NAS100 - Update Dear Friends in Trading,

How I see it,

I will be waiting for a clear and decisive break below the PIVOT.

Keynote:

I am not trading NASDAQ at all...just monitoring patiently!!

I will keep you in the loop as the stock market progress...

I sincerely hope my point of view offers a valued insight

Thank you for taking the time study my analysis.

Market indices

DowJones breakout retest supported at 44390Key Support and Resistance Levels

Resistance Level 1: 45197

Resistance Level 2: 45500

Resistance Level 3: 46000

Support Level 1: 44390

Support Level 2: 43900

Support Level 3: 43590

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

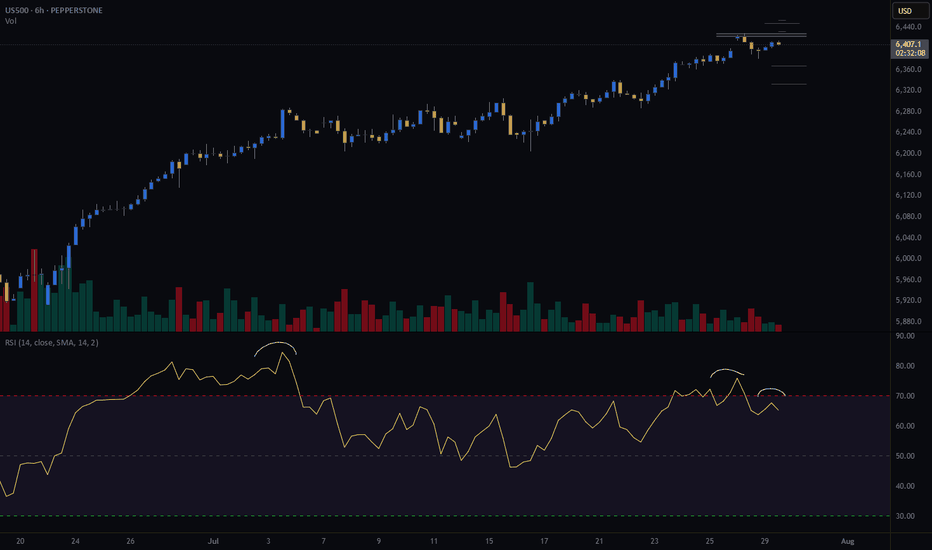

S&P500 uptrend pause supported at 6355The S&P 500 slipped -0.12% after initially rising +0.3%, as Fed Chair Powell’s cautious “wait-and-see” stance on rate cuts dampened sentiment. The metals and mining sector dragged the index lower, falling nearly -4% after the U.S. announced surprise copper tariff details—excluding refined metal until 2027—leading to a sharp -20% drop in COMEX copper futures.

However, market sentiment rebounded overnight, driven by strong tech earnings. Meta surged +11.5% post-market on upbeat Q3 guidance and rising AI-driven ad revenues, while Microsoft rose over +8% thanks to better-than-expected Azure cloud growth and a $30 billion AI infrastructure investment.

Conclusion:

Despite short-term pressure from the Fed’s tone and commodity weakness, strong AI-driven earnings from major tech firms are likely to support a positive bias for the S&P 500 in the near term, especially in the tech-heavy growth segments. Broader gains may depend on upcoming inflation data and Fed clarity.

Key Support and Resistance Levels

Resistance Level 1: 6470

Resistance Level 2: 6500

Resistance Level 3: 6545

Support Level 1: 6355

Support Level 2: 6315

Support Level 3: 6282

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

DXY Top-Down Analysis: Market Structure & Directional Bias This video demonstrates a top-down analysis of DXY. I'll show you how to identify market structure, value areas, directional bias, and key support and resistance levels. You'll learn to analyze the market from weekly to hourly timeframes using Heikin-Ashi candles and the 200 EMA.

USNAS100 New ATH, looks a Correction...Wall Street Indices Hit Record Highs as AI Momentum Builds

Indices tied to the S&P 500 and Nasdaq reached fresh all-time highs on Thursday, driven by strong earnings reports from Meta and Microsoft. The results reinforced investor optimism that AI investments are delivering tangible returns and fueling future growth.

