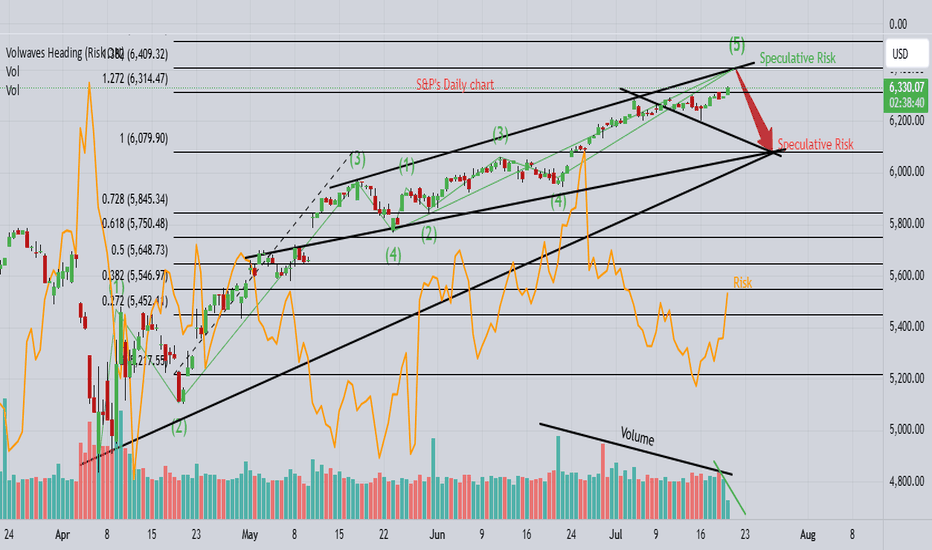

S&P's "hugely overbought" towards 6375!1). Position Volume dropping! 2). Big institutions (Banks & Insurance) have backed off on higher Risk positions! 3). Huge resistance at .728 fib & trend! 4). Trump tariff talk is likely adding to a fall as well! 5). We're looking for a "SELL" trade @ 6375, since buying is too risky at the moment...Good Luck!

Market indices

VIX: From “Calm Tension” to a ReboundWhy does a small uptick matter today… if we’ve already seen 60+ readings four times in the past 17 years?

The first week of August 2025 brought back a familiar market force: volatility.

The VIX, which tracks expected fluctuations in the S&P 500, jumped 21% in just a few days, rising from 17.4 to 20.37, with an intraday high of 21.9 on August 1.

At first glance, the move may seem minor. But it broke through key long-term moving averages (SMA 50 and 200) and exited its recent comfort zone (14–19 pts). That alone is enough to make portfolio managers and traders pay attention again.

🔙 Historical context: when the VIX truly spiked

📅 Date 🔺 VIX intraday 🧨 Trigger

Oct 1, 2008 96.40 Subprime mortgage crisis, Lehman collapse, AIG bailout

Mar 2, 2020 85.47 COVID-19 global spread, border shutdowns

Aug 5, 2024 65.73 Surprise Fed rate hike + overheated jobs data

Apr 7, 2025 60.13 Panic over new U.S. tariffs on global partners

Compared to those moments, today's VIX levels look “mild.” But the technical and macroeconomic signals suggest that volatility may be establishing a new baseline.

1. 📊 Breakdown: First week of August 2025

Weekly increase: from 17.4 → 20.37 (+21%).

Technical breakout: monthly close above both the 50-day and 200-day simple moving averages (SMA 19.25 and 19.45).

MACD on the monthly chart has flipped positive for the first time since March 2023.

Key drivers:

🏛️ The Fed left interest rates unchanged on July 30, but two dissenting votes favored a rate cut.

👷♂️ Softening jobs data: July NFP came in at only +73,000 jobs (vs. +110,000 expected).

🧾 New U.S. tariffs, announced on August 1, reignited inflation concerns.

2. ⚖️ Comparing August 2025 to the August 2024 storm

Factor August 2024 August 2025 (Week 1)

🔺 VIX peak 65.73 21.9

🏛️ Fed stance Surprise 25 bp rate hike Rates unchanged, internal division

👷 Labor market Hot, wage pressures Cooling down

📉 S&P 500 reaction −12% in 3 weeks Approx. −3% decline underway

💧 Market liquidity Very low (pre-market) Normal

Conclusion:

2024 was a systemic shock.

2025 is more of a volatility warning sign—but one that matters for risk management.

3. 📍 Technical signals to monitor

The monthly MACD just turned positive, which historically precedes sustained volatility spikes.

Key short-term range: 18–22 pts. A sustained close above 22 could trigger heavy selling in high-beta stocks.

Options expiration (OPEX, Aug 16) may amplify moves via gamma flows.

4. 🔮 What could move the VIX next?

📅 Date 📌 Event ⚠️ Volatility Risk

Aug 14 Core CPI (July) Reading above 0.3% m/m could reignite hawkish Fed bets

Aug 22–23 Jackson Hole Symposium Powell’s speech could reset the policy outlook

End of Aug Q2 GDP revision Confirm whether slowdown = soft landing or stagflation

📌 Note: The VIX cannot be traded directly. Exposure is typically obtained through futures, options, or ETNs—each with specific risks like contango, low liquidity, and roll decay.

📌 Final thoughts

The VIX doesn’t need to hit 60 to send a message.

The fact that it’s breaking above long-term averages, reacting sharply to macro data, and threatening key levels is enough to suggest that the era of ultra-low volatility may be ending.

History shows us that major VIX spikes come fast and unannounced.

If you remember 2008, 2020, or even April 2025—you know that preparation beats prediction.

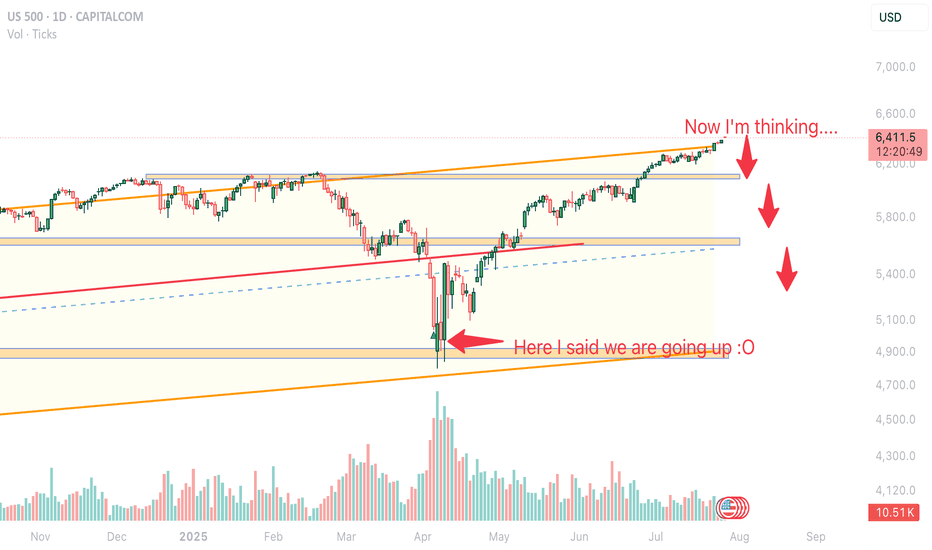

Correction will be to 6050-6190, probably the upper limit Now I notice something very important and things and the analyses of many actually coincide. Monthly support from the accumulated volume lies between 6050 and 6170. 4h indicators show a clear reversal. Separately, at these levels are the previous ATH. In my opinion, it is possible to stop even at 6180-6190. We will probably start with a gap on Monday. Now here comes the moment and over the weekend what will take place as conversations and statements in the media, but it is very likely that the minimum could happen as early as Monday night (USA time) or by Tuesday. I agree that this correction was necessary and should have happened as soon as possible because things became difficult even for bulls like me.

Dow Jones Wave Analysis – 1 August 2025

- Dow Jones broke the support zone

- Likely to fall to support level 43000.00

The Dow Jones index broke the support zone between the support level 44000.00 and the 38.2% Fibonacci correction of the upward impulse from June.

The breakout of this support zone accelerated the active short-term correction iv.

Dow Jones index can be expected to fall to the next support level at 43000.00 (target for the completion of the active correction iv and the former resistance from May and June).

