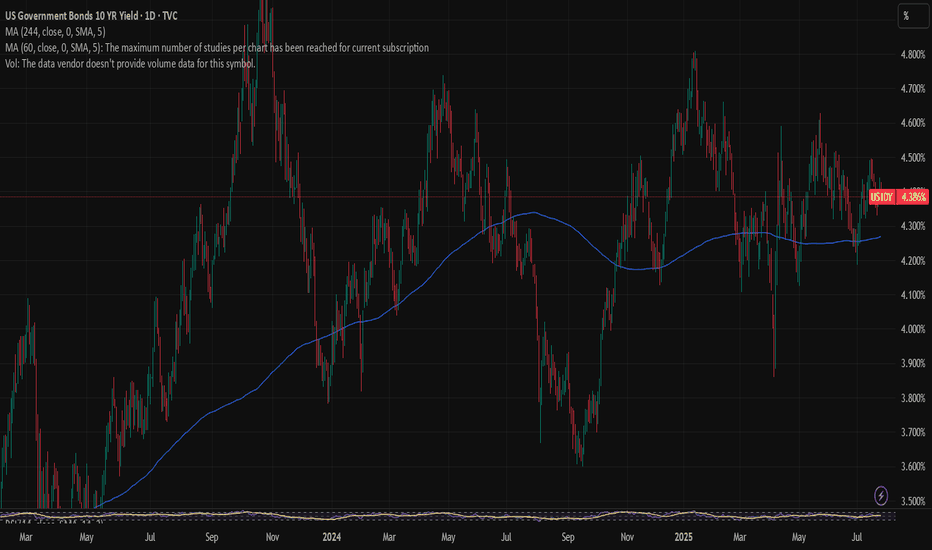

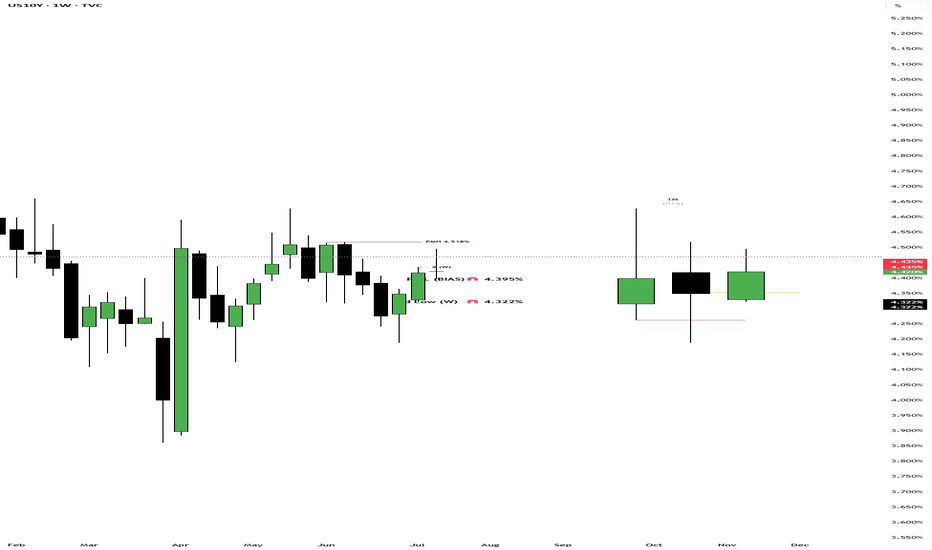

US 10Y TREASURY: FOMC week During the previous week investors were digesting the latest macro data aiming to set expectations for the forthcoming FOMC meeting, which is scheduled for Wednesday, July 30th. The 10Y Treasury yields were moving between 4,32% and 4,44%, closing the week at 4,38%. The drop in yields during the seco

Government bonds

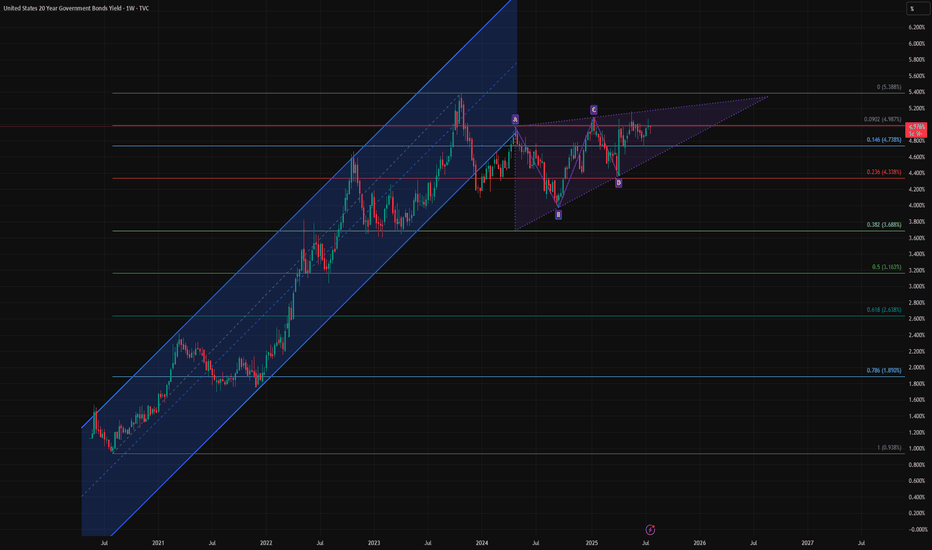

Bond Bulls Smell Blood: 20-Year Yields Likely to Fall🧩 Fundamental Bear Case for 20-Year Yields

1. Recession Risk and Slowing Growth

Leading economic indicators (e.g., ISM Manufacturing, Conference Board LEI) continue to suggest softening demand across key sectors.

A recession or significant slowdown would drive capital into long-duration Treasuries

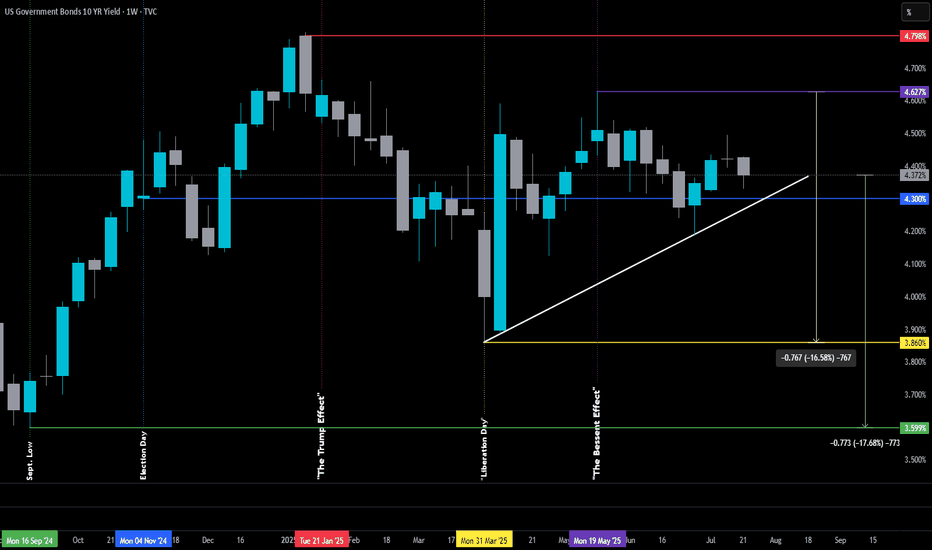

The Bessent Effect: Part I-Challenge the FedThe Bessent Effect: Part I-Challenge the Fed

Originally posted on June 30th, 2025, but it was removed by a moderator — I misinterpreted the posting guidelines (I tend to read a little too deep between the lines sometimes).

For context, the original version didn’t include the White or Green lines.

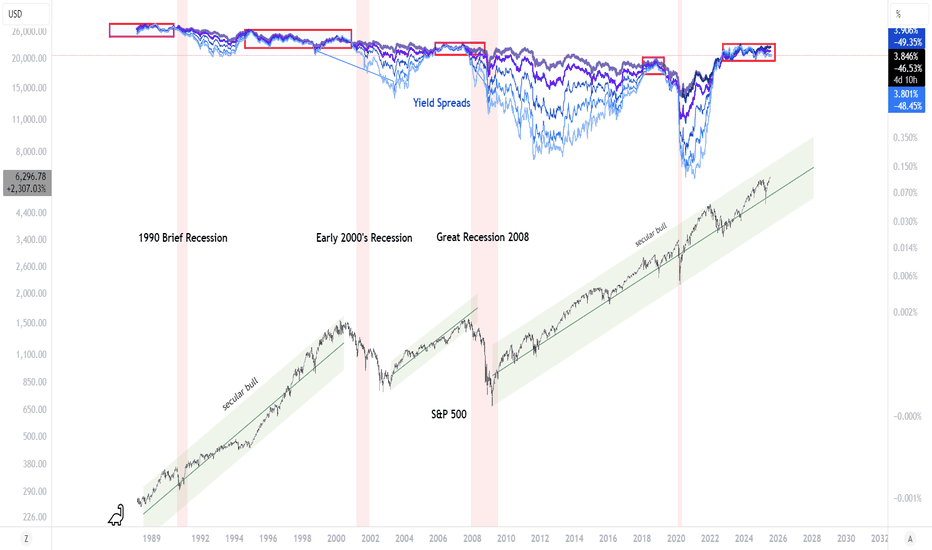

Yield Spreads Warning About the Secular Bull MarketAre we in the final innings of the current secular bull market that emerged from the robust injection of liquidity in response to the 2008 Financial Crisis? Yield spreads are giving us a warning and one that should not be dismissed. Yield spreads show (shorter to longer in lighter blue to darker b

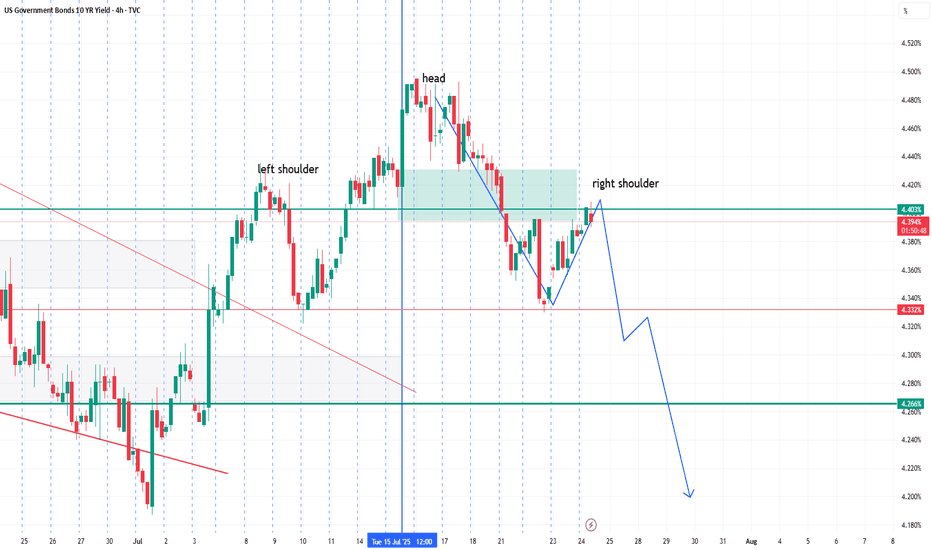

UST 10Y Technical Outlook for the week July 21-25 (updated dailyUS Treasury 10Y Technical Outlook for the week July 21-25 (updated daily)

Overnight

On Friday, the yield on the US 10-year Treasury note slightly declined to 4.44%, driven by investor reactions to the latest University of Michigan Consumer Sentiment data and remarks from Federal Reserve Governor Chr

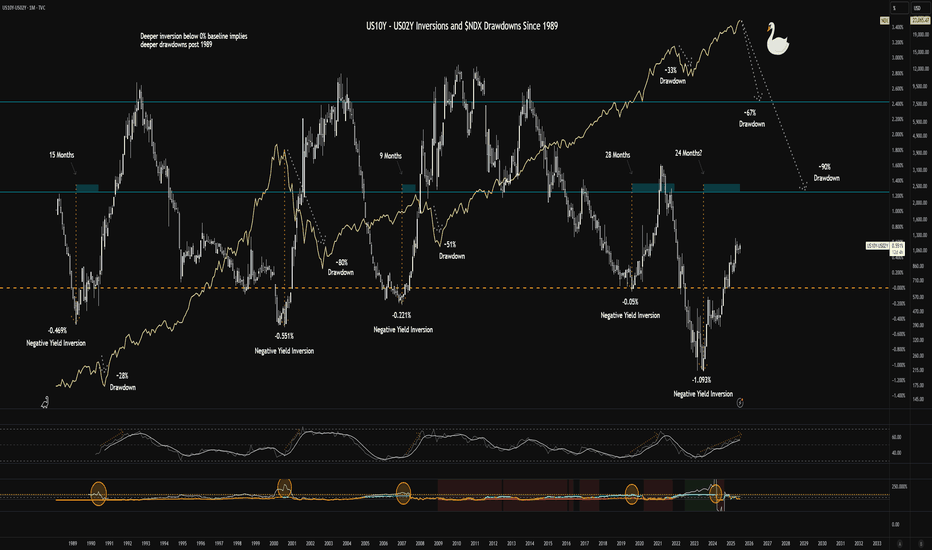

$US10Y - $US02Y Inversion and $NDX Drawdowns Since 1989I cleaned the chart a bit for readability.

The chart shows historical inversions in the TVC:US10Y and TVC:US02Y and the drawdowns in the NASDAQ:NDX that followed. The implication is that we should expect to see a >50% drawdown within 4 months. I'm not calling the "why" but only drawing paral

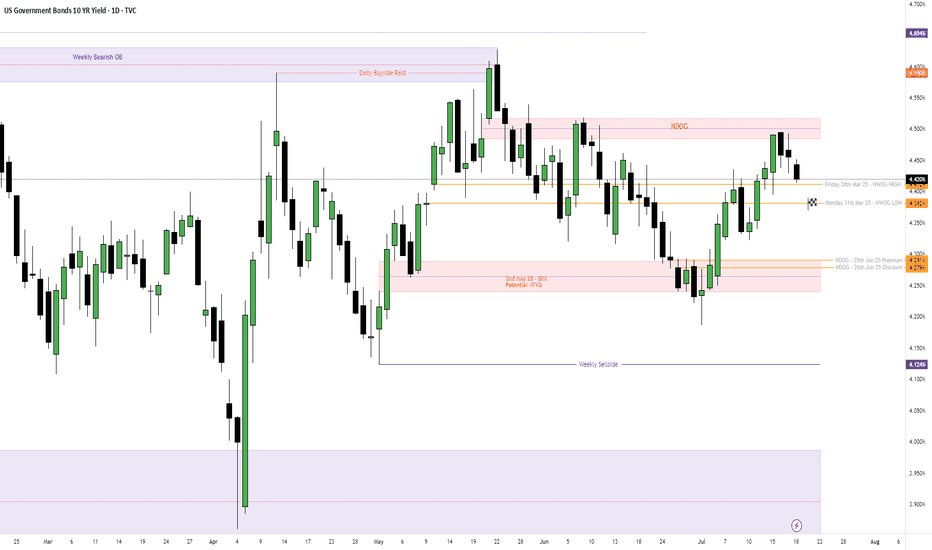

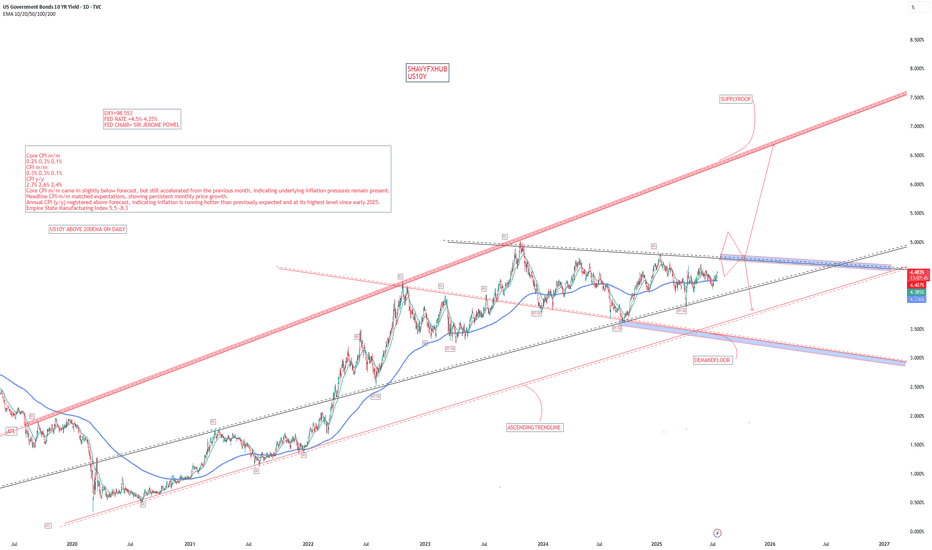

US10Y UNITED STATES GOVERNMENT 10 YEAR BOND YIELD .US 10-Year Treasury Yield Reaction to July 15, 2025 Economic Data

Key Economic Data (July 15, 2025)

Indicator Actual Forecast Previous

Core CPI m/m 0.2% 0.3% 0.1%

CPI m/m 0.3% 0.3% 0.1%

CPI y/y 2.7% 2.6% 2.4%

Empire State Mfg Index 5.5 — -8.3

Market Reaction: US 10-Year Treasury Yield

Yield Movement

See all popular ideas

Rates

SymbolPrice & chgYield

SymbolYield / Price

SymbolPrice & chgYield

SymbolYield / Price

Bond collections

| 1 month | 3 months | 6 months | 1 year | 3 years | 5 years | 10 years | 30 years | |

|---|---|---|---|---|---|---|---|---|

| - | - | - | - | - | - | - | - | |

| - | - | - | - | - | - | - | - | |

| - | - | - | - | - | - | - | - | |

| - | - | - | - | - | - | - | - | |

| - | - | - | - | - | - | - | - | |

| - | - | - | - | - | - | - | - | |

| - | - | - | - | - | - | - | - | |

| - | - | - | - | - | - | - | - | |

| - | - | - | - | - | - | - | - |