US02YThe differential between the US02Y (2-year U.S. Treasury yield) and EUR02Y (2-year Eurozone government bond yield) significantly influences the trade directional bias for the USD and EUR this month. Here's how:

Impact of Yield Differential on Currency Trade

Interest Rate Differentials: A widening yield spread between US02Y and EUR02Y, where U.S. yields rise more than Eurozone yields, typically supports the U.S. dollar (USD) against the euro (EUR). This is because higher yields in the U.S. attract more capital, increasing demand for the USD and causing it to appreciate relative to the EUR. Conversely, if Eurozone yields rise faster, the euro may strengthen against the dollar.

Monetary Policy Expectations: The yield differential also reflects expectations about future monetary policy actions by the Federal Reserve (Fed) and the European Central Bank (ECB). If the yield spread widens in favor of the U.S., it may indicate expectations of more aggressive rate hikes by the Fed compared to the ECB, supporting the USD. If the spread narrows or reverses, it could signal a more dovish Fed stance or a more hawkish ECB stance, potentially weakening the USD.

Risk Sentiment and Economic Outlook: Rising yields in either region can signal improving economic conditions and confidence, attracting investment and supporting the respective currency. However, if yields rise due to inflation concerns or economic uncertainty, the impact on currency strength can be more complex.

Trade Directional Bias This Month

USD Bias: If the US02Y yield remains higher than the EUR02Y yield, Long positions in the USD, expecting it to strengthen against the EUR due to higher returns and potentially more aggressive Fed rate hikes.

EUR Bias: Conversely, if the EUR02Y yield rises faster than the US02Y yield, long positions in the EUR, anticipating euro strength due to higher returns and possibly more hawkish ECB policy.

Key Factors to Watch

Monetary Policy Announcements: Any statements from the Fed or ECB about future rate decisions can significantly impact yield differentials and currency movements.

Economic Indicators: Data on inflation, GDP growth, and employment can influence yield spreads and currency trade.

Market Sentiment: Shifts in investor risk appetite and confidence in economic growth can also affect currency direction.

In summary, the yield differential between US02Y and EUR02Y is a crucial indicator for determining trade directional bias in the USD/EUR pair. A wider spread favoring the U.S. generally supports the USD, while a narrowing or reversal supports the EUR.

Government bonds

EUR02YThe EUR 2-year yield (EUR 2Y) influences the euro currency strength primarily through its role as a short-term interest rate indicator reflecting market expectations of monetary policy and economic conditions in the Eurozone.

How EUR 2Y Yield Affects Euro Strength

Interest Rate Expectations and Carry Trade: The 2-year yield is sensitive to expectations about ECB policy moves, such as rate hikes or cuts. Rising EUR 2Y yields typically signal expectations of tighter ECB policy or stronger economic growth, which attract capital inflows seeking higher returns, thereby supporting euro appreciation. Conversely, falling 2Y yields suggest easing or weaker growth, reducing euro demand.

Monetary Policy Differentials: The EUR 2Y yield compared to US 2-year Treasury yields forms part of the short-term interest rate differential. A narrowing differential (i.e., EUR 2Y rising relative to USD 2Y) tends to strengthen the euro, while a widening gap favoring the US dollar weakens the euro. This is because capital flows follow yield advantages, influencing currency demand.

Market Sentiment and Risk Appetite: Since the 2-year yield reflects near-term economic and policy outlook, it also captures market sentiment. If investors perceive the Eurozone economy as resilient and the ECB as likely to maintain or raise rates, EUR 2Y yields rise, boosting euro strength. If uncertainty or dovish signals dominate, yields fall and the euro weakens.

Bond Market and Currency Link: Bond yields, including the 2-year, serve as indicators of a nation's economic health and monetary stance. Higher short-term yields increase the attractiveness of euro-denominated assets, increasing demand for the euro currency.

Summary

The EUR 2-year yield acts as a barometer of ECB policy expectations and Eurozone economic prospects. Rising EUR 2Y yields generally support euro strength by attracting capital inflows and narrowing yield differentials with the US. Falling EUR 2Y yields signal dovish policy or economic weakness, leading to euro depreciation. Therefore, movements in the EUR 2Y yield should be watched by forex traders as a key driver of the euro's directional bias against other currencies, notably the USD.

US02YAs of April 2025, China holds approximately $759 billion to $761 billion in U.S. Treasury securities, making it the second-largest foreign holder of U.S. debt after Japan. This is a significant reduction from its peak holdings of $1.316 trillion in November 2013.

Potential Effects if China Sells Its U.S. Treasury Holdings

If China decides to sell off its U.S. Treasury holdings, the potential effects could be substantial:

Spike in U.S. Interest Rates: A mass sell-off would flood the market with U.S. Treasuries, depressing their prices and causing yields (interest rates) to rise sharply. Higher borrowing costs for the U.S. government could exacerbate fiscal challenges.

Weakened U.S. Dollar: Selling large amounts of Treasuries would likely weaken the dollar as demand for dollar-denominated assets declines. This could lead to inflationary pressures within the U.S..

Global Financial Shock: The sudden liquidation of such a large asset pool could destabilize global financial markets, given the interconnectedness of economies and reliance on U.S. Treasuries as a safe-haven asset.

Economic Impact on China: Dumping Treasuries would also hurt China by reducing the value of its remaining holdings and potentially destabilizing its own economy due to reduced export competitiveness and financial ripple effects.

Likelihood of a Sell-Off

Despite these risks, such a move is considered unlikely for several reasons:

Mutual Economic Dependency: The U.S.-China economic relationship is deeply intertwined, with China relying on U.S. debt as a safe investment for its foreign exchange reserves and the U.S. benefiting from China's purchase of Treasuries to fund its deficit.

Self-Inflicted Damage: A sell-off would harm China’s own financial stability and trade relations, making it a risky strategy even during heightened tensions.

In conclusion, while the threat of China weaponizing its Treasury holdings exists, it remains a double-edged sword that would inflict significant damage on both economies and global markets

US 10Y TREASURY: to be or not to be – recessionMarket uncertainty continues to be supported with tariffs-narrative induced by US Administration and other world governments. The tariffs-war intensified between the US and China, bringing them to the level of absurdity. The fear of stagflation is for one more time active on financial markets. The 10Y Treasury yields ended one more week at higher grounds. They started the week around 3,87% and ended it at 4,49%. The highest weekly level was reached on Friday, at the level of 4,58%. As analysts involved in a matter noted, the highest sellers of US Treasuries were China and Japan.

The tariffs-war is currently disrupting the market. This sentiment does not have anything to do with current macro data and anticipation on future monetary policy. It has to do with a perception of investors regarding future effects of currently imposed tariffs, which are changeable on a daily basis. The sentiment is the one that is supporting extreme volatilities, as markets face it for the last few weeks now. In the future period, this will all settle down, and the market will find its equilibrium level. It is just a game of nerves at this moment.

10YR Bond Yields: Panic on LTF, Calm on HTF📉 10YR Bond Yields: Panic on LTF, Calm on HTF

Yes, the recent spike in the 10-Year Yield is causing some short-term panic. But if you zoom out to the monthly timeframe, the bigger picture looks far more constructive.

🔍 Here’s what the chart says:

The MACD and RSI on the monthly are both pointing down.

Yields touched 4.5%, historically a key recession threshold.

We’re now seeing a MACD bearish crossover and a clear bearish divergence—classic signs of a trend reversal.

💡 What does this mean?

If no new fear or shock hits the market, yields are likely headed down, potentially toward the 2% range in the coming months. This would naturally ease pressure on equities and crypto.

📉 Conclusion:

This recent spike in yields seems to be transitional, not structural.

The chart suggests that the top is in, and the market is correcting from an overextended zone.

The Fed might not even need to intervene—the bond market is likely to correct on its own.

Stay calm. Stay rational. Always zoom out.

#10YearYield #BondMarket #MacroAnalysis #InterestRates #RecessionWatch #MarketPanic #MACD #TechnicalAnalysis #FederalReserve #CryptoMarkets #StockMarketInsights #StayCalmZoomOut #DYOR

10Y Bond Yield Long (Bond Short): Another recession signal?Take note that I do have a bias on when analyzing the bond yield. But the counts are valid nonetheless, except that another leg down is also valid (as briefly mentioned). Take this as a part 2 to the multi-assets analysis that I made on 11th April.

The 10 Year: When Should We Worry?All over the media eyes are on yields but what exactly do the different potential rates of the 10-year yield mean in terms of debt servicing for the United States? I made this chart to visualize the danger points.

I am not saying I think we will get there I just wanted to know myself and help others to understand what each pain point can mean to the United States economy.

PPI Misses Across the Board — Rate Cut Setup StrengthensFresh inflation data just gave the market a clear signal: the Fed has room to cut sooner than expected.

PPI Snapshot (Actual vs. Forecast):

PPI MoM: -0.4% vs. 0.2% ✅

Core PPI MoM: -0.1% vs. 0.3% ✅

PPI YoY: 2.7% vs. 3.3% ✅

Core PPI YoY: 3.3% vs. 3.6% ✅

PPI ex Food/Energy/Trade YoY: 3.4% vs. 3.5% ✅

🧠 Prices aren’t just slowing — they’re contracting. Combined with soft CPI, this disinflation confirms a Fed-friendly trend and clears the way for policy easing.

🧨 The Twist: 10-Year Yield Spiked

Despite stocks falling, the 10-year yield moved up — a rare divergence in risk-off environments.

This likely reflects three key forces:

Hedge funds facing margin calls, forced to liquidate bond positions.

Political actors unloading treasuries amid U.S. fiscal tensions.

A potential counter-strike to Trump’s efforts to push yields down via market stress.

💡 Ironically, this may help the Fed. Rising yields tighten financial conditions on their own, giving Powell more space to act without risking an inflation resurgence.

🧭 Sector Playbook (Macro-Aligned)

Tech and Growth — Overweight. These sectors thrive on falling rates and an easing narrative.

Bonds — Accumulate. Yield spike could offer a prime entry point before a Fed pivot.

Crypto — Risk-On. Disinflation + volatility = breakout fuel.

Energy and Defense — Hold. May underperform in a growth-led rally (Besides nuclear).

Defensives — Underweight. Safety trade could unwind as liquidity improves.

Small Caps — Speculative. Could bounce hard if liquidity rotation begins.

⚠️ Final Thought

Markets are digesting short-term chaos, but underneath it all, the macro signals are aligning. Even without a "golden tweet," the inflation data is giving Powell the green light.

If the Fed wants to cut — the data is here. The only thing missing is confirmation from Powell’s tone.

#Disinflation #FedCut #YieldSpike #MacroUpdate #CPI #BondMarket #TradingViewIdeas #MarketOutlook #SectorRotation

Double top in equities in 2025 as per 2006-2007 fractal1. This fractal follows the 2006-2007 cycle using US10Y (leading indicator).

2. The orange lines denote a peak in SPY. In this case, a second top in equities this cycle is expected in late Q4 2025, or early 2026 (latest).

3. The bottom in equities appear to be circa Q4 2026, or Q1 2027. Qualitatively, this could point to the house flipping blue.

4. Interestingly, this chart expects a short-term spike in US10Y before its eventual descent to just under 3% by 2027. We may have already seeing this spike in April 2025 ala tariffs.

5. Technical recession is pretty much already on its way. 2026 will not be kind.

6. AMEX:GLD and US Treasury Bonds ( NASDAQ:TLT AMEX:TMF ) will likely be fantastic safe havens.

7. BTC is tethered to SPY, so watch the cycle closely. Liquidate your alt portfolio by 2026.

8. DXY is expected to perform poorly with targets of 95, 85 and 75.

9. We want China to do well but avoid China like the plague.

US yeilds in a corrective rebound In analysis from a few weeks back, we talked about bearish USD and presented a bearish outlook. Since then dollar fall nicely and one of the reason are also lower US yields.

Looking at US yeilds I see bearish impulsive price action down from 4.8%, which could keep the US dollar in a downtrend. What we’ve seen so far is a strong rebound from 3.8%, as shown on the updated 4-hour chart. This rebound suggests that yields are stepping into a correction now, which could unfold as an A-B-C structure. So, it looks like we could see a bit more upside in the near term before US yields turn back to the downside. At the same time, this could mean the US dollar may find some support soon or remain in consolidation a bit longer.

GH

It’s the bond market that's putting Trump in his placeIt’s the bond market that's putting Trump in his place. Normally, when stocks fall, investors flock to U.S. Treasuries. But this week, long-term yields have risen sharply over the first three days. That means Treasuries aren’t being bought — they’re being sold. With America’s massive national debt, higher interest rates make debt servicing more expensive. Sure, they could fire up the printing press, but an abundance of dollars just fuels inflation.

At the same time, the dollar has weakened against the euro, and investors are net sellers of U.S. equities.

Trump doesn’t have good cards to play. He’s had to pull the emergency brake and put the retaliatory tariffs on hold. Officially, the reason given is public “nervousness and unrest” — an absurd excuse. Since when has he ever cared about that?

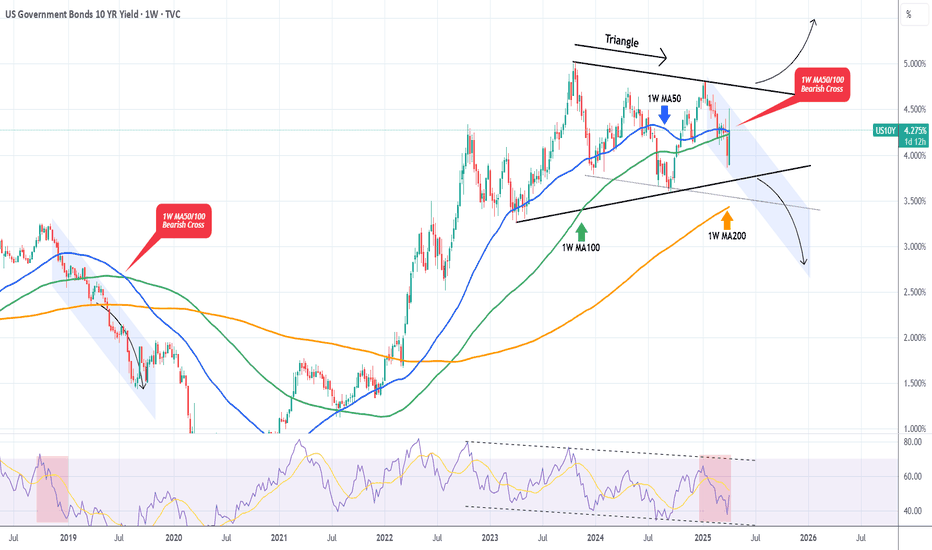

US10Y This break-out will be massive.The U.S. Government Bonds 10YR Yield (US10Y) is trading within a 2-year Triangle pattern and following this week's trade events, got back on its 1W MA50 (blue trend-line). A potential break-out either way from this long-term pattern will be massive.

We do believe though that there are higher probabilities for a bearish break-out as the 1W MA50 is about to cross below the 1W MA100 and form the first 1W MA50/100 Bearish Cross since July 22 2019. Interestingly enough, that was following the last Trade War between the U.S. and China.

At the same time, the 1W RSI has been within a Channel Down since late 2022, indicating a huge Bearish Divergence.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Danger: Recession could be on the way - Yield Curve observationsThis chart shows the monthly yield curve, being the 10 year US Treasury yield - the 2 year bond curve.

In my previous charts, I had pointed out that 2 weeks after the yield curve curve uninverts that recessions are typically either just started or about to start.

This is shown on the charts by the white dotted line.

While looking at the charts, i noticed that the RSI has a tendency to go above 70 when there is a big crash in the markets - pointed out the previous 3 on the chart as the dot com bubble, 2007-2009 financial crash, and the covid crash.

Note that the Covid crash happened before the spike in the yield curve, and this probably has something to do with the global stimulus that was printed in quick response to the pandemic.

Currently, the RSI is NOT above 70. But it is showing evidance of wanting to break through.

I believed that the tariff war that is going on was not going to be as worrying as the previous crashes - but this chart is showing that we are in dangerous territory.

Will be following this chart carefully

Giant 10 Year Yield to the Upside - The Economy is CookedThings are historically bad. The biggest reversal you can imagine. The economic situation has continued to decline.

How are you handling this?

The tariff make the headlines but why is the 10 year yield behaving this way.

Maybe a flight to safety. This is crazy this nuts. I can't even believe this is happening.

WHY EVERYTHING IS GOING DOWN? ANSWER IS HERE!Understanding the Simultaneous Decline in EVERYTHING!

1. The Influence of U.S. Treasury Yields and Interest Rates

The U.S. 10-year Treasury bond yield is a major benchmark in global finance. When yields rise, it signifies that bonds are becoming more attractive relative to riskier assets. Rising yields typically occur when:

Investor Demand Shifts: Investors move from risky assets (like equities or crypto) to safer, higher-yielding government bonds.

Inflation Expectations: Higher inflation expectations often lead investors to demand higher yields, which in turn increases borrowing costs.

Cause and Effect:

When Treasury yields increase, the opportunity cost of holding lower-yielding assets rises. This makes stocks, precious metals like gold, and speculative assets like cryptocurrencies less attractive. Even gold, typically seen as a safe haven, can lose its charm if fixed-income assets provide competitive returns with significantly lower risk.

2. M2 Money Supply Dynamics

The M2 money supply measures the total liquidity available in the economy, including cash, checking deposits, and easily convertible near-money assets. Changes in M2 can impact asset prices in several ways:

Expanding M2: More liquidity in the market initially can boost asset prices. However, if this expansion leads to rising inflation, it may eventually trigger higher interest rates and bond yields.

Contraction or Slowing Growth in M2: A tightening in liquidity can reduce the flow of money into various asset classes. This dampens overall market sentiment and makes riskier assets less attractive.

Cause and Effect:

If M2 growth slows or contracts, there is less capital to chase after higher returns in equities and crypto. At the same time, if there is an expectation of tightening monetary policy, investors recalibrate risk expectations, which leads to a broader sell-off across multiple asset classes.

3. Investor Sentiment and Risk-Off Behavior

In periods where both Treasury yields are rising and the money supply signals less liquidity, the overall investor sentiment often shifts toward a "risk-off" stance. This means:

Safe-Haven Demand: Investors move into safe assets like government bonds, which drives up bond prices and yields while pulling money out of riskier assets such as stocks, gold, and cryptocurrencies.

Correlation Effect: As riskier assets are sold off, their prices fall in tandem. Therefore, even if gold typically acts as a counterweight to stocks, in a severe risk-off environment, all asset classes might decline.

Cause and Effect:

With a risk-off sentiment dominating the market, traditional safe havens (like gold) and growth-oriented assets (stocks and crypto) can experience simultaneous declines. Rising yields encourage a rotation away from these riskier positions, which reinforces the downward trend across multiple markets.

4. Historical Context: The Trump Era and Beyond

During the Trump administration, we observed episodes where Treasury bond prices surged significantly (e.g., a 10% surge) as investors sought refuge during periods of political and economic uncertainty. Eventually, as market sentiment shifted, yields rose, and this led to higher borrowing costs. The resulting effect was a broad-based retreat in many asset classes.

Example: In those periods, as yields climbed to around 4%, investor appetite for risk diminished. The market corrected across equities, precious metals, and cryptocurrencies, with all asset classes experiencing pressure concurrently.

Cause and Effect:

In the current climate, if similar dynamics are at work—namely, rising yields accompanied by tightening M2 growth—then we might see a similar pattern: gold, the S&P 500, and crypto all experience declines together because investor risk appetite is sharply reduced.

Conclusion

The simultaneous decline in gold, the S&P 500, and cryptocurrencies can primarily be attributed to rising U.S. Treasury yields and tightening M2 money supply. As yields rise:

The relative attractiveness of low-risk government bonds improves, encouraging a shift in investment away from riskier assets.

Increased yields raise borrowing costs, which in turn dampens economic growth and investor sentiment.

Slowing liquidity (as measured by M2) further restricts the available capital chasing after higher returns.

This confluence of factors leads to a widespread "risk-off" environment where even traditional safe havens like gold may fall as the entire market adjusts to a higher interest rate and lower liquidity backdrop. Investors thus move across asset classes in a coordinated fashion, leading to declines in gold, equities, and crypto alike.

Understanding this cause-and-effect relationship is crucial for professional traders who rely on disciplined strategies. With a clear view of the broader economic signals, you can navigate these shifts with precision—helping you not only to avoid costly mistakes but also to capitalize on high-probability opportunities that emerge during these market transitions.

US 10Y TREASURY: the Bad, the Good and TariffsAt the first look at the 10Y US benchmark chart, one might say that it looks pretty scary as of the end of last week. However, historically, it happens. Trade tariff war has started, which triggered a massive market uncertainty and a sell-off on financial markets. Naturally, the first idea in investors' perspectives for the future period is a recession on a world's scale and in the US and this was reflected in the US yields. It started at the beginning of the week, where yields from the 4,35% took the down course for the rest of the week, ending it with the 3,86% at the Fridays trading session. However, after reaching the lowest level, the yields reverted just a bit to end the week at the level of 3,99%. The strong move was also supported by Fed Chair Powell's comment that a trade war will have a negative effect on the US economy, which cannot be estimated at this moment.

The volatility of markets might continue for another week in a row. Markets will cope with estimation of countermeasures, which are slowly announced by other countries. Based on current probabilities there are equal chances that the market will test the 4,0% level, or it might move once again down, to test levels below the 4%.

US10Y: This pattern has been extremely bullish for stocks.The U.S. Government Bonds 10 YR Yield is heavily bearish on its 1W technical outlook (RSI = 36.788, MACD = -0.034, ADX = 32.176) and that has historically been favorable for stocks. More specifically, when the Yields have been trending down inside a Channel Up since 2010, the S&P500 was on an uptrend. Going into more detail on the US10Y RSI on the 1W timeframe, it is almost on the 34.20 trendline, which is a key level as every time it hit that (see the dashed vertical lines), the S&P500 bottomed. The exception to the rule was, needless to say the COVID crash in Feb 2020. According to this, Trump's tariffs create the perfect market opportunity for a new long term buy.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##