Forex market

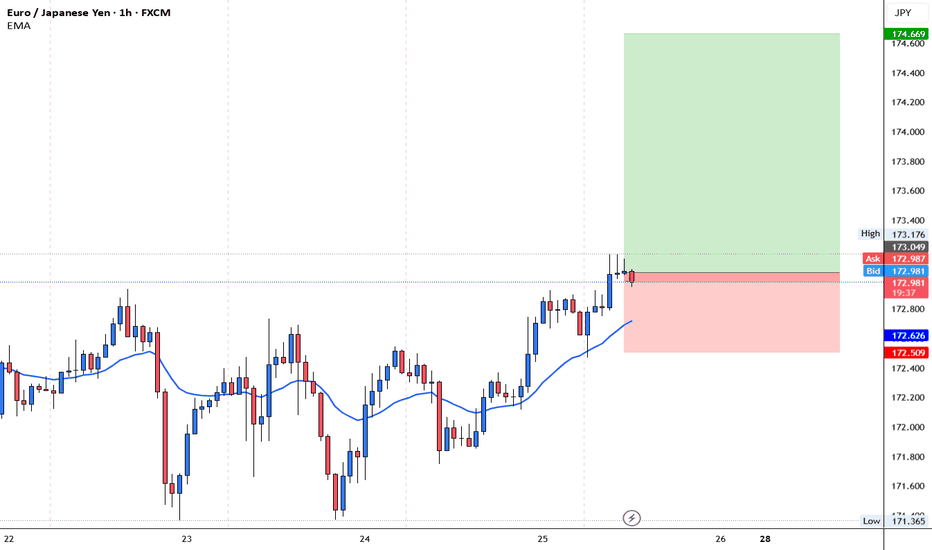

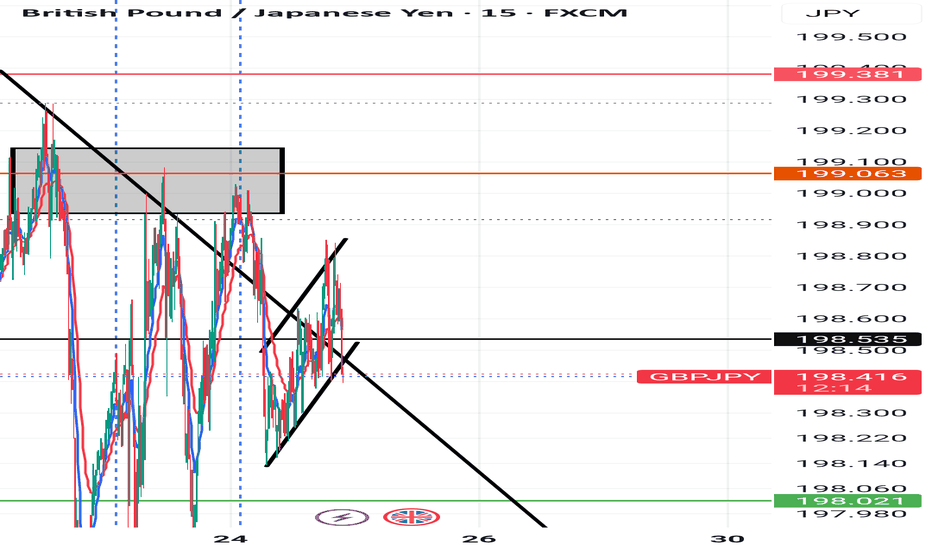

EURJPY BUYJust an idea for short term target with SL and TP.

Timeframe: H1

Price: 173.049

SL: 172.509

TP: 174.669

SL will move to breakeven at 1:1

Close 50% at 1:2

Remaining will run till 1:3

Risk Disclaimer:

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Past performance is not indicative of future results. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

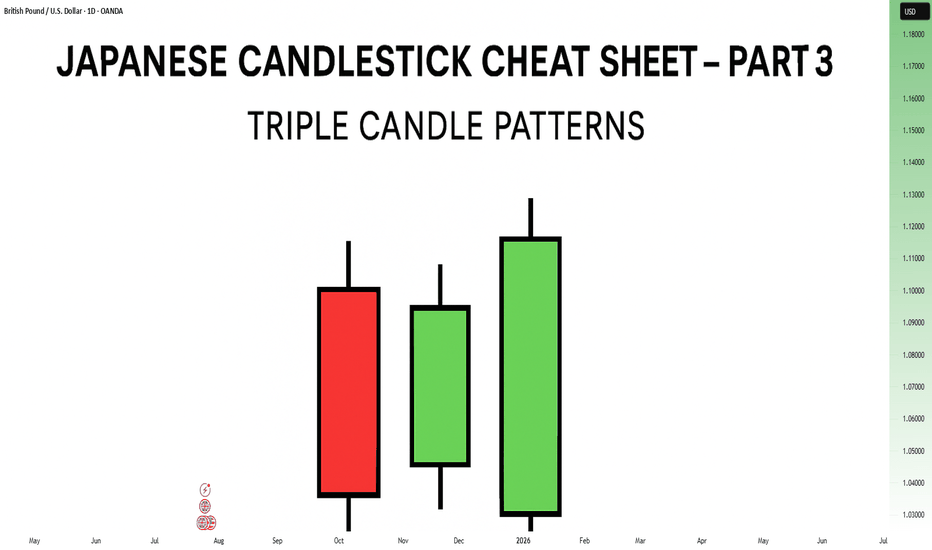

Japanese Candlestick Cheat Sheet – Part Three- 3 candle patternsSo far in this series, we've broken down single candle formations ( Part 1 ) and explored double candle signals ( Part 2 ) — the kind of patterns that give you quick, often powerful hints about the market’s mood.

But now it’s time to go a step further.

👉 In Part 3, we dive into triple candlestick formations — patterns that take more time to form, but often offer stronger confirmation and a more reliable narrative.

They’re like reading three full sentences from the market instead of just one or two words.

If you’re ready to spot momentum shifts (not noise), this lesson is for you.

Let’s decode the story behind formations like Morning Star, Three White Soldiers, and so on.

MORNING STAR

Bias: Bullish

What is the Morning Star pattern?

The Morning Star pattern consists of a bearish candle, a small-bodied middle candle, and a bullish candle, forming at the end of a downtrend to signal potential reversal. This pattern reflects a shift from seller dominance to buyer strength, as the middle candle marks a pause before a reversal. The Morning Star is a reliable signal that buyer interest is reemerging.

Understanding Morning Stars helps traders anticipate shifts in momentum, providing valuable entry points for new uptrends.

Meaning:

Found in downtrends; signals potential bullish reversal as buyers gain control, with strength confirmed by the third candle closing above the first.

BULLISH ABANDONED BABY

Bias: Bullish

What is the Bullish Abandoned Baby pattern?

The Bullish Abandoned Baby is a rare but powerful reversal pattern that consists of a bearish candle, a gapped doji, and a bullish candle. The middle doji reflects indecision, while the third bullish candle confirms the reversal. This pattern highlights a dramatic shift in sentiment, showing that buyers are prepared to take control.

Recognizing the Bullish Abandoned Baby can offer traders insights into pivotal market shifts.

Meaning:

Appears in downtrends; suggests a strong bullish reversal, as the middle doji shows indecision, with confirmation by a strong bullish move.

THREE WHITE SOLDIERS

What is the Three White Soldiers pattern?

The Three White Soldiers pattern consists of three consecutive bullish candles, each closing higher than the last, often appearing in downtrends to signal a potential bullish reversal. This pattern reflects sustained buying pressure, indicating that buyer sentiment is strong. Psychologically, it shows that buyers are steadily gaining confidence, pushing prices upward.

For traders, Three White Soldiers provide a clear signal of momentum, ideal for capturing emerging trends.

Meaning:

Found in downtrends; signals potential trend reversal, showing sustained buying strength, often signaling the start of a bullish trend.

MORNING DOJI STAR

What is the Morning Doji Star pattern?

The Morning Doji Star pattern is similar to the Morning Star, but with a doji as the middle candle, indicating greater indecision before a reversal. This pattern consists of a bearish candle, a doji, and a bullish candle, highlighting a transition from bearish to bullish sentiment. The doji reflects a moment when market sentiment is balanced, but the third candle confirms a bullish shift.

Interpreting Morning Doji Stars can help traders identify turning points in downtrends, providing valuable entry opportunities.

Meaning:

Appears in downtrends; signals potential bullish reversal, with indecision from the doji and confirmation by a strong bullish candle.

EVENING STAR

What is the Evening Star pattern?

The Evening Star is a three-candle pattern that appears at the top of an uptrend, signaling a potential bearish reversal. It consists of a bullish candle, a small-bodied middle candle, and a bearish candle, showing a transition from buyer control to seller strength. This pattern often appears at market peaks, where optimism is giving way to caution.

Understanding the Evening Star pattern helps traders anticipate downtrend formations, allowing them to time their exits.

Meaning:

Found in uptrends; signals potential bearish reversal as sellers gain control, confirmed if the third candle closes below the first.

BEARISH ABANDONED BABY

What is the Bearish Abandoned Baby pattern?

The Bearish Abandoned Baby is the bearish counterpart to the Bullish Abandoned Baby and consists of a bullish candle, a gapped doji, and a bearish candle. This pattern reveals a dramatic shift in sentiment from bullish to bearish, highlighting a sudden reversal at the top of an uptrend.

Recognizing the Bearish Abandoned Baby can offer traders insight into market tops and impending trend changes.

Meaning:

Appears in uptrends; indicates strong bearish reversal, as indecision in the doji is followed by selling strength.

THREE BLACK CROWS

What is the Three Black Crows pattern?

The Three Black Crows pattern consists of three consecutive bearish candles, each closing lower than the last, appearing in uptrends to signal potential reversal. This pattern reflects sustained selling pressure, indicating that sellers are gaining control. The Three Black Crows highlight a moment when buyer confidence wanes, marking the beginning of downward momentum.

For traders, this pattern provides a clear signal to avoid buying into weakening trends or even entering short trades.

Meaning:

Found in uptrends; signals potential bearish reversal, with sustained selling pressure often marking the start of a downtrend.

EVENING DOJI STAR

What is the Evening Doji Star pattern?

The Evening Doji Star is similar to the Evening Star, but with a doji as the middle candle, highlighting greater indecision. This pattern consists of a bullish candle, a doji, and a bearish candle, indicating a shift from bullish to bearish sentiment. The doji suggests that buyers are losing control, with sellers prepared to reverse the trend.

Understanding Evening Doji Stars allows traders to recognize market tops, helping them avoid overextended trends.

Meaning:

Appears in uptrends; signals potential bearish reversal, as the doji suggests indecision, confirmed by strong selling on the third candle.

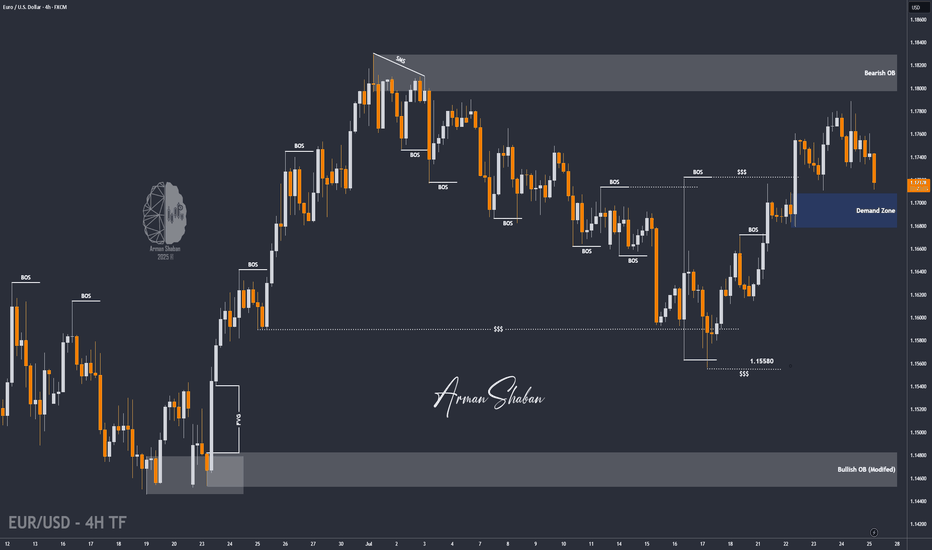

EUR/USD | Correction Near Key Demand – Watching for Rebound!By analyzing the EURUSD chart on the 4-hour timeframe, we can see that after the last analysis, the price started a correction and is currently trading around 1.17150. I expect that once it enters the 1.16780–1.17100 zone, we could see a rebound from this key demand area. If the price holds above this zone, the next bullish targets will be 1.17370 as the first target and 1.17730 as the second.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

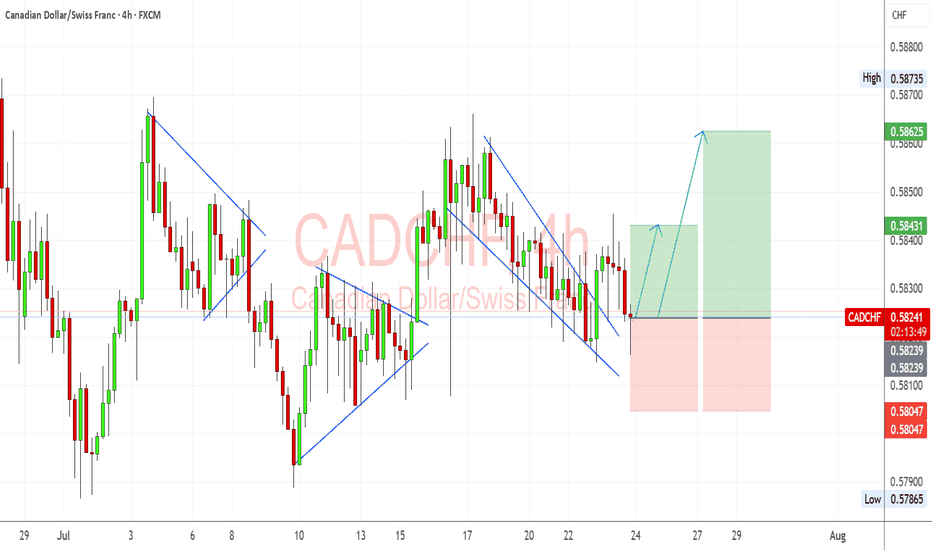

CADCHF Bullish Reversal in Motion Channel Break & Momentum ShiftCADCHF setup is developing into a potential bullish recovery after a breakout from a falling wedge. I’m looking for signs of buyer control as price attempts to build higher structure off the recent breakout.

📊 Technical View (My Setup Insight):

Falling Wedge Breakout: Price has cleanly broken out of the descending channel/wedge formation. That’s often a reversal signal, especially near support zones.

Support Holding: The pair found buyers around 0.5810–0.5820, an area tested multiple times in July. This zone has acted as a soft base.

Bullish Flag Recovery: Prior corrective patterns (flags/pennants) were followed by strong impulsive moves, and we may be repeating this pattern now.

Next Targets:

TP1: 0.5843 – aligns with previous structure and minor resistance.

TP2: 0.5862 – near the most recent high and top of consolidation.

Stop-Loss: Below 0.5800 to invalidate the reversal structure.

🧮 Fundamental Drivers (My Outlook):

CAD Support from Oil Stability: Oil prices have firmed around $78–$80, which helps the CAD via improved trade and energy revenue prospects.

SNB Stance Neutral-Dovish: Swiss inflation remains soft, and SNB has signaled comfort with its current policy rate, reducing CHF bullish pressure.

BoC Hawkish Bias: Despite softening Canadian CPI, the BoC remains cautious and hasn’t ruled out future hikes. CAD remains supported relative to CHF.

Global Risk Mood: CHF is sensitive to risk-off flows. With equities and commodities rebounding modestly, safe haven flows into CHF may slow.

⚠️ Risks to the Setup:

A sudden drop in oil prices could hurt CAD.

Risk-off sentiment due to geopolitical tensions or US equity selloffs could fuel CHF strength.

Any surprise SNB jawboning about FX could cause CHF to spike.

📆 Upcoming Events to Monitor:

Canadian GDP / Retail Sales – if strong, reinforces CAD recovery.

Swiss KOF Economic Barometer – gives insight into CHF macro tone.

Oil Inventories – strong builds or drawdowns influence CAD indirectly.

🔁 Leader/Lagger Context:

CADCHF is often a lagger, especially when risk sentiment or oil makes bigger moves. It can follow USDCHF or USDCAD behavior due to shared components.

If oil or global risk sentiment shifts, CADCHF tends to react with a small lag, making it great for secondary confirmation trades.

🧩 Summary – Bias & Watchpoints:

I currently hold a bullish bias on CADCHF following the falling wedge breakout and support defense. Fundamentals are moderately in favor of CAD due to oil stability and BoC’s cautious stance versus the more passive SNB. Key risks include any renewed CHF demand from risk-off shifts or soft Canadian economic surprises. The most critical levels now lie at 0.5843 and 0.5862 for upside targets, while 0.5800 remains key invalidation support.

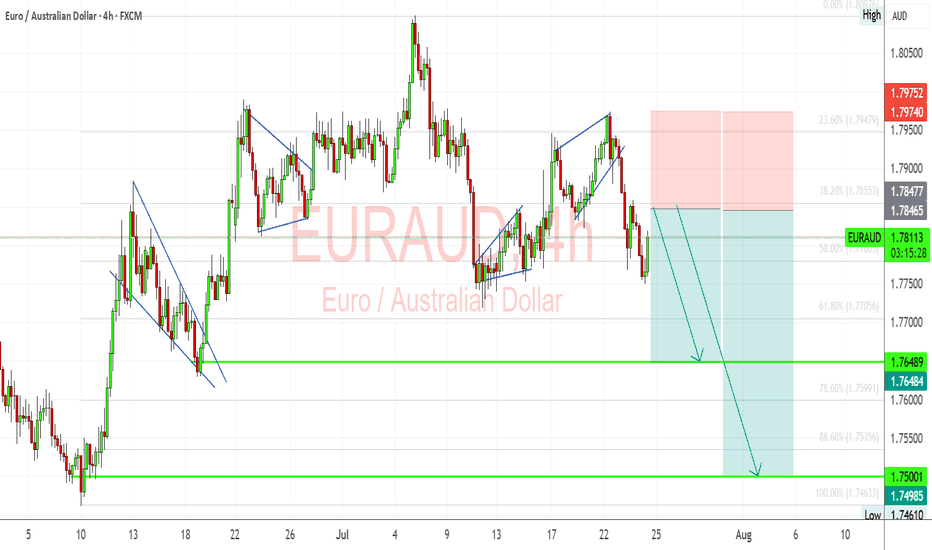

EURAUD Breakdown: Bearish Continuation Ahead of ECBEURAUD is showing signs of renewed downside pressure as fundamental and technical forces align in favor of Australian dollar strength. With the European Central Bank expected to hold rates steady and provide a cautious growth outlook, the euro remains vulnerable. Meanwhile, upside surprises in Australian inflation and supportive commodity dynamics continue to boost AUD sentiment. Technically, the pair has broken down from a rising wedge, confirming bearish momentum and setting the stage for further declines toward key support near 1.7648 and potentially 1.7500.

🟢 Current Bias: Bearish

🔑 Key Fundamentals:

ECB: Markets expect the ECB to hold rates steady this week. While this ends a 7-year streak of cuts, the bank has turned cautiously neutral, with no clear signal of future tightening. Core inflation remains subdued, and growth momentum across Germany and the euro area is weak.

RBA & Australia: The RBA faces persistent inflation risks after the June CPI surprised to the upside, putting rate hikes back on the table. The Aussie dollar is drawing strength from this, especially with rising commodity prices and China's potential fiscal stimulus aiding demand-side confidence.

Macro Divergence: Australia’s macro picture is improving vs. the eurozone. AUD has tailwinds; EUR is under pressure from stagnant growth and tepid inflation outlook.

⚠️ Risks to Bias:

ECB Surprise: A sudden hawkish tone from the ECB (e.g., lifting forecasts or emphasizing wage-driven inflation risk) could spark short-term EUR upside.

RBA Softness: A dovish RBA pivot or weak Aussie data could weaken AUD strength and slow EURAUD downside.

Geopolitical Risk: Broader global volatility (e.g., US-China, oil disruptions) could cause flows into euro as a semi-safe haven.

📅 Key News/Events to Watch:

ECB Rate Decision & Press Conference – July 25

Eurozone Flash GDP + CPI – Next week

China industrial data (AUD-sensitive)

RBA August Meeting Statement (early Aug)

📉 Technical Breakdown (4H Chart):

Price broke bearish from a wedge consolidation.

Minor bullish pullbacks are being sold into, confirming a distribution phase.

Targets:

1st Target: 1.76480 (support & fib confluence)

2nd Target: 1.7500–1.7460 zone (major swing low)

Resistance: 1.7855–1.7975 zone is key invalidation area.

Structure favors lower highs & continuation patterns until support zones break.

🧭 Leader/Lagger Behavior:

AUD is leading the move. Strong CPI and China demand backdrop are fueling bullish AUD momentum.

EUR is lagging, tracking broader USD risk tone and internal Eurozone data weakness.

EURAUD is currently reactive to external forces rather than setting direction for other pairs.

✅ Summary: Bias and Watchpoints

Bias: Bearish

Fundamentals: Weak Eurozone growth vs. hotter Aussie inflation and hawkish RBA tone.

Risk: ECB hawkish tilt or a dovish shift from the RBA.

Event to Watch: ECB press conference and Aussie CPI commentary from policymakers.

Leader/Lagger: Lagger — following AUD strength rather than leading.

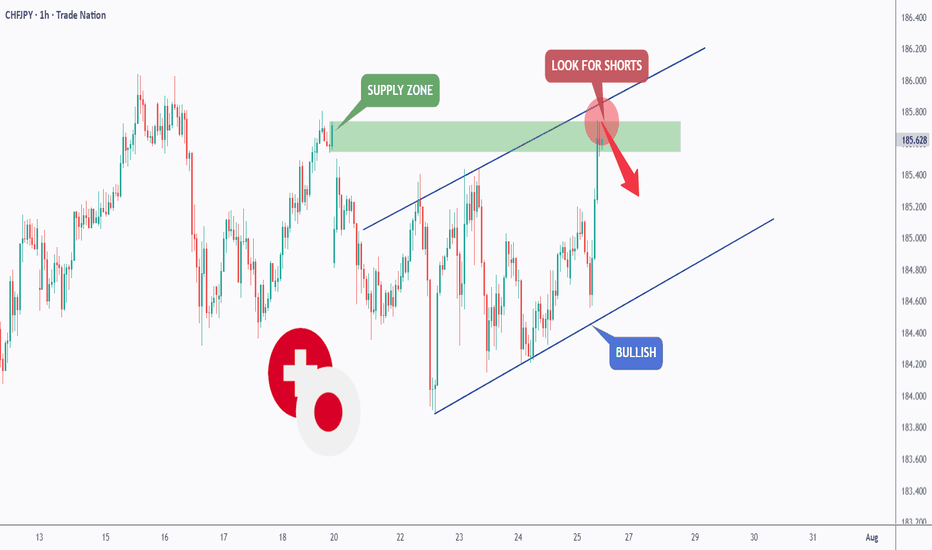

CHFJPY - The Bulls Are Exhausted!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈CHFJPY has been overall bullish trading within the rising channel marked in blue and it is currently retesting the upper bound of it.

Moreover, the green zone is a strong supply.

🏹 Thus, the highlighted red circle is a strong area to look for sell setups as it is the intersection of the upper blue trendline and green supply.

📚 As per my trading style:

As #CHFJPY is hovering around the red circle zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

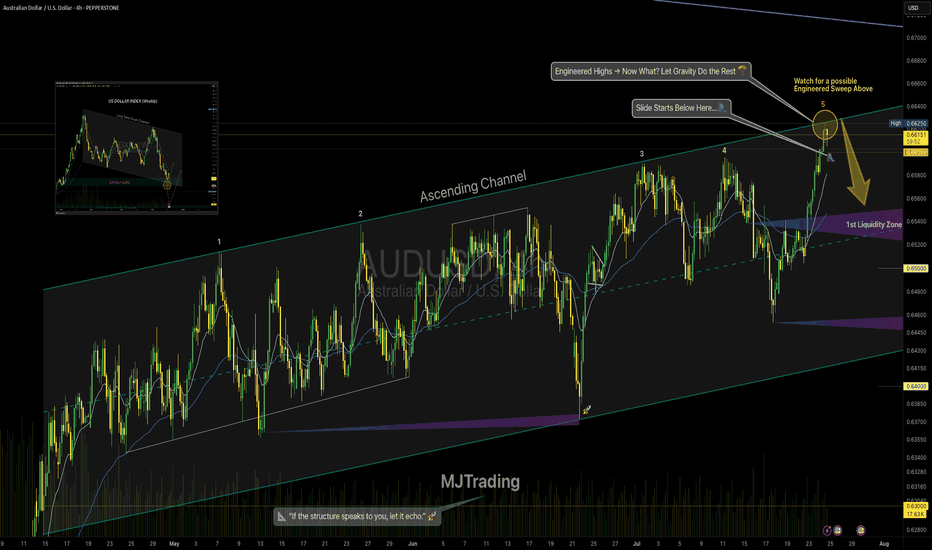

AUDUSD Engineered to Drop?🧠MJTrading:

📸 Viewing Tip:

🛠️ Some layout elements may shift depending on your screen size.

🔗 View the fixed high-resolution chart here:

🔻 OANDA:AUDUSD – Tagged the Top | Smart Money Eyes Lower Levels??

📍 Perfect Respect of Channel Structure

AUDUSD has just kissed the upper boundary of a long-standing ascending channel, showing sharp rejection — a sign that premium pricing might now shift toward discount levels.

📈 The aggressive push into the highs likely aimed to clear buy stops — fulfilling smart money objectives before a potential reversal.

📉 And here’s the subtle clue:

Just below the last bullish candle lies a thin slide — a structural weakness.

If price breaks and closes below that full body bearish candle (Below 0.66000), the market could slip fast, unleashing a momentum-driven drop into the first liquidity zone (0.6520s).

🧠 For smart money lovers, this is the classic:

Sweep → Trap → Slide

📏 And for fans of parallelism, the chart’s geometry offers a rare beauty — lines in harmony, structure in rhythm, and opportunity in alignment.

🔍 What to Watch For:

Break below 0.66000 (last candle body) = entry signal

0.6520–0.6540: first liquidity zone

0.6400–0.6300: deeper cleanout, if bearish pressure sustains

Inset: DXY bouncing from long-term demand supports bearish thesis

Manage your risk wisely...

For Lower time frame traders:

Psychology Always Matters:

(Click on the pictures for caption and concepts)

#AUDUSD #SmartMoney #LiquiditySweep #ChannelTrading #ChartDesigner #MJTrading #PriceAction #Forex

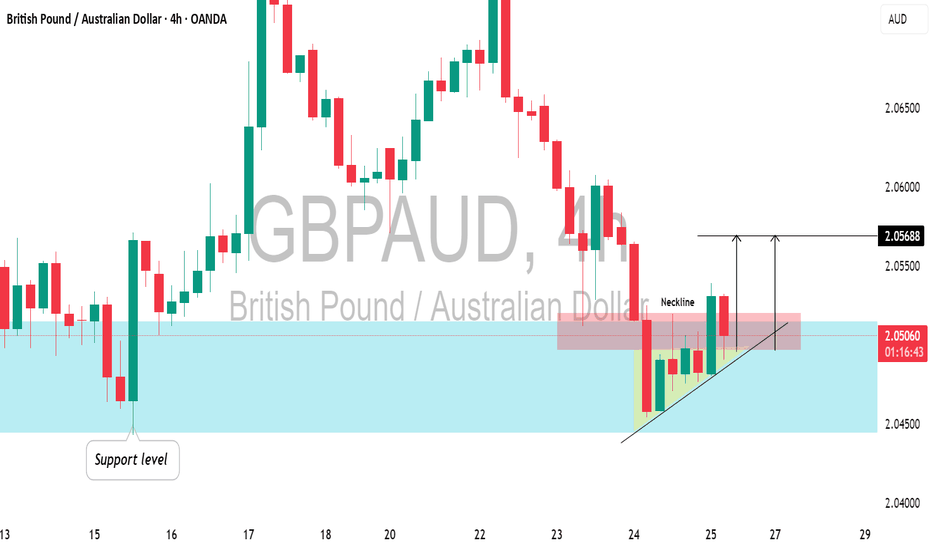

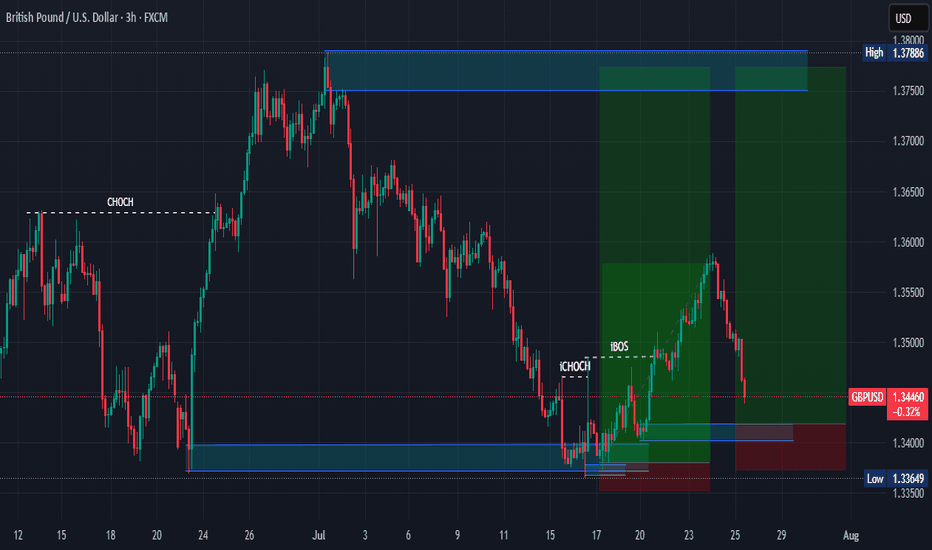

GBP/USD Technical Analysis Anticipating a bullish reversal Price made a CHoCH, followed by a Break of Structure (BOS), confirming a bullish shift.

Currently, price is retracing into a high-confluence zone:

Internal demand (order block)

Imbalance (IMB)

Near the EMA

Reaction expected around 1.34300–1.34600.

If this zone holds, we anticipate a bullish push toward 1.36000+ (better to make a confirmation entry)

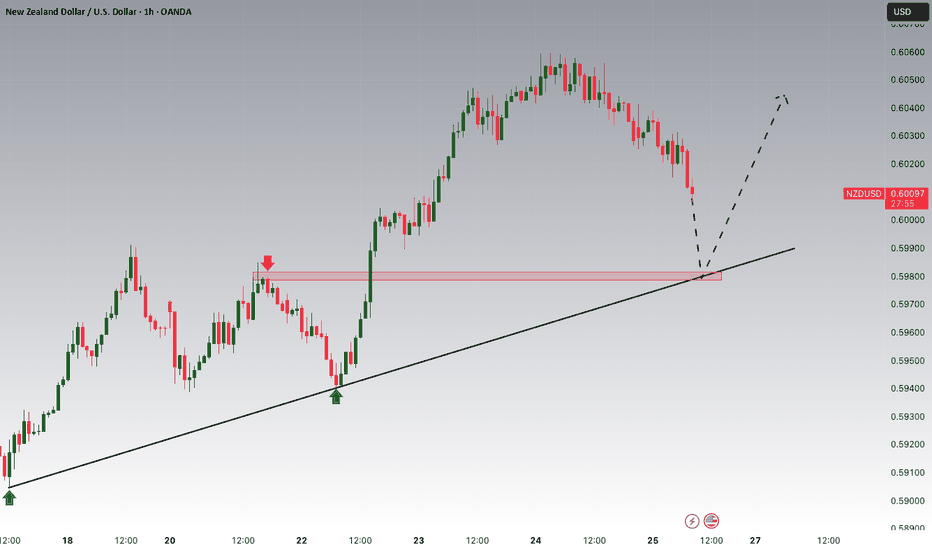

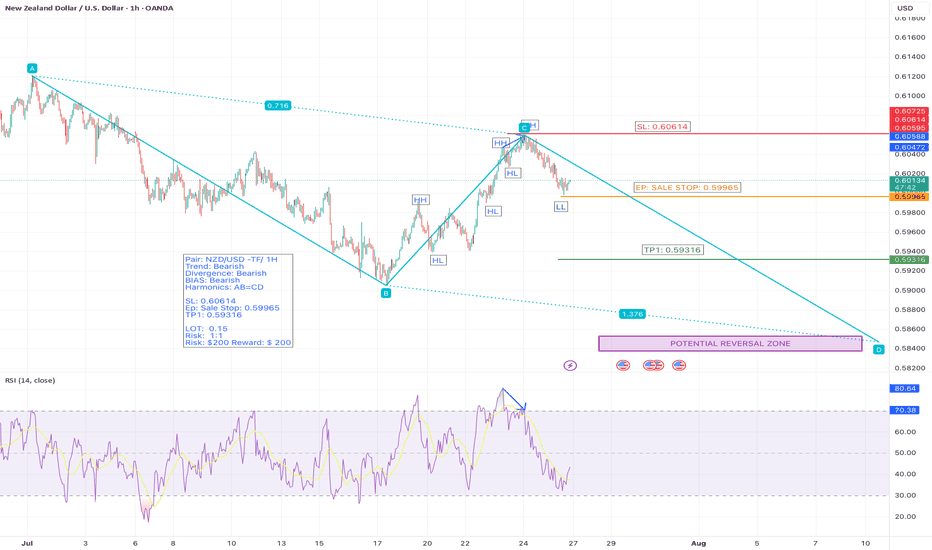

NZD/USD – 1H | Bearish Setup at Breakout of LL| AB=CD HarmonicsWe’re currently eyeing a bearish continuation on NZD/USD based on clear market structure and harmonic confirmation.

📉 Trend: Bearish

🔍 Divergence: Bearish

📐 Harmonics: AB=CD pattern

📊 Bias: Bearish

🧠 Technical Breakdown

✅ Price has broken the previous Higher Low , confirming a structural shift.

✅ A Lower High is about to form — Now we’re waiting for the breakout of the previous Lower Low to confirm trend continuation.

✅ We’ve placed a Sell Stop below that Lower L ow, targeting bearish continuation.

✅ The AB=CD harmonic pattern shows potential for extended downside — reversal zone still far.

📌 Trade Setup

🔹 Entry: Sell Stop @ 0.59965 (breakout of Lower Low)

🔹 Stop Loss: 0.60614

🔹 Take Profit: 0.59316

🔹 Risk/Reward: 1:1

🔹 Lot Size: 0.38

🔹 Risk: $200

🔹 Reward: $200

⚠️ Note: This is a pending setup. Trade only triggers on the breakout of the previous Lower Low, keeping the bearish structure intact.

#NZDUSD #ForexSetup #BearishBreakout #LowerLow #PriceAction #SmartMoney #ABCDPattern

#HarmonicTrading #ForexStrategy #SellSetup #TradingView #FXMarket #ForexSignals

#DayTrading #SwingTrading #ChartAnalysis #TradeSmart #ForexTrader #RiskManagement

#ForexEducation #BearishStructure #FibonacciTrading #MarketStructure #BreakoutTrade

