Corn

"CORN going down" by ThinkingAntsOkDaily Chart Explanation:

- Price started its down move from the Major Resistance Zone.

- Price made a retracement towards the Middle Resistance Zone.

- Now, it should be strong enough to go down towards our targets to the Support Zone first and to the Major Support Zone then.

Weekly Vision:

Updates coming soon!

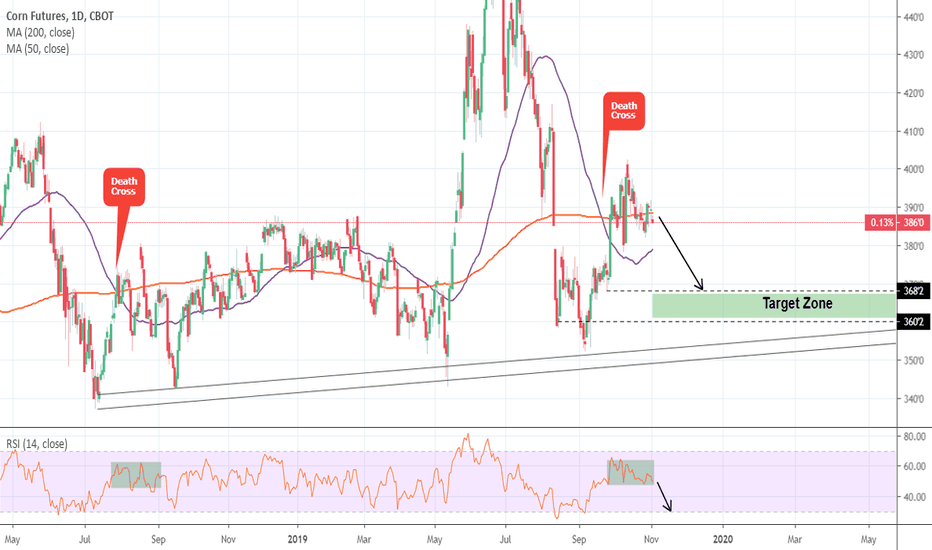

Corn: Short opportunity on 1D Death Cross and RSI.Corn has been consolidating recently following the 402 peak on 1D (RSI = 54.610, STOCH = 53.472, MACD = 0.760, ADX = 18.642) after the September Death Cross. A similar candle sequence took place in August 2018, when after a 1D Death Cross (MA50 under MA200) and a market Top, the price made a new Low (Higher Low on 1W).

Since the RSI is on the same zone as then, we are expecting a decline towards 368'2 - 360'2.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

CORNUSD LONG TRADE - PRICE HAS RETESTED NOW GOING UPHey traders,

This is my analysis for Corn currently on the H1 charts.

We can see that corn was trading in this descending triangle pattern.

Price broke out then retested before holding strong.

MACD Bearish momentum also seems to be decreasing

Daily trade analysis and ideas:

Telegram: t.me

Facebook: www.facebook.com

Twitter: forex_dojo

Instagram: www.instagram.com

Website: www.forexshinobi.com

Tiktok: @forexshinobi

ForexShinobi

"Corn on a Resistance Zone" by ThinkingAntsOkDaily Chart Explanation:

- On the Weekly Vision, price is in a huge lateralization, we see it has potential to move down towards the Support Zone.

- Now, price is on the Resistance Zone.

- We expect it to bounce from here.

- We are looking for sell setups on lower timeframes.

Weekly Vision:

Updates coming soon!

CORN DAILY ANALYSIS - WHAT IS CORN DOING?Corn currently is stuck in the middle of this range. Nothing really to say here.

Corn is currently in the upward phase of the trading range after failing to reach the bottom of the range.

Best to wait for price to make a move at one of the orange S/R levels I have labeled.

There are plenty of other setups for commodities trading this week! Please see my related ideas. I have analysis on Gold, Natural Gas, Soybeans, and Sugar.

Daily trade analysis and ideas:

Telegram: t.me

Facebook: www.facebook.com

Twitter: forex_dojo

Instagram: www.instagram.com

Website: www.forexshinobi.com

ForexShinobi

An easy corn tradeType of position: Buy

Entry point: 3.58 or below

Exit point target: 4.48 (30% profit)

Time span: 287 days

You can enter some Corn CFD or use the Teucrium Corn Fund to make a similar trade.

There is a clear pattern in the last 5 years for trading corn. We have a low around the beginning of September and we are bullish throughout most of the year until mid-late summer. The average gain as seen on the chart for the last 5 years is 30% and the average bullish time span is around 287 days.

You can use leverage or options to increase the profit potential.

Moreover, there is a high risk of crops freezing in the US which can boost the corn prices even faster:

www.youtube.com

Me and my clients caught the crypto bubble, the marijuana bubble, and we are preparing for the bull market in the precious metals now.

If you are risk tolerant and want to potentially make fortunes, feel free to message me to get a free trial of my fund.

