The Nature of Zones — Reversals, Continuations, and the FlowWe’ve all heard trading terms like Major Trend and Major Counter-Trend levels. These are zones where price either breaks through and continues (Trend Levels) or sharply reverses (Counter-Trend Levels). In the crypto world, these levels are often separated by enormous gaps, due to the nature of the space — as I’ve mentioned in a previous idea: Crypto Charts Whisper—Are You Listening?

Let’s get one thing clear from the start. These levels are not just thin lines that traders casually draw across a chart. They are zones. So, as a skilled trader, anytime someone mentions support or resistance, keep in mind: interact with these as zones, not levels.

Why? The answer lies in the nature of the candlestick itself. Most support and resistance areas — 99% of the time — are defined by candlesticks such as inverted hammers, shooting stars, etc. For instance, in an uptrend near its peak, you’ll often spot an inverted hammer with a rejection wick that’s at least 25–50% of the candle’s body. The longer the wick, the stronger the rejection. In that sense, the high and the close of that candle form the zone. And what better tool to use for this than the rectangle?

Now, to slowly return to our main point — many of you might’ve noticed that zones often change their nature, especially resistance zones. If you’re experienced, you already know: price tends to go higher by nature. So when a counter-trend zone gets broken and price pushes above it, it shifts — it becomes a trend zone. Later, if price retests it from above, it often turns into support, and with another reversal, it can shift again — becoming a counter-trend zone once more.

But my point goes deeper than what you’ll hear in lessons or YouTube videos. Like I said in another post — A Follow-up to “Adjustments for Better Readings & VSA vs BTC” — if it’s already out there, it’s probably old news.

A skilled trader keeps an open mind — merging everything into one system. And it's part of this oneness mindset that elite traders follow, which I want to share now.

So I ask you:

What if the idea of trend and counter-trend zones didn’t just apply to major levels?

What if this concept applied everywhere on the chart?

For me, this isn’t just a question anymore — it’s a fact. A fact that made me a better trader. I won’t lie — before I got good at this, I failed over and over. But I never quit. That’s not the point though. The point is to expand your vision and train yourself to react just like the elite do.

Take double or triple tops/bottoms — standard or rounded. These formations also act exactly like trend and counter-trend zones. And they stay relevant well into the future. Every level is tested at least twice, from both directions. Maybe not immediately, but eventually — across multiple time frames.

And just like that, a level becomes a major zone for future use — especially if you trade across multiple time frames. So be careful: if you’re only looking at the 1-hour chart, you might miss something important that’s playing out on the 3-minute. And that can trigger psychological discomfort... leading to FOMO — and all the mistakes that come with it.

Also remember — double and triple tops/bottoms are zones, not exact lines. Many traders lose trades by a single tick, just because they forget that rule.

Let’s go a bit deeper now.

Think about all the small highs and lows that appear between those tops and bottoms on a 3-minute chart.

How can they help you trade better? The answer goes back to my previous idea: Location, Location, Location — Consistency and Alignment.

I get it — staying observant 24/7 is hard. That’s why institutions and big players work in teams, in shifts. They’re never alone. You shouldn’t be either.

There’s a lot more that could be said about these levels and zones — how they reveal future trend behavior, a flow! even without indicators or VSA. It has to do with how specific highs and lows behave at certain points in time... but let’s leave that for now.

For the outro, remember this:

The real edge isn’t in indicators.

It’s in your ability to catch the flow of price,

And to read strength or weakness through the simple structures within the zones Big Players create — whether visible or hidden.

A chart isn’t a single truth.

It’s a battlefield of conflicting zones and mixed signals.

If this mindset resonates with you and you want to go deeper — whether it’s building confidence or spotting hidden signals early — I work with a small circle of traders, sharing TA privately every day. Feel free to reach out.

Until next time, be well and trade wisely.

Zones

GBPJPY: Weekly OverviewHello Traders,

Everything is clear in the chart. the yellow line is a HTF resistance.

********************************************************

The indicated levels are determined based on the most reaction points and the assumption of approximately equal distance between the zones.

Some of these points can also be confirmed by the mathematical intervals of Murray.

You can enter with/without confirmation. IF you want to take confirmation you can use LTF analysis, Spike move confirmation, Trend Strength confirmation and ETC.

SL could be placed below the zone or regarding the LTF swings.

TP is the next zone or the nearest moving S&R, which are median and borders of the drawn channels.

*******************************************************************

Role of different zones:

GREEN: Just long trades allowed on them.

RED: Just Short trades allowed on them.

BLUE: both long and short trades allowed on them.

