XTZUSDT Fibonacci Retest and Rebound Potential: Is Tezos Ready?Detailed Analysis of XTZ/USDT Chart (Daily Timeframe):

The XTZUSDT pair (Tezos vs USDT) has shown strong momentum following a breakout above previous support zones, with a sharp rally toward $1.17 before retracing.

Currently, the price is testing the Fibonacci Retracement levels, specifically the 0.5 ($0.8877) and 0.618 ($0.7998) zones — which also align with a key previous demand zone. This zone is critical for determining the next directional move.

---

🟢 Bullish Scenario:

If the price holds above the $0.80–$0.88 zone (Fibonacci support area), this could confirm a valid breakout retest.

Potential upside targets include:

$1.0379 (minor resistance)

$1.1721 (recent local high)

Further targets: $1.5090 – $1.7942, and potentially the major high at $1.9081.

This structure may form a bullish continuation pattern, especially if supported by volume.

---

🔴 Bearish Scenario:

A breakdown below $0.7998 may trigger further selling pressure toward $0.70 – $0.65.

A deeper retracement could take price back into the previous accumulation zone between $0.55 – $0.50.

Failure to hold the Fibonacci levels may confirm a bull trap, invalidating the recent breakout.

---

📌 Pattern Insights:

The current price action resembles a Bullish Flag / Retest Structure.

The 0.5–0.618 Fibonacci levels serve as a key confluence area for potential trend continuation.

This is a common setup before a major upside move — if the support holds.

---

Conclusion: XTZ is at a decisive moment. As long as the price stays above $0.80, the bullish trend remains intact. However, a drop below could shift momentum back to the bears. Traders should watch this zone closely for confirmation.

#XTZUSDT #Tezos #CryptoAnalysis #AltcoinSeason #FibonacciRetracement #BreakoutRetest #TechnicalAnalysis #CryptoTrading #BullishScenario #BearishScenario

Xtzusdtperp

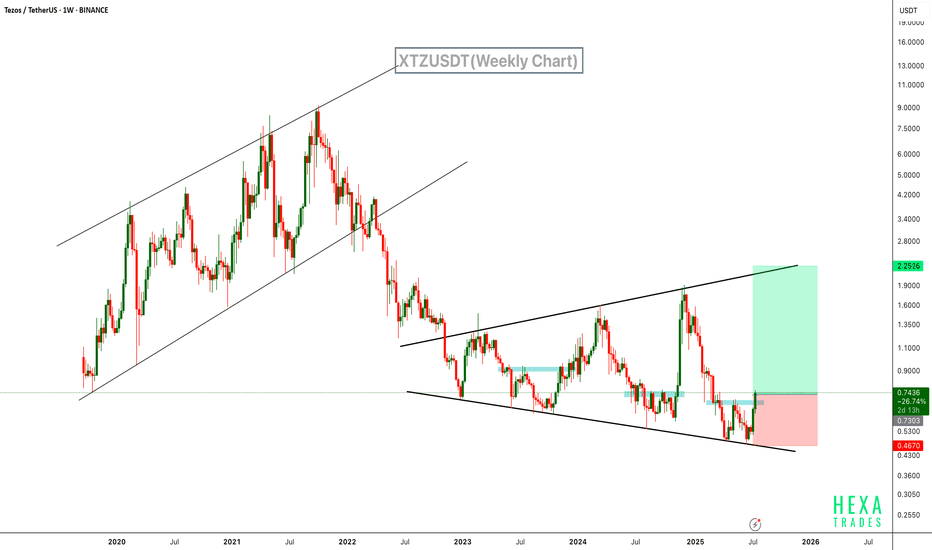

XTZ Is Waking Up – Next Stop $2.25?SEED_DONKEYDAN_MARKET_CAP:XTZ is currently bouncing from the lower boundary of a broadening wedge pattern on the weekly chart, signaling a potential trend reversal. This structure, characterized by widening price swings, has been developing since mid-2022.

The recent bullish move has pushed the price above a key resistance zone, with rising volume supporting the momentum. The upper boundary of the wedge aligns with the next major target zone near $2.25.

