Will the BoJ's hawkish approach affect the yen's strength?

US equity markets plunged amid growing concerns that the Trump administration's tariffs, set to be announced on April 2, could be aggressively implemented. Goldman Sachs warned that US tariff rates could reach as high as 18%, potentially shaving 1.0% off GDP growth and pushing the unemployment rate to 4.5% this year.

Bank of Japan Governor Kazuo Ueda signaled a continued tightening stance, stating that if persistently rising food prices lead to broader inflation, the central bank would consider raising interest rates.

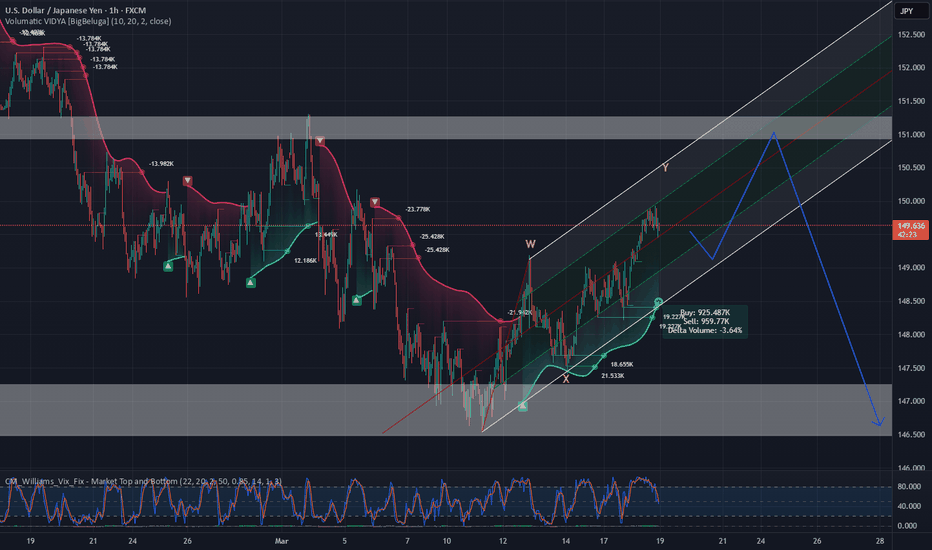

USDJPY broke below the support at 149.50 before retracing to 150.00. However, failing to reenter the channel, the price hovers near the channel’s lower bound. If USDJPY fails to reenter the channel, the price may break below 149.50 again. Conversely, if USDJPY reenters the channel, the price could gain upward momentum toward the resistance at 151.30.

Yen

USDJPY - Critical area for the pair!The USD/JPY pair currently sits at a critical technical juncture, trading around the 149.84 level, where market participants are closely watching for directional cues. The price action has been respecting an ascending trendline since early March, suggesting underlying bullish momentum, while simultaneously testing the lower boundary of a significant resistance zone highlighted in blue on the chart. This confluence creates a decisive moment for traders – a break below the trendline could trigger another downward leg toward support near 149.00, while sustained strength above the current level might signal continuation of the uptrend toward the upper resistance band at 151.00. The chart's annotated projection suggests the possibility of one more pullback before resuming higher, making this a pivotal area for determining whether bears will gain temporary control or if bulls will maintain dominance without further consolidation.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

GBPJPY GJ looks bullish

194.764 is a major zone looking at the 1w, 1d, 4h, and the 1h. If GJ currently find support. We possibly going to experience the bullish power, as the trend is changing.

Another bullish confirmations will be:

- moving average forming dynamic support on 4h

- bullish candlestick formation in the 4h

- bullish continuation pattern on the 1h

- lower time frame (15m and 5m) for entry

Buying tp zone is 198.00

USD/JPY H4 | Falling to Fibonacci confluence supportUSD/JPY is falling towards a multi-swing-low support and could potentially bounce off this level to climb higher.

Buy entry is at 150.11 which is a multi-swing-low support that aligns with a confluence of Fibonacci levels i.e. the 23.6% and 38.2% retracements.

Stop loss is at 149.30 which is a level that lies underneath a multi-swing-low support and the 38.2% Fibonacci retracement level.

Take profit is at 151.17 which is an overlap resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

EUR/JPY H4 | Falling to a multi-swing-low supportEUR/JPY is falling towards a multi-swing-low support and could potentially bounce off this level to climb higher.

Buy entry is at 160.93 which is a multi-swing-low support.

Stop loss is at 159.90 which is a level that lies underneath an overlap support and the 38.2% Fibonacci retracement.

Take profit is at 164.00 which is a swing-high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

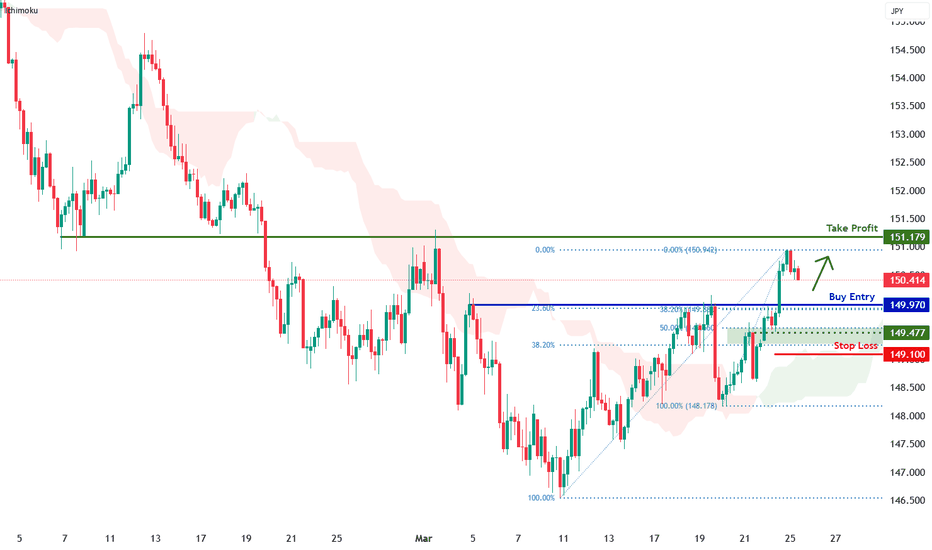

USD/JPY H4 | Falling to pullback supportUSD/JPY is falling towards a pullback support and could potentially bounce off this level to climb higher.

Buy entry is at 149.97 which is a pullback support that aligns with a confluence of Fibonacci levels i.e. the 23.6% and 38.2% retracements.

Stop loss is at 149.10 which is a level that lies underneath an overlap support and the 38.2% Fibonacci retracement.

Take profit is at 151.17 which is an overlap resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 63% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third-party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

USDJPY BUY📊 EUR/JPY - Order Block & Break of Structure (BOS) Strategy 📊

Tracking EUR/JPY on the 15-minute timeframe, we see a potential bullish setup based on order blocks (OBs) and smart money concepts (SMC). However, confirmation via Break of Structure (BOS) on lower timeframes will be key before entering a trade.

Key Zones:

Bullish Order Block (Demand Zone): 161.000 - 160.700

Expecting price to drop into this area, where institutions previously showed strong buying pressure.

Looking for BOS on lower timeframes (M5/M1) to confirm bullish intent before entering a buy position.

Bearish Order Block (Supply Zone): 163.500 - 163.700

A strong resistance level where price previously sold off.

If price reaches this area, we could see a reaction or potential reversal.

Trade Plan:

📉 Wait for price to enter the demand zone (161.000 - 160.700).

🔎 Look for a Break of Structure (BOS) on lower timeframes (M5/M1) to confirm bullish reversal.

✅ Enter a long position upon confirmation.

🎯 Targeting the supply zone at 163.500 - 163.700.

⚠️ Stop-loss below 160.700 to manage risk.

USDJPY Buy Setup – Breakout Confirmation & Seasonal TailwindTechnical: USDJPY has broken above a downtrend resistance line after finding support at the 61.8% Fibonacci retracement level at 146.95 . This breakout suggests the corrective phase may have ended, signaling potential for further upside. Pullbacks toward 149.70 (a retest of the broken trendline) present an attractive entry opportunity. Upside targets are 152.74 and 157.10 in the short to medium term. The setup is invalidated below 147.97 , with a break below 146.33 negating further bullish expectations.

Fundamental: Commercial selling of the Japanese Yen and renewed dollar purchases indicate a shift favoring USD over JPY, supporting the bullish technical outlook.

Seasonal: Over the past 25 years , USDJPY has risen 76% of the time between March 25 – April 8 , with an average gain of 1.04% .

Trade Idea:

Entry: On pullbacks toward 149.70

Stop Loss: 147.97 (or 146.33 for extended risk management)

Targets: 152.74 and 157.10

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Japan's Tariff Worries and BOJ Rate Hike HintsThe Japanese yen remained weak around 150.7 per dollar on Tuesday, near a three-week low, as the U.S. dollar gained strength. Trump's plan to impose tariffs on autos, pharmaceuticals, and other sectors raised concerns for Japan’s export-driven economy.

