CORN FUTURES (ZC1!) WeeklyDates in the future with the greatest probability for a price high or price low.

The Djinn Predictive Indicators are simple mathematical equations. Once an equation is given to Siri the algorithm provides the future price swing date. Djinn Indicators work on all charts, for any asset category and in all time frames. Occasionally a Djinn Predictive Indicator will miss its prediction date by one candlestick. If multiple Djinn prediction dates are missed and are plowed through by same color Henikin Ashi candles the asset is being "reset". The "reset" is complete when Henikin Ashi candles are back in sync with Djinn price high or low prediction dates.

One way the Djinn Indicator is used to enter and exit trades:

For best results trade in the direction of the trend.

The Linear Regression channel is used to determine trend direction. The Linear Regression is set at 2 -2 30.

When a green Henikin Ashi candle intersects with the linear regression upper deviation line (green line) and both indicators intersect with a Djinn prediction date a sell is triggered.

When a red Henikin Ashi candle intersects with the linear regression lower deviation line (red line) and both indicators intersect with a Djinn prediction date a buy is triggered.

This trading strategy works on daily, weekly and Monthly Djinn Predictive charts.

This is not trading advice. Trade at your own risk.

Zc1

CORN FUTURES (ZC1!) MonthlyDates in the future with the greatest probability for a price high or price low.

The Djinn Predictive Indicators are simple mathematical equations. Once an equation is given to Siri the algorithm provides the future price swing date. Djinn Indicators work on all charts, for any asset category and in all time frames. Occasionally a Djinn Predictive Indicator will miss its prediction date by one candlestick. If multiple Djinn prediction dates are missed and are plowed through by same color Henikin Ashi candles the asset is being "reset". The "reset" is complete when Henikin Ashi candles are back in sync with Djinn price high or low prediction dates.

One way the Djinn Indicator is used to enter and exit trades:

For best results trade in the direction of the trend.

The Linear Regression channel is used to determine trend direction. The Linear Regression is set at 2 -2 30.

When a green Henikin Ashi candle intersects with the linear regression upper deviation line (green line) and both indicators intersect with a Djinn prediction date a sell is triggered.

When a red Henikin Ashi candle intersects with the linear regression lower deviation line (red line) and both indicators intersect with a Djinn prediction date a buy is triggered.

This trading strategy works on daily, weekly and Monthly Djinn Predictive charts.

This is not trading advice. Trade at your own risk.

Long Term Prospects for CORNUSDThe CORNUSD, symbol ZC, is in a long-term Bear Market with price trading above the 50 week ema, but below the 200 and 800 week emas. The the long term emas are mostly flat, signaling accumulation / distribution. The price action appears to be finishing up the b-wave of a final y-wave down. This would correspond with a long-term commodities bottom expected in 2021.

The Market is in a deep correction on the daily, with price above the 50 ema, which is below the 200 and 800 emas, with the long term emas pretty much right on top of each other and mostly flat, signaling accumulation / distribution. Price is topping out in the b-wave of a a-b-c sell-off. Expect price to trade back below 3.606 before putting in a bottom. There is a serious Seasonal nature to the Corn market. Prices bottom in early Spring and then shoot up in May time frame. The chart expected price pattern reflects that with what that means in terms of the Elliott Wave pattern.

The Market was on the verge of being in a Bull Market on the 4 hour, with price trading back below the 50 ema, which is above the 200 ema, which is heading towards trading above the 800 ema. Price is now technically back in an correction. Would expect price to bang around here, testing emas, before turning down steadily in the c-wave of this correction. Probably open down next weeks, trade up towards the back end of the coming week to finish out an M-Top formation, before resuming the greater down-trend.

This is my CORNUSD look ahead for my own trading purposes. FUTURES trading involves risk. Feel free to comment, but trade off of this post at your own peril.

CORN futures: Cycles, 200MA cross and a double bottom“Hmmm, whats corn up to?” Glad you asked.

Looks like harvest is upon us. All commodities are cyclical, and agricultural commodities are seasonally cyclical. The red cycle lines go back to when Noah came off the ark and so you could almost set this to your clock. Now I’m not about to speculate what market conditions cause the price to normally rise in corn; go ask a farmer that question. This year however seems somehow different. I am absolutely expecting the typical rise and fall that happens every year. However this year seems to have set itself up different from all other years.

The Price action has crossed the 200 week MA and has just bounced off it proving its support. In the process creating a double bottom. The neckline of the double bottom indicated by the red dotted line will serve as our breakout point. Now I would not be in the slightest surprised that once it hits that neck line we get a failure and a return to the lower blue trend line. This condition will create a triangle, ultimately increasing the potential upward pressure that the price will see once the cycle hits. In 2015, 2016, and 2019 the rise going into the cycle peak was very sudden and I believe that the triangle could present a condition where the rush could really push this thing upward beyond the long term resistance at 4.22.

From where the price is today we’re looking at ~10% return if we have a return to resistance at 4.22. However given a triangle, a change in trend indicated by the 200 week MA cross this could indicate a very savage rise.

"CORN going down" by ThinkingAntsOkDaily Chart Explanation:

- Price started its down move from the Major Resistance Zone.

- Price made a retracement towards the Middle Resistance Zone.

- Now, it should be strong enough to go down towards our targets to the Support Zone first and to the Major Support Zone then.

Weekly Vision:

Updates coming soon!

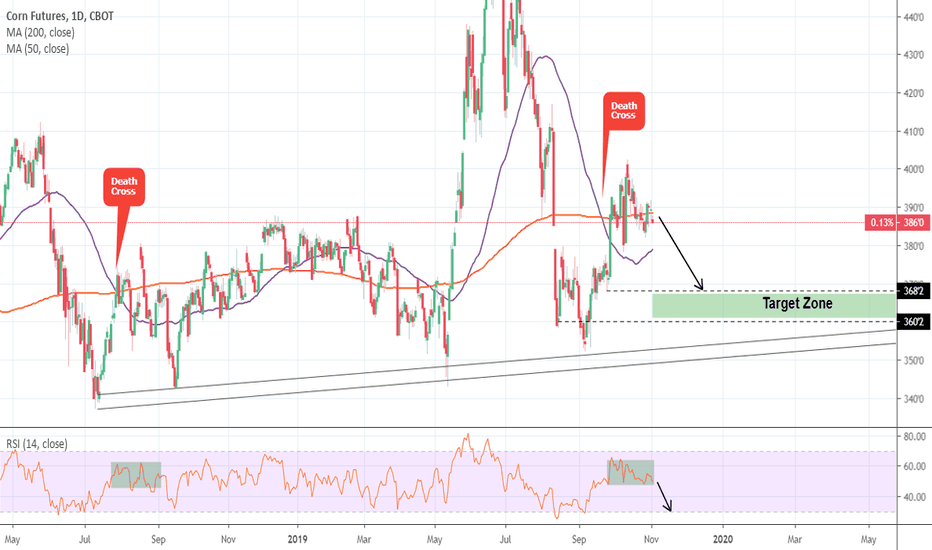

Corn: Short opportunity on 1D Death Cross and RSI.Corn has been consolidating recently following the 402 peak on 1D (RSI = 54.610, STOCH = 53.472, MACD = 0.760, ADX = 18.642) after the September Death Cross. A similar candle sequence took place in August 2018, when after a 1D Death Cross (MA50 under MA200) and a market Top, the price made a new Low (Higher Low on 1W).

Since the RSI is on the same zone as then, we are expecting a decline towards 368'2 - 360'2.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

"Corn on a Resistance Zone" by ThinkingAntsOkDaily Chart Explanation:

- On the Weekly Vision, price is in a huge lateralization, we see it has potential to move down towards the Support Zone.

- Now, price is on the Resistance Zone.

- We expect it to bounce from here.

- We are looking for sell setups on lower timeframes.

Weekly Vision:

Updates coming soon!

"Corn is retesting the Resistance Zone" by ThinkingAntsOkDaily Chart Explanation:

- Price started its down move after bouncing on the Major Resistance Zone.

- Now, price is on the Middle Resistance Zone.

- If it bounces from here, it has potential to continue its down move towards the Support Zone and, then, towards the Major Support Zone.

- We are looking for sell setups on lower timeframes.

Weekly Vision:

Updates coming soon!

"Top and Bottom Analysis on Corn" by ThinkingAntsOk4H Chart Explanation:

- Price is on a Micro Ascending Channel.

- Bearish Divergence on MACD.

- If price breaks the Channel, it has potential to move down towards the Middle Support Zone first and, then, towards the Support Zone.

Weekly Vision:

Daily Vision:

Updates coming soon!

Corn Sep 24 SHORTM pattern

Looking at our daily continuous corn contract we will first use our indicators such as RSI, Stoch RSI, and

MACD to determine possible directional position.

Or RSI is heading down the slightest but has been at this high level three major times with no success to

break through and has gone flat. Our Stoch RSI shows slight less buying pressure with the buy RSI above the sell

RSI, therefore still showing slight, not strong but still bullish presence.

Our MACD shows overbought conditions with our buy and sell looking to cross for selling pressure.

(Only 1 real bearish signs with a reasonable half bullish indicator.)

A 10R chart will show a more favorable move to the downside which will break it through the latest low.

an upside move using this technique is unlikely due to previous candle strength after Sep 17 drop.

We are in lower lows and lower highs pattern and are testing the third resistance touch with little strength

to break out.

THE WEEK AHEAD: GDXJ, /ZC, /ZSEARNINGS:

No earnings announcements this coming week in underlyings with highly liquid options with ideal rank/implied metrics (>70% rank/>50% 30-day implied).

EXCHANGE-TRADED FUNDS:

SLV (82/29)

GDX (74/33)

TLT (71/15)

GDXJ (60/37)

GLD (59/15)

XOP (35/37)

Precious metals ... again, with GDXJ offering the best volatility metrics (>50% rank/>35% 30-day implied)

BROAD MARKET:

IWM (23/19)

SPY (13/13)

QQQ (11/18)

EEM (7/16)

EFA (15/11)

FUTURES:

/SI (82/28)

/UB (71/5)

/ZB (71/12)

/ZN (61/6)

/ZS (63/28)

/GC (59/15)

/ZC (52/28)

Pictured here is a corn short strangle in the October/40 days 'til expiry cycle with strikes camped out around the 1 standard deviation on the put side at 14 delta and the call side at the 13 delta strike, resulting in a delta neutral setup supposedly paying 4.00 at the mid price with break evens at 336 and 409. Naturally, that'll have to be priced out during regular market hours. There also may be some benefit in going out to November, where the implied volatility is at 25.3% versus October's 24.1% and where implied volatility contracts from there into winter and spring with February at 20.5% and April at 17.5%.

An alternative trade would be in October beans; the 830/990 short strangle paying 4.75 with the short put erected at the one standard deviation strike on the put side, the call at the equally delta'd strike on the call. For contrast: corn's implied volatility term structure: October -- 23.3%, November 17.8%, December 19.2%, February 16.6%, April 15.8%.

Naturally, either of these setups can be transformed into defined risk, iron condor trades by buying wings.

VIX/VIX DERIVATIVES:

Yowsa! VIX finished the week at sub-14 (13.74), so it's basically time to hand sit on what you put on in August volatility and wait for the next >20 pop to short.

"Top and Bottom Analysis on Corn" by ThinkingAntsOk4 Hour Chart Explanation:

- Price started its down move on the Resistance Zone.

- Now, it is on a Bearish Corrective Structure.

- It has potential to move down towards the Middle Support Zone and, then, the Support Zone indicated on the chart.

Check out our last predictions on CORN (they were really precise)!!!

Weekly Analysis:

Daily Analysis:

Updates coming soon!

ZCK2020-ZCU2019 - Commodity Spread Trading on Corn FuturesZCK2020-ZCU2019

Spreads on corn futures almost reaching Take Profit.

Spreads are one of the most profitable forms of trading there are thanks to the statistical advantage on the seasonality of commodities.

If done respecting the rules of operation, you get on average a Winrate of 87% with a Risk Reward of 2/1.

Joe Ross is my greatest master in this field.

Corn bottomed?Corn bounced right off the range I mentioned on my last idea, Aggressive traders might go long here but it's probably best to wait for MACD signal and further strength. Seasonally corn is Not bullish at this time of the year, so it's best to be careful with longs

**If you're interested in joining a group of like-minded traders, send me a PM. This is NOT a subscription service, just bunch of average traders sharing insights in a FREE group

"Corn: going down as expected" by ThinkingAntsOkDaily Chart Explanation:

- Price bounced on the Major Resistance Zone and started the down move.

- It reached our first target for the bear move at the Middle Support Zone (4.00).

- Now, it has potential to move down towards our second target at the Support Zone (3.395).

- We are looking for sell setups on lower timeframes.

Check our our Weekly Vision. Updates coming soon!

Weekly Vision:

Looking for a tradeable low in Corntarget for short corn idea that I posted was hit, now I’m looking for a tradeable low, more downside is likely but it’s probably better to stay flat and let the market figure out from where to bounce and then get on the trend.

If 400 doesn’t hold, a low might form in the 380-391 region

** Just an idea NOT a forecast

"Short Setup on Corn (ZC1!)" by ThinkingAntsOk4 Hour Chart Explanation:

- Price bounced on the Resistance Zone (check it on the Weekly or Daily Vision).

- Price broke the Ascending Trendline.

- Price is, currently, on a Bearish Corrective Structure (ABC Elliot Count).

- If it breaks it at 4,215, the Short Move will be started.

- Our targets for that down move are the two Middle Support Zone and, finally, the Weekly Support Zone.

Check our Weekly and Daily Analysis. They can be really helpful for you!

Weekly Analysis:

Daily Analysis:

"Top and Bottom Analysis on Commodities: Corn" by ThinkingAntsOk4 Hour Chart Explanation:

- Price bounced on the Macro Resistance Zone and broke the Ascending Trendline.

- It is currently retesting the Resistance Zone (Pullback).

- If price starts its down path, we have two potential targets points: the Middle Support Zone at 3,782 and the Major Support Zone at 3,424.

Also, our Weekly and Daily Analysis are short views on the Corn.

Weekly Analysis:

Daily Analysis: