$XTZ Long-Term Accumulation AnalysisSEED_DONKEYDAN_MARKET_CAP:XTZ Long-Term Accumulation Analysis

🔸XTZ has been consolidating in a major accumulation zone between $0.50 – $0.76 for a long period, showing strong demand at lower levels. Current price is above this range, suggesting patience is needed for the bulk of entries — but partial exposure can be taken now to avoid missing upside.

🔸 Smart Entry Zone:

Primary accumulation entries remain between $0.50 – $0.76. Wait for a pullback into this range to add larger positions, but consider adding a small position at the current price to catch any early moves.

🔸 Upside Target: $6.00+

Once accumulation resolves, historical patterns point toward a potential rally to $3.00, $4.20, and eventually $6.00+.

🔸 Risk Level at $0.48:

A sustained break below $0.48 would invalidate the accumulation structure.

🔸 Outlook:

Add a light position now at 0.90 and , then wait for price to revisit the $0.50 – $0.76 zone before building the core position. Hold for long-term upside.

Xtzusdsignals

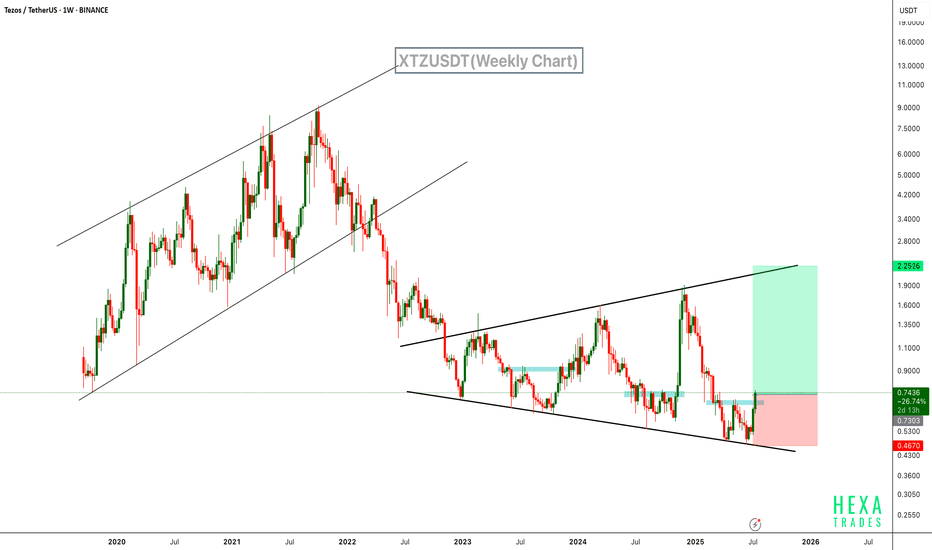

XTZ Is Waking Up – Next Stop $2.25?SEED_DONKEYDAN_MARKET_CAP:XTZ is currently bouncing from the lower boundary of a broadening wedge pattern on the weekly chart, signaling a potential trend reversal. This structure, characterized by widening price swings, has been developing since mid-2022.

The recent bullish move has pushed the price above a key resistance zone, with rising volume supporting the momentum. The upper boundary of the wedge aligns with the next major target zone near $2.25.

Resistance 1: $1.00

Resistance 2: $1.45

Resistance 3: $2.25

Cheers

Hexa

BINANCE:XTZUSDT

XTZUSDT: Buyers Could Step In Here! XTZUSDT: Buyers Could Step In Here! 🔥

This blue box marks a critical level where buyers might become active from multiple perspectives.

Key Confirmation Factors:

CDV spikes, lower timeframe upward structure breaks, buyer dominance on volume profile, and liquidation heatmaps showing fresh liquidity above.

Reactions here could be pivotal. Keep your strategy sharp and always confirm your entries.

Don’t just watch! Act! Boost, comment, and follow for more killer insights! 🚀

Let me tell you, this is something special. These insights, these setups—they’re not just good; they’re game-changers. I've spent years refining my approach, and the results speak for themselves. People are always asking, "How do you spot these opportunities?" It’s simple: experience, clarity, and a focus on high-probability moves.

Want to know how I use heatmaps, cumulative volume delta, and volume footprint techniques to find demand zones with precision? I’m happy to share—just send me a message. No cost, no catch. I believe in helping people make smarter decisions.

Here are some of my recent analyses. Each one highlights key opportunities:

🚀 GMTUSDT: %35 FAST REJECTION FROM THE RED BOX

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

This list? It’s just a small piece of what I’ve been working on. There’s so much more. Go check my profile, see the results for yourself. My goal is simple: provide value and help you win. If you’ve got questions, I’ve got answers. Let’s get to work!

XTZ/USD: Strong Bearish Case Building – Technical AnalysisLooking at the XTZ/USD daily chart, multiple technical indicators and price action are aligning to present a compelling bearish case. Here's why I'm convinced we're heading lower:

Key Bearish Evidence:

MACD Structure

The MACD indicator is showing textbook bearish signals:

Clear bearish crossover on the daily timeframe

Histogram bars turning increasingly negative

Momentum clearly shifting downward

This suggests strong selling pressure and weakening buying interest.

RSI Confirmation

The RSI tells a clear story:

Recently rejected from overbought territory

Making lower highs alongside price

Currently showing downward momentum

No signs of positive divergence to suggest a bottom

Price Action Analysis

The price structure couldn't be more bearish:

Failed to hold above the $1.65 resistance

Series of lower highs and lower lows

Recently broke below key moving averages

Volume increasing on down moves

Market Structure

After the November rally, we're seeing classic distribution patterns:

Sharp rejection from recent highs

Increasing selling volume

Failed attempts to reclaim higher levels

Breakdown of support levels

Risk Levels:

Immediate resistance: $1.65

Critical support: $1.20

Target zone: $0.75 (Previous accumulation area)

What Makes This Setup Particularly Bearish:

The recent rally was sharp but unsustainable

Multiple timeframe confirmation of bearish momentum

Clear volume profile supporting the downside move

Technical indicators all aligning for further downside

The most telling aspect is how quickly the recent gains were given back, suggesting the bulls are exhausted and bears are taking control. Until we see a clear break and hold above $1.65, the path of least resistance remains firmly to the downside.

Traders should watch the $1.20 support level closely - a break below this could accelerate the downward movement toward the previous accumulation zone at $0.75.

XTZUSDT Analysis: Is a Big Move on the Horizon?Yello Paradisers! Ready for another deep dive into the #XTZUSDT action? Let's uncover what's brewing and how you can navigate the market like a pro.

💎Currently, SEED_DONKEYDAN_MARKET_CAP:XTZ is sitting pretty within a crucial support zone at $0.740. This position hints at a potential upward swing, provided it maintains its current momentum. A breakthrough from this level could see it breach a major supply zone.

💎Reflecting on recent performance, SEED_DONKEYDAN_MARKET_CAP:XTZ has shown resilience. After hitting lower lows, it has managed to restore momentum and rebound to previous support levels. Now, it's crucial for SEED_DONKEYDAN_MARKET_CAP:XTZ to surpass the descending resistance and hold a strong position at the support.

💎This scenario significantly increases the probability of an upward move. The recent completion of the retest phase, coupled with a firm hold on multiple EMAs, suggests that SEED_DONKEYDAN_MARKET_CAP:XTZ is gearing up to surpass the descending resistance.

💎So, what's the game plan? Exercise patience and wait for a proper breakout above the resistance level before making any trade moves. As seasoned SEED_DONKEYDAN_MARKET_CAP:XTZ traders know, cryptocurrency markets are like strategic games. While the current bullish momentum is promising, it's wise to have a contingency plan (Plan B).

💎If SEED_DONKEYDAN_MARKET_CAP:XTZ fails to capitalize on this momentum and starts to decline, look for a rally from a lower demand level around $0.669. A breakdown below this point would invalidate the bullish outlook, leading to a significant price drop.

