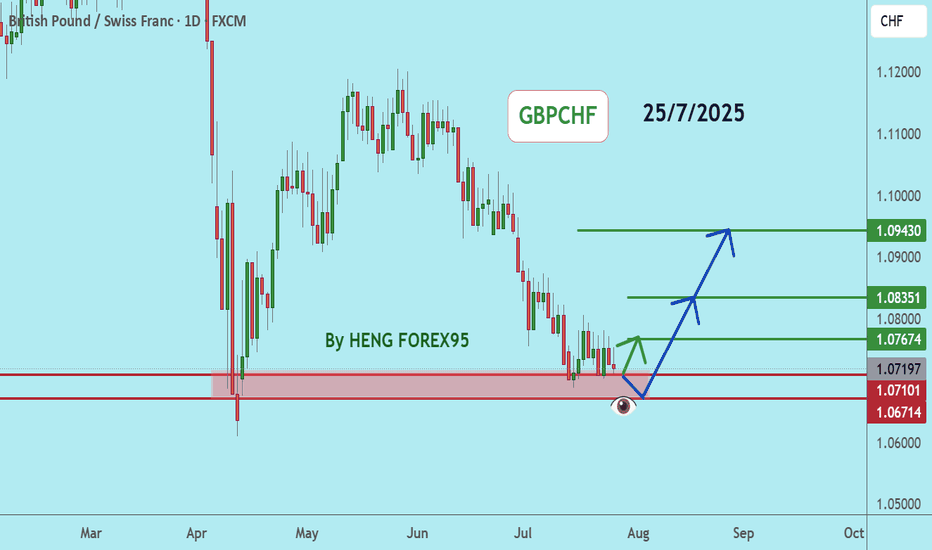

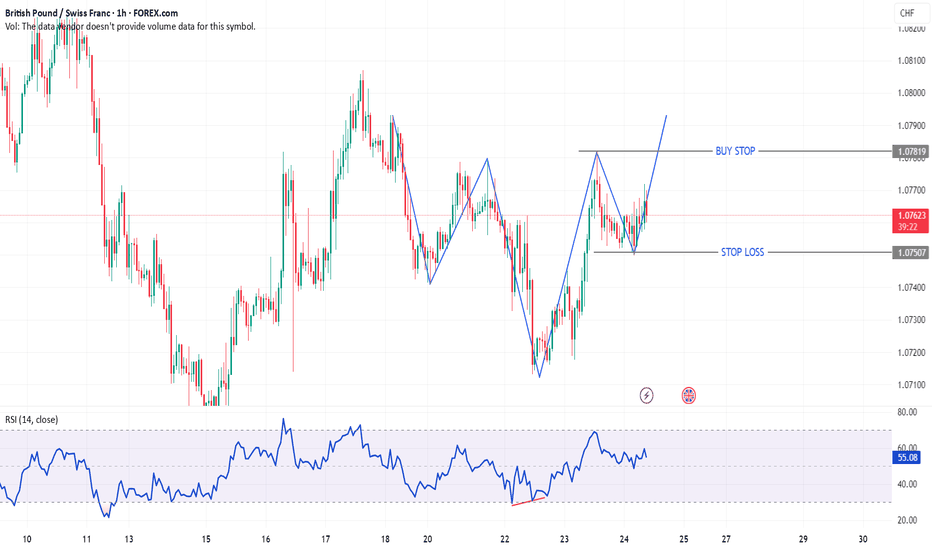

GBPCHFGBPCHF price is near the main support zone 1.07101-1.06714. If the price cannot break through the 1.06714 level, it is expected that the price will rebound. Consider buying the red zone.

🔥Trading futures, forex, CFDs and stocks carries a risk of loss.

Please consider carefully whether such trading is suitable for you.

>>GooD Luck 😊

❤️ Like and subscribe to never miss a new idea!

Forex market

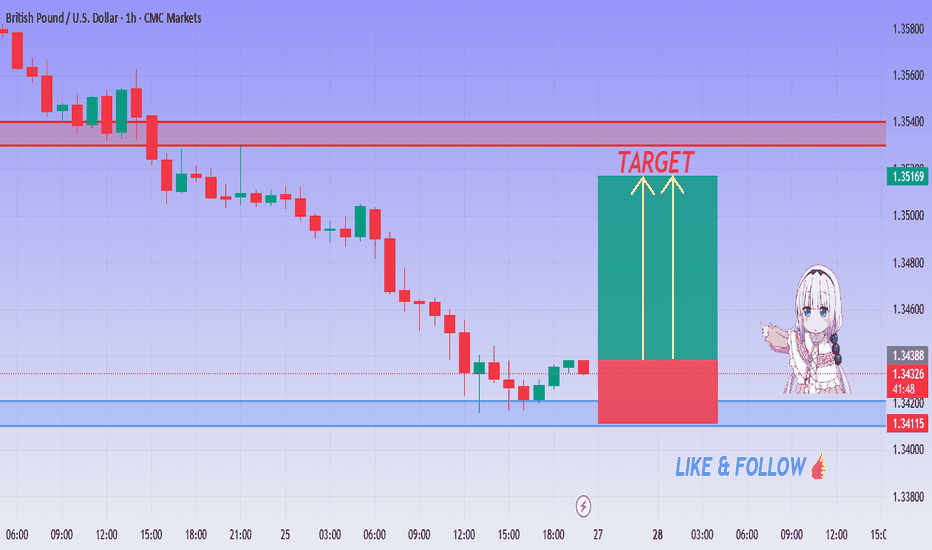

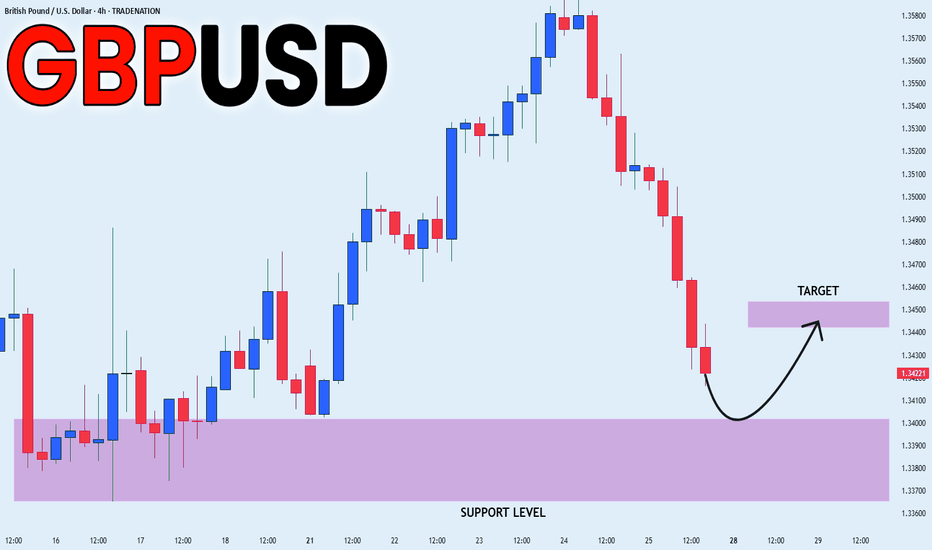

GBP/USD BUY Setup - Big Pump Loading Above Support!💚 GBP/USD Demand Rejection ! BUY Setup Activated!

👩💻 Dear traders,

GBP/USD is bouncing from a clear demand zone between 1.3420 – 1.3440 on the 1H timeframe. Early signs of rejection are forming, signaling a high-probability intraday long.

Bias – Bullish

🎯 Target – 1.34900

🎯 Target – 1.35160

🎯 Final Target – 1.35400

🛑 Safe Stop Loss – 1.34110

📊 Reasoning:

– Price tapped a well-defined demand zone (blue box)

– Small red box marks optimal stop placement below zone

– Two yellow arrows show projected upside path

– Previous support held strongly, momentum shifting bullish

– Excellent R:R for intraday buyers

🍀 Stay patient, wait for the bounce confirmation, and trade smart!

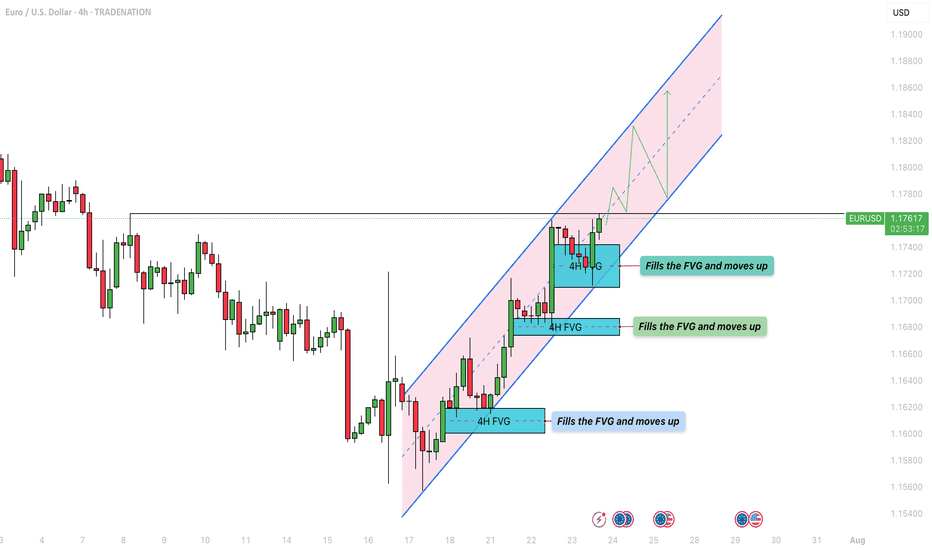

EUR/USD - Bullish parallel channel formation!The EUR/USD currency pair is currently exhibiting a bullish market structure on the 4-hour timeframe, moving steadily within a well-defined ascending parallel channel. Price action has consistently bounced between the lower and upper boundaries of the channel, with each dip finding support at the lower trendline and each rally meeting resistance near the upper trendline. This ongoing pattern suggests a strong and orderly bullish trend as the pair continues to make higher highs and higher lows within the channel.

The Market’s Upward Momentum

One notable feature of this trend is the recurring formation of 4-hour Fair Value Gaps (FVGs) during each upward leg. These FVGs act as temporary inefficiencies in the price movement, which the market consistently returns to fill before resuming its bullish momentum. As shown in the chart, the EUR/USD has filled multiple FVGs over the past week. Today, the pair once again retraced to fill a newly formed 4H FVG and has since continued its move higher. This repeated behavior reinforces the strength of the uptrend, as the market efficiently corrects itself and then propels further in the direction of the overall trend.

Bullish Outlook

From a bullish perspective, the key level to watch is the horizontal resistance zone around 1.1766. A confirmed break and hold above this level would signal a strong continuation of the current uptrend. Should the price sustain itself above this level, it could initiate a renewed push toward the upper boundary of the ascending channel, potentially targeting levels near 1.1820 and beyond. This scenario would confirm market confidence and open the door for further gains.

Bearish Risk

On the flip side, the bearish case would involve a false breakout above the 1.1766 resistance level, followed by a sharp rejection and a break below the rising lower trendline of the channel. Such a move would invalidate the current structure and shift the bias to the downside. In that case, the 4-hour FVG located between approximately 1.1710 and 1.1740 will act as a critical support zone. If this area fails to hold, it could trigger a deeper retracement and potentially lead to a more prolonged bearish correction.

Final thoughts

In summary, the EUR/USD is currently respecting a bullish parallel channel on the 4-hour timeframe, with upward moves consistently leaving and then filling 4H FVGs before continuing higher. The 1.1766 level is pivotal, a sustained break above it favors continued bullish momentum, while a rejection and breakdown from the channel could signal a bearish reversal. Traders should closely monitor price behavior around this key level and the integrity of the ascending channel to anticipate the next significant move.

-------------------------

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Thanks for your support. If you enjoyed this analysis, make sure to follow me so you don't miss the next one. And if you found it helpful, feel free to drop a like 👍 and leave a comment 💬, I’d love to hear your thoughts!

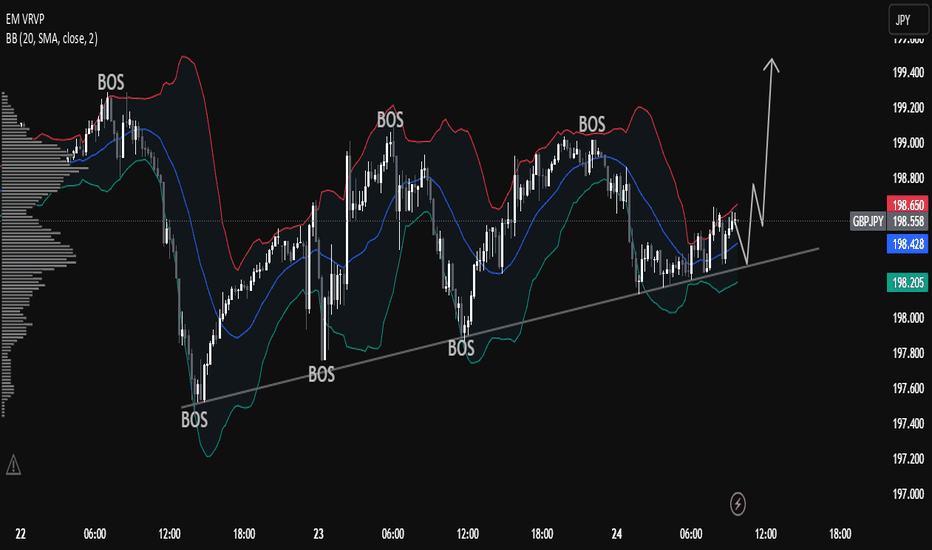

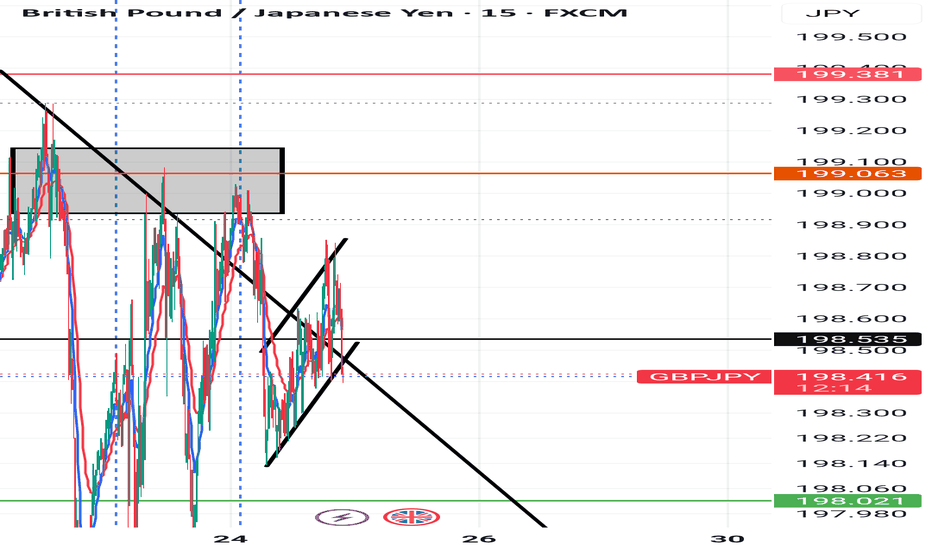

Understanding Market Structure: GBPJPY Trendline Support 📊 GBPJPY Technical Analysis — 15-Min Chart (As of July 24, 2025)

Trend Structure & Price Action

The chart shows a clear ascending trendline, connecting higher lows across the last sessions.

Multiple Break of Structure (BOS) points confirm bullish market behavior, with price consistently forming higher highs and higher lows.

The most recent BOS and price rejection from the lower boundary of the cloud band indicate bullish intent is still active.

Indicators Used

Custom Cloud Band (EMA Based 20, 1.5 settings):

Price is oscillating within and around the cloud band.

Recent candles are attempting to reclaim the upper band, suggesting building bullish momentum.

Volume Profile (VRVP) shows strong volume support around the 198.200–198.500 range, aligning with the trendline.

Support & Resistance

Support Zone: 198.200 (trendline confluence + volume shelf)

Immediate Resistance: 198.800–199.000

Major Resistance: 199.400 (next psychological level and prior high)

Forecast & Trade Idea (Educational Purpose)

If price continues to respect the ascending trendline and breaks above the recent local high (~198.750), we could see a bullish breakout toward 199.200+.

A bullish flag or small consolidation above the trendline before breakout is likely, as illustrated by the arrow.

Invalidation occurs if price breaks and closes below the trendline and 198.200, which may trigger a short-term correction.

✅ Conclusion

GBPJPY is currently in a bullish market structure with support from both trendline and volume profile. A clean breakout above 198.800 with volume confirmation could fuel continuation toward 199.200 and beyond. Risk management is crucial — watch for false breakouts or a shift in structure below the rising trendline.

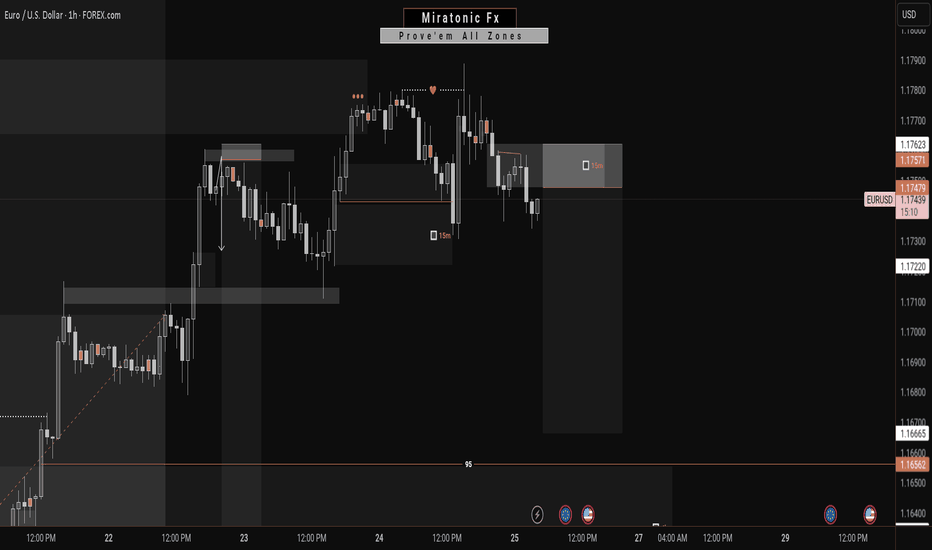

EURUSD | Time For A Pullback?The week kicked off with strong impulsive moves to the upside, leaving no room for deeper correction. Then slowly from Wednesday, we started to see a decline in strength in the bullish run.

Now, with price edging toward the next swing low for a possible bearish change of character, is this a good way to ride the stream to the downside?

Keep your A-game on as we watch price unfold, and trade reactively to price movement.

Do not forget to guard your capitals with risk management.

Good luck traders. 👍

Follow me for more and more of these analyses.

See you on the next one. 🫡

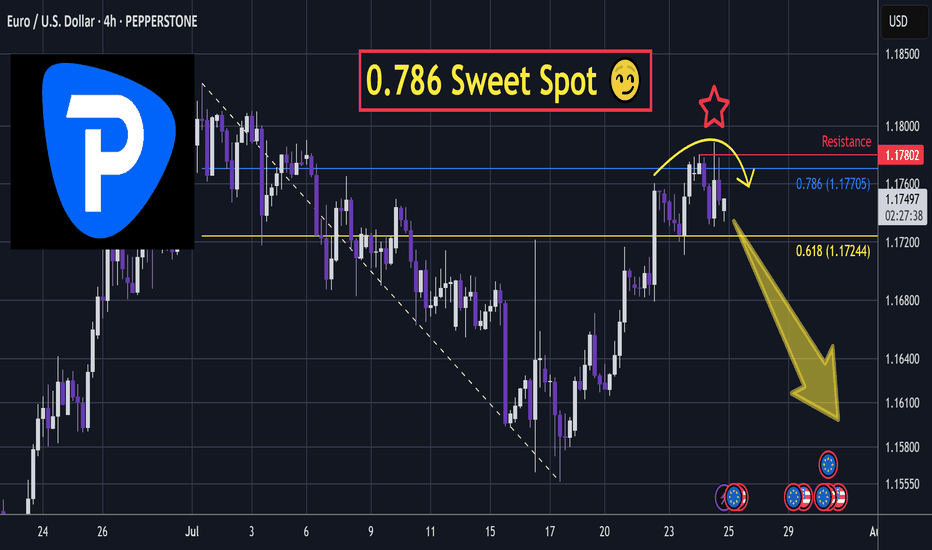

EURUSD - Short Term Setup Could Trigger MAJOR ReversalThis bounce is likely to be a connective wave into another wave down.

In the video I break down a classic algo driven liquidity sweep just above the 0.786 retracement.

This signals potential reversal.

Stop loss placement depends on how aggressive you want to be with margin.

Tighter risk gives more upside potential with defined exposure.

Invalidation of potential retracement failure swing @ $1.18.

If this unfolds on a higher timeframe, it could develop into a heavy-hitting move.

I'm layering shorts through this area, as discussed in the video.

Trade executed on Pepperstone CFD 👍.

This analysis is shared for educational purposes only and does not constitute financial advice. Please conduct your own research before making any trading decisions.

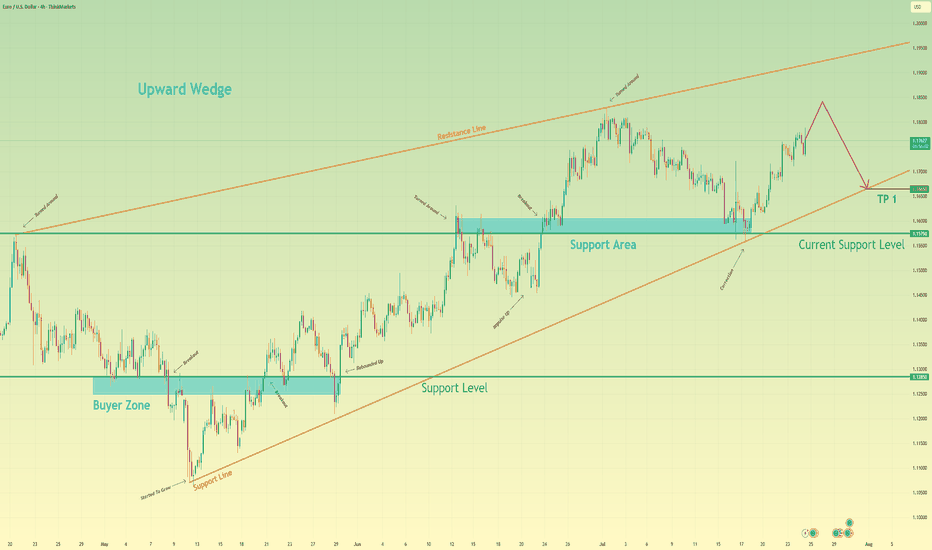

Euro will rise a little and then start to fall to support lineHello traders, I want share with you my opinion about Euro. After a prolonged consolidation period, a strong upward trend was initiated from the buyer zone around 1.1285, propelling the EUR significantly higher. This initial impulsive move has since transitioned into a more complex and mature phase, taking the shape of a large upward wedge formation, a pattern which often signals underlying exhaustion in the prevailing trend. Currently, the pair is operating within this defined market zone, characterized by a clear ascending support line and a corresponding resistance line. The price action inside the wedge has become corrective, with the most recent upward correction originating from the support area near 1.1575. The working hypothesis is centered on a short-term bearish scenario, which anticipates that this current rally will fail as it approaches the upper boundary of the wedge. A rejection from this resistance would confirm that selling pressure is increasing and that the bullish momentum is waning. This would likely trigger a significant downward rotation within the structure, with the immediate objective being a retest of the main ascending support line. For this reason, the TP is strategically and logically placed at the 1.1665 level, as this point lies directly on the trend line and serves as the most critical test for the existing uptrend's viability. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

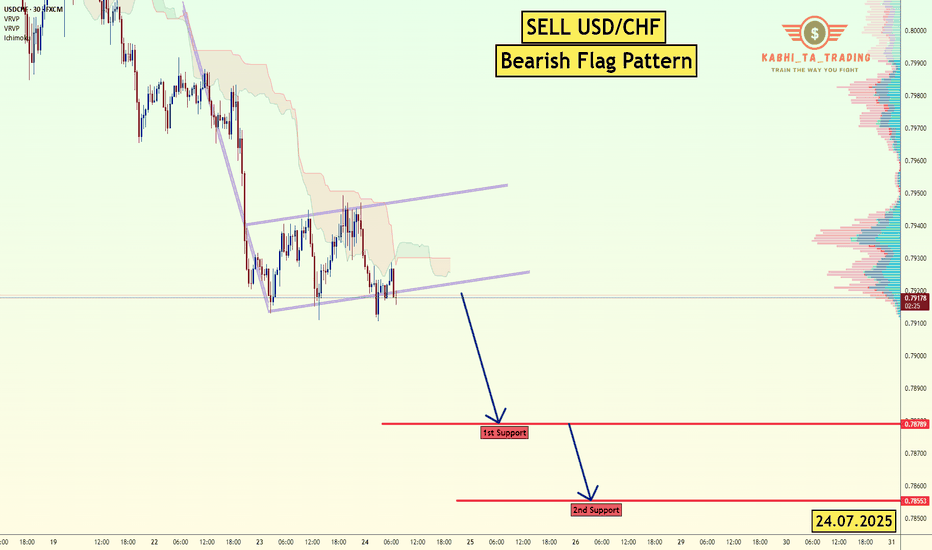

USD/CHF - Bearish Flag (24.07.2025)The USD/CHF Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Bearish Flag Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 0.7878

2nd Support – 0.7855

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

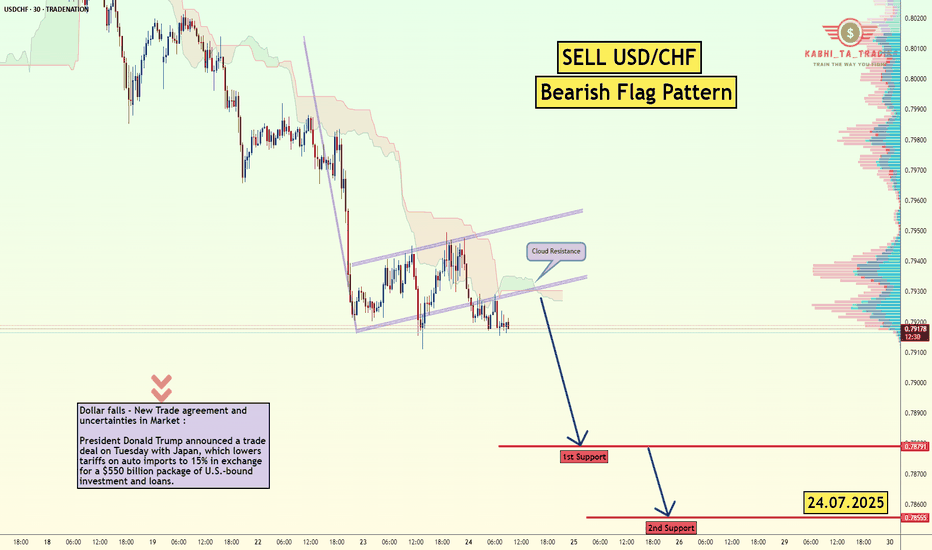

USD/CHF - Bearish Flag (24.07.2025)Fundamental Updates :

Dollar falls - New Trade agreement and uncertainties in Market :

President Donald Trump announced a trade deal on Tuesday with Japan, which lowers tariffs on auto imports to 15% in exchange for a $550 billion package of U.S.-bound investment and loans.

The USD/CHF Pair on the M30 timeframe presents a Potential Selling Opportunity due to a recent Formation of a Bearish Flag Pattern. This suggests a shift in momentum towards the downside in the coming hours.

Possible Short Trade:

Entry: Consider Entering A Short Position around Trendline Of The Pattern.

Target Levels:

1st Support – 0.7878

2nd Support – 0.7855

🎁 Please hit the like button and

🎁 Leave a comment to support for My Post !

Your likes and comments are incredibly motivating and will encourage me to share more analysis with you.

Best Regards, KABHI_TA_TRADING

Thank you.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

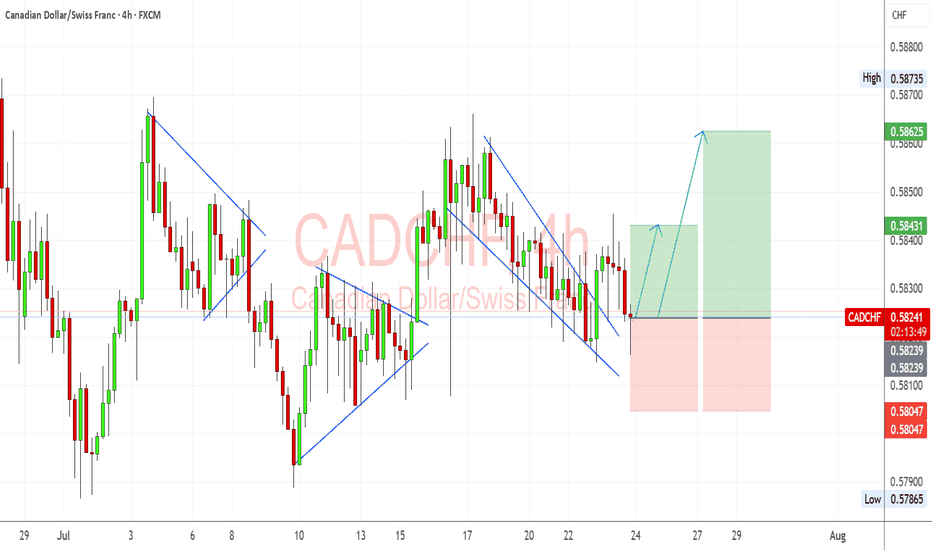

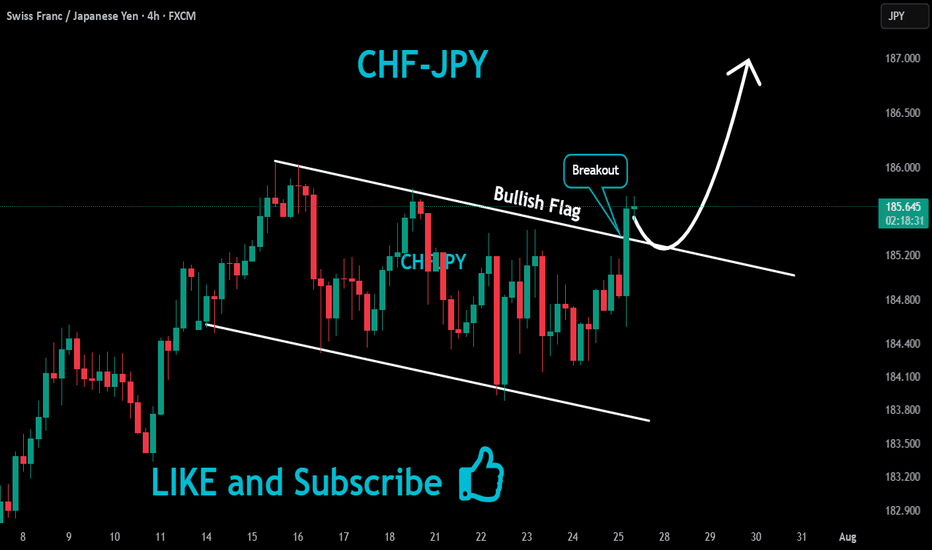

CADCHF Bullish Reversal in Motion Channel Break & Momentum ShiftCADCHF setup is developing into a potential bullish recovery after a breakout from a falling wedge. I’m looking for signs of buyer control as price attempts to build higher structure off the recent breakout.

📊 Technical View (My Setup Insight):

Falling Wedge Breakout: Price has cleanly broken out of the descending channel/wedge formation. That’s often a reversal signal, especially near support zones.

Support Holding: The pair found buyers around 0.5810–0.5820, an area tested multiple times in July. This zone has acted as a soft base.

Bullish Flag Recovery: Prior corrective patterns (flags/pennants) were followed by strong impulsive moves, and we may be repeating this pattern now.

Next Targets:

TP1: 0.5843 – aligns with previous structure and minor resistance.

TP2: 0.5862 – near the most recent high and top of consolidation.

Stop-Loss: Below 0.5800 to invalidate the reversal structure.

🧮 Fundamental Drivers (My Outlook):

CAD Support from Oil Stability: Oil prices have firmed around $78–$80, which helps the CAD via improved trade and energy revenue prospects.

SNB Stance Neutral-Dovish: Swiss inflation remains soft, and SNB has signaled comfort with its current policy rate, reducing CHF bullish pressure.

BoC Hawkish Bias: Despite softening Canadian CPI, the BoC remains cautious and hasn’t ruled out future hikes. CAD remains supported relative to CHF.

Global Risk Mood: CHF is sensitive to risk-off flows. With equities and commodities rebounding modestly, safe haven flows into CHF may slow.

⚠️ Risks to the Setup:

A sudden drop in oil prices could hurt CAD.

Risk-off sentiment due to geopolitical tensions or US equity selloffs could fuel CHF strength.

Any surprise SNB jawboning about FX could cause CHF to spike.

📆 Upcoming Events to Monitor:

Canadian GDP / Retail Sales – if strong, reinforces CAD recovery.

Swiss KOF Economic Barometer – gives insight into CHF macro tone.

Oil Inventories – strong builds or drawdowns influence CAD indirectly.

🔁 Leader/Lagger Context:

CADCHF is often a lagger, especially when risk sentiment or oil makes bigger moves. It can follow USDCHF or USDCAD behavior due to shared components.

If oil or global risk sentiment shifts, CADCHF tends to react with a small lag, making it great for secondary confirmation trades.

🧩 Summary – Bias & Watchpoints:

I currently hold a bullish bias on CADCHF following the falling wedge breakout and support defense. Fundamentals are moderately in favor of CAD due to oil stability and BoC’s cautious stance versus the more passive SNB. Key risks include any renewed CHF demand from risk-off shifts or soft Canadian economic surprises. The most critical levels now lie at 0.5843 and 0.5862 for upside targets, while 0.5800 remains key invalidation support.

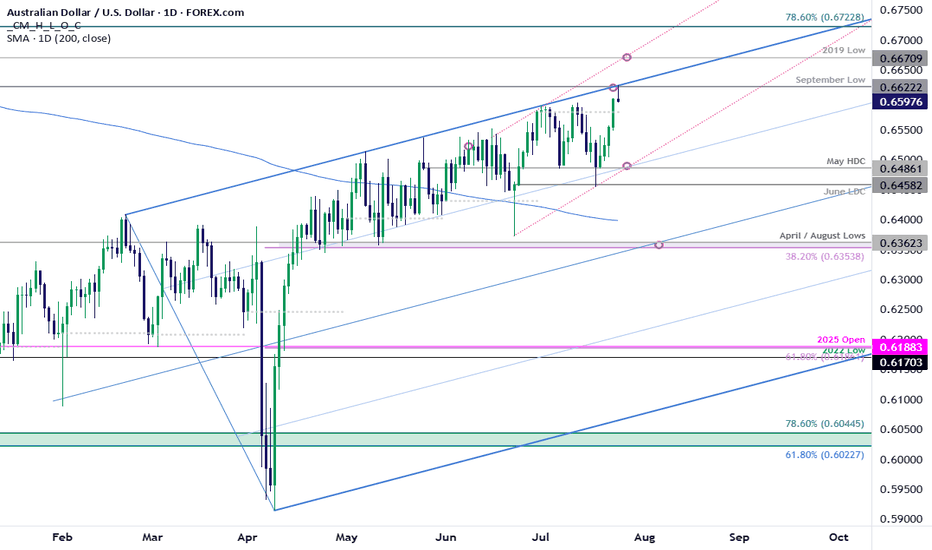

AUD/USD Bulls Eye BreakoutThe Australian Dollar surged more than 1.8% this week with AUD/USD now testing multi-month uptrend resistance at fresh yearly highs. A four-day rally takes price into confluent resistance at the September low / upper parallel at 6622- The focus is on today’s close with the immediate advance vulnerable while below this key slope. Subsequent resistance objectives eyed at the 2019 low at 6671 and the 78.6% retracement of the broader 2024 decline at 6723.

Initial support rests with the July open at 6581 and is backed by the May high-day close (HDC) / weekly open at 6486-6506. Losses would need to be limited to this region for the late-June advance to remain viable (near-term bullish invalidation). Subsequent support seen at the June low-day close (LDC) at 6458 with a break below 6350 ultimately needed to suggest a more significant high is in place / larger reversal is underway.

Bottom line: A breakout of the July opening-range takes AUD/USD into confluent uptrend resistance- risk for topside exhaustion / price inflection here. From a trading standpoint, a good zone to reduce portions of long-exposure / raise protective stops – losses shudl be limited to 6486 IF price is heading higher on this stretch with a close above this slope needed to fuel the next leg of the advance.

Keep in mind the FOMC interest rate decision is on tap next week with Core Personal Consumption Expenditures (PCE) and Non-Farm Payrolls (NFPs) slated into the monthly cross. Stay nimble into the releases and watch the weekly closes here.

-MB

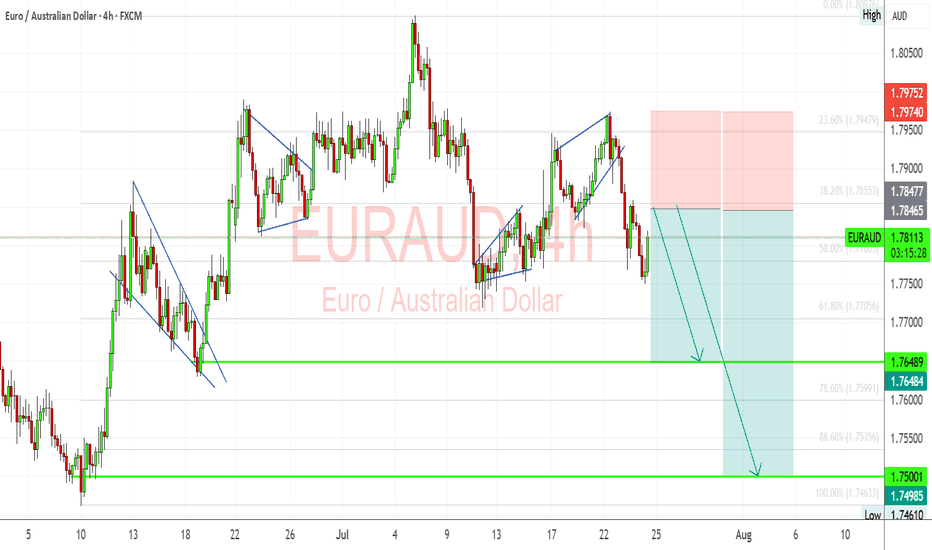

EURAUD Breakdown: Bearish Continuation Ahead of ECBEURAUD is showing signs of renewed downside pressure as fundamental and technical forces align in favor of Australian dollar strength. With the European Central Bank expected to hold rates steady and provide a cautious growth outlook, the euro remains vulnerable. Meanwhile, upside surprises in Australian inflation and supportive commodity dynamics continue to boost AUD sentiment. Technically, the pair has broken down from a rising wedge, confirming bearish momentum and setting the stage for further declines toward key support near 1.7648 and potentially 1.7500.

🟢 Current Bias: Bearish

🔑 Key Fundamentals:

ECB: Markets expect the ECB to hold rates steady this week. While this ends a 7-year streak of cuts, the bank has turned cautiously neutral, with no clear signal of future tightening. Core inflation remains subdued, and growth momentum across Germany and the euro area is weak.

RBA & Australia: The RBA faces persistent inflation risks after the June CPI surprised to the upside, putting rate hikes back on the table. The Aussie dollar is drawing strength from this, especially with rising commodity prices and China's potential fiscal stimulus aiding demand-side confidence.

Macro Divergence: Australia’s macro picture is improving vs. the eurozone. AUD has tailwinds; EUR is under pressure from stagnant growth and tepid inflation outlook.

⚠️ Risks to Bias:

ECB Surprise: A sudden hawkish tone from the ECB (e.g., lifting forecasts or emphasizing wage-driven inflation risk) could spark short-term EUR upside.

RBA Softness: A dovish RBA pivot or weak Aussie data could weaken AUD strength and slow EURAUD downside.

Geopolitical Risk: Broader global volatility (e.g., US-China, oil disruptions) could cause flows into euro as a semi-safe haven.

📅 Key News/Events to Watch:

ECB Rate Decision & Press Conference – July 25

Eurozone Flash GDP + CPI – Next week

China industrial data (AUD-sensitive)

RBA August Meeting Statement (early Aug)

📉 Technical Breakdown (4H Chart):

Price broke bearish from a wedge consolidation.

Minor bullish pullbacks are being sold into, confirming a distribution phase.

Targets:

1st Target: 1.76480 (support & fib confluence)

2nd Target: 1.7500–1.7460 zone (major swing low)

Resistance: 1.7855–1.7975 zone is key invalidation area.

Structure favors lower highs & continuation patterns until support zones break.

🧭 Leader/Lagger Behavior:

AUD is leading the move. Strong CPI and China demand backdrop are fueling bullish AUD momentum.

EUR is lagging, tracking broader USD risk tone and internal Eurozone data weakness.

EURAUD is currently reactive to external forces rather than setting direction for other pairs.

✅ Summary: Bias and Watchpoints

Bias: Bearish

Fundamentals: Weak Eurozone growth vs. hotter Aussie inflation and hawkish RBA tone.

Risk: ECB hawkish tilt or a dovish shift from the RBA.

Event to Watch: ECB press conference and Aussie CPI commentary from policymakers.

Leader/Lagger: Lagger — following AUD strength rather than leading.

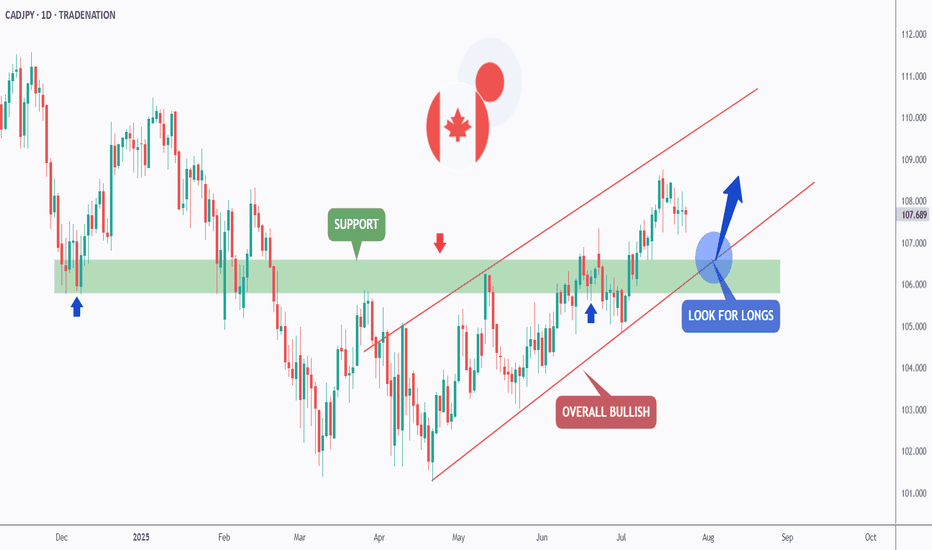

CADJPY - The Bulls Are Stronger than Ever!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈CADJPY has been overall bullish trading within the rising wedge pattern marked in red.

This week, CADJPY has been retesting the lower bound of the wedge.

Moreover, the green zone is a strong weekly support.

🏹 Thus, the highlighted blue circle is a strong area to look for buy setups as it is the intersection of the lower red trendline and green support.

📚 As per my trading style:

As #CADJPY approaches the blue circle zone, I will be looking for trend-following bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

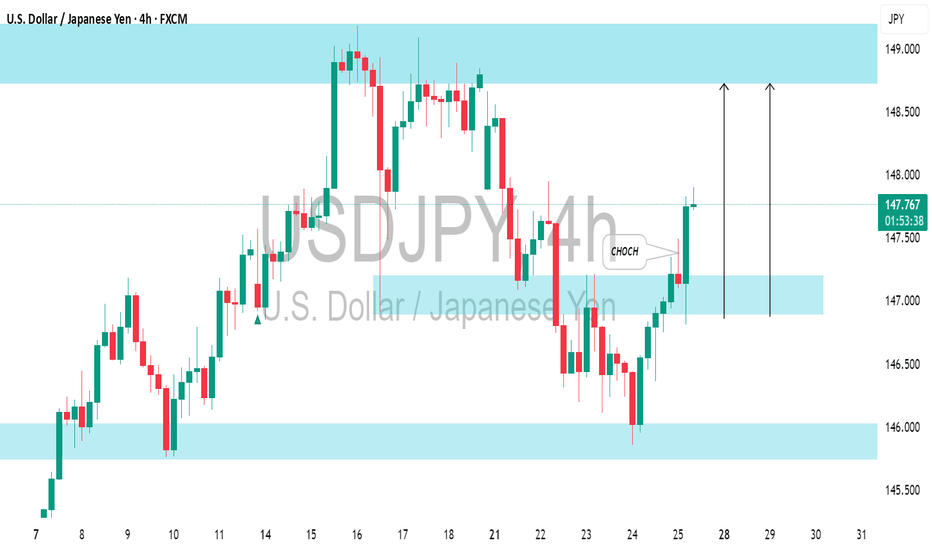

USDJPY: Confirmed CHoCH & Bullish OutlookI spotted a confirmed Change of Character on 📈USDJPY on 4-hour timeframe.

The market, currently in a global bullish trend, has effectively broken through a minor bearish trend and surpassed a key horizontal resistance level.

It is likely to continue rising, with the next resistance at 149.00.

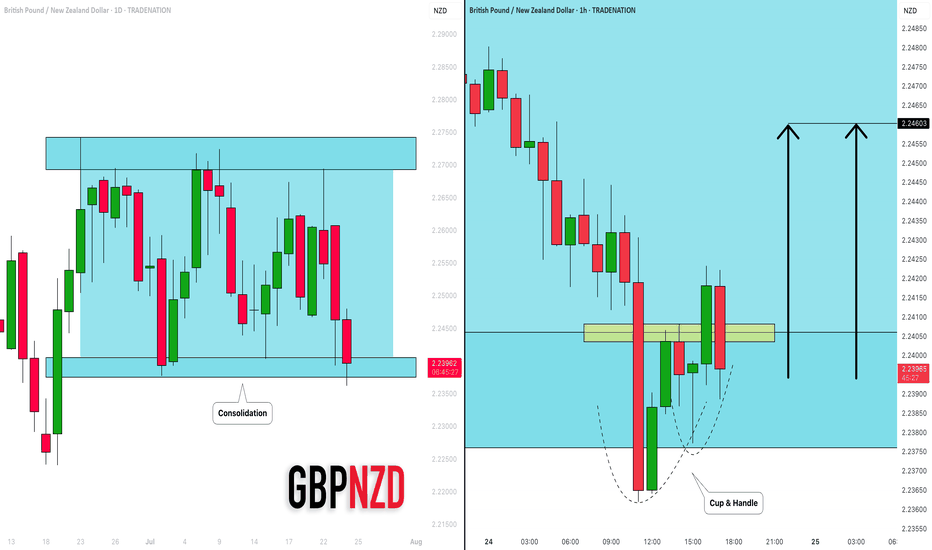

GBPNZD: Bullish Move in a Channel 🇬🇧🇳🇿

I see a horizontal parallel channel on GBPNZD on a daily.

The price is currently testing its support.

On an hourly time frame, a cup & handle pattern was formed on that.

Its neckline was violated with the today's high impact news.

I think that the price may bounce at least to 2.246 level.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

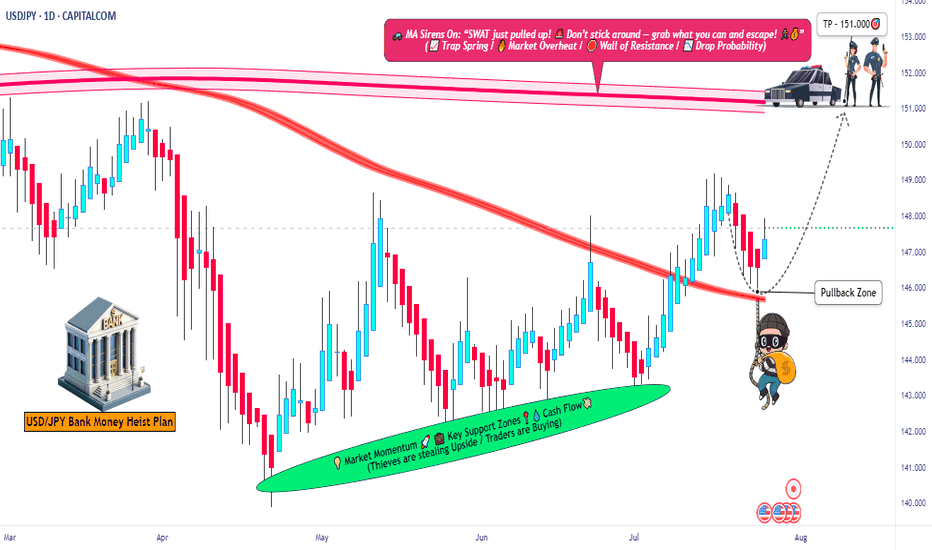

USD/JPY Robbery Route | Enter at Dip, Exit Before Police💥USD/JPY Forex Money Heist Plan 🎯 — Ninja Robbery at 146.000💥

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Dear Market Bandits, Money Makers & Risky Robbers 🤑💰💸✈️

Welcome to another Thief Trader-style operation. We've cracked open the USD/JPY vault (aka "The Gopher" 💹), and here's the blueprint to pull off this forex heist like true professionals. 💼🎭💵

🚨 Strategy Overview

This isn't just a trade – it’s a well-researched, precision-timed robbery mission based on technicals, macro analysis, sentiment, and the bigger global picture.

Expect action near critical zones – especially the moving average barricade, where police (aka risk) is waiting. Stay sharp.

🔓 Entry Point – Unlock the Vault

📈 Watch for bullish pullbacks near 146.000.

Whether it's a dip, zone test, or wick bounce — you’re looking to layer buy limit orders like a seasoned thief using DCA tactics.

Enter on swings or any bullish confirmation.

Heist Window is Open.

🛑 Stop Loss – Escape Route

📍 SL near 143.000 (1D swing low) — adjust based on your capital and position size.

💡 Don’t go blind — SL is your backup plan, not an optional accessory.

Custom-fit it based on how many entries you’re stacking.

🎯 Target – Vault Exit Point

🏁 151.000 or exit before resistance heat catches on.

No greedy thieves here — precision exit is key.

Lock profits, vanish in style. 🕶️💼💸

🧲 Scalpers Take Note

Only long side raids are valid. Scalping against the trend? That's walking into a trap.

Use trailing SLs and protect your loot.

Small bag or big vault — play your game smart. 🎯💰

📢 Fundamental Boosters

USD/JPY’s bullish run isn’t random — it’s backed by:

📊 Macro shifts,

📈 COT reports,

🧠 Sentiment drivers,

📉 Intermarket trends,

And a whole mix of thief-level intel 🔍

🧭 Dive deeper before acting. The map’s been provided. 🔗🌍

🗞 News Traps Ahead – Move Cautiously

🚫 Avoid new trades during major releases

🔁 Use trailing SLs on open positions

💡 Position management is a thief’s best defense. Risk management keeps you in the game. 🎯🧠

🔥💖 Support the Heist Crew

Smash that ❤️🔥 Boost Button to keep our robbery engine running.

Each boost = strength for our crew.

💬 Share the love, spread the intel, and trade like a rogue with brains. 🤝💵

👀 Stay tuned for more high-profile FX heists from Thief Trader.

Until next time — loot wisely, vanish clean. 🐱👤💨

USDCAD SELLUSD/CAD rallies to 1.3680 as the market focuses on a hawkish Fed

The US Dollar extends its recovery for the second consecutive day, supported by strong US data. Upbeat US business activity and Jobless Claims support the Fed's "wait and see" rhetoric. In Canada, the weak Retail Sales data keep hopes for a BoC rate cut alive.

The year will be politically marked by Trump’s return to the White House. A Republican government is seen as positive for financial markets, but Trump’s pledge to cut taxes and impose tariffs on foreign goods and services may introduce uncertainty to both the political and economic landscape.

Canada’s political crisis peaked in late 2024 with a no-confidence vote against Prime Minister Justin Trudeau, leading to snap elections and a weakened Liberal minority government. Policy uncertainty and economic challenges dominate 2025’s outlook, raising concerns over market stability and investor confidence.

The BoC is set to continue easing interest rates through 2025, at least at a faster pace than the Fed is expected to, which could apply pressure on CAD’s already-rising rate differential.

SUPPORT 1.36991

SUPPORT 1.36739

SUPPORT 1.36495

RESISTANCE 1.37346

RESISTANCE 1.37455

GBP_USD LONG FROM SUPPORT|

✅GBP_USD has been falling recently

And the pair seems locally oversold

So as the pair is approaching

A horizontal support of 1.3399

Price growth is to be expected

LONG🚀

✅Like and subscribe to never miss a new idea!✅

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.