Russell2000 sideways consolidation supported at 2232Key Support and Resistance Levels

Resistance Level 1: 2278

Resistance Level 2: 2300

Resistance Level 3: 2318

Support Level 1: 2232

Support Level 2: 2213

Support Level 3: 2193

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Market indices

NSDQ100 important support at 23188US equities pulled back, breaking a six-day winning streak for the S&P 500 (-0.30%) as sentiment cooled ahead of key earnings and the Federal Reserve’s rate decision. The Nasdaq 100 (NDX) was weighed down by weakness in megacap tech stocks—the Mag-7 fell -0.68%, with Meta declining -2.46% and Microsoft earnings due after the close.

Post-earnings disappointments also pressured tech-related sentiment. PayPal slumped -8.66% on soft volume growth, despite unveiling a new crypto merchant feature, and UnitedHealth fell -7.46% on weaker sales. These sharp declines indicate heightened sensitivity to earnings misses in a market priced for perfection.

Meanwhile, market volatility could rise amid geopolitical jitters. A massive magnitude-8.8 earthquake in Russia’s Far East triggered tsunami alerts across the Pacific, briefly affecting Hawaii, California, and Shanghai. While many warnings were later downgraded, the event injected caution into markets.

On the macro front, investors are bracing for the Fed’s rate decision later today. The central bank is expected to hold rates steady, but traders are watching closely for guidance on future cuts—particularly in light of Trump’s renewed pressure for easing and ongoing global trade uncertainty, including tariff threats toward India.

Conclusion for Nasdaq 100 Trading:

With sentiment fragile and earnings risk front and center, traders in the Nasdaq 100 should expect near-term volatility, especially around Microsoft and Meta's earnings reports. The tech sector's leadership is under pressure, and any disappointing results could drag the index lower. Watch the Fed’s tone closely—a neutral or hawkish stance could further weigh on rate-sensitive tech. Cautious positioning or selective hedging may be warranted, particularly as geopolitical risks and trade policy uncertainty resurface.

Key Support and Resistance Levels

Resistance Level 1: 23568

Resistance Level 2: 23687

Resistance Level 3: 23812

Support Level 1: 23188

Support Level 2: 23047

Support Level 3: 22965

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

Good turnaround by market as expected from the channel bottom.We had given a message that the market was nearing the bottom and there can be a turnaround sooner than later and market turned around today. This bounce can be currently seen as a technical bounce but it can become a full fledged fightback by bulls if it crosses key resistance levels of Mother line, Father line and Mid-channel resistance. These are the 3 key resistances in front of us currently. All eyes on the important trade deal announcements and with US and China which are on going any news on that from can disrupt the market proceedings in either way. Support and resistance levels for Nifty are as under:

Key Nifty Resistances: 24849 (Trend line resistance), 24922 (Motherline Resistance of hourly chart), 25028, 25070 (Father line resistance), 25189 (Mid-channel resistance), 25243 (Very important resistance for Bulls to conquer). Above 25243 Bulls can gain control of Nifty.

Key Support levels: 25741, 25627 (Channel bottom Support), 24519.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

