Gold (XAUUSD) – Waiting for Buy Opportunity Near Range SupportWe're currently inside a range and approaching its lower boundary.

There was a chance to go long a bit lower, but there’s still time — the highlighted zone looks like a solid area to consider longs.

We’re patiently waiting for price to enter the zone and give us a valid buy signal.

No rush. Let the market come to us

Xuausd

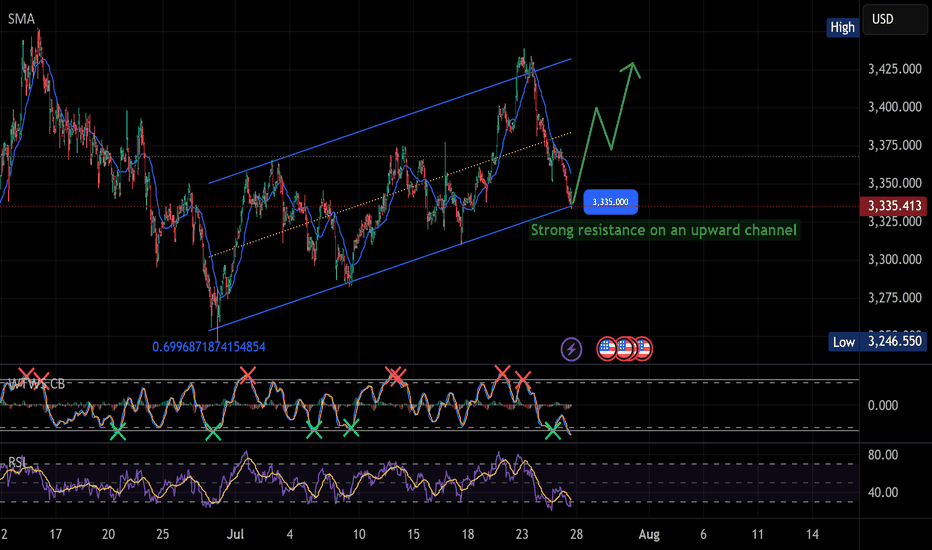

Gold is holding strong at support!GOLD – Bullish Bounce Coming? CAPITALCOM:GOLD

Gold is moving inside an upward channel.

A bounce is likely from $3,335 – eyes on $3,425 📈

Don’t miss the move. Let the market pay you! 💰

📈 If the bounce happens, price may rise toward:

Target 1: $3,375

Target 2: $3,425+

✅ Price just touched the bottom of the channel around $3,335 – a strong support area.

✅ RSI is oversold ➜ This usually means a bounce is coming.

✅ Momentum indicators are showing signs of bullish reversal.

WHAT DO YOU THINK ?Hello dears

Given the regular sinusoidal trend that gold is taking, it was expected to move to the specified numbers, but don't forget that we are at a price ceiling and a sharp upward movement at the end of the upward trend can be a trap...

In case of a drop, the specified ranges are good support.

*Trade safely with us*

Gold - Why a drop to 3250 could be the perfect buy!Gold has been in a strong and sustained uptrend, showing impressive momentum with minimal pullbacks along the way. At the moment, Gold is forming a rising wedge pattern, which could indicate potential short-term downside price action. If we see a retracement from current levels, I’ll be watching closely for a long opportunity.

A break below this rising wedge would suggest possible short-term downside movement. This would actually be healthy for the overall trend, as small pullbacks are a natural and necessary part of a strong uptrend. It helps shake out weak hands, reset indicators, and build stronger support for the next leg higher.

Why a drop to around 3250?

If the wedge breaks, there’s an imbalance zone (4h FVG) sitting just below the current price level that has yet to be filled. These imbalance zones are created when price moves sharply in one direction, leaving gaps in the market structure. These areas often act as magnets, drawing price back to fill them before the trend resumes.

This particular imbalance zone lines up perfectly with the golden pocket Fibonacci retracement, adding further significance to the level as a strong area of support for the bulls. When technical confluences align like this, they tend to become high-probability reaction zones.

It’s also worth noting that this was the last major high that was broken before Gold made its most recent move upward. That makes this level even more likely to be defended by buyers. Bulls who missed the initial breakout will be watching this level closely for entries.

What are we watching for?

If Gold fails to hold the structure of the rising wedge, it opens the door for a sharper pullback towards the 3250 zone. This level aligns with multiple key confluences: the support zone, the 4h FVG, and the golden pocket. All of these factors together make it a prime level to look for bullish setups.

Conclusion

Gold remains in a strong uptrend but is starting to show early signs of a potential short-term pullback if it loses the rising wedge structure. Should that happen, the primary target for downside would be the 3250 level. This is where I’ll be looking for long opportunities, as it aligns with major support, the 4h imbalance zone, and the golden pocket retracement.

While this pullback would be short-term in nature, the broader trend remains bullish. As long as key levels hold and market structure stays intact, the bigger picture favors further upside. A healthy retracement here could set the stage for a more sustainable and explosive next leg up.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

Gold - Price is at resistance with bearish RSI divergencePrice is at resistance with bearish RSI divergence (overbought at 72.39) and a potential double top forming. Volume is declining, indicating weakening momentum.

Stochastic Oscillator (14, 1, 3): The Stochastic is at 90.48, well into the overbought territory (above 80). This indicates that the price may be overextended and due for a pullback.

Relative Strength Index (RSI, 14): The RSI is at 72.39, also in the overbought zone (above 70). Additionally, there’s a bearish divergence—while the price made a higher high near $3,135.060, the RSI made a lower high, signaling weakening momentum.

Simple Moving Average (SMA, 14, 2) on RSI: The RSI’s SMA is at 68.05, showing that the RSI is still elevated but trending downward, supporting the bearish divergence.

Resistance Rejection: The price is failing to break through the $3,132.528–$3,135.060 resistance zone, as evidenced by the red circle showing a sharp rejection.

Bearish Divergence: The RSI (72.39) shows a bearish divergence, indicating that the upward momentum is fading despite the price hitting a higher high.

Overbought Indicators: Both the Stochastic (90.48) and RSI (72.39) are in overbought territory, suggesting the price is overextended and likely to correct.

Volume Decline: Decreasing volume on the recent push to resistance indicates a lack of buying conviction, increasing the likelihood of a reversal.

Double Top Potential: The price action near $3,135.060 resembles a double top pattern, a bearish reversal setup, especially with the rejection at this level.

Monitor for Confirmation: Watch for a bearish candlestick pattern (e.g., a shooting star or bearish engulfing) on the 5-minute chart to confirm the reversal before entering the trade.

Risk Management: Only risk a small percentage of your account (e.g., 1-2%) on this trade. Adjust position size based on the stop loss distance.

GOLD SHORT SETUP: TARGETING $3,100 FROM OVERBOUGHT CONDITIONSGOLD SHORT SETUP: TARGETING $3,100 FROM OVERBOUGHT CONDITIONS

Looking at the current Gold chart, we're seeing potential exhaustion signs near all-time highs. While the trend remains strongly bullish (all moving averages pointing up), several indicators suggest we may be due for a pullback to the $3,100 level.

Key Observations

Overbought RSI (77.09): The RSI is showing overbought conditions without divergence yet, but at levels where previous corrections have occurred.

Extreme Stochastic (97.99): Nearly maxed out at 98, suggesting limited upside momentum remains.

Williams %R near zero (-2.44): Showing extreme buying pressure that historically doesn't sustain.

CCI above 140: At 146.61, well into overbought territory.

Moving Average Spacing: While all MAs signal "Buy," the distance between recent EMAs (10, 20) and price indicates stretched conditions.

Risk Management

This is a counter-trend trade against strong bullish momentum, so position sizing should be conservative. The R2 pivot at $3,045 and the 10-day SMA at $3,046 should act as initial support levels and could provide clues about whether the pullback thesis is playing out.

Gold - Great long opportunities in this uptrend!4-hour timeframe

Gold is currently in a strong uptrend, consistently reaching new all-time highs.

There are potential opportunities to enter long positions on Gold during this 4-hour pullback, with the $2950 level being a key area to watch for potential longs.

This level has several confluences supporting it:

1. Support zone

2. Trendline

3. Fibonacci Golden Pocket (0.618 - 0.65)

Daily timeframe

The $2950 level on Gold appears to be an ideal point to manage long positions and ride the uptrend. If Gold breaks below this level, we could see a decline to around $2800. Therefore, it's important to monitor the $2950 level closely.

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

Lets chat in the comment section. See you there :)

Gold Near Peak Level Despite Fed HawkishnessGold prices remained near a record high above $2,900 per ounce, as investors turned to trusted assets with rising trade tensions and economic uncertainty. The White House announced that Trump’s reciprocal tariffs could be introduced as early as Thursday, following his 25% tariff on steel and aluminum imports. These add to existing tariffs, including 10% on Chinese goods and 25% on Canadian and Mexican imports, though the latter are paused. Meanwhile, U.S. inflation data exceeded expectations, reinforcing the Fed’s cautious stance on rate cuts and weighing on gold’s appeal.

Technically, resistance stands at 2,949, with further levels at 2,975 and 3,000. Support is at 2,885, followed by 2,830 and 2,760 if declines continue.

Gold Breaks Records Above $2,850Gold surged past $2,850 per ounce, hitting a record high as investors turned to reliable long-term assets with fears that the US-China trade war could slow global growth. While President Trump delayed tariffs on Mexico and Canada, he imposed a 10% duty on Chinese imports, prompting Beijing to announce retaliatory tariffs on US energy products effective next week.

