KSE100 Technical Analysis 29-07-2025KSE100 Technical Analysis (1H Time Frame) 29-07-2025

The index displayed heavy selling pressure in the last two hours, with big bearish candles. However, it touched a bullish measuring gap at 137600 and showed a small sign of upward reversal.

Key Observations

- Expected reversal from the current level of 137600 or further down to the secondary support at 137100 (50% Fibonacci retracement level).

- Potential upward reversal may face resistance at 138630 (bottom of the bearish IFDZ).

- Possible pullback to 138150 before resuming the upward journey.

Outlook

We remain bullish on the index, considering today's downward movement as a potential spring for renewed upward momentum. The revised immediate target price is 140590.

Market indices

Tuesday 29 July: Forex Market thoughts The EUR has begun the week under pressure following the US / EUR trade deal.

EUR weakness could be out down to what they call 'sell the fact', meaning buy last week's deal rumours / sell (take profit) on the announcement. Or, more likely, it could be because it appears the US has the better side of the deal. Either way, all of lat week's EUR positivity has dissipated.

I didn't get involved in a EUR short trade yesterday, but there is a case to say it was viable.

The USD and JPY begin the week on the front foot. Possibly benefitting from 'EUR liquidity', or possibly due to 'positioning' ahead of this week's FOMC and BOJ meetings.

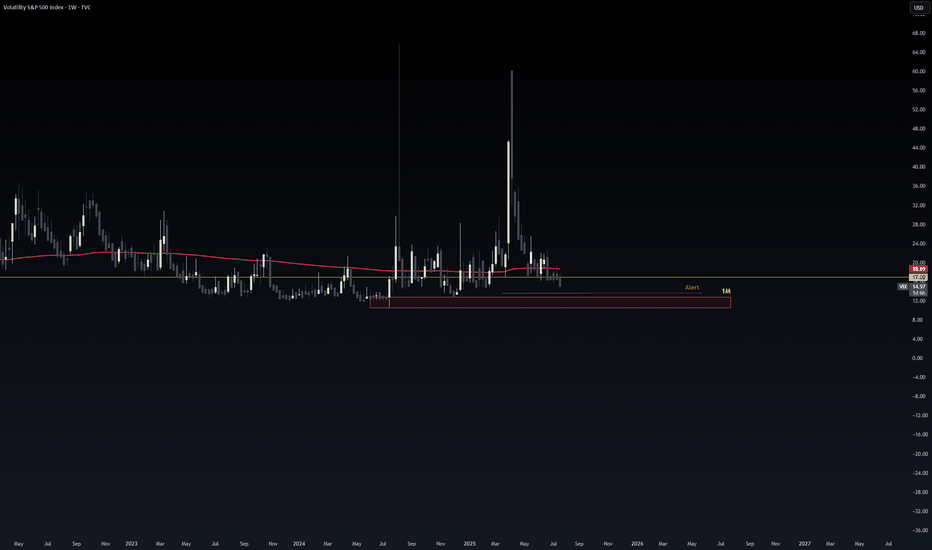

As things stand, with the VIX below 15 and the S&P still riding high, I maintain my view that according to market fundamentals, 'risk on' trades 'should' be viable. Which means staying patient and waiting for a turnaround, particularly on the JPY charts.

If that turnaround doesn't come, I could be forced to change my view.

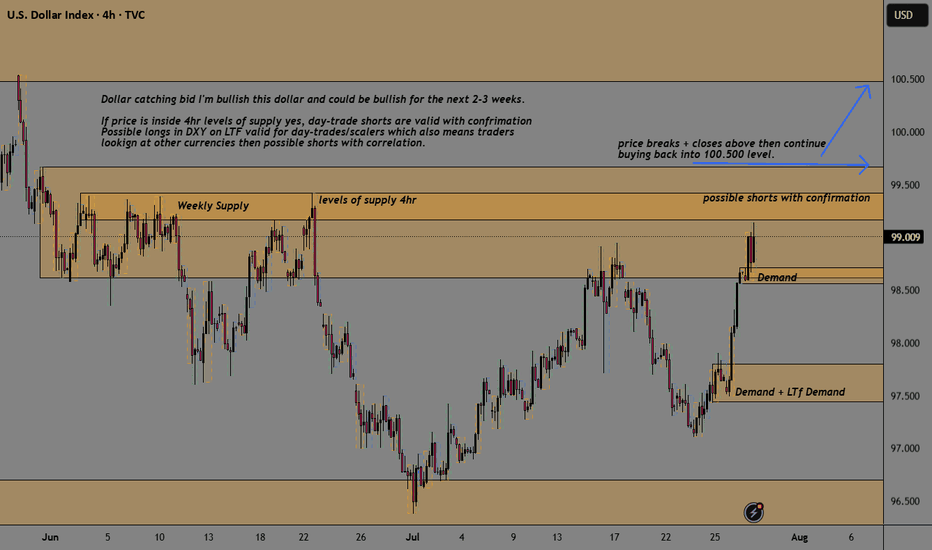

THE DOLLAR INDEX HAS FINALLY BROKEN THE DOWNWARD TRENDLINETVC:DXY (Dollar Index) has been in massive downward trend from the beginning of the year 2025 which was very bad for the Dollar. as from the previous weeks, we have been seeing the dollar index making some significant moves is very interesting as this will cause pairs like USDJPY to start pumping as well, because USDJPY is correlates positively with DXY why pairs like EURUSD,GBPUSD AND GOLD will be dropping. As a matter of fact let's see close the daily candle above the current.resistance level before anticipating for any massive move.

NOTE: THIS IS NOT A FINANCIAL ADVICE DO YOUR RESEARCH.

FOLLOW ME FOR MORE UPDATES.

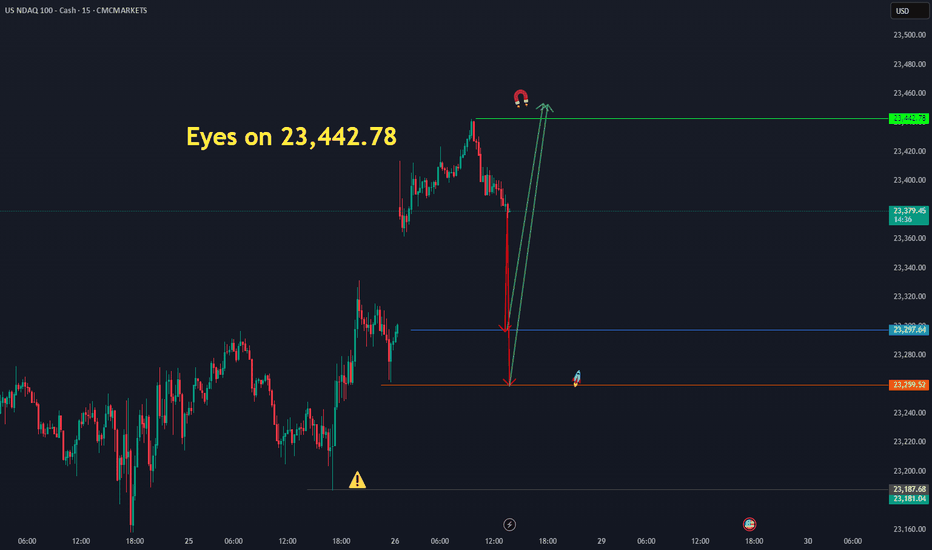

NAS/TEC100 - LETS GET NASTY ON NAS100Team, NAS currently sitting at 23480, before the US market open

however during the market open, please be aware of the volatility that may hit your stop loss

You have 2 options to trade on this NAS- NASTY

Option 1: wait for market open, if it hits 23500-23515 - then short with stop loss at 23580

Option 2: Short at the current market with small volume - and if the market open with volatile, you can take another advantage of shorting more volume as per option 1 instructed.

