Is Corn Price on the Edge of a 25% Drop?In this idea, I am trying to read and forecast the behavior of the chart in the next 4.5 months . I do not follow corn production, harvest, demand, etc.

Since April 2022 (its 9-year highs) has lost about 40% . Its relatively long-going bearish trend means that most of the drop likely has happened.

Let's quickly study previous drops that lasted more than a year and erased more than 40% of the corn price.

The last one started 11 years ago. It happened during world economic growth. The price lost more than 61% for 26 months of the trend.

Another drop occurred during the GFC and lasted for 24 months. Corn lost 60.5% of its price. Important to note that the price reached its lowest point in December 2008 (in the sixth month after the drop started), then the price fluctuated and reached about the same level in September 2009. Considering the crisis and its trend low reached in 6 months, it is not the perfect example to compare with the current 2022-2023 corn price trend.

Let's continue to delve into the past! 44% tumble was printed between April 2004 and November 2005, i.e. 19 months .

Sending back 17 years ago, we can see a 64.4 % drop in 25 months .

Here we are in 1983, the era of high dollar inflation (and not only). The Fed chair Volcker Jr. is fighting with inflation ECONOMICS:USIRYY , and America is recovering from its 1979-1982 recession. The world economy is starting to recover from recession/slowdown too.

Between late August 1983 and February 1987 ( 43 months ), corn prices fell by 61.9% .

These data series are not enough to firmly generalize bearish trends . Besides, price movements in the past do not determine possible future patterns.

We can gently conclude that a bearish trend in corn prices that lasts more than a year could last between 19 and 43 months and show a drop between 40 and 64.4%.

In view of those facts and the performance of the corn daily prices in the last 1.5 months,

I forecast several scenarios.

In the first one, I expect that the price would break the 469-470 support zone and come to 400 cents per bushel until the end of September .

Then I expect some correction lasting 3-5 weeks. And the realization of scenario #1.5 (continuation of scenario #1), we could see a breakout of 400 cents and move to 345 cents per bushel before the end of the year . That would be the low or almost the low of the current long-term bearish trend for maze price. Combined scenarios #1 and #1.5 would mean minus 25% from the current price and a drop of 57.5% since April 2022.

There are two alternatives . In scenario #2 after reaching 400 cents, the price would return to 470 cents .

In scenario #3 the current support zone would be a minimum of the trend for the next 4.5 months.

Corn

Corn: Prepare to pop 🍿Corn has continued to sell off over the last few days and is now approaching our blue buy zone from USX 496 to USX 470. The downward movement in the form of the blue wave (b) should end there. Subsequently, we expect the blue wave (c) to rise to around USX 600, making it worthwhile for prospective buyers to place long orders in our blue buy zone. Our alternative scenario, with a 25% probability, occurs if the price falls further than we expect. In this case, a break of the support level at USX 474.25 would give it significant downside momentum that buyers should take note of.

Continuous CornContinuous Corn – Weekly: (Busy Chart) Currently in a sideways grinder going into an acres battle and Weather Market. Do not hesitate to Make decisions. The Red downtrending pitchfork controls the trend. Nearby resistance against the upper red line is set up with the 6.93 retracement target but volume by price resistance at 6.75-6.80. If the red line is broken for a short time look at further retracements that coincide with the lower blue line on the uptrending pitchfork. (7.24, 7.68, and 7.94) Theoretically the blue uptrend fork is still in play as long as the dashed gray uptrend line is not broken. Should we break below 6.23 then we most likely will see a test of the median line before we see 7.00 again. Median red line support in the 4.50 area targets Dec futures this Fall… **Many If/Then scenarios at Play**

Volume by price acts as a magnet. Currently the 6.75 area is pulling it up and would be resistance. The next volume spike by price is the 5.50 area and then the 4.25 area. This will act as support/risk moving forward as contract months roll forward...

It’s Corn!You know the “It’s Corn” song trending on TikTok? It brings a smile to our face every time we hear it. But if you look at Corn’s price chart and fundamental outlook, that’s a whole other story…

Corn’s recent breakout of a symmetrical triangle towards the downside caught our attention. With the clear break and an ensuing retest, Corn is now trading right on previous support levels. We think this might just be a small reprieve in the downward direction it is headed.

Not only that, when you zoom out to a longer timeframe, Corn has just broken its long-term trend support established since 2020.

This combined with the symmetrical triangle break proves to provide a strong bearish case from here. Classical chart pattern analysis points the take-profit range from the triangle pattern, at roughly 292 points away. From the initial point of breakout, 292 points away takes us back to the 360 level which was the average price seen from 2014 to 2020, back to pre-covid and pre-Russian/Ukraine conflict levels.

Additionally, in a or few previous analyses we emphasized how many of the commodities have started to return to ‘normality’ with prices moving back to pre-war levels. We have already seen Wheat and Soybean retracing most of the War rally as prices tumbled, therefore it’s not hard to see Corn do the same soon.

Other supporting fundamental factors include the falling Ethanol prices and in turn, lower usage of corn for Ethanol, resulting in overall supply to increase.

Fertilizer prices have also fallen from all-time highs, with continued downward momentum. Lower fertilizer cost means better margins for the farmers and potentially higher usage of fertilizers in planting, which may result in better crop yield. Both factors work to lower corn price through more competitive pricing from the farmers and increased supply.

Combined, we think the fundamental and technical chart set-up provides a convincing case for Corn to fall lower. We set our stops above the triangle apex and at the previous level of resistance, 688, and our initial take-profit levels at 565 followed by 455, giving us a risk reward of roughly 1.46 and 3.66 from the current level of 637.6. Each 0.0025 point increment in CME Corn Futures is equal to 12.5 USD.

The charts above were generated using CME’s Real-Time data available on TradingView. Inspirante Trading Solutions is subscribed to both TradingView Premium and CME Real-time Market Data which allows us to identify trading set-ups in real-time and express our market opinions. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

Disclaimer:

The contents in this Idea are intended for information purpose only and do not constitute investment recommendation or advice. Nor are they used to promote any specific products or services. They serve as an integral part of a case study to demonstrate fundamental concepts in risk management under given market scenarios. A full version of the disclaimer is available in our profile description.

Reference:

www.cmegroup.com

www.cmegroup.com

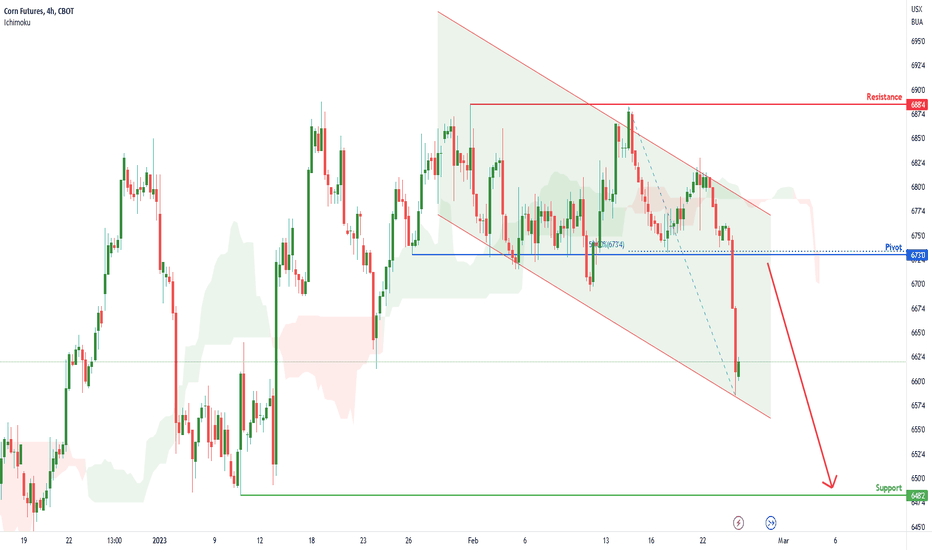

Corn Futures ( ZC1! ), H4 Potential for Bearish DropTitle: Corn Futures ( ZC1! ), H4 Potential for Bearish Drop

Type: Bearish Drop

Resistance: 688.50

Pivot: 673.00

Support: 648.25

Preferred case: Looking at the H4 chart, my overall bias for ZC1! is bearish due to the current price crossing below the Ichimoku cloud, indicating a bearish market. To add confluence to this bias, price is also within a descending channel. If this bearish momentum continues, expect price to possibly retest the pivot at 673.00 where the overlap resistance and 50% Fibonacci line is before heading towards the support at 648.25, where the previous swing low is.

Alternative scenario: Price may head back up to retest the resistance at 688.50 where the recent high is located.

Fundamentals: There are no major news.

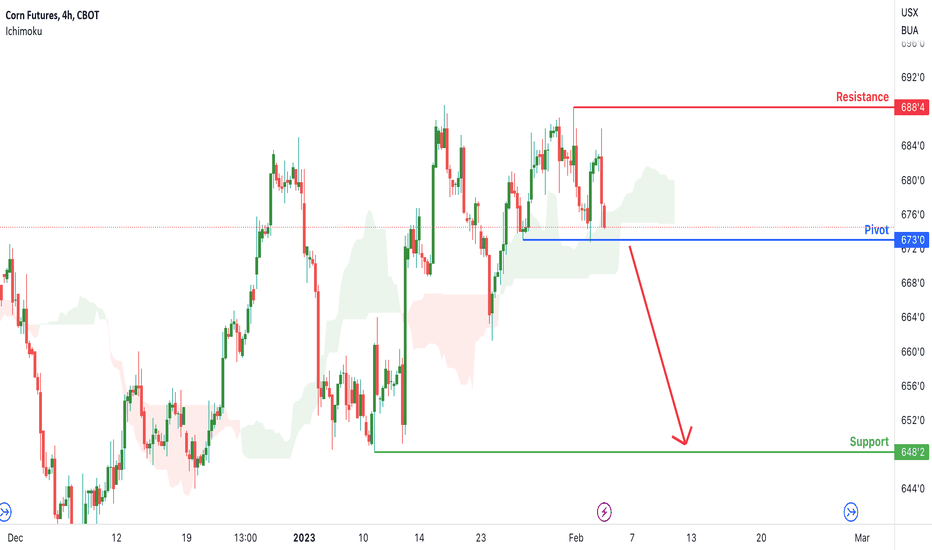

Corn Futures ( ZC1! ), H4 Potential for Bearish DropTitle: Corn Futures ( ZC1! ), H4 Potential for Bearish Drop

Type: Bearish Drop

Resistance: 688.50

Pivot: 673.00

Support: 648.25

Preferred case: Looking at the H4 chart, my overall bias for ZC1! is bearish due to the current price crossing below the Ichimoku cloud, indicating a bearish market. If this bearish momentum continues, expect price to possibly head towards the support at 648.25, where the previous swing low is.

Alternative scenario: Price may head back up to retest the resistance at 688.50 where the recent high is located.

Fundamentals: There are no major news.

Corn Futures ( ZC1! ), H4 Potential for Bullish ContinuationTitle: Corn Futures ( ZC1! ), H4 Potential for Bullish Continuation

Type: Bullish Continuation

Resistance: 706.50

Pivot: 6681.00

Support: 673.00

Preferred case: Looking at the H4 chart, my overall bias for ZC1! is bullish due to the current price being above the Ichimoku cloud, indicating a bullish market. If this bullish momentum continues, expect price to possibly head towards the resistance at 706.50, where the previous swing high is.

Alternative scenario: Price may head back down to retest the support at 673.00 where the recent low is located.

Fundamentals: There are no major news.

Corn Futures ( ZC1! ), H4 Potential for Bullish RiseTitle: Corn Futures ( ZC1! ), H4 Potential for Bullish Rise

Type: Bullish Rise

Resistance: 706.50

Pivot: 688.75

Support: 661.25

Preferred case: Looking at the H4 chart, my overall bias for ZC1! is bullish due to the current price being above the Ichimoku cloud, indicating a bullish market. If this bullish momentum continues, expect price to possibly head towards the resistance at 706.50, where the previous swing high is.

Alternative scenario: Price may head back down to retest the support at 661.25 where the 61.8% Fibonacci line and recent low are located.

Fundamentals: There are no major news.

Corn Futures ( ZC1! ), H4 Potential for Bearish DropTitle: Corn Futures ( ZC1! ), H4 Potential for Bearish Drop

Type: Bearish Drop

Resistance: 671.75

Pivot: 660.00

Support: 636.00

Preferred case: Looking at the H4 chart, my overall bias for ZC1! is bearish due to the current price being below the Ichimoku cloud, indicating a bearish market. If this bearish momentum continues, expect price to possibly continue heading towards the support at 636.00, where the previous swing low is.

Alternative scenario: Price may head back up to retest the pivot at 660.00 where the 50% Fibonacci line is.

Fundamentals: There are no major news.

ZC1! Potential For Bearish ContinuationLooking at the H4 chart, my overall bias for ZC1! is bearish due to the current price being below the Ichimoku cloud, indicating a bearish market. Looking for a sell stop entry at 648.50, to catch the bearish momentum. Stop loss will be placed at 664.00, where the recent high is. Take profit will be at 635.00, where the previous swing low is.

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Corn Futures ( ZC1! ), H4 Potential for Bearish DropTitle: Corn Futures ( ZC1! ), H4 Potential for Bearish Drop

Type: Bearish Drop

Resistance: 671.75

Pivot: 660.00

Support: 636.00

Preferred case: Looking at the H4 chart, my overall bias for ZC1! is bearish due to the current price being below the Ichimoku cloud, indicating a bearish market. If this bearish momentum continues, expect price to possibly continue heading towards the support at 636.00, where the previous swing low is.

Alternative scenario: Price may head back up to retest the pivot at 660.00 where the 50% Fibonacci line is.

Fundamentals: There are no major news.

ZC1! Potential For Bearish ContinuationLooking at the H4 chart, my overall bias for ZC1! is bearish due to the current price being below the Ichimoku cloud, indicating a bearish market. Looking for a possible sell entry at 659.25, where the 50% Fibonacci line and the liquidity hotspots are located. Stop loss will be at 671.75, where the 61.8% Fibonacci line is. Take profit will be at 638.25, where the -27.2% Fibonacci expansion line is.

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

ZC1! Potential For Bearish ContinuationLooking at the H4 chart, my overall bias for ZC1! is bearish due to the current price being below the Ichimoku cloud, indicating a bearish market. Looking for a pullback sell entry at 659.25, where the 50% Fibonacci line is. Stop loss will be at 671.75, where the 50% Fibonacci line is. Take profit will be at 635.00, where the previous swing low is.

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Corn Futures ( ZC1! ), H4 Potential for Bullish RiseTitle: Corn Futures ( ZC1! ), H4 Potential for Bullish Rise

Type: Bullish Rise

Resistance: 698.50

Pivot: 651.25

Support: 638.25

Preferred case: Looking at the H4 chart, my overall bias for ZC1! is bullish due to the current price being above the Ichimoku cloud, indicating a bullish market. If this bullish momentum continues, expect price to possibly head towards the resistance at 698.50, where the previous swing high is.

Alternative scenario: Price may head back down to retest the pivot at 651.25 where the 23.6% Fibonacci line and recent low are located.

Fundamentals: There are no major news.

ZC1! Potential For Bullish ContinuationLooking at the H4 chart, my overall bias for ZC1! is bullish due to the current price being above the Ichimoku cloud , indicating a bullish market. Looking for a pullback buy entry at 671.75, where the 50% Fibonacci line is. Stop loss will be at 659.25, where the 50% Fibonacci line is. Take profit will be at 698.25, where the previous swing highs are located.

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Corn Futures ( ZC1! ), H4 Potential for Bullish RiseTitle: Corn Futures ( ZC1! ), H4 Potential for Bullish Rise

Type: Bullish Rise

Resistance: 700.00

Pivot: 651.25

Support: 638.25

Preferred case: Looking at the H4 chart, my overall bias for ZC1! is bullish due to the current price being above the Ichimoku cloud, indicating a bullish market. If this bullish momentum continues, expect price to possibly head towards the resistance at 700.00, where the previous swing high is.

Alternative scenario: Price may head back down to retest the pivot at 651.25 where the 23.6% Fibonacci line and recent low are located.

Fundamentals: There are no major news.

Corn Potential For Bullish ContinuationLooking at the H4 chart, my overall bias for ZC1! is bullish due to the current price being above the Ichimoku cloud , indicating a bullish market. Looking for a pullback buy entry at 671.75, where the 50% Fibonacci line is. Stop loss will be at 659.25, where the 50% Fibonacci line is. Take profit will be at 698.25, where the previous swing highs are located.

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Price Action Analysis of Corn Futuresas we can see the apparent divergence was shown between April 2021 and April 2022.

followed by a drop-down below 0.236 Fibonacci level.

the price is still moving in a trading range which makes it hard to predict his next move.

Break bellow MA 209 with Big Volume signal a short entry.

Corn Futures ( ZC1! ), H4 Potential for Bullish RiseTitle: Corn Futures ( ZC1! ), H4 Potential for Bullish Rise

Type: Bullish Rise

Resistance: 700.00

Pivot: 651.25

Support: 638.25

Preferred case: Looking at the H4 chart, my overall bias for ZC1! is bullish due to the current price being above the Ichimoku cloud, indicating a bullish market. If this bullish momentum continues, expect price to possibly head towards the resistance at 700.00, where the previous swing high is.

Alternative scenario: Price may head back down to retest the pivot at 651.25 where the 23.6% Fibonacci line and recent low are located.

Fundamentals: There are no major news.

ZC1! Potential for Bullish Continuation Looking at the H4 chart, my overall bias for ZC1! is bullish due to the current price being above the Ichimoku cloud, indicating a bullish market. Looking for a pullback buy entry at 671.75, where the 50% Fibonacci line is. Stop loss will be at 659.25, where the 50% Fibonacci line is. Take profit will be at 698.25, where the previous swing highs are located.

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Corn Futures ( ZC1! ), H4 Potential for Bullish RiseTitle: Corn Futures ( ZC1! ), H4 Potential for Bullish Rise

Type: Bullish Rise

Resistance: 684.25

Pivot: 651.25

Support: 638.25

Preferred case: Looking at the H4 chart, my overall bias for ZC1! is bullish due to the current price being above the Ichimoku cloud, indicating a bullish market. If this bullish momentum continues, expect price to possibly head towards the resistance at 684.25, where the 78.6% Fibonacci line is.

Alternative scenario: Price may head back down to retest the pivot at 651.25 where the 23.6% Fibonacci line and recent low are located.

Fundamentals: There are no major news.

ZC1! Potential For Bullish ContinuationLooking at the H4 chart, my overall bias for ZC1! is bullish due to the current price being above the Ichimoku cloud, indicating a bullish market. Looking for a possible pullback buy entry at 660.00, where the 50% Fibonacci line is. Stop loss will be at 644.00, where the previous swing low is. Take profit will be at 680.00, where the 61.8% Fibonacci line is.

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.