#TradersOfInstagram #TradersOfTradingView #CryptoAndForex

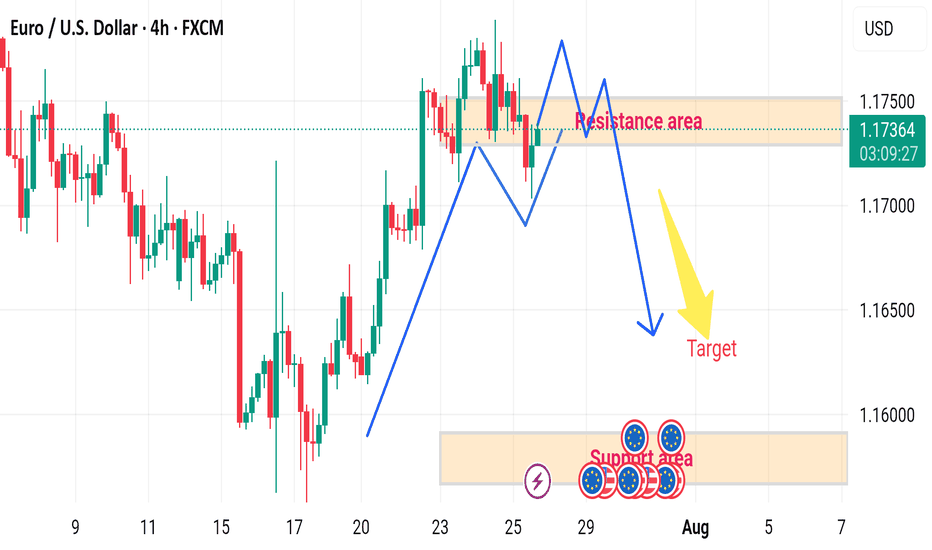

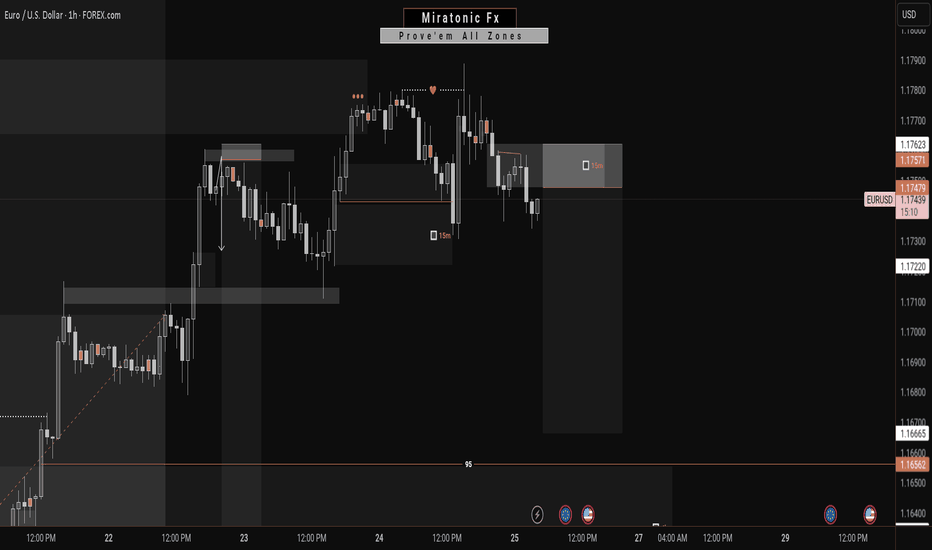

EUR/USD H4 DOWNWARD 🔄 Disrupted EUR/USD 4H Analysis

🟢 Current Context:

Price is currently at 1.17375, slightly below the resistance area (1.17400–1.17500).

Market shows a recent bullish impulse, followed by consolidation within the marked resistance zone.

Projection in the image suggests a double-top pattern forming at resistance, followed by a bearish reversal toward the target demand area (~1.15800–1.16000).

---

⚠️ Disruption Points:

1️⃣ Failed Double Top Scenario

Disruption Hypothesis: Instead of forming a clean double top and reversing, price may break above the resistance zone at 1.17500.

Reasoning: Strong bullish momentum and recent higher highs indicate potential for bullish continuation, invalidating the bearish target.

Disrupted Path: Price could break out → retest the resistance as new support → continue toward 1.18000–1.18300 zone.

2️⃣ Mid-Range Liquidity Trap

The current range may act as a liquidity trap:

Smart money could push the price slightly below support (fake breakdown), attract sellers, then reverse sharply upwards.

This would trap retail sellers targeting the 1.15800 zone.

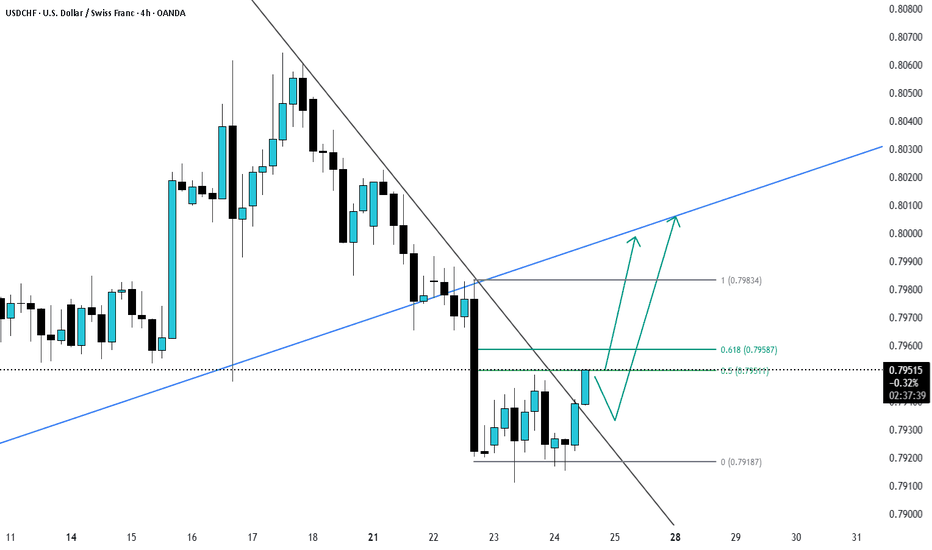

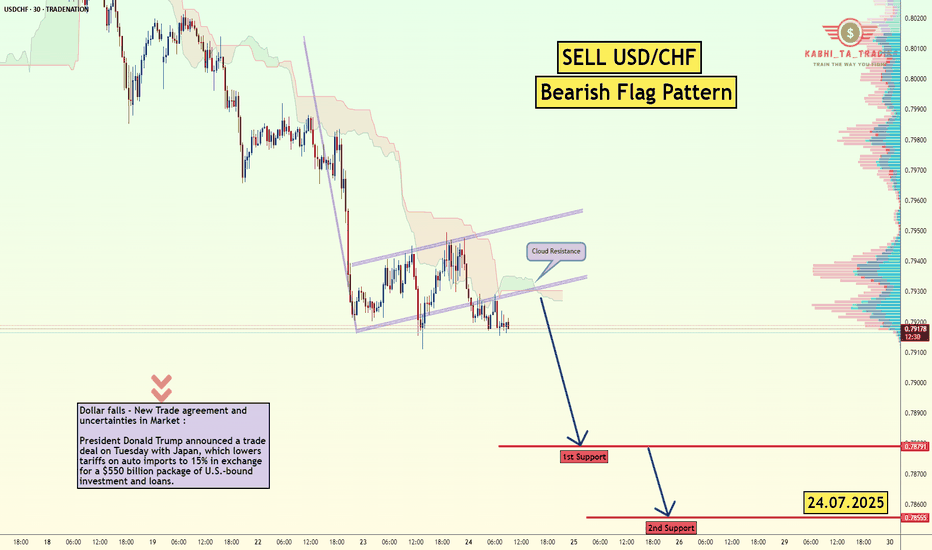

USD/CHF - Bearish Flag (24.07.2025)Fundamental Updates :

Dollar falls - New Trade agreement and uncertainties in Market :

President Donald Trump announced a trade deal on Tuesday with Japan, which lowers tariffs on auto imports to 15% in exchange for a $550 billion package of U.S.-bound investment and loans.

The USD/CHF Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Bearish Flag Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 0.7878

2nd Support – 0.7855

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

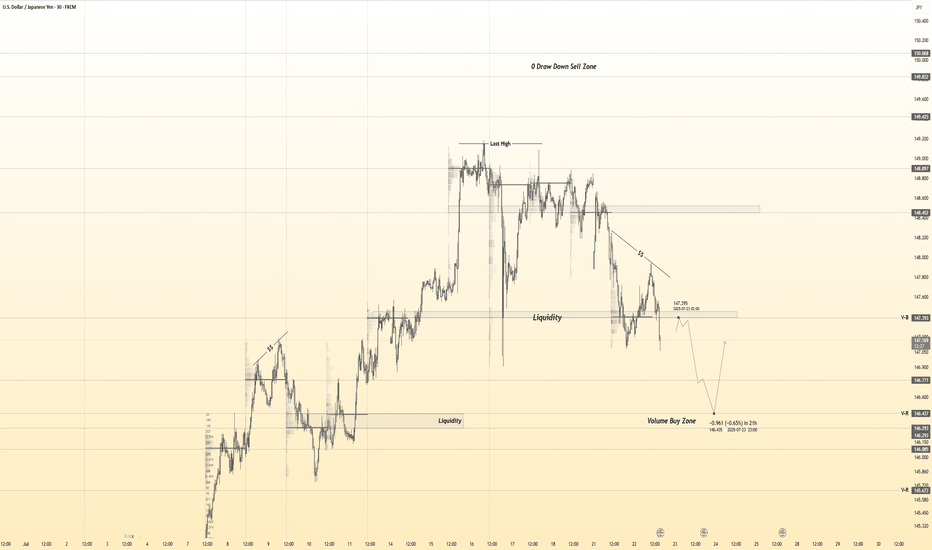

USDJPY 30Min Engaged ( Buy & Sell Reversal Entry's Detected )————-

➕ Objective: Precision Volume Execution

Time Frame: 30-Minute Warfare

Entry Protocol: Only after volume-verified breakout

🩸 Bullish Reversal : 146.450

🩸 Bearish Reversal : 147.350

➗ Hanzo Protocol: Volume-Tiered Entry Authority

➕ Zone Activated: Dynamic market pressure detected.

The level isn’t just price — it’s a memory of where they moved size.

Volume is rising beneath the surface — not noise, but preparation.

🔥 Tactical Note:

We wait for the energy signature — when volume betrays intention.

The trap gets set. The weak follow. We execute.

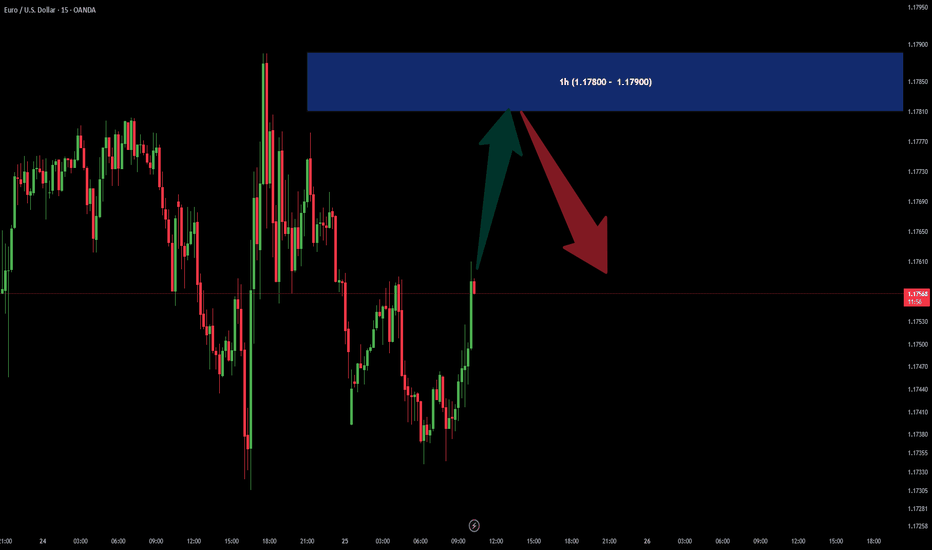

EURUSD | Time For A Pullback?The week kicked off with strong impulsive moves to the upside, leaving no room for deeper correction. Then slowly from Wednesday, we started to see a decline in strength in the bullish run.

Now, with price edging toward the next swing low for a possible bearish change of character, is this a good way to ride the stream to the downside?

Keep your A-game on as we watch price unfold, and trade reactively to price movement.

Do not forget to guard your capitals with risk management.

Good luck traders. 👍

Follow me for more and more of these analyses.

See you on the next one. 🫡