For the next two months, I will be posting free trading ideas in crypto, stocks and commodities .

"Corn is retesting the Resistance Zone" by ThinkingAntsOkDaily Chart Explanation:

- Price started its down move after bouncing on the Major Resistance Zone.

- Now, price is on the Middle Resistance Zone.

- If it bounces from here, it has potential to continue its down move towards the Support Zone and, then, towards the Major Support Zone.

- We are looking for sell setups on lower timeframes.

Weekly Vision:

Updates coming soon!

Corn Futures ZC supply and demand forecast analysisSupply and Demand and any trading strategy can be quite overwhelming at times. When looking at the Corn Futures ZC weekly timeframe we can see there is a super strong weekly demand imbalance created around 3600. The strength of that demand imbalance is quite strong, we already have price reacting to it, we are expecting Corn Futures ZC to rally higher, there is a lot of room for Corn Futures to keep on moving to the upside.

You can use Corn Futures options or various ETFs to trade Corn Futures as well, you are not exclusively limited to the Corn Futures ticker. We don’t need any specific tools to learn how to trade Futures or Corn. You can pay attention to Corn fundamental analysis or even Corn Seasonal analysis, but all that will be a lot of hard work just to learn that fundamentals where good to sell Corn Futures but you did not know there was a pretty strong weekly demand imbalance in control and you should have gone long on Corn Futures ZC instead of shorts.

We can day trade and do intraday on Corn Futures as well. Supply and demand can be applied to any market and asset. Futures intraday and day trading is also possible by using simple rules that will help you locate brand new imbalances to trade. You can use other trading strategies to day trade futures and Corn futures. By knowing there is a very strong weekly demand imbalance in control, you can use other trading strategies to plan your intraday trades.

"Top and Bottom Analysis on Corn" by ThinkingAntsOk4H Chart Explanation:

- Price is on a Micro Ascending Channel.

- Bearish Divergence on MACD.

- If price breaks the Channel, it has potential to move down towards the Middle Support Zone first and, then, towards the Support Zone.

Weekly Vision:

Daily Vision:

Updates coming soon!

Corn Sep 24 SHORTM pattern

Looking at our daily continuous corn contract we will first use our indicators such as RSI, Stoch RSI, and

MACD to determine possible directional position.

Or RSI is heading down the slightest but has been at this high level three major times with no success to

break through and has gone flat. Our Stoch RSI shows slight less buying pressure with the buy RSI above the sell

RSI, therefore still showing slight, not strong but still bullish presence.

Our MACD shows overbought conditions with our buy and sell looking to cross for selling pressure.

(Only 1 real bearish signs with a reasonable half bullish indicator.)

A 10R chart will show a more favorable move to the downside which will break it through the latest low.

an upside move using this technique is unlikely due to previous candle strength after Sep 17 drop.

We are in lower lows and lower highs pattern and are testing the third resistance touch with little strength

to break out.

Corn to make a Head and Shoulders Pattern? Bullish Agriculture!I have been trading the agricultural commodities much more lately. On a long term approach (investing) I am bullish agricultural because I see food supplies diminishing due to weather. Just this Spring and Summer, crop yields did not produce as much as before and according to information on Martin Armstrong's blog, farmers planted crops late in the East due to a lingering winter. I expect these weather uncertainties to keep occurring.

Soil in the west is also diminishing. This can easily be remedied through things such as Zinc and other things like phosphate etc but don't want to get too scientific here.

What this means is that in the future we will likely transition to indoor/greenhouse farming.

Another bullish aspect is China. If you follow my work, I have said the only reason China would come to make a trade deal/truce is if their credit problem worsens, and if their food issue worsens. China has been hit hard with the swine flu and the army virus and the government is subsidizing food prices, especially pork. This could be a more short term/intermediate term catalyst.

Onto the charts. A good confluence for Corn. We hit a major support/flip zone at around the 3.45 zone.

You can see the downtrend with its lower highs and lower lows. They are well defined. Remember, by definition once a lower high swing is broken and we stop making new lower lows, the downtrend is now nullified. We either range or begin an uptrend.

We can see the lower high swing at 3.60 was broken and also retested. Buyers are coming on here.

On the daily we are now awaiting our first HIGHER LOW swing in a possible new uptrend which we could have here. This would make a head and shoulders pattern and the confirmed higher low swing once we break above the neckline at the 3.70 zone.

Overall this is looking good. We could see a move up to the 4.00 level.

THE WEEK AHEAD: GDXJ, /ZC, /ZSEARNINGS:

No earnings announcements this coming week in underlyings with highly liquid options with ideal rank/implied metrics (>70% rank/>50% 30-day implied).

