GBPUSD Ascending Wedge SetupOANDA:GBPUSD

GBPUSD in a clean little ascending wedge, with long-term bearish bias and short term bullish bias - On the daily, theres some recent clean and strong bullish price action and on the weekly theres a strong bullish candle forming.

To time a better entry, make sure to get on to the lower timeframes.

Anyways guys, good luck and don't forget to trade like a casino.

Fx

(AUDNZD) Short Trade setupWe Have Found Rising wedge in AUDNZD, The chart we are Doing Analysis is 1 Hrs.

There is 12 Pips Risk and 64 Pips Reward You can take Entry Now

or Wait for Rising wedge Break to Downside.

On the technical analysis chart, a wedge pattern is a market trend commonly found in traded assets. The pattern is characterized by a contracting range in prices coupled with an upward trend in prices or a downward trend in prices.

Credit: Wikipedia

Note: This is only for Educational Purpose this is not Investment advice.

Please support the setup with your likes, comments and by following on Trading View.

Thanks

Adil Khan.

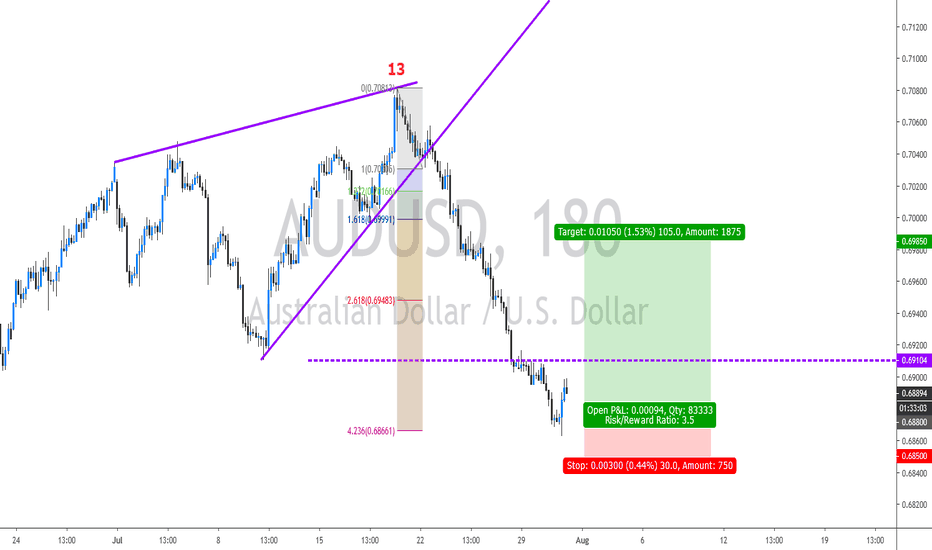

AUDUSD - Stalls @ 423.6%FX:AUDUSD

OANDA:AUDUSD

FOREXCOM:AUDUSD

SAXO:AUDUSD

AUDUSD - Intraday - We look to Buy at 0.6880 (stop at 0.6850)

7 negative daily performances in succession. Prices have reacted from the 423.6% Fibonacci extension level. Buying posted in Asia. Posted a Bullish Outside candle on the 4 hour chart. There is scope for mild selling at the open but losses should be limited. Further upside is expected and we look to set longs in early trade.

Our profit targets will be 0.6985 and 0.7000

Resistance: 0.6920 / 0.6954 / 0.6985

Support: 0.6866 / 0.6831 / 0.6800

AUDUSD - Looks to be forming a bullish flagAUDUSD - Intraday - We look to Buy at 0.6745 (stop at 0.6715)

Posted Mixed Daily results for the last 7 days. RSI (relative strength indicator) is flat and reading close to 50 (mid-point) highlighting the fact that we are non- trending. Trading between support at 0.6745 and resistance at 0.6821. Preferred trade is to buy on dips. Price action is forming a bullish flag which has a bias to break to the upside. The formation has a measured move target of 0.6885.

Our profit targets will be 0.6815 and 0.6885

Resistance: 0.6816 / 0.6885 / 0.6925

Support: 0.6745 / 0.6700 / 0.6677

GBPCAD SELL - SWING TARGET 1.55500New swing lows being created daily wick retested the weekly res as a resistance with price also moving under the MA's no daily or weekly long signals currently. This pair will I feel will continue to find bearish support zones. Purple horizontal lines are back tested daily key levels ranging from 2011-2013. Clearly sterling is in its weakest position for years

EURUSD range break, looking for re-test.Seems like everyone has been watching this range on the EURUSD. We did close slightly below the support but the break was not strong enough to warrant an entry in my opinion.

We are now re-testing the break. I will personally await for a close below 1.1170 or below the recent lows depicted with the black line. Remember a re-test really is confirmed when it makes a new low after re-testing support-turned-resistance zone. Would look to take profits at the 1.1120 zone.

Top and Bottom Analysis on USDJPY by ThinkingAntsOkThis is not a Trade Idea, use this as a frame for decision making based on where are the main technical areas on the chart

Main Items we see on the 4hs chart:

a)Price is against the lower trendline of the descending channel

b)On the same are mentioned in the previous item we have a secondary trendline (dots line) converging on the same spot

c)Convergences are major reversal zones

d)Currently, the price made a bullish movement, and we think the target of this movement is either the trendline of the previous corrective structure or the higher trendline of the descending channel

e)If the price reaches these areas mentioned on d) we will be looking for reversal signals or, symptoms of weakness of the bullish movement

Daily Vision:

Weekly Vision:

EURAUD - Limited upsideEURAUD - Intraday - We look to Sell at 1.6616 (stop at 1.6656)

An Evening Doji Star formation has been posted at the high. Buying posted in Asia. Bespoke resistance is located at 1.6616. The previous swing high is located at 1.6626. The 50% Fibonacci retracement is located at 1.6596 from 1.6787 to 1.6406. Preferred trade is to sell into rallies.

Our profit targets will be 1.6350 and 1.6300

Resistance: 1.6596 / 1.6616 / 1.6626

Support: 1.6406 / 1.6349 / 1.6300

AUDJPY – Possibly forming a bullish reverse Head and Shoulders pAUDJPY - Intraday - We look to Buy a break of 72.16 (stop at 71.86)

The 423.6% Fibonacci extension level of the 76.28-75.13 move is at 71.40. A Doji style candle has been posted from the base. A bullish reverse Head and Shoulders is forming. Trend line resistance is located at 72.16. A break of 72.16 is needed to confirm follow through bullish momentum. The formation has a measured move target of 73.75.

Our profit targets will be 72.75 and 74.00

Resistance: 72.16 / 73.07 / 73.75

Support: 71.23 / 71.40 / 71.00

Short Setup + Explanation on USDJPY by ThinkingAntsOkConsider this as an idea to develop your own setup:

Main items on the 4hs Chart:

a)Price Broke out from a Weekly triangle structure

b)Currently, there is a consolidation structure between the resistance zone and the ascending trendline (yellow solid trendline)

c)On MACD we can observe a divergence on the Histogram, that can be considered as a weak signal of the current bullish movement

d)On the chart, we have set Stop zone / Entry Zone / Take Profit or Break-even zone, use them as a guide of where to set your orders

Weekly Vision:

EURO | Nice opportunity for ShortWait for correction to the Weekly M3 Pivot, then Sell between the 55/100 EMA and below/at the Weekly M3.

Conservative Target is M1 of Future Weekly Pivot and Agressive Target is at S2 Future Weekly Pivot.

M1 is more likely and more safe because it is also the bottom of the Support Zone (Blue).

Shorting Euro is generally a good idea these days because you also get money (Swap) from most brokers for holding the position over night.

USDCAD Short Trade Short position on USD/CAD ahead of tomorrows FOMC meeting and CAD GDP report

The fundamentals mentioned will both highly impact this pair and the currency markets overall tomorrow

However we can see clear indications to take this pair short with the double top on the 4H and taking a look at the HTF

- 30 Pips risk

- TP1 = 1.3090 = 85 pips

- TP2 = 1.3000 = 175 pips

High R:R setup

Make sure to either mitigate your risk heading into the fundamental announces tomorrow or to move your SL to B/E after 30 pips in profit

*This is NOT financial advice*

"AUDUSD facing a strong Support Zone" by ThinkingAntsOk4H Chart Explanation:

- Price is in a 4H range since May, between the Resistance and the Support Zone.

- It bounced in the bottom of the range.

- Price broke the Dashed Descending Trendline.

- If price breaks 0.6905, it has potential to move up towards the Resistance Zone at 0.7035.

Our Weekly and Daily Analysis support this idea! Also, our last prediction on AUDUSD was really accurate. Check it on the Related Ideas!

Weekly View:

Daily View: