation heatmaps showing fresh liquidity above.

Reactions here could be pivotal. Keep your strategy sharp and always confirm your entries.

Don’t just watch! Act! Boost, comment, and follow for more killer insights! 🚀

Let me tell you, this is something special. These insights, these setups—they’re not just good; they’re game-changers. I've spent years refining my approach, and the results speak for themselves. People are always asking, "How do you spot these opportunities?" It’s simple: experience, clarity, and a focus on high-probability moves.

Want to know how I use heatmaps, cumulative volume delta, and volume footprint techniques to find demand zones with precision? I’m happy to share—just send me a message. No cost, no catch. I believe in helping people make smarter decisions.

Here are some of my recent analyses. Each one highlights key opportunities:

🚀 GMTUSDT: %35 FAST REJECTION FROM THE RED BOX

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

This list? It’s just a small piece of what I’ve been working on. There’s so much more. Go check my profile, see the results for yourself. My goal is simple: provide value and help you win. If you’ve got questions, I’ve got answers. Let’s get to work!

XTZ/USD: Strong Bearish Case Building – Technical AnalysisLooking at the XTZ/USD daily chart, multiple technical indicators and price action are aligning to present a compelling bearish case. Here's why I'm convinced we're heading lower:

Key Bearish Evidence:

MACD Structure

The MACD indicator is showing textbook bearish signals:

Clear bearish crossover on the daily timeframe

Histogram bars turning increasingly negative

Momentum clearly shifting downward

This suggests strong selling pressure and weakening buying interest.

RSI Confirmation

The RSI tells a clear story:

Recently rejected from overbought territory

Making lower highs alongside price

Currently showing downward momentum

No signs of positive divergence to suggest a bottom

Price Action Analysis

The price structure couldn't be more bearish:

Failed to hold above the $1.65 resistance

Series of lower highs and lower lows

Recently broke below key moving averages

Volume increasing on down moves

Market Structure

After the November rally, we're seeing classic distribution patterns:

Sharp rejection from recent highs

Increasing selling volume

Failed attempts to reclaim higher levels

Breakdown of support levels

Risk Levels:

Immediate resistance: $1.65

Critical support: $1.20

Target zone: $0.75 (Previous accumulation area)

What Makes This Setup Particularly Bearish:

The recent rally was sharp but unsustainable

Multiple timeframe confirmation of bearish momentum

Clear volume profile supporting the downside move

Technical indicators all aligning for further downside

The most telling aspect is how quickly the recent gains were given back, suggesting the bulls are exhausted and bears are taking control. Until we see a clear break and hold above $1.65, the path of least resistance remains firmly to the downside.

Traders should watch the $1.20 support level closely - a break below this could accelerate the downward movement toward the previous accumulation zone at $0.75.

Tezos XTZ price “finally” shoot outOldies here?) Do you remember that there was such a coin as #XTZ ?)

Yes - yes - this is the “stick” that shoots once a year and falls 3y)

It's hard to believe that the current growth of the OKX:XTZUSDT price will be above $1.58-1.78

Therefore, this idea will probably be more interesting for #Tezos holders

Although.... maybe we don't know something about the bright future of this project ?)

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

#XTZ/USDT#XTZ

The price is moving in a 4-hour channel and sticking to it well

The price rebounded well from the lower border of its neck at the green support level of 0.910

We have a tendency to stabilize above the Moving Average 100

We have oversold resistance on the RSI indicator to support the rise, with a downtrend about to break higher

Entry price is 0.910

The first goal is 0.980

Second goal 1.053

Third goal 1.12

Fourth goal 1.20

#XTZ (SPOT) entry range( 0.560- 0.682) T.(1.180) SL(0.541)BINANCE:XTZUSDT

entry range( 0.560- 0.682)

Target1 (0.890) - Target2 (1.180)

1 Extra Targets(optional) in chart, if you like to continue in the trade with making stoploss very high.

SL .1D close below (0.541)

It is heavy coin , it may take time to achieve the targets.

*** collect the coin slowly in the entry range ***

*** No FOMO - No Rush , it is a long journey ***

**** #Manta ,#OMNI, #DYM, #AI, #IO, #XAI , #ACE #NFP #RAD #WLD #ORDI #BLUR #SUI #Voxel #AEVO #VITE #APE #RDNT #FLUX #NMR #VANRY #TRB #HBAR #DGB #XEC #ERN #ALT #IO #ACA #HIVE #ASTR #ARDR #PIXEL #LTO #AERGO #SCRT #ATA #HOOK #FLOW #KSM #HFT #MINA #DATA #SC #JOE #RDNT #IQ #CFX #BICO #CTSI #KMD #FXS #DEGO #FORTH # AST #PORTAL #CYBER #RIF #ENJ #ZIL #APT #GALA #STEEM #ONE #LINK #NTRN #COTI #RENDER #ICX #IMX #ALICE #PYR #XTZ ****

Tezos painting a double bottom pattern on the weekly chart?XTZ just hit its previous breakout target and much like hbar proceeded to then fly right past it and keep pumping. We can see price action is now about to reach a potential double bottom neckline on the weekly chart here. Always a good chance after a pump like this price will end to consolidate a bit before getting a second wind needed to confirm the breakout of this pattern and head up to the next target, but being that we are now in the parabolic phase of the bull market and total2 chart is about to confirm a cup and handle breakout, we may see a much shorter period of consolidation before it does try to validate the double bottom patter than we normally would. If we can confirm the breakout around where I have arbitrarily placed the dotted measured move line Tezos could climb back to $2.50 and reclaim some of its previous glory. *not financial advice*