BOJ minutes from January showed officials remain open to future rate hikes depending on wage and inflation trends, with one member suggesting a possible increase to 1% in late fiscal 2025. Still, the BOJ kept rates steady at 0.5% last week, maintaining a cautious stance with global tensions.

Key resistance is at 151.70, with further levels at 152.70 and 154.00. Support stands at 147.00, followed by 145.80 and 143.00.

Yen Slips to 149 as Inflation EasesThe yen fell to around 149 per dollar on Friday, ending a two-day rally, after Japan’s core inflation eased to 3% in February from 3.2% in January, still above expectations of 2.9%. This marked the second month of stronger inflation, reinforcing the case for future rate hikes.

Earlier, the BoJ held rates at 0.5% and maintained a cautious stance, citing global uncertainties, particularly rising U.S. tariffs. The bank also reiterated its focus on monitoring currency moves. A stronger U.S. dollar further pressured the yen amid global growth and trade concerns.

Key resistance is at 150.30, with further levels at 152.00 and 154.90. Support stands at 147.00, followed by 145.80 and 143.00.

USDJPY SELL SETUP!!From a technical perspective, examining the USD/JPY chart, we might notice that prices are forming a lower high, which often indicates a potential downtrend. The price respecting Fibonacci retracement levels can also suggest that the market is reacting to key support and resistance levels. When traders see the price approaching these levels and behaving predictably, it can bolster their confidence in the direction of their trades.

Overall, the expectation is for a continuing strength in the yen, especially if the market sentiment remains focused on potential rate hikes from the Fed. This scenario might lead to more bearish moves for the USD/JPY pair, making it important to watch for any significant economic data releases or comments from central bank officials that could signal changes in monetary policy.

USD/JPY Analysis: Dollar Weakens After Fed DecisionUSD/JPY Analysis: Dollar Weakens After Fed Decision

Yesterday, the Federal Reserve announced its interest rate decision, which, as expected, remained unchanged. Fed Chair Jerome Powell emphasised that there is no rush to cut rates amid uncertainty surrounding US inflation and the tariff policies implemented by the Trump administration.

This key announcement triggered volatility in financial markets, notably:

→ US stock indices rose;

→ the US dollar weakened, which was evident in currency (and cryptocurrency) charts involving USD pairs.

The most significant movement occurred in the USD/JPY chart, as the Bank of Japan was also active yesterday. While it also left interest rates unchanged, it acknowledged growing uncertainty around Japan’s economy and added a new reference to the "changing trade environment."

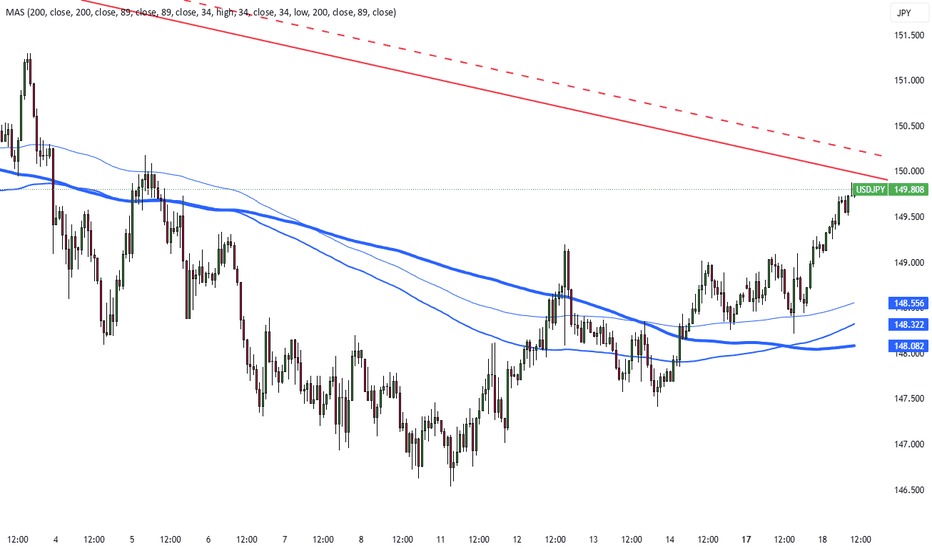

Technical Analysis of USD/JPY

As we noted on 21 February when analysing the Japanese yen’s exchange rate against the US dollar:

→ Price fluctuations are forming a downward channel (marked in red).

→ The former support at the lower boundary of the blue channel may now act as resistance.

Since then, the price has:

→ Tested the breakout level (indicated by an arrow) before continuing to decline within the channel, confirming its relevance.

→ Reached the lower boundary of the channel and rebounded upwards from the 147 yen per dollar level.

Given that the price is closely interacting with the channel lines and is currently around its median, it suggests that supply and demand are relatively balanced under these conditions. This is further supported by the fact that neither the Fed nor the Bank of Japan introduced surprises, leaving interest rates unchanged.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Dollar Weakens Post-Fed, Lifting Yen Beyond 148.5The yen strengthened past 148.5 per dollar, rising for a second session as the dollar weakened after the Fed reaffirmed two rate cuts this year. Fed Chair Powell downplayed Trump’s tariffs as short-lived. The BoJ kept rates at 0.5% on Wednesday, adopting a cautious stance amid global risks, especially US tariffs. It also emphasized monitoring forex markets and their impact on the economy.

Key resistance is at 150.30, with further levels at 152.00 and 154.90. Support stands at 147.00, followed by 145.80 and 143.00.

EUR/JPY Market Analysis: Potential Reversal at Key Resistance LeThe EUR/JPY pair, on the 4-hour chart, exhibits a strong bullish impulse that recently peaked around 163.64 , aligning with a key Fibonacci extension level (1.618). This area marks a critical resistance zone, where price action has shown signs of rejection.

The Harmonic pattern, such as the b]Crab , suggest potential exhaustion of the uptrend. The latest leg upward reached a 2.618 extension , reinforcing the possibility of a corrective move. Support levels to monitor include ** 162.23 ** (BC) and ** 160.59 ** (T1), which could serve as downside targets if bearish momentum gains traction.

For traders, a decisive break above **163.64** could invalidate the short-term bearish bias, paving the way for further upside. Conversely, sustained rejection from this level may trigger a deeper retracement towards key Fibonacci and harmonic support zones.

Conclusion : The pair is at a critical inflection point, where price action and confirmation of rejection signals will determine the next directional move. Traders should watch for price action at resistance and key support levels to assess trade opportunities.

Japanese Yen Hits Two-Week Low Before BoJ MeetingThe yen fell past 149.5 per dollar, a two-week low, ahead of the BoJ's policy decision. The central bank is expected to hold rates at 0.5% on Wednesday while assessing U.S. policy impacts. Despite a pause, rate hikes are anticipated later this year as rising wages and inflation support policy normalization. Major firms agreed to wage hikes for the third straight year, increasing consumer spending and inflation.

Key resistance is at 150.30, with further levels at 152.00 and 154.90. Support stands at 147.00, followed by 145.80 and 143.00.

Sentiment Extreme on the Yen Could Bode Well for Commodity FXI take a closer look at the Japanese yen futures market to highlight why I think the Japanese yen has reached an important inflection point. And that could further support the bounce of yen pairs such as AUD/JPY, CAD/JPY and NZD/JPY - alongside USD/JPY should the Fed not be as dovish as many hope.

Matt Simpson, Market Analyst at City index and Forex.com

GBPJPY - Higher Probability Favors Upside ContinuationThe GBP/JPY pair is displaying strong bullish momentum as it trades near 192.25, having recently tested but failed to break through the key resistance level at 193.05. After forming a higher low structure within an ascending trendline since late February, the pair shows notable strength with buyers stepping in at each pullback. Technical analysis suggests that the higher probability move is a continuation to the upside, with price likely to break above the horizontal resistance at 193.05 after a possible minor retracement. If this bullish scenario plays out, we could see the pair extend toward the 194.50 level before potentially reaching higher targets as indicated by the upward-pointing arrow on the chart. The ascending trendline and the support zone marked by the blue box near 191.00 should provide solid foundations for this anticipated upward move, keeping the overall bullish bias intact as long as price remains above these key structural levels.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

USDJPY - Bullish pattern towards descending trendlineThe USD/JPY pair appears to be forming a potential reversal pattern after reaching a low around 146.50 in early March. Having bounced from this support level, the price is now hovering near 148.60 with indications of a larger corrective move ahead. Technical analysis suggests we are expecting a bigger correction in this area, with the price likely to test higher levels before encountering significant resistance. The initial price target will be the upper boundary of the blue box area (approximately 150.50-151.00), with potential to go toward the descending trendline that has been capping price action since January.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.