GBP Falls as Trade Tensions Fuel RecessionThe British pound fell to $1.28, its lowest since March 4, as Trump’s trade policies fueled recession fears. After China imposed 34% tariffs on U.S. goods, markets raised BoE rate cut bets. Traders now price in 88 bps of cuts by December, up from 43 bps in March, with a 90% chance of a 25bps cut in May.

If GBP/USD breaks above 1.2850, resistance levels are at 1.2900 and 1.2940. Support is at 1.2715, followed by 1.2650 and 1.2600.

Zforexresearch

Euro Firms as U.S.-China-EU Trade Rift WidensThe euro hovered near $1.10, its highest since October 2024, as the dollar weakened and trade tensions escalated. China plans to impose 34% tariffs on all U.S. goods from April 10, following Trump’s 10% tariff on all imports, including 20% on EU and 34% on Chinese goods. France urged firms to halt U.S. investments, and the EU is preparing countermeasures. Markets now price in a 90% chance of an ECB rate cut in April, with the deposit rate seen falling to 1.65% by December from 2.5%.

Key resistance is at 1.1100, followed by 1.1150 and 1.1215. Support lies at 1.0900, then 1.0850 and 1.0730.

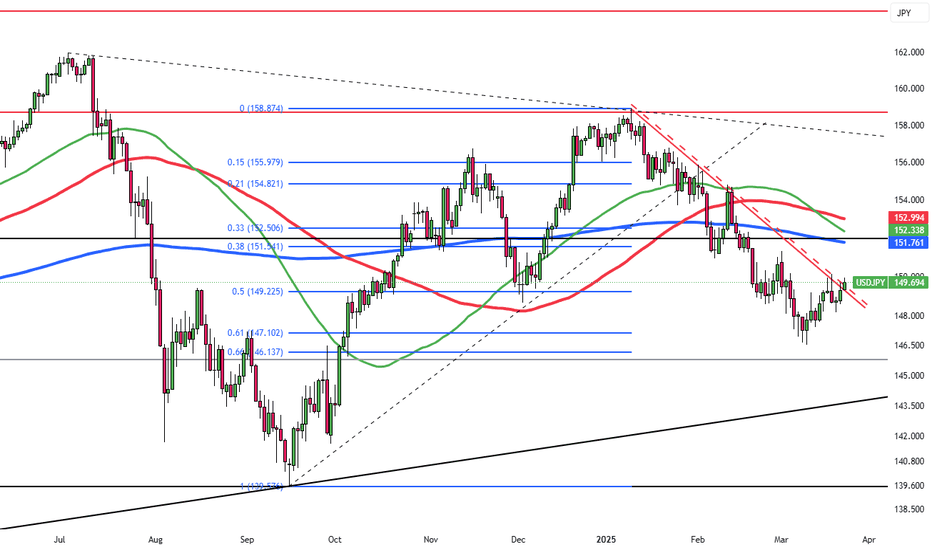

Yen Climbs on Trade Talks, Record SurplusThe Japanese yen climbed toward 147 per dollar on Tuesday, reversing losses as trade uncertainty lifted safe-haven demand. Trump agreed to begin trade talks with Japan after speaking with PM Shigeru Ishiba and Treasury Secretary Scott Bessent to lead talks covering tariffs, currency, and subsidies. Trump denied delaying tariffs, saying they may stay indefinitely. Domestically, Japan’s current account surplus hit a record high in February, backed by strong exports and lower imports, further supporting the yen.

Key resistance is at 148.70, with further levels at 152.70 and 157.70. Support stands at 145.60, followed by 143.00 and 141.80.

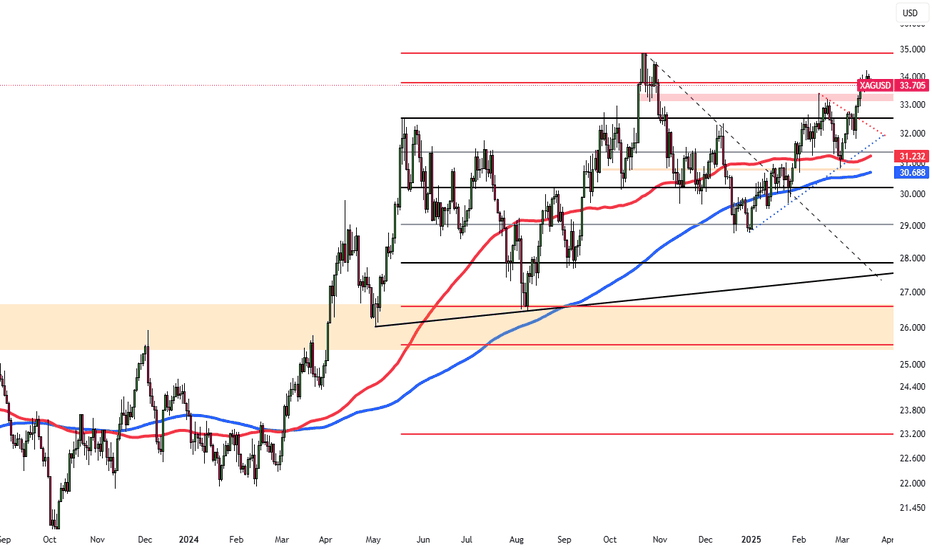

Silver Rebounds Sharply on Risk AversionSilver rebounded Monday, rising 2.3% to $30.22 an ounce after hitting a seven-month low. The recovery followed sharp market volatility and recession fears from rising U.S.-China trade tensions. While silver benefits from safe-haven demand, its industrial use remains a weakness. Broader market sell-offs could keep price action choppy, but intensified risk aversion and Fed easing could support silver demand.

If silver breaks above $30.90, resistance levels are at $31.40 and $32.50. Support stands at $29.00, followed by $28.40 and $27.50.

Gold Stabilizes Near 3-Week LowGold steadied around $3,030 per ounce on Monday after falling over 1% to a three-week low. The drop sparked speculation that investors were taking profits or covering losses amid broader market declines driven by recession fears from escalating trade tensions. Fed Chair Jerome Powell warned that tariffs could raise inflation and slow growth, underscoring challenges for policymakers.

Key resistance is at $3,050, followed by $3,085 and $3,105. Support stands at $2,980, then $2,930 and $2830.

Silver Rises as Markets Eye Trump TariffsSilver rose above $33 on Tuesday, rebounding as trade and economic concerns supported safe-haven demand. Hopes that Trump may adopt a more targeted tariff plan ahead of the April 2 deadline offered some relief, though his new pledges to tax autos and pharmaceuticals added uncertainty. Expectations of further Fed rate cuts also supported silver. Markets now anticipate one cut in June, another in September, and growing chances of a third in December.

If silver breaks above $33.80, the next resistance levels are $34.05 and $34.85. On the downside, support is at $33.10, with further levels at $32.50 and $32.15 if selling pressure increases.

Yen Steady Near 150.7 as Dollar StrengthensThe Japanese yen hovered near 150.7 per dollar on Tuesday as the U.S. dollar strengthened. Concerns grew over Japan’s exports following Trump’s proposed tariffs on autos and pharmaceuticals. BOJ minutes showed officials remain open to future rate hikes, with one member suggesting a 1% rate by late FY2025. The central bank kept rates steady at 0.5% last week, citing global uncertainties.

Key resistance is at 151.70, with further levels at 152.70 and 154.00. Support stands at 147.00, followed by 145.80 and 143.00.

Tariff Fears Drive Silver to $33.10Silver rose above $33.10 per ounce on Tuesday, snapping a four-day losing streak. The market focused on U.S. diplomatic efforts in the Russia-Ukraine conflict and escalating violence in the Middle East after an Israeli airstrike on a Gaza hospital.

A weaker U.S. dollar also supported silver, with concerns growing that Trump’s proposed tariffs could slow economic growth, fueling speculation of further Fed rate cuts. Meanwhile, investors assessed China’s outlook after Premier Li Qiang urged global cooperation to stabilize economic conditions.

If silver breaks above $33.75, the next resistance levels are $34.05 and $34.85. On the downside, support is at $33.10, with further levels at $32.50 and $32.15 if selling pressure increases.

Gold Nears $3,010, PCE in FocusGold hovered around $3,010 per ounce after three straight losses as markets observed Trump’s mixed tariff signals. He suggested possible levies on cars and Venezuelan oil but hinted some countries may be exempt from next week’s reciprocal tariffs, creating uncertainty.

Gold remained supported, though pressure came from Fed official Raphael Bostic, who forecast slower inflation progress and just one 25bps rate cut this year. Friday’s PCE data is now awaited for more clues on the Fed’s next move.

GBP/USD Stable at $1.292: Budget AwaitedGBP/USD is trading steadily around $1.292 as markets await British finance minister Rachel Reeves’ spring budget update. Despite dollar strength from solid U.S. data and rising Treasury yields, the pound remains resilient, supported by cautious optimism over the UK’s fiscal outlook. Traders are watching the upcoming budget for clues on spending and economic forecasts, which could impact GBP/USD in the near term.

If GBP/USD breaks above 1.3050, the next resistance levels are 1.3100 and 1.3150. On the downside, support stands at 1.2860, with further levels at 1.2800 and 1.2715 if selling pressure increases.

US PMI Strength Drives Dollar HigherEUR/USD is trading at $1.08 as the U.S. dollar strengthens on solid U.S. services PMI data, which signaled economic resilience and pushed yields higher. Confidence in the dollar was further enabled by Trump’s remarks suggesting not all April 2 tariffs will be implemented, with possible exemptions for some countries. Meanwhile, the euro is under pressure as its recent rally fades and Eurozone economic signals weaken, keeping EUR/USD on a downward path driven by dollar strength.

Key resistance is at 1.0860, followed by 1.0950 and 1.1000. Support stands at 1.0730, with further levels at 1.0660 and 1.0600.

Japan's Tariff Worries and BOJ Rate Hike HintsThe Japanese yen remained weak around 150.7 per dollar on Tuesday, near a three-week low, as the U.S. dollar gained strength. Trump's plan to impose tariffs on autos, pharmaceuticals, and other sectors raised concerns for Japan’s export-driven economy.

BOJ minutes from January showed officials remain open to future rate hikes depending on wage and inflation trends, with one member suggesting a possible increase to 1% in late fiscal 2025. Still, the BOJ kept rates steady at 0.5% last week, maintaining a cautious stance with global tensions.

Key resistance is at 151.70, with further levels at 152.70 and 154.00. Support stands at 147.00, followed by 145.80 and 143.00.

Silver's Limited Rebound at $33.06Posting a modest rebound after last week’s dip, silver currently trades around $33.06 per ounce. The recovery is limited as easing geopolitical tensions compete with the pressure from a strong U.S. dollar. Demand stays strong due to tariff uncertainty and inflation risks, but weak industrial outlook, mainly from China, and hopes for a Russia-Ukraine ceasefire are limiting silver’s gains. Still, tightening supply and global economic concerns are helping keep silver near five-month highs.

If silver breaks above $33.75, the next resistance levels are $34.05 and $34.85. On the downside, support is at $33.10, with further levels at $32.50 and $32.15 if selling pressure increases.

Ukraine Talks and Gaza Tensions Influence XAUUSD Gold dipped to around $3,015 per ounce as hopes for a Russia-Ukraine peace deal grew after talks between Ukrainian and U.S. officials. Further negotiations with Russia are expected later today.

Despite the drop, gold remains supported by the tension over U.S. tariffs and Fed rate cut expectations. The Fed kept rates steady last week while signaling two potential cuts this year. Meanwhile, geopolitical pressures remain high as Israel resumed airstrikes on Hamas targets in Gaza.

Key resistance stands at $3082, with further levels at $3100 and $3,150. Support is at $3000, followed by $2,980 and $2,916.

Dollar Pressure Support GBP/USD at 1.2915GBP/USD is trading around 1.2915, supported by a weaker U.S. dollar and steady investor sentiment. The pound benefits from political stability and steady UK economic expectations with the focus on the upcoming April 2 U.S. tariff announcement. The pair is rebounding from recent lows but remains range-bound as traders await new drivers, especially from U.S. trade actions and global growth indicators.

If GBP/USD breaks above 1.3050, the next resistance levels are 1.3100 and 1.3150. On the downside, support stands at 1.2860, with further levels at 1.2800 and 1.2715 if selling pressure increases.

Yen Weakens Toward 150 on Weak DataThe Japanese yen weakened toward 150 per dollar, extending losses as disappointing business activity data overshadowed the BOJ’s hawkish stance. Japan’s private sector contracted in March for the first time in five months, with manufacturing shrinking for a ninth month and services slipping into negative territory.

While the BOJ kept its policy rate at 0.5% last week and maintained a careful tone before Trump’s predicted April 2 tariff announcement, the central bank is still expected to raise rates later this year due to steady inflation and wage growth. Ongoing external pressures also continued to weigh on the yen.

Key resistance is at 150.30, with further levels at 152.00 and 154.90. Support stands at 147.00, followed by 145.80 and 143.00.

Silver Steadies Near $33.20 After PullbackSilver hovered near $33.20 on Friday morning after two consecutive sessions of decline. The recent upward momentum, initially fueled by China’s stimulus measures, has temporarily stalled. Nevertheless, the potential for further gains remains intact amid persistent uncertainty surrounding former President Trump’s tariff policies and escalating geopolitical risks. In addition, the Federal Reserve’s soft approach to interest rates, even if temporary, continues to support interest in non-yielding assets like silver.

If silver breaks above $33.75, the next resistance levels are $34.05 and $34.85. On the downside, support is at $33.10, with further levels at $32.50 and $32.15 if selling pressure increases.

GBP Retreats as BoE Maintains PolicyThe pound dipped below $1.30, retreating from a four-month high after the BoE held rates at 4.5% and signaled a cautious approach to easing policy, despite recent inflation progress.

Global trade tensions added pressure, with new U.S. tariffs prompting retaliatory moves and raising inflation risks.

UK data showed weak growth, steady 4.4% unemployment, and wage growth easing to 5.8%, in line with forecasts. In the U.S., the Fed kept rates steady but reaffirmed plans for two cuts this year.

If GBP/USD breaks above 1.3050, the next resistance levels are 1.3100 and 1.3150. On the downside, support stands at 1.2860, with further levels at 1.2800 and 1.2715 if selling pressure increases.

Silver Holds Near $33.60 as Fed Signals 2025 Rate CutsSilver hovered near $33.60 after the Fed held rates at 4.25%-4.5%, signaling 50 bps cuts by 2025. Despite trade-war fears and Trump’s policies, silver remains near a five-month high.

Lease rates surged as stockpiles shrank, especially in London, with silver flowing to the US for higher prices, widening market price gaps. Spot silver is up 17% this year, outperforming other commodities.

Tariffs strain silver transfers from Canada and Mexico, tightening supply and fueling fears of a prolonged “silver squeeze.”

If silver breaks above $34.05, the next resistance levels are $34.85 and $35.00. On the downside, support is at $33.80, with further levels at $33.15 and $32.75 if selling pressure increases.

Silver Holds Near $33.80 as Fed Rate Cut Bets Provide SupportSilver edged lower to approximately $33.80 during early Asian trading on Friday, losing momentum. However, the downside may remain limited, as softer U.S. consumer and producer inflation data could provide room for the Federal Reserve to consider an interest rate cut in June, offering some support for the metal.

Additionally, concerns over U.S. President Donald Trump's protectionist policies potentially pushing the world's largest economy into a recession could further support silver's appeal.

If silver breaks above $34.00, the next resistance levels are $34.85 and $35.00. On the downside, support is at $33.80, with further levels at $33.15 and $32.75 if selling pressure increases.

Euro Weakens Against USD Ahead of Key Economic DataThe EUR/USD pair declined to around 1.0835 during Friday’s Asian session, as the Euro (EUR) weakened against the US Dollar (USD) amid rising trade tensions between the U.S. and the European Union. Later in the day, market focus will shift to key economic releases, including Germany’s February Harmonized Index of Consumer Prices (HICP) and the preliminary Michigan Consumer Sentiment Index for March.

Key resistance is at 1.0950, followed by 1.1000 and 1.1050. Support stands at 1.0800, with further levels at 1.0730 and 1.0650.

Yen Supported by BOJ TighteningThe Japanese yen stabilized around 148 per dollar on Wednesday, recovering after two days of declines as a weaker US dollar offset trade conflict concerns. Trump vowed more tariffs after the EU and Canada retaliated against his steel and aluminum duties, escalating tensions.

The yen remained supported by expectations of further BOJ rate hikes, driven by strong wage growth and inflation. Japanese companies approved significant wage increases for the third year, boosting consumer spending and giving the BOJ more flexibility for future hikes.

Key resistance is at 149.20, with further levels at 152.00 and 154.90. Support stands at 147.00, followed by 145.80 and 143.00.