OK, pick your strategy! do NOT be shy.

I am going to have small short position and will consider adding more during US market opening after 5-10 minutes, much easier to see the direction of the market - we do LIVE trading everyday. Please note: if NAS fall below 23450-40 bring stop loss to BE (Break even)

1st TARGET range: 23435-23416 - make sure take 70% volume

2nd target at 23390 to 23376

Why do I short on NAS when tomorrow rate decision, i think this quarter report, market will not be the same as last quarter, even rate cut!

US Dollar Index: Down YTD, But at a 5-Week HighThe U.S. dollar plays a leading role in the performance of U.S. stocks versus international stocks. The greenback endured its worst first-half performance since 1973, helping ex-U.S. equities post massive absolute and relative gains through June. But could the narrative be shifting? And what might it mean for investors?

The U.S. Dollar Index (DXY) sits at a five-week high ahead of the July Federal Reserve interest rate decision and the key July jobs report to be released on August 1. Up four sessions in a row, the dollar appears poised to post its best month since last December (in fact, the DXY's first positive month of 2025). If it’s the start of a protracted recovery, then the “U.S. exceptionalism” trade could be back in vogue over the second half, resulting in the same old story of U.S. over international in the stock market.

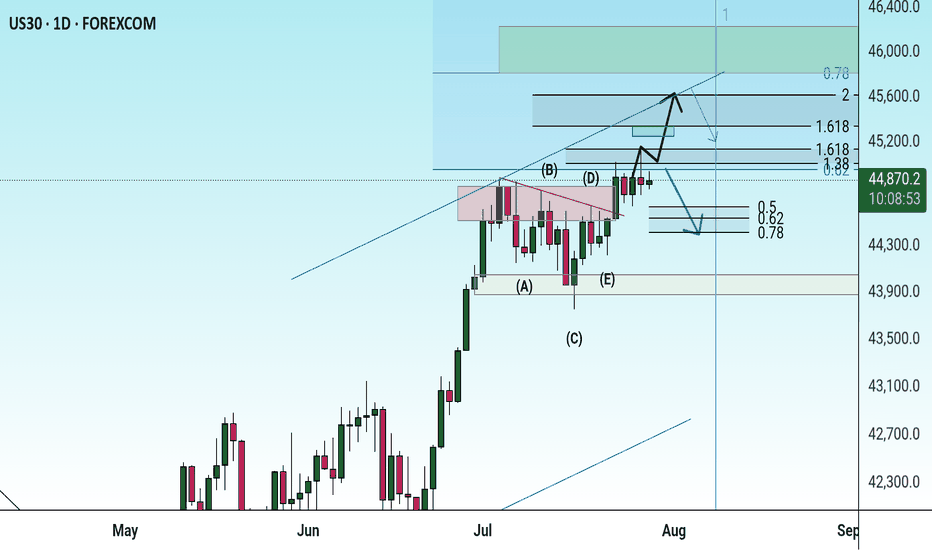

DowJones bullish breakout support at 44390Key Support and Resistance Levels

Resistance Level 1: 45197

Resistance Level 2: 45507

Resistance Level 3: 46000

Support Level 1: 44390

Support Level 2: 43900

Support Level 3: 43590

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

DAX: Local Bearish Bias! Short!

My dear friends,

Today we will analyse DAX together☺️

The in-trend continuation seems likely as the current long-term trend appears to be strong, and price is holding below a key level of 24,252.78 So a bearish continuation seems plausible, targeting the next low. We should enter on confirmation, and place a stop-loss beyond the recent swing level.

❤️Sending you lots of Love and Hugs❤️

S&P500 uptrend pause supported at 6355US equities were largely subdued, with the S&P 500 inching up +0.02%, marking its sixth straight record high, the longest streak since July 2023. Despite the headline gain, over 70% of S&P 500 stocks declined, revealing weak breadth and suggesting index gains are being driven by a narrow group of large-cap tech names.

Tech led the way, with the information technology sector +0.77% and the Mag-7 rising +0.79%.

Semiconductors outperformed, as the Philadelphia Semiconductor Index climbed +1.62%, driven by AMD’s +4.32% surge.

Momentum is building ahead of key Big Tech earnings: Microsoft and Meta report tomorrow; Apple and Amazon follow Thursday.

Meanwhile, traders are staying cautious ahead of a busy macro week:

FOMC decision (Wednesday),

Core PCE, Q2 GDP, ISM, and nonfarm payrolls still to come.

Geopolitical developments include a possible 90-day US-China trade truce extension and Taiwan cancelling overseas travel, which may help de-escalate tensions.

On the corporate front:

Apple's India strategy sees it surpass China as the top smartphone source for US buyers.

Harley-Davidson may sell its finance unit in a $5B deal with Pimco and KKR.

Vitol rewarded top staff with $10.6B in share buybacks—a record.

Conclusion for S&P 500 Trading

The S&P 500 continues to post record highs, but narrow leadership and weak breadth raise red flags. With tech doing the heavy lifting, near-term direction hinges on earnings from Microsoft, Meta, Apple, and Amazon. Broader market upside looks fragile ahead of critical Fed and economic data, suggesting that any disappointment could trigger a pullback. Stay cautious and watch for rotation or retracement if macro or earnings catalysts falter.

Key Support and Resistance Levels

Resistance Level 1: 6430

Resistance Level 2: 6470

Resistance Level 3: 6500

Support Level 1: 6355

Support Level 2: 6315

Support Level 3: 6280

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

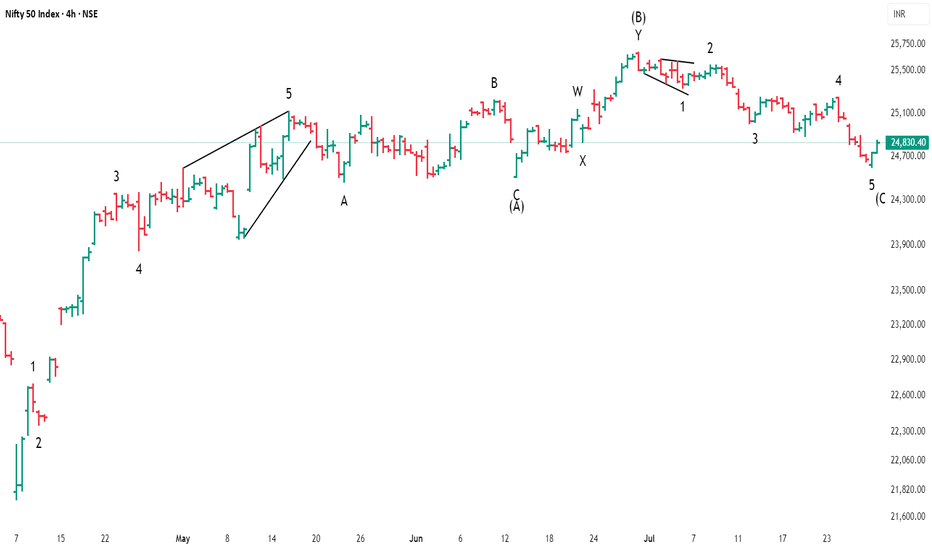

Nifty bounced backOur observation aligns well with the earlier analysis. The time cycle highlighted July 29 as a potential inflection point, and the strong short covering during the monthly expiry has clearly supported the 200+ point bounce today.

With NIFTY closing at 24,820, if it manages to cross the 24,850 level tomorrow, the path to 25,000 and possibly higher resistance levels should open up, signaling a stronger recovery.

Keep watching key supports around 24,700 as the base; sustained momentum above 24,850 will be crucial to confirm the bullish reversal. Stay nimble and monitor volumes and global cues for confirmation.

BankNifty levels - Jul 30, 2025Utilizing the support and resistance levels of BankNifty, along with the 5-minute timeframe candlesticks and VWAP, can enhance the precision of trade entries and exits on or near these levels. It is crucial to recognize that these levels are not static, and they undergo alterations as market dynamics evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We trust that this information proves valuable to you.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you successful trading endeavors!

Nifty levels - Jul 30, 2025Nifty support and resistance levels are valuable tools for making informed trading decisions, specifically when combined with the analysis of 5-minute timeframe candlesticks and VWAP. By closely monitoring these levels and observing the price movements within this timeframe, traders can enhance the accuracy of their entry and exit points. It is important to bear in mind that support and resistance levels are not fixed, and they can change over time as market conditions evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance to consider. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We hope you find this information beneficial in your trading endeavors.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you success in your trading activities!

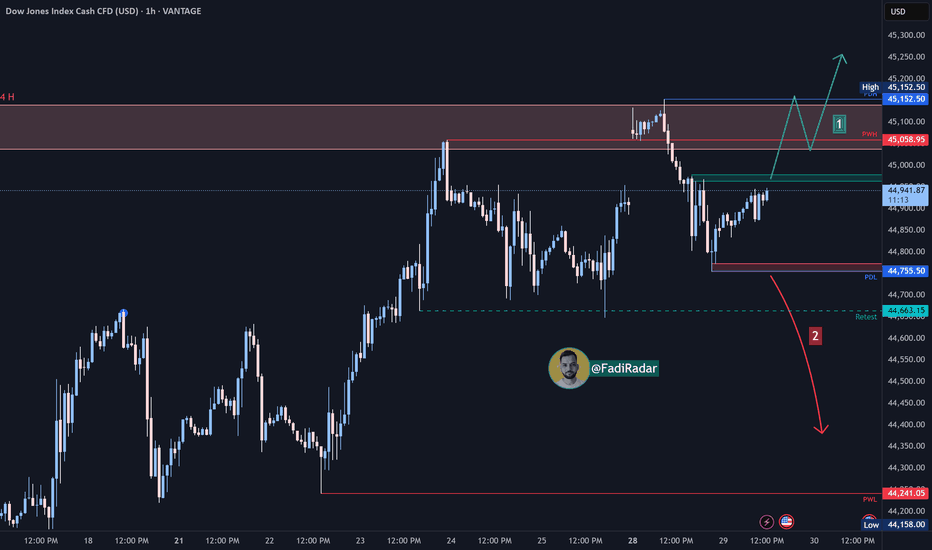

Dow Jones Index Analysis (US30 / Dow Jones):🔹 The index completed the expected correction and successfully retested the PDH level at 44,750 USD.

1️⃣ If bullish momentum leads to a break and close above 44,970 USD, the price is likely to form a new high or retest the previous peak.

2️⃣ However, a break and close below the 44,760 USD support could trigger a decline toward 44,660 USD.

🔻 A confirmed break below that level may resume the bearish trend and open the way toward 44,250 USD.

⚠️ Disclaimer:

This analysis is not financial advice. It is recommended to monitor the markets and carefully analyze the data before making any investment decisions.

OVERVIEW The price is currently undergoing a bearish correctionUS30 OVERVIEW

The price is currently undergoing a bearish correction, targeting 44910. To confirm a bearish trend continuation, the price must break below 44770, which would likely lead to a move toward 44610.

However, if the price stabilizes above 44910 on the 4H timeframe, a bullish reversal may begin. A confirmed break above 45100 would strengthen bullish momentum and open the path toward 45290.

Key Levels:

• Pivot Line: 45045

• Support: 44910 – 44770 – 44610

• Resistance: 45100 – 45290