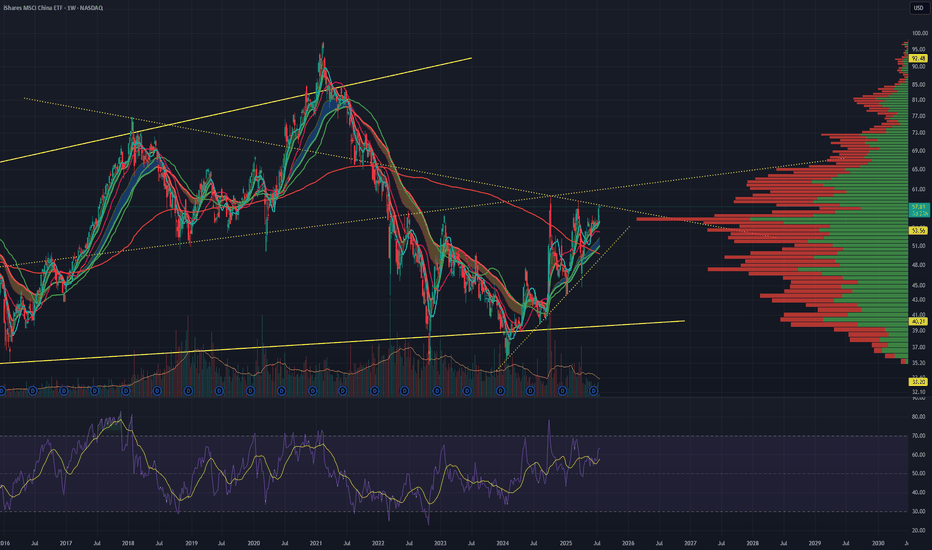

ETF market

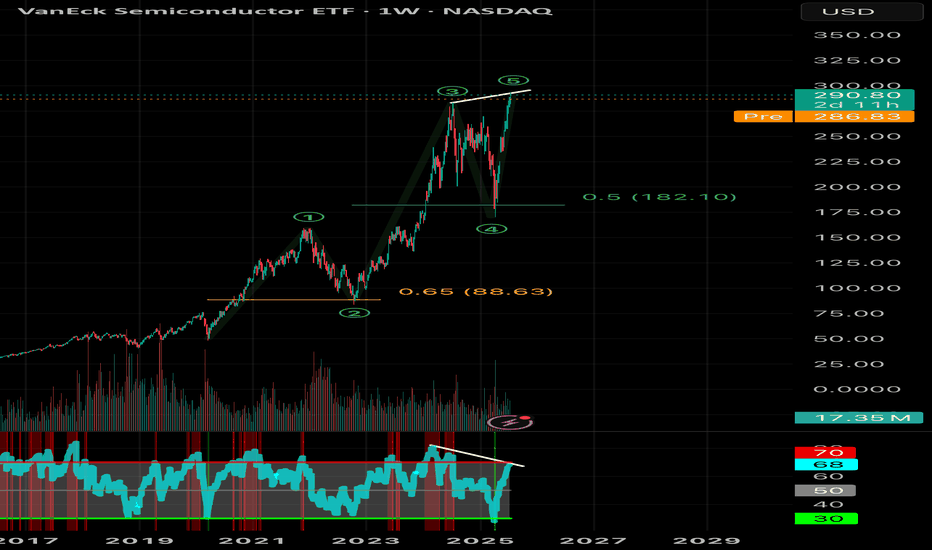

Bearish DivergencesWe could be running out of steam here. This to me looks like the final leg of the grand supercycle in semis. Bearish divergences on the RSI and a final 5th wave move up. If we reach $300 I’d expect a rejection and possible roll over. Keep an eye on this, retail are loading up but the charts don’t support the hysteria at these levels.

Not financial advice

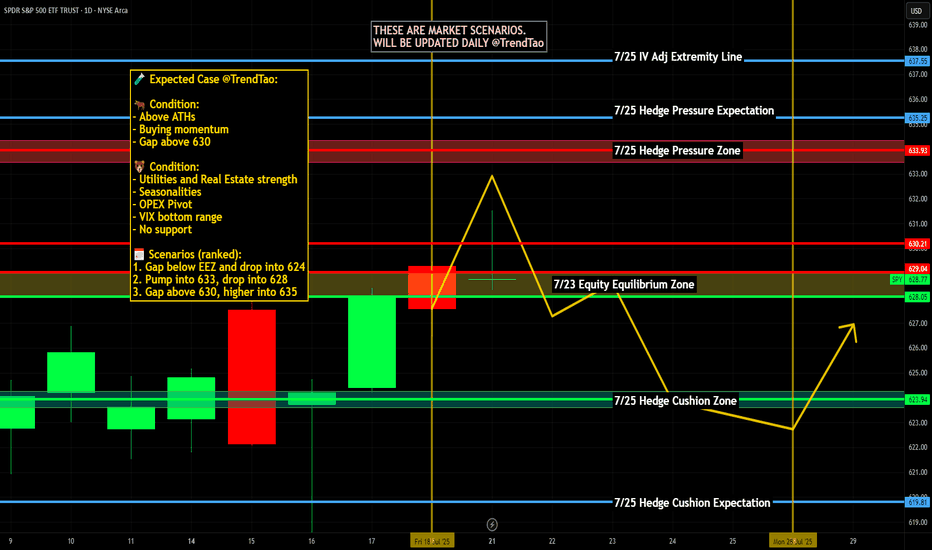

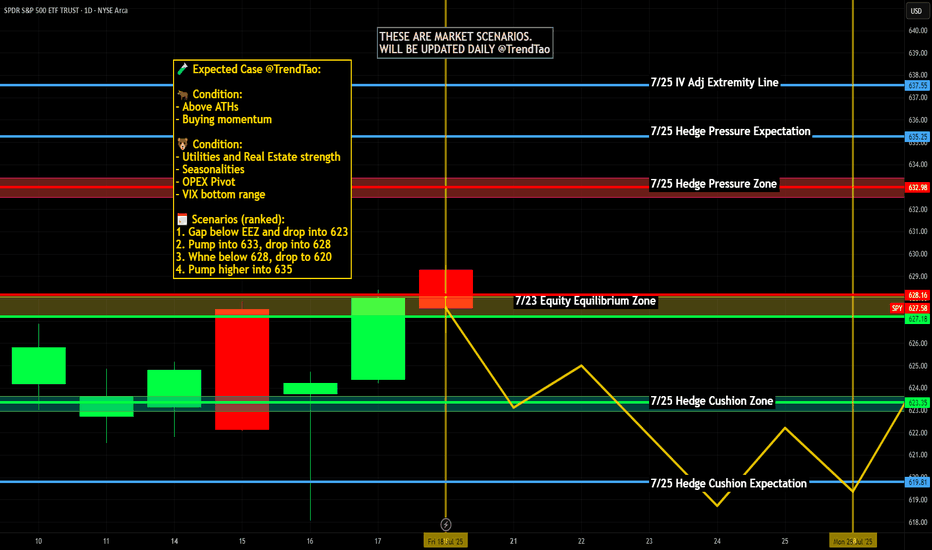

Nightly $SPY / $SPX Scenarios for July 22, 2025🔮 Nightly AMEX:SPY / SP:SPX Scenarios for July 22, 2025 🔮

