Check if it can rise to around 0.5452

Hello, traders. Nice to meet you.

If you "Follow" us, you'll always get the latest information quickly.

Have a great day.

-------------------------------------

(AUSDT 1D chart)

It hasn't been long since EOS changed to A.

Nevertheless, the formation of the HA-Low and HA-High indicators suggests that a wave has begun to form.

However, since the DOM (-60) indicator hasn't yet formed, if it fails to find support from the HA-Low indicator, further declines could occur, so we need to consider countermeasures.

With the HA-Low and HA-High indicators in place, we can now trade in line with our basic trading strategy.

In other words, this refers to a trade where you buy in the DOM(-60) ~ HA-Low range and sell in the HA-High ~ DOM(60) range.

This ultimately refers to a trading strategy within a box range.

Trend trading strategies proceed by either rising in the HA-High ~ DOM(60) range or falling in the DOM(-60) ~ HA-Low range.

In other words, a rise in the HA-High ~ DOM(60) range is likely to lead to a stepwise uptrend, while a decline in the DOM(-60) ~ HA-Low range is likely to lead to a stepwise downtrend.

In this sense, key support and resistance levels are the 0.5013 point and the 0.5847-0.6238 range.

Currently, the price is rising above 0.5013, so if support is found around 0.5013, it would be a good time to buy.

The first sell zone is around 0.5452, where a volume profile zone has formed.

If the price rises above this level and maintains, it is expected to continue upward, likely reaching the 0.5847-0.6238 range.

-

The low trendline has not yet been formed.

The low of the candlestick indicated by the finger is the first selection point for drawing the low trendline.

Since a high trendline has been formed, we should also examine whether the price can rise along the high trendline.

-

Thank you for reading to the end.

I wish you successful trading.

--------------------------------------------------

- This is an explanation of the big picture.

(3-year bull market, 1-year bear market pattern)

I will explain in more detail when the bear market begins.

------------------------------------------------------

Crypto market

GRT. USDTTake Graph seriously.

This project is the backbone of data indexing in the Web 3 world.

Although Graph has a market cap of $10.4 billion, its current price is only $0.093.

Graph organizes complex data for both Aave and Uniswap.

So it will be very easy for Graph to break through the channel and hit $0.11.

" The next targets of the graph will be determined after crossing the price of $0.12 "

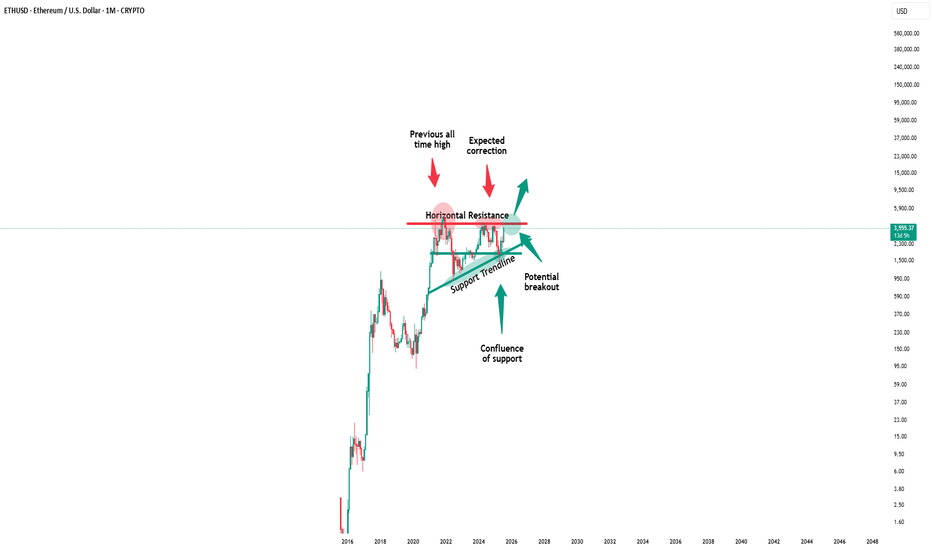

Ethereum - Finally new all time highs!🔬Ethereum ( CRYPTO:ETHUSD ) will break out now:

🔎Analysis summary:

For more than four years, Ethereum has overall been moving sideways. However now Ethereum is once again retesting previous all time highs and preparing a bullish breakout. Multiple retests are generally considered bullish so the breakout is very likely to happen any time soon.

📝Levels to watch:

$4.000

🙏🏻#LONGTERMVISION

SwingTraderPhil

Bitcoin Turned Down — It Was Only a Matter of TimeBitcoin Turned Down — It Was Only a Matter of Time

When the price gets stuck at the top and can’t move higher, it’s always a reason to stop and think. BTC got stuck around $118,000, started to form long upper wicks, and the volume started to decline. All of this pointed to a classic case of fading bullish momentum.

At this point, my indicator gave several key signals: weakening buying power, a change in momentum, and the formation of a potential reversal zone. I refrained from opening long positions — and this decision turned out to be the right one. The price went down and is now trading around $114,000.

Next, I will wait for a retest of the imbalance zone and work from the reaction from this zone.

It is important to understand: this correction is not something unusual. This is a technically sound phase after a strong rally. The market gets rid of speculative positions, gets rid of excessive leverage and prepares for either a reset or a deeper correction.

The market has weakened predictably, and that's actually a good thing. When the structure becomes clear, we can trade with a plan rather than just following our gut instinct.

TaousdtThe volume profile on this chart along with other macro factors suggest we extend to the 1.618 at some point

(Probably q4)

~171%

There would be potential for price acceptance at these levels aswell and eventual continuation given the fundamentals of this one.. could easily be a multi cycle coin...

High-Risk Crypto Bet – DODO AnalysisDODO is a decentralized finance (#DeFi) protocol that has seen a brutal 99% drawdown from its peak — making it one of the most devalued tokens in the market.

📉 Structure:

The chart shows a “channel within a channel” structure — a signal of prolonged capitulation. DODO is currently in a range where most have written it off. But history shows that such zones often precede major reversals.

🌀 Formation:

A potential inverse head and shoulders pattern is developing — a classic reversal setup. The minimal target from this structure is around $0.08.

📈 Early Signal:

Price has already bounced +75% from the bottom — a possible sign of early accumulation.

☕ Bigger Picture:

This zone might be forming the right side of a long-term cup pattern — hinting at a potential macro reversal if the market supports.

DeGRAM | BTCUSD reached the support level📊 Technical Analysis

● BTCUSD has bounced from confluence support at 112.3k–114.8k, reclaiming the ascending support line and validating the lower boundary of the rising triangle.

● Price action suggests a bullish continuation setup with targets at 119.9k and extension to the upper resistance near 122.5k–125k.

💡 Fundamental Analysis

● US labor data slowdown and dovish Fed commentary have pulled real yields lower, boosting crypto demand.

● Glassnode reports ongoing whale accumulation and rising stablecoin inflows, signaling positive capital rotation into BTC.

✨ Summary

Long above 114.8k. Targets 119.9k → 122.5k+. Setup invalidated on a break below 112.3k support.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

15-minute analysisThe price went up to 3717 and got rejected. It’s currently sitting around the 3666 level with low volume, and for now, the market seems calm.

It’s clear that a significant level has formed here, which looks reliable.

We also have another key level around 3580.

Based on my analysis, I expect the price to react to one of these two levels and then potentially start a move toward the 38,000 mark.

ARB – Critical Support ZonePrice is retesting a major support at $0.363. This level has acted as a strong pivot multiple times in the past, providing both support and resistance. Bulls need to hold this zone to avoid a deeper retrace. Below it, next support is down at $0.264.

Plan:

• Hold above $0.363 – could see a local bounce and retest of $0.44–0.50 resistance

• Lose $0.363 – opens the way for a larger flush down toward $0.26

• No setup for longs if we close below support — would flip bias to short on breakdown

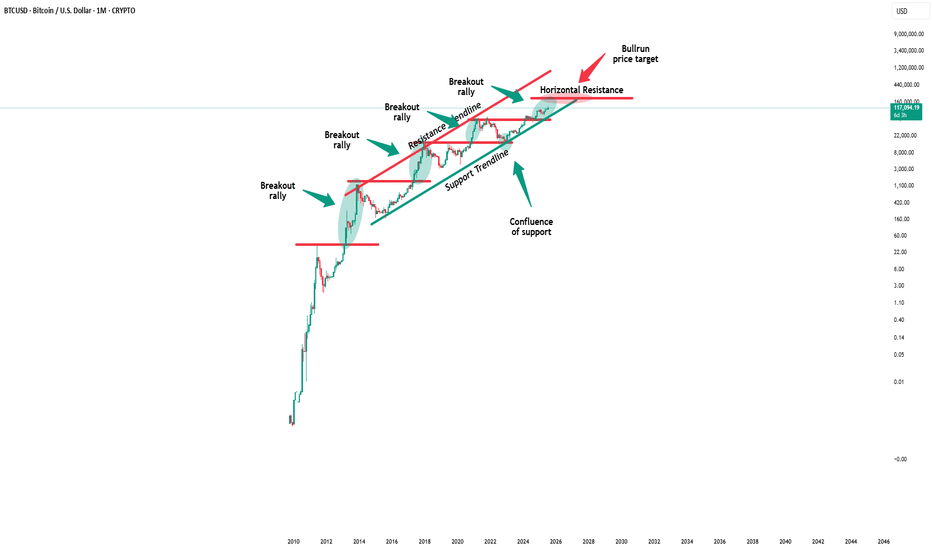

Bitcoin - The cycles are playing out!⚔️Bitcoin ( CRYPTO:BTCUSD ) just repeats another cycle:

🔎Analysis summary:

Following all of the previous all time high breakouts, Bitcoin will now further extend the rally. After some simple calculation, we can see that Bitcoin will rally another +50% in order to reach the overall price target. However there will be volatility along the way so make sure to remain calm.

📝Levels to watch:

$200.000

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

BTC – Still looking heavy below key resistanceDespite a short-term relief bounce after Monday’s drop, BTC remains below the critical 1D MSS + S/R (red box). Structure is weak until this level is reclaimed. Bears remain in control as long as price can’t close above 115.7k.

Plan:

Maintain bearish bias while below the red box — expecting new lows, targeting the green demand/OB cluster around 108.3k.

Flip the red box (close above 115.7k) and the outlook shifts to neutral or bullish.

BITCOIN TRADING IS 100% PROBABILITY,ANY KEY LEVEL IN THIS CHART CAN FAIL,pls manage your risk and build a strong mindset.

bitcoin is showing a bullish drive. If i retest the 123k level again and gets rejected we are selling down ,the structure has given us a clue on 135k and above possible upswing on sentiment ,this level represents the ascending trendline and a supply roof.

#btc #bitcoin #crypto #eth #sol

BTC - THIS IS THE END !?I didn’t want to jump to conclusions, so I waited for the NY open to see how the market would react — and so far, things don’t look bad at all. 🤔

Yeah, that previous-week correction wasn’t fun, but honestly, it’s perfectly healthy price action.

Thanks to that sharp drop, #Bitcoin managed to:

✅ Fully close the CME gap ;

✅ Fill a pretty large FVG ;

✅ Cleanly retest the previous high ;

✅ Perfectly touch the 50-day MA — which has historically sparked solid moves.

Sure, it was unpleasant. Sure, things didn’t go exactly as planned. 🤷♂️

But is this the end? Absolutely not. We haven’t even reached any of the typical panic points yet.

I think on the LTF we’ll dip once more to shake out early longers — then we’ll continue upward. 🐋

is trend bullish or bearish?look at this canal we are in lower low and lower high trend is bearish !!but know i think trend is still bearish why becuase we havnt reach the upper band the canal it must break the upper band

to sure bullish trend is start again its take a time maybe 1 or 2 month but now we are in another Lower low again in 170 price after touch it and reject it maybe market goes down just remmember this post for now i think a long and exit in 170 maybe good .ijust wana trust myself again i wait for its will be happen

XRP 4H – Double Bottom… or Just Another Lower High?

XRP bounced cleanly from major support — the same zone that sparked its last leg up.

This could mark the early stages of a double bottom or just another bear market rally before continuation.

🔹 Previous top = strong supply rejection

🔹 Current support = high-volume bounce zone

🔹 Stoch RSI turning up from oversold

Key confirmation would be:

– Break of $3.15

– Retest + continuation

Otherwise? Another fakeout lower high could trap longs.

ETC 4H Analysis : V-Pattern Breakout , $23M Buy & Key Fib LevelsHey , how's it going? Come over here — Satoshi's got something for you !

⏱ We are analyzing Ethereum Classic (ETC) on the 4-hour timeframe .

👀 After breaking above the $19.1 level, Ethereum Classic started a strong and high-momentum bullish move and reached the $25.28 resistance, where it was rejected and entered a deep correction .

A V-pattern support has now formed, and a breakout of this pattern could serve as a signal for the end of the correction .

🎮 We're observing the key Fibonacci zones , drawn from the breakout level and its pullback area .

The 0 level is considered our support base , while the other Fibonacci levels act as resistances and potential long-entry triggers .

The most important upcoming resistance is at $21.16 , which serves as the main trigger for our long position .

We will now monitor whether ETC forms a higher low before reaching this resistance , or reacts to it and then forms a higher low — both scenarios would be valid setups for a long position .

As for the 0.236 Fibonacci level , it's the nearest support, and a pullback to this zone is also possible .

⚙️ The RSI oscillator previously had a key resistance at 57.78 , which has now been broken to the upside , and RSI is currently holding above this level .

🔼 Volume may increase again tomorrow during the New York session .

Today, in the marked candle , $23 million worth of Ethereum Classic was bought , and this market maker buy helped save ETC from a deeper correction .

🖥 Summary :

The breakout of the V-pattern allowed ETC to push upward and form a higher low .

Once the pullback to the identified Fibonacci zone completes , we can open our long position , or alternatively , set a buy stop at that level with a wider stop-loss to manage risk properly .

💡 Disclaimer :))) .

BTC Long Setup (Post-Liquidation Reclaim)Hey Candle Fam,

The weak hands just got flushed harder than a memecoin rug—perfect. While retail panicked on the dip, smart money was quietly filling bags near $114k. Now it’s our turn to strike with precision.

🔥 BTC Long Setup (Post-Liquidation Reclaim)

🎯 Entry: $114,390–$113,800

🛡️ Stop Loss: $111,900

💰 Targets: $121k / $130k / $140k

📊 Strategy: Liquidity Grab + Weekly Demand Tap

– HTF bias: Still bullish, above key $115k zone

– LTF confluence: Sweep of lows + CHoCH forming on 12H/1H

– Footprint data: Volume absorption + delta flip confirm buyer interest

⚠️ Caution:

Breakdown below $110k would invalidate this setup and likely trigger a strong bearish leg. This is not a “to the moon” YOLO.

Stick to your system, manage risk, and remove emotion.

🧠 Final Note:

We don’t chase dreams—we execute plans.

All the hours we spend studying this game? It’s not for fun. It’s for freedom.

Financial independence is the goal—this is the craft.

Candle Craft | Signal. Structure. Execution.

ZRO – Best SetupPrice is consolidating near key equal lows around $1.48–1.50. Liquidity likely sits below these lows, making a sweep into that zone attractive for larger players. Chasing longs here is risky without confirmation.

Plan:

• Wait for a clean sweep below the equal lows

• Look for a strong reclaim of the range back above $1.50 (failed breakdown)

• Entry trigger is confirmation of buyers stepping in after the sweep

If these conditions are met, targeting $2.46 and higher makes sense. No sweep/reclaim = no trade.

Ethereum Wave Analysis – 4 August 2025- Ethereum reversed from the key support level 3400.00

- Likely to rise to resistance level 3800.00

The Ethereum cryptocurrency recently reversed from the support zone between the key support level of 3400.00 (formerly a resistance level from January) and the upper trendline of the recently broken up channel from May.

This support zone was further strengthened by the 38.2% Fibonacci correction of the previous sharp upward impulse from July.

Given the clear daily uptrend, Ethereum cryptocurrency can be expected to rise to the next resistance level 3800.00.