Adding to the uncertainty, Trump suggested US control over the Gaza Strip for reconstruction. Meanwhile, interest rate futures signaled rising expectations for two Fed rate cuts this year, a sharp shift from last month’s outlook. Weaker-than-expected job openings in the JOLTS report and a six-month low in factory orders reinforced this sentiment.

Technically, resistance levels stand at 2879, 2917, and 2950. Support is at 2830, followed by 2790 and 2760.

XAU Gold 30MinIchimoku Cloud

The red cloud indicates a prevailing bearish trend in the past.

Flat areas of the cloud highlight potential future resistance zones.

Key Support and Resistance Levels

Key Support (Orange Line): Around 2,649.77

Important Resistances (Yellow and Green Lines):

First Resistance: 2,655.39

Second Resistance: 2,667.41

Risk and Reward Area

The red area below the chart represents the Stop Loss zone (loss area).

The green area above indicates the Take Profit zone (profit area).

A trade has been executed with a balanced risk-to-reward ratio.

Relative Strength Index (RSI)

Current RSI value: 47.58

RSI below 50 indicates relative market weakness in the current state.

Green Arrows

The green arrow at the bottom of the chart suggests a potential bullish reversal from the key support level.

Analysis Conclusion:

The recent downtrend has tested the support level at 2,649.77.

If the price stabilizes at this level and breaks through the first resistance at 2,655.39, there is a possibility of growth towards the next resistance at 2,667.41.

The RSI needs to cross above 50 to confirm buyer strength.

Otherwise, breaking the support level may lead to further decline.

XAU Gold 4H TradeFriends, the first trade on gold begins. I’m taking a long position on gold with a 4-hour timeframe, which I believe will show results in the next three to four days. There will be daily updates added to the analysis based on 30-minute intervals, so it’s a good idea to follow me to also see trades on lower timeframes.

For this trade, I’ve hypothetically invested $500 with 20x leverage. You can adjust these amounts based on your own strategies and techniques. The main goal is to identify trends in gold across various timeframes and share insights.

If you have any thoughts or suggestions, I’d be happy to hear them in the comments.

Thank you!

XAUUSD - Gold Monthly TargetOverview:

Gold and silver have outperformed most other "safe haven" assets. These precious metals are ending the year with remarkable gains. Investors have flocked to them as hedges against inflation and market volatility, helping to drive their values upward.

Price:

The Bull trend started back in March! (2040). Nine months of continued bullish price actions and blue candles and the price has topped all the way to 2800. Last month (November) we saw gold drop to 2500 finding support.

Today gold is back on track creating higher highs in the intraday timeframes.

Monthly:

The Cup and handle pattern. On the monthly gold is currently in the cup and handle bull run. Pay attention to the Fibb retracement levels. Gold has already touched the 50% and found support at the .618. With the current volume and bullish momentum, gold could easily find the strength to break higher and reach the target (3500) in the next 3-4 months

Monthly Pattern Target:

3560

Key Levels:

Resistance:

2750

3150

Support:

2500

2600

XAUUSD, 15-MINUTES TIMEFRAME CHARTXAUUSD, 15-minute timeframe chart

General outlook

XAUUSD has been under selling pressure within the last couple of hours . The pair moved up to the support level of 2,599.00.

Possible scenario

The best way to use this opportunity is to place a buy order at 2,600.

Set your stop loss at 2,590. below the previous low ($10.00 loss for 0.01 lot) and take profit at 2,625. ($25.00 profit for 0.01 lot).

The risk-reward ratio for this order is 1:1.

update on goldmy last take on gold if we get the dollar to buy we can see a drop on gold break of the four hour trend to possibly the 4hr fvg below. now golds been on a uptrend so a break of 2500 and close will be a starting confirmation. we need then to see a retest on the lower time frames of the break of structure to see confirmation on the sale.

this is an updated chart and showit did in fact broken and closed on the four hour trend. an order block was formed and gained at 2500 to see a retractable level to see if it will respect and continue to drop lower. targets to be 2560 and 2448 and finial target of 2441 thats a weekly low.

hopefully i was able to give you guys a more detailed explanation on what I see on gold.

please let me know what you think of my analysis 🙏

Premium Gold idea for this upcoming week $$$Based on historical trends and current market conditions, XAU/USD is likely to be bearish for day trading with a starting price of 2414.44. Traders should monitor real-time market dynamics and economic data releases for potential price movements throughout the upcoming week.

Entry: 2414.44

SL: 2422.72

Target 1: 2370.95

target 2: 2332.10

#Xauusd #bearishtrend #daytrading #marketanalysis #financialmarkets #priceprediction #economicdata #realtimemarketdynamics

Like share comment and click the follow button for more