🌍 Market-Moving News 🌍

🚀 Tech & EV Stocks in Focus Ahead of Earnings

Futures were quiet ahead of Tuesday’s open, but key movers included Astera Labs (+19%), Alphabet (+2.7%), Netflix +2%, and Robinhood –4.9% after being passed over for the S&P 500. Investors are positioning ahead of major tech and EV earnings this week — including Tesla, Alphabet, Lockheed Martin, Coca‑Cola, and Honeywell

📣 Powell Speech Eyed for Rate Clues

Fed Chair Jerome Powell is set to speak at 8:30 AM ET today at the Integrated Review of the Capital Framework for Large Banks Conference in D.C. Markets will be watching for any indications on future interest rate direction

🌏 Japan’s Political Shift Has Little Market Impact

Japan’s ruling coalition lost its upper-house majority over the weekend, but markets remained stable as it was largely expected. The yen held steady, and Asian equities stayed calm amid the holiday—focus remains on upcoming corporate earnings

📊 Key Data Releases & Events 📊

📅 Tuesday, July 22:

8:30 AM ET – Powell Speech: Key address at the bank regulation conference. Tone and forward guidance may sway bond and equity markets.

After Market Close – Alphabet & Tesla Earnings: Heavyweights due today—market attention will track revenue guidance, especially on advertising, EV demand, and AI.

⚠️ Disclaimer:

For educational and informational purposes only. Not financial advice—consult a licensed advisor before making investment decisions.

📌 #trading #stockmarket #tech #Fed #earnings #AI #infrastructure #volatility

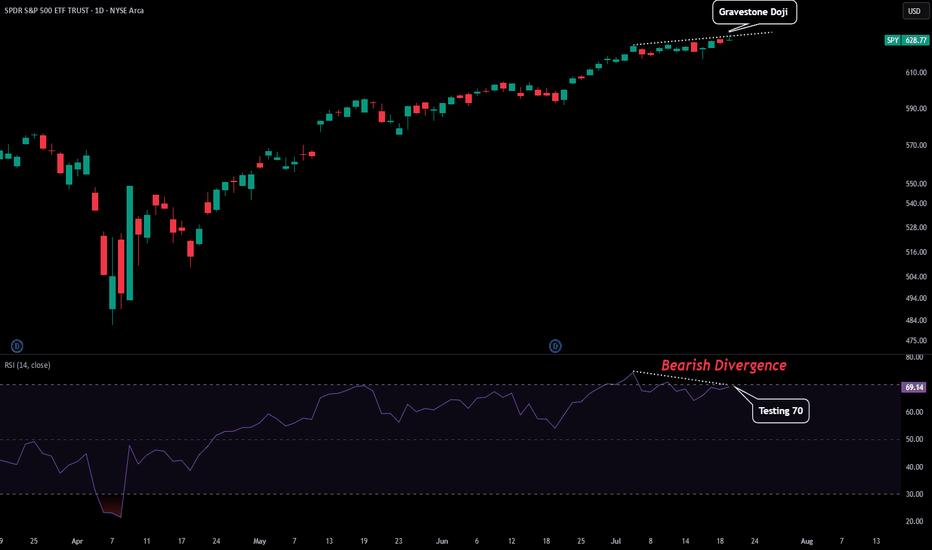

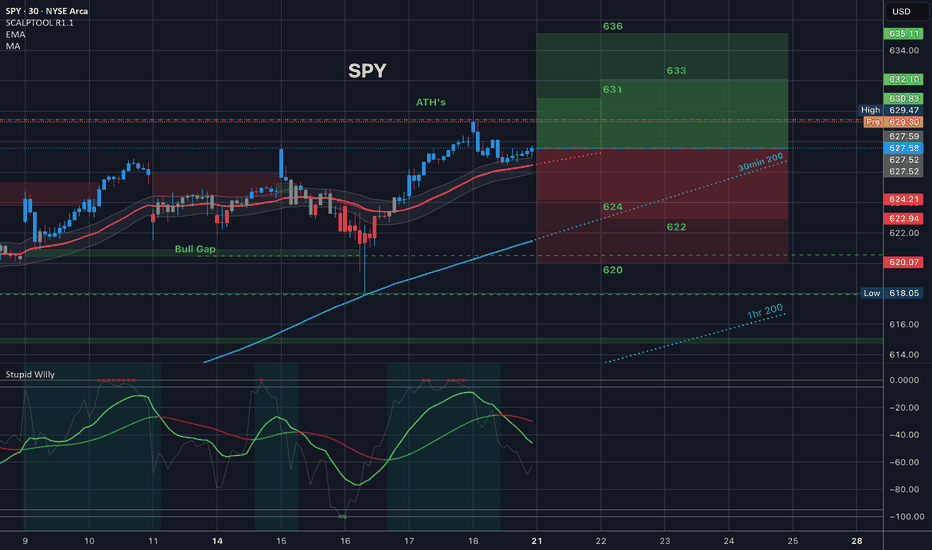

SPY - First Signs of TroubleFrom this entire uptrend we might be seeing the first signs of trouble.

Here are some reasons for this from a technical perspective:

-Daily Printed a Gravestone Doji

-RSI Testing Overbought as Resistance

-Slight Bearish Divergence on Daily RSI

-Momentum Stalling

There could also be some catalyst tomorrow that contribute to this. Powell speaks tomorrow so depending on what he says could either add fuel to a market reversal or negate these bearish signals and send us on another leg. Prepare for volatility.

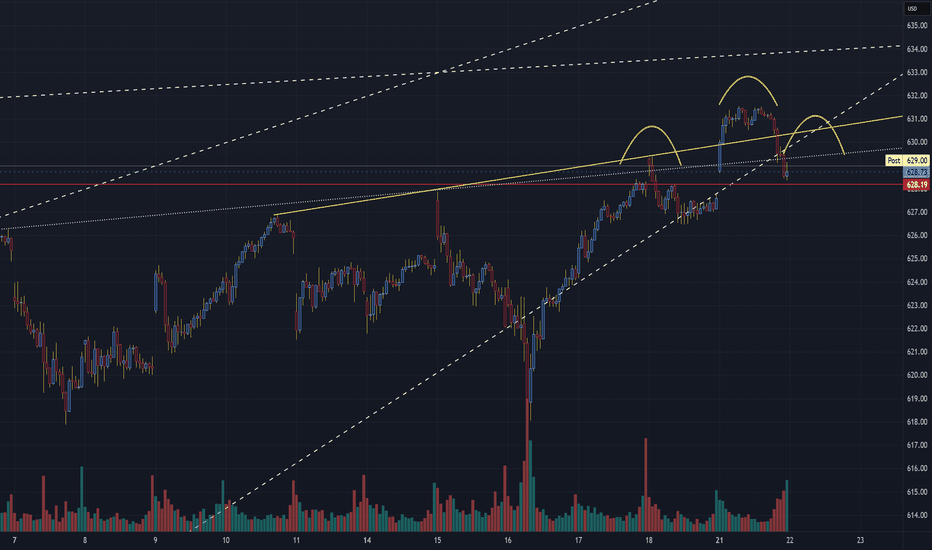

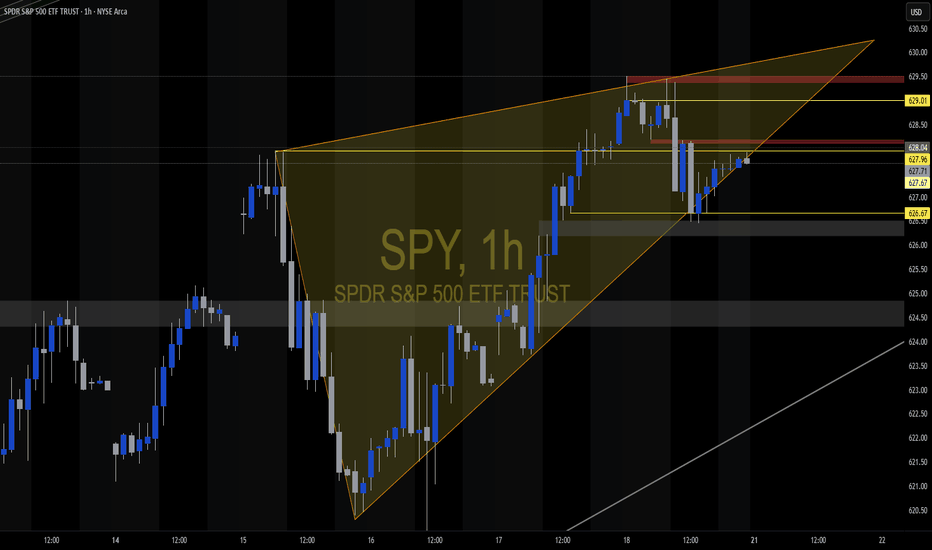

SPY Forming A Bearish Head and Shoulders PatternSPX Technical Update – Bearish Watch

Chart Focus: S&P 500 Index (30-Min Chart)

Date: July 21, 2025

🧠 Pattern Watch: Classic Head & Shoulders Formation

A clear head and shoulders pattern has emerged on the short-term 30-minute chart, signaling a potential bearish reversal after the recent uptrend.

Left Shoulder: Around 630.75

Head: Peaked near 633.00

Right Shoulder: Capped just under 631.00

Neckline: Sits near the 628.75–628.20 zone, marked by a yellow upward-sloping trendline and tested support.

📉 Bearish Breakdown in Play

The price has now broken below the neckline zone at 628.75 with increasing volume — an early confirmation of a bearish break.

The break beneath the rising wedge support and neckline suggests increased downside risk in the near term.

🧭 Technical Levels to Watch

Key Level Type Action

633.00 Resistance (Head) Likely capped unless strong reversal

631.00 Resistance Right shoulder, overhead rejection

628.75 Neckline Support (Broken) Bearish trigger zone

628.20 Intraday support Final support test (now resistance)

625.50 Initial Target Breakdown projection

622.75 Lower Support Measured move target zone

📌 Measured Move Projection:

A break of ~4.5 points from head to neckline projects a target near 624–625 in the near term.

📊 Volume Profile Note

Volume expanded on the neckline break, supporting the validity of the pattern.

Recent bars show a rise in selling pressure as bulls failed to reclaim above 630 after the breakdown.

🔍 Summary Outlook

Bearish Bias: Valid while below 628.75 neckline resistance.

Invalidation Zone: A sustained close above 631.00 would invalidate the bearish pattern.

Watch for Retest: Any bounce into 628.75–629.25 could act as a retest and fade opportunity.

📆 Next Steps:

Short-term traders should monitor price action around 625.50 and 622.75 as the most likely zones for support. Watch for further confirmation with broader index weakness or macro catalysts.

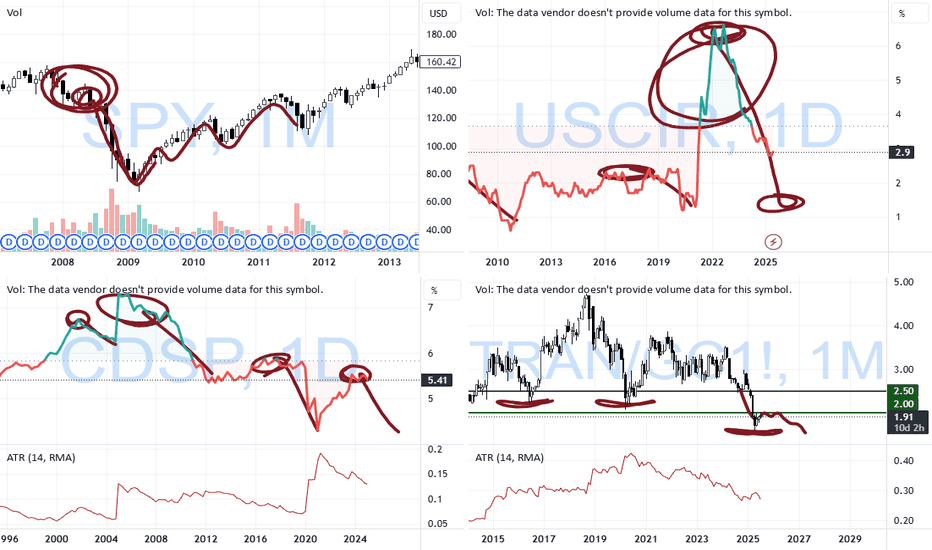

July 21 Special Update : Metals, SPY & More. What's Next.This special update is to highlight why I continue to believe traders should stay very cautious of this rally in the SPY/QQQ/BTCUSD.

