Zecusdlong

ZEC Price at Resistance | holding ema 200zec coin price holding above the ema 200 also at very critical level

As you can see red zone is very important zone for price to climb , if zec coin price close above this red zone it can move higher

and after breakout price can easily touch 90 - 100$ in short time

zec coin chart looks perfect, our plan is watching the bounce with breakout of resistance and buying the retest of the red zone will wait for the daily close above this zone than we will enter long trade

zec available on binance future platform you can check it out

binance future is very risky so don't use blindly

LONG ZEC/USD HEARTATTACKINCOMING!I am very confident on the ZEC / USD pair, I expect some long positions to bring some satisfaction into our pockets. If this move is seen by the bulls as an H&S we can see the ZEC move up to the third target between $ 165 and $ 175. I chose this pair as an analysis because Zcash in addition to halving the rewards is still a bit behind the main Bitcoin forks. If you appreciated my work you can donate I would be grateful. If you want to donate me privately or simply to chat with me, do not hesitate to contact me privately. Thanks for your attention guys!

ZECUSD is getting bounced from the strongest support lineHey, friends hope you are well and welcome the new update on Zcash (ZEC) coin.

By the grace of Allah the most high my previous idea has been executed exactly as per defined targets:

Now on the weekly chart the priceline is having very nice bounce from 25 and 100 simple moving averages moreover the 25 SMA also has formed bull cross with 100 simple moving average. The 200 SMA is at $135 that can work as strong resistance as well.

On daily chart the priceline is moving in down channel since 1st Aug 2020. Now finally the priceline is closed above exponential moving averages with the time period of 10 and 21. The EMA 10 and 21 also have formed bull cross that can lead the priceline of Zcash to breakout the resistance of this down channel as well.

Volume profile of complete channel showing no interest of traders below $51 and very less interest above $80. Therefore a movement upto $80 is confirmed and there will be less chances to break down the support.

As we have seen earlier that the priceline of ZEC is getting bounced from the 25 and 100 SMAs on the weekly chart and also closed above the EMAs 10 and 21 on daily chart and likely to break out the resistance of the down channel as well. In the meanwhile, it has also formed the most significant bullish move and that move is the price action has reached the support. And this is the most strongest support since Nov 2019. We can observe that after reaching at this support the priceline 1st rallied 186% then 209%. At this time we can again expect another powerful bullish move again.

Conclusion:

Even though the priceline is having a very nice bounce from the long term support on weekly chart, however, we should use this support as stop-loss as well. If the next bullish rally will be started from here (as it seems to be) then a move up to 200 SMA can be expected that is at $135 at the time of writing.

ZEC/USD will rise!!!I see a bullish gartley pattern and expect a pull back to 55.85 for Zerocash. If it breaks yellow resistance in a bullish way, it can continue to its grow.

Targets:

-55.85

-58.7

-61.55

-63.30

Stop loss:

51.10

Have a nice day,

Berk.

ZECUSD: Downtrend (11.09.2020)On D1, the cloud is directing downward, indicating a downtrend.

On H4, the price fluctuates around the cloud, which indicates the formation of a correction.

Besides, on H4 and H1, the correction model in the form of a triangle is visually well visible.

We recommend selling on the breakdown of the downward correction model boundaries, or in case of false growth to the level of 68 (when RSI will reached overbought level on H1 and H4).

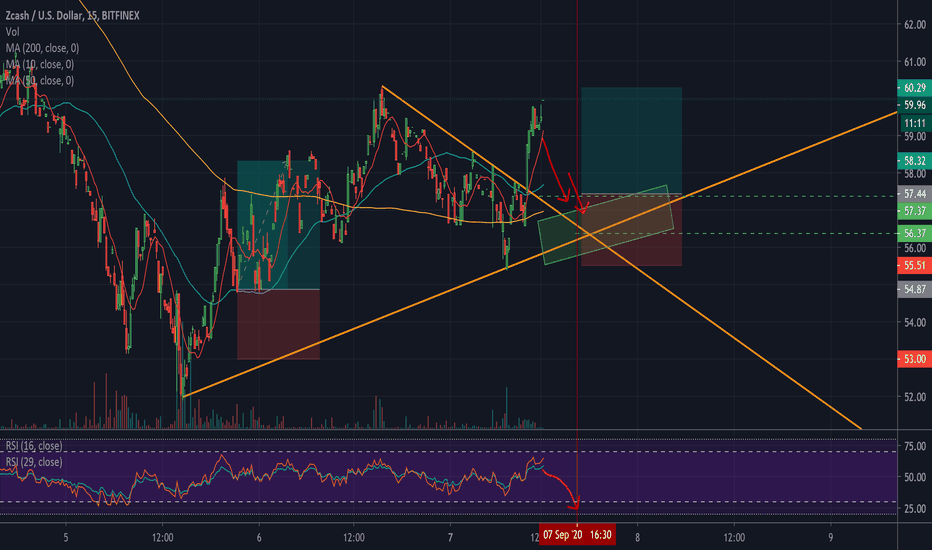

ZCash Needing a Dip to 56.37-57.37 to Cross trendlines to LongI've been having success at Scalping #Zcash and #Litecoin as of late. Their patterns have become quite prediectable. In this chart you can see where a descending overthrow trendline meets the underlying, more powerful uptrendline. If the price action meets at the exact spot needed, a long may be the best opportunity. Granted I may need other confluences such as the RSI and I'll take a look at the MACD. But after some major drops in Crypto overnight, it seems like they're trying to make a comeback. with resistance on Zcash being around the $60 mark, I wouldn't shoot for any higher than that as my Take Profit. Let me know what you think.

Here's a previous Zcash win using my double RSI strategy. The (Over sold on the 19, diference of 7 or more between the 16 ans 29 RSI, Crossed The 50 and the 200 MA was used as support. Was the perfect time to pull the trigger and land nearly a 20 pip scalp.

ZECUSD: Good opportunity for LongAt D1, the cloud is directing upward, indicating an uptrend. The RSI moved down and the price found support on the Ichimoku cloud.

At H4, the cloud is directing downward, indicating a price correction at the D1 timeframe.

Besides, RSI is at the oversold level, which indicates the weakness of sellers.

We recommend buying ZECUSDT near the 50% Fibonacci level and take the profit near the level of 108.

Zcash correction completedWell it looks like Zcash dropped one more Fibonacci level to around the 78.6% retracement level (~$79.16). In my defense, I did say “wait for confirmation”... Whether you bought it around the 61.8% retracement level or waited for it to fall, you won’t have any regrets in the long run. (If you don’t already know, cryptocurrencies follow bitcoin’s lead, bitcoin moves in four year cycles, crypto’s growth relative to fiat is always logarithmic... but that’s getting off topic). Although you can’t go wrong buying crypto at any time during the current bull run, it’s always fun to try to identify the bottom of a C wave in an Elliot wave pattern as a perfect time to buy. I believe that’s where we are at right now with Zcash.

There’s something else interesting about the support level Zcash just bounced at, however. It almost perfectly lines up with the Feb 14 resistance level. That level (~$76.10), coupled with the 78.6% Fibonacci retracement level of the current correction, makes for an ideal new support level and great buy opportunity.

Great Zcash buy opportunity!ZECUSD formed a beautiful Elliot wave from July 5 - Aug 6. The correction that has followed is fitting nicely into Fibonacci retracement lines and it’s easy to see that we are on the C wave of an ABC correction. This has almost hit the 61.8% retracement ($84.39). I fully expect it to turn the corner there and enter another 5 waves up. As always, wait for confirmation. Note that so many other cryptos are bullish right now, whereas ZEC is doing it’s obligatory post-rally ABC dance. ZEC almost always moves with the rest of the crowd (and, when it doesn’t, it mimics whatever Monero is doing). The overall crypto trend, and Monero itself, are bullish right now ( duh ). Thus, we have every reason to believe that ZEC is at the perfect moment to buy. Once it tags that fib line, it should waste no time joining back up with the rest of the herd in the running of the bulls!

ZECUSD: Analysis using Ichimoku 30/06/2020H4

On D1, the cloud is directing upward, indicating an uptrend.

Conclusion:

Locally, we recommend buying when the RSI reaches an oversold level on the H4.

H1

At H4, the cloud is directing downward, indicating a downtrend.

Conclusion:

Locally, we recommend selling when the RSI reaches an overbought level on the H1.

ZECBTC UPDATE 990410ZECBTC UPDATE 990410

The probability of a fall is higher, but eventually the numbers 61 and 65 will be seen.

Failure of the process and increase of ZEC\BTC up to 25%Failure of the process and increase of ZEC\BTC up to 25% (But if it closes above 603)

25% profit at point 710