Zeta

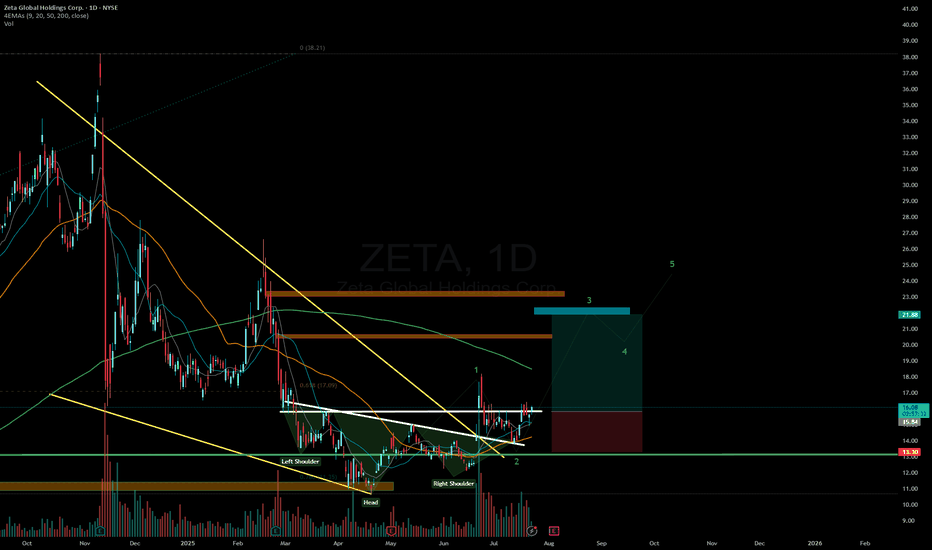

ZETA: when a wedge isn’t just a wedge — it’s a launchpadTechnically, this setup is textbook clean. Price completed the fifth wave within a falling wedge and instantly reacted with a bullish breakout. The expected breakdown didn’t happen — instead, buyers stepped in, confirmed by rising volume. All EMAs are compressed at the bottom of the structure, signaling a clear shift in momentum. The volume profile shows strong accumulation around $14, while the area above current levels is a vacuum — ideal conditions for acceleration.

The key resistance zone is $16.70–17.20 — former base highs and the 0.236 Fibonacci retracement. If price breaks this area with volume, the next stop is likely $24.48 (0.5 Fibo). Classical wedge targets land at $38.28 and $55.33 (1.272 and 1.618 extensions). If a trending leg begins, it could move fast — because there’s simply no supply overhead.

Fundamentals:

ZETA isn’t a profitable company yet, but it shows consistent revenue growth and aggressive expansion. Capitalization is rising, debt is manageable, and institutional interest has increased over recent quarters. In an environment where tech and AI are regaining momentum, ZETA could be a speculative second-tier breakout candidate.

Tactical plan:

— Entry: market or after a retest of $14.00–14.30

— First target: $17.20

— Main target: $24.48

— Continuation: $38.28+

— Stop: below $13.00 (bottom wedge boundary)

When the market prints a wedge like this and the crowd ignores it — that’s often the best trap setup. Only this time, it’s not for retail buyers. It’s for the shorts. Because when a falling wedge breaks to the upside with volume — it’s time to buckle up.

#ZETA/USDT#ZETA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel. This support is at 0.1933.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are heading towards stability above the 100 Moving Average.

Entry price: 0.2014

First target: 0.2076

Second target: 0.2144

Third target: 0.2228

#ZETA/USDT#ZETA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a rebound from the lower boundary of the descending channel, which is support at 0.2386.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.2590

First target: 0.2682

Second target: 0.2800

Third target: 0.2935

#ZETA/USDT#ZETA

The price is moving within a descending channel on the 1-hour frame and is expected to continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward move with a breakout.

We have a support area at the lower boundary of the channel at 0.2400.

Entry price: 0.2435

First target: 0.240

Second target: 0.2526

Third target: 0.2435

#ZETA/USDT#ZETA

The price is moving within a descending channel on the 1-hour frame and is expected to continue lower.

We have a trend to stabilize below the 100 moving average once again.

We have a downtrend on the RSI indicator, supporting the upward move with a breakout.

We have a resistance area at the upper limit of the channel at 0.3088.

Entry price: 0.3022

First target: 0.2924

Second target: 0.2858

Third target: 0.2780

#ZETA/USDT#ZETA

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are seeing a bounce from the lower boundary of the descending channel, which is support at 0.3013.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.3140

First target: 0.3390

Second target: 0.3637

Third target: 0.3954

$ZETA will continue to climb up > $30 - Ignore FUD, accumulate like the whales 🐋

- Zeta Global Holdings Corp. (NYSE: ZETA) reported robust financial performance in the third quarter of 2024, with revenue reaching $268 million—a 42% year-over-year increase.

STOCK TARGET ADVISOR

- This growth underscores the company's strong market position and effective strategic initiatives.

- Analysts have responded positively, with Needham & Company LLC reaffirming a "buy" rating and setting a price target of $43.00, suggesting a potential upside of approximately 99.81% from the current share price.

Zeta ($ZETAusdt): Daily Chart Analysis for Strategic EntryI spend time researching and finding the best entries and setups, so make sure to boost and follow for more.

Zeta ( KUCOIN:ZETAUSDT ): Daily Chart Analysis for Strategic Entry

Trade Setup:

- Entry Price: $0.7003

- Stop-Loss: $0.5102

- Take-Profit Targets:

- TP1: $1.0624

- TP2: $1.7275

Fundamental Analysis:

Zeta ( KUCOIN:ZETAUSDT ) is an emerging cryptocurrency focusing on decentralized interoperability across blockchain networks. Its ability to facilitate seamless asset transfers and support cross-chain smart contracts makes it a unique player in the market. Recent upgrades to its protocol, including enhanced transaction speeds and reduced fees, have increased its adoption in DeFi ecosystems.

Technical Analysis (Daily Chart):

- Current Price: $0.7150

- Moving Averages:

- 50-Day SMA: $0.6500

- 200-Day SMA: $0.5800

- Relative Strength Index (RSI): Currently at 58, showing bullish momentum but still within a neutral zone.

- Support and Resistance Levels:

- Support: $0.6000

- Resistance: $0.8500

The daily chart shows a clear ascending trendline, with KUCOIN:ZETAUSDT recently breaking above a key resistance level at $0.6900. A sustained hold above $0.7000 could confirm a breakout toward TP1 at $1.0624, with TP2 at $1.7275 as a long-term target.

Market Sentiment:

ZETA has seen growing interest following announcements of strategic partnerships with major DeFi platforms. Increased trading volume indicates strong investor confidence, particularly among institutional players exploring cross-chain solutions.

Risk Management:

Setting a stop-loss at $0.5102 limits potential downside risk, ensuring a manageable loss if the trade moves against expectations. The take-profit targets offer an excellent risk-to-reward ratio for traders looking to capitalize on ZETA's upward momentum.

When the Market’s Call, We Stand Tall. Bull or Bear, We’ll Brave It All!

Zetachain , young valuable It’s a young chart but a promising project like zeta gives me good vibes, the chart is similar to some of the previous cycle birds so I think it’s cool to have some and accumulate in percentages till the box , not sure if it’s goes in that direction tho but if it’s go it’s a chance .

ZETA reversal ZETA recently suffered a short attack on its earnings which were amazing

The short attack made Zeta dropped a lot making it a very cheap stock to own.

After the short attack was over and the cloud was cleared Zeta is now moving very quickly towards its ATH .

Zeta has bounced off really nicely from its 200 SMA and 50 SMA

Entry : Now ( 25-27)

Stop loss : 19

#ZETA Looks prime for a 300% Rally but can you Hold?NYSE:ZETA looks promising, breaking out as we speak.

I've opened a small position and plan to increase it too if it dips into my buy zones.

My manual buy levels are:

- $0.7889

- $0.7557

- $0.7122

- $0.6867

SL: $0.5901

Targets: .97, 1.26, 1.55, 1.87, 2.17, 2.55, 2.89, 3.01

Feel free to add and DCA (Dollar Cost Average) if you like it when it dips.

dyor, nfa

$FIDA

Do hit that like button if you like it and share your views in the comment section.

Thank you

#PEACE

Support range: 0.6903-0.7160

Hello, traders.

If you "Follow", you can always get new information quickly.

Please click "Boost" as well.

Have a nice day today.

-------------------------------------

(ZETAUSDT 1W chart)

The point to watch is whether the MS-Signal (M-Signal on the 1W chart) indicator can rise above and maintain the price.

In other words, the key is whether it can receive support near 0.7160 and rise above 0.618 (0.8178).

-

(1D chart)

The current volume profile range is formed at 2.0699.

Therefore, from the current price position, it is expected that a full-fledged uptrend will begin only when it rises above 2.0699.

In order to show such an uptrend, it is important to first find support near 0.7160 and then rise above 0.8390.

If it fails to rise and falls below 0.6903, it is necessary to check whether it can find support near 0.5408.

-

Have a good time.

Thank you.

--------------------------------------------------

- Big picture

I used TradingView's INDEX chart to check the entire range of BTC.

(BTCUSD 12M chart)

Looking at the big picture, it seems that it has been maintaining an uptrend following a pattern since 2015.

In other words, it is a pattern that maintains a 3-year uptrend and faces a 1-year downtrend.

Accordingly, the upward trend is expected to continue until 2025.

-

(LOG chart)

As you can see from the LOG chart, the upward trend is decreasing.

Accordingly, the 46K-48K range is expected to be a very important support and resistance range from a long-term perspective.

Therefore, we do not expect to see prices below 44K-48K in the future.

-

The Fibonacci ratio on the left is the Fibonacci ratio of the upward trend that started in 2015.

In other words, it is the Fibonacci ratio of the first wave of the upward wave.

The Fibonacci ratio on the right is the Fibonacci ratio of the upward trend that started in 2019.

Therefore, it is expected that this Fibonacci ratio will be used until 2026.

-

No matter what anyone says, the chart has already been created and is already moving.

It is up to you to decide how to view and respond to this.

When the ATH is updated, there are no support and resistance points, so the Fibonacci ratio can be used appropriately.

However, although the Fibonacci ratio is useful for chart analysis, it is ambiguous when used as support and resistance.

This is because the user must directly select the important selection points required to create Fibonacci.

Therefore, since it is expressed differently depending on how the user specifies the selection points, it can be useful for chart analysis, but it can be seen as ambiguous when used for trading strategies.

1st : 44234.54

2nd : 61383.23

3rd : 89126.41

101875.70-106275.10 (Overshooting)

4th : 134018.28

151166.97-157451.83 (Overshooting)

5th : 178910.15

-----------------

ZETAUSDT Ascending Triangle PatternZETAUSDT Technical analysis update

ZETA price has formed an ascending triangle pattern on the daily chart and is moving towards the triangle's resistance for a potential breakout. The price is trading above the 100 EMA, which is considered bullish. A confirmed breakout can be anticipated once the price surpasses the 0.80 level on the daily chart. If this breakout occurs, it may lead to strong upward momentum and further bullish action.

ZETAUSDT Bearish Continuation.ZETAUSDT TEchnical analysis update

ZETA has formed a bearish triangle pattern on the 4-hour chart. A breakdown below the triangle's support level has been confirmed, suggesting increased bearish momentum. With this breakdown, the price may potentially drop to the $0.34 level as the next support target. If selling pressure continues, further declines could occur before any signs of a reversal emerge.

Unlocking the Comedy: When Token Vesting Turns into a Token DumpThis particular COINBASE:ZETAUSD COINBASE:ZETAUSD project has a 13% unlock of the circulating supply , which, while not as extreme as BINANCE:TIAUSDT 's 80% set to release in under 48 hours, still presents a solid opportunity for profit. I speculate and anticipate a 15% price drop within four days following the unlock , as those receiving the tokens are likely to sell off a great portion to unsuspecting investors.

When researching the founders, it’s evident they are trying to maintain a low profile , which is often a red flag for projects lacking substance. The founders, Charlie Pyle and Ankur Nandwani, have not made significant contributions relative to the enormous funds they are collecting through this questionable venture. Notably, they recently left or were fired from prominent projects, likely seeing an opportunity to cash in by launching yet another crypto project amidst the sea of existing ones . They seem to be targeting decentralization believers and hopefuls who dream of striking it rich early on, only to find themselves investing in yet another lackluster scheme. Many of these investors are eager to believe in the potential of new projects, but when you look behind the scenes, it’s often just another facade run by self-proclaimed academic philosophers with little to offer .

The upcoming cliff unlock primarily benefits core contributors and advisors, who will receive 11% of the circulating supply monthly from August 1, 2024, to February 1, 2025.

In the chart, you’ll notice some fake pumps highlighted in the green circle I drew. However, the overall trend for this project is clearly downward . The three yellow circles with purple centers indicate the days of each cliff unlock, and it’s evident that selling pressure increases in the days that follow. Keep an eye on these patterns as they reveal the true nature of the market!