Yaroslav

European markets keen to adaptEuropean Union leaders are open to new deals with China. In order to hedge the current risk of US trade tariffs China has spread its trade network far and wide. All over Africa, Chinese companies have invested and gained majority shares in mining companies, utilities and agriculture. Next week we will see during the EU-China summit what investments China will make in the EU. There is a large network of political advocates for China across Europe. This is more under the radar influence balance that is being stepped up by EU leaders as we head towards Parliament elections in May.

In addition to trade talks with China, EU ambassadors are preparing to go ahead with trade talks with the US. France is the only nation to hold off on their consent. The trading bloc is eager to begin cutting industrial tariffs. Any additional tariffs or disputes with the US would come at a very bad time for the EU.

The economic struggle in the EU is apparent and data sets have dragged the Euro down. The European Central Bank will publish their monetary policy meeting minutes on Wednesday, shedding a light on a discussion that motivated ECB President Mario Draghi’s announcement that officials should reflect on ways to offset negative interest rates currently in the European Union. There could a plan in the works at providing a bailout for European banks that are suffering loses to their profit margins.

The Euro is bouncing off of a key support level of 1.1200. Technical analysis shows us that we are still in a bearish consolidation and we need to break the trendline to the top and solidify there. Once price breaks above 1.1300 we can start to look for long positions after we get confirmation of commitment from bullish traders.

OPEC doing more than we thought possibleSince the start of the year, oil has been slowly and steadily heading higher. OPEC+ has been doing a large amount of production cuts and a subsequent rally has persisted in the market. Even when Crude Oil inventories rise in the US, this has little effect on the price of oil. But more often we see a fall inventories and price rises in reaction to this.

Our view of the current oil market is balanced. Price is currently overheated, but this has never stopped commodity prices from rising further. In fact, the more short traders get trapped, the higher price goes as they stop out of their positions. Data is mixed, but technicals are positively bullish. The surprise buildup of inventories barely affected the price.

If market sentiment is to turn south, due to negative news from trade negotiations, oil prices could decline along with equity markets. Oil is sensitive to sentiment and seems to be ready for a correction.

If you are bullish oil, the target would be the strong fibo level of 61.8% located at $64.00. More likely we will witness a correction which will take oil prices down to $60 before the rally continues.

Brexit no-deal off the tableGBPUSD

We finally have some clarification for one of the biggest market risks – Brexit. The no-deal Brexit has been blocked in the British Parliament. This sent the pound higher and provided stable footing for traders to speculate from. Additionally, Prime Minister Theresa May has reached out to the Labour party’s Jeremy Corbyn for support. They used to be enemies on the way the saw Brexit, but as they say, the strongest allies are past enemies. All alliances that lead the economy towards a stable future is welcome. Ministers within the government that have been predominantly voting against everything May has pushed forward are resigning at an increasing rate. The public will not miss them.

Fundamentally, the UK’s biggest export is their services sector, particularly financial services. Services sector data sets have shown a contraction that was not priced into the forecast. This is due to the Brexit uncertainty and companies moving head offices out of London and into the Eurozone.

Pound Sterling received the lift it was looking for. Price is currently above the channel line, above the 200EMA and above the psychological level of 1.3000. A long trade could be opened if a retest of the 200EMA was to appear. Also, a breakthrough of 1.3200 could be an entry point with a take profit below 1.3400.

Crypto back on the radarBitcoin

Cryptocurrency is back on our radar. There was a sharp increase across the board for major cryptocurrencies especially the heavyweight Bitcoin. On the Chicago Mercantile Exchange Bitcoin traded more than 10k contracts in one day. The volume is about 20 times the average for 2019. There is definitely a big fish in this market and he is set on buying. This rally led bitcoin to breakout of the slump it has been in since December 2018. Price jumped clear out and broke through the resistance level of $4400.

The price action seems to continue higher with no indication of a correction just yet. The chart below shows Bitcoin to stay above the 200EMA which is a bullish signal. Keep in mind that we are also in overbought territory, but even after the indicator dipped down below the overbought line, price continued to rise. Yet another buy signal.

Horizontal resistance levels are located at $5056 and $5441 the first of which has already been tested more than once. We will likely trade around $6000 in the very near future.

Next leg down for the US dollar, dollar weaknessUS Dollar

We are entering a period of time in the financial markets where it is difficult to sustain trends. All over the world, monetary policy from the central banks has been mostly negative. Guidance from the Swiss National Bank, the Federal Reserve and from the European Central Bank has been that the economic slowdown in their respective countries and all over the world could move their hand to a form of action that would stimulate the economy. From lowering interest rates, lowering quantitive tightening measures to increasing quantitive easing. But what do the countries who have no more room to lower interest rates do? How much more of quantitive easing do you increase if you have already been increasing it for the last 7 years? Economies such as Switzerland and Japan could be in real trouble with the European Union not far behind. They have interest rates at or below 0%.

The United States policy makers where just barely ahead of the curve. They have raised interest rates while there was Trump mania and the tax cuts enacted by him. During the last two years of stock market stagnation they leveraged the tools at their disposal and now have wiggle room. They can lower interest rates from 2.50%, they can lower the portfolio tightening program to synthetically stimulate their economy. Also, they allow stock buybacks from corporate America which also acts as a way to float the market and increase stock prices while there is no real growth, creating a bubble in the process.

Looking towards interest rate decisions, investors are pricing in that the Fed will lower interest rates by the end of the year, with a combined probability of 73%. Considering economic data, trade balance is the most prominent indicator of domestic health. There was a sharp drop in imports of -$6.8 billion, indicating that there is a shortage of purchasing power and demand within the country.

Beyond the DXY

The equally weighted dollar average has the dollar pinned in the middle of a price channel it has been oscillating in for over 3 quarters. This is a result of the Euro and Pound giving up positions. If the next leg of instability for the world economy is to show itself in the near future, safe haven assets like the Swiss Franc, Gold, and the Japanese Yen will take the lead as a risk-off trades ensue.

Theresa May promises to step down like David CameronPound Sterling

The British government and the Pound along with them seem to be totally confused on what action to take. The Pound has been in a flat and the British parliament has also been undecided on what direction they plan to take things. It has been a long and unproductive 2.5-year ordeal after the initial Brexit vote. The outcome is worrisome, Prime Minister Theresa May announced her intention to step down from the role of PM if she could get support for her Brexit proposal. It’s strange it had to come to this, the previous Prime Minister David Cameron also stepped down because of Brexit. There are many distractions to keep traders busy and no one knows what to make of the possibility of a new Prime minister. Could this solve the issue of Great Britain leaving the EU? Probably not. Will this help GB make new trade agreements with the surrounding countries, not to mention the rest of the world? Probably not.

Parliament voted on the possibility of majority support for any available solution. The outcome was no majority support for anything: no deal, no second referendum, no new common market, no UK customs union or anything else. This seriously undermines stability for Sterling and the UK markets for the foreseeable future. Both the EU and GB are equally interested in a positive outcome. As long as we avoid the destructive no-deal Brexit, the Sterling will find footing for a recovery.

But, if a proper trade agreement with the EU is not outlined there will be serious issues of economic stability. If British companies do not have access to trade partners as their EU counterparts have, Great Britain will be a begging nation open to anyone with half a desire to make trade agreements. Their neighbor Norway, part of the European Free Trade Association, has publicly stated that they do not want Great Britain a part of EFTA; “They are a bully” and “the benefit is just not there”.

The Sterling broke through the uptrend trendline and seems to be consolidating in a triangle pattern. If price stays below 1.31114, we could have a continuation to the downside and test 1.30000.

Time to price in market events, NZD weaknessNew Zealand Dollar

The New Zealand Dollar fell sharply after the rate decision from the Reserve Bank of New Zealand. There were no changes to monetary policy but they did make clear that the next move would be a rate cut. Market participants jumped on this open and clear language to capitalize and price in what would most likely happen in the near future. Trading the NZD could be done through a number of vehicles including the Japanese Yen, Swiss Franc and Pound Sterling where the volatility is present and the sentiment is neutral.

Currently NZDJPY has broken below the 200EMA and solidified there. The Yen will soak up any weakness the Kiwi may show in the time to come before the next interest rate decision from the RBNZ. A short trade could be enacted from the current price with a stop loss at the level of 75.58 and a take profit at 74.00

Counter trend break and retestPound weakness needs to be capitalized on. The political uncertainty around Brexit is at an all time high and the pound is showing weakness despite strong employment and CPI data sets.

Technically the currency pair is exhibiting strong bearish signals. On the daily timeframe price has dropped below the 50EMA and 200EMA signaling a high probability of a continuation after the retest of the broken trendline. For more information please visit my youtube video.

WTI Crude oilCrude oil inventories have the sharpest decline in 8 months. With a forecast of 0.309M barrels of Crude Oil Inventories the actual figure was -9.589. On top of the dollar weakness this has caused WTI oil futures to jump above 60$.

Oil is trading above the 200EMA which will act as a strong level of support. Fundamental news that are affecting the price of oil is the fact that Russia and OPEC are doing so much to decrease output throughout the world. According to OPEC+ member countries are going to reduce the output of oil by 1.2 million barrels in 2019. Also, the cartel cancelled its meeting in April, meaning that they will keep these production cuts all through the slow season of summer up until June, when they will decide future action. We believe that OPEC and its allies will keep this policy all the way through the year.

A possible entry point for long position presents itself if price will dip down to the level of the 200EMA at 58.73. Entries can be made as low as 58.00 with stop losses located below 57.25.

USDJPY and safe haven assetsSafe haven assets are on the rise. In the time to come we believe that safe have assets will continue their climb. US president Donald Trump recently stated that tariffs on China will stay until they comply with the “deal”. The “deal” is very difficult to comply with as it includes buying additional US goods and enforcing international copyright laws. This whole situation adds to the risk-off scenario and instability of world economic growth.

Dovish guidance from the world central banks add to this category of investment opportunities. The Swiss National Bank, Bank of England, and Federal Reserve all recently made comments that they will take a dovish approach to monetary policy and not raise interest rates in the near future. The SNB already is keeping interest rates at -0.25%. The lowest current interest rate in the world. Collectively the monetary authorities are indicating to us that we are in the late end of the business cycle.

The Australian and New Zealand Dollars have managed to standout in the currency markets. This is due to supportive economic data from their countries. Australia is enjoying an 8 year low in their jobless rate. The NZD actually picked up due to growth in their GDP. We would like to point out that the risk aversion currently present in the market could cause the Japanese Yen to grow while other currencies sink.

US stock marketThe Federal Reserve has announced that they will not be raising interest rates and that they do not plan to in the foreseeable future. Chair Powell kept repeating that the economy is in good shape. The dovish surprise was great; besides the downgrade of growth, inflation, and interest rates we now know that the quantitative tightening (QT) program will be decreased to $35 billion per month from previous $50 billion. QT is when the Federal Reserve sells assets it has on its balance sheets. All the stocks and bonds it bought over the quantitative easing program (QE) it has been selling since 2018. Which could have caused the fall in the stock market. Besides all this, the next move from the Fed may be a rate cut!

The equity market has also taken to correcting its pricing. Stocks grew on the news of rates not rising in the near future them quickly fell at the end of the day. This is the same move we saw after the first time the Fed led on that they will not be raising rates like the said they would. Now stocks are poised to retake September highs with the help of the Fed.

The opposite scenario is also probable. The SPY showed us signs of topping out last week. Now we see more evidence in a bearish shooting star formation and a negative RSI divergence. If we close below 281, we could potentially see another slide to the downside.

USDUSD

At the start of the year, markets priced in two interest rate hikes from the Federal Reserve. Then that number dropped down to one after dovish remarks from Fed Chair Jerome Powell which led investors to lower their expectations. Now with another surprise we have an even more dovish stance that was not necessarily priced in by investors. The dollar drops like a rock.

The Federal Reserve has announced that they will not be raising interest rates and that they do not plan to in the foreseeable future. Chair Powell kept repeating that the economy is in good shape. The dovish surprise was great; besides the downgrade of growth, inflation, and interest rates we now know that the quantitative tightening (QT) program will be decreased to $35 billion per month from previous $50 billion. QT is when the Federal Reserve sells assets it has on its balance sheets. All the stocks and bonds it bought over the quantitative easing program (QE) it has been selling since 2018. Which could have caused the fall in the stock market. Besides all this, the next move from the Fed may be a rate cut!

The graph below shows us the equally weighted dollar average of the G7 currencies. It’s the price of the dollar in relation to all the other main currencies. We have broken through the trendline going up and retested it. In classical technical analysis the next move is a strong impulse down. Fundamental factors confirm this move. What do the other currencies tell us?

The time for dollar weakness has comeHello Traders!

Technical Analysis

The USDJPY has been enjoying a smooth upward growth for the dollar. Recently the rhetoric from the Federal Reserve has been very dovish. Combined with the economic slowdown and falling wage growth in the US the pressure is building on the US dollar. Technically the rate of growth of the currency pair has increased before breaking this trendline and retesting it after a bounce off the 200 EMA. This is a classic break and retest pattern of a trend, and with the coming dollar weakness this pair looks to be promising along with the USDCAD.

Fundamental Analysis

Jerome Powell will be giving speaches on Monday and Tuesday confirming his dovish stance on the Dollar. US core CPI dataset will be published on Tuesday and PPI will come out on Wednesday. The most important information for this pair will come out on Friday in the form of BoJ interest rate decision and press conference.

Please have a look at my Youtube video regarding this pair. Simple yet effective explanation.