Underlying economic data suggest that this is one big speculative rally following the April Tariff collapse.

And, the economic data I see from my custom indexes suggests the markets are moving into a very volatile and potentially dangerous topping pattern.

As I've stated many times in this video. I'm not saying the markets have topped and you should SELL EVERYTHING. I'm suggesting this market is extremely over-valued in terms of the underlying risk factors at play and the very clear data that suggests the markets are already in a recessionary price trend.

You may ask, "How can the markets continue to rally like this in a moderate recession?".

The answer is simple.

All bubbles end with a super-speculative phase. This phase is where everyone piles into a euphoric attempt to ride the rally higher.

It happened in the late 1990s. It has happened again through the 2000-2005+ housing bubble. Heck, it has occurred in the collectors market over the past few decades where people spent fortunes on the "hottest items" (think Beanie-Babies) only to find out they bought at the height of the bubble.

That is why I continue to urge traders to remain cautious and to withdraw profits from this speculative rally phase. Protect your investment capital immediately and consider the risks associated with the information I share in this video.

I'm not trying to scare anyone. I'm just trying to be realistic in terms of what I see in my data and why I believe now is the best time to MOVE TO SAFETY.

My data suggests that the markets are about to enter a fragile and potentially dangerous pullback phase. If you want to ride it out - go for it.

Otherwise, prepare for significant volatility over the next six months or more.

Get some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

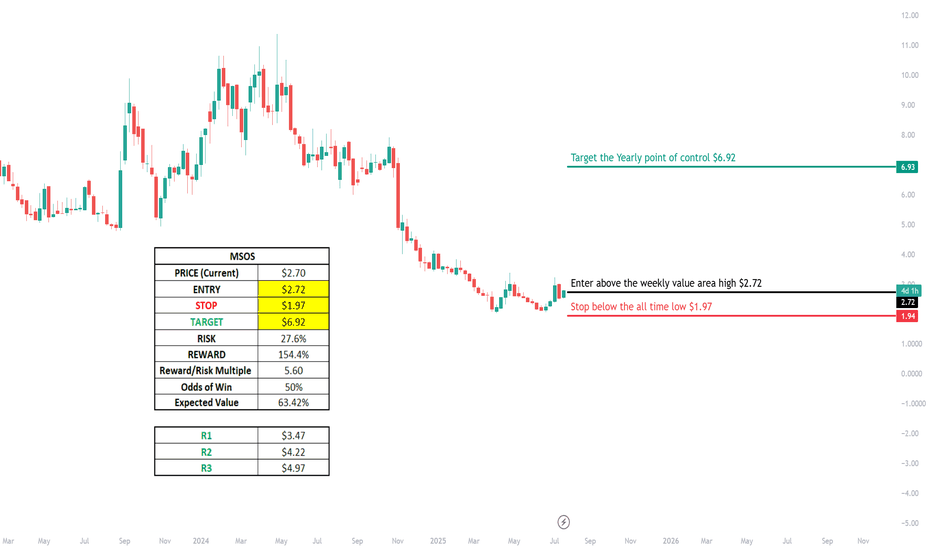

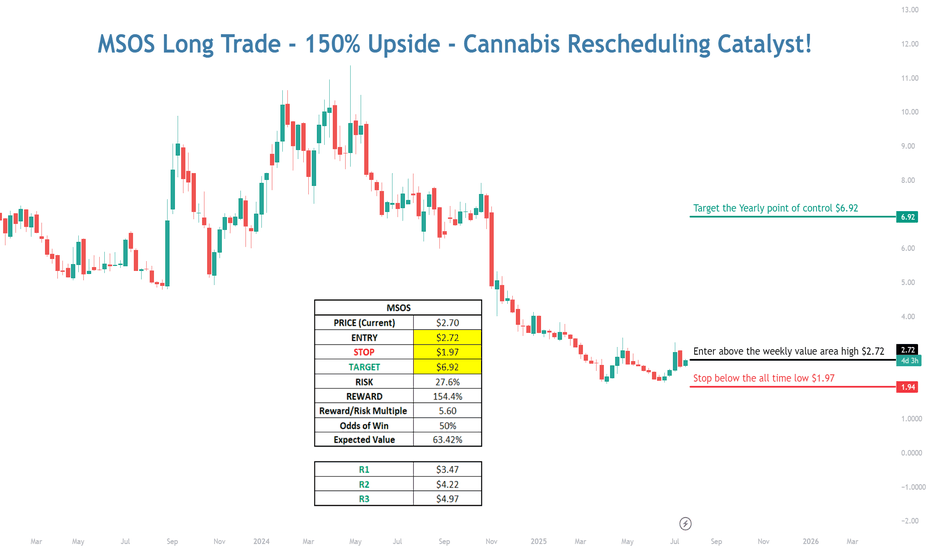

MSOS Long with 150% Upside - Cannabis Rescheduling Catalyst💠 Catalyst : Cannabis is currently classified as a schedule I drug alongside heroin, bath salts, and synthetic opioids that kill thousands every year — all while being safer than Tylenol and legal in over half the country. Cannabis is likely to be rescheduled to a schedule III drug soon after Terry Cole is confirmed as the head of the DEA. The vote to confirm him is expected to take place...TODAY

As a schedule I drug, cannabis companies can’t deduct regular business expenses for tax purposes, have limited access to banking, must transact with customers in all cash, and US multi-state operators are unable to list on the major US exchanges.

Terry Cole will be confirmed as the new head of the DEA, and when he is confirmed, the stalled process to reschedule cannabis from a schedule I to a schedule III drug should resume. If cannabis is rescheduled, that will pave the way for further research, destigmatize it, and open the door to banking and uplisting of US multi-state operators to the major exchanges in the near future.

This trade capitalizes on the fact that investors are not positioned for reform and further positive catalysts. The worst-case scenario is priced into the MSOS ETF, and when good news on rescheduling hits the tape, that should start a NEW Bull market in the MSOS cannabis stocks.

💠 Technical Setup:

Bear Market

• Multi-year bear market throughout the entire Biden administration on promises to reschedule that were never followed through on

• Capitulation when Trump won the election on the prospect of potentially another 4 years of no reform

Bearish to Bullish Technical Transition!

• LT Stage 1A Bottom Signal (Price > 50D SMA)

• ST Stage 2A Breakout (First day Price > 10D EMA and 20D SMA)

• Hourly Chart – Breaking out above Weekly Value Area

• Daily Chart – Trading above the Monthly Value Area

• Overlapping prior monthly value areas in sight!

• VPOC in sight!

• Weekly Chart – Targeting a retest of the Yearly POC

💠 Trade Plan

ENTRY: $2.72 (Break above weekly value area high)

STOP: $1.97 (Below the prior all-time-low)

TARGET: 6.92 (A retest of the yearly point of control from 2024)

RISK: 27.6%

REWARD: 154.4%

R/R Multiple: 5.6X

Probability of Win: 50%

Expected Value: 63.42%

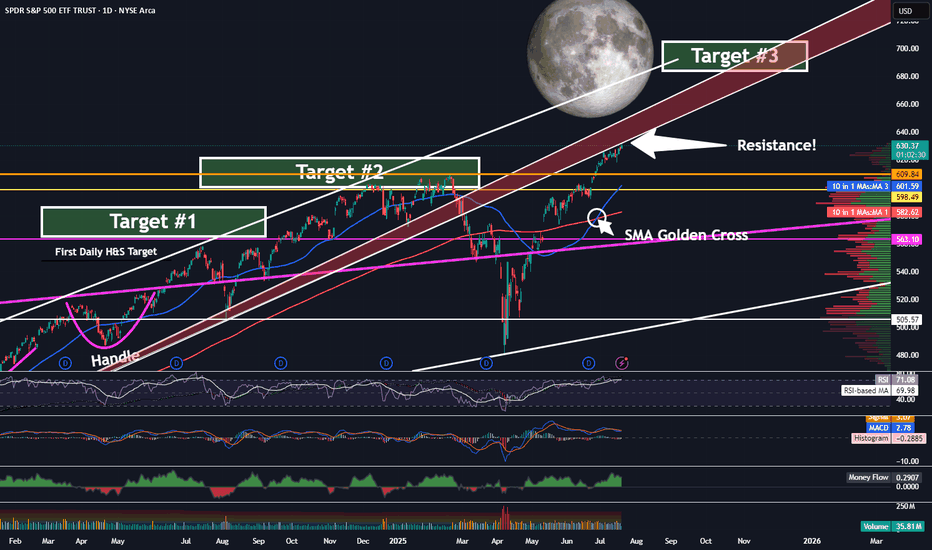

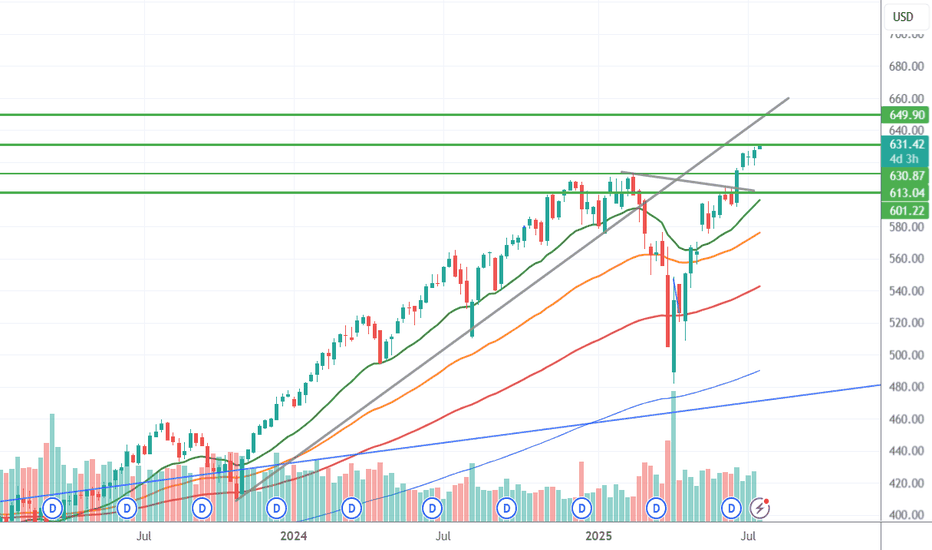

SPY - On Our Way To Target 3 ...But First?Trading Fam,

It's been a while since I updated you all on the SPY, which, as you know, we track closely to help us determine the overall market trend. Since we have now exceeded my Target #2, it's time for me to give you all another update. But first, a little context for my new readers which I have been getting a lot of recently, thanks to my new indicator hitting it out of the park.

So, we began marking targets on our chart here after spotting an inverse H&S on the daily chart a few years ago. Many of my followers back then were doubtful the pattern would fully form, or if it did, that it would actually play out. But the pattern completed about 14 months ago and subsequently broke the neckline in June of last year. I then knew we were going full send and have been predicting a 700 SPY final target since. This target has been made utilizing both that inverse H&S pattern as well as a longer-trend Elliot Wave, which I don't have denoted here at this point. The chart gets too messy with all of my markings. Regardless, we are currently in wave 5 and heading steadily towards that 670-700 target #3, my final target.

But be careful! Today, we have hit the underside of that RED area, which is HUGE resistance. I would expect that we will NOT break straight through this without some pullback prior. Indeed, the market is overextended at this moment, and we'll need the volume to be able to push through. Could this occur? Of course, anything is possible. But, it is not likely right now.

My guess is that we'll at least pull back to one of those levels below us or possibly even re-touch that 200 SMA in red before the final push.

Anyways, it is worth taking note of what may be ahead of us in the next few weeks or months so that you can plan your trades accordingly. Stay with me. We're almost there.

✌️Stew

MSOS Long with 150% Upside - Cannabis Rescheduling Catalyst💠 Catalyst: Cannabis is currently classified as a schedule I drug alongside heroin, bath salts, and synthetic opioids that kill thousands every year — all while being safer than Tylenol and legal in over half the country. Cannabis is likely to be rescheduled to a schedule III drug soon after Terry Cole is confirmed as the head of the DEA. The vote to confirm him is expected to take place...TODAY

As a schedule I drug, cannabis companies can’t deduct regular business expenses for tax purposes, have limited access to banking, must transact with customers in all cash, and US multi-state operators are unable to list on the major US exchanges.

Terry Cole will be confirmed as the new head of the DEA, and when he is confirmed, the stalled process to reschedule cannabis from a schedule I to a schedule III drug should resume. If cannabis is rescheduled, that will pave the way for further research, destigmatize it, and open the door to banking and uplisting of US multi-state operators to the major exchanges in the near future.

This trade capitalizes on the fact that investors are not positioned for reform and further positive catalysts. The worst-case scenario is priced into the MSOS ETF, and when good news on rescheduling hits the tape, that should start a NEW Bull market in the MSOS cannabis stocks.

💠 Technical Setup:

Bear Market

• Multi-year bear market throughout the entire Biden administration on promises to reschedule that were never followed through on

• Capitulation when Trump won the election on the prospect of potentially another 4 years of no reform

Bearish to Bullish Technical Transition!

• LT Stage 1A Bottom Signal (Price > 50D SMA)

• ST Stage 2A Breakout (First day Price > 10D EMA and 20D SMA)

• Hourly Chart – Breaking out above Weekly Value Area

• Daily Chart – Trading above the Monthly Value Area

• Overlapping prior monthly value areas in sight!

• VPOC in sight!

• Weekly Chart – Targeting a retest of the Yearly POC

💠 Trade Plan

ENTRY: $2.72 (Break above weekly value area high)

STOP: $1.97 (Below the prior all-time-low)

TARGET: 6.92 (A retest of the yearly point of control from 2024)

RISK: 27.6%

REWARD: 154.4%

R/R Multiple: 5.6X

Probability of Win: 50%

Expected Value: 63.42%

SPY: Climbing the Wall of Worry — But Is a Turn Coming?SPY: Climbing the Wall of Worry — But Is a Turn Coming?

The S&P 500 (SPY) is pushing into a critical zone as we approach July 28th, and I can’t ignore the confluence of signals piling up here.

Technical Setup

We’re testing the top of a rising wedge formation.

Key round number overhead at $640 — a psychological and options magnet.

Price is extended well above moving averages with declining volume, often a warning sign for bulls.

Multiple resistance lines converge in this zone, creating a high-pressure point.

📆 Timing Matters

July 28 = weekly options expiry — with massive open interest clustered around $630–$640.

Seasonally, late July often marks a peak before August chop.

Add in some “tin foil hat” vibes: SPY’s riding momentum while major indices are diverging (looking at you, IWM), and the macro narrative feels shaky at best.

What Would Confirm a Reversal?

Breakdown below $625 with a high-volume red candle.

Bearish engulfing or shooting star candle near resistance.

VIX divergence or big money flowing into puts mid-week.

Key Levels

Resistance: $640 / $649.90

Support: $630 / $622 / $595

Reversal target (if confirmed): $594–$575 area

Final Thoughts

As we all know, markets can stay irrational longer than you can stay solvent. However, when trendlines, round numbers, timing, and seasonality align, I start watching for cracks. This may not be the top — but it might be the spark.

Following closely. Alerts set. Ready for the flush if it comes.

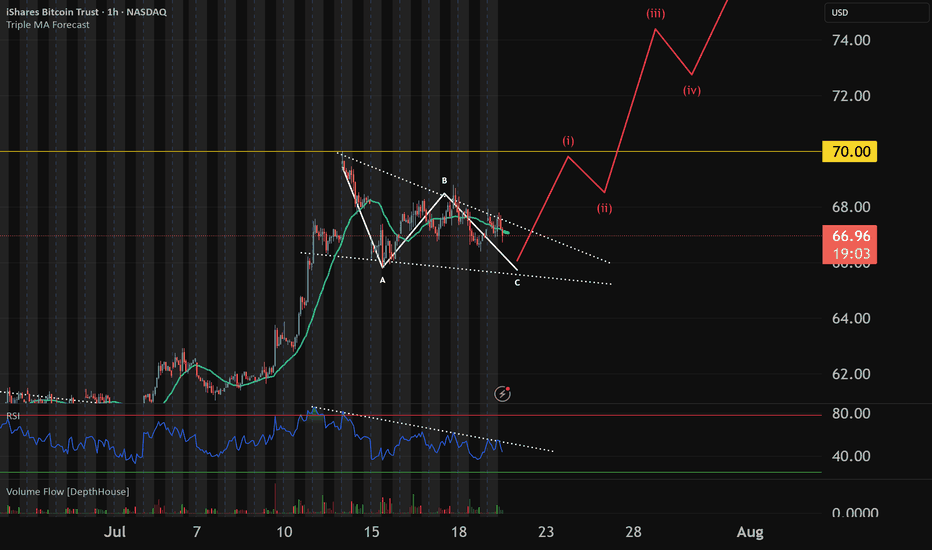

IBIT finishing C wave before next leg upIBIT is following an ABC correction after creating a new ATH. Crypto market has been hitting ATH in market value and ETH/alts have been expanding upwards as BTC has stalled which shows a rotation from large caps to rest of the market. This indicates a bull market cycle and we will be looking for a Euphoric BTC new ATH before a top is made. This is a dip to buy and will load up some more IBIT options on red days this week

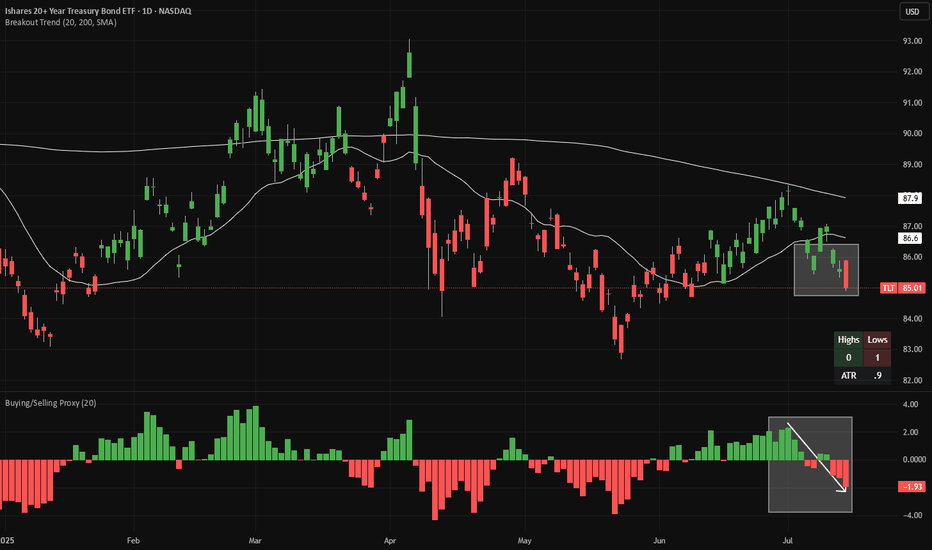

TLT short - warning signs from JapanTLT is making 20-day lows (red candles in the main chart), while continuing to make 20-week lows on a weekly chart (not shown). Meanwhile, looking at a proxy of net buying/selling (bottom panel), we have flipped from buying to selling.

Looking at Japanese bond yields, 10-year JGBs (JP10Y) just broke out of tight range. This is the third attempt to trade above ~1.59% recently, which we saw earlier today. As Japan's is one of the world's leading overseas investors, this is an obvious warning sign for bonds globally.

There is good risk/reward to short bonds here, with a stop-loss if the price closes at a 20-day high. If a 20-day high is made, the candles will change color from red to green.

Both indicators (Breakout Trend and Buying/Selling Proxy) are available for free on TradingView.

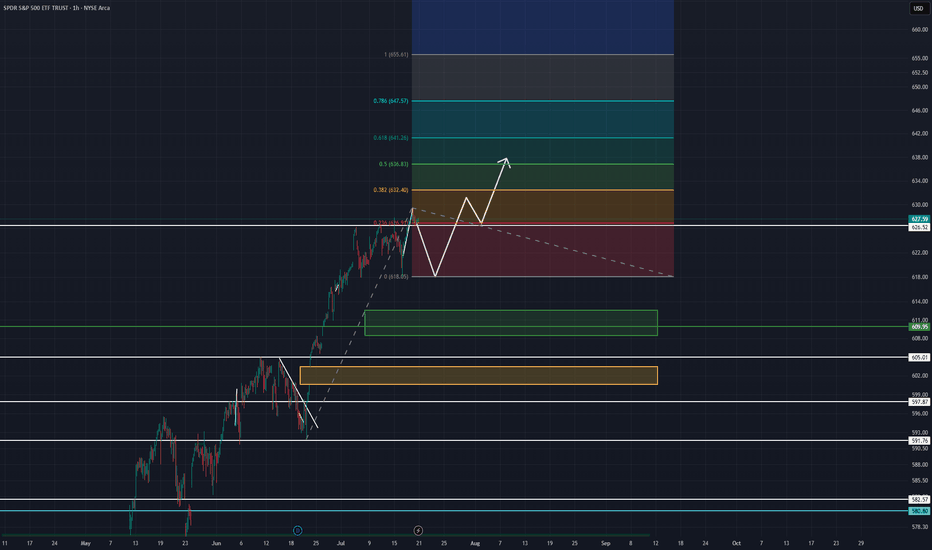

SPY July 21-25AMEX:SPY

Looking at the 4 hr. timeframe on SPY. Bearish divergence is signaling a need for some cool off. I assume this will happen almost immediately, Monday maybe into Tuesday. I expect to keep above strong support levels at 618 and 609.95. Drops below 609 will change my stance to a more bearish tone. assuming we hold these levels, I expect that SPY will continue upward after some small consolidation up here in the range. Looking at a trend-based fib, some price points to the upside above ath's(all time highs) would be 633.52 and 637.85. Even 654.

Economic and policy fundamentals could shift any bullishness into another sharp pullback or even up into higher price targets.

Not much to be bearish abut this week, earnings season is kicking off and this could play a role as well; Tesla and google & blue chips happening Tuesday- Thursday.

These earnings could be the mystery seasoning to shake up this week's movement.

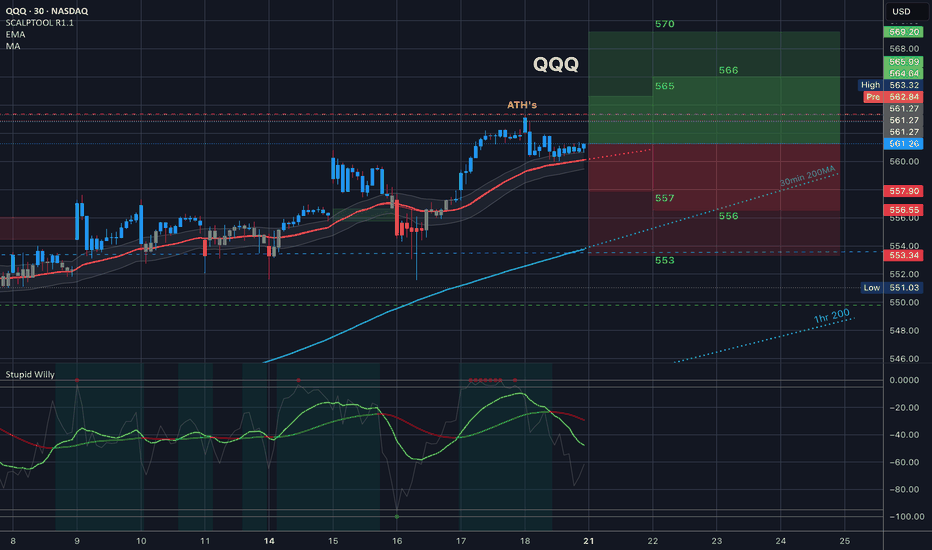

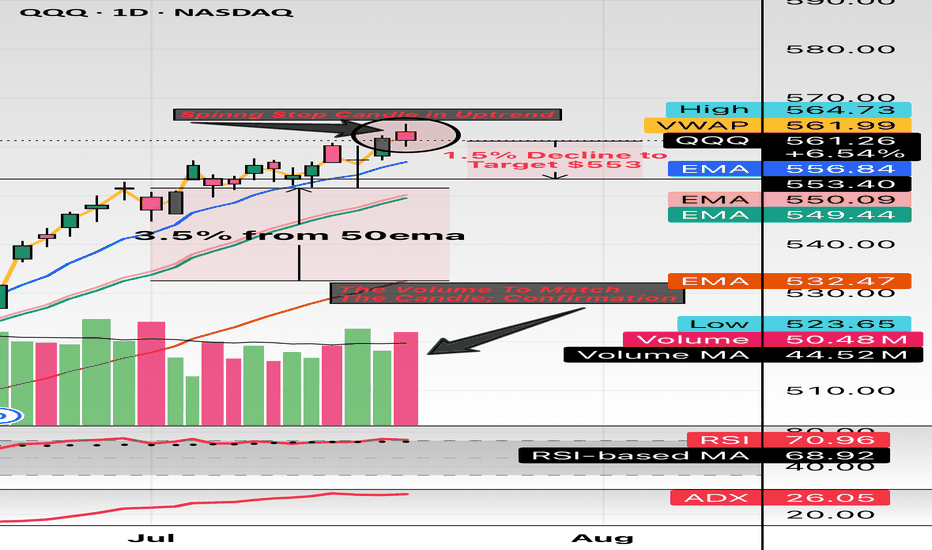

$QQQ this might the spot. Hello and good night, evening, afternoon, or morning wherever you may be. I have been looking at names all day and I wanted to check the indexes: NASDAQ:QQQ and $SPY.

Here we have the indexes up almost 30% from the April lows and sitting about 10% YTD. The candle highlighted is the spinning stop candle and has volume to match. These candles usually take place (green or red) in downtrends or uptrends and provide pivotal indication. The market has major earnings this week (07/21/2025 to 07/25/2025) with names like Google, Tesla, General Dynamics, Verizon, Domino’s And so forth.

This week could be a catalyst to see some great volatility. I believe staying 3% from moving averages so I have noted 3.5% from the 50EMA and revisiting the 20EMA and 21EMA in the low $550 area. My target is $553 which is only a 1.4% move which can happen in one session in this environment while staying 3.5% above the 50EMA.

My trade idea will be $553p for 07/25/2025. Good luck!

WSL

Weekly $SPY / $SPX Scenarios for July 21–25, 2025🔮 Weekly AMEX:SPY / SP:SPX Scenarios for July 21–25, 2025 🔮

🌍 Market-Moving News 🌍

🏦 Fed Chair Powell Speaks — Markets Key Into Tone

Federal Reserve Chair Jay Powell’s Jackson Hole speech is the week’s centerpiece. Markets will be closely listening for clues on inflation strategy, rate-cut timing, and sensitivity to geopolitical inflation drivers like tariffs.

📦 Tariff Deadlines Gain Spotlight

Multiple tariff deadlines are set this week for targeted trade partners including the EU, Mexico, Canada, Japan, South Korea, and Thailand. Any new announcements or extensions could trigger volatility in trade-exposed sectors.

🛢️ Oil Market Mixed Signals

Brent crude prices have stabilized near mid-$70s, but OPEC+ discussions regarding supply extensions and global growth concerns continue to inject uncertainty into energy-linked equities.

📈 Big Tech Earnings Kick Off

The “Magnificent Seven” tech giants begin reporting: Nvidia leads on Tuesday, followed by Microsoft, Amazon, Alphabet, and Meta later in the week. Expect significant sentiment swings based on forward commentary.

📊 Key Data Releases & Events 📊

📅 Monday, July 21

Quiet session ahead of a packed week of speeches and data.

📅 Tuesday, July 22

8:30 AM ET – Existing Home Sales (June):

Measures signed contracts on previously owned homes—a key housing indicator.

After Market Close – Nvidia Q2 Earnings:

Market will watch guidance and China commentary.

📅 Wednesday, July 23

8:30 AM ET – Leading Economic Indicators (June):

An early gauge of U.S. economic momentum.

📅 Thursday, July 24

8:30 AM ET – Initial & Continuing Jobless Claims:

Labor-market health indicator.

📅 Friday, July 25

8:30 AM ET – Durable Goods Orders (June):

Signals demand for long-lasting goods, often driven by business spending.

8:30 AM ET – New Home Sales (June):

Follows existing home data for housing sector insight.

4:00 PM ET – Fed Chair Powell Speech at Jackson Hole:

Expect commentary on inflation, growth, and rate-path clarity.

⚠️ Disclaimer:

This content is for educational and informational purposes only and should not be construed as financial advice. Consult a licensed financial advisor before making investment decisions.

📌 #trading #stockmarket #economy #Fed #earnings #housing #durablegoods #JacksonHole #technicalanalysis

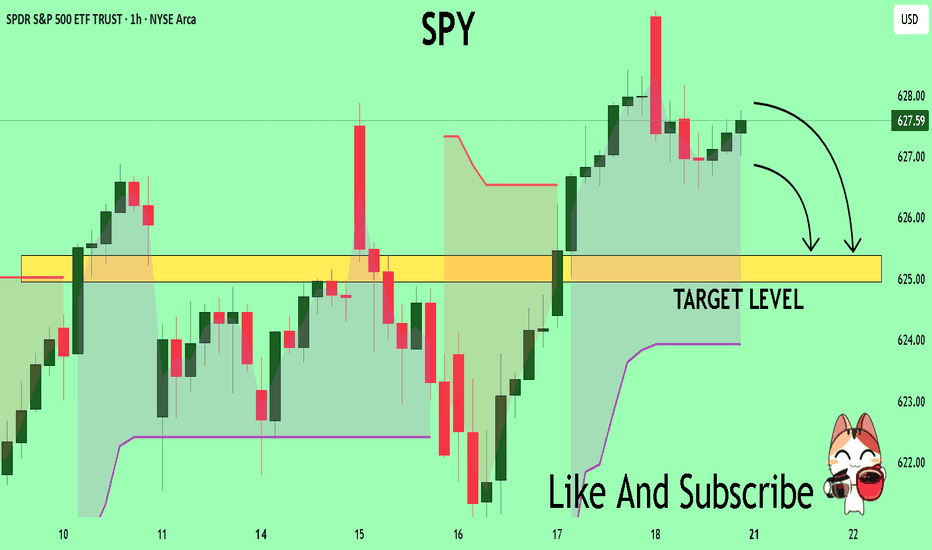

SPY What Next? SELL!

My dear friends,

Please, find my technical outlook for SPY below:

The instrument tests an important psychological level 627.59

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 625.38

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK