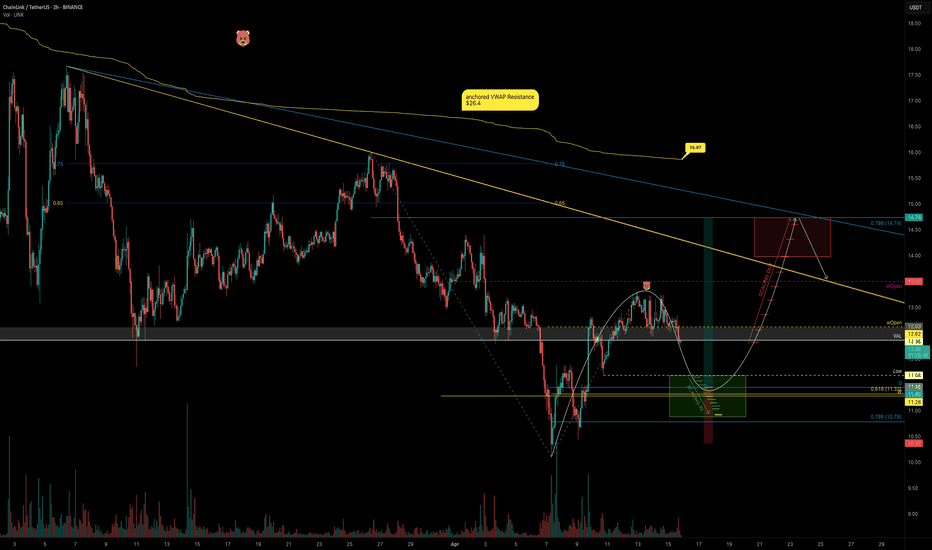

LINK’s Swing Setup Could Push Past $15LINK bounced right off the $10 mark, charging upward toward the monthly open before slamming into resistance around $13.25. But now what?

Let’s break it down — because the next high-probability setup is taking shape, and it’s one you don’t want to miss.

The Current Situation:

LINK is:

Below the Point of Control (POC) of this trading range (~$11.35).

Below the monthly open at $13.5.

Still in a bearish trend on the 4H, showing lower highs.

Facing decent rejection from the monthly level.

We’re currently trading below the weekly open at $12.62, now sitting right on the Value Area Low (VAL) at $12.36. That puts us in a precarious spot and sets the stage for the next move.

Bearish, bearish, bearish. When bullish sir? Staying patient and waiting for a real shift in market structure is key.

The Bearish Play: Liquidity Grab Incoming?

There’s a liquidity pocket waiting below at $11.68, the most recent swing low. If LINK loses VAL and bearish pressure kicks in, this becomes the next logical target.

But here's where things get interesting...

The Bullish Setup: Confluence-Backed Long Opportunity

This isn’t just any random support zone — there’s a perfect confluence stack forming:

Swing low: $11.68

Daily support level: $11.45

Weekly support level: $11.28

POC of trading range: ~$11.35

0.618 Fibonacci retracement lands in this zone as well

That’s four layers of support in one tight cluster. This is where we want to scale into longs.

The Play: Scaling In

Entry: Ladder long positions from $11.68 down to the 0.786 fib (near $11.2)

Stop Loss: Below $10.35 for invalidation

Target: 0.786 fib retracement of the previous downward wave at ~$14.5

R:R: Approx. 3:1, with a potential +30% gain

The trend remains bearish but the chart is setting up a prime reversal zone. Patience is key here.

🔔 Set alerts. Watch for volume spikes. Look for SFPs or bullish engulfing candles etc.

The next move on LINK could offer one of the best swing setups especially since this trade could extend past the $15 mark, putting you ahead of the curve.

💬 Found this helpful? Drop a like and comment below. Want TA on another coin? Let me know and I’ll break it down for you.

Happy trading everyone! 💪

Zonetozone

DJ30 dipping into the ocean150 pip SL. DJ30 is looking for a new floor again, it was consolidating around the last area. I have not looked for possible resistance areas. You could also take 300 pip exit 1 in here just to be safe...

Also the stop loss is small. A wiggle room of 300 pip is never too bad.

