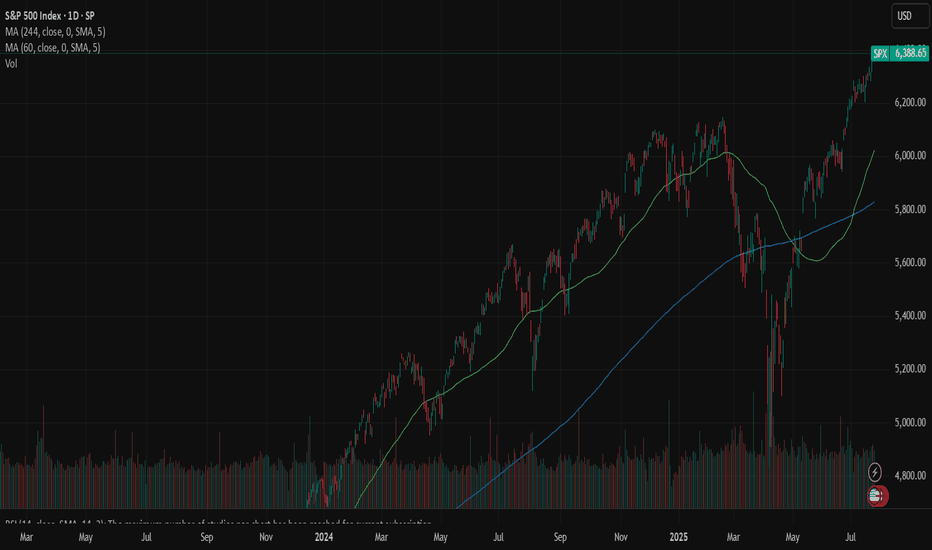

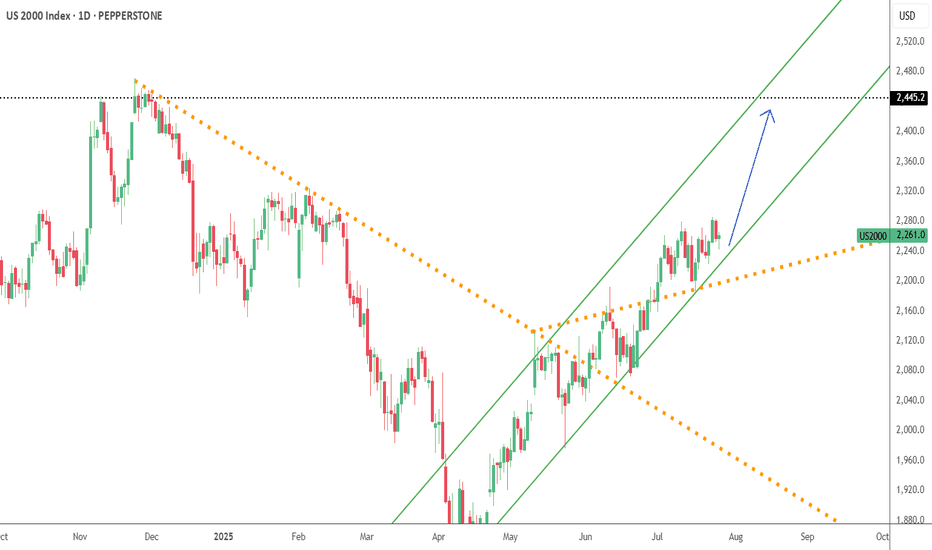

SPX: Tariffs deal (un)certainty Investors' optimism continued to hold at the U.S. equity markets another week in a row. The S&P 500 posted another weekly winning streak, supported by solid earnings of companies included in the index. The index also reached another all time highest level, with Friday's level of 6.388, gaining around 1,5% for the week.

Tech companies were once again main contributors to the surge of the index. Alphabet posted better than expected quarterly results, supporting the surge in share price of 4%. Tesla shares gained 3,5% for the week. The company reported strong vehicle delivery numbers and progress in AI-driven autonomous driving technology. Analysts are noting that 82% of all companies included in the S&P 500 index, that have already reported quarterly results, have beaten the market expectations.

Alongside strong earnings reports, recent advancements in U.S. trade negotiations have contributed to market gains. Earlier this week, President Donald Trump announced a significant trade agreement with Japan, which includes a 15% reciprocal tariff arrangement—an important step toward redefining trade terms between the two nations. Additionally, the U.S. and Indonesia have reportedly reached a framework agreement for a trade deal, reflecting a broader U.S. effort to strengthen and stabilize trade partnerships in Asia. On Friday, President Trump expressed confidence that more trade agreements will be finalized ahead of the August 1 deadline for new tariffs. One of these possible deals involves the European Union. Investors have welcomed these developments, as they help reduce tariff-related uncertainties and ease concerns about escalating trade disputes that could disrupt global supply chains and impact corporate earnings.

The week ahead brings a bunch of important macro data for the U.S. as well as the FOMC meeting, where Fed members will discuss a potential change in interest rates. Markets are currently not expecting that the Fed will make a move at this meeting. Certainly, with JOLTs, NFP, PCE data in combination with the FOMC meeting, the week ahead might bring back some higher volatility in the US equity markets, in case of any unexpected news.

Market indices

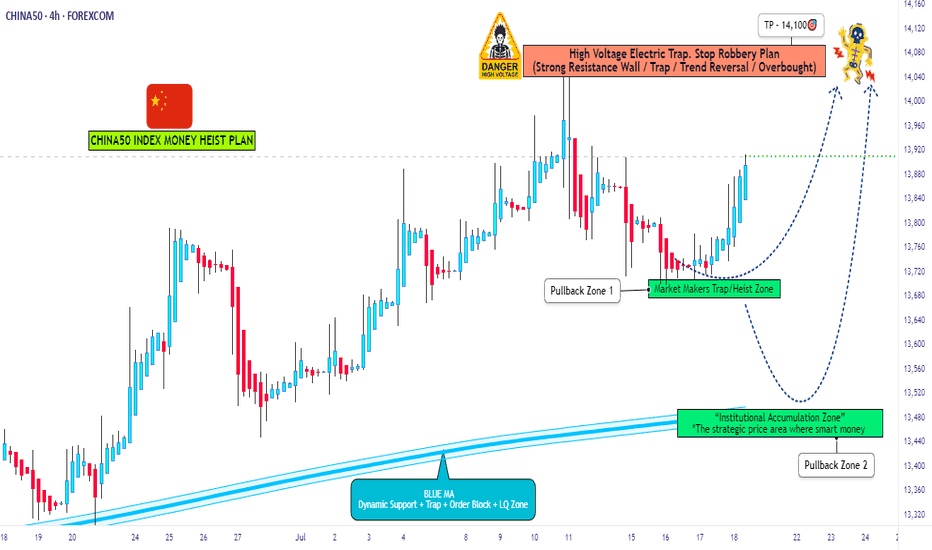

China50 Target Locked | Long Setup via Thief Strategy🏴☠️ CHINA50 Market Robbery Blueprint 🔥 | Thief Trading Style (Swing/Day Plan)

🌍 Hey Money Makers, Chart Hackers, and Global Robbers! 💰🤑💸

Welcome to the new Heist Plan by your favorite thief in the game — this time targeting the CHINA50 Index CFD like a smooth criminal on the charts. 🎯📊

This is not your average technical analysis — it's a strategic robbery based on Thief Trading Style™, blending deep technical + fundamental analysis, market psychology, and raw trader instincts.

💼 THE SETUP — PREPARE FOR THE ROBBERY 🎯

We're looking at a bullish operation, setting up to break into the high-value vaults near a high-risk, high-reward resistance zone — beware, it's a high-voltage trap area where pro sellers and bearish robbers set their ambush. ⚡🔌

This plan includes a layered DCA-style entry, aiming for max profit with controlled risk. Chart alarms on, mindset ready. 🧠📈🔔

🟢 ENTRY: "The Robbery Begins"

📍 Zone-1 Buy: Near 0.63700 after MA pullback

📍 Zone-2 Buy: Near 0.62800 deeper pullback

🛠️ Entry Style: Limit Orders + DCA Layering

🎯 Wait for MA crossover confirmations and price reaction zones — don’t chase, trap the market.

🔻 STOP LOSS: "Plan the Escape Route"

⛔ SL for Pullback-1: 13540 (4H swing low)

⛔ SL for Pullback-2: 13350

📌 SL placement depends on your position sizing & risk management. Control the loss; live to rob another day. 🎭💼

🎯 TARGET ZONE: “Cash Out Point”

💸 First TP: 14100

🏁 Let the profit ride if momentum allows. Use a trailing SL once it moves in your favor to lock in gains.

👀 Scalpers Note:

Only play the long side. If your capital is heavy, take early moves. If you’re light, swing it with the gang. Stay on the bullish train and avoid shorting traps. Use tight trailing SL.

🔎 THE STORY BEHIND THE HEIST – WHY BULLISH?

CHINA50 shows bullish momentum driven by:

💹 Technical bounce off major support

🌏 Macroeconomic & geopolitical sentiment

📰 Volume + sentiment shift (risk-on)

📈 Cross-market index confirmation

🧠 Smart traders are preparing, not reacting. Stay ahead of the herd.