Trade smart, Paradisers! Stay disciplined, patient, and focused. This is the only way you can make it far in your crypto trading journey. Be a PRO

MyCryptoParadise

iFeel the success🌴

XTZUSD Extinct crypto starting to move?Tezos (XTZUSD), a long forgotten market favorite, is posting today the strongest 1D green candle since February 22 2023. This is backed up by a long 1D RSI Bullish Divergence. As long as the 0.6300 Support holds, we expect XTZ to target first the Lower Highs 2 (dashed) trend-line and the 1D MA200 (orange trend-line) and finally the strongest long-term Resistance Cluster, the 1W MA50 (red trend-line) along with the 0.92500 Resistance.

Our target is 0.9000. Notice the similarities between the current mid-2023 Triangle, with that a year ago in 2022. That broke the Support to the downside and extended to the 2.0 Fibonacci level, while the current is breaking above the Triangle. Keep that in mind however, in case the 0.63000 Support breaks.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

XTZUSDT Idea and AnalysisHI dear traders!

The 200-Day SMA has become a support line for the uptrend and the bullish major channel is still valid.

After price crossing the short-term and downward trend line (The minor trend channel), the price moves bullish towards the daily pivot point.

✅ ✅ Risk warning, disclaimer: the above is a personal market judgment and analysis based on published information and historical chart data on The trading view,

And only some of these analyzes are my actual real trades.

I hope Traders consider I am Not responsible for your trades and investment decision.

#Xtz is in the important Price******* First of all I Should Say Trade with your own Risk*******

XTZ is in the Strong Support Line in 4H Time Frame.

If the Line Support the Price it can goes to the S1,S2,S3

But if it breaks the support Line it can goes deep in the ocean :)

if you see the positive sign you can buy at 6.2 for target 6.6 or 7 in first step.

the RSI Stoch is going to cross from the button.

XTZ/USDT - LONG ----- Welcome, dear followers! -----

- Here is my trading methodology. I trade with a normal system and analysis of resistance and support, as well as price reversal patterns.

- For the record, I do not place a stop loss within my trades. So that I only risk 1.5% of my total capital in order to support the loss due to a price reversal against me.

- If a price reversed against my expectation and touched the drawn line r3, then I transferred targets to the entry point and waited for the price to close at it with a loss equal to almost zero.

- Today's deal is shown in the chart, and here are the entry and exit points below.

-- Support me with numbers and follow up on my account for other deals in the future. Thank you for coming to this part. --

-------------------------------------------------------

⚡️⚡️ XTZ/USDT ⚡️⚡️

Exchange: Binance Futures

Trade Type: Breakout (Long)

Leverage: Isolated (1.0X)

Entry Orders:

1) 1.417 - 100.0%

Take-Profit Orders:

1) 1.543 - 70.0%

2) 1.612 - 25.0%

3) 1.72 - 5.0%

Trailing Configuration:

Stop: Breakeven -

Trigger: Target (1)

🟢 XTZUSDT - 4H (19.09.2022)🟢 XTZUSDT

TF: 4H

Side: Long

Pattern: Double Bottom + Bull Flag

Entry: $1.4329

SL: $1.4010

TP 1: $1.4912

TP 2: $1.5420

TP 3: $1.5831

TP 4: $1.6242

This thing will fly as it's at strong support now.

XTZUSDT Long SignalXTZUSDT has made some clear moves in the near-past and it has confirmed the Short term confirmation, which is clearly seen in the chart. It's just a matter of time for it to gain momentum and go sky-rocketing in the upward direction. I am fully bullish on XTZUSDT and currently my setup for $XTZ is as follows:

Entries : 1.21 - 1.40

One time Entry: 1.34

Short Term: 1.42 - 1.52 - 1.60 - 1.72 - 1.85 - 1.94

Mid Term: 2.10 - 2.48 - 2.93 - 3.58 - 4.72 - 6.08

1.08 - 1.02 (Trailing)

Please be aware with your money!