I like to use the hours when the markets are just slowing down, I think volatility will be higher when Asian session opens in about 40 min

Tutorial TOP DOWN Entry/ Exits DKLs ...Good morning,

I took the time to show you my analysis and how I work.

- Top Down D1 to H1

- Intraday through scalping

- DKLs / HKLs

- Important Zones

- Zone to Zone

- Specific asset volatility

- Entries

- Stop Losses and Exits

Hope you like it so far and could catch some pips. Let me know in the comments below.

XAUUSD continuing bullish tomorrow?Within the Top Down Analysis from D1, the trend is continuing upwards.

It broke the last H1 ceiling and is going somewhere towards north. The safest option is going bullish from zone to zone, until there is more structure.

Be careful around 2357. Reversal for a bigger retracement is possible around there.

This trade should play out before the USD News in the afternoon 4 pm GMT+1

I took 300 pips SL to get around the DKL points.

TOP DOWN Analysis on AUDUSDThis Reversal Strategy was constructed to speculate on possible reversals.

You make a Top Down Analysis in the Daily Chart, find the Daily Floor and Ceiling and stay within the consolidation. The Entry is a lower high for sells and higher lows for buys, when you see a reversal within the daily frame.

This idea is based on the strategy but in a smaller time frame for scalping. I still use H4 zones for bigger moves.

The StopLoss on Forex is always around 10 and 20 pip. (20 pip for more volatile days)

The StopLoss on indices is between 150 and 200 pip in a low volume (small wig) environment and between 300 and 500 pip on high volatile days.

StopLoss on XAUUSD is between 50 pip in low volume and about 200-300 pip throughout high volatility.

Using this strategy when course arrives at Daily/ Hourly Key Levels (DKL/ HKL) is a little more tricky than entering at the floor or taking beginnings of retracements, get a feel for reversals so you ll know what I m talking about.

Also make sure not to confuse a retracement with a simple pullback.

AUDUSD bullish todayPossibly its going to fly towards the HKLs of last Wednesday. But we do not know about a pullback. Try this first zone and set BE after TP1. Don't be greedy. If we get any volume today, it will be most probably bullish.

Correlation between Gold and US30 is contrary to the regular. If you want to hedge, use buy and sell positions instead of taking one direction.

DJ30 breaking into new zone.Take the first pullback, stay in Entry Zone, and save BE after Exit 1.

Unfortunately, my latest ideas from Saturday were not published.. They all reached at least Exit 1. But I will repost my Top Down Analysis and share the eBook I was working on very soon (!), so you can jump right in.

It's ok if you just want to watch for now, I am testing this channel to go public.

Stay tuned :) I might share another idea today.

GJ buyGJ has formed a double bottom on the 30min and the 1hr chart. The 30min chart has formed the double bottom on a 200ema support. Price went up, came back for a retest to confirm a buy. I jumped into a buy from the close of the previous stick bullish stick...We should go up to 169.683 at least. If you scalp you will catch good pips. Zone to zone trading is the safest on a volatile pair like this. Wait till we get to the zone and see what price does

Some BOS and ChOCH In this chart we can see some pattern that fits to this strategy.

We saw a lot of liquidity in the path few months.

And sometimes the market can give u some bouncy bull trend for a couple of days or even week or two.

In this chart , u can see some pattern that give us some indication that may be some poll up , and then it going down to check the LL prices

And after that we can hope.

Daily chart perspective on GJand GU similarlyThe daily time frame seems to be painting a skew double bottom, as price did in the 4hr time frame on the 28 September for the midweek reversal. Price could go up strong from the current zone that its in, or it could come all the way down to test 154.756 to confirm a very big double bottom on the daily to give a strong push up. We are at a critical zone now, so trade carefully and look after your trades. I am in 100pips profit at the moment from the morning buy, so will bring trades to profit and monitor from there

Could we be going to test a high structure from 2016???We have not been to this zone since August 2016, and right now there are no structures to the left to stop us from going there. Ifwe get a bigger time frame retest, we could push there before the end of this week. If we get there and break it, we will go up even further. GJ is now pushing up as aggressively as USDJPY is, which is currently breaking record highs.