EXCHANGE-TRADED FUNDS:

SLV (82/29)

GDX (74/33)

TLT (71/15)

GDXJ (60/37)

GLD (59/15)

XOP (35/37)

Precious metals ... again, with GDXJ offering the best volatility metrics (>50% rank/>35% 30-day implied)

BROAD MARKET:

IWM (23/19)

SPY (13/13)

QQQ (11/18)

EEM (7/16)

EFA (15/11)

FUTURES:

/SI (82/28)

/UB (71/5)

/ZB (71/12)

/ZN (61/6)

/ZS (63/28)

/GC (59/15)

/ZC (52/28)

Pictured here is a corn short strangle in the October/40 days 'til expiry cycle with strikes camped out around the 1 standard deviation on the put side at 14 delta and the call side at the 13 delta strike, resulting in a delta neutral setup supposedly paying 4.00 at the mid price with break evens at 336 and 409. Naturally, that'll have to be priced out during regular market hours. There also may be some benefit in going out to November, where the implied volatility is at 25.3% versus October's 24.1% and where implied volatility contracts from there into winter and spring with February at 20.5% and April at 17.5%.

An alternative trade would be in October beans; the 830/990 short strangle paying 4.75 with the short put erected at the one standard deviation strike on the put side, the call at the equally delta'd strike on the call. For contrast: corn's implied volatility term structure: October -- 23.3%, November 17.8%, December 19.2%, February 16.6%, April 15.8%.

Naturally, either of these setups can be transformed into defined risk, iron condor trades by buying wings.

VIX/VIX DERIVATIVES:

Yowsa! VIX finished the week at sub-14 (13.74), so it's basically time to hand sit on what you put on in August volatility and wait for the next >20 pop to short.

"Top and Bottom Analysis on Corn" by ThinkingAntsOk4 Hour Chart Explanation:

- Price started its down move on the Resistance Zone.

- Now, it is on a Bearish Corrective Structure.

- It has potential to move down towards the Middle Support Zone and, then, the Support Zone indicated on the chart.

Check out our last predictions on CORN (they were really precise)!!!

Weekly Analysis:

Daily Analysis:

Updates coming soon!

Wait...I didn't have any CORN!Corn on the 4 hour chart looking interesting. A potential head and shoulders can occur. We have a left shoulder and we also have a head. Potentially making a right shoulder here.

Other confluences to increase our probabilities is the fact that the reversal is occurring at a support/flip zone at the 3.56 zone. Keep an eye on this. I don't trade agricultural commodities much, but I recently added corn, soybeans and wheat to my trading list.

Let us await for the right shoulder and higher low confirmation with a break above 3.70.

ZCK2020-ZCU2019 - Commodity Spread Trading on Corn FuturesZCK2020-ZCU2019

Spreads on corn futures almost reaching Take Profit.

Spreads are one of the most profitable forms of trading there are thanks to the statistical advantage on the seasonality of commodities.

If done respecting the rules of operation, you get on average a Winrate of 87% with a Risk Reward of 2/1.

Joe Ross is my greatest master in this field.

Corn bottomed?Corn bounced right off the range I mentioned on my last idea, Aggressive traders might go long here but it's probably best to wait for MACD signal and further strength. Seasonally corn is Not bullish at this time of the year, so it's best to be careful with longs

**If you're interested in joining a group of like-minded traders, send me a PM. This is NOT a subscription service, just bunch of average traders sharing insights in a FREE group

"Corn: going down as expected" by ThinkingAntsOkDaily Chart Explanation:

- Price bounced on the Major Resistance Zone and started the down move.

- It reached our first target for the bear move at the Middle Support Zone (4.00).

- Now, it has potential to move down towards our second target at the Support Zone (3.395).

- We are looking for sell setups on lower timeframes.

Check our our Weekly Vision. Updates coming soon!

Weekly Vision:

Looking for a tradeable low in Corntarget for short corn idea that I posted was hit, now I’m looking for a tradeable low, more downside is likely but it’s probably better to stay flat and let the market figure out from where to bounce and then get on the trend.

If 400 doesn’t hold, a low might form in the 380-391 region

** Just an idea NOT a forecast

"Short Setup on Corn (ZC1!)" by ThinkingAntsOk4 Hour Chart Explanation:

- Price bounced on the Resistance Zone (check it on the Weekly or Daily Vision).

- Price broke the Ascending Trendline.

- Price is, currently, on a Bearish Corrective Structure (ABC Elliot Count).

- If it breaks it at 4,215, the Short Move will be started.

- Our targets for that down move are the two Middle Support Zone and, finally, the Weekly Support Zone.

Check our Weekly and Daily Analysis. They can be really helpful for you!

Weekly Analysis:

Daily Analysis:

"Top and Bottom Analysis on Commodities: Corn" by ThinkingAntsOk4 Hour Chart Explanation:

- Price bounced on the Macro Resistance Zone and broke the Ascending Trendline.

- It is currently retesting the Resistance Zone (Pullback).

- If price starts its down path, we have two potential targets points: the Middle Support Zone at 3,782 and the Major Support Zone at 3,424.

Also, our Weekly and Daily Analysis are short views on the Corn.

Weekly Analysis:

Daily Analysis: