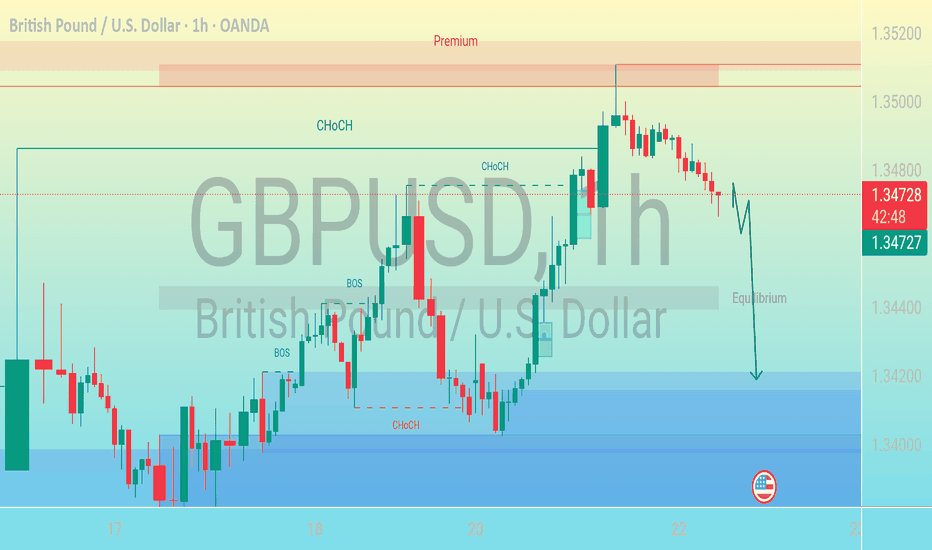

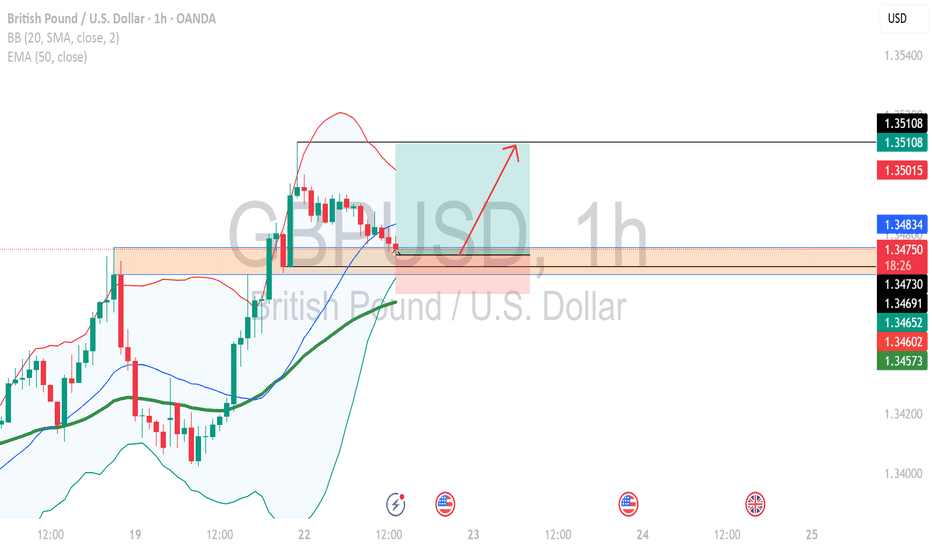

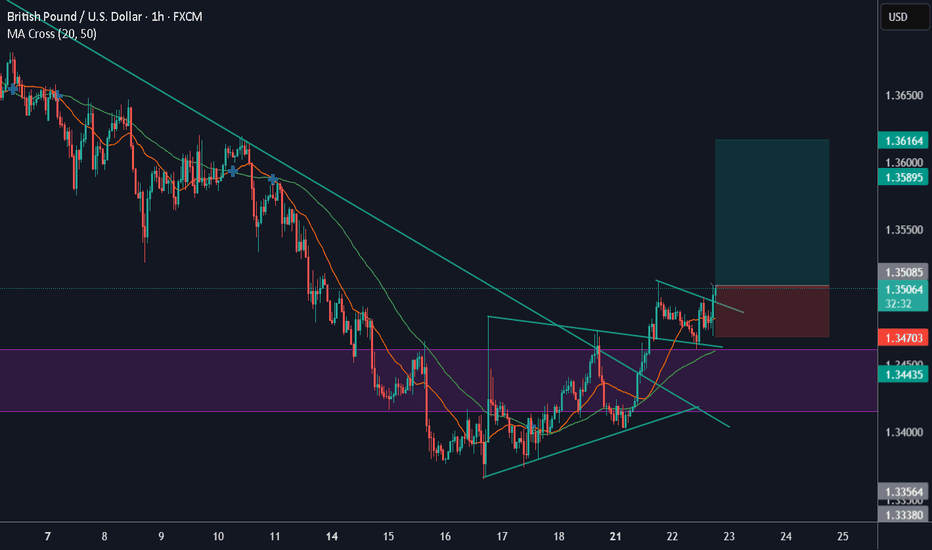

Bearish Move After CHoCH – Targeting Discount Zone"This is a GBP/USD (British Pound / U.S. Dollar) forex trading chart on the 1-hour timeframe, published on TradingView. Let’s break down and describe its key elements:

---

🕒 Timeframe & Pair

Currency Pair: GBP/USD

Timeframe: 1-hour (each candlestick = 1 hour)

Date & Time: July 22, 2025, 06:12 UTC

---

📉 Price Action

Current Price: ~1.34690

The price has recently moved from a premium zone (upper part of the range) and is heading downward.

The red candle at the top shows bearish momentum starting to form after a rally.

---

🔁 Market Structure Labels

CHoCH = Change of Character

Signals a possible reversal or shift in trend (e.g., from bearish to bullish or vice versa).

Several CHoCH points are marked throughout the chart, indicating key shifts.

BOS = Break of Structure

Indicates a significant breach of previous market structure (e.g., support/resistance).

Suggests a trend continuation or momentum confirmation.

---

⚖️ Zones

Premium Zone (Top shaded region):

Price considered overvalued, typically a good area for potential short (sell) positions.

Discount Zone (Bottom shaded region):

Price considered undervalued, potential area for buys.

Equilibrium (Middle horizontal level):

Represents fair value or a midpoint between premium and discount zones.

The price is expected to return here before potentially continuing lower.

---

⬇️ Projected Movement

A downward arrow is drawn from the current price, suggesting:

The analyst expects a pullback to the equilibrium level.

Followed by a further decline into the discount zone around 1.34200 or lower.

---

🇺🇸 News/Event Icon

U.S. flag icon near the expected price drop indicates a potential economic news release or event from the U.S. that could influence the price movement.

Forex market

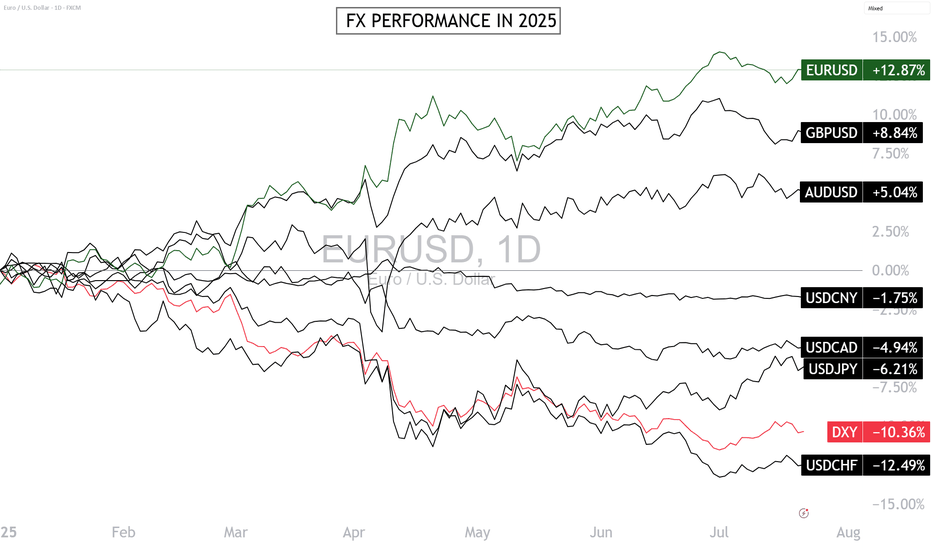

Can the Euro-Dollar Maintain Its Leadership in the FX Market?The Euro-Dollar is the best-performing major FX pair in 2025, and a short-term consolidation phase has begun below $1.18. This strength of the euro-dollar is surprising given the divergence in monetary policies. Can the euro-dollar go higher this year? How can this strength be explained fundamentally? In this week of ECB monetary policy decision (Thursday, July 24), let’s take a technical and fundamental look at the euro-dollar, which is stalling after reaching the technical resistance at $1.18.

1) Euro-Dollar’s Leadership in 2025 Defies the Logic of Monetary Policy Divergence

2025 is proving surprising in the FX market: the euro-dollar (EUR/USD) is the top-performing pair, with a gain of over 12% since the beginning of the year. This outperformance is puzzling if we rely on classic monetary fundamentals. The divergence between the Federal Reserve (Fed) and the European Central Bank (ECB) should favor the dollar.

The Fed maintains a prolonged monetary status quo with high rates due to persistent inflation and labor market tensions. In contrast, the ECB continued its rate-cutting cycle, reflecting a weaker European economy and better-contained inflation. Theoretically, this monetary asymmetry should have strengthened the dollar — yet the euro leads. This paradox is explained by a combination of fundamental factors.

2) Unexpected Fundamentals Are Driving the Euro-Dollar’s Strength in 2025

The euro-dollar’s bullish trend this year ignores the interest rate differential between the Fed and the ECB, both current and projected for the end of 2025.

Here’s a summary of the bullish fundamentals that allowed the euro-dollar to overlook monetary divergence:

• Trump administration’s fiscal policy raises concerns over U.S. debt sustainability (see long-term bond yields)

• Trade war initiated by the Trump administration creates economic slowdown risks for U.S. companies heavily reliant on international trade

• U.S. administration’s political will to improve currency competitiveness for exporters

• European stocks catching up to U.S. stocks in valuation

• Emerging markets’ will to diversify their public debt issuance

• Euro catching up as a global reserve currency as diversification away from the U.S. dollar

• Germany’s structural shift in fiscal and debt policy with massive investments in defense and industry

• EU stimulus spending and the ECB’s perceived monetary policy coherence

3) Is $1.18 the Final High for the Euro-Dollar in 2025? Probably Not.

The euro-dollar has been consolidating since early July after hitting $1.18. Is this the peak for the year? The answer is no — unless EUR/USD breaks below the $1.13/$1.15 support and unless institutional net positions reverse from their upward trend (see yellow line in CFTC COT data).

DISCLAIMER:

This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions.

This content is not intended to manipulate the market or encourage any specific financial behavior.

Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results.

Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content.

The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services.

Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA.

Products and services of Swissquote are only intended for those permitted to receive them under local law.

All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade.

Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties.

The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

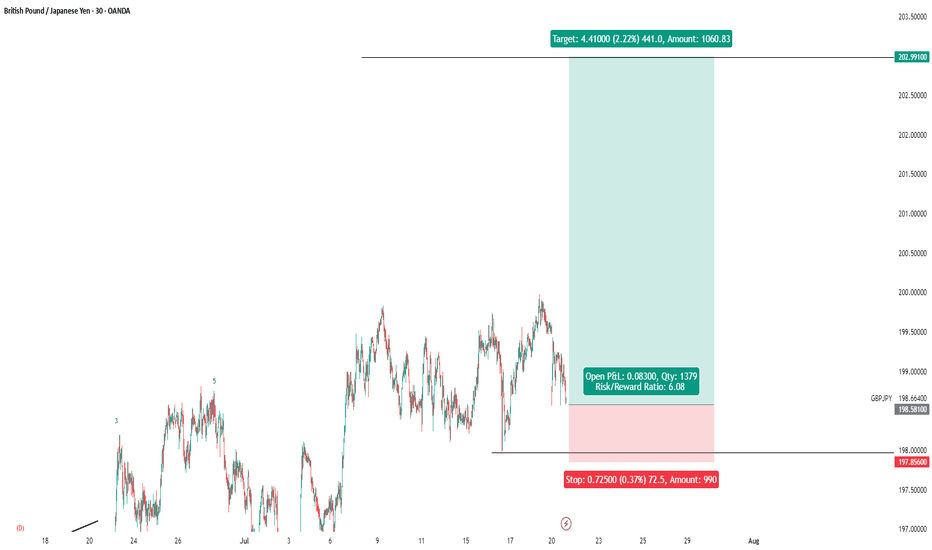

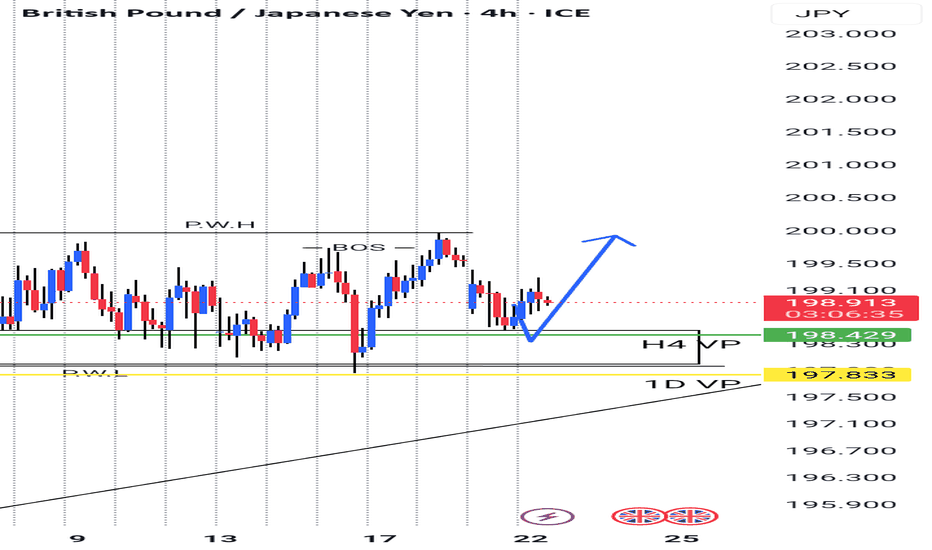

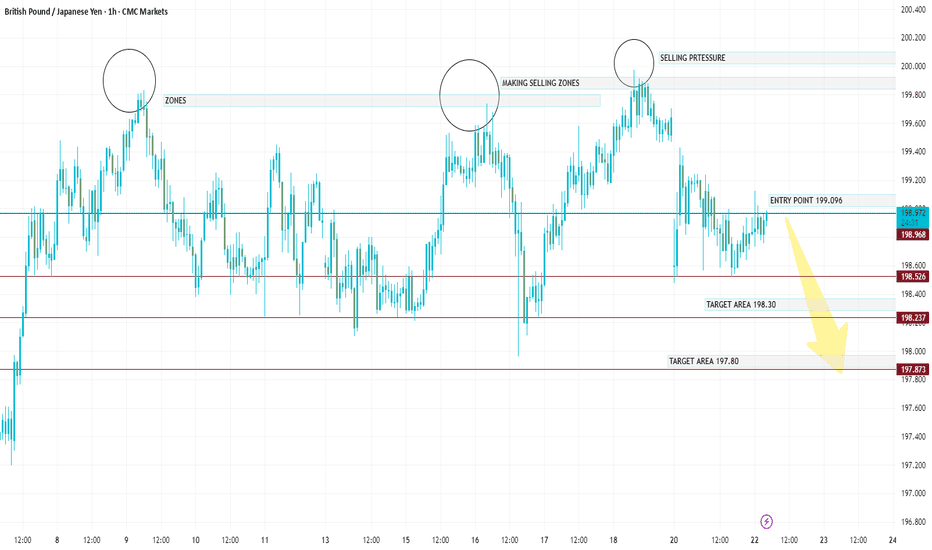

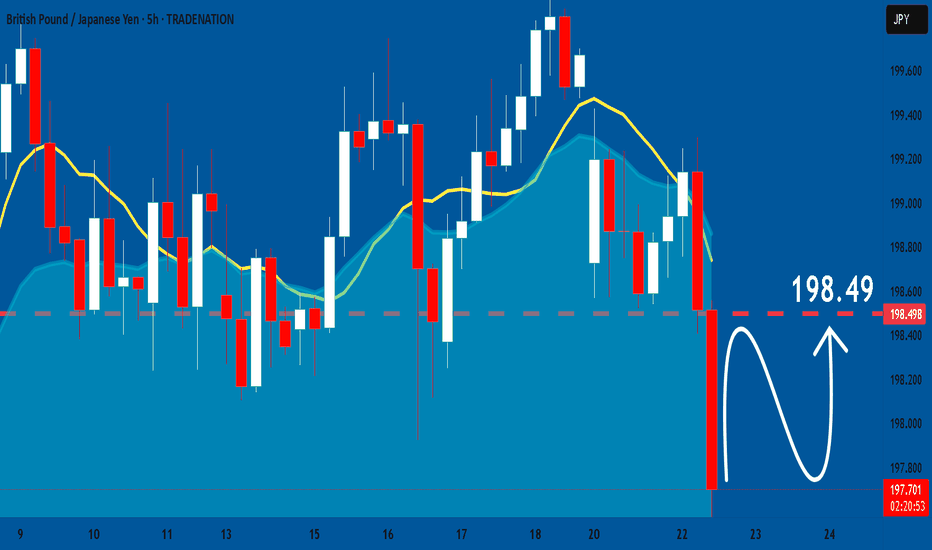

Gbpjpy buy signal. Don't forget about stop-loss.

Write in the comments all your questions and instruments analysis of which you want to see.

Friends, push the like button, write a comment, and share with your mates - that would be the best THANK YOU.

P.S. I personally will open entry if the price will show it according to my strategy.

Always make your analysis before a trade

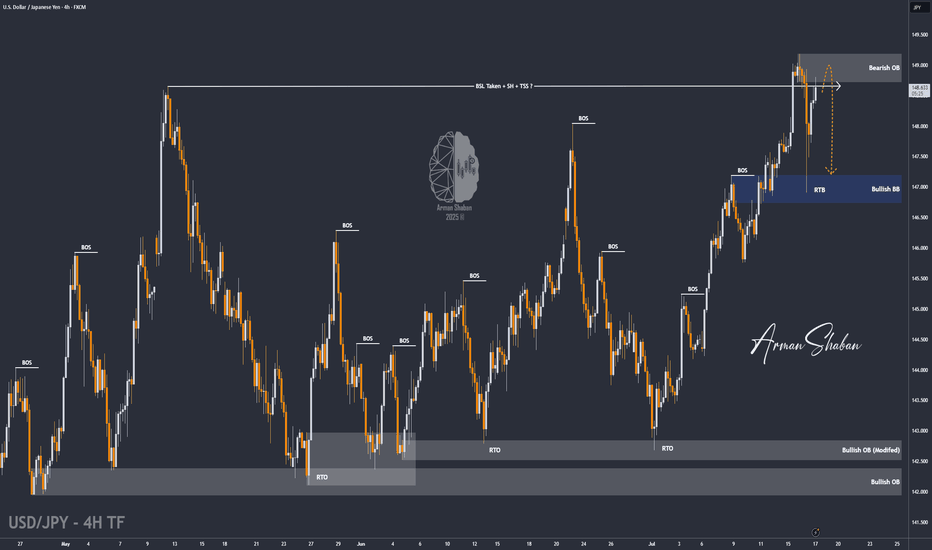

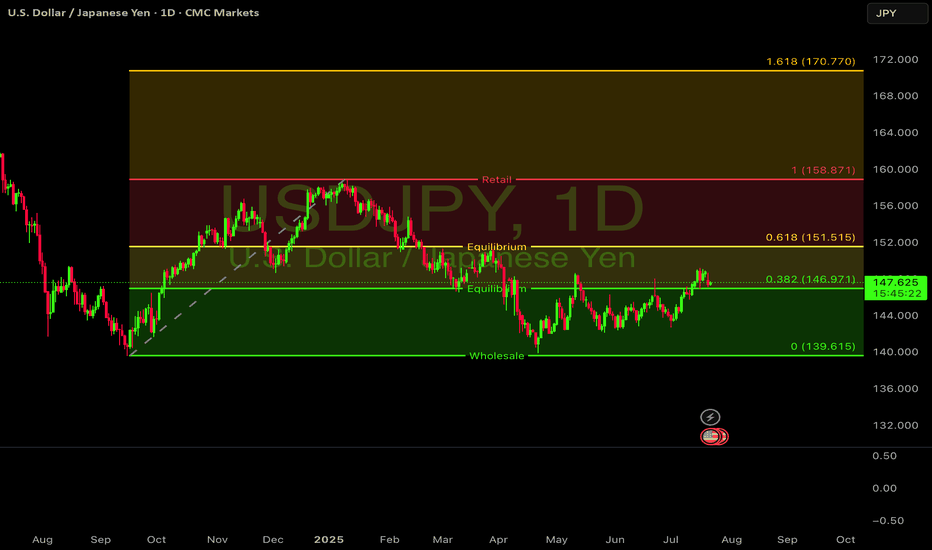

USD/JPY : Get Ready for another Fall ! (READ THE CAPTION)By analyzing the USDJPY chart on the 4-hour timeframe, we can see that after our last daily timeframe analysis, the price started its rally from the 144 zone and, as expected, hit all three targets at 145.5, 147.35, and 148.65, delivering over 500 pips in returns — even reaching as high as 149.2! Once the price broke above 148.65 and swept the liquidity above this level, it faced selling pressure and dropped to 146.9. Currently trading around 148.65, if USDJPY manages to hold below the supply zone between 148.65 and 149.2, we can expect further downside movement. This analysis will be updated with your support!

THE DAILY ANALYSIS :

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

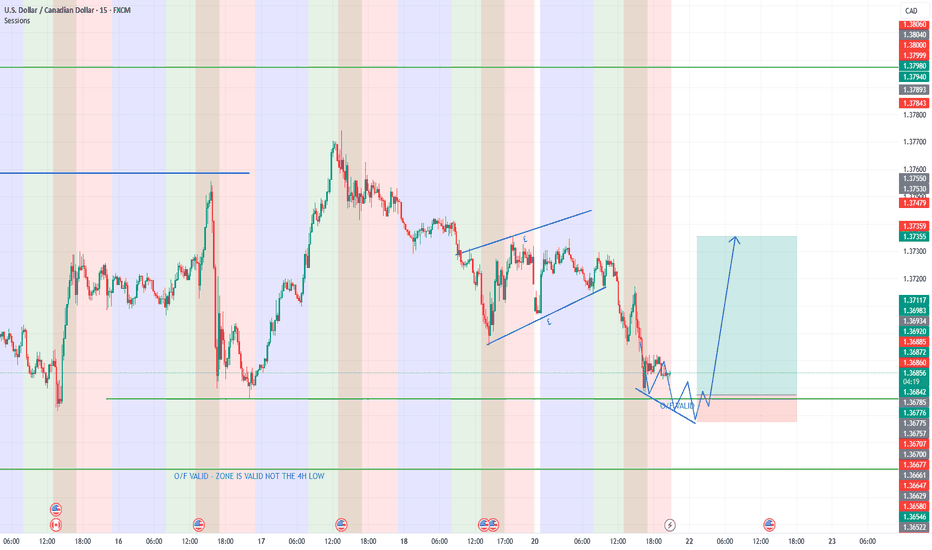

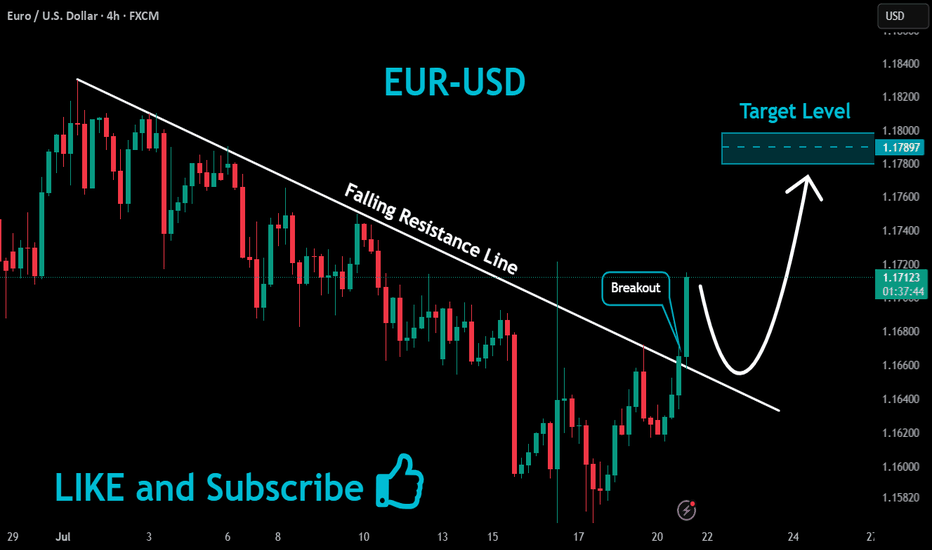

USDCAD BUYLooking for USDCAD to push lower and activate orders underneath the daily swing low that is highlighted.

To have an entry we are looking to approach and take low in a corrective manner, to form the first 15minute swing low after taking the zone and then to push down one last time to activate more buy orders before pushing up to the high of the first consolidation highlighted on the chart.

Must see CVD absorption once the low is taken before looking for a 1 minute reversal for the entry.

Stoploss below what will be the newly formed low (allow 3 pips below this)

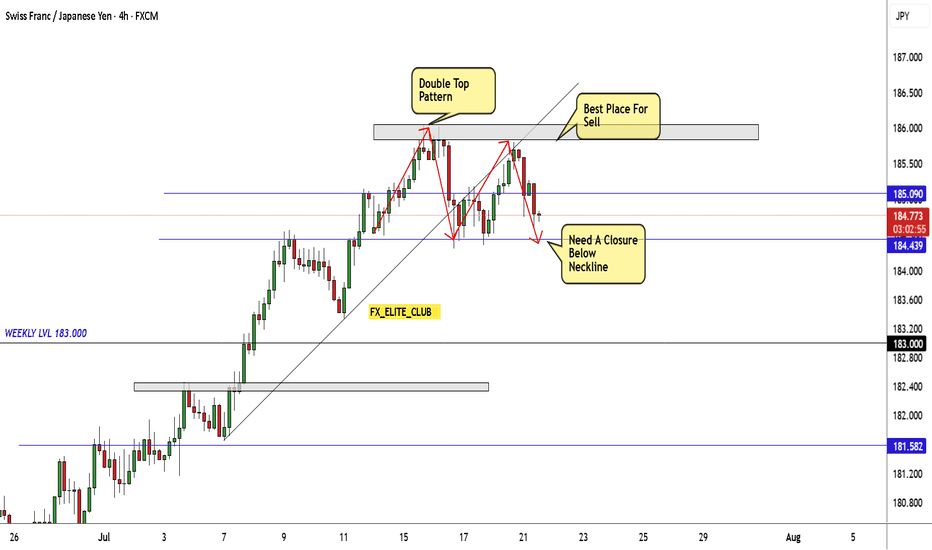

CHF/JPY Creating Double Top Reversal Pattern , Ready To Sell ?Here is my opinion on CHF/JPY 4H Chart , if we take a look we will see that the price moved tp upside very hard without any correction and now finally we have a reversal pattern but still not confirmed , so we have 2 places to sell this pair , first one is highest one around 185.800 To 186.000 and the second one if the price confirmed the pattern and closed below the neckline then we can enter a sell trade and targeting the nearest support . if we have not a closure below the neckline to confirm the pattern then this setup not valid .

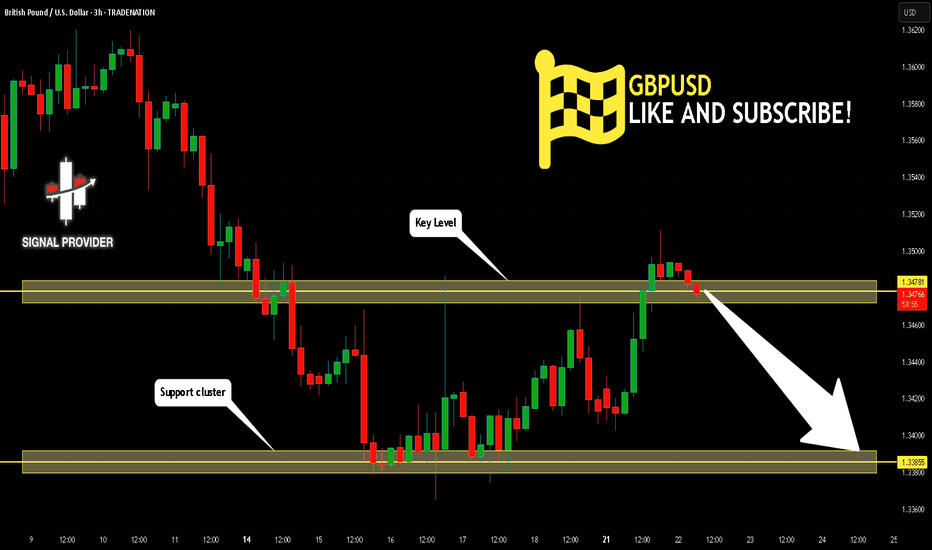

GBPUSD Will Go Down From Resistance! Short!

Here is our detailed technical review for GBPUSD.

Time Frame: 3h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is testing a major horizontal structure 1.347.

Taking into consideration the structure & trend analysis, I believe that the market will reach 1.338 level soon.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

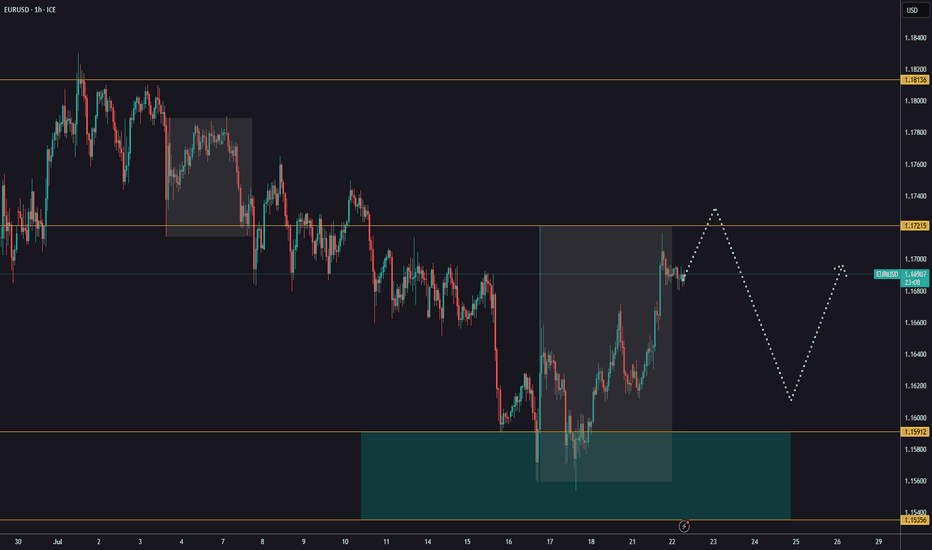

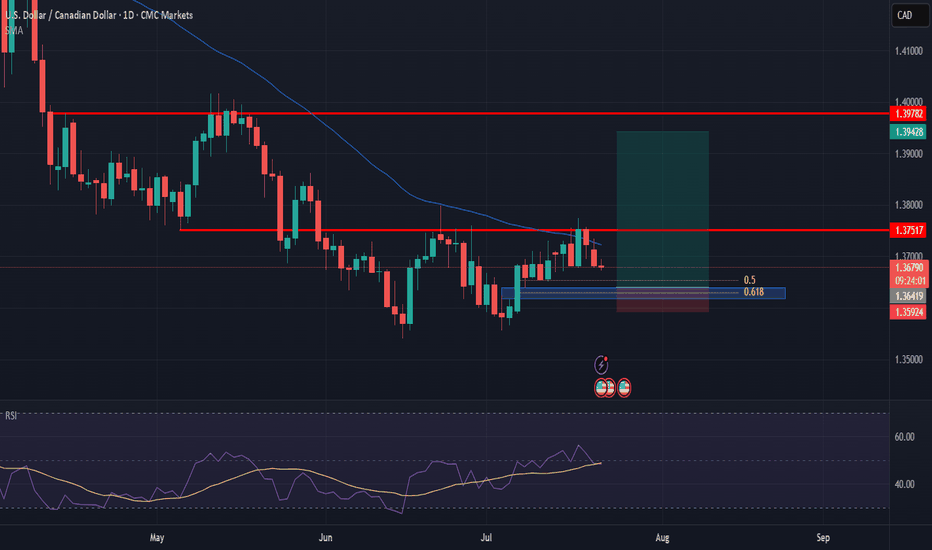

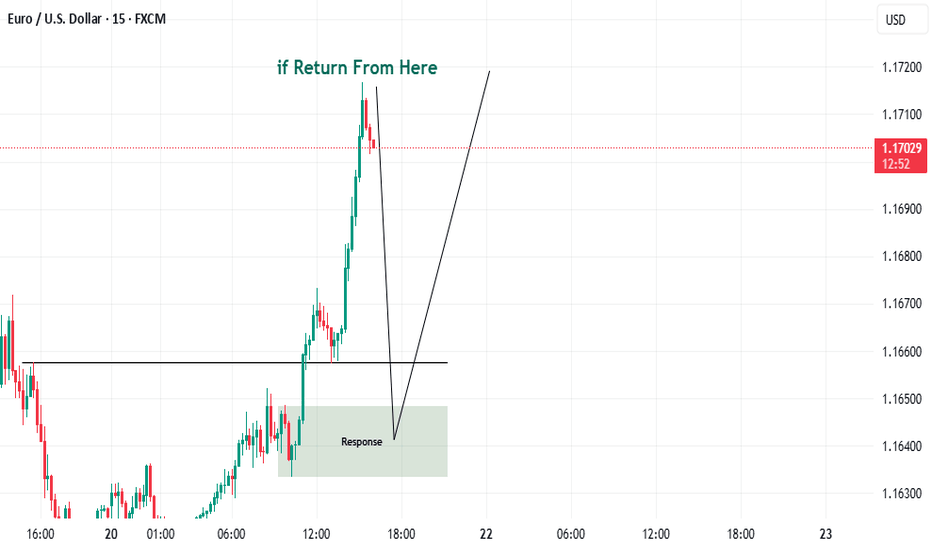

Key resistance for EURUSDYesterday, EURUSD moved higher and reached a key resistance level at 1,1720.

Watch closely to see if there’s enough momentum for a breakout and further upside.

If the price gets rejected, we could see a deeper correction.

Increased volatility is likely on Thursday following the ECB decision.

At the current levels, there’s no clear reason to enter a trade.

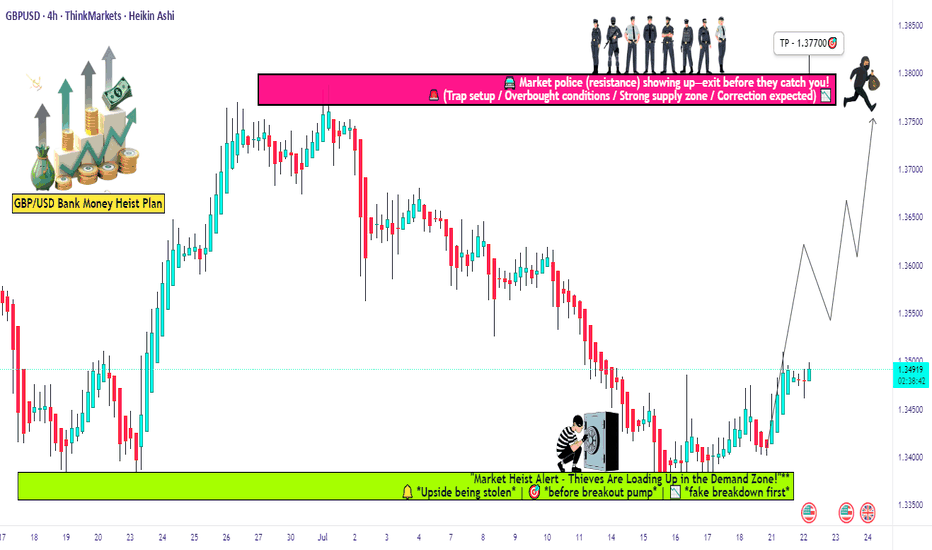

GBP/USD Long Setup: Loot & Escape Before Bears Attack!🏴☠️ GBP/USD HEIST ALERT: "The Cable" Bank Robbery Plan! 💰🚨

Thief Trading Strategy | Swing/Day Trade | High-Risk, High-Reward Loot!

🤑 DEAR MARKET PIRATES & MONEY SNATCHERS!

Based on our 🔥Thief Trading Masterplan🔥, we’re targeting the GBP/USD ("The Cable") for a bullish heist! Police barricades (resistance) are risky, but overbought markets = consolidation = TREND REVERSAL TRAP! Bears are strong here, but smart robbers take profits early!

🎯 Mission: LONG ENTRY + ESCAPE BEFORE THE POLICE (SELLERS) ARRIVE!

🔓 ENTRY: "VAULT IS OPEN!"

📍 Bullish Loot Zone: Swipe longs at any price—but smart thieves use Buy Limits near 15M/30M swing lows for pullback entries!

📍 Pro Thief Move: DCA/Layering strategy (multiple limit orders for max loot).

🛑 STOP LOSS: "DON’T GET CAUGHT!"

📍 SL @ Recent Swing Low (4H): 1.33700 (Adjust based on your risk, lot size, & entry layers!).

📍 Day/Swing Trade? Tighten SL if scalping!

🎯 TARGETS: "LOOT & BOUNCE!"

✅ 1.37700 (Main Heist Target)

✅ Scalpers: Trail SL & escape early!

✅ Swing Bandits: Hold for bigger payout!

📢 THIEF’S FUNDAMENTAL INTEL

Why GBP/USD? Bullish momentum from:

Macro Trends (COT Report, Sentiment, Liquidity Zones)

Intermarket Signals (Stocks, Bonds, Commodities)

News Trap Alerts (Avoid high-impact news chaos!)

🚨 THIEF’S GOLDEN RULES

✔ AVOID NEWS VOLATILITY! (No new trades during releases)

✔ TRAILING SL = SAFE ESCAPE ROUTE! (Lock profits like a pro)

✔ BOOST THIS IDEA! 💥 More boosts = stronger heist crew!

💎 FINAL WARNING

This is a HIGH-RISK heist! Only risk what you can lose.

Market conditions change FAST! Adapt or get caught.

Not advice—just a pirate’s plan! Do your own analysis.

🚀 NEXT HEIST COMING SOON… STAY TUNED, ROBBERS! 🏴☠️💸

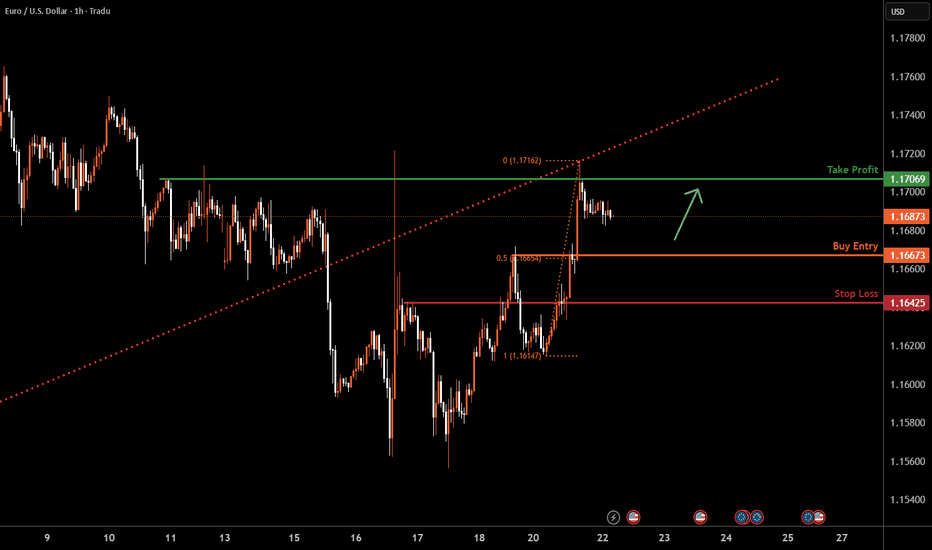

EURUSD H1 I Bullish Bounce Off Based on the H1 chart analysis, the price is falling toward our buy entry level at 1.1667 a pullback support that aligns with the 50% Fib retracement.

Our take profit is set at 1.1706, a swing high resistance.

The stop loss is placed at 1.1642, a pullback support.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

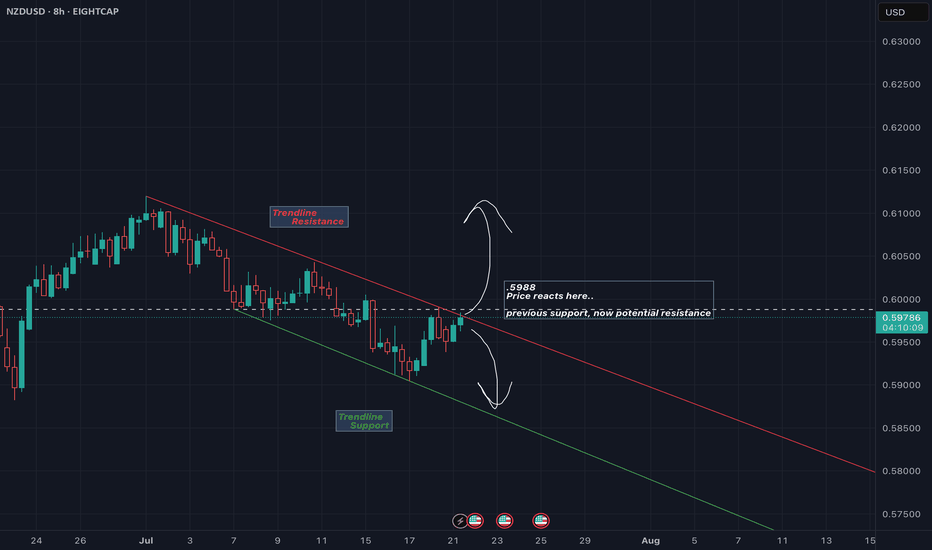

EURUSD Massive Bullish Breakout!

HI,Traders !

#EURUSD is trading in a strong

Uptrend and the price just

Made a massive bullish

Breakout of the falling

Resistance line and the

Breakout is confirmed

So after a potential pullback

We will be expecting a

Further bullish continuation !

Comment and subscribe to help us grow !

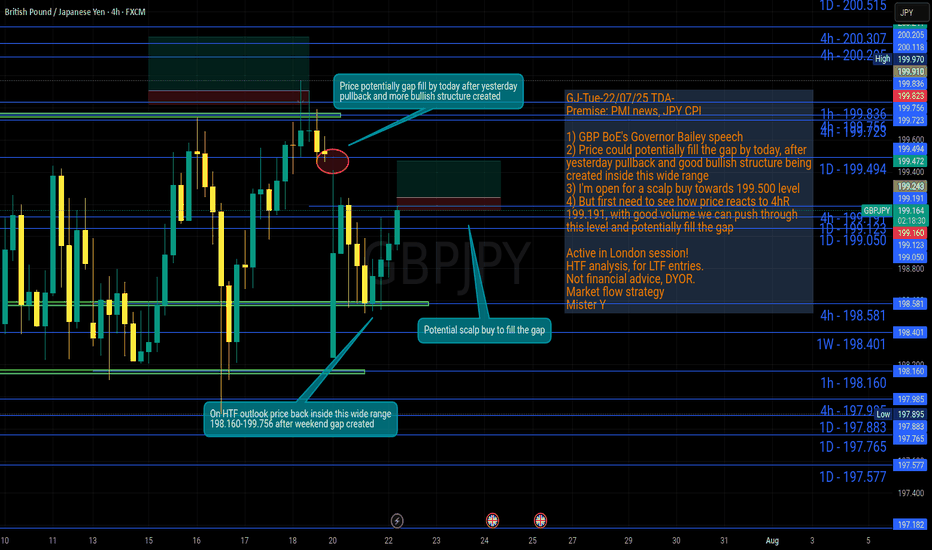

GJ-Tue-22/07/25 TDA-Potential scalp buy to fill the gap!Analysis done directly on the chart!

Weekend gaps in the majority of times (if not all the time) at some point

will be filled.

Premise:

A simple idea plan (like Tradingview public posts) won't describe everything.

No one can predict how market will move, it's always good to react to how it moves.

It gives an idea of how price might move, but no one come from FUTURE.

So I always encourage people to openly and actively discuss in real time.

I don't give signals blindly, people should learn

and understand the skill.

Following blindly signals you won't know how to

manage the trade, where precisely put sl and tp,

lot size and replicate the move over time.

That's why you need active real time discussions.

Trading is not get rich quick scheme!

Active in London session!

Not financial advice, DYOR.

Market Flow Strategy

Mister Y

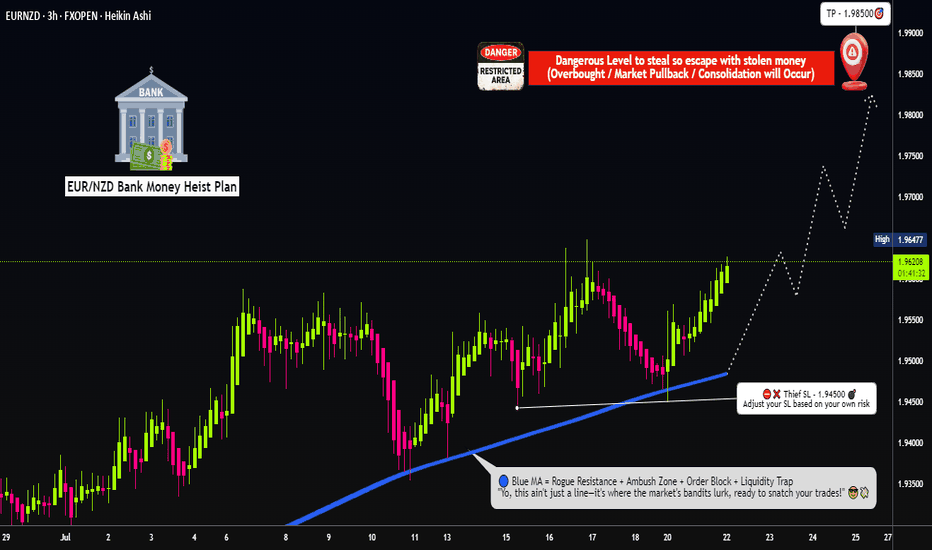

Euro vs Kiwi Bull Raid: High Reward Target Strategy🏴☠️EUR/NZD Heist Plan: "Robbing the Kiwi Vault with Thief Trading Style" 💰🔥

🌍 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌍

Dear Money Makers, Chart Bandits & Market Strategists! 🤑💸✈️

Here’s the EUR/NZD (Euro vs Kiwi) blueprint crafted using the signature 🔥Thief Trading Style🔥 — a blend of bold technicals, insightful fundamentals, and pure tactical precision. We’re setting our sights on a potential bullish breakout — targeting the high-security resistance zone where big money hides.

💡The Robbery Plan (Thief Entry Setup):

🟢 Entry Point:

"The vault is wide open — time to extract the bullish loot!"

⚔️ Entry can be taken at market price, but the smarter thieves use a layered Buy Limit strategy at pullback zones (near swing lows/highs on the 15-30 min TF) to snipe the best entries with reduced exposure.

🔁 Scaling in = DCA-style Thief Method: split entries for efficiency, just like robbing in waves.

🔻 Stop Loss Plan (Escape Route):

🔒 Place SL below the recent swing low using 3H timeframe (1.94500 for scalpers/day traders).

🛡️ Adjust based on risk appetite, lot size, and number of entries in play.

🎯 Take Profit Target:

🏁 Exit the heist near 1.98500, where strong resistance awaits. That’s the Danger Zone — the edge of our mission.

🔍EUR/NZD Outlook Snapshot:

This pair is flashing bullish vibes due to:

🏛️ Macro & Fundamental tailwinds

📊 COT positioning & Sentiment readings

🔗 Intermarket influences

📈 Price structure & liquidity zones

For more depth: dive into external analysis tools, COT reports, and sentiment dashboards to fine-tune your view. The direction is clear — the bulls are assembling.

⚠️ Trading Alerts & Risk Management Reminders:

🚨 News releases = volatility mines.

Before entering, make sure to:

Avoid new positions near red-flag economic events

Protect your open trades with trailing SLs or partial exits

Stay alert — the market shifts fast, adapt faster

💬 Final Word from the Vault Boss:

📢 Smashing likes = boosting the crew. 💥

Support the Thief Trading Style by hitting the BOOST button and keep the robbery crew rolling strong 💪💸

We're here to outsmart the market — one clean chart raid at a time.

Stay tuned for the next master plan. Until then, rob smart, rob safe. 🧠🔐💥

$USDJPY looking primed for another leg up.FX:USDJPY looking primed for another leg up.

The weekly chart shows a textbook Stage 2 uptrend, holding strong above the 200 EMA. After a healthy pullback, the price is now testing a key pivot level around 147.60, which aligns with a major support zone.

On the 4-hour chart, the Stochastic oscillator is approaching oversold territory, suggesting the recent selling pressure may be exhausted. A bounce from this support could be the catalyst for a move back to the 155-160 resistance area.

#USDJPY #Forex #FX #Trading #Bullish

GBPJPY: Swing Trading & Technical Analysis

It is essential that we apply multitimeframe technical analysis and there is no better example of why that is the case than the current GBPJPY chart which, if analyzed properly, clearly points in the upward direction.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️