GOLD Will Go Higher From Support! Buy!

Here is our detailed technical review for GOLD.

Time Frame: 12h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is testing a major horizontal structure 3,311.57.

Taking into consideration the structure & trend analysis, I believe that the market will reach 3,369.04 level soon.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

Futures market

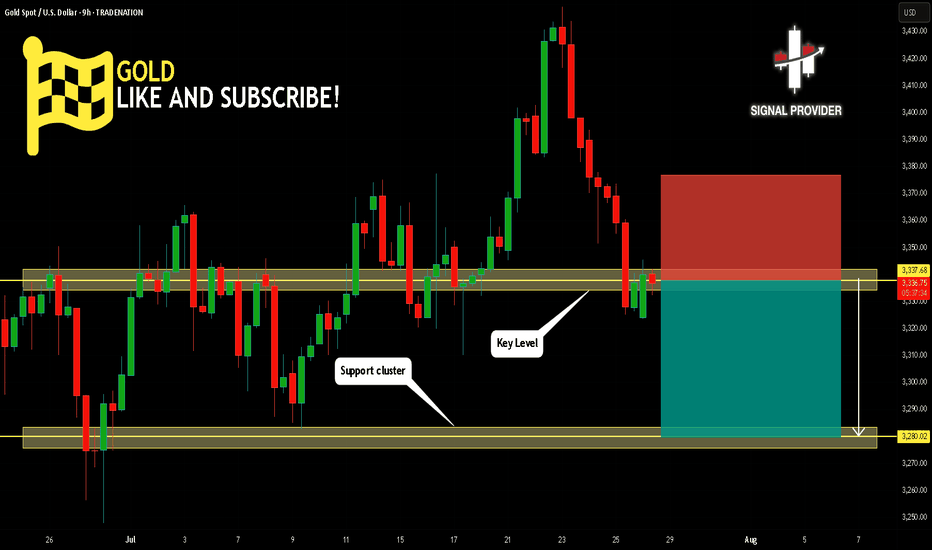

GOLD Will Move Lower! Sell!

Here is our detailed technical review for GOLD.

Time Frame: 9h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is testing a major horizontal structure 3,337.68.

Taking into consideration the structure & trend analysis, I believe that the market will reach 3,280.02 level soon.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Like and subscribe and comment my ideas if you enjoy them!

DeGRAM | GOLD reached the $3300 level📊 Technical Analysis

● XAUUSD remains capped below a broken trendline retest near 3,355, while price forms a lower-high inside a descending channel.

● The repeated rejection of the 3,357.83 resistance level, coupled with failed bullish continuation, points to renewed downside toward 3,300 and 3,262.

💡 Fundamental Analysis

● A rebound in the DXY after strong US consumer sentiment and pending home sales adds pressure to gold, reaffirming real-yield strength.

● Traders are reducing long exposure ahead of upcoming NFP data and Powell’s next statement, shifting bias away from risk hedges.

✨ Summary

Short bias below 3,355. Break under 3,320 eyes 3,300 → 3,262. Key breakdown risk if lower trendline fails.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

USOIL IS GOING BULLISH. FOR HOW LONG?USOIL IS GOING BULLISH. FOR HOW LONG?

Brent has started this week with a strong bullish momentum and holds near 6-week high on supply fears. President Trump announced plans to impose tariffs on Indian exports and penalize its Russian oil imports. In a parallel move, the US introduced its most extensive sanctions on Iran in seven years. The United States has even offered its oil to the world in exchange for Iranian and Russian oil, but there is evidence that the US production capacity is now at historic highs and is unlikely to grow in the near future.

However, technically oil shows us bearish divergence on RSI and bearish wedge here. The price may reverse towards 6,900.00 as a first target. EIA data showed US crude inventories jumped by 7.7 million barrels last week—the largest increase in six months and defying forecasts for a decline. Market participants are waiting for the OPEC+ meeting this week, expecting a significant output hike.

XAU/USD Intraday Plan | Support & Resistance to WatchGold staged a minor recovery overnight after bouncing from the 3,267 Support Zone, and is now trading around 3,305. Price remains below both the 50MA and 200MA, which continue to slope downward—confirming short-term bearish structure.

This current move is still corrective unless bulls manage to reclaim the 3,309–3,334 resistance zone. A clean break and hold above 3,334 would be the first sign of strength, opening up potential retests of 3,348 and 3,362.

Until then, any rallies into the 3,309–3,334 zone should be viewed with caution. If the bounce loses steam, watch for a retest of 3,289 - 3,267. A break below that would expose the 3,241 and 3,208 levels, with the HTF Support Zone (3,241–3,208) acting as a broader downside cushion.

📌 Key Levels to Watch

Resistance:

‣ 3,309

‣ 3,334

‣ 3,348

‣ 3,362

Support:

‣ 3,289

‣ 3,267

‣ 3,241

‣ 3,208

🔍 Fundamental Focus – Thursday, July 31

Big day for data.

🟥 Core PCE, Employment Cost Index, and Unemployment Claims — all critical for Fed outlook and could move gold sharply.

⚠️ Volatility expected around 2:30pm. Stay nimble and manage risk carefully.

XAUUSD Analysis : Channel Break, Demand Zone + SR - Interchange"High-Probability Zone Reaction & SR Flip Confirmation"

Gold (XAUUSD) is currently reacting from a significant support zone after completing a bearish breakout from a well-established ascending channel. The market structure indicates both threat and opportunity depending on how price behaves around key levels ahead.

🔍 Structure Breakdown & Price Behavior:

🔹 1. Rising Channel Violation

Over the past few weeks, price was comfortably moving inside a well-respected ascending channel, making higher highs and higher lows.

Recently, however, price broke below the lower boundary, which is often a bearish signal—indicating a possible trend reversal or a deeper correction phase.

Such breakdowns suggest buyers are losing control, and bearish sentiment is gaining strength.

🔹 2. Supply Zone Reaction & Drop

Before the breakout, we observed a sharp rejection from a high point, triggering a sell-off.

The price completed its move into a previously defined supply zone, resulting in a strong bearish impulsive leg that pushed it outside the channel.

This move shows clear institutional distribution—where large sellers unloaded positions around that zone.

📍 Key Zone Focus:

🟩 Previous Reversal / Demand Zone (Green Box)

Price is now sitting in a historically strong demand zone, which acted as a major reversal point in the past.

This area is marked as the first zone of interest where buyers might step back in to defend.

The green box represents a liquidity pocket where institutions previously accumulated positions—hence it’s a strong bounce candidate.

🟦 SR Interchange Zone (Blue Box)

The next major level above current price is the SR Interchange zone, around 3,320–3,340.

This level was previously broken and now acts as resistance.

It's crucial because it represents the battle zone where the market will decide whether to continue bearish or shift back bullish.

🧠 Market Psychology & Order Flow Insight:

The recent aggressive selling pressure from the highs, followed by a bounce from the demand zone, shows a shift from euphoria to fear.

Sellers are active at supply, while buyers are attempting to defend the previous demand.

The market is currently in decision mode—and the SR flip zone (3,320–3,340) will be the judge.

A break and retest above this level signals strength and potential for a trend resumption.

A failure to reclaim it would confirm bearish dominance and open doors for deeper targets.

🔄 Possible Scenarios Ahead:

📈 Scenario 1 – Bullish Rejection & Breakout:

If buyers successfully hold the 3,280–3,260 demand zone and push price above the SR Interchange zone, we can expect:

📍 Target 1: 3,360 (mid-term resistance)

📍 Target 2: 3,400–3,420 (previous high & upper trendline)

This would confirm a fakeout from the channel and a bullish continuation pattern.

📉 Scenario 2 – Failure at Resistance & Drop Continuation:

If price fails to reclaim the interchange zone, expect a retest of the green demand, followed by a potential drop toward:

📍 3,260 – local support

📍 3,240 – major support (unfilled demand below)

📍 3,220–3,200 – ultimate downside target

This would solidify a bearish market structure, confirming the sellers are in control.

🧭 Key Levels To Watch:

Level Type Price Range Significance

Supply Zone ~3,400–3,420 Major institutional selling area

SR Interchange (Blue) ~3,320–3,340 Critical resistance / flip zone

Current Price ~3,297 Watching reaction for momentum shift

Demand Zone (Green) ~3,280–3,260 Key support / bounce zone

Major Demand Pending ~3,240–3,220 Next support level if drop continues

✅ Conclusion:

Gold is at a critical inflection point.

The recent bearish breakout signals weakness, but the current support zone may provide a short-term bullish setup if buyers defend it effectively. A successful reclaim of the SR flip zone will shift sentiment bullish again. Otherwise, a deeper correction is likely.

This setup is ideal for both swing and intraday traders—look for confirmation signals at the current support and SR zone before executing trades.

Short selling remains the main themeGold hit a low of around 3267 yesterday and fluctuated until closing at 3274. Gold fluctuated upward at the opening today. Currently, gold is fluctuating around yesterday's rebound point of 3305. This is the resistance we need to pay attention to in the short term.

From the 4H analysis, today's short-term resistance is around 3305-3315. If gold wants to rise, it needs to stabilize above 3315. Focus on the 3335 first-line pressure, and rebound to the 3305-3315 resistance area during the day. You can consider shorting and follow the trend to see the decline unchanged, looking towards 3290-3280. Rely on this range to maintain the main tone of high-altitude participation. For the middle position, watch more and do less, be cautious in chasing orders, and wait patiently for key points to enter the market.

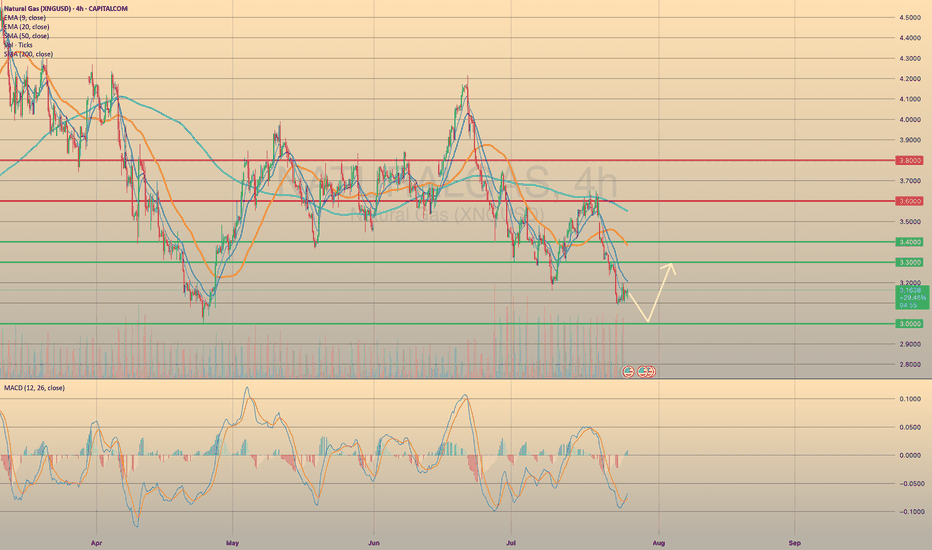

XNGUSD CONTINUES ITS DOWNWARD TREND. FOR HOW LONG?XNGUSD CONTINUES ITS DOWNWARD TREND. FOR HOW LONG?

Recent bearish impulse started at the beginning of this week may come to an end soon. Yesterday the U.S. Natural Gas Storage report came out. Numbers appeared to be lower than expected and lower than previous. (23b vs 28b vs 46b). This is bullish signal for the market participants. Minutes after the report came out, market reacted bullish, however, soon price went sideways.

Right now gas prices continue to decline. Still, the opportunity for short-sellers here is quite limited. Not so far below there is a level of 3.0000, form where I expect the price to rebound, supposedly to a 3.3000.

Gold 30Min Engaged ( Bullish Reversal Entry Detected )Time Frame: 30-Minute Warfare

Entry Protocol: Only after volume-verified breakout

🩸Bullish Reversal - 3318

➗ Hanzo Protocol: Volume-Tiered Entry Authority

➕ Zone Activated: Dynamic market pressure detected.

The level isn’t just price — it’s a memory of where they moved size.

Volume is rising beneath the surface — not noise, but preparation.

🔥 Tactical Note:

We wait for the energy signature — when volume betrays intention.

The trap gets set. The weak follow. We execute.

Crude Oil’s $70 Surge Still Faces 3-Year Channel ResistanceAlthough news points to a crude oil price surge, technical analysis indicates price cap risks remain within the borders of a 3-year descending channel.

Should a clear hold emerge above the $70 barrier, the bullish rebound in price action from the $64.40 zone, in line with the weekly RSI’s rebound off the neutral 50 zone, may extend toward the channel’s upper boundary at $72.40, $74.40, and $77 in more extreme scenarios.

A confirmed hold above the $77–78 zone may shift the primary trend away from bearish dominance and pave the way for longer-term bullish forecasts.

On the downside, if a price drop results in a clean break below the $64 barrier, downside risks may extend toward the mid-zone of the long-standing channel, with potential support levels at $63.20, $61.80, and $59.70, respectively.

Written by Razan Hilal, CMT

XAUUSD H2 | Downside Target 3270Gold (XAUUSD) recently rejected from a key resistance zone around 3300, showing strong bearish momentum on the 2H timeframe.

💡 Setup Idea:

• Price broke support → Retest as new resistance ✅

• Clean imbalance left behind → Fills expected 📉

• Target: 3270 zone (300 pips move) 🎯

• Risk-Reward potential is solid for intraday/swing entries.

Trade Plan:

If price holds below 3300, we expect continuation toward the 3270 zone. This area also aligns with previous structure and liquidity grab.

🕐 Timeframe: 2H

📌 Resistance: 3300

🎯 Target: 3270

📍 RR: 1:2+

#XAUUSD #GoldSetup #PriceAction #SmartMoney #FXTrading #TradingView #ForYou

Hellena | GOLD (4H): LONG to area of 3370 (Wave 2).Colleagues, gold is once again disrupting our plans, and I have to revise the wave marking. It's not easy, but the most important thing is to keep doing it.

Now I'm back to the previous marking — the price is in wave “2” correction.

To complete this wave, the price needs to overcome the level of wave “W” of the middle order 3246.82. Then the correction will be completed and wave “3” will begin an upward movement.

I see the minimum target in the area of the 3370 level.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

NATURAL GAS REACHED THE KEY SUPPORT LEVEL. WHERE TO GO NEXT?NATURAL GAS REACHED THE KEY SUPPORT LEVEL. WHERE TO GO NEXT?

XNGUSD has come to a crucial support level of 3.0000. Although the sentiment here stays as quite bearish (seasonally, August is not the perfect month for natgas buyers), we expect the price to rebound from the level of 3.0000 towards 3.3000 first. Afterwards, the continuation of bearish trend is expected with final target of 2.6000 before cold season beginning.

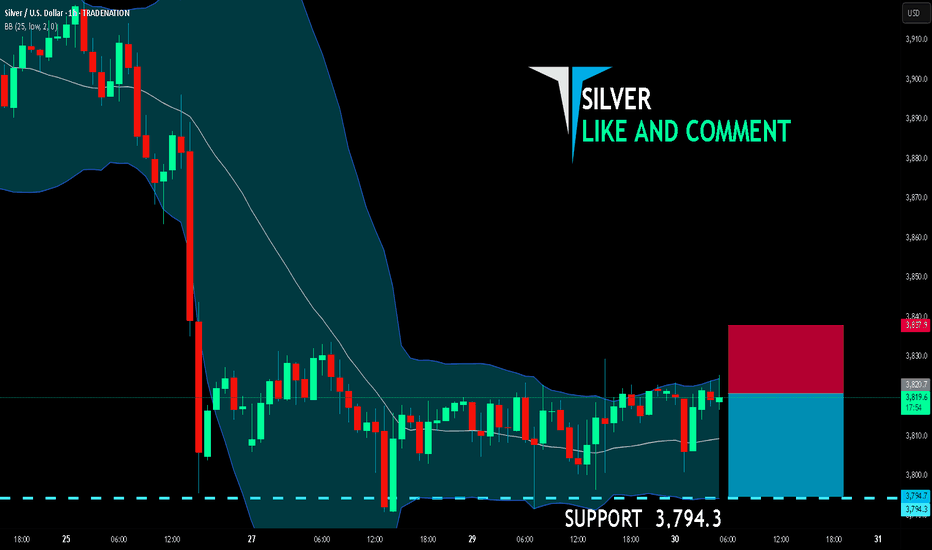

SILVER SENDS CLEAR BEARISH SIGNALS|SHORT

SILVER SIGNAL

Trade Direction: short

Entry Level: 3,820.7

Target Level: 3,794.3

Stop Loss: 3,837.9

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Summary of Today's Trading StrategyPrimary Bias: "Clearly Bearish" (Influenced by last night's Fed news).

Primary Plan: "Sell" on Rally (Sell the Rally)

Concept: Following the strong bearish trend, wait for the price to make a small upward correction to find a favorable entry point for a Short position.

Entry Points:

Entry Point 1 (Fib 0.618 M15 / Minor Resistance): Approximately 3,305 - 3,310 USD.

Condition: Wait for a clear bearish reversal candlestick signal.

Entry Point 2 (Strong Resistance): Approximately 3,325 - 3,330 USD (the previous support that was just broken).

Condition: If the price bounces up to this level and shows a reversal signal, it will be a much more advantageous point for a Short entry.

Take Profit (TP):

TP1 (Recent Low): Approximately 3,280 - 3,290 USD (the "Area of Interest" zone in H4).

TP2: If this zone is broken, there is a chance to move down to 3,260 - 3,270 USD.

Stop Loss (SL):

Above the Short entry point or above the next resistance level by approximately 5-10 USD.

Secondary Plan: "Sell" on Breakdown Continuation

Concept: If the price doesn't bounce to a resistance level and instead continues to break below the previous low.

Entry Points:

Break below approximately 3,280 - 3,290 USD (the recent low / H4 support).

Take Profit (TP):

TP1: Approximately 3,260 USD.

TP2: Approximately 3,250 USD.

Stop Loss (SL):

Above the low that was just broken by a small margin.

Additional Cautions:

Low Volume in the Morning: The market may not move severely until the London Session (in the afternoon).

Avoid Counter-Trend Long Positions: Opening a Long position is very high-risk because the main trend is clearly and strongly bearish.

Risk Management: Determine an appropriate lot size and always set a Stop Loss (SL) for every order.

Good luck with your trading today! 📈📉

GOLD Breakdown Setup | Clean Sell Targets Ahead!XAU/USD (Gold) Analysis – 2H Timeframe

After a clear rejection from higher levels, Gold has pulled back to retest the broken support zone around 3340–3350, which now acts as a resistance.

If the price sustains below this zone, we can expect a smooth move down toward clean liquidity areas below.

This is a textbook bearish continuation setup. 💥

🔻 Trade Idea – Short Setup:

• Sell Below: 3,340

• Target 1: 3,300

• Target 2: 3,280

• Stop Loss: 3,355 (above resistance zone)

🧠 Confluences:

• Bearish market structure

• Support zone retest

• Trend continuation

• High-impact USD news ahead (watch for volatility)

📅 Key Dates: July 30 – Aug 1

⚡ NY session could trigger the move!