Crypto market

ETH 4H Mid-Zone BounceETH on the 4H

ETH found support right at the midpoint between the 0.382 and 0.236 Fib levels — exactly at yesterday’s close.

Price closed above the BB center, and the SMA is also holding above it — early signs of recovery.

RSI formed a double bottom in the oversold zone and has now crossed above its moving average.

MACD is about to flip bullish.

I remain bullish and still holding my long, but with tight risk management.

Always take profits and manage risk.

Interaction is welcome.

#Bitcoin Sunday Update $BTC bounced from the $112,398 support #Bitcoin Sunday Update

CRYPTOCAP:BTC bounced from the $112,398 support and is now trading above $113,700. If it holds above this level, a push toward $120K is likely. However, if downside continues, next key support sits near $110K — both supports could trigger a rebound toward $120K. Stay alert for range play before breakout.

BTCUSD CORRECTIONBTCUSD just met strong supply at 120 K, showing clear distribution from large sellers, yet price still respects the primary rising trendline. Below, absorption blocks cluster at 110 K–105 K where bids keep stepping in.

Targets:

• Upside — 125 K if the trendline holds and 120 K is reclaimed.

• Downside — 110 K on a break of trend support.

#BTCUSD #globaltrade #investment #investing #stockmarket #wealth #realestate #markets #economy #finance #money #forex #trading #price #business #currency #blockchain #crypto #cryptocurrency #airdrop #btc #ethereum #ico #altcoin #cryptonews #Bitcoin #ipo

Is it a time for NEOUSDT? 30% potential profit - 7.50 USD targetThe chart shows a 4-hour candlestick pattern for NEO/USDT on Binance, covering mid-July to early August 2025. The price has recently declined from a peak near 8.81 USD to the current level of 5.76 USD, indicating a significant pullback. The moving averages (red and green lines) suggest a bearish trend with a crossover, but the price is approaching a support level around 5.5 USD. The oscillator at the bottom shows oversold conditions with a slight upward movement, hinting at a potential reversal. If buying volume increases and the support holds, a recovery to 7.50 USD appears achievable in the near term, aligning with the previous resistance zone.

Potential TP: 7.50 USD

Multi-Timeframe Market Analysis – Bullish Opportunity Setting U🔍 Multi-Timeframe Market Analysis – Bullish Opportunity Setting Up?

I’ve been closely tracking a potential bullish setup using a multi-timeframe approach. Here’s a quick breakdown:

📅 Weekly Timeframe:

Price is currently trading inside a Weekly Type 2 Bullish Fair Value Gap (FVG) — a key higher timeframe support zone.

No bearish break on weekly structure yet, so bullish bias remains valid unless this FVG fails.

📉 Daily Timeframe:

We’re seeing a bearish orderflow leg, but this is unfolding within the weekly bullish FVG, reducing confidence in downside continuation.

My bias here: Neutral to bullish, watching lower timeframes for confirmation.

⏳ H4 Timeframe:

A dealing range is forming, hinting at potential accumulation or reversal.

Since this is happening after price tapped the weekly FVG, I suspect smart money is accumulating long positions.

I’ll be watching for bullish FVG formation within this range to confirm the setup.

⏱ Lower Timeframes (H1–M15):

Looking for internal liquidity sweeps followed by bullish FVGs.

These will be my entry triggers, with targets at external liquidity levels like daily swing highs.

🎯 My Trading Plan:

Favoring buy setups unless weekly FVG is invalidated.

Focused on H4 breakout and lower timeframe confirmation.

Risk managed entries only, with clear invalidation and targets.

💬 How do you approach multi-timeframe confluence in your trades? Drop your thoughts below!

#Trading #Forex #TechnicalAnalysis #SmartMoney #FVG #MarketStructure #Liquidity #MultiTimeframe #PriceAction #TraderMindset #SwingTrading

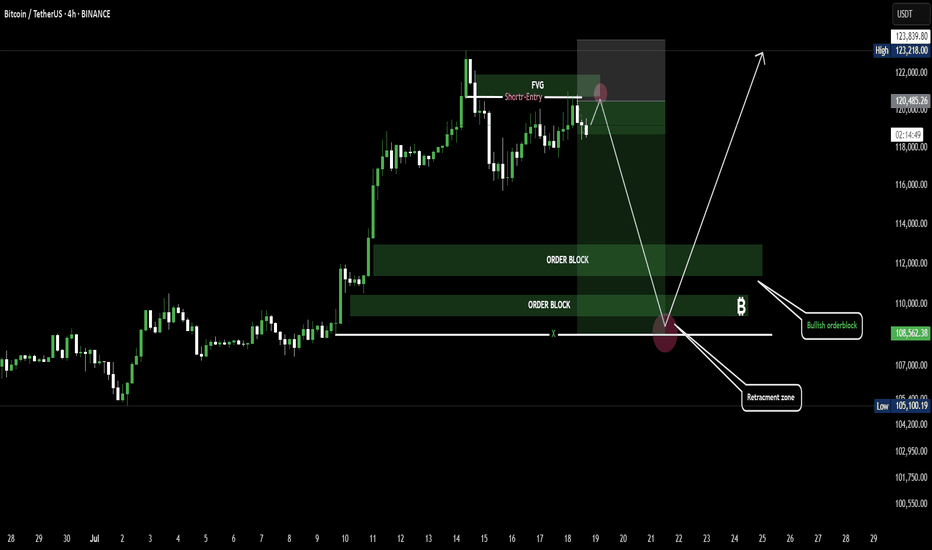

BTC Retracement Loading.....Bullish Bounce Ahead?Bitcoin is showing signs of a short-term pullback after tapping into a Fair Value Gap (FVG) zone, triggering a potential short setup. Price is likely to retrace toward the bullish order block and retracement zone around 105,000–110,000. If that area holds, we could see a strong bounce back toward the 123,000 level.

Bitcoin.Dominance Key LevelsThese are the important BTC.D levels we need to be looking at:

60% - ETH will finally break $4k.

60%-57% - ETH all time high

57%-52% - This is the most important range. If we fill this 5% gap, ETH will be at a very nice all time high price which we have been waiting for for years.

53%-49% - ETH continues to pump and at an all time high, I dont know if any further drop in BTC.D will be fueled by mainly just ETH or if we will see a ETH --> midsize marketcap --> small size marketcap rotation of money like we did in the 2021 altseason. If we do fill that 57%-52% gap mentioned above and i see money start to rotate into other coins fueled by euphoria, i will be looking at coins such as GETTEX:QNT , EURONEXT:ALGO , CRYPTOCAP:LINK any many more.

Below 49% - money to be made everywhere, throw your money in and watch it go up 50% in one day. be smart, but there will be opportunities everywhere. dont throw all your money in one place, enjoy euphoria for a bit, but you want to sell while everybody is euphoric and thinks price will never go down.

I'm not saying these levels ARE going to be hit, im just speaking on what I think will happen WHEN these levels DO get hit.

I mostly have my eyes on Ethereum Ecosystem coins, but i also have my eyes on a lot of AI coins. Everybody is investing in AI currently, in 2021 we saw Facebook announce their Metaverse and we saw metaverse coins like INDEX:GALA go up 9x.

DOW THEORYBack to the Roots: Learn the Theory, Improve Signal

Charles Dow

Before we explore Dow Theory, let’s take a moment to understand who Charles Dow was — and why his ideas still matter today.

Charles Dow wasn’t a financial expert. He was a journalist with a sharp eye for market behavior. In the late 1800s, he began to write about how prices move, how trends form, and what they might mean. His goal was simple: to bring structure and logic to the chaotic world of stock prices.

More importantly, he believed that markets move in trends , and that these trends reflect the collective psychology of all investors. This basic idea became the starting point of technical analysis .

Dow created one of the first stock indexes, which helped investors see the bigger picture instead of focusing only on individual stocks. He also promoted transparency in financial data — long before it was required by law.

In 1889, Dow co-founded The Wall Street Journal, a newspaper that became the voice of financial markets. Through its pages, he published his observations on price behavior, setting the foundation for what would later be known as Dow Theory .

Dow Theory

At the heart of Dow Theory lies a simple but powerful idea:

The market discounts everything.

This means that all known information — earnings reports, interest rates, economic events, political changes, and even future expectations — is already reflected in the price. Price is not random. It is the result of collective investor behavior based on all available knowledge.

Charles Dow didn’t write this exact sentence, but his work clearly reflected this belief. He trusted that by analyzing price movements alone, one could understand the overall direction of the market — because price already includes all the important signals.

Dow and later analysts outlined a set of guiding principles. These are now known as the Six Core Principles of Dow Theory , and they continue to serve as a foundation for modern technical analysis.

The market discounts everything

The market moves in three trends

Major trends have three phases

Averages must confirm each other

Volume confirms the trend

A trend stays in place until it clearly reverses

🔸🔸🔸 The Market Moves in Three Trends 🔸🔸🔸

According to Dow Theory, market movements are not random. Prices move in three different dimensions and time frames: the primary trend , the secondary trend , and the minor (short-term) trend. These three types of movement often occur at the same time. It is very important for an investor to distinguish between them.

The primary trend shows the general direction of the market and can last for months or even years. It’s the major upward or downward movement.

The secondary trend refers to corrections or pullbacks that move in the opposite direction of the primary trend.

The minor trend typically consists of daily or weekly fluctuations and is often considered market “noise.” These short-term movements can occur in the same or opposite direction of the primary trend and may last from a few hours to two or three weeks.

Dow Theory emphasizes that understanding this three-layered structure can protect investors from many mistakes. The theory not only classifies trends but also offers valuable lessons about investor behavior.

It especially highlights the importance of three key principles:

Don’t go against the main trend

Short-term moves can easily confuse traders. Trading against the primary trend often leads to losses. That is why it is crucial to identify the main trend and follow it.

Diversify your exposure

In Dow’s time, technology wasn’t as advanced as it is today, but he still followed multiple indexes (like industrials and transport) to reduce risk. The same principle applies today: investors shouldn’t rely on a single asset — diversification remains a critical part of managing risk.

Define your holding period before entering a trade

Each type of trend comes with a different time expectation. The holding period you choose will play a key role in shaping your trading strategy and aligning it with your financial goals. Instead of debating how long each type of trend should last, it’s more important to define your intended holding period before entering a position.

Your answer to the question “Which holding period suits me?” reflects not only your trading style and lifestyle, but also determines which chart timeframes and indicator timeframes you should use.

🔸🔸🔸 Major Trends Have Three Phases 🔸🔸🔸

According to Dow Theory, major (primary) trends consist of three phases. This structure reflects how investor psychology changes over time and how those emotions are reflected in price action. Regardless of whether the trend is bullish or bearish, each major trend includes these three stages:

Accumulation Phase

The first stage of a bull market often looks like a small bounce during a bear trend. Most people still feel negative about the market. They are afraid to buy again after losing money. Trading volume is low, and prices move in a narrow range. The market stops making new lows, but investors are still unsure. Many have left the market or are very careful now. The price action becomes slow and sideways. It feels boring. But during this quiet time, smart investors slowly start buying. This is how a new trend begins — silently and with doubt.

However, there is no clear signal that a bull market has started. Buying now carries two big risks. First, the market may still go lower. Second, even if a bull trend is coming, no one knows when it will start. How long can you wait while the market does nothing? Holding positions in a flat market has costs — financial, emotional, and missed opportunities elsewhere. That’s why this phase is difficult for most traders to handle.

Public Participation Phase

The market begins to recover, and the broader investor base starts to notice positive changes. News improves, technical indicators give bullish signals. Prices rise, and trading volume increases. This is usually the strongest part of the trend. At this stage, more disciplined and research-driven investors — who follow the market closely — start buying in. They see confirmation in both price action and economic data. Their confidence supports the trend, and momentum grows. The market attracts more attention. Confidence replaces fear. Many investors who stayed out during the earlier phase now feel safer to enter.

Joining the market during this phase is important. The trend is already underway, but there’s still room to grow. Risk is lower than in the early phase, and potential rewards are still high. For many investors, this is the best time to take a position.

Excess Phase

The market enters a phase of excessive optimism. Prices have been rising for a long time, attracting more and more participants. However, during this stage, institutional investors and professional traders who entered earlier begin to gradually take profits.

Although prices remain high, momentum weakens, and the rate of increase slows down. Looking at the volume profile, prices may reach new highs but often without volume support. Technical indicators frequently show bearish divergences. These conditions generate early technical signals that the primary trend may be coming to an end.

🔸🔸🔸 Averages must Confirm Each Other 🔸🔸🔸

According to Dow Theory, a market trend is considered valid only when different indexes move in the same direction. The term “average” here refers to an index or the general direction of a price series. This principle is used to assess whether a price movement is supported by broad market participation.

A single index reaching a new high or low is not enough. For a real and sustainable trend to be confirmed, related indexes are expected to show similar movement and generate signals in the same direction. If this confirmation is missing, the current move may be considered weak or temporary.

How to Analyze It:

Identify related indexes

Choose multiple indexes that represent the same market, sector, or economic domain.

Compare trend direction

Review the price structures of the selected indexes. Are they all showing similar patterns? Did the new highs or lows form around the same time?

Look for confirmation

If multiple indexes form new structures in the same direction (e.g., all make new highs in an uptrend), this increases the validity of the trend.If only one index is moving while others are not participating, confirmation is lacking.

Be cautious without confirmation

When confirmation is missing, trading strategies should be more conservative, or additional signals should be awaited before taking action.

🔸🔸🔸 Volume Confirms the Trend 🔸🔸🔸

According to Dow Theory, the validity of a market trend depends not only on price movement but also on trading volume. For a trend to be considered strong and sustainable, price action should be supported by volume.

Why Is Volume Important?

In a rising market, increasing volume is expected. This indicates growing investor interest and broader participation in the trend.

In a falling market, if the decline happens with high volume, it suggests serious selling pressure and strengthens the trend.

Declining volume may signal a loss of momentum and suggest that the current trend is weakening or nearing its end.

How to Analyze It:

Observe the relationship between price and volume:

Price rising + volume increasing → Strong trend

Price rising + volume decreasing → Lack of confirmation; caution is advised

Check volume during breakouts:

If resistance or highs are broken with strong volume → Reliable signal

If breakouts happen on low volume → May indicate a false move (fakeout)

🔸🔸🔸 A Trend Persists Until a Clear Reversal Occurs 🔸🔸🔸

This core principle of Dow Theory is at the heart of all trend-following strategies.

It states that once a price begins moving in a certain direction, the trend is assumed to continue — until there is clear and technically confirmed evidence that it has ended.

Why Is This Principle Important?

Follow, don’t predict

Instead of guessing what the market will do next, traders stay with the current direction.

Reduces emotional decisions

Trades are based on technical signals, not assumptions like “the price is too high, it must fall.”

A weak trend is not the same as a reversal

Not every pullback means the trend is over. You need clear confirmation before assuming a reversal — such as a breakdown, volume shift, momentum loss, or structural change.

How to Apply It

First, identify the trend direction clearly, and trade in that direction.

Pullbacks are seen as normal movements within the trend — not as reversals.

Even when signs of a reversal appear, wait for confirmation before acting.

Confirmation signals may include:

Failure to form new highs or lows

A break of previous support or resistance

Sudden drop in volume or volume rising in the opposite direction

Weakness or divergence in momentum indicators

Strategic Benefit

This principle is especially useful in trend-following strategies. It helps avoid premature exits and allows traders to stay in profitable trends longer. By focusing on technical confirmation instead of speculation or panic, it encourages disciplined and systematic decision-making.

SOL/USDT 1H Chart – Technical Analysis BreakdownTrend Reversal Structure: Price broke out of a descending trendline after sweeping prior lows (liquidity grab), indicating a possible bullish reversal setup.

Point of Control (POC): Price is currently retesting the POC area (high-volume node), aligning with the trendline and prior support — a potential bounce zone.

RSI Divergence: Bullish RSI divergence marked near the sweep confirms the loss of bearish momentum, strengthening the case for upward continuation.

EPIC/USDT 1H Setup – Bearish Flag Breakdown Incoming? We’re currently observing EPIC/USDT on the 1-hour chart, and the price action is following a classic bearish structure.

🔹 The trend remains strongly bearish overall.

🔹 The market is currently in a retracement phase, forming a new Lower High (LH).

🔹 A clear bearish flag pattern has formed, typically signaling continuation to the downside.

🔹 Once price breaks the Lower Low (LL) support, we expect bearish momentum to resume.

📌 Trade Setup Breakdown:

Pair: EPIC/USDT

Timeframe: 1H

Trend: Bearish

Divergence: None

Pattern: Bearish Flag

Bias: Bearish

Strategy: Sell Stop at LL Breakout

🔻 Entry Price (EP): 1.662

🔴 Stop Loss (SL): 1.938

🟢 Take Profit (TP1): 1.386

⚖️ Risk:Reward Ratio: 1:1

💼 Why This Setup Works:

✅ Clear bearish flag within a downtrend

✅ Retracement forming Lower Highs — classic continuation structure

✅ Breakout of LL confirms bearish momentum

✅ Clean risk-to-reward structure with tight SL and precise TP

💬 What’s your take on EPIC/USDT?

Do you see the same continuation forming? Share your thoughts below 👇

🔔 Don’t forget to follow me for more clean, high-probability trade setups, patterns, and price action plays. Let’s trade smart together! 💹

#EPICUSDT #CryptoTrading #BearishFlag #PriceActionSetup #CryptoAnalysis #1HChart #TrendContinuation #TechnicalSetup #TradeSmart #CryptoSignals #BearishStructure #SellSetup #RiskReward #TradingStrategy #ChartPatterns #BreakoutTrade #CryptoBearish #TradingViewIdeas #CryptoTraders #TradeWhatYouSee #SmartEntry #SwingTradeCrypto #CryptoCommunity #AltcoinAnalysis

Bitcoin at Key Support: A Strategic Long OpportunityBitcoin has reached a significant support level, coinciding with the 50-day moving average around 112,000. The recent correction appears to have been absorbed by the market, and the broader uptrend remains intact.

This area presents an attractive opportunity for long entries, with a recommended stop-loss placed just below Friday’s low.

Target levels for the upward movement are projected at 117,000, 121,000, 123,300, and potentially higher.

Traders should monitor price action closely around this zone to confirm bullish momentum and manage risk accordingly.

#PORTAL/USDT#PORTAL

The price is moving within an ascending channel on the 1-hour frame, adhering well to it, and is on track to break it strongly upwards and retest it.

We have support from the lower boundary of the ascending channel, at 0.0414.

We have a downtrend on the RSI indicator that is about to break and retest, supporting the upside.

There is a major support area in green at 0.0413, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 0.0448

First target: 0.0467

Second target: 0.0486

Third target: 0.0508

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

BTC TRADE PLAN 11/07/2025 - Diamond PatternDear traders,

Technical Analysis of BTCUSDT (Bitcoin/USDT) – July 11, 2025

🕐 Timeframe: 4H

Price has broken above the major resistance at $110,000 and is now trading around $118,000, forming a Diamond Top pattern — a classic reversal formation that may signal an upcoming downtrend or correction.

🔻 Key Highlights:

Major Resistance: $118,000 – current top and potential reversal point.

Key Support: $110,000 – if broken, next targets may lie around $95,000–$100,000.

Diamond Pattern: Typically a bearish reversal signal after a strong uptrend.

RSI Indicator: Currently in overbought territory (above 85), suggesting buyer exhaustion.

📉 Possible Scenario:

Price may reverse from $118,000 -120,000 and test the $110,000 support. A break below that could lead to a deeper correction in the coming weeks.

Regards,

Alireza!

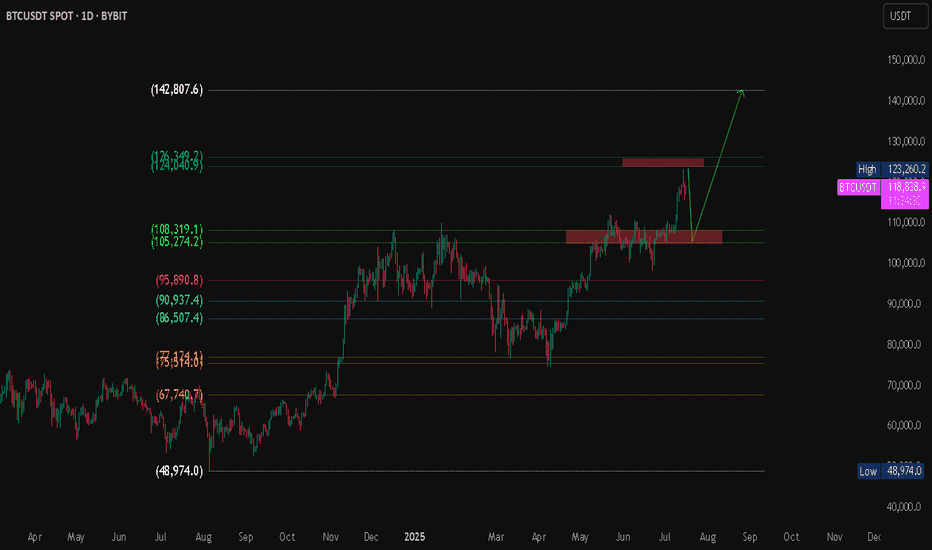

BTC/USDT Technical Analysis Market Overview

Bitcoin is currently trading at $118,788, with an intraday high of $119,311. The market has recently tested a major resistance zone and is showing signs of a potential pullback toward a key demand zone before a possible continuation to higher levels.

Projected Scenario (Bullish Bias)

Expected pullback to the support zone around $105K – $108K.

If price holds and shows a bullish reversal, a breakout above $124K is expected.

Primary upside target: $142,807 (Fibonacci projection / potential new high).

ETH vs BTC, Trend shift?📝 After months of underperformance, we're finally seeing some relative strength from ETH vs BTC.

📍ETH/BTC has bounced off a key historical support zone — a level that previously marked major reversals in the cycle.

📈 While the bounce is still in early stages, it breaks the streak of lower lows and gives hope for a trend shift. If we apply the logic of diminishing returns, even a conservative positive scenario suggests a potential move of +150–200% from the bottom, aligning with previous cycle rebounds.

💡 It’s still too early to call a full rotation, but this is the first sign of real momentum from Ethereum in a long time. Worth keeping an eye on.