Resistance 1: $1.00

Resistance 2: $1.45

Resistance 3: $2.25

Cheers

Hexa

BINANCE:XTZUSDT

XTZ/USDT Ready for a Massive Breakout After Prolonged Downtrend!Technical Analysis (1D Timeframe):

The XTZ/USDT pair is forming a well-defined descending triangle pattern, with sustained selling pressure since late 2024. However, the price action is now signaling a potential breakout as it approaches the apex of the triangle, supported by a strong accumulation zone around $0.4720–$0.5247.

🔍 Analysis Details:

Descending Trendline Resistance: Price has repeatedly failed to break above the descending resistance line since December 2024. It is now testing the edge of the triangle, which typically precedes a significant breakout.

Strong Support Zone: The consolidation zone between $0.4720 and $0.5247 has acted as a key accumulation area, successfully holding off bearish momentum.

Potential Breakout: A breakout above the triangle resistance, especially with confirmation above $0.5797, could trigger a strong bullish rally toward the next resistance levels.

🎯 Target Resistances (Upon Confirmed Breakout):

1. $0.5797 – Initial breakout confirmation

2. $0.6326 – Minor resistance

3. $0.7281 – Significant resistance from previous structure

4. $0.9145 – Medium-term bullish target

5. $1.0445 – Strong resistance zone

6. $1.2022 – Final breakout target

⚠️ Note:

A valid breakout requires a daily candle close above the descending trendline, ideally supported by volume confirmation. A pullback to the breakout zone may occur and could offer a second entry opportunity.

#XTZ #Tezos #XTZUSDT #CryptoBreakout #DescendingTriangle #AltcoinAnalysis #TechnicalAnalysis #CryptoSignals #TrendReversal #BullishSetup

Tezos XTZ price “finally” shoot outOldies here?) Do you remember that there was such a coin as #XTZ ?)

Yes - yes - this is the “stick” that shoots once a year and falls 3y)

It's hard to believe that the current growth of the OKX:XTZUSDT price will be above $1.58-1.78

Therefore, this idea will probably be more interesting for #Tezos holders

Although.... maybe we don't know something about the bright future of this project ?)

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

#XTZ/USDT#XTZ

The price is moving in a 4-hour channel and sticking to it well

The price rebounded well from the lower border of its neck at the green support level of 0.910

We have a tendency to stabilize above the Moving Average 100

We have oversold resistance on the RSI indicator to support the rise, with a downtrend about to break higher

Entry price is 0.910

The first goal is 0.980

Second goal 1.053

Third goal 1.12

Fourth goal 1.20

XTZ/USDT: Preparing for a Strong Bullish MoveXtz/usdt is showing strong bullish potential as it breaks out of its consolidation box on the weekly time frame. This breakout could signal the start of a significant upward trend, especially since these box patterns have been performing well in recent setups.

Key observations:

- The breakout above the box indicates a shift in momentum, with buyers gaining control.

- Momentum indicators such as RSI and MACD are turning positive, adding confidence to the bullish case.

- Increased volume during the breakout is a sign of strong market participation.

Tips for trading xtz/usdt:

1. Wait for confirmation of the breakout with a daily candle close above the consolidation box.

2. A retest of the box's upper boundary as support can provide a safer entry point.

3. Keep an eye on trading volume; a low-volume breakout may indicate a lack of conviction.

4. Set stop-loss levels below the breakout zone to manage risk effectively.

5. Define clear profit-taking levels based on prior resistance zones or Fibonacci extensions.

Potential targets:

- First target: .

- Second target: .

This analysis is for educational purposes only. Always trade with proper risk management and conduct your own research.

Tezos XTZUSDT price is at a critical point, where to go next?Here is the whole trading history of the once quite popular pair XTZUSDT

The XTZ price grew skillfully during 2019-2021 from $0.35 to $9

And then a stable downward trend, which has been going on for more than a year

Now the XTZUSD price is at a critical point.

If buyers can gain a foothold above $0.75 , there will be a good chance of working out the blue scenario. In the medium term, it is the growth to the liquidity zone of $1.20-1.80

If sellers do not meet resistance from Tezos buyers, and the XTZUSDT price is confidently fixed below $0.75, then the next purchase zone is not earlier than $0.46-0.56

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

XTZ/BTC Bottom is in?Hi folks, welcome back to RS_Crypto Analysis. It appears that the XTZ/BTC pair has been forming a falling wedge pattern for 1659 days. Based on this analysis, it is possible that the current price represents a bottom for the pair. It is expected that the XTZ/BTC pair may see an upward movement within the next 1-3 months.