OEX /SPX Bullish wave 5 pattern crossroads The chart posted is the sp 100 I am posting it as we are now at the crossroad for bull or bear count .We have rallied to .786 as I will show and have a wave a x 1.27 = c at the .786 High But if we break above 5922 in the Cash SP 500 There is NOTHING to stop it from reaching a target of 3005 in the OEX where wave A up or wave 1 x 1.618 = wave C Top or wave 3 in the SP 500 WAVE A or WAVE 1 up 5481 - 4835 = 646 x 1.618 =1045 plus wave B low or wave 2 5102low= 5102plus 1045 =6147.22 The exact high . This is the reason I took the loss and moved LONG .Best of trades WAVETIMER

S&P 500 Obeying Elliott Wave TheoryThis is an update of a previous publication. A Flat occurred for Wave 2(Green) and if Wave 3 is over, we can expect a Zigzag for Wave 4. Zigzags have 3 waves. A confirmation at its current location will trigger a sell for Wave 4(Green).

For more information on the same, go to:

US100The US100 (Nasdaq 100) has shown a dramatic shift in trend, forming what appears to be a large-scale bearish harmonic pattern or potential M-top structure. After reaching its peak in mid-2025, the index has entered a sharp downward trajectory, shedding significant value in a short span.

This chart raises a critical question for long-term investors and traders:

Are we witnessing the early phase of a prolonged bear market that could stretch into 2026 and beyond?

🔻 Key Observations:

Bearish structure developing with aggressive selling pressure.

Potential breakdown from long-term support trendlines.

Momentum suggests institutional risk-off behavior.

Stay alert for macroeconomic cues, interest rate policy, and earnings season signals. A break below 13,000 could confirm a deeper bear cycle

The Low Is In: Why the S&P 500 Just Confirmed a Bullish Reversal🔥 The Low Is In: Why the S&P 500 Just Confirmed a Major Bullish Reversal 🔥

The market just gave us a gift.

After weeks of drifting lower and sentiment turning cautious, the S&P 500 has touched — and bounced — off a critical rising trendline for the third time since May 2025. That third touch isn't just a technical coincidence… it's often the launchpad for a new impulsive leg higher.

📈 The Power of the 3rd Touch: Trendline Validation Complete

Look at the chart. This isn’t guesswork. Since May, the S&P 500 has been respecting a well-defined ascending trendline, one that connects multiple higher lows during this bull run.

The first touch was the May liftoff after the April consolidation.

The second came in June — a clean retest and bounce.

Now, as of early August, the third touch has held once again, exactly where the bulls needed it most.

This isn’t a random line on a chart. This is institutional flow stepping in to defend structure.

And when a rising trendline holds for a third time after a strong uptrend? That’s a classic continuation signal.

📉 RSI Washout + Structural Support = Perfect Storm for a Bottom

The RSI printed a dramatic dip to ~32, a level that screams “oversold” on the 4-hour timeframe. But notice the context — it happened right at structural support.

This is not weakness. This is accumulation.

Big players shake out weak hands on low timeframes… right before they send it.

🧠 Sentiment Is Offside… Again

Let’s not forget: this retrace came after a huge run-up since March. People expected a deeper correction. Bears started getting loud again.

That’s how bull markets trap you — by convincing you it’s over right before the next leg higher.

And with macro tailwinds (liquidity expansion, fiscal spend, tariff rollbacks), earnings season beats, and global capital rotation into U.S. equities, this setup is ripe for a violent upside squeeze.

🚀 8,700 in Sight: My End-of-Year Price Target Is Very Much in Play

Today’s close around 6,220 means the S&P 500 would need to rally ~40% to hit my target of 8,700 by year-end.

Sounds crazy? Not if you’ve seen what happens during parabolic melt-ups.

This isn’t just hope:

📊 Strong breadth under the surface

🏛️ Dovish policy pivot now expected in Q4

💸 Retail and institutional capital both re-engaging

📉 Bond yields are starting to roll over, supporting equity valuations

When bull markets enter their euphoria phase, they don’t stop at “reasonable” targets. They blast through them.

💡 The Setup Is Textbook — Now It’s About Execution

✅ Trendline defended

✅ RSI reset

✅ Sentiment shaken out

✅ Structure intact

The technicals just aligned with the macro. The low is in — and the runway to 8,700 is wide open.

Strap in. Q4 could be one for the history books.

US500 SP500 Sell the news- ShortHello fellow traders, what do you think? Am I predicting FUTURE? This is my early entry, cautious, but holding steady, checking from time to time but general rule- what went up will eventually fall. The price is just a Wave of coincidance and events, trade carefully! Protect capital! don't copy my idea it's an idea NOT A TRADING ADVISE

Dow Jones Triple Top & Critical Trendline Break - Buy The Dip?Potential Tripple Top formation spotted on the Dow. This would represent a full fibonacci retracement, which leads me to believe a 38.2 retest is likely. If this 23.6 level can hold support and price does not close below the fib band (orange channel), then the bullish continuation to new all time highs can still happen in Q3/Q4 of this year. The clear trendline break dating back to April is very concerning (white line), leading me to believe more downside in the coming weeks.

Let me know what you think in the comments!

Thanks

The worst drops often come later!Don’t be fooled by the first crash… The worst drops often come later in a bear market.

Let’s break down the brutal truth about the 2008 GFC and what it teaches us today. 🧵

1.

In the 2007–2009 bear market, the S&P 500 had 7 failed rallies before finally bottoming.

Every bounce looked like the bottom — and every one was a trap.

👇

2.

The early drops were steep:

🔻 Down 11%

🔻 Down 17%

But the most violent crashes came after those…

Near the END — not the beginning — of the bear market.

3.

Later stage declines:

❌ Down 28%

❌ Down 36%

❌ Down 29%

That’s when capitulation kicked in.

Investors gave up. Fear took over.

4.

Capitulation volume isn’t a guaranteed bottom.

It feels like it’s over.

But if fundamentals haven’t turned and the trend isn’t broken, the bear can still bite — hard.

5.

Final crashes are like cliffs:

Markets are exhausted.

Hope is crushed.

And that’s finally when the real bottom shows up.

6.

The lesson?

Bear markets are full of traps.

Relief rallies can fool even seasoned pros.

Stay patient. Wait for trend confirmation. Don’t chase fake bottoms.

7.

📉 The biggest crashes usually happen at the end of the bear market.

That’s the final flush — and it sets the stage for true opportunity.

Learn from the past. Don’t get trapped. Stay sharp.

Nifty Analysis EOD – August 2, 2025 – Friday🟢 Nifty Analysis EOD – August 2, 2025 – Friday 🔴

Trapped at the Top, Slammed at the Close – Bulls Burnt Out!

🗓️ Nifty Summary

With the continuation of yesterday's hidden weakness, today's session gave early hope but ended with a bearish surprise. Nifty opened near the key support zone of 24,735 ~ 24,725, hovered indecisively, then suddenly rallied to 24,780, trapping bulls just under resistance.

But the trap was set.

A sharp reversal followed as Nifty broke not just the day’s low, but also the previous day’s support zone of 24,660 ~ 24,675, pulling the index lower into the 24,565.35 close — the second lowest close since May 12.

A fierce 2–3 hour tug-of-war between bulls and bears took place in a tight 40–50 point range until 2:50 PM, when bulls gave up—leading to a 100+ point fall in the last half-hour. shocked many traders, especially those fatigued from the earlier choppy action.

Much like yesterday, both sides of the trade were available today.

Did you catch them?

Zoom Out View :

Today’s close is just 23 points above the June 3 close, wiping out nearly 59 sessions (81 days) of gain.

Will the zone of 24460 ~ 24542 provide support again, or are we headed for a retest of the 24000 ~ 23800 and 23200 ~ 22800 (Pattern Target and Virgin) range?

Yes, you read correctly 23200 ~ 22800…!

Not so soon…but eventually…!

wish you tell me crazy and hope I am wrong…!

📈 5 Min Time Frame Chart with Intraday Levels

📉 Daily Time Frame Chart with Intraday Levels

🕯️ Daily Candle Breakdown

Open: 24,734.90

High: 24,784.15

Low: 24,535.05

Close: 24,565.35

Change: −203.00 (−0.82%)

Candle Structure

🔴 Large bearish body (169.55 pts)

☁️ Moderate upper wick (49.25 pts)

⬇️ Short lower wick (30.30 pts)

Interpretation

Opened lower, climbed early but failed at 24,780+.

Selling dominated the rest of the session, closing near lows.

Moderate upper wick shows early bullish attempt was rejected.

Candle Type

Bearish Marubozu-like – clear seller dominance.

Key Insight

Sellers defended 24,780–24,800 zone.

Closing near 24,560 keeps the short-term bias bearish.

Next support: 24,500, 24,470 ~ 24460

⚠️ Bulls must reclaim 24,735+ on closing basis to neutralize sentiment.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 212.37

IB Range: 87.55 → Medium

Market Structure: Balanced

Trades Triggered

🕙 10:05 AM – Long Entry → 🎯 Target Hit (R:R – 1:1)

🕚 11:09 AM – Short Entry → 🎯 Target Hit (R:R – 1:2)

🔍 Trade Summary

Both sides were offered—clean hit on long and solid breakdown on short. A Gladiator’s delight.

📊 Support & Resistance Levels

🔼 Resistance Zones

24620

24660 ~ 24675

24725 ~ 24735

24780 ~ 24795

24860 ~ 24880

🔽 Support Zones

24,542 ~ 24,535

24,500

24,470 ~ 24,460

24,380

💬 Final Thoughts

"Traps are laid where confidence is highest. Stay alert, stay flexible."

A textbook day where patience paid off — those who didn’t force trades were rewarded with clean moves in both directions.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

NAS100 – Sharp Breakdown After Tariffs & Jobs Data MissAfter a macro-driven selloff, NAS100 broke decisively below 23,025.0, taking out prior structure and confirming bearish pressure. The drop followed two key catalysts:

📉 Jobs Report Miss: Only 73K jobs added in July vs 200K+ expected — signals a slowing economy.

📛 Tariff Shock: President Trump imposed new tariffs on 90+ countries, up to 41%, rattling global sentiment.

Support at: 22,870.0 🔽 & 22,640.0

Resistance at: 23,025.0 🔼 & 23,200.0

🔎 Bias:

🔼 Bullish: Sustained strength above 22,870 with momentum could aim for 23,025 retest.

🔽 Bearish: Rejection below 23,025 or break under 22,870 opens space to 22,640 and possibly 22,518.

🎯 Let the dust settle – market could still be digesting the shock.

📛 Disclaimer: Not financial advice. Trade responsibly.

Nasdaq US100 Wave 3 Expansion Toward 31,606 in PlayNasdaq US100 has completed a significant wave cycle with a confirmed wave 1 in the broader Elliott Wave structure. Following this, price underwent a corrective wave 2 that extended from the $22,237 supply zone down to $16,334, marking the conclusion of the previous cycle’s correction. This structure now signals the initiation of a fresh upward impulse, setting the stage for a powerful wave 3 advance.

The emergence of wave 3 will gain full confirmation once price successfully breaks above the external supply zone, reclaiming $22,237. If this breakout occurs with sustained momentum, the wave 3 projection targets an expansion toward $31,606, which aligns with the 161.8% Fibonacci extension from the prior cycle. This forthcoming rally is anticipated to unfold in a five-subwave format, indicative of a high-momentum bullish leg.

As long as price action remains above the key support at $16,334, the bullish cycle remains valid. All eyes should now be on the breakout structure and volume profile around $22,237, as it represents the gateway to a much broader impulsive move.

KSE 100 Technical Analysis | 01 AUGUST 2025 (corrected)KSE 100 Technical Analysis | 01 AUGUST 2025

The KSE 100 index is moving in a textbook bullish pattern, having recently completed a trading range marked by a horizontal channel in light blue. This pattern has provided a strong base for the index's renewed uptrend. We expect the index to be more stable and stronger than in recent days.

Key Levels

- *Immediate Support*: 140300

- *New Immediate Target*: 142840

Current Trend

- The index is highly bullish and always in an uptrend, with multiple strong supports in place.

Expectation

- The index is expected to continue its upward movement, driven by its strong bullish pattern and support levels.

KSE 100 Technical Analysis 01-08-2025KSE 100 Technical Analysis | 01-08-2025

The KSE 100 index has formed a trading range between 136000 and 140200. After breaching the previous resistance at 13900, the index retested this level in the final hour of trading. We expect the index to rise from this level, cross the upper limit of the trading range, and move towards a new target.

Key Levels

- *Support*: 136000

- *Resistance*: 140200 (upper limit of the trading range)

- *Recent Breakout Level*: 139000 (successfully breached and retested)

Expected Movement

- Rise from current levels

- Breakout above 140200

- Target: 142775 (applicable after successful breakout)

Current Trend

- The index is still in a bullish trend, with potential for further upside.