WHITE: No trades allowed on them! just use them as TP points

$AMD $120 retest then $130 push through. R/R looks incredible..Hello, NASDAQ:AMD Advanced Micro Devices, INC looks TASTY. I'm almost salivating. NASDAQ:NVDA may take a backseat and NASDAQ:AMD could start seeing monster upside. Something in my gut is telling me this name wants to GO. I'm looking at $120c for 6/20 and $130c for 6/20. This thing can launch.. it's hanging on an upside trendline, it may break but this $110 area may represent local support. Earnings report were good and after an abysmal 2024 after having highs and totally wiping them out hitting lows of $80, I think this could be the time for NASDAQ:AMD longs. It has taken the 20 day EMA/SMA over and now could curl to the 200 day EMA/SMA. 200 SMA is $126. This seems like a really good setup especially R/R here. Very cheap calls for a name that can see a 10-15% week.

WSL.

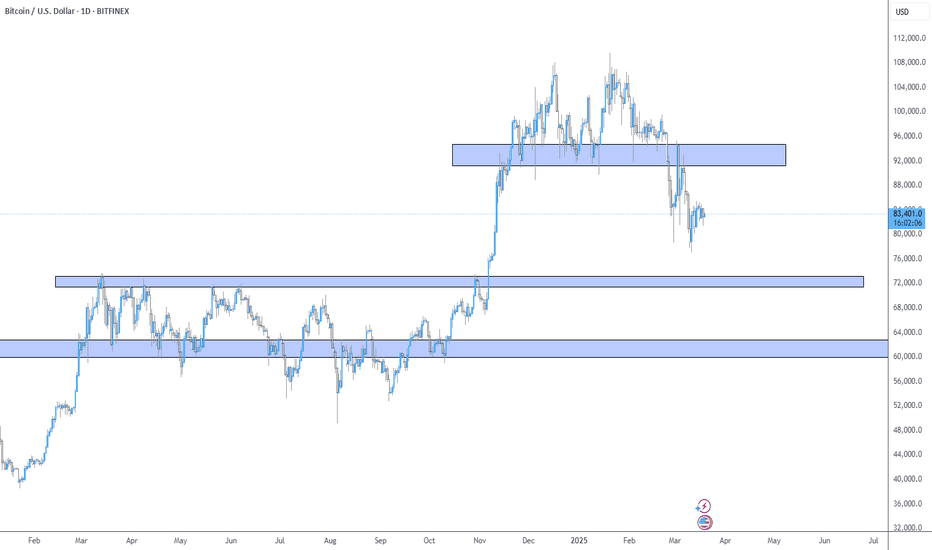

BTC ZonesHere are my simplistic zones that price has been respecting and will most likely follow. Do you think Bitcoin will pull down to the support levels below?

I see price making a slight move towards the support levels then contesting resistance for new highs. Based on history, we know how crypto tends to move in these months. COINBASE:BTCUSD

AMD Daily and Weekly Supply and Demand Zones! Some people are thinking there is a bottom for AMD but I still don't see enough for me to think it's at the bottom. I would love for price to break back to $119.21 and retest it for support to go towards $129.07 and fill those gaps on the Daily. If price breaks that $114.16 zone, seems like price would want to go back to $106.09.

GBPUSD Week 2 Swing Zone & LevelHappy new year pip hunters.

Welcome back to Pinchpips Swing zone and level, SZL.

We start off the new year with SZ has indicated around 933-990, and Levels as marked.

Price action determines trades, so either of a or b could playout.

Entry is based on the 5 min candlesticks pattern with SL @ 10-15 pips from entry.

TP is as price action and momentum determines. However SL is usually moved to Breakeven, BE once entry pinches +20pips.

NOT buying USDCADThe USDCAD price has moved into the Daily sell zone, which suggests the possibility of new sell positions entering the market, potentially driving the price down. In the case that the zone is broken, there is a high likelihood of further price increases (which, in my opinion, is less likely).

For those looking to short, I would recommend looking for a simple breakout pattern on lower timeframes and participating accordingly. BUT make sure to wait until after the NFT news and observe what market will do with price.

Good luck, and stay cautious, don't forget it's Friday!

A+ Trade Set ups All From Respecting Simple Levels! We identify high-quality trade opportunities by focusing on key support and resistance levels. By respecting these fundamental price points, traders can enhance their decision-making process. Support levels act as a floor where buying interest tends to emerge, while resistance levels serve as a ceiling where selling pressure usually mounts. Recognizing and adhering to these simple levels helps traders pinpoint entry and exit points more effectively, increasing the probability of successful trades and improving overall trading performance.

AMEX:SPY

Gold ideaAs we have seen gold has made a rally downards and meet us with great profits as we have entered on a confirmation on 2519 price on bearish side and got a profit on 2500 level of price the price can hover around this level of support and can eventually go higher to its price level of 2530 and higher than that if price breaks above 2530 and sustains price can go over 2550 of physiological Resistance level so we are watching price closely and keenly so that we can make profits

Nasdaq Weekend Pre MarketIt's the weekend. I like to go out to my larger charts and clean off the entire chart and start analyzing the instrument for next weeks trading.

We know that price is going to move up or down from where it currently is located, so we just need to make up a game plan to trade it..

Looking out at the 4 hour, 1 hour, and 15 minute charts for our trend and target analysis. Then dialing it down to the 3 minute or 15 minute to look for an entry!

WHO WANTS TO RIOT ON THE MOON? RIOT Chart looking pretty good when you look at the greater picture.

Don't think we quite make it to Mars on RIOT.

Dogecoin, probably.

Yes the smaller moves are not really covered on this chart.

But also, this is a key zone for RIOT on the weekly chart.

IT goes back quite far.

Put/Call info below.

rejection trends in red.

support trends in green.

price zones marked.

Leads out to next April.

Good luck!!

Euro can rebound down from resistance line and continue fallHello traders, I want share with you my opinion about Euro. Looking at the chart, we can see how the price a not long time ago started to rise inside the upward channel, where firstly it declined to the 1.0780 resistance level, which coincided with the seller zone. Soon, the price broke this level and declined to support line of the channel, after which EUR at once rebounded and made an upward impulse to the resistance line of the channel, breaking the 1.0780 level one more time. Next, the price some time traded near, but later Euro turned around and started to decline inside the downward channel, leaving the past channel. In the downward channel, EUR fell to the support level, which coincided with the buyer zone, breaking the 1.0780 resistance level also. After this, the price bounced from the 1.0620 level and tried to rise, but declined to the buyer zone, which a not long time rebounded up to the resistance line of the channel, making a fake breakout. At the moment, I think that the Euro can rebound down from the resistance line, break the support level, and continue to decline in a downward channel. For this reason, I set my target at the 1.0500 level. Please share this idea with your friends and click Boost 🚀

GRAM Global!!!And so the graph is a little bit clearer!

making adjustments!

The volume price has moved lower to 0.05.

A good local zone of 0.031-0.028 has appeared.

Buy level at 0.0291.

A global zone of 0.0172-0.0109 has appeared.

Buy level 0,0149

Growth imbalance

Zones 0.0512-0.0624

Level 0.055

Zone 0.0907-0.1319

Level 0.102

Zone 0.216-0.418

Level 0.265-0.285 (maybe I'll close some or all of it?)

Zone 1.77-6.58 Most likely to sell?

Identify & understand key supply and demand areas $SPYUnderstanding supply and demand is essential. Here’s a quick intro to how we can benefit as traders by using AMEX:SPY as an example.

1. Identifying Potential Entry and Exit Points:

Supply zones represent areas where selling pressure exceeds buying pressure, potentially causing price to reverse. Demand zones, on the other hand, indicate areas where buying pressure exceeds selling pressure, potentially leading to price bouncing. Traders can use these zones to identify optimal entry and exit points for their trades.

2. Risk Management:

By incorporating supply and demand zones into our analysis, traders can effectively manage risk. Placing stop-loss orders just beyond key supply and demand zones can help protect capital by minimizing losses if price moves against our positions.

3. Confirmation of Trading Signals:

Supply and demand zones can act as confirmation for other trading signals, such as candlestick patterns or technical indicators. When these signals align with key supply or demand zones, it increases the probability of a successful trade.

4. Understanding Market Sentiment:

Monitoring supply and demand zones can provide insights into market sentiment. For example, a strong demand zone being consistently respected may indicate bullish sentiment, while repeated failures to break above a supply zone may signal bearish sentiment.

Understanding institutional & hedge funds impact

1. Liquidity Impact:

Institutional buyers and “whales” often execute large orders that can significantly impact liquidity in the market. Their trades can absorb available liquidity, causing rapid price movements in the direction of their trades.

2. Price Manipulation:

Institutional buyers and whales have the financial resources to manipulate prices in their favor. They may strategically place large orders to create artificial supply or demand zones, inducing retail traders to buy or sell, only to reverse the market direction once their positions are filled.

3. Market Direction Influence:

Institutional traders and whales often have access to extensive research, data analysis, and insider information. Their trading activities can signal market trends and influence the direction of price movements, prompting retail traders to follow suit.

4. Impact on Support and Resistance Levels:

The trading activities of institutional buyers and whales can lead to the formation of significant support and resistance levels. These levels often coincide with key supply and demand zones, making them important areas for traders to monitor.

Understanding the behavior of institutional buyers and whales is essential because it provides insights into market dynamics and helps anticipate potential price movements.

In conclusion, mastering the concepts of supply and demand zones can significantly enhance your trading prowess, especially when applied to instruments like $SPY. These zones serve as crucial indicators of market sentiment, providing valuable insights into potential price reversals and continuations. By incorporating supply and demand analysis into your trading strategy, you can identify optimal entry and exit points, manage risk effectively, and increase the probability of successful trades.

Furthermore, understanding the influence of institutional buyers and whales adds another layer of depth to your trading analysis. Their substantial trading activities often shape market dynamics, influencing price movements and the formation of key support and resistance levels. By closely monitoring their actions alongside supply and demand zones, traders can gain a clearer understanding of market trends and make more informed decisions.

Remember, trading is both an art and a science, requiring continuous learning and adaptation.

Happy trading!

ZILLOW, WILLOW WHEREOW THE PRICE GO? imma be honest, I'm running out of creative titles, so you get what you get.

Trends labeled

Price targets labeled.

really neat setup on zillow here.

These buy zones are marked at some major support, we have a short term trend leading to a top, and may have already hit. We have a long term support trend going in the bearish price direction.

All of the above can help determine potential price movements.

With RSI being overextended, the market as a whole, there is potential for quick downside right past support trend, into the zones of major price support, which will then create even stronger support, which will allow the price to keep climbing back up.

I'm hesitant to predict anything before seeing where it heads into earnings (13th labeled)

BUT..

IDK, something like this maybe?

Essentially, I don't know how it will look, or how steep it goes, but it's good to be prepared for some potential scenarios. This chart can cover quite a few of them if you're patient and wait for the right trade.

Overall, I would suggest being careful, and should the price go up before going down, it might be a better option to look for a short entry and ride the price down than jumping into a long position, especially with how this chart looks.

Bitcoin can reach resistance level and then rebound downHello traders, I want share with you my opinion about Bitcoin. Observing the chart, we can see that the price some days ago rebounded from the support line and made a strong upward impulse to the support level, which coincided with the buyer zone. After this, BTC in a short time broke the 60800 level, made a retest, and continued to move up to the resistance level, which coincided with the seller zone. Price even entered to seller zone, but soon turned around and declined lower the 71250 level, making a fake breakout. Also then price started to trades in the range, where firstly it broke support line and fell to the support level. Then Bitcoin rebounded from the 60800 support level and made impulse up to the seller zone, but when it reached this area, the price at once exited, making a fake breakout of the resistance level. Next, the price some time traded near the resistance level and then declined below, but a not long time ago BTC turned around and started to grow, so now it trades near the 71250 level. Now, I think that Bitcoin can reach a resistance level and then rebound down. For this case, I set my 1st Take Profit at the 65000 level. Please share this idea with your friends and click Boost 🚀

Support And Resistance Lines Are Not Real: Prove Me WrongIn this video, I draw random lines on the chart to prove a point. I think we need to ask ourselves the following questions to become better traders:

How will I define support and resistance consistently ?

How will I use support and resistance in my trading?

Do I need support and resistance in my trading?

Is support and resistance a reliable measure for markets?

Are the lines that I have been drawing for so long actually meaningful?

MATIC 44-61$Now the price is in the asset redistribution zone of 0.4238-2.1520

The price of the volume of this redistribution is 0.8450

The price of the total volume is 0.0218

There are already 3697 between them%

Expected growth 44.7959-61.4676

From the current value, another 3,600%

CADCHF SHORTEven though we have a high probability chance of going short from this zone at 0.65280. We have seen how price has decided to deliver price bearish. On this zone on the 5Min, price has already mitigated the Demand zone and its set to go bearish from my analysis. See where you come in and trail stop loss when it breaks through 0.64930 for the potential target at 0.64704

GPT consolidation!The asset entered the global control zone of 0.70965-0.87273 to the level of 0.76610 and formed a consolidation in the form of a triangle!

Locally, 0.70669-0.85229 reached the levels of 0.74976 and 0.76469 in the control zone.

When going down!

Areas of interest Locale 0.62763-0.58877 level 0.61509

And global 0.54092-0.48359 level 0.52250 (BUCKET)

The price of the total volume is 0.45979

I bought it right now!!!

stop 0.66906

YNDX Who knew?The distribution in the range 87.11-74.93 marked the beginning of the movement!

Refueling in the control zone 55.45-47.70 confirmed the continuation of movement.

+ in this zone, I set new levels on the distribution, in the range of 53.81-44.02.

Subsequent control zones Global 35.83-26.92 and local 29.46-24.10 were breached with a squish!

Sales stopped in the Global Area of Interest 18.42-11.16

Local area of interest 16.46-11.24

The purchase level of 14.59 is the result

The price of the total volume is 32.08

Results:

1) The initial distribution of the asset 87.11-74.93 shows us the end point 15.77!

2) Refueling in control zones 55.45-47.70 corrects the end point 14.59!

3) The black Swan does not play a special role on the end point! He can only speed up or slow down the course of events!

I personally associate this process with a car!

HOW MUCH FUEL YOU FILL IN THE TANK, THAT'S HOW MUCH IT WILL LAST

!!! MATH AND NO MAGIC !!!