XTZ/USDT - LONG ----- Welcome, dear followers! -----

- Here is my trading methodology. I trade with a normal system and analysis of resistance and support, as well as price reversal patterns.

- For the record, I do not place a stop loss within my trades. So that I only risk 1.5% of my total capital in order to support the loss due to a price reversal against me.

- If a price reversed against my expectation and touched the drawn line r3, then I transferred targets to the entry point and waited for the price to close at it with a loss equal to almost zero.

- Today's deal is shown in the chart, and here are the entry and exit points below.

-- Support me with numbers and follow up on my account for other deals in the future. Thank you for coming to this part. --

-------------------------------------------------------

⚡️⚡️ XTZ/USDT ⚡️⚡️

Exchange: Binance Futures

Trade Type: Breakout (Long)

Leverage: Isolated (1.0X)

Entry Orders:

1) 1.417 - 100.0%

Take-Profit Orders:

1) 1.543 - 70.0%

2) 1.612 - 25.0%

3) 1.72 - 5.0%

Trailing Configuration:

Stop: Breakeven -

Trigger: Target (1)

🟢 XTZUSDT - 4H (19.09.2022)🟢 XTZUSDT

TF: 4H

Side: Long

Pattern: Double Bottom + Bull Flag

Entry: $1.4329

SL: $1.4010

TP 1: $1.4912

TP 2: $1.5420

TP 3: $1.5831

TP 4: $1.6242

This thing will fly as it's at strong support now.

XTZUSDT Long SignalXTZUSDT has made some clear moves in the near-past and it has confirmed the Short term confirmation, which is clearly seen in the chart. It's just a matter of time for it to gain momentum and go sky-rocketing in the upward direction. I am fully bullish on XTZUSDT and currently my setup for $XTZ is as follows:

Entries : 1.21 - 1.40

One time Entry: 1.34

Short Term: 1.42 - 1.52 - 1.60 - 1.72 - 1.85 - 1.94

Mid Term: 2.10 - 2.48 - 2.93 - 3.58 - 4.72 - 6.08

1.08 - 1.02 (Trailing)

Please be aware with your money!

XTZUSDT: Bearish Channeling, Bearish Bias doesn't end yet?Hello Fellow Tezos Coin Investor/Trader, Here's a Technical outlook of XTZUSDT!

Support our content by smashing the like and follow button, you also can share your opinion in the comment section below.

XTZUSDT is creating a bearish channeling. Furthermore, The MACD indicator created a death cross, which confirmed a potential downside momentum to the target area.

All explanations are presented on the chart.

The roadmap will be invalid after reaching the target/resistance area.

"Disclaimer: The outlook is only for educational purposes, not a recommendation to buy or sell the cryptocurrency"

XTZ pattern breakout XTZ / USDT

Price broke-out the bullish pattern on its fifth try

the overall market still in bear/ sideway

However this is bullish momentum for XTZ

if price able to hold above resistance line for next few hours expecting more bullish movements and first resistance is around 2.55$ (first TP )

Best of wishes

XTZ Big pump incomingHello Traders!

XTZ has formed a bullish accumulation pattern at the bottom and now it's broken towards the upside.

I am expecting a 38% rise in this bull run.

XTZ Buy limit@ 1.908

Stoploss 1.84(-3.61%)

Target 1, 2.16(+12.8%)

Target 2, 2.36(+23.8%)

Final T.P 2.64(+38%)

Risk management tip,

Use 10% of account max with 10x leverage.

XTZ Daily Review & 2 Possible StoriesXTZ at Daily chart is at very important place named " Liquidity Base "

thats the last base of compression

if it engulf this base we have sell story :)

our confirmation is william PR indicator and Cp moves up and strong weekly Supply above that works perfectly

but it can provides a good buy even it engulf the LqBase

helped by priceaction and RTM & ICT METHODS & ORDERFLOW & SMARTMONEY CONCEPT

sincerely BEARBOURSE