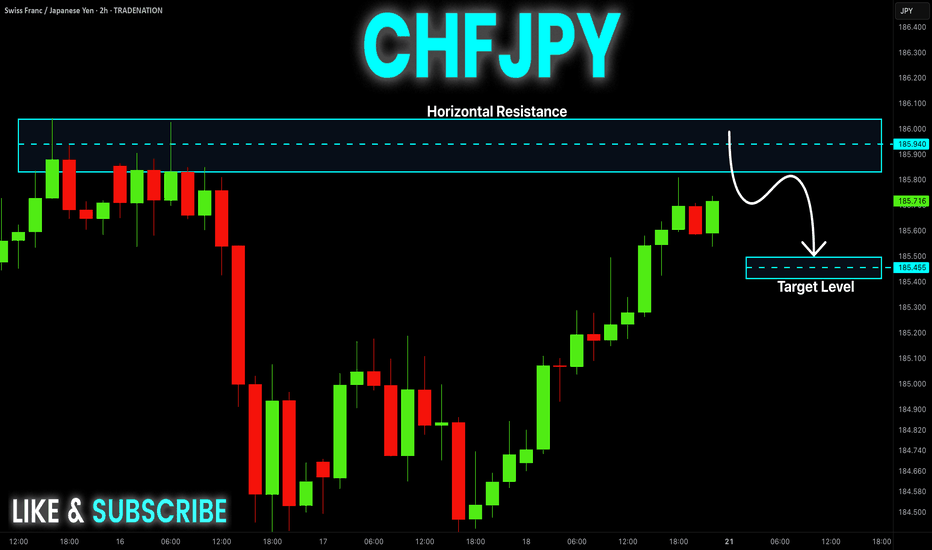

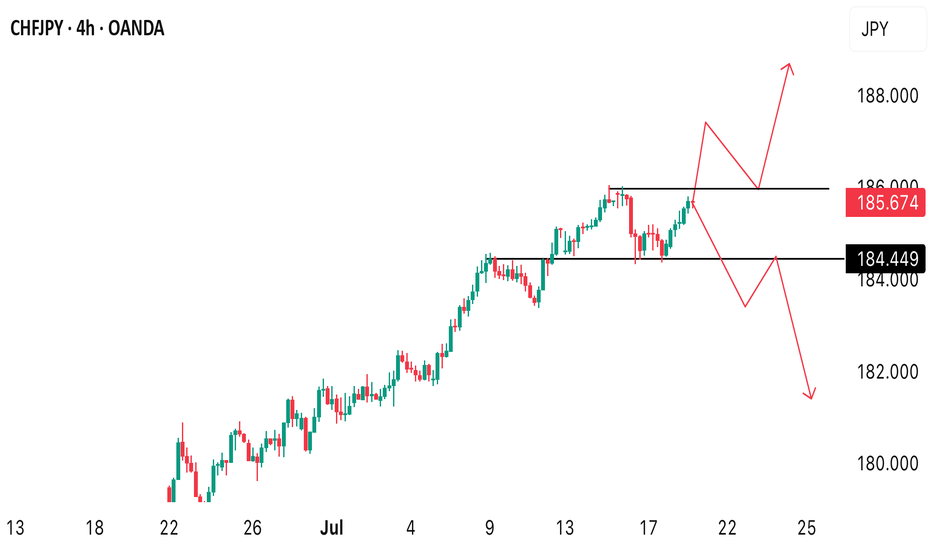

CHF-JPY Resistance Ahead! Sell!

Hello,Traders!