👉 For deeper insight, refer to:

✅ Macro Reports

✅ COT Data

✅ Intermarket Correlations

✅ CHINA-specific index outlooks

⚠️ RISK WARNING – TRADING EVENTS & VOLATILITY

🗓️ News releases can flip sentiment fast — we advise:

❌ Avoid new positions during high-impact events

🔁 Use trailing SLs to protect profit

🔔 Always manage position sizing and alerts wisely

❤️ SUPPORT THE CREW | BOOST THE PLAN

Love this analysis? Smash that Boost Button to power the team.

Join the Thief Squad and trade like legends — Steal Smart, Trade Sharp. 💥💪💰

Every day in the market is a new heist opportunity — if you have a plan. Stay tuned for more wild robbery blueprints.

📌 This is not financial advice. Trade at your own risk. Adjust based on your personal strategy and capital. Market conditions evolve fast — stay updated, stay alert.

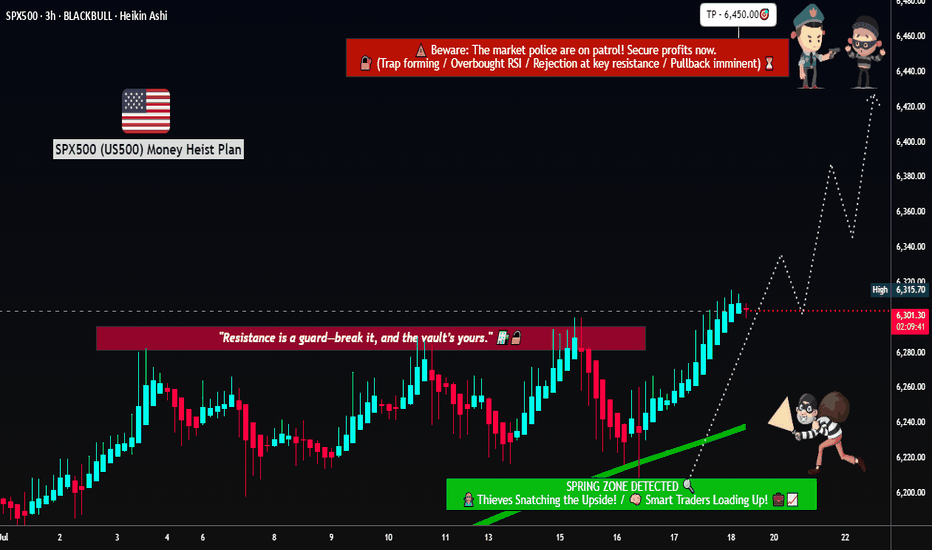

Rob the Rally SPX500: Enter Before Resistance Catches You🦹♂️💰**“SPX500 Street Heist” – Thief-Style Robbery Plan for Bulls!**📈💸

(Powered by Thief Trader's Market Robbing Tactics – Scalp | Swing | Day Trade Edition)

🌍Hello, Global Money Hunters!

📣 Salaam, Bonjour, Ola, Hola, Hallo, Marhaba & Welcome to the heist floor! 🎩💼

Thief Trader is back again with a loaded plan to rob the market clean — this time targeting the mighty SPX500 / US500 🎯. Based on a fusion of technical setups, macro sentiment, and the Thief Trading System, we’ve set our sights on the next breakout vault of Wall Street.

🎯 The Gameplan – Heist the Resistance Vault

The index is entering a high-risk resistance barricade — overbought, consolidated, and heavily guarded by bearish robbers (sellers). This is the zone where the market police lurk and trend reversals often get triggered. However, smart thieves always plan with precision.

Here’s the mission briefing:

🔓Entry Zone (Break-in Point)

💥 “The vault is open — grab the bullish loot!”

Enter Long anywhere close to market price or on pullbacks near recent swing lows/highs.

Preferred timeframes: 15-min to 30-min for sniper-level accuracy.

Deploy DCA-style limit orders (layered entries for maximum control).

🛑Stop Loss (Escape Hatch)

Base SL on recent swing low candle wicks on the 4H timeframe.

Suggested: ~6250.00 — but adapt based on your risk appetite, lot size, and position stacking.

📈Target / Loot Location

🎯 Primary Take-Profit: 6450.00

Or… pull out early if you spot resistance fighters guarding the vault.

Use trailing SL to secure gains and manage getaway.

⚡Scalper’s Notice

Only Long-side allowed!

Got big capital? Jump in now.

Running low? Tag along with swing traders and follow the robbery protocol.

Always protect your bag with dynamic trailing stops.

🧠Fundamental Fuel Behind the Plan

Bullish sentiment across major indices

Macro trends, COT positioning, sentiment outlook, and intermarket analysis all greenlit

Geopolitical and Fed tone supportive — tap into real data before entering

👉 Always analyze: News, Fundamentals, Sentiment, COT reports, and macro conditions.

🚨NEWS ZONE ALERT – No Loud Moves!

Avoid entry during major economic news drops

Use trailing SLs to guard profits

Don’t let your open trades get caught in the chaos of news releases!

💥Let’s Boost the Thief Army!

Smash the BOOST button 💖 to power up the robbery crew.

Support the strategy, share the love, and stay ahead of the game using Thief Trading Style. Every trade is a step closer to freedom from financial traps. 🚀💰🎉

📌Disclaimer: This is a general market analysis for educational purposes and should not be considered personal financial advice. Please evaluate your own risk management strategy before placing trades.

📌Markets shift fast — stay flexible, stay alert, and always rob smart.

🔥Stay locked in for the next heist plan — Thief Trader signing off for now…

💸💼📈 Trade smart. Rob harder. 🤑🦹♂️📊

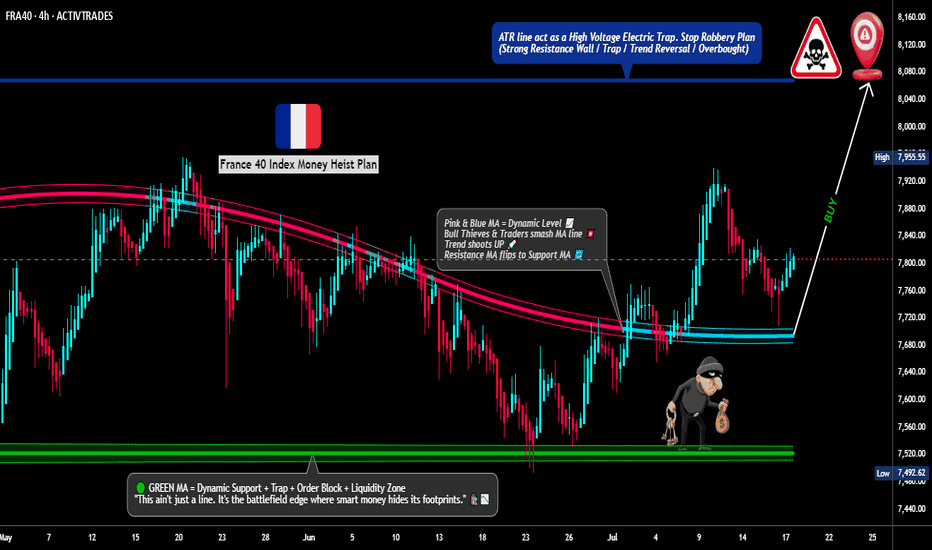

"FRA40/CAC40 HEIST! Bullish Loot Before Bear Trap – Act Fast!"💰 FRA40/CAC40 "FRANCE40" INDEX HEIST – THIEF TRADING STYLE MASTER PLAN 🏴☠️🚀

🔥 Steal the Market Like a Pro – Bullish Loot & Escape Before the Trap! 🔥

🤑 GREETINGS, FELLOW MONEY MAKERS & MARKET ROBBERS!

🌟 Hi! Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

This is your VIP invite to the ultimate FRA40/CAC40 heist! Based on the 🔥Thief Trading Style🔥, we’re locking in a bullish raid before the bears set their trap. Time to swipe the loot & escape like a pro!

📜 THE HEIST BLUEPRINT – TECHNICAL & FUNDAMENTAL RAID PLAN

🎯 ENTRY POINT: "THE VAULT IS OPEN!"

📈 Long Entry: The market’s handing out free cash—swipe bullish positions at any price!

🔄 Pro Thief Move: Use buy limit orders within 15-30 min timeframe for pullback entries.

🎲 DCA/Layering Strategy: Deploy multiple limit orders to maximize loot & minimize risk.

🛑 STOP LOSS – SAFETY NET FOR THIEVES

SL at Nearest Swing Low (4H TF): 7650.00 (Adjust based on your risk, lot size & entry layers).

⚠️ Warning: Bears are lurking—don’t get caught in their trap!

🏆 TAKE PROFIT – ESCAPE BEFORE THE POLICE ARRIVE!

🎯 Primary Target: 8060.00 (or exit early if the market turns sketchy).

🚨 Danger Zone: Yellow MA Zone (Overbought, Reversal Risk, Bear Trap!)

📡 FUNDAMENTAL BACKUP – WHY THIS HEIST WILL WORK

💰 France40 is riding bullish momentum due to:

Strong Macro Data (Eurozone recovery signals)

Institutional Buying (COT Report Insights)

Geopolitical Calm (For Now… Stay Alert!)

Index-Specific Strength (Tech & Luxury Stocks Leading)

🔗 For full analysis (Fundamentals, COT, Intermarket Trends, Sentiment Score):

👉 Check the Liinkk 🔗! 👈

🚨 TRADING ALERT – NEWS & POSITION MANAGEMENT

📰 High-Impact News = Market Chaos! Protect Your Loot:

❌ Avoid new trades during major news drops.

🔐 Use Trailing Stops to lock profits & dodge sudden reversals.

💥 BOOST THE HEIST – SUPPORT THE MISSION!

🚀 Hit the "Boost" button to strengthen our robbery squad!

💰 More boosts = More profitable raids!

🎉 Let’s dominate the market daily with the Thief Trading Style!

🔐 DISCLAIMER (LEGAL SAFETY NET)

This is NOT financial advice—just a strategic raid plan. Trade at your own risk. Markets change fast; adapt or get caught!

🤑 Stay tuned for the next heist… The vaults won’t rob themselves! 🐱👤💨

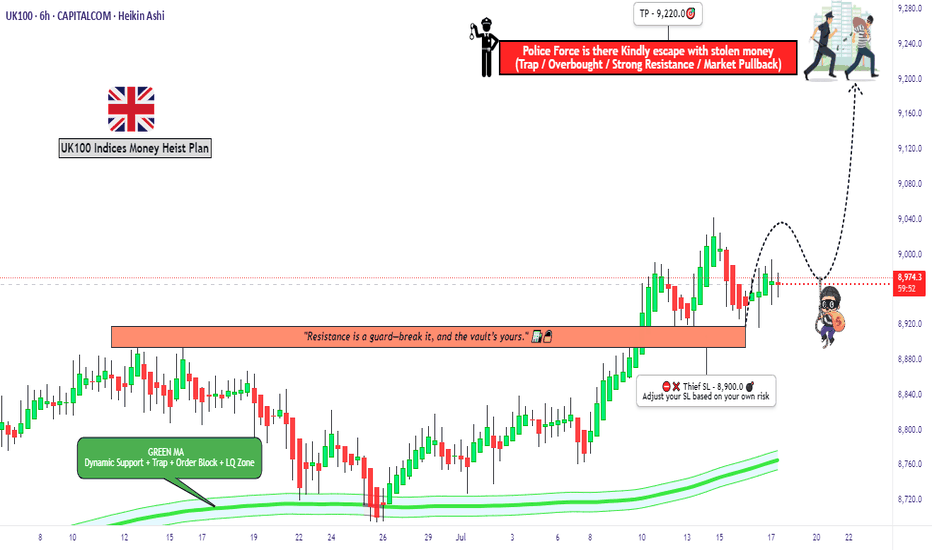

"UK100 Bulls Vault Open! Grab the Loot & Escape Early"🏴☠️💰"UK100 / FTSE100 Market Heist Blueprint" – A Thief Trading Operation for High-Profit Target Extraction 💼📈

🌍 Hola! Hi! Bonjour! Ola! Hallo! Marhaba!

To all the Market Robbers, Smart Thieves, and Strategic Money Makers — welcome to another Thief Trading Heist Plan™.

Ready your gear and charts — the UK100 / FTSE100 index is our next vault.

🔥Heist Objective: Swipe the Bullish Loot Before the Police Trap Hits! 🔥

Based on sharp Thief-style technical and macro-fundamental analysis, the market is showing bullish exhaustion and early signs of trap reversal zones. Our goal is clear: extract max value from the bulls and escape before the heat catches on.

🚨The current price action is nearing a Red Zone — high-risk area filled with potential police traps (supply zones, resistance, and bear setups). Timing and smart entries are key.

🎯 Strategy Overview (Day/Swing Trade)

Entry Plan:

🟢 “The Vault’s Open!” – Start accumulating long positions now or set buy limits near recent 15m/30m swing lows. Layer your entries (DCA method) for better control and efficiency.

Stop Loss (SL):

🔐 SL below recent swing low on 4H timeframe (~8900.0)

Adjust based on your risk appetite, position size, and how many layered orders you've got lined up.

Target Zone (TP):

🏁 Primary Target: 9220.0

Always be ready to exit early if market signals shift. He who escapes lives to rob another day.

🧲 Scalpers Note:

Only operate long within this framework. Big capital players can jump in earlier; others can trail behind with the swing traders. Always use trailing SLs to lock in stolen loot and reduce exposure.

📰 What's Driving the Market?

Current bullish sentiment is backed by:

Fundamental strength

Sentiment & COT reports

Macro data & intermarket correlation

Geopolitical & institutional flow analysis

Stay updated through your reliable sources and plug into key market dynamics and positioning reports.

⚠️ Trading Precaution:

🚫 Avoid new positions during high-impact news

💼 Manage your trades with care

🔁 Use trailing SLs to secure profits during volatility

💥Boost the Robbery – Support the Crew💥

If this heist plan aligns with your mission, smash that Boost button. Support the thief movement, and let’s build a strong trading crew where money is made with precision, strategy, and no mercy. 💰🤑

🔒 Final Notes (Read Before You Rob):

📌 This is a strategic trade setup, not financial advice. Always tailor the plan based on your risk management, capital size, and market conviction.

📌 Markets evolve. Stay alert, adapt fast, and trade like a thief — unseen, smart, and always two steps ahead.

💬Drop your thoughts, results, or setups below — and if you're in, type "HEIST READY" in the comments.

Stay tuned, another plan is on the way... 🏴☠️📊🔥

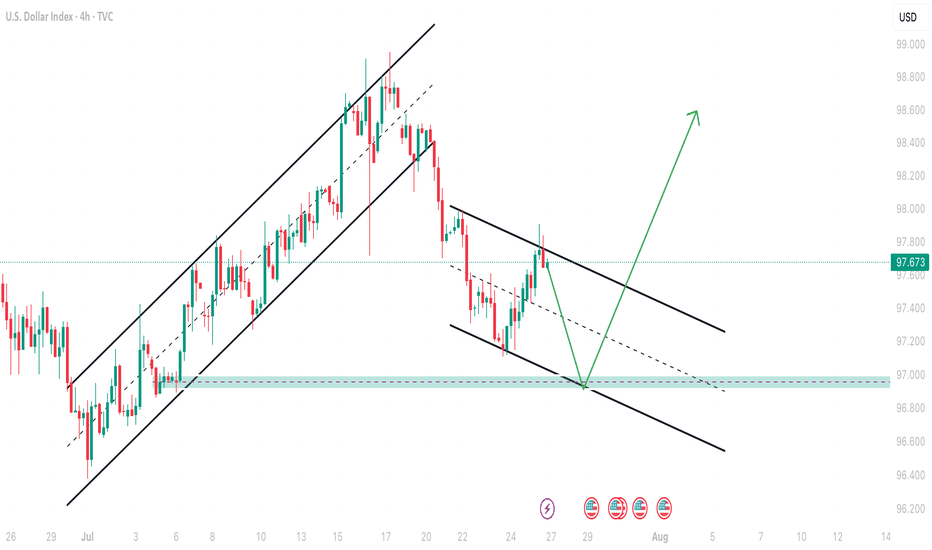

DXY index moving towards down in higher timeframeAs you can see DXY index is moving inside channel and now its time for second swing failure to go down.Then channel movement will finish and it will breakout towards upward so i recomand trade USD pairs accordingly.This is my analysis not a financial advice so trade according your risk management.

HK50 Index Robbery Plan – Bulls in Control, Load Up🚨💸💥**HK50 MONEY HEIST ALERT – Thief Trading Style Entry Plan!**💥💸🚨

"Swipe the Trend, Rob the Risk – The Hong Kong Vault is Open!"

🌍🌎Hey there, Global Money Movers, Heist Planners & Market Robbers!🕵️♂️💰

Welcome to another high-stakes operation brought to you by the Thief Trading Style – where strategy meets chaos, and profits are earned with precision. 🏴☠️📊

🎯 Mission Brief: HK50 Index Robbery – Long Entry Blueprint

Based on our exclusive blend of technical & fundamental analysis, the HK50 (Hong Kong Index) is entering the Loot Zone – bullish bias detected and price action confirming a strategic long opportunity. Here's how we execute the plan:

🔓 ENTRY – The Vault is Open!

🎯 Strike anywhere near recent swing lows/highs on the 15m or 30m timeframe.

💡 Ideal Entry Zones: Closest bullish structure or reversal support.

📌 Tip: Set alerts at key reaction zones – timing is the true thief’s edge.

🛑 STOP LOSS – Escape Hatch Point

🛡️ SL placed below nearest swing low on the 4H timeframe (~23640.0).

💡 Adjust based on your risk tolerance, lot size, and trade stacking.

🏁 TARGET – The Getaway Route

🎯 TP zone: ~25200.0

🚀 Optional: Use Trailing SL to maximize robbery exit on spikes or trap fails.

💬 “Escape before target” if market sentiment flips or volatility surges.

🧲 Scalper Alert: Ride the Bull Only!

💵 Scalping allowed on buy side only.

If you’ve got capital power – go direct. Otherwise, join the swing thieves and ride with momentum. 📈💣

🧠 Why Bullish? | Heist Justification

📊 Current momentum supported by:

🔎 Technical Trend Reversal Patterns

📉 ATR exhaustion near previous downside levels

📰 Positive Macro, Global Cues, & Institutional Sentiment

👉 For the full scoop – combine this with:

📰 COT Data & Market Sentiment

🌐 Intermarket & Geopolitical Outlook

📈 Index-Specific & Seasonal Cycle Studies

Stay ahead, rob smart! 💼💼

⚠️ Risk & News Alert – Don’t Get Caught!

🔔 Avoid entries during major news drops!

✅ Use trailing stop-losses on running trades.

🚷 Protect your loot at all costs – market volatility is the real SWAT team! 🚓

💥Support Our Robbery Crew!

📢 Smash the Boost Button 💣💥 to support the Thief Trading Style revolution!

Together, we rob with discipline, plan with clarity, and exit with satisfaction.

💰Let’s stack profits, not just candles. 📈🤑

📝 Disclaimer:

This is a high-level market outlook, not financial advice. Adjust based on your capital, risk tolerance, and analysis. Always monitor your trades and adapt to the ever-changing market landscape.

Follow for more Heist Plans – this is just the beginning! 🕶️🔐

**See you at the next vault…**🚁💼📈

#ThiefTrading #HK50 #MarketHeist #IndexAnalysis #BullishBreakout #SmartMoney #ScalpersWelcome #SwingTrading #TechnicalAnalysis #RiskReward #TradingViewElite #ProfitWithStyle

US500 Bulls Assemble | Breakout Heist Strategy📈🚨 MASTER HEIST PLAN: “SPX500 ROBBERY – THIEF TRADING STYLE 🔥💸” 🚨📈

(The Ultimate Long Strategy Blueprint for Smart Day/Swing Traders)

🌍 Greetings to All Market Bandits, Bullish Burglars, and Chart Snipers!

Hola! Bonjour! Ola! Hallo! Marhaba! 🙌

🦹♂️This is your friendly chart thief checking in with the latest SPX500/US500 masterplan!

This isn’t just a trade—it’s a heist 🎯. We’re not here to participate, we’re here to dominate! Welcome to the Thief Trading Style, where we map, trap, and snatch those pips with ruthless precision. 🧠🔍💰

🚀 THIEF TRADE SETUP - SPX500/US500

A mix of technical sniper entries + fundamental black ops analysis = 💸 Maximum Extraction. 💸

🎯 ENTRY PLAN: THE BREAKOUT HEIST

📍Buy Entry Zone: Wait for the clean breakout + candle close above 6270.00.

"The vault opens once we clear that wall. Let the bullish getaway begin!" 💥🚪📈

🛠️Thief Tips for Entry:

Use Buy Stop Orders above resistance levels.

OR layer in Buy Limit Orders near recent pullbacks (15/30m swing zones) using DCA Style (Dollar Cost Average layering like a pro).

Want stealth mode? Set that alert (alarm), and strike when the breakout sings. 🔔🎯

🛑 STOP LOSS – PROTECT THE LOOT

🧨Set your SL smart—beneath the nearest swing low using the 2H timeframe for stronger structure.

💬 “Look, don’t gamble. A thief knows when to run. Set that stop where I showed ya, or risk losin’ the bag.” 💼💣

❗Your SL should reflect your risk per trade, lot size, and number of entries. It’s your getaway plan—don’t mess it up.

💥 TARGETS – WHERE WE CASH OUT

🏴☠️Primary Take Profit (TP1): 6310.00

🏴☠️Secondary Take Profit (TP2): 6370.00

💹 Scalp Traders: Stick to the Long Side Only. Ride the momentum, but use trailing SL to lock it in.

🔍 THIEF FUNDAMENTAL INTEL: WHY THIS IS OUR MOMENT

Current SPX500 bullishness driven by:

✅ Positive macro & geopolitical tailwinds

✅ Institutional positioning (COT reports)

✅ Intermarket analysis showing strong correlations

✅ Momentum building with sentiment and volume

📌 Stay sharp—check all your fundamental reports, news catalysts, and sentiment tools before executing your move. Smart thieves plan every detail. 🎓📊

⚠️ NEWS RELEASE REMINDER

📢 News = Chaos. Don’t get caught in the spray:

🔒Avoid entering trades just before big announcements.

🚀 Use Trailing SL to secure profit if you're already in.

Stay agile. Stay smart. Stay rich. 💼🚁

❤️ SUPPORT THE HEIST – HIT THAT BOOST BUTTON!

👊 Liked the plan? Hit the Boost to join the elite robbery crew.

Every boost fuels the mission. Every like sharpens the strategy. Let's build a team of smart, profitable traders. 🚀💸🔥

🧠 Remember: This is general analysis – not financial advice. Manage your risk like a true thief. Stay updated. Adapt fast. Don't get caught. 🕵️♂️

🎉See you in the next Heist Plan! Keep your tools sharp, your charts cleaner, and your profit bags fatter. 🤑🔥

JP225 Long Trap or Bull Escape? Heist in Motion.🦹♂️🎯 JP225 Ninja Heist: Breakout Loot Plan 💥💰 (Long Game Playbook)

🌟Hi! Hola! Ola! Bonjour! Hallo! Assallamu Allaikum!🌟

Dear Money Makers, Market Raiders & Silent Robbers, 🤑💰💸✈️

It’s time to gear up for the ultimate breakout heist on the JP225 / NIKKEI Index CFD Market. Based on my 🔥Thief Trading style🔥—a mix of slick technical strategy and deep fundamental recon—this operation is primed for a bullish break-in.

🧠 Plan of Attack:

Our team is targeting a long-side entry only, aiming to loot the market before it hits the Electric Trap Resistance Zone ⚡—a known danger zone where big bears lie in wait. Let’s outsmart them!

🚪 Entry Plan – The Door to Gold

📈 "The heist is on once we crack that resistance vault!"

📍Trigger: Wait for candle close above 40,100 – that's your breakout cue.

🧲Pullback Setup: Place Buy Limit near recent swing low on the 15/30 min timeframe, or stack multiple DCA-style orders to scale in silently.

🔔 Don’t forget to set alerts—you snooze, you lose.

🛡️ Stop Loss – Don’t Get Caught

🛑 "Keep your escape plan ready, always!"

📍Preferred SL: Recent swing low on 4H timeframe @ 39,500

🎯 Adjust based on your risk level and lot sizing.

🧠 Smart robbers move stop loss only after breakout confirmation—don’t let hesitation cost you your cut.

🎯 Profit Target – Secure the Bag

🏴☠️ Escape Plan: Aim for 41,200 or bail early if the scene gets messy.

Use trailing SLs to protect your stash.

Scalpers, only play long side. Let the swing traders set the traps while you slice the pie.

📊 Why This Trade Works:

JP225 is currently fueled by:

🔼 Strong bullish momentum

🔍 Technical breakout setup

💹 Fundamental backdrop: macro trends, institutional flow, COT report, and global sentiment lining up like guards on break

🗞️ Want more intel? Check out the broaderr macroeconomic, sentiment, and positioning insights 🔗🔗🔗

⚠️ Risk Management Alert:

📰 During news hours, don’t act greedy.

❌ Avoid entries near big news drops.

✅ Use trailing SLs to protect profits from volatility whiplash.

❤️ Robbery Crew Boost Request

💥Hit that Boost if this plan helps you grab the market loot!

Let’s grow our Thief Trading Army together—every trader deserves a smooth escape and a fat wallet 🏆💪💸

📌 Disclaimer: This is not financial advice. Just a masterplan from a fellow market raider. Adapt your risk and strategy based on your own style. Markets can flip faster than you can say “bank run”—stay updated, stay sharp, and stay stealthy. 🕶️

🎭 See you at the next heist.

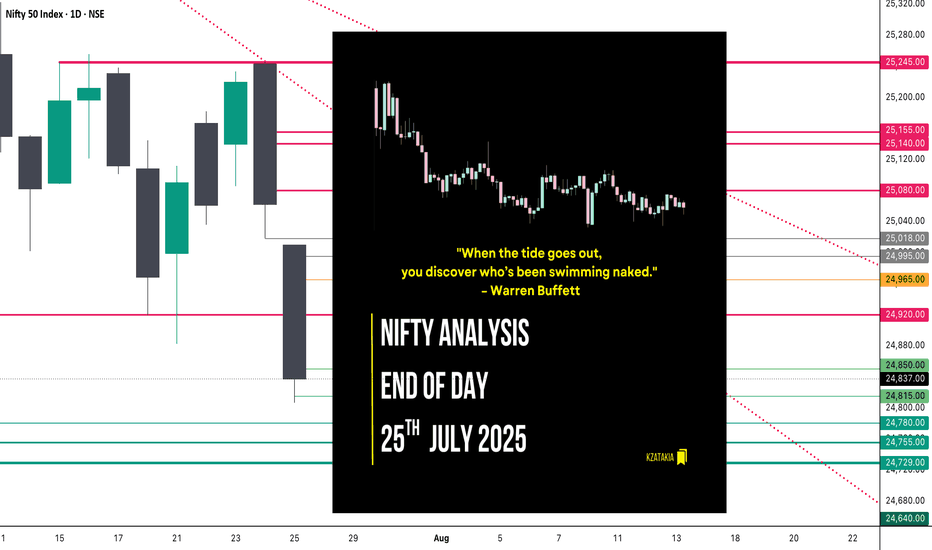