Gold is looking boldGold is taking off. Working to new highs towards 1350-1360. There is a strong point of resistance, the 2013 trend line, but once we pass that there is a lot of room to work with. 1376 is the next strong point of resistance. Until then there is a lot of room to scalp.

A good place to put stop losses for longer-term trades would be 1308 because if price reaches that and goes lower, the tide has changed. Until then, trend is your friend and along with oil, gold is looking bullish. For a perfect entry, one could wait until price has reached the light blue trend line that started from November 12th.

Shorting a German Stock, Autos under preassureAutomakers are under pressure. Trump has been alerted by the US Commerce Department that imported cars pose a security threat to the US economy. We wonder what he will do about it. This will inevitably have a negative effect on Japanese and European automakers as vehicle exports play a large role in their respective economies.

Volkswagen AG (VOW)

This stock has been in a sideways consolidation for more than 3 quarters now. It is trading below the 200day EMA and is a stock in play due to its fundamentals. In September 2015 during the emissions scandal in the US the stock fell more than 63%. If the US will raise tariffs the fall will be enough to drop the price to the light blue trend line and beyond. Also the fact that the German economy is slowing, will add additional pressure to the stock. All signs point to a short entry.

Target 1: 140 Target 2: 135 Target 3: Hold sell position until reason to liquidate

The Pound set to continue its declineThe dollar continues its advance. Investors see a global slowdown but figure the US economy to be the biggest and strongest so they put their bets on it coming out ahead. Trump has signed a shutdown avoidance agreement but is now pushing for a national emergency in order to siphon funds from the budget agreed on by congress. Very sticky situation that could lead to a fall in the dollar if the funds are misappropriated.

The pound is continuing its decline. We see more turmoil than solutions being propagated in the UK. Prime Minister Theresa May faced hardships yet again from her Parliament when they refused to endorse her return to the EU negotiating table. Who will be in charge of the negotiations remains to be seen but we remain bearish on the whole situation because the deadline is quickly approaching.

We look towards the employment data set for the UK on Tuesday to figure out if inflation will stay within the bounds of the mandate the Bank of England. This data is important, it shows us if the BoE might change its monetary policy because of sharp declines in employment or earnings. After all this data is compiled, we will see an inflation report on Thursday.

Technical analysis shows us that the pound will likely continue its descent. Two doji candles indicate that despite a good data set from the UK the pound is not ready to climb back to previous highs. The price crossed over the 21 EMA and remains under the 200 EMA. A support level at 1.26734 is a good level to put target take-profits.

Oil is gonna make a run for itOil climbed, and broke through the neckline of the reverse head and shoulders pattern that has been in play for the past few months. The growth was due to supply cuts and reduced output from OPEC countries. Russia has also agreed to participate in the cutbacks. Saudia Arabia will be repairing a damaged offshore field, and this will decrease supply and increase the price of oil in the week to come. In total oil rose 4.2% the past week. Gains are being stifled by a few factors as well. US inventories are rising, the global slowdown is decreasing demand, and US output is at a record high. To counterbalance this Chinese imports of oil are rising by about 4.8% each quarter for the past three quarters.

Starting on the week of February 18th China-US trade talks will continue in Washington as the leaders of both nations will sit down to reach an agreement before March 1st. Also the US may put sanctions on Venezuelan exports and further decrease world supply.

So long as WTI stays above 54.00 we see a bullish play in motion. If and when oil breaks through the Fibonacci resistance level of 38.2% at the price of 55.63 we will see the biggest spike up. The next level of resistance is the 200-EMA. The first strong target of the bullish movement is 57.34 and the next target is 59.00.

Russia US relationsRussia and the US are butting heads again. Senate Foreign Relations Committee and both Republicans and Democrats are pushing for much stricter sanctions. A new bill called the “Defending American security from Kremlin Aggression Act (DASKA)” of 2019 will impose new sanctions on Russia. The new legislation will target Russian banks and individuals as well as Russia’s oil and gas sector. This includes anyone who is providing services, financing, goods or any support to the development of oil in Russia. This is bone chilling for Russia.

USDRUB

The currency pair USDRUB is in a perfect channel. Between 64.75(65.00) and 70.00. Price did not drop below the 38.2% Fibonacci level and has stayed above the 200-EMA. Price has crossed over the 21-EMA and with this we received all the signals that we need to enter a long. If price continues to stay above the 67.00 mark, we recommend opening long positions with a target at the resistance line seen in bright pink on the graph, around 69.25.

EURNZD-what is strong and what is weak?In the forex market, everything is determined on a relative basis. The best outcomes for trades come when we find currency pairs that are polar opposites in strength and fundamental stability. It is always wise to value both currencies instead of just one. How do we determine what is weak and what is strong? The normal process of qualitative valuation, like is performed on the stock market, does not fully apply. People who do not trade the financial markets often assume a currency is stable and fixed. That is just not true. In the forex market, the change in price of the instrument is twofold and if you forget to value, the other side of the pair you are operating based on luck.

EURNZD

This currency pair has gone through some wild gyrations in the past session. This was due to the Reserve Bank of New Zealand announcing that it will keep interest rates where they are but giving direct guidance of a future rate cut. We know that the current state of markets produces extreme volatility not only when fundamentals change, but also when the promise of a change is encountered. The Euro is plagued with many risks, including political, economic and ECB fiscal policy changes. The New Zealand dollar on the other hand looks surprisingly strong.

The pair has broken through local support at 1.6535 and retraced back today. If tomorrow is a bearish day, we recommend opening a short position with a target of 1.6400.

Crude oil set to break from its rangeThere are a few conditions developing for oil to break out of its range. After the three month tumble oil has reversed and is cued for a break of the reverse head and shoulders neckline. The slowdown of growth and risk-on speculative hunger is a factor of oil not taking off already. We expect an eventual breakout from the range crude has made for itself these past few months, but during this trade we recommend reasonable targets and short stop losses.

Yesterday OPEC talks had our attention, but very little news came from the meeting. Saudia Arabia has promised to deepen output cuts. While in the US, Congress is working on a NOPEC bill.

The impact of oil on currencies:

Importers of oil – these countries are worse off when the price of oil rises. JPY, CNY, EUR, ZAR, TRY.

Exporters of oil – these countries benefit when the price of oil rises. CAD, MXN, RUB, NOK.

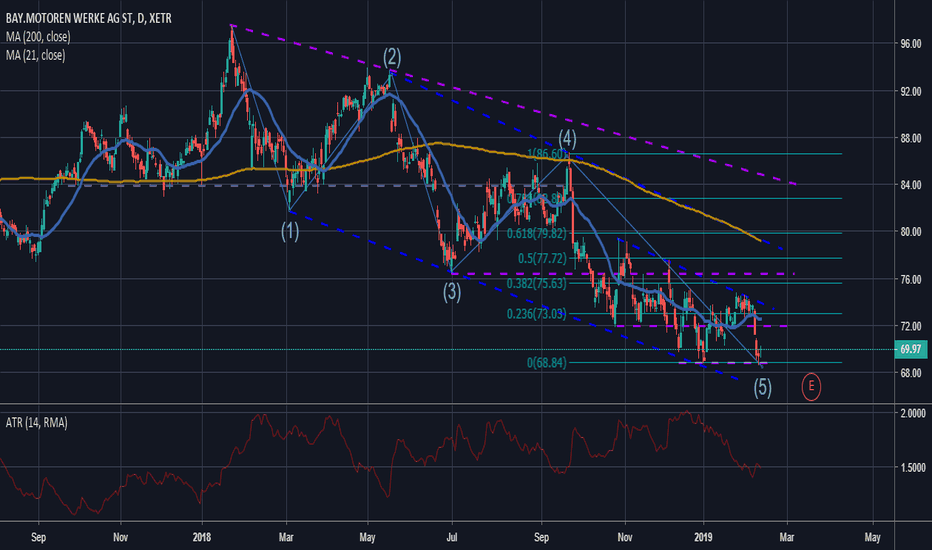

BMW, end of cycle fadeIn Europe and Japan car makers are leading the advance on the stock market today. A new concern for automakers is Car Sharing which has taken off in cities like Moscow. BMW and Daimler are joining forces to combat ride hailing software and car sharing. DMW’s DriveNow unit which is their version of Car Sharing together with Daimler operate a total of 20,000 vehicles in 20 large international cities. Each company owns 50% in the new venture, but they remain rivals in their core business.

The reason we are presenting this trade is that global macro indicators are on the rise. A change in sentiment is approaching and BMW is a cyclical stock. Meaning it fluctuates in very wide price moves and we have currently come up against a very strong level of support. Last time these levels were in play was 2016, and the reversal from these levels was quick and strong.

BMW is at the bottom of a weeklong descent due to difficulties around Brexit and the slowing economy in Germany. We are looking for something called the “fade”. Markets move in wave formations and we expect a correction up to 72.00. For this quick long trade we put a stop loss order around 68.50 and enter the market at 69.80-70.00. The average true range of the stock is currently around 1.5€. The Fibonacci level of 38.2% is too far away, currently if we reach 72.00 this week, we can expect a retest of the 23.6% Fibonacci level at 73.00. This is not a buy and hold strategy, move your stop loss up after price breaks 71.00.