Why Tariffs & Why Now?Trump's tariffs aim to reshape international trade. They target imports from China, Mexico, and Canada starting February 1.

The president sees tariffs as both a policy tool and a growing revenue stream. By imposing fees on foreign goods, he hopes to protect U.S. industries and encourage fair trade practices. U.S. manufacturers face an uneven playing field when compared to foreign counterparts like those in Mexico and China, due to differences in regulations and quality controls.

For instance, China doesn’t have strict regulations like OSHA, which ensures worker safety and environmental standards in the U.S. Additionally, Chinese manufacturers often don't face the same level of quality control scrutiny that domestic manufacturing companies do. These disparities make it difficult to directly compare commodities, as U.S. manufacturers shoulder higher costs to comply with regulations, while foreign manufacturers benefit from fewer restrictions. As a result, domestic manufacturers and distributors struggle to compete on price, which is one of the reasons tariffs are viewed as protecting national strategic interest.

Jamie Dimon, CEO of JPMorgan Chase, in a CNBC interview today from Davos, Switzerland, where the World Economic Forum is taking place said, “I would put in perspective: If it’s a little inflationary, but it’s good for national security, so be it. I mean, get over it.”

Citation: www.cnn.com

Tariffs are not new to Trump’s strategy. The trade war with China in 2018 established a framework for using tariffs to gain leverage. This latest round builds on that approach, with broader goals for economic influence. Trump has proposed a 10% tariff on Chinese goods. The reasoning ties to China’s fentanyl production and export practices.

This decision follows conversations with China’s President Xi Jinping. Trump urged stricter measures against fentanyl production and shipping, linking it to broader trade concerns. American businesses already face up to 25% tariffs on many Chinese imports. These new fees would add further strain to supply chains, raising prices for consumers. However, it will promote domestic manufacturing and bulster this important sector of the economy.

Mexico and Canada are also in Trump’s sights. He plans to impose 25% tariffs on goods imported from these neighboring countries. Canadian Prime Minister Justin Trudeau has expressed concerns saying that Canada supplies vital materials like oil, steel, and lumber. He went on to claim that the U.S. Tariffs could disrupt this trade and raise costs for American industries.

Both nations aim to avoid direct trade conflict while protecting their economies from potential damage. Trump’s tariffs serve multiple purposes. They are designed to pressure trade partners, reduce deficits, and address what he views as unfair practices. Tariffs also play a role in domestic revenue generation. They are a tax on imported goods, and higher tariffs mean more money for government programs. Economists warn of potential downsides, including higher consumer prices. Some argue that the inflationary effects could complicate the Federal Reserve’s plans for interest rate cuts. Let's explore that further now.

What does the data say concerning Tariffs?

The ISM Manufacturing PMI (Purchasing Managers' Index) is a key economic indicator that measures the health of the U.S. manufacturing sector. Compiled through surveys of supply chain executives, it tracks new orders, production, employment, supplier deliveries, and inventory levels. A reading above 50 indicates expansion, while a reading below 50 signals contraction. As a barometer of economic activity, the PMI provides valuable insight into broader economic trends and business conditions.

Since the second half of 2022, the ISM Manufacturing PMI has been in contraction territory, reflecting ongoing struggles in the manufacturing sector. Factors such as high interest rates, which increase borrowing costs for businesses, and weaker global demand have weighed heavily on production. Tariffs, while aimed at protecting domestic manufacturing, could potentially exacerbate these challenges by raising input costs, further pressuring profit margins. Critics argue that higher tariffs could contribute to inflation, limiting the Federal Reserve’s ability to lower interest rates and support broader economic growth.

A strong dollar has also added to manufacturers' woes, echoing the environment during Trump's 2017 inauguration. A strong dollar makes U.S. exports more expensive and imports cheaper, reducing competitiveness for domestic manufacturers. In 2017, the dollar weakened after initial strength leading into the Trump inaguration, providing a temporary boost to manufacturing by making exports more affordable and imports pricier. A similar trend today could aid the sector, but its timing and magnitude remain uncertain, leaving manufacturers navigating a complex and challenging economic environment.

A strong dollar is closely tied to domestic interest rates, as higher rates make U.S. financial assets more attractive to global investors. With the Federal Reserve’s benchmark interest rate, or Fed Funds Rate, at elevated levels, there is a strong incentive for multinational corporations and foreign investors to acquire dollars to purchase U.S. Treasuries.

These assets offer a combination of safety and competitive yields, drawing capital inflows that drive up demand for the dollar. For instance, the U.S. 2-year Treasury yield currently sits at 4.295%, significantly higher than China’s 2-year yield of 1.26%. This wide yield differential makes U.S. Treasuries a far more appealing investment, strengthening the dollar in the process.

The Fed’s success in controlling inflation has further bolstered the dollar's appeal. As inflation trends downward toward the 2% target, the relative stability of the U.S. economy enhances confidence in dollar-denominated assets. This dynamic creates a feedback loop: high interest rates attract foreign capital, which strengthens the dollar, making U.S. exports more expensive and imports cheaper. While this helps curb inflation, it poses challenges for domestic manufacturing by eroding competitiveness. This delicate balance underscores the complexity of managing monetary policy while considering its ripple effects on trade and the broader economy.

One bright spot for domestic manufacturing is that it appears to have hit rock bottom after years of sharp declines. Similar to the transportation sector, which shows signs of recovery as reflected in the recent ATA tonnage index, manufacturing seems to be stabilizing. The worst may be over, and the sector is finally showing signs of life. New orders for manufacturing have moved back into growth mode, offering hope for a sustained rebound. This shift signals that demand is returning, which could provide a foundation for manufacturers to rebuild and capitalize on future opportunities.

Yeilds

Rate Cut Incoming. Buckle Up"What the Yield Curve and Fed Moves Mean for Your Next Trade."

Historically, when the Federal Reserve lowers the federal funds rate while the yield spread is negative (also known as an inverted yield curve), it has often been an indicator of an impending market correction or recession.

Let’s break this down:

Historically, the bond market is a key indicator. Typically, long-term bonds offer higher yields than short-term bonds; This a healthy sign. When that flips and short-term yields surpass long-term ones, we get what’s called an inverted yield curve. This inversion signals that investors are getting nervous about the near-term economy. When the Fed then steps in to lower rates, they’re trying to stimulate growth, but it often comes too late.

Looking back at past events:

The dot-com crash of 2000: The yield curve inverted, the Fed cut rates, and a 35% market correction followed.

The 2008 financial crisis: Again, the yield curve inverted, rates were cut, and the market saw a major downturn exceeding 50%.

Going back even further, the same pattern held in the 1970s and 1980s.

The big questions are:

Why does this combination signal trouble?

Will this pattern repeat itself again?

While history tends to repeat itself, the data shows that when the Fed cuts rates with a negative yield spread, market corrections often follow. The inverted curve suggests tighter credit conditions, reduced lending, and lack of confidence, all piling on top of one another creating a recipe for disaster.

Stepping back even further, we see that investor sentiment and the bond market tend to lead the way. Credit tightens, and companies cut back on spending. Another a perfect recipe for an economic slowdown and market drop.

It's a familiar cycle. So lets buckle up.

The Bond Market is Pricing in a Collapse of The Yen Carry TradeThe spread between the US10Y and JP10Y has historically been a great leading indicator of contraction within the Yen Carry Trade and likely will be into the future.

If we were to apply TA to it, we can see that the spread appears to be Double Topping and has formed a Bearish Shark at this top as the RSI breaks down and the MACD Diverges. If we are to take this as a warning, then we should expect this spread to go down significantly, and that would be accompanied by the contraction of the Carry Trade, leading to lower liquidity and signfiicantly tighter credit conditions and ultimately a depreciation in market pricing.

I think we could see JPY and USD strength during this time but would avoid other currencies.

Longest Consolidation Period Since 00's | 1D, 1W ChartsAAPL Tech Giant vs The World

AAPL has had a rough couple of weeks so to speak. With Treasury yields, to their new iPhone 15 overheating issue, there is much to be said about how this will playout in the long run for AAPL stock. Tech giants 12 month price-to-earnings ratio fell to 27 from 34, but APPL is forecasted to reach higher earnings in Q4 and beyond. September could be said to be a messy month for The Magnificent 7, but hopefully this is the calm before the storm.

1W Chart

- Moving Average: Let me explain why this is such an important indicator. As you can see I have labeled the number of times AAPL ducked bellow the 50 D SMA, and after every duck came a rally to the upside, as soon as it broke through the average. This has been a 15 year trend. Now if it were to duck under the 50 D SMA again, after it already had, then this would be a very bad sign . Expect to be consolidation for God knows how long.

- RSI: In every bull rally, I have shown the average support levels in the RSI, this is to make sure we are staying on trend. Now there is a red line that can be seen at 37, this indicates the lowest level the RSI has gone during a Bull Rally, if it were to break this level, we are now in the longest consolidation period since the 00's.

1D Chart

- Moving average: Nothing fancy, it's there just in case, However, there are important levels that need to be discussed. There are 2 potential levels of support that AAPL needs to hit in order for it not to be considered consolidation. 164 and 157, with 157 being the lowest. Obviously not these exact same numbers but around this area is what we need to be looking at for a couple of days.

- Stoch RSI: Is at a level where we can start breaking higher.

Extra

- Make sure to look at other Tech Giants and Treasury Yields for any correlation, as I did not have the time to include them in this Idea.

Please let me know your thoughts in the comments, if you liked this Idea, give it a boost as it helps he out in making more charts for you guys!

DXY | JPY | CREDIT EVENT | DECRYPTERS Hi People Welcome to Team " DECRYPTERS"

SO we Have 3 Main events this Week Lets Get A DEEP DIVE IN TO THEM

1- FED :- FED RATE HIKES ( PRICED IN ) + PRESS CONFERENCE ( HAWKISH )

AS we predicted Last time what Ever Happen Rate hikes will be increased we still stand by our words . Lets go further Either we are Getting 50 BPS This time or We are Getting 25 BPS next time

WHY Is That So ... ??

The Attached Charts shows the overall level of financial conditions in an economy The conditions are on Same levels When FED was ABOUT to hike Rates Meaning .

Further more —Dot plots , Fed curves ,GSUSCFI Index and Bloom Berg Index & Fall in Credit spread "ALL" Indicating ease in financial system Meaning this Data provide Evidence that FED Can increase More Interest Rates As Credit spread also falling to positive signal for economy

— Rise In commodity Prices Like (RBAB Gasoline) Indicates more higher Prices in Energy sectors.

— Lastly Good inflation trading above 20 years average & CPI Also printing higher on Y/Y Basis.

2- EURO RATE HIKES :-

THIS comes With same Expectations Rate hikes + Hawkish Stance with & Lagarde speech.

Lets Discuss JPY NEWS ON FRIDAY

3- BOJ REPORT :-

A surprise can be Expected From Other Side Like

They can Increase the range of "10 -years JGB" 50 BPS TO 75 /100 BPS

( BOND BUYING BACK PROGRAM) This will Cause bonds Prices to Rise / Yields to Fall &

"JPY TO GET WEAKEN"

—Other yield can React Negatively To IT ( LIKE US -10 YEAR)

Fundamentals favour soybean, sugar and wheatAgricultural commodities, led by grains rose sharply in 2022. The two main catalysts for the upside in price were the Russia-Ukraine war alongside other supply challenges. There has been a number of cascading events around these two catalysts involving government interventions globally as food prices soared.

However, from mid-October the renewal of the Black Sea grain initiative for six months, helped quell concerns of access to Black Sea ports. We have seen prices decline since then, but from a high level.

It’s worth noting that grain exports from Ukraine under the Black Sea Grain Initiative dropped to 3.1mn tons in January compared to 3.6mn tons in December 2022 owing to a slowdown in inspections1. In 2023, the supply demand balance appears to be favouring soybeans, wheat, and sugar.

Extreme drought in Argentina lends a tailwind to soybean prices

In the case of soybean, a gloomier supply outlook has been a key tailwind for prices in 2023. Argentina, the world’s third largest soybean producer, is expected to see a weaker crop at 35.5mn tons owing to persistent drought and high temperatures. The Foreign Agricultural Service of the US Department of Agriculture (USDA) estimates the crop at just 36mn tons after the USDA previously predicted a crop of 45.5mn tons.

However, both estimates are still well above the assessments of local experts. The Rosario Grain Exchange, which asserts the drought is the worst in 60 years, lowered its soybean forecast to 34.5mn tons. Thus, future downward revisions by USDA are quite likely which should help soybeans continue to find support.

Net speculative positioning in soybean futures has increased 124% since the start of October underscoring the positive sentiment owing to the tighter supply outlook.

Tighter supply on the global sugar market

Sugar prices are trading at a six year high. Investors remain concerned over the prospects of the sugar crop in India, the world’s second largest sugar exporter. Sugar cane processing in Maharashtra, the most important growing State, could end 45 to 60 days earlier than last year owing to heavy rainfall that has reduced the availability of sugar cane.

In 2022, sugar production reached a record 13.7mn tons, which allowed India to export a record high 11.2mn tons of sugar.2 The Indian Sugar mills Association (ISMA) revised its estimate for domestic sugar production lower from 36.5mn tons to 34mn tons for the 2022/23 season2. This is raising concerns that the Indian government will not approve any further sugar exports for the current marketing year owing to the recent reports of weak production.

This does suggest a tighter global sugar market particularly as we are in the midst of Brazil’s (the world’s largest sugar producer) sugarcane off-season. Although Brazil produces sugar all year round, during this period (December to March) few mills continue to crush. Supply from Thailand, the world’s third largest sugar producer is unlikely to fill the gap left behind by the smaller Indian harvest particularly during Brazil’s off-crop.

The front end of the sugar futures curve has been in backwardation over the past 3 months and currently provides a roll yield of 7.2% highlighting the tightness in the sugar market.

Wheat most exposed to geopolitical tensions

Wheat prices have under most pressure from the improved supply prospects from the Black Sea Region. However total grain exports have declined by 29% to 27.7mn tons in the ongoing season (from 1 July 2022 to 31 January 2023), with wheat exports down 42% over the prior year.3 The ongoing escalation in the Russia Ukraine war continue to threaten supply from the breadbasket of Europe.

The US Department of Agriculture is forecasting a noticeably smaller Russian wheat crop of 91 million tons for 2022 in sharp contrast to Russia’s State Statistics Agency estimate at a record high of 104.4mn tons. According to the consultant firm SovEcon, the key growing region in the south of Russia has seen only around 40-80% of its normal rainfall over the past three months. The forecasts of this year’s crop in Russia are less optimistic. In the 2022/23 season, a record crop in Russia enabled ample supply of the wheat markets, despite a considerably lower crop in war-torn Ukraine in particular, thereby dampening prices.

Lower supply is likely in the coming season, however, not only from the top wheat producers – Russia and the US – but also from Ukraine on account of the ongoing military conflict. The Ukrainian Grain Association (UGA) anticipates a crop volume of 16 million tons. According to the Ukrainian Agriculture Ministry, 20 million tons of wheat were harvested last year. Before the war, the crop had totalled around 30 million tons.

Net speculative positioning in wheat futures is currently more than 2-standard deviations below its five-year average, underscoring the extreme bearishness on the wheat market.

Amidst the ongoing conflict and lower wheat supply from Russia and Ukraine, wheat prices appear positioned for a rebound from current levels.

Sources

1 Bloomberg as of 31 January 2023

2 Indian Sugar Mills Association as of 30 December 2022

3 Bloomberg as of 31 December 2022

Dollar In A Corrective Recovery Ahead Of US CPI Next WeekHello traders,

This will be just a quick recap on some of the markets ahead of US Cpi next week.

USD is still in a recovery mode, with room for more upside I think, especially if stocks will stay under pressure.

Have a nice weekend everyone.

GH

Trade of 2023? TLT! Big Boring BondsWhat is the big trade for 2023? I think it is going to be BONDS. This is my thesis on going long NASDAQ:TLT to start 2023. I walk through the reason that when yields go up, bond values go down (as did TLT) and why I think that TLT is likely to go back up over the course of this 2023 and beyond.

TLT Targeting A Test of 99.19Technical & Trade View

TLT (ishares 20+ Year Treasury Bond ETF)

Bias: Bullish Above Bearish below 93.27

Technicals

Primary support is 93.27

Primary pattern objective is 99.19

Acceptance above 95.40 next pattern confirmation

Acceptance below 93.20 opens a test of 90.30

20 Day VWAP bearish , 5 Day VWAP bearish

Notes

US CPI released today, volatility expected around the print

Goldman Sachs expects ‘a below-consensus 0.44% increase in core CPI in October (vs. 0.5% consensus), which would lower the year-on-year rate to 6.46% (vs. 6.5% consensus). We expect moderate increases in both food and energy prices to raise headline CPI by 0.49% (vs. 0.6% consensus), which would lower the year-on-year rate to 7.8% (vs. 7.9% consensus)'

Going forward Goldman 'expect monthly core CPI inflation to remain in the 0.3-0.4% range for the next couple of months before edging down to 0.2-0.3% next year. We forecast year-over-year core CPI inflation of 6.2% in December 2022, 3.3% in December 2023, and 2.7% in December 2024. The deceleration we expect in 2023 is driven more by goods than services categories'

10 yrIf rates do not get blocked by that weekly 200 ema and reject from the 1.64 lvl then I would say we are heading into some serious pain for risk assets with a C wave target of 2.14 basis points. IDK guys but im thinking 1.64 holds and SP500 completes my C wave around 4250. Then back up to 5,000 EOY

US 10 Year yield looks to be heading lower soonThe 10 year treasury yield looks ready to resolve its multi-month consolidation triangle to the downside. There's room for another run up to the .70% area over the next couple weeks, but I ultimately believe we are heading for lower yields. Note the fairly swift rejection from the rally above the 50MA at the end of May / start of June.

I'm not making any plays directly on treasuries, but watching closely because a definitive break lower in yields would signal that stock markets may be heading for a major risk-off move.

$TVIX to hit $99.38, with trials to break $100.27In next 60 days, as $DJI continues to dramatically falls, among other market indices (e.g. oil most likely to hit below $40), thereby high-market caps (e.g., $MSFT, $AAPL, $AMZN) to settle down to new lower valuations, most likely all to hit below $600B, or even lower as it all used to hold on <$500B, thereupon $TVIX becomes a safe bet to break up its old adjusted supports and it is possible to reach to its $115 support.

Please feel free to comment, Happy Holidays, and trade safe!

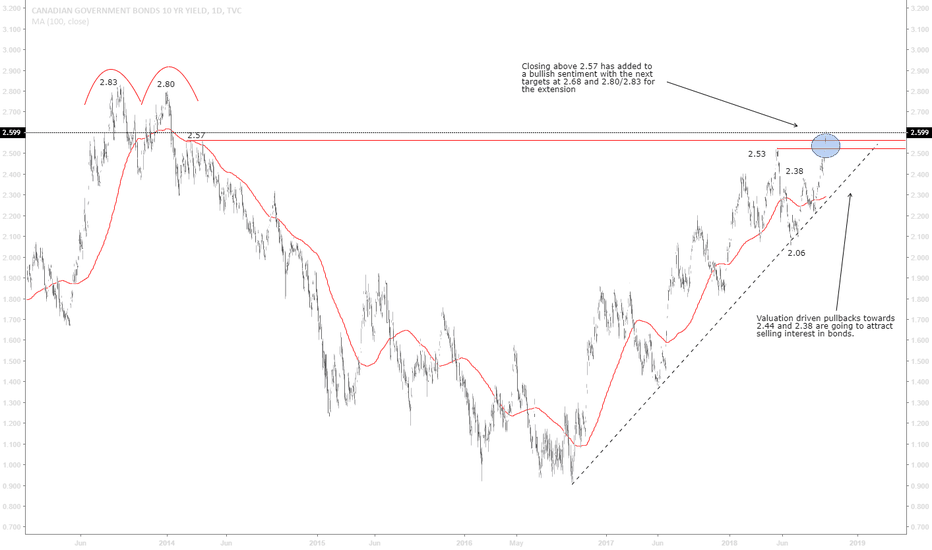

Canadian yields reaching new 4 year highs=> Global yields are on the move as we all know and have been expecting for since the beginning of the year.

=> Here in Canada we can see the same scenario playing out as we break above a 4 year high and unlock 2.80/2.83 for a test.

=> This is a major turning point for the global economy and we are witnessing it live here on tradingview. Highly recommended for all those wanting to dig deeper in these discussions to jump in and join the telegram channel as we are advancing the conversation in real-time.

=> Bookmark this chapter in your economic textbooks as we are in for a very active few quarters ahead.

=> GL those trading in Canadian equities