XAUUSDXAU/USD represents the exchange rate between one troy ounce of gold (XAU) and the US dollar (USD). It shows how much in US dollars is required to purchase one ounce of gold. This pair is widely traded across forex and commodities markets and is considered a key indicator of global economic stability and investor sentiment.

Historically, gold was pegged to the US dollar under the Bretton Woods Agreement from 1944 to 1971. During this period, one ounce of gold was fixed at $35, and the US government guaranteed the convertibility of dollars into gold. In 1971, President Richard Nixon ended the gold standard, allowing gold to trade freely on global markets. This led to significant volatility in the price of gold, which began to reflect real-time market forces such as supply, demand, inflation, and geopolitical events.

In the decades that followed, gold experienced several major price movements. In 1980, gold surged to around $850 per ounce due to high inflation and geopolitical instability. It then declined and remained relatively low through the 1990s, reaching a low near $270 in 2000. Starting in the mid-2000s, gold began a strong upward trend driven by concerns about inflation, financial crises, and central bank policies, culminating in a peak near $1,920 in 2011 during the Eurozone crisis and Federal Reserve monetary easing.

In 2020, gold hit a new all-time high around $2,070 during the global uncertainty of the COVID-19 pandemic. Since then, it has continued to be influenced by economic data, interest rate decisions, inflation trends, and geopolitical developments. In 2024 and 2025, gold has remained strong, supported by central bank buying and expectations of future rate cuts. As of August 2025, the current price of gold has reached $3,363 per ounce, reflecting heightened demand and ongoing macroeconomic uncertainty.

XAU/USD is influenced by many factors, including the strength of the US dollar, inflation expectations, geopolitical risks, and investor demand for safe haven assets. When the dollar weakens or global uncertainty increases, gold typically gains value. Traders and investors often use gold to hedge against economic instability, inflation, or currency devaluation.

Today, gold remains one of the most important assets in global markets, and XAU/USD continues to be a major pair for both short-term traders and long-term investors.

Futures market

GOLD: NEW WEEK TECHNICAL BIAS (MARKET OPEN)CONTEXT

▪︎ HTFs Bias: Bullish stance remains intact until a valid structural breach occurs.

▪︎ Monthly Context: Despite consistent upper wick rejections, price continues to close above prior monthly opens — suggesting bullish resilience.

▪︎ Weekly View: Current price action reflects a Value Compression Phase (VCP) within the premium zone of the active range, implying potential buildup for a bullish Impulse Drive.

▪︎ Daily Alignment: Daily price behavior mirrors the Weekly context, supporting a continuation thesis.

Preferred Scenario: Leaning towards a Retrace Precision Entry (RPE) before the Ascend Sequence resumes. Watching:

• Point A (shallow pullback) near B/C level, or

• Point B (deep pullback) into the pending Rejection Zone (ARB).

Invalidation Trigger: A structural breach below 3336, backed by bearish momentum and microstructure shift, targets first 3280, then levels below.

Uncertainty Variable: Will price first sweep 3433.2 before retracing? Or will it retrace from market open? This remains unclear and demands a patient, reactive stance.

📌 Disclaimer: This is a strategic directional bias, not financial advice. Execute only with confirmation and proper risk management.

Gold Plan B For 4 Aug onwardsAs you can see that gold is moving good in channel of Bullish so next hurdle can be 3374-3380 and then it can retest the support of Non-Farm 3336-3340 and then continue this channel till further 3452-3458 and then we can expect a big fall in gold and this time support point will be 3290-3300 which will hold gold to go up again.

Gold establishes bullish wave. Wait for recovery point to BUY✏️ OANDA:XAUUSD Nonfarm announcement has shaped a new trend for gold price. completely broke the previous bearish wave structures and formed a new bullish trend with the break of wave 1 peak around 3315. Trading strategy next week only focuses on BUY signals. Maybe this bullish wave can make gold reach the all-time high.

📉 Key Levels

Support 3333-3315

Resistance 3373-3416

BUY zone: 3333 ; 3315 ( Strong support zone)

BUY DCA trigger Break resistance 3373

Target 3416

Leave your comments on the idea. I am happy to read your views.

Gold in the strong bullish momentum.WE will be expecting gold to con tinue its climb as NFP.

A sudden rejection is seen on 1st of Aug a good strong sign of bull coming in.

point is where to trade.

i personally expect for a pullback and point of interest for me for now nearest will be 3345 next 3330 lastly 3310-14.

where can we expect gold to climb up to.

first pitstop will be 3391-3403 and next 3465-87.

all the best traders.

Gold Daily Bias – Bulls Have the Ball, But Watch the TrapGold Daily Chart – August Outlook

Bias is still bullish for August.

Price is holding well above the big 3M FVG ($2,900–$3,100).

Strong bounce from Weekly Low ($3,331) heading toward Weekly High ($3,416).

Above $3,416 we’ve got $3,451 (M-H) and ATH ($3,508) as liquidity targets .

Seasonal tailwinds could help push us higher into Q4.

Blind spots to watch:

Still range-bound between $3,330–$3,450 for months — no clean break yet.

Unfilled FVG near $3,210 could be a draw if we reject from resistance.

August liquidity is thin — spikes can reverse fast.

Triple-top risk if we reject near $3,450 again.

Game plan:

Bullish if we get a daily close above $3,416 (confirmation) and ideally above $3,451 to aim for ATH.

If breakout fails, I’ll target range play back toward $3,290–$3,210.

Bias = bullish, but I’m staying nimble.

Risk Capacity: The Real Reason Traders Blow Accounts | Ep. 4In this pre-recorded video, I unpack one of the most overlooked reasons why traders blow their accounts over and over again, and it’s not about your system, strategy, or signal.

It’s about risk capacity, the internal threshold your nervous system can handle before fear, greed, or shutdown kicks in.

This is part of my ongoing series on YouTube “Rebuilding the Trader Within”, where I reflect on the emotional and psychological dimensions of trading that no indicator can fix.

If you've ever found yourself repeating the same mistakes, feeling stuck at the same equity level, or losing composure in high-stakes trades... this might be the pattern underneath it all.

I'm still learning too, and I’d love to hear your thoughts. Drop a comment — let’s grow together.

#RiskCapacity #TradingPsychology #TraderMindset #RebuildingTheTraderWithin #ForexMentorship #TraderGrowth #InnerWork #ForexPsychology

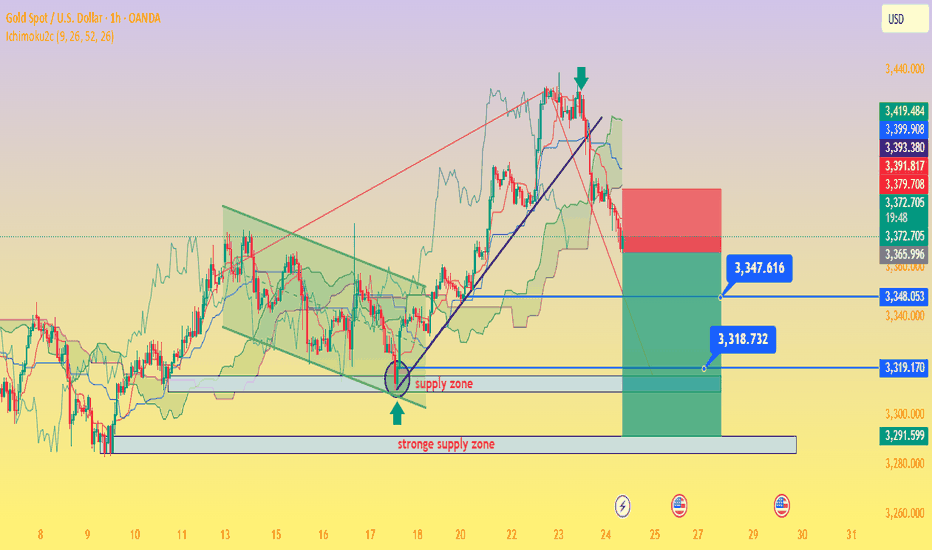

Gold (XAU/USD): Supply Zone Rejection & Bearish Breakdown Chart Breakdown:

Supply zone rejection: Gold revisited the “supply zone” (light green/grey area) and failed to break above — a classic signal of seller dominance.

Uptrend invalidated: A sharp rise (steep black trendline) ended with a peak marked by the green arrow, followed by a decisive breakdown.

Ichimoku Cloud test: Prices slipped through the Ichimoku components, reinforcing the shift to bearish sentiment.

Potential targets: The red/green risk‑reward box highlights a short position, targeting ~3,347 then ~3,318 levels (blue labels) as initial support zones.

Strong supply base: The extensive grey zone below marks a "stronger supply zone" — this could cap any modest bounce and keep the downtrend intact.

🔍 Interpretation:

Bias: Bearish — sellers have taken control after a failed breakout.

Strategy: Short on rallies toward the mid‑green/red box (~3,373–3,380), targeting ~3,347 first and then ~3,319. Watch for support at the strong supply region (~3,292) for potential reversal or consolidation.

Risk management: Keep stop above the red zone—above recent highs (~3,380+) to limit risk.

🚀 In a nutshell: After failing to break supply and losing its short‑term uptrend, gold appears poised for a pullback. The next key levels to watch are ~3,347 and ~3,319—where buyers might step back in, or the downtrend continues toward the deeper supply base.

Gold (XAU/USD) in Symmetrical Triangle – Short‑Term Squeeze,Price Structure & Technical Setup

Gold is consolidating within a symmetrical triangle, showing lower highs and higher lows—a classic precursor to breakout in either direction

Fxglory Ltd

+5

TradingView

+5

Babypips.com

+5

TradingView

+2

Babypips.com

+2

TradingView

+2

.

Trendlines converge tightly around $3,326–$3,334, hinting at imminent directional acceleration

Investopedia

+4

TradingView

+4

TradingView

+4

.

🎯 Key Levels & Targets

Scenario Trigger Confirm Area Targets Stop Loss

Bullish Breakout above $3,344–$3,350 $3,369 → $3,396 → $3,422–$3,550 ~$3,340

Bearish Breakdown below ~$3,326–$3,320 $3,320 → $3,300 → $3,297 → $3,255 ~$3,335–$3,340

A breakout above $3,344–$3,350 validated with volume may drive prices toward $3,400+, with extended targets up to $3,550 or higher in bullish conditions

Traders Union

Time Price Research

.

A drop below $3,326–$3,320 risks further decline, targeting $3,300, $3,297, and eventually $3,255 if breakdown momentum builds .

📉 Market Context & Drivers

U.S. dollar strength, easing safe-haven demand, and optimistic trade sentiment are constraining gold’s upside unless breakout forces emerge .

Key upcoming catalysts: FOMC guidance, U.S. macro data (GDP, inflation), and geopolitical developments—their tone could tip the bias direction .

⚙️ Trade Rules & Risk Management

Wait for a confirmed breakout or breakdown—do not trade mid-range.

Confirm break with at least one close outside the triangle and rising volume .

Position sizing: Risk 1–2% per trade, adjust stop-loss to price structure ($8–$15 depending on volatility).

Take profits in stages: scale out at minor milestones (first targets), trail stop for extended targets.

Avoid chasing price within the middle of the triangle—risk/reward is unfavorable.

🧠 Why This Plan?

Follows textbook symmetrical triangle trading methodology: entry on breakout, stop beyond pattern opposite side, projection based on triangle height .

Aligns with broader outlook: bearish unless convincing upside breakout appears, consistent with analyst consensus hedging current bull exhaustion and wait‑and‑see on policy signals .

✅ Summary

Gold is coiling inside a tight triangle range near $3,326–$3,334, with breakout potential identified to either side:

Bullish breakout over $3,344–$3,350 targets up to $3,550 or beyond.

Bearish breakdown under $3,326–$3,320 risks slide towards $3,300–$3,255.

Wait for confirmation, apply disciplined risk controls, and let volume validate the move.

Gold long: Completion of Cycle degree Wave 4Hello, in this video, I go through Gold Elliott Wave structure on a cycle level (again) before zooming in on the latest 5-waves structure that is Cycle level wave 4. I talk about using existing broken trendlines and how that allows me to determine the strength of a move when there are false breakouts, whether to the upside or the downside.

Lastly, I discuss on how to trade this on the short-term using lower timeframe and price action. Most importantly, where to set the stop and the rationale for it.

Good luck!

Sell NATGAS into OCT/NOVNatalie has fromed a H&S and has broke through all of the supporting EMAs leading to most of the indicators turning bearish.

My approach for the forseeable is seeling bounces until the winter season approaches.

Of course Natalie is extremely susceptible to trend changes due to economical data and has to be monitored closely. Currenlty I'm a bear.

Only selling once it breaks and retests, where I will once again reasses based on economics such as storage, production, imports and demand.

Target around $2.5 where interestingly a gap (red rectangle) sits from Nov - 24.

Elliot Wave (although not a great fan) kind of aligns as well as the 0.786 fib level which began forming at the beginning of 2024.

Storage | Volatility | Price Outlook

U.S. natural gas markets are stabilizing as volatility trends back toward seasonal norms.

📉 Volatility has dropped from 81% in Q4 2024 to 69% in mid-2025

🏪 Storage is currently at 3,075 Bcf,

🔻 4.7% lower YoY

🔺 5.9% higher than the 5-year average

🚢 LNG exports remain strong—up 22% YoY and 74% above the 5-year average

🔌 Domestic demand is seasonally weaker but steady

➡️ Despite being below last year’s levels, storage surplus vs. the 5-year average acts as a soft ceiling on price.

➡️ Historical analogs suggest a fair value range between $2.50–$3.20/MMBtu in the short term.

📊 Current price action around $3.00–$3.40 looks slightly overheated unless a fresh catalyst emerges (heatwave, export spike, etc.).

🧭 Watching for:

Injection trends over the next few weeks

Cooling demand in power sector

Resistance around $3.40

Support near $2.80

Silver The Week AheadKey Support and Resistance Levels

Resistance Level 1: 3756

Resistance Level 2: 3855

Resistance Level 3: 3915

Support Level 1: 3600

Support Level 2: 3544

Support Level 3: 3480

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

XAUUSD Weekly Outlook – August 4–8, 2025New Month. New Week. New Questions.

Will the market reward hesitation — or bold reaction?

Will POTUS pump price with policy noise, or will smart money fade the manipulation?

August is historically a quieter month for hedge funds — but don’t mistake silence for safety. It's also the time when the Fed retreats to Jackson Hole, reflecting and recalibrating. Will September bring another rate cut… or another twist?

Stay sharp. This isn’t a month to sleep on.

"Last week's game plan played out nearly to perfection — well, almost! Let’s dive in and break down where gold could be headed next week."

Gold kicks off August with a strong breakout above $3360, powered by a weakening U.S. dollar, rising global risk appetite, and persistent institutional demand. With Jackson Hole on the horizon and shifting Fed expectations, volatility is set to spike. The big question: will gold extend above premium, or retrace to rebalance?

After the last rejection near 3440, price broke cleanly below its ascending channel. Now, gold appears to be forming a potential lower high around the broken trendline — a rejection here could trigger a drop toward the key $3250 support zone.

🟡 XAUUSD – August Macro Outlook

💰 Price: $3362

📅 Date: August 3, 2025

📈 Bias: Bullish but extended — high in premium

🔸 Monthly Overview

📊 Trend: Bullish continuation (CHoCH April 2023)

🧱 Supply Zone: 3350–3439 → monthly wick trap

⚠️ RSI 80+, price nearing 100% Fib extension

🔮 Breakout above 3439 → 3505 / 3610 next

🔻 Rejection → pullback to 3270 / 3180

🔸 Weekly Outlook

💥 Structure: Strong bullish, EMA stack intact

🟥 Final HTF Supply: 3350–3439 (currently testing)

🟦 Demand Below: 3270 → 3215 → 3070

🎯 Targets if breakout: 3505 → 3560 → 3610

🔸 Daily Structure

⚔️ Now testing: 3355–3375 → last valid supply

🎭 Above that → internal trap at 3398–3412

🧨 Final ceiling at 3430–3439 — breakout or reversal?

🔸 H4 / H1 Key Zones

🟥 Supply: 3360–3375 / 3385–3398 / 3430–3439

🟫 Flip Long Zone: 3322–3310

🟦 Bullish Demand: 3285–3260 → 3222–3205

⚠️ RSI elevated, watch for reaction not breakout

🔹 Execution Plan

✅ Above 3439 → Expansion to 3505 / 3610

🔁 Pullback to 3325 / 3285 → Sniper long zones

🔻 Rejection from 3375 → Short scalp → Target 3320

📌 3439 = Key Monthly Pivot

🟢 Hold above → New expansion wave

🔴 Fail below → Retrace toward value

Extended:

🔸 Scenario 1: Breakout and Expansion

If bulls push through 3375 with conviction and break above 3439, gold enters a fresh leg of macro price discovery. This would activate a clean expansion path toward:

3405 (short-term extension)

3505 → 3560 → 3610 (Fibonacci projections)

3740 (full trend extension if momentum persists)

This scenario requires solid bullish confirmation, especially on H4 or D1 structure. Traders should look for LTF OB re-entries or bullish flags above 3350 to join the trend safely.

🔸 Scenario 2: Rejection and Retrace

If gold rejects from the 3360–3375 zone and fails to hold above it, a controlled retracement is likely. Key downside targets include:

3325 → first flip zone for re-entry

3285 → origin of the latest rally (strong buy zone)

3215–3180 → high-timeframe demand and imbalance fill

Only a breakdown below 3260 would threaten the bullish structure and shift bias toward neutral or bearish.

🔸 Conclusion

Gold is approaching its inflection point. The macro trend is intact, but momentum is stretched, and the market now demands clear validation.

📌 3439 remains the weekly pivot:

Above → Expansion toward 3500+

Below → Retracement to reclaim value

For next week, the most probable path is early consolidation inside 3360–3375, followed by a decisive reaction — either continuation toward 3405+, or a corrective drop toward 3325/3285 to reset structure.

Disclaimer: For educational context only.

#XAUUSD #Gold #SmartMoney #TradingAnalysis #SMC #USD #GoldOutlook

XAUUSD Gold Trading Plan – Monday, 4th August 2025 (M30 TF)Strategy Type: Intraday Trend Trading (Buy-the-Dip)

Timeframe: 30-Minute (M30)

Market Bias: Bullish

Execution Style: Step-Ladder Scaling into Strength

🧠 Market Outlook

Gold remains in a bullish trend structure, supported by geopolitical risk, moderate inflation sentiment, and the weakening US Dollar. While Friday showed signs of short-term exhaustion, price is still forming higher lows on the 30-minute chart, suggesting intraday momentum remains to the upside.

Based on current price action and Fibonacci retracement levels, I expect a healthy pullback early Monday before a push towards new short-term highs. I will be trading in phases — buying on dips and scaling out at each resistance zone.

✅ Phase 1: Buy on Dip at 3352 (Key Support Zone)

Entry Zone: 3352

Reasoning:

3352 lines up with M30 demand zone (previous accumulation area)

61.8% Fibonacci retracement of the last M30 bullish swing

Likely to act as intraday support if price retraces from current levels

Confirmation:

Strong bullish candlestick reversal (e.g. bullish engulfing, hammer, or rejection wick) on M30

Volume uptick or bullish divergence on RSI preferred

Stop Loss:

Just below 3346 (below the last valid swing low to protect the trade)

🎯 Target 1: 3361

Why: This is the first intraday resistance and previous minor high on M30

Action:

Secure partial profits (~50%)

Move SL to breakeven or +5 pips to protect capital

Wait for next retracement

✅ Phase 2: Wait for Pullback After 3361

Retracement Zone: Expected dip to 3356–3358 area (new higher low)

Re-Entry Condition:

Retest of breakout level with strong bullish candle on M30

Maintain bullish market structure

🎯 Target 2: 3370

Why: This is the next resistance zone and price magnet based on Friday's volume profile

Action:

Secure additional 30% profit

Trail SL below structure (~3362)

✅ Phase 3: Wait for Final Dip Before Final Push

Retracement Zone: Around 3364–3366 (support flip area)

Re-Entry Condition:

Rejection of this zone with continuation pattern (bullish flag, ascending triangle)

🎯 Target 3: 3379

Why: 3379 is near the top of current intraday channel and strong resistance on 4H/M30

Action:

Close all remaining positions

Assess for potential breakout above 3380 only if momentum is strong

⚠️ Risk Management Plan

Max Risk: 1.5% account risk split across 3 phases (0.5% per entry)

All SLs defined before entry — no averaging down

Trades invalidated if price breaks and closes below 3346 on M30

🔁 Summary Table

Entry Level Target Action

Buy @ 3352 TP1 = 3361 Secure partial profit, trail SL

Re-buy ~3356–3358 TP2 = 3370 Secure partial profit, trail SL

Re-buy ~3364–3366 TP3 = 3379 Close full position

🧭 Other Key Watch Points

DXY: Watching for rejection below 104.60 – bullish for Gold

News Events: Low-impact day; watch for any unscheduled Fed speakers

RSI + Volume: Using RSI (14) and OBV to confirm entry strength on M30

XAUUSD NEW OUTLOOKAccording to H1 analysis gold market going in buying pressure from last 2 day

now market break the resistance zone and make it RBS (RESISTANCE BECOME SUPPORT) so now market close at support level market will touch the Support zone IF you want to buy gold then you have to best chance to buy from SUPPORT level dont be greedy use money management

TRADE AT YOUR OWN RISK

SILVER My Opinion! SELL!

My dear friends,

Please, find my technical outlook for SILVER below:

The price is coiling around a solid key level - 37.026

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 36.725

Safe Stop Loss - 37.189

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

STRONG BUY | PALLADIUM Strategy: Impulse Correction

Direction: Bullish

Moving Average: Blue above Red

Fib Retracement: 38.2 reached

MACD > 0

Support : Finding additional confluence, as the weekly bounces off a massive support structure

1st Target = 1336

2nd Target = 1419

3rd Target = 1527

Lots: 0.2 (Plan to pyramid into this one)

RISK: Tariff Wars continue to hamper global growth as supply chains feel the brunt of the disruption.

Trade 4/20

Silver against many world M2 supplies.Here we see silver divided by many global m2 supplies...

We can see silver is JUST STARTING ITS MOVE to catch up to gold.

We corrected for the 1.4 quadrillion in M2, and see silver's targets all over $100!

This confirms silver is ready to move again, after gold's run, and perhaps make an explosive move higher!

XAUUSD Live Trade with 11,641 USD ProfitsI managed to ride the momentum last night on XAUUSD and made over 11,641 usd profit on a live trading account. Gold usually create a range. It will create a top and a bottom then it will spend most of its time inside that range. That is pretty much how XAUUSD moves. If you can identify the top and the bottom then you can short it from the top and do a long trade on the bottom. The price will just travel from bottom to top and top to bottom. You can scalp your way to profits on this move if you can time it properly. Once in a while, a break from the top or the bottom happens. This is where you switch from trading the range to trading breakouts.

When you trade breakouts, you must trade it with the knowledge that less than 15 percent of breakouts are successful. Failed breakouts are very common. You need to have some form of stoploss below your breakout levels. You will know that the breakout fails once your stoploss is hit. If the breakout is successful then ride it. Do not put some TP (target price or take profit price) rather just trail your profits. Move your stops a few pips behind the price. Just enough distance to let the price breathe. If the price reverses then it will hit your stops. If the breakout is strong then you will ride it for a while until it reverses.

It will form another top and bottom again and move inside that range. Switch your approach again in trading long trades near the bottom and short trades near the top.

Just remember to always have some stoploss on every trade and never try to predict what the market will do or how the price will move. Let the market do its thing and just react to its movements.

Goodluck on your trades.

xauusdxauusd Focus on red line

From the price level of 3368 and above, gold is expected to pull back at least until the Stochastic on the M30–H1 timeframes reaches oversold levels.

After that, a bullish continuation is likely, pushing the price up to around 3400.

This area will be a critical decision point — determining whether the market will continue its uptrend or reverse into a downtrend.

If the H4 chart prints a reversal candlestick pattern, it would indicate the beginning of a bearish trend, which could potentially lead to a downward movement of up to 20,000 points.

XAU/USD | Next Key Zone: Watch for Rejection at $3334! (READ)By analyzing the gold chart on the 4-hour timeframe, we can see that, just as expected, the price dropped from $3310 to $3288 in the first leg, where it hit a demand zone and bounced up to $3305, delivering a 170-pip rally. The main bearish move from $3333 to $3288 yielded 450 pips, bringing the total return on this analysis to over 620 pips!

In the second phase, gold dropped sharply again to $3268, and once more found demand, currently trading around $3307. If the price holds above $3294, we could expect further upside toward the $3322–$3334 zone. Once gold reaches this area, a strong bearish rejection is likely, with a potential return of 250 to 400 pips.

All key supply and demand levels are marked on the chart — make sure to monitor them closely and study the chart in detail. Hope you’ve made the most of this powerful analysis!

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban