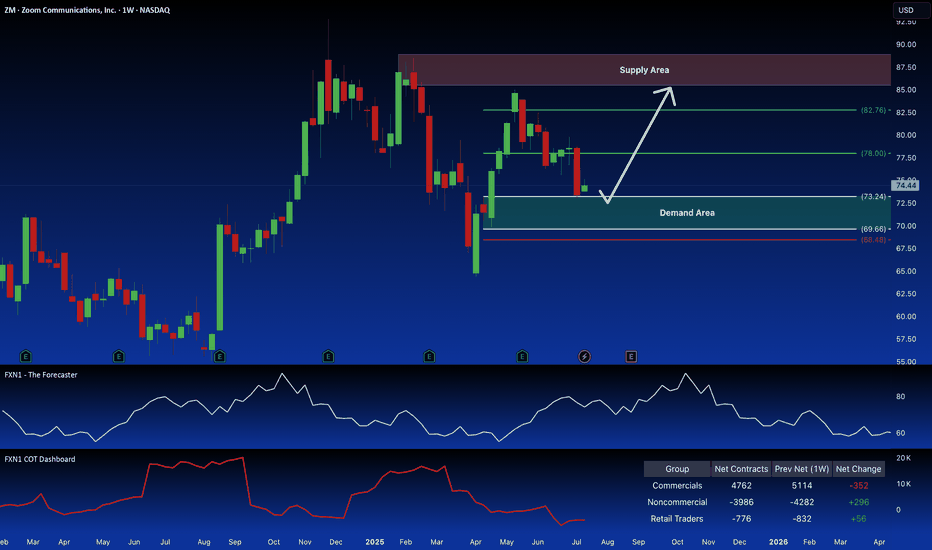

Zoom (ZM): Potential Long Setup at Demand ZoneZoom Video Communications (ZM) recently experienced a rejection at a key demand zone on its weekly chart. Non-commercial traders have increased their long positions, and forecasts suggest a potential upward trend. I'm considering a long trade setup based on a retest of that demand zone. What are your thoughts?

✅ Please share your thoughts about ZOOM in the comments section below and HIT LIKE if you appreciate my analysis. Don't forget to FOLLOW ME; you will help us a lot with this small contribution.

Zm

ZM Zoom Video Communications Potential BreakoutIf you haven`t bought ZM at the end of the giant falling wedge:

Now Zoom Video Communications (ZM) is currently showing a bullish pennant pattern, which is often a precursor to an upward breakout.

With the stock approaching the $72 level, a breakout could lead to a swift move higher, given the strong technical setup.

For speculative traders, buying the $72 strike price calls expiring this Friday at a $0.12 premium offers an appealing risk-reward ratio.

If ZM breaks above the resistance, these calls could rapidly gain value.

ZM Zoom Video Communications Options Ahead of EarningsIf you haven`t sold ZM before the correction:

Now analyzing the options chain and the chart patterns of ZM Zoom Video Communications prior to the earnings report this week,

I would consider purchasing the 70usd strike price Calls with

an expiration date of 2025-6-20,

for a premium of approximately $5.10.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Zoom's Surges 2.47% Early Thursday on Q2 Earnings ReportZoom Video Communications, Inc. (NASDAQ: NASDAQ:ZM ) showcased its ability to navigate the post-pandemic landscape with a solid Q2 earnings report, leading to a 2.47% surge in Thursday’s premarket trading. Despite facing headwinds from decelerating growth, the company outperformed Wall Street expectations, offering a glimmer of hope for investors.

Key Financial Highlights

For the quarter ended July 31, Zoom (NASDAQ: NASDAQ:ZM ) reported adjusted earnings of $1.39 per share, a 4% increase from the previous year, and above analyst projections of $1.21 per share. Revenue rose 2% to $1.162 billion, also surpassing estimates of $1.149 billion. However, this marked the tenth consecutive quarter of slowing sales growth, reflecting the company’s ongoing transition from the explosive demand driven by the COVID-19 pandemic to a more stabilized market environment.

The enterprise segment, a key area of focus for Zoom (NASDAQ: NASDAQ:ZM ), saw revenue rise 3.5% to $683 million, beating expectations of $675 million. This growth is particularly encouraging as Zoom continues to evolve into a comprehensive communications platform, catering to business needs beyond its core video conferencing service.

Future Outlook: Revenue Re-Acceleration on the Horizon?

Zoom’s guidance for the October quarter has further bolstered investor confidence. The company expects revenue between $1.16 billion and $1.165 billion, slightly above analyst estimates of $1.157 billion. This outlook, along with an upward revision of its full-year revenue and profit forecasts, suggests that Zoom’s expanded product suite is gaining traction with enterprise customers.

Despite these positive developments, Zoom’s stock remains under pressure, having dropped nearly 18% before the earnings report and 16% year-to-date. The market has been concerned about the company’s ability to maintain growth, particularly as competition intensifies from giants like Microsoft and its Teams platform.

Strategic Shifts and Leadership Changes

Zoom’s efforts to diversify its offerings are evident in its recent moves. The company is expanding its business tools to include phone systems, contact centers, and AI-powered assistants. Additionally, the launch of a single-use webinar service capable of hosting up to 1 million attendees signals Zoom’s commitment to innovation and adaptability.

However, the announcement of CFO Kelly Steckelberg’s departure at the end of the fiscal quarter has added an element of uncertainty. While Zoom clarified that Steckelberg’s exit is not due to any internal disagreements, the search for a successor will be closely watched by investors.

Navigating the Post-Pandemic World

Zoom’s success during the pandemic was unprecedented, but the company now faces the challenge of maintaining relevance in a world that is gradually returning to in-person interactions. The ongoing decline in consumer and small business customers has been a point of concern, with sales in this segment remaining flat year-over-year. However, the company reported its lowest ever churn rate, indicating some stability in this crucial market.

CEO Eric Yuan emphasized the resilience of Zoom’s business, particularly among smaller customers, and highlighted the platform’s role in hosting significant political events, including those supporting Vice President Kamala Harris. This demonstrates Zoom’s continued importance in various sectors, even as it navigates a more competitive and less predictable environment.

Conclusion

Zoom’s Q2 earnings report may have provided a short-term boost to its stock, but the road ahead remains challenging. The company’s ability to reaccelerate growth, especially in its enterprise segment, will be critical in determining its long-term success. As Zoom continues to innovate and expand its product offerings, investors will be watching closely to see if the company can sustain its momentum in a post-pandemic world.

With the market’s focus on the bottom line and the looming leadership transition, Zoom’s next moves will be pivotal in shaping its future trajectory.

Zoom Video Communications Reports Results for First QuarterZoom Video Communications ( NASDAQ:ZM ) has raised its annual forecast for profit and revenue, citing robust demand for its product portfolio as companies continue to adopt hybrid work. The company's efforts to incorporate artificial intelligence (AI) and broaden its range of services have been successful, with the introduction of Zoom Workplace, an AI-powered, open collaboration platform in March, along with new AI companion expansions first unveiled in September last year, for paid users. Zoom, along with platforms like Microsoft's Teams and Cisco's CSCO.O, opens new tab Webex, are pandemic darlings, which most businesses and individuals turned to for connecting with employees and friends.

The company now expects 2025 revenue of about $4.61 billion to $4.62 billion, up from its earlier forecast of about $4.6 billion. Analysts expect revenue of $4.61 billion, according to LSEG data. On an adjusted basis, it expects full-year earnings between $4.99 and $5.02 per share, compared with its previous forecast of between $4.85 and $4.88. For the second quarter, Zoom sees revenue between $1.145 billion and $1.150 billion, slightly below analysts' average estimate of $1.15 billion.

The company posted revenue of $1.14 billion, up 3.2%, for the first quarter ended April 30 and above analysts' expectations of $1.13 billion. Zoom Video Communications ( NASDAQ:ZM ) reported financial results for the first fiscal quarter of fiscal year 2025, with total revenue of $1,141.2 million, up 3.2% year over year as reported and 3.5% in constant currency. Enterprise revenue was $665.7 million, up 5.3% year over year, and Online revenue was $475.5 million, flat year over year.

Income from operations and operating margin was $203.0 million, compared to GAAP income from operations of $9.7 million in the first quarter of fiscal year 2024. Non-GAAP net income for the first quarter was $426.3 million, after adjusting for stock-based compensation expense and related payroll taxes, acquisition-related expenses, restructuring expenses, litigation settlements, net, and the tax effects on non-GAAP adjustments. Non-GAAP net income per share was $1.35. In the first quarter of fiscal year 2024, non-GAAP net income was $353.3 million, or $1.16 per share.

Cash and marketable securities were $7.4 billion, with net cash provided by operating activities being $588.2 million for the first quarter, compared to $418.5 million in the first quarter of fiscal year 2024, up 40.6% year over year. Free cash flow, which is net cash provided by operating activities less purchases of property and equipment, was $569.7 million, compared to $396.7 million in the first quarter of fiscal year 2024, up 43.6% year over year.

Customer metrics for total revenue included acquiring new customers, with 3,883 customers contributing more than $100,000 in trailing 12 months of revenue, up approximately 8.5% from the same quarter last fiscal year.

Technical Outlook

Zoom Video Communications stock ( NASDAQ:ZM ) has been forming a Trough and Crest pattern or should and Neck pattern concurrently for the past 1 year now. The stock is down 1.69% in Premarket Trading approaching support level of $61 a move that will validate a bearish reversal.

ZM Zoom Video Communications Options Ahead of EarningsIf you haven`t bought ZM before the previous earnings:

Then, after analyzing the options chain and the chart patterns of ZM Zoom Video Communications prior to the earnings report this week,

I would consider purchasing the 65usd strike price Calls with

an expiration date of 2024-12-20,

for a premium of approximately $8.00.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

ZM Zoom Video Communications Options Ahead of Earnings If you haven`t sold ZM before the previous earnings:

Then analyzing the options chain and the chart patterns of ZM Zoom Video Communications prior to the earnings report this week,

I would consider purchasing the 61usd strike price in the money Calls with

an expiration date of 2024-3-1,

for a premium of approximately $3.95.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

$ROKU reversal trade ideaNothing crazy here but NASDAQ:ROKU continues to follow that downward trendline and respects the previous supports broken. If this turns down from the current test of resistance then the short play is intact.

BUT if the trendline is broken along with resistance, then this setup is nice to take long considering that the RSI indicator appears to be bottoming a well.

Is ZM Finally Buyable?ZM longs have been absolutely eviscerated since 2020. One of the quintessential names of the 2020 exuberance, it has since seen a 90% drawdown from the 2020 high to the 2023 low late last year.

However, ZM has seen a trading range between 60 and 75 for almost a year now. This basing has clear analogs to Wyckoff accumulation, and the failed breakdown in October with low volume and no follow through could have finally put in a durable bottom. The 50SMA crossed above the 200SMA in January, providing a clue about the possibility for a shift in trend on this beaten down name.

If ZM sees markup and can break out of this accumulation range, it is possible we could see a gap fill of the August 2022 earning gap around 97.4.

As a trade, a tight stop at the recent low of 63.06 presents a very favorable setup, with a potential > 10:1 RR.

There was a time when ZM was a clear no-touch, and for good reason. But after the absolute destruction in value over the last few years, to finally allow price to re-align with more reasonable valuation levels, this name can finally be taken back out of the penalty box.

ZM Zoom Video Communications Options Ahead of EarningsIf you haven`t sold ZM here:

or ahead of the previous earnings:

Then analyzing the options chain and the chart patterns of RUM Rumble prior to the earnings report this week,

I would consider purchasing the 60usd strike price Puts with

an expiration date of 2023-11-24,

for a premium of approximately $1.25.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

ZM: Zoom has officially topped...Short it.I'm short $ZM since earlier today, I believe it has peaked here. Investors are likely to take profits now that competition has increased dramatically for them.

They thrived when the world was locked down due to the threat of COVID-19, but now that vaccines will be widely available and distributed globally very soon, holding shares has become extremely risky. I'd urge everyone holding to sell and buy something oversold with proceeds...If interested in knowing what to buy now, contact me.

A short here has very low risk, I think it can last for a long time falling, so do your own due diligence with sizing to not risk more than 1-2% if it goes against you by 3 average ranges.

Cheers,

Ivan Labrie.

ZM Zoom Video Communications Options Ahead Of EarningsIf you haven`t entered ZM here:

Or sold here:

Then analyzing the options chain and the chart patterns of ZM Zoom Video Communications prior to the earnings report this week,

I would consider purchasing the 66usd strike price Puts with

an expiration date of 2023-8-25,

for a premium of approximately $3.45.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

Zoom Potential Rounding Bottoming Zoom Video was a darling stock during the pandemic when office workers were sheltering in place at home and communicating via video chats. Price hit a high near $600 in Q4 of 2020 and has fallen roughly -80% to current levels where it has levelled off and appears to be forming a bottom in the $70 range.

Currently price is attempting to hold and trend above the 200ma which it hasn't done since the summer of 2021 when the previous attempt to regain the 200ma failed. Going forward we want to see price hold above the 200ma and take out short-term resistance at $75-$76.The short-term MA's are currently rising above the longer MA's which is an indication of a short-term bullish trend for price. We want to see price continue to move higher and for the short MA's to rise above the 200ma for a sign of bullish trend continuation.

The PPO indicator show the green RSI line rising above the purple signal line which is a short-term bullish momentum indication. Both lines trending above the 0 level indicates intermediate to long-term bullish momentum behind price.

The TDI indicator shows the RSI line crossing above 60 and in the upper half of the white Bollinger Bands which indicates a short-term bullish trend in price. The overall action of the green RSI line is trending between the 40-80 levels which indicates intermediate to long-term bullish price trend. Going forward we want to see the green RSI line continue to rise above the 60 level for short-term bullish bias in price which would help maintain above the 200ma.

Price gapped down in Aug of 2022 so should Zoom hold current bullish bias and take out short-term resistance levels we could see a move to fill the gap up near $95-$96.

My entry is at $73.95 with a stop loss at $68. No upper price target for now other than the gap target, will raise my stop-loss order as price moves higher and creates a series of higher highs and higher lows assuming that a breakout is coming.