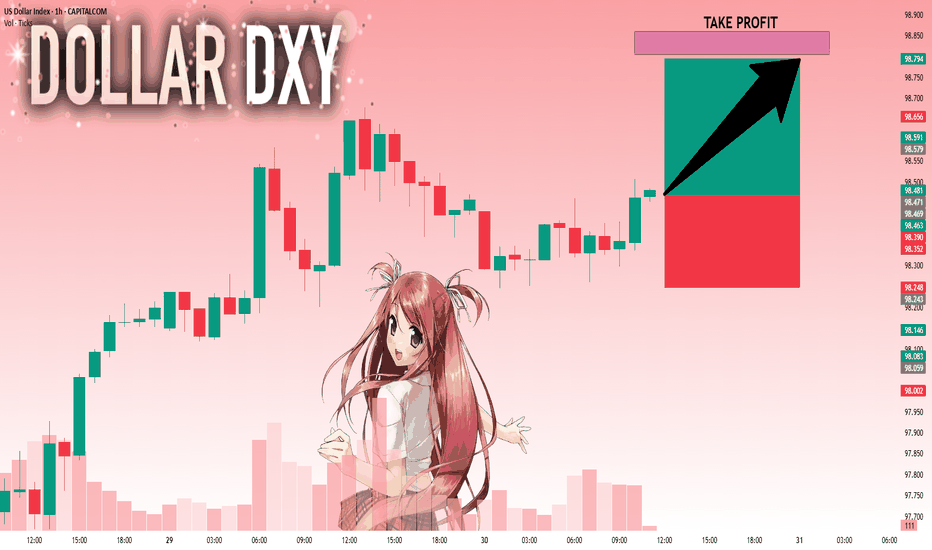

DXY: Bulls Are Winning! Long!

My dear friends,

Today we will analyse DXY together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding above a key level of 98.471 So a bullish continuation seems plausible, targeting the next high. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️

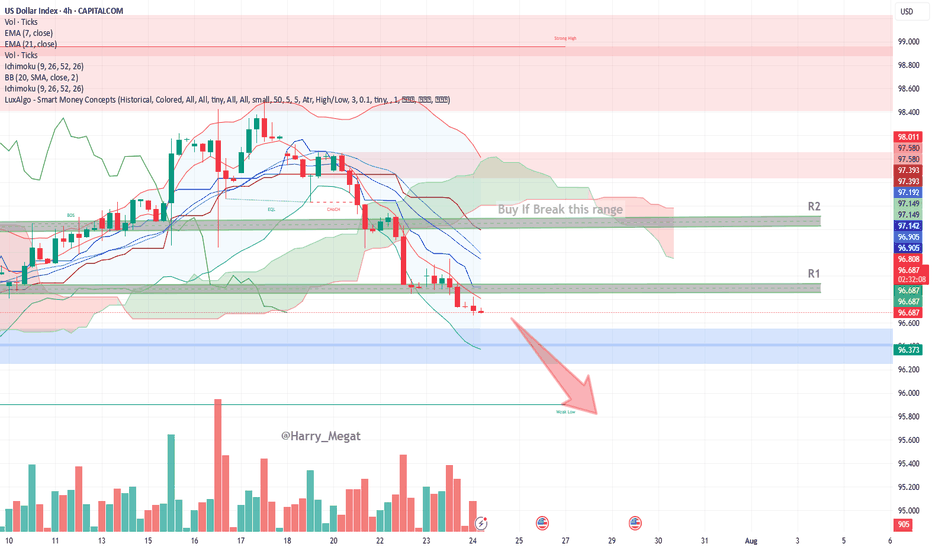

US Dollar Index (DXY) – 4H Chart AnalysisUS Dollar Index (DXY) – 4H Chart Analysis

**Current Trend:** Bearish

Price trades below EMAs, Ichimoku Cloud, and within a bearish channel.

#**Bearish Scenario (Favorable)**

* **Conditions:**

* Price remains below EMA 7 & 21

* Stays under Ichimoku Cloud and 96.812 resistance (R1)

* Lower lows forming, bearish momentum increasing

* **Confirmation:**

Break below **96.37 (blue zone)**

* **Target:**

* TP1: 96.00

* TP2: 95.60 (next weak support)

**Bullish Scenario (Reversal)**

* **Conditions:**

* Price must break above **96.81 (EMA 7 + resistance)**

* Break above **R1 → 96.90**, and then above **R2 → 97.14–97.19**

* Bullish candles close above the Ichimoku cloud

* **Confirmation:**

Break and retest of **97.20**

* **Target:**

* TP1: 97.39

* TP2: 97.58 (key structure)

* TP3: 98.00 (major resistance)

**Bias:** Bearish unless DXY breaks above **97.20** with strong volume and bullish structure.

Dow Jones Futures Edge Up Ahead of Fed, GDP & Tech EarningsDow Jones Futures Edge Up Ahead of Fed, GDP & Tech Earnings – Bearish Bias Below 44,770

Dow Jones futures rose slightly overnight as investors brace for a packed session. Key events include the release of Q2 GDP data before the market opens, the Federal Reserve’s policy decision in the afternoon, and earnings reports from major tech firms later in the day.

Yesterday, the Dow Jones managed to break below the ascending channel, which technically indicates a new bearish signal for today.

The price stabilizing below 44,770, along with an attempt to break the support line at 44,610, suggests a potential downward move.

Initially today, before the opening of the New York session, the price may attempt to rise toward 44,770 as a retest. However, we anticipate a decline afterward, aiming to break and pass the support level at 44,610, and then extend the drop toward 44,360.

The bullish scenario becomes valid only if the price stabilizes above 44,770. If it can trade above this level for a longer duration, it may rise further toward 44,910.

Key Levels

• Support: 44,610 - 44,360.

• Resistance: 44,770 - 44,910 - 45,100.

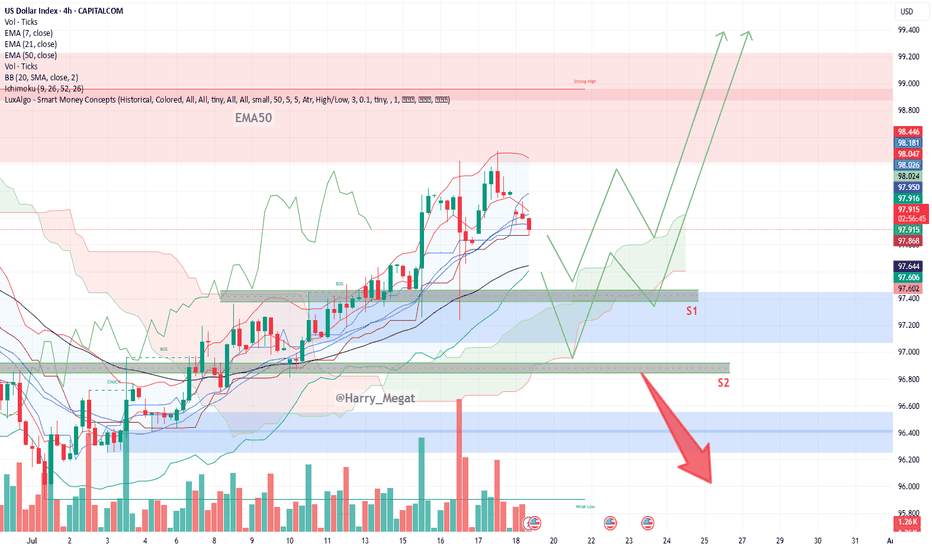

DXY Chart Outlook: Trend, Support, and Price Objectives**DXY Chart Outlook: Trend, Support, and Price Objectives (Reworded Analysis)**

**Trend Overview**

* The DXY chart reflects a **clear upward trajectory**, characterized by a sequence of **ascending highs and higher lows** — a classic sign of bullish momentum.

* Currently, the price is **retracing toward the 50-day EMA**, which appears to be holding as **dynamic support**.

* Two important **horizontal support zones** are marked:

* **Support 1 (S1):** \~97.400 (aligned with EMA-50)

* **Support 2 (S2):** \~96.800 (a deeper correction level)

**Projected Price Zones**

* **Near-Term Objective:** **98.800 to 99.000**

* A rebound from the EMA or S1 could send price higher toward this zone, continuing the current bullish structure.

* **Mid-Term Target:** **99.200 to 99.400**

* If the price successfully clears the 99.000 resistance, further bullish continuation could aim for this intermediate target range.

* **Extended Target:** **100.000+**

* A sustained breakout beyond 99.400 could open the path toward **psychological resistance at 100.000**, possibly higher on strong momentum.

**Support Zones to Watch**

* **S1 (97.400):** This level coincides with the 50-day EMA and represents a **first line of defense**.

* **S2 (96.800):** Should the price fall below S1, this secondary level could provide **stronger support** and potential bounce opportunity.

**Risk Management**

* Consider placing a **protective stop** just below S2 — around **96.500** — to safeguard against a potential trend reversal or deeper correction.

**Summary**

* The DXY remains **technically bullish**, with potential upside targets at **98.800**, **99.400**, and eventually **100.000+**.

* Traders can monitor **S1 and S2** for potential entries or trend confirmation.

* A **breakdown below 96.500** would invalidate the bullish setup and warrant caution.

SPX500 Awaits Fed – Key Support at 6388 in FocusSPX500 Awaits Fed Decision – Breakdown Below 6365 Could Deepen Correction

Following the registration of a new all-time high at the beginning of the week, the price has started to decline. Also, investors await the Federal Reserve's policy statement later today for guidance on the future path of monetary policy.

The price is currently positioned below the 6388 level, which is a key zone in conjunction with the support line at 6365. This area signals the potential for a new downward correction if the price stabilizes below 6365.

A sustained move below 6365, confirmed by a 1H or 4H candle close, would open the door to a sharper decline toward 6341, followed by 6319, both considered critical support zones.

As for the bullish scenario: if the price finds support and manages to rebound today, the first step toward recovery would be a breakout above 6388, which may lead to a climb toward 6415. Breaking above 6415 would pave the way to retest the resistance zone at 6427, with the potential to reach a new all-time high at 6454.

Key Levels

• Support: 6365 - 6341 - 6319.

• Resistance: 6388 - 6415 - 6427.

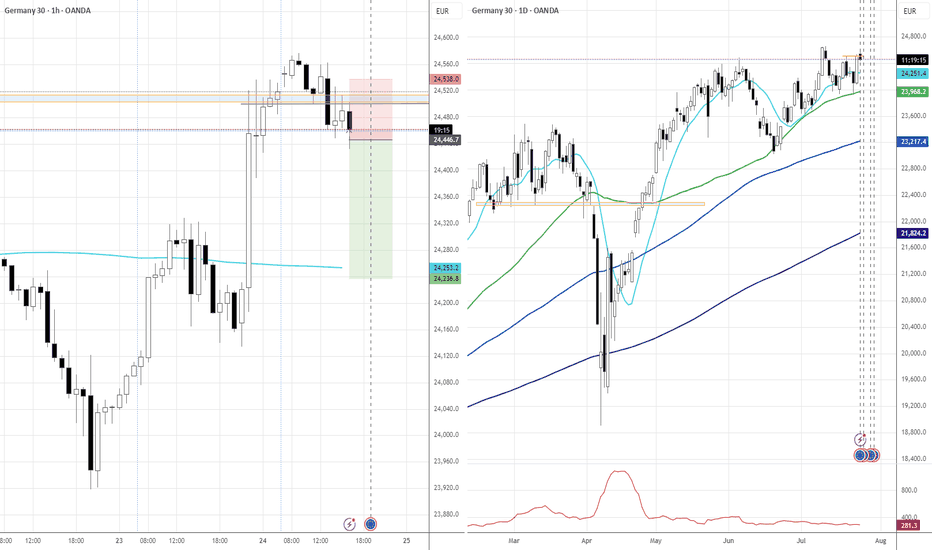

CAC40 Bullish breakout retestThe CAC 40 index continues to display a bullish bias, underpinned by a well-established rising trend. Recent intraday price action indicates a breakout from consolidation, suggesting renewed upward momentum.

Key Technical Levels:

Support:

7770 – This level marks the prior consolidation zone and now serves as critical support.

7740 – Secondary support, guarding against deeper downside.

7700 – Key psychological and technical level; a breach would suggest trend weakness.

Resistance:

7940 – Immediate upside target from the breakout pattern.

7970 – Minor resistance within an extended bullish leg.

8000 – Major psychological resistance and potential profit-taking zone.

Trading Scenarios:

Bullish Scenario:

A corrective pullback toward the 7770 level, followed by a bullish reversal, would confirm support and potentially set the stage for an advance toward 7940, with scope to extend to 7970 and 8000 in the medium term.

Bearish Scenario:

A daily close below 7770 would invalidate the bullish breakout and suggest a short-term trend reversal. This would open the door to a retracement toward 7740, with extended downside risk to 7700.