Meanwhile, Fed Chair Jerome Powell noted it's still too early to predict a rate cut in September, emphasizing that current monetary policy is not constraining economic activity. His comments followed a stronger-than-expected Q2 GDP reading, further supporting the Fed’s cautious stance.

Technical Outlook – USNAS100

After reaching recent highs, the index appears to be entering a corrective phase. A pullback toward 23470 is likely, with bullish momentum expected to resume if the price stabilizes above 23440. A sustained move above that level would target a new ATH near 23870.

However, a break below 23440 could trigger a deeper correction toward 23295.

Support: 23540 • 23440 • 23295

Resistance: 23870 • 24040

the retail trader outlookWe see that the wedge pattern has been completed and the bullish market is strong as the candles a huge, this is a high risk low reward trade as it clear and obvious to the vest public that the markets wants to rally. the role of the dollar price plays a vital role in this not happening as we see that the dollar has formed the yearly low as is starting to move up in an increasingly high speed suggesting that Gold is more likely to be affected by the sudden Rally in the dollar currency and the opposite is true given a drop in dollar.

Nifty Analysis EOD – August 1, 2025 – Thursday🟢 Nifty Analysis EOD – August 1, 2025 – Thursday 🔴

🎢 Illusion Rally: What You See, Isn’t What It Was!

🧾 Nifty Summary

As we all expected, a negative gap-down opening occurred due to external news. Nifty opened 183 points lower, tested the 24,660–24,675 support zone, then rebounded sharply after a symmetrical triangle + VWAP breakout. The rally pierced through all key levels like a hot knife through butter, topping at 24,950, only to reverse with equal intensity. Closed at 24,765.

📌 Despite the technical structure, today’s move had no clear technical reasoning — more likely triggered by a mix of tariff news, confidence in Modi, weekly + monthly expiry, and manipulation.

📌 in spite of a bullish candle, strong upper rejection from 24,950 hints weakness. Candle appears bullish on colour, but bears dominated intraday close — forming a bearish Moboroshi Candle (illusion of strength).

📌 Bearish Moboroshi Candle Structure : close > open and close < Previous Close

🔍 Intraday Walk

📉 Gap down of 183 pts

🟢 Support held at 24,660–24,675

🔺 Symmetrical triangle + VWAP breakout

🚀 Sharp upmove to 24,950 zone

🔁 Reversal with same intensity

📉 Closed at 24,765 — below prior close

🖼 5 Min Time Frame Chart with Intraday Levels

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 24,642.25

High: 24,956.50

Low: 24,635.00

Close: 24,768.35

Change: −86.70 (−0.35%)

Candle Structure:

✅ Green Candle (Close > Open) → +126.10 pts real body

⬆️ Upper Wick → 188.15 pts (Very Long)

⬇️ Lower Wick → 7.25 pts (Tiny)

Interpretation:

Opened near yesterday's low

Intraday sharp rally towards 24,950+

Faced strong selling at highs

Closed above open, but way below high — signals clear rejection

Candle Type:

📌 Bearish Moboroshi Candle — Appears bullish but hides weakness

🧠 Buyers strong initially, but sellers took control at the top

Key Insight:

Bulls need decisive close above 24,880–24,910

Else, expect drift back toward 24,660–24,675

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 208.29

IB Range: 93.95 → Medium

Market Structure: Unbalanced

Trades Triggered:

✅ 10:40 AM – Long Entry → Trailing Target Hit (R:R – 1:6.25)

📌 Trade Summary: Big R:R win today on breakout with trailing logic execution!

🧱 Support & Resistance Levels

🔺 Resistance Zones:

24,820 ~ 24,830

24,850

24,880 ~ 24,890

24,910

🔻 Support Zones:

24,780

24,725 ~ 24,715

24,660 ~ 24,650

24,620 ~ 24,600

💭 Final Thoughts

"When the move can’t be explained, the best position is caution."

Today's market behavior reinforces the idea that not all moves are technical. Keep your tools sharp, but don’t ignore contextual chaos.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nasdaq Index Analysis (US100 / NASDAQ):The Nasdaq index rose following yesterday’s Fed decision and is currently trading near 23,700 USD.

1️⃣ The most likely scenario is a pullback to retest the 23,570 USD zone, or even 23,500 USD, before resuming its upward movement toward a new high.

2️⃣ However, if the price breaks below 23,500 USD and holds, it could trigger a decline toward 23,350 USD, followed by 23,200 USD.

⚠️ Disclaimer:

This analysis is not financial advice. It is recommended to monitor the markets and carefully analyze the data before making any investment decisions.

SPX500 Hits New Highs but Fed Caution Limits MomentumSPX500 Overview

Market Context:

The Fed's reluctance to commit to a rate cut in the upcoming September meeting has forced markets to reassess their outlook. This hesitation pushed Treasury yields and the US dollar higher in late trading, weighing on equities.

As it stands, the probability of a rate cut appears to be pushed further out on the timeline, introducing short-term headwinds for risk assets.

Technical Outlook:

SPX500 printed a new all-time high and maintains bullish momentum after stabilizing above the previous ATH at 6427. As long as the price holds above this level, the bullish continuation toward 6454 remains likely, with a further extension to 6480 possible.

A bearish correction would only be confirmed by a break below 6415.

Resistance Levels: 6454, 6480

Support Levels: 6415, 6389

Nifty levels - Aug 01, 2025Nifty support and resistance levels are valuable tools for making informed trading decisions, specifically when combined with the analysis of 5-minute timeframe candlesticks and VWAP. By closely monitoring these levels and observing the price movements within this timeframe, traders can enhance the accuracy of their entry and exit points. It is important to bear in mind that support and resistance levels are not fixed, and they can change over time as market conditions evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance to consider. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We hope you find this information beneficial in your trading endeavors.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you success in your trading activities!

BankNifty levels - Aug 01, 2025Utilizing the support and resistance levels of BankNifty, along with the 5-minute timeframe candlesticks and VWAP, can enhance the precision of trade entries and exits on or near these levels. It is crucial to recognize that these levels are not static, and they undergo alterations as market dynamics evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We trust that this information proves valuable to you.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you successful trading endeavors!

FOMC rate decision 30-07-2025FOMC announced no change to interest rate, but the new tariffs is the major player for the upcoming quarter, we shall see its effect on the economy and corporates earnings soon, then the fed can make better judgment whether to lower interest rate or not.

Disclaimer: This content is NOT a financial advise, it is for educational purpose only.

US 10Y yield: Triangular Consolidation, next 6-7%I’ve spotted a well-known triangular pattern forming on the US 10-year Treasury yield.

This appears to be the development of a large Wave 4.

Wave E of Wave 4 may still be unfolding.

Watch to see if it holds above the Wave C low at 3.9%.

A breakout above resistance near 4.7% would confirm the pattern.

The target zone is set between the 38.2% and 61.8% retracement levels of Waves 1 to 3,

highlighted with a blue box between 6% and 7%.

Could tariffs cause a major spike in yields—or will something else trigger it?

Share your thoughts in the comments below.

S&P Market Update – Signs of a Short-Term Correction?Although the S&P remains in an uptrend, recent price action suggests that momentum may be fading.

📉 Key Observations:

A Key Day Reversal occurred at 6409 – a potential warning signal.

We're seeing RSI divergence: price made a new high, but RSI didn’t follow suit.

The market is grinding higher, but without conviction.

📊 What to Watch:

The 15-day EMA, currently at 6317, is acting as near-term support. A close below this level could trigger a short-term correction.

Initial downside targets: 6147–6100, the previous highs from late 2024 and early 2025.

✅ To negate this bearish bias, the market would need to break above 6409 and continue higher with stronger momentum.

Stay alert — the technicals are flashing red flags. Always manage risk accordingly.

Disclaimer:

The information posted on Trading View is for informative purposes and is not intended to constitute advice in any form, including but not limited to investment, accounting, tax, legal or regulatory advice. The information therefore has no regard to the specific investment objectives, financial situation or particular needs of any specific recipient. Opinions expressed are our current opinions as of the date appearing on Trading View only. All illustrations, forecasts or hypothetical data are for illustrative purposes only. The Society of Technical Analysts Ltd does not make representation that the information provided is appropriate for use in all jurisdictions or by all Investors or other potential Investors. Parties are therefore responsible for compliance with applicable local laws and regulations. The Society of Technical Analysts will not be held liable for any loss or damage resulting directly or indirectly from the use of any information on this site.

Nifty again back towards the upper rangeNifty’s recent rise can be attributed to short covering ahead of the monthly expiry, which often results in a surge as traders close their short positions.

Currently, the index faces a strong resistance zone around 25,000–25,100. A clear move above this range could indicate a trend change or a shift towards a more bullish outlook. If Nifty does not decisively cross this resistance, the market is expected to remain neutral to sideways, meaning price action could stay range-bound without a clear direction.

Additionally, 24,600 will act as a strong support level. As long as Nifty stays above 24,600, market sentiment should remain stable, supporting a constructive stance. A break below this level could signal increased caution.

Summary:

Rise driven by short covering ahead of expiry.

Strong resistance at 25,000–25,100.

24,600 will act as strong support.

Above 25,100: Trend change or bullish breakout likely.

Below 25,100: Market remains neutral/sideways.

Above 24,600: Sentiment stays steady; below may warrant caution.

Unless Nifty crosses above the resistance zone or drops below strong support, the outlook remains stable and sideways.

Nifty 24780 Pullback possible on next 1-2 days On 31 July, if someone watch closely price action he could capture Today up move coz Nifty gave almost same price action as 13 June let's try to find what is the Same thing: -

(A)31 July 2025: gap down is (-70%)

volume around 97 million

Bounce Back after gap down around +1%

(B) 13 June: gap down was (-80%)

Volume around 93 million

Bounce back after gap down around +1

On 13 June Nifty faced resistance of 24980 level then retraced. Due to such similarities, we can conclude that it could be pullback around 24780 level although I don't say market will behave same as before, I know every second of market is very dynamic and different from past days, but technical analysis always based on historical data. so, this is just assumption. take the trade on your own analysis & research.

DAX sideways consolidation support at 24070The DAX remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 24070 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 24070 would confirm ongoing upside momentum, with potential targets at:

24605 – initial resistance

24740 – psychological and structural level

24910 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 24070 would weaken the bullish outlook and suggest deeper downside risk toward:

23935 – minor support

23820 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the DAX holds above 23925. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Has Geopolitics Clouded Brazil's Market Horizon?The Bovespa Index, Brazil's benchmark stock market index, faces significant headwinds from an unexpected source: escalating geopolitical tensions with the United States. Recent decisions by the US administration to impose a steep 50% tariff on most Brazilian imports, citing the ongoing prosecution of former President Jair Bolsonaro, have introduced considerable uncertainty. This move, framed by the US as a response to perceived "human rights abuses" and an undermining of the rule of law in Brazil's judiciary, marks a departure from conventional trade disputes, intertwining economic policy with internal political affairs. Brazilian President Luiz Inácio Lula da Silva has firmly rejected this interference, asserting Brazil's sovereignty and its willingness to negotiate trade, but not judicial independence.

The economic repercussions of these tariffs are multifaceted. While key sectors like civil aircraft, energy, orange juice, and refined copper have secured exemptions, critical exports such as beef and coffee face the full 50% duty. Brazilian meatpackers anticipate losses exceeding $1 billion, and coffee exporters foresee significant impacts. Goldman Sachs estimates an effective tariff rate of around 30.8% on total Brazilian shipments to the US. Beyond direct trade, the dispute dampens investor confidence, particularly given the US's existing trade surplus with Brazil. The threat of Brazilian retaliation looms, potentially exacerbating economic instability and further impacting the Bovespa.

The dispute extends into the technological and high-tech realms, adding another layer of complexity. US sanctions against Brazilian Supreme Court Justice Alexandre de Moraes, who oversees Bolsonaro's trial, directly link to his judicial orders against social media companies like X and Rumble for alleged disinformation. This raises concerns about digital policy and free speech, with some analysts arguing that regulating major US tech companies constitutes a trade issue given their economic significance. Furthermore, while the aerospace industry (Embraer) received an exemption, the broader impact on high-tech sectors and intellectual property concerns, previously highlighted by the USTR regarding Brazilian patent protection, contribute to a cautious investment environment. These intertwined geopolitical, economic, and technological factors collectively contribute to a volatile outlook for the Bovespa Index.