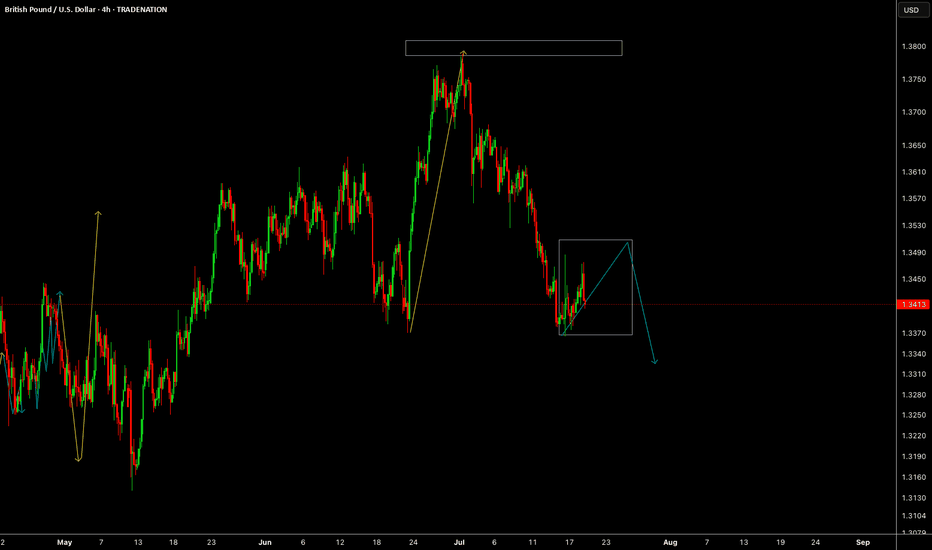

CHF-JPY keeps growing in

An uptrend and the pair is

Locally oversold so after the

Retest of the horizontal

Resistance of 186.000

From where we will be

Expecting a local bearish

Pullback on Monday

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Forex market

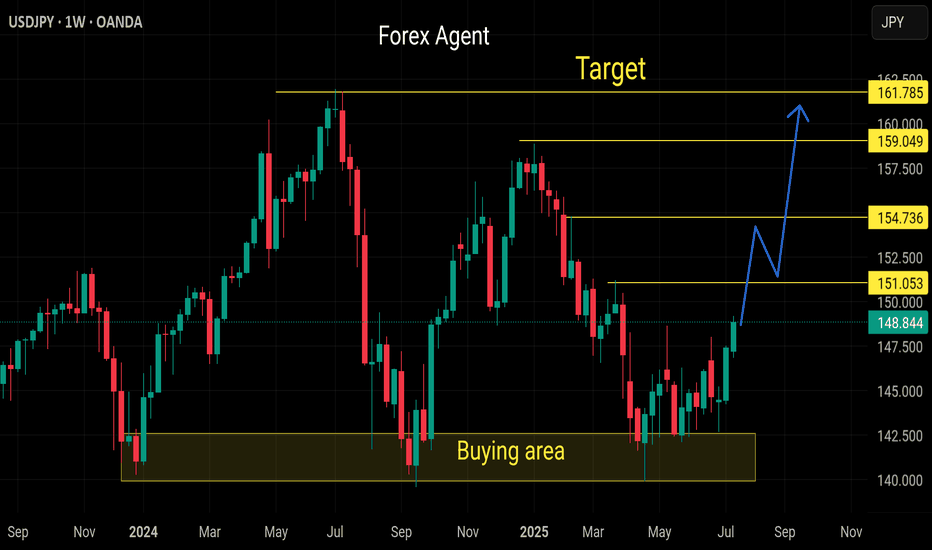

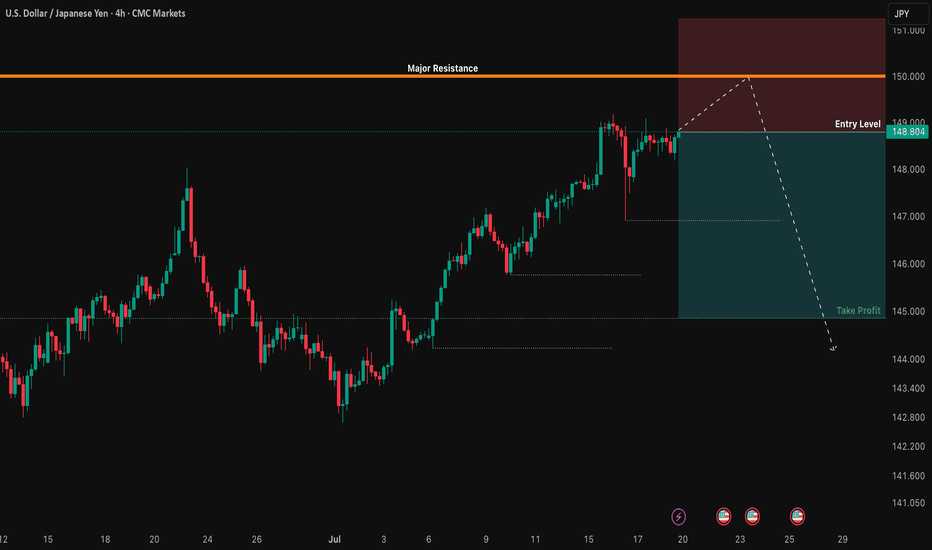

USD/JPY: The 150.00 Rejection SignalThe chart for USD/JPY looks like a simple one-way street going up. But underneath the surface, my quantitative models are in a state of conflict, and that's a high-clarity signal that something is about to change.

This isn't a signal to short right now. This is a signal to be patient and watch for a very specific setup that the "smart money" models are anticipating.

The Quant Conflict 🤖

My analysis involves several different mathematical models. Here's the situation:

One model, which is great at tracking trends, is still signaling BUY , following the obvious upward momentum.

However, two other, more complex models that analyze the relationships between economic data are now flashing a SELL signal. They are detecting underlying weakness that the price chart isn't showing yet.

When the simple trend model and the complex structural models disagree, it often means a major turning point is near. We are siding with the smarter models, but we need price action to confirm their warning.

The Game Plan 📊

We will use the 150.00 level as our "line in the sand." We are waiting for the market to fail at this level and then break down, which would confirm the bearish quant signal. This is our high-probability entry trigger.

Here is the exact setup we are waiting for:

📉 THE SETUP: A patient short position, waiting for confirmation of a breakdown.

👉 ENTRY: We enter only on a confirmed daily close below 148.00.

⛔️ STOP LOSS: Place the stop just above the psychological wall at 150.25.

🎯 TAKE PROFIT: Our primary target is the major support level at 145.00.

This is a setup where patience pays. We are letting the market do the hard work and show its hand before we commit. Let's watch this one closely.

What to expect next on CHFJPYTrend remains strongly bullish from the higher timeframe. Monthly, & weekly. Daily timeframe is slightly bullish but currently loosing some momentum. Therefore, from the H4 timeframe, we’re likely to see either a break above the current resistance to form a new high or were to see a decline below the key level.

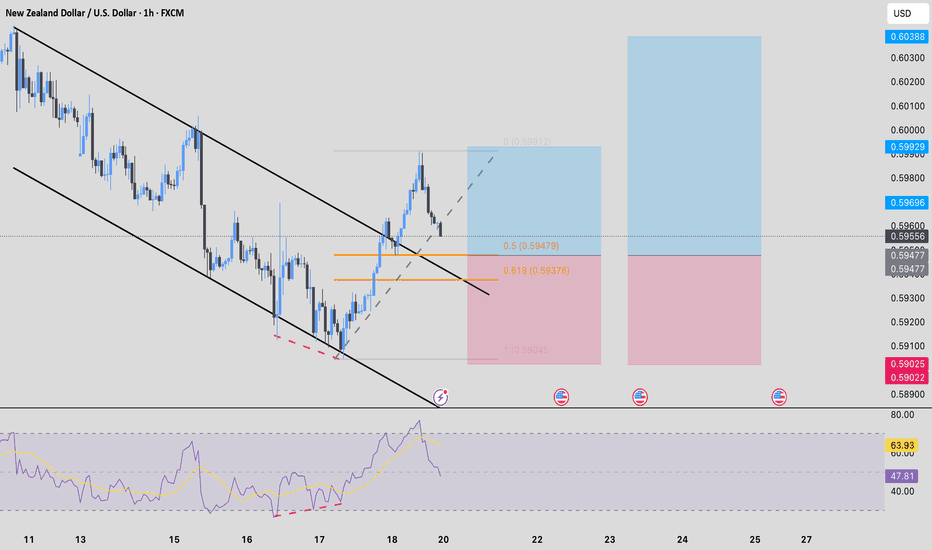

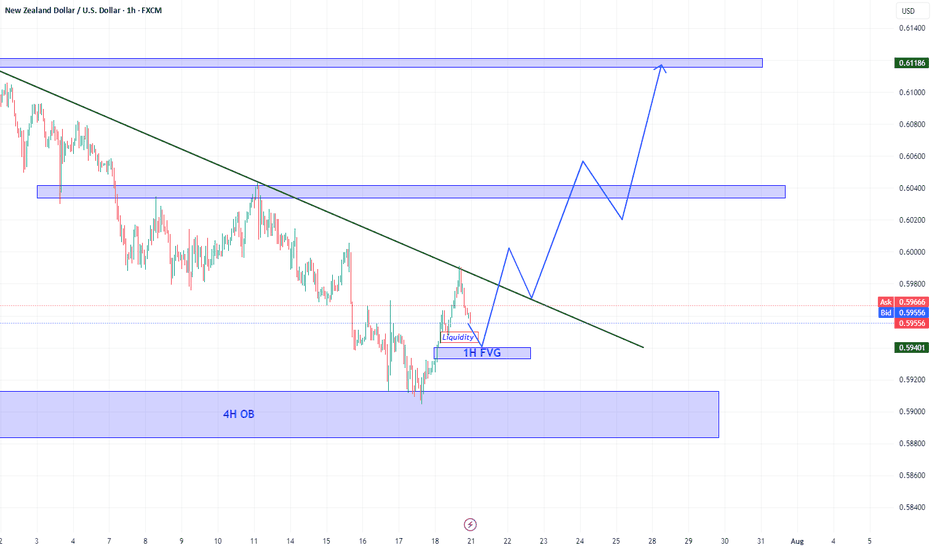

NZDUSD - BUY Idea on H1A Long opportunity on NZD/USD after a divergence was formed, potentially changing the trend as it breaks the trendline and marks new Higher highs after a series of Lower lows and lower highs.

- Entry to be taken around the 0.5 to 0.61 fib levels

- Stop Loss below the previous Low

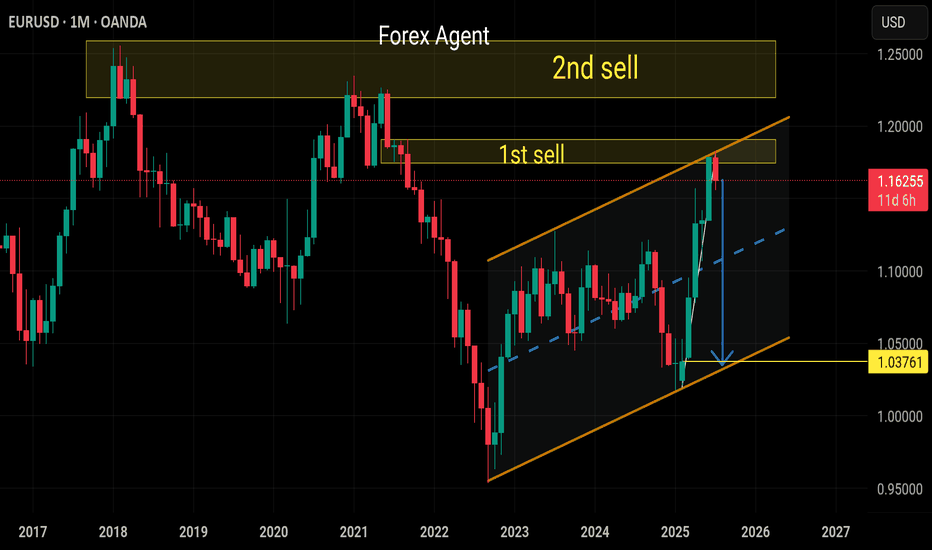

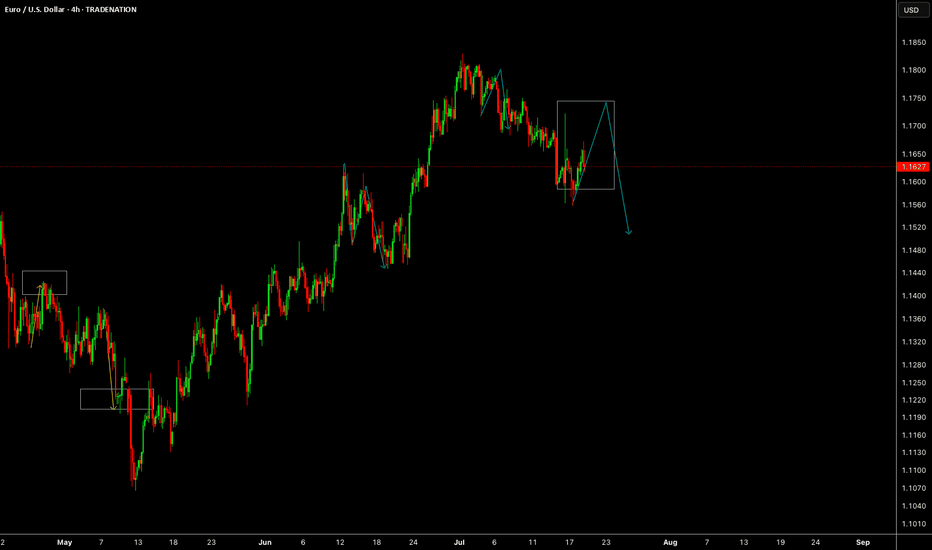

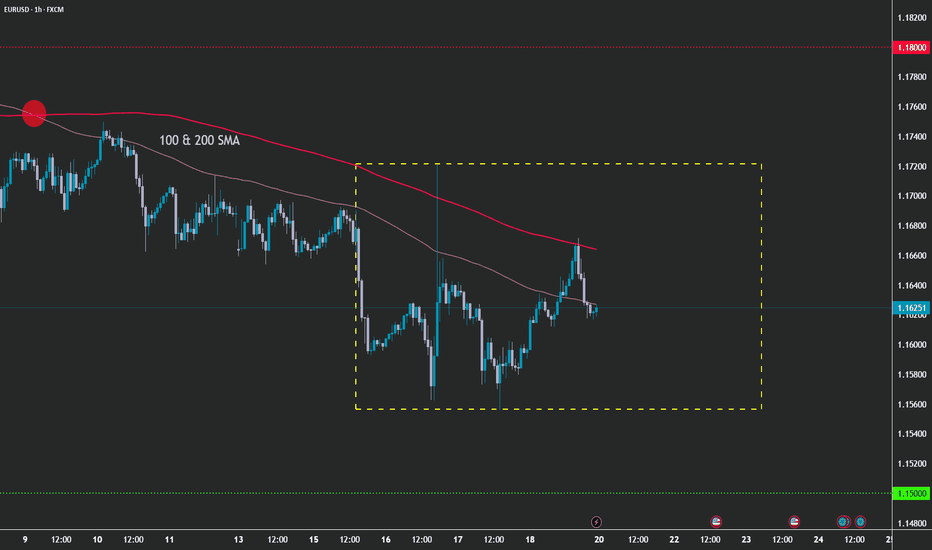

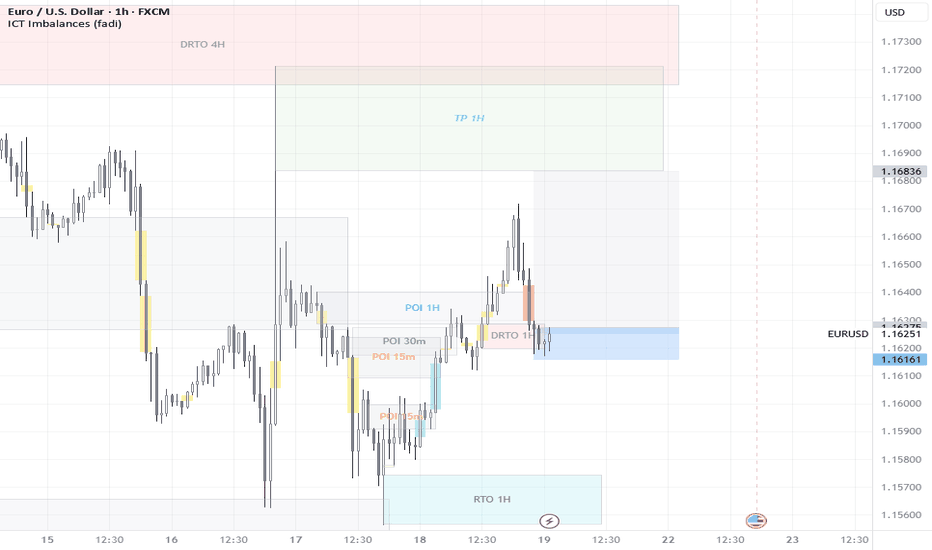

EUR/USD - Pattern & SMA PerspectiveDear Friends in Trading,

How I see it,

Keynotes:

A] Under Pressure

B] Previous Swing Support Area

C] Contraction/Accumulation

Rangebound pattern:

1) Short term correction trend holding firm

2) Decisive breakout expansion required above or below range

3) Pair suggests that greenback bulls are in charge at this time

I sincerely hope my point of view offers a valued insight.

Thank you for taking the time study my)) analysis.

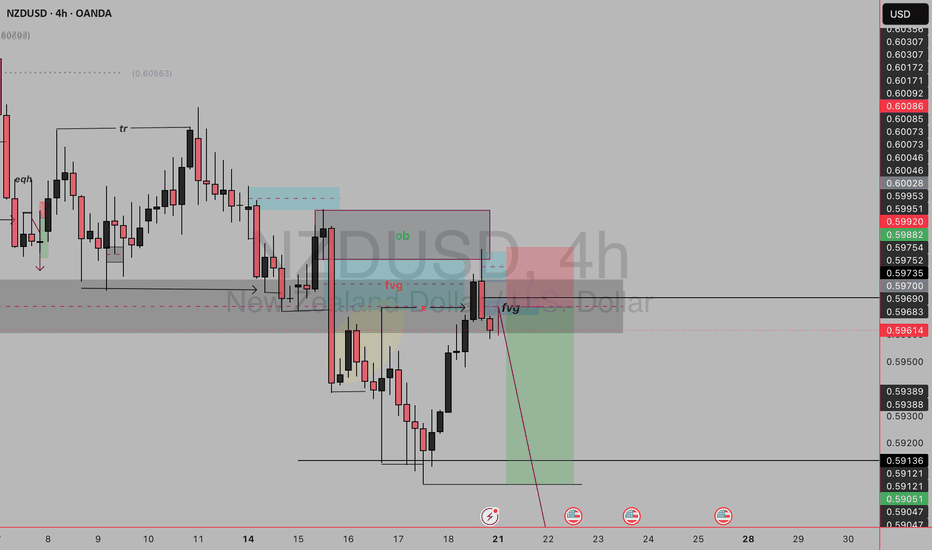

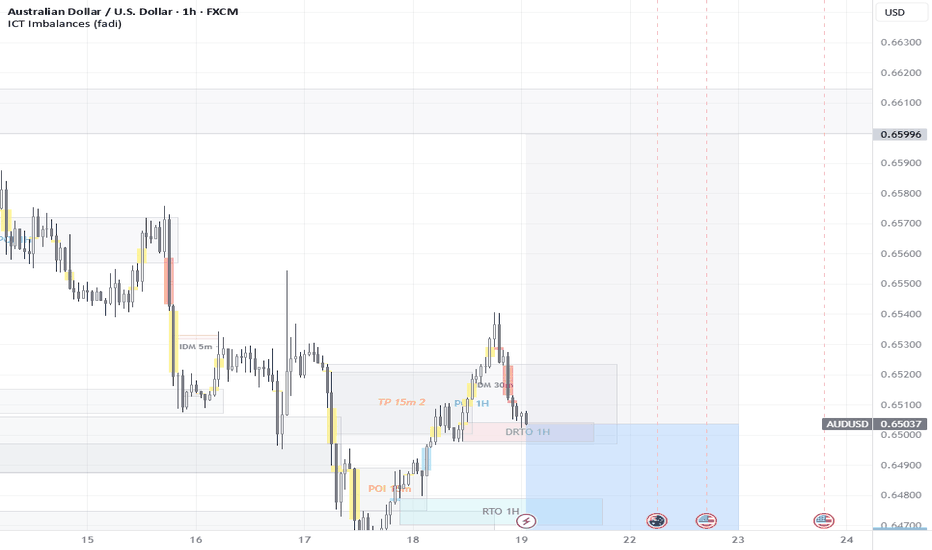

NZDUSD SELL SETUP✅Market Structure: Bearish.

Clear lower highs and lower lows.

Price retraced into a premium zone after the last strong sell-off.

✅Key Elements in the Setup

1.OB (Order Block) – Blue zone:

This is the last bullish candle before a strong bearish move.

Acts as a supply zone.

Price tapped into it before reacting.

2.FVG (Fair Value Gap) – Highlighted (yellow & blue):

Imbalance in price action (inefficient movement).

You marked this as confluence — price filled the FVG and rejected.

3.Liquidity Grab (EQH):

Equal highs were taken out — classic liquidity sweep.

This hints at a manipulation before the real move.

✅Entry Trigger:

Price pushed into the OB + FVG zone.

Rejection candle + break of structure on the lower timeframe.

You entered after that shift.

✅Trade Components

Entry: After price rejects OB + FVG area.

Stop Loss: Above OB and liquidity sweep (~0.60086).

Take Profit: Into previous low (~0.59047) or a bit lower for extended target.

Risk:Reward: Very healthy, above 1:4.

✅ Confluences Supporting the Sell

Premium pricing (above 50% of swing range).

Price filled FVG + tapped OB.

Liquidity above EQH taken.

Sharp rejection from that zone.

FVG left behind on the way down = price likely to seek lower inefficiencies.

NZDUSD keep bullish The main direction is bullish

-Price has rebounded from the 4H Order Block (OB), showing strong bullish intent and forming a Change of Character (CHOCH).

- Currently, the price is pulling back and is expected to retest the 1H Fair Value Gap (FVG) around 0.5940–0.5947, which aligns with a liquidity zone.

- A successful rejection from the FVG followed by a break and close above the descending trendline will strengthen the bullish structure and confirm continuation.

We have to enter points:

1- 0.5947 Where have a liquidity

2- 0.5940 Where FVG

Targets:

1- Resistance 1 (around 0.6040) – First take-profit area. Watch for candle behavior here (e.g.,

long upper wick or rejection); a close below could signal a short-term pullback.

2- Resistance 2 (around 0.6118) – Final bullish target if momentum continues.