Conclusion:

The CAC 40 remains technically bullish as long as price holds above the 7770 support level. Traders should watch for confirmation of support on pullbacks to position for a continuation higher. A decisive break below 7770, however, would shift sentiment to neutral-to-bearish, triggering a deeper correction.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

BankNfity levels - Jul 31, 2025Utilizing the support and resistance levels of BankNifty, along with the 5-minute timeframe candlesticks and VWAP, can enhance the precision of trade entries and exits on or near these levels. It is crucial to recognize that these levels are not static, and they undergo alterations as market dynamics evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We trust that this information proves valuable to you.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you successful trading endeavors!

Nifty levels - Jul 31, 2025Nifty support and resistance levels are valuable tools for making informed trading decisions, specifically when combined with the analysis of 5-minute timeframe candlesticks and VWAP. By closely monitoring these levels and observing the price movements within this timeframe, traders can enhance the accuracy of their entry and exit points. It is important to bear in mind that support and resistance levels are not fixed, and they can change over time as market conditions evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance to consider. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We hope you find this information beneficial in your trading endeavors.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you success in your trading activities!

Nasdaq Finds Support at $23,305.0FenzoFx—Nasdaq dipped yesterday and formed a bearish FVG. However, the selling pressure eased as soon as the price tested the ascending trendline.

The last day's low at $23,305.0 is the immediate support. That said, a close above the immediate resistance at $23,375.0 can trigger the uptrend, targeting the highs at $23,535.0.

NAS100 MAY FORM THE BEARISH HEAD AND SHOULDERS.NAS100 MAY FORM THE BEARISH HEAD AND SHOULDERS.

NAS100 has been trading sideways since the beginning of the week, forming local highs with lows staying at same price for the most part. The price seem to form the Head and Shoulders reversal pattern

What is a Head and Shoulders?

A Head and Shoulders pattern is a reversal chart pattern signaling a potential trend change. It consists of three peaks: two lower "shoulders" and a higher "head" in the middle, connected by a "neckline" (support level). A bullish (inverse) Head and Shoulders forms at a downtrend's end, signaling an uptrend; a bearish Head and Shoulders forms at an uptrend's end, signaling a downtrend.

Currently the SMA50 is pushing on NAS100 from above, while SMA200 is supporting the price. In case the SMA200 on 30-m minutes timeframe gets broken, we may see the decline towards 23,200.00 support level.

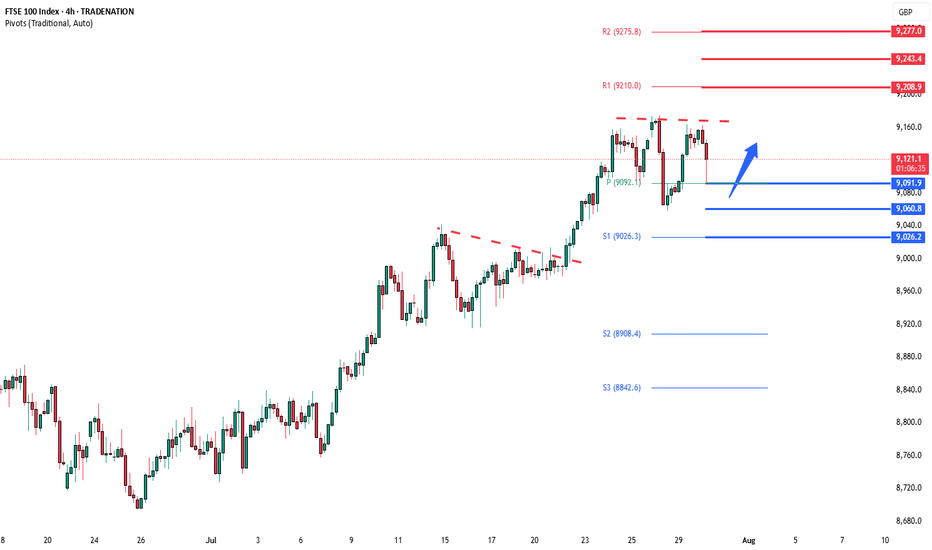

FTSE oversold bounce supported at 9092The FTSE remains in a bullish trend, with recent price action showing signs of a corrective pullback within the broader uptrend.

Support Zone: 9092 – a key level from previous consolidation. Price is currently testing or approaching this level.

A bullish rebound from 9092 would confirm ongoing upside momentum, with potential targets at:

9210 – initial resistance

9243 – psychological and structural level

9276 – extended resistance on the longer-term chart

Bearish Scenario:

A confirmed break and daily close below 9092 would weaken the bullish outlook and suggest deeper downside risk toward:

9062 – minor support

9026 – stronger support and potential demand zone

Outlook:

Bullish bias remains intact while the FTSE holds above 9092. A sustained break below this level could shift momentum to the downside in the short term.

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

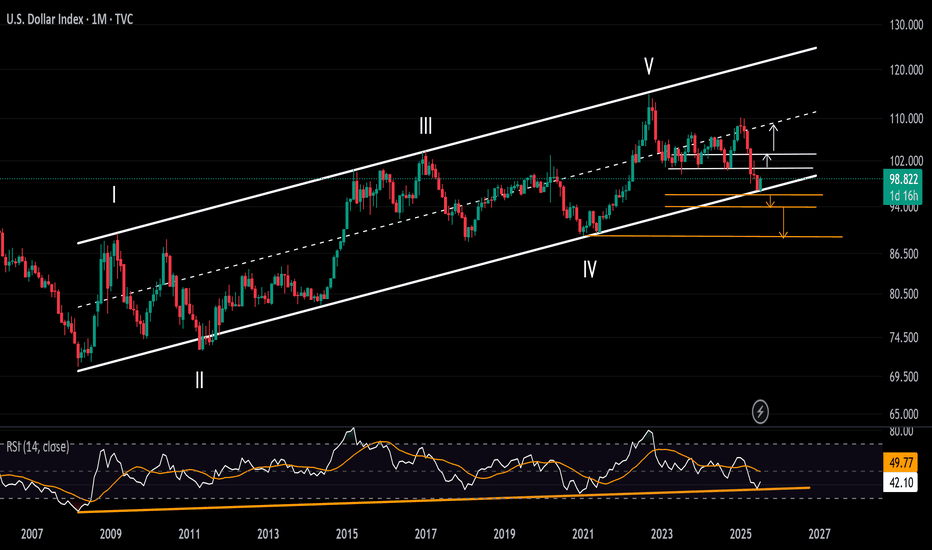

DXY | Timeframe: 1MWith the breakout of the downtrend line drawn since 1985 and its breach in late 2014, the DXY index officially entered a relatively stable upward trend and is currently oscillating within a parallel channel. Although, on the monthly timeframe, it has recently touched the lower boundary of the channel, we can expect at least a rise toward the channel’s midline. However, if the lower support of the channel is broken, a static support around the approximate rate of 88 can be considered a notable support level. Should this support also fail, the long-term downtrend dating back to 1985 would be regarded as the most important support for the DXY index. Meanwhile, moving averages such as the MA50, MA100, and other longer-period moving averages serve as dynamic supports along the way.

It is also worth mentioning that currently reaching the 120 level is considered an ideal target for the DXY index, and ultimately, it is by breaking this resistance zone that the index can reach its “Utopia”.

---------

I will try to continuously update this analysis of the TOTAL symbol according to market changes and developments. Also, I welcome reading your critiques and comments, so don’t forget to leave a comment!

DOLLAR INDEX The federal funds rate is the interest rate at which U.S. banks and credit unions lend their excess reserve balances to other banks overnight, usually on an uncollateralized basis. This rate is set as a target range by the Federal Open Market Committee (FOMC), which is the policymaking arm of the Federal Reserve. The current target range as of July 2025 is approximately 4.25% to 4.5%.

The federal funds rate is a key benchmark that influences broader interest rates across the economy, including loans, credit cards, and mortgages. When the Fed changes this rate, it indirectly affects borrowing costs for consumers and businesses. For example, increasing the rate makes borrowing more expensive and tends to slow down economic activity to control inflation, while lowering the rate stimulates growth by making credit cheaper.

The Fed adjusts this rate based on economic conditions aiming to maintain stable prices and maximum employment. It is a vital tool of U.S. monetary policy, impacting economic growth, inflation, and financial markets.

In summary:

It is the overnight lending rate between banks for reserve balances.

It is set as a target range by the Federal Reserve's FOMC.

It influences many other interest rates in the economy.

Current range (July 2025) is about 4.25% to 4.5%.

1. ADP Non-Farm Employment Change (Forecast: +82K, Previous: -33K)

Above Forecast:

If ADP employment is much stronger than expected, the Fed would see this as a sign of ongoing labor market resilience. Robust job growth would support consumer spending, potentially keep wage pressures elevated, and could make the Fed less likely to ease policy soon. This reinforces the case for holding rates steady or staying data-dependent on further cuts.

Below Forecast or Negative:

If ADP jobs gain falls short or is negative again, the Fed may interpret it as a weakening labor market, raising recession risk and reducing inflationary wage pressures. This outcome could increase the chances of a future rate cut or prompt a more dovish tone, provided it aligns with other softening indicators.

2. Advance GDP q/q (Forecast: +2.4%, Previous: -0.5%)

Above Forecast:

A GDP print above 2.4% signals surprisingly strong economic growth and likely sustains the Fed’s view that the U.S. economy is avoiding recession. The Fed may delay rate cuts or take a more cautious approach, as stronger growth can support higher inflation or at least reduce the urgency for support.

Below Forecast or Negative:

Weak GDP—especially if close to zero or negative—would signal that the economy remains at risk of stagnation or recession. The Fed may then pivot to a more dovish stance, become more willing to cut rates, or accelerate discussions on easing to avoid a downturn.

3. Advance GDP Price Index q/q (Forecast: 2.3%, Previous: 3.8%)

Above Forecast:

A significantly higher-than-expected GDP Price Index (an inflation measure) points to persistent or resurgent inflationary pressures in the economy. The Fed might see this as a reason to delay cuts or maintain restrictive rates for longer.

Below Forecast:

If the Price Index prints well below 2.3%, it suggests that inflation is cooling faster than anticipated. This outcome could allow the Fed to move toward easing policy if other conditions warrant, as price stability is more clearly in hand.

Bottom Line Table: Data Surprises and Likely Fed Reaction

Data Surprise Fed Outlook/Action

All above forecast Hawkish bias, rate cuts delayed or on hold

All below forecast Dovish bias, higher chances of rate cut

Mixed Data-dependent, further confirmation needed

Summary:

The Fed’s interpretation hinges on how these figures compare to forecasts and to each other. Stronger growth, jobs, and inflation = less rush to cut; weaker numbers = lower rates sooner. If growth or jobs are especially weak or inflation falls sharply, expect more dovish Fed commentary and a greater likelihood of future easing. Conversely, if the data all surprise to the upside, hawkish (rate-hold) messaging is likely to persist.

The U.S. Dollar Index (DXY) is a financial benchmark that measures the value of the United States dollar relative to a basket of six major foreign currencies. It provides a weighted average reflecting the dollar's strength or weakness against these currencies. The DXY is widely used by traders, investors, and economists to gauge the overall performance and health of the U.S. dollar on the global stage.

Key Features of the DXY:

Currencies included and their weights:

Euro (EUR) – 57.6%

Japanese Yen (JPY) – 13.6%

British Pound (GBP) – 11.9%

Canadian Dollar (CAD) – 9.1%

Swedish Krona (SEK) – 4.2%

Swiss Franc (CHF) – 3.6%

It was established in 1973 after the collapse of the Bretton Woods system to serve as a dynamic measure of the dollar's value.

The index reflects changes in the exchange rates of theses versus the U.S. dollar, with a higher DXY indicating a stronger dollar.

The DXY influences global trade dynamics, commodity prices (like oil and gold)

HSI dipping, traders are flipping,stay Zen - Index is yoga-ing!Hello everyone!

Today HK50 PEPPERSTONE:HK50 D open at 25350, Hi:25446 Lo:25164

IMO: Deep retracement is happening with profit taking from futures expiring tomorrow for traders & waiting for catalysts for talks next week.

For 4H - Index moving closer to Gravity Trend Line - look out for entry for swing (using shorter tf to entry).

At point of writing ✍️: the HK50 $PEPPERSTONE uptrend mode is on track and now in the retracing mode.

currently on D Chart -

🗝️ Resistance Level : 25300

Support Level : 24950

Support level 24558 (MA30)

🗝️ Strong Support Level : 24048 (Gravity Trend Line)

1H Chart HK50 $PEPPERSTONE

If today not able to close 25304 (25335 HSI), it's likely a deep retracement.

Shor term pullback -for swing trade and for mid-longer term it's still on bull track. Most likely people profit taking before the HSI futures expires tomorrow.

Macro view - Index continue to be Bullish. Well, markets cooled a bit waiting for details from the ongoing US-China trade talks early August'25.

Higher Hi🚩point marked in Chart HK50 $PEPPERSTONE

21May2025 -23909

11June2025 -24430

25June2025 -24531

16Jul2025 - 24842

18Jul2025 - 25052

24Jul2025 - 25729

?? ??2025 - 26163 Revised Target

The HSI Index HSI:HSI

At point of writing ✍️ Index is being sucked towards to D GravityLine - 24085; it fall below the sideway box.

If it doesn't close above the key support level this week, the deep retracement is happening.

🧨🧨🧨Pay attention and cautious.

🗝️ Next Resistance Level : 25350

🗝️ Next Support Level : 24900-25200

🗝️ Strong Support Level : 24300-24750

Let's follow your own zentradingstrategy , continue to trade; Observe your emotions as you would the clouds—passing, shifting, never you.— Mindfulness helps you respond, not react, in volatile markets and moments.

Be ease at trading!

** Please Boost 🚀, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea!

Share your trading journey here to encourage the community and friends who pursing the same journey.

DXY Surge Pressures Currency Market in Volatile Market WeekThe US Dollar Index (DXY) has held its rebound off historical support zones on both the price chart and the RSI indicator throughout July. The monthly RSI is bouncing off a support line extending between the troughs of 2008 and 2020. Meanwhile, price action is rebounding from a support trendline that connects the lows of 2008, 2014, and 2021, within the 96–94 zone.

Bearish Scenario: A solid close below this support zone may confirm a long-term bearish signal, potentially pushing the index toward the 94 and 90 levels.

Bullish Scenario: A confident move above 100 and 103 could signal a reversal in the currency market, potentially leading the DXY back toward the mid-range of the long-standing channel between 105 and 107, originating from the 2008 lows.

Written by Razan Hilal, CMT

Dow Jones Index (DJI) – July 30, 2025 | 30-Min Chart Analysis

1. Current Market Structure

DJI is consolidating just below the intraday resistance at 44,777. Price is attempting to recover after a sharp drop from the 45,154 high.

2. Supply Zone Rejection

Price faced strong rejection near 45,154 and again at 44,968 — confirming this area as an active seller zone.

3. Support Zone Defense

Buyers stepped in at 44,587 and 44,403, creating a short-term demand base. These levels have provided stability for now.

4. Trend Outlook

The lower high formation and recent sharp sell-off hint at bearish pressure. Price is currently in a retracement — unless 44,968 breaks cleanly, sellers remain in control.

5. Key Levels to Watch

Resistance 44,777 → 44,968 → 45,154

Support 44,587 → 44,403 → 44,239

🔁 Bias: Short-term bearish unless price breaks above 44,968 and holds.

U.S. Dollar Index (DXY) – July 30, 2025 | 15-Min Chart1. **Range-Bound Structure**

DXY is consolidating between 98.588 support and 99.134 resistance. The 98.68–98.74 zone has acted as demand, but repeated retests show weakening buyer interest.

2. **Failed Breakouts**

Multiple rejections at 99.134 indicate it's a trap zone where sellers absorb buy-side pressure.

3. **Bearish Momentum Signs**

Lower highs and wicks into resistance with weak closes suggest distribution. Momentum likely shows bearish divergence.

4. **Critical Levels**

* **Support:** 98.588 — a break below this opens downside potential.

* **Resistance:** 99.134 — bulls need a strong breakout above this for continuation to 99.41+.

Summary:

Sellers dominate below 99.134. If 98.588 breaks, expect bearish continuation. Only a confirmed breakout above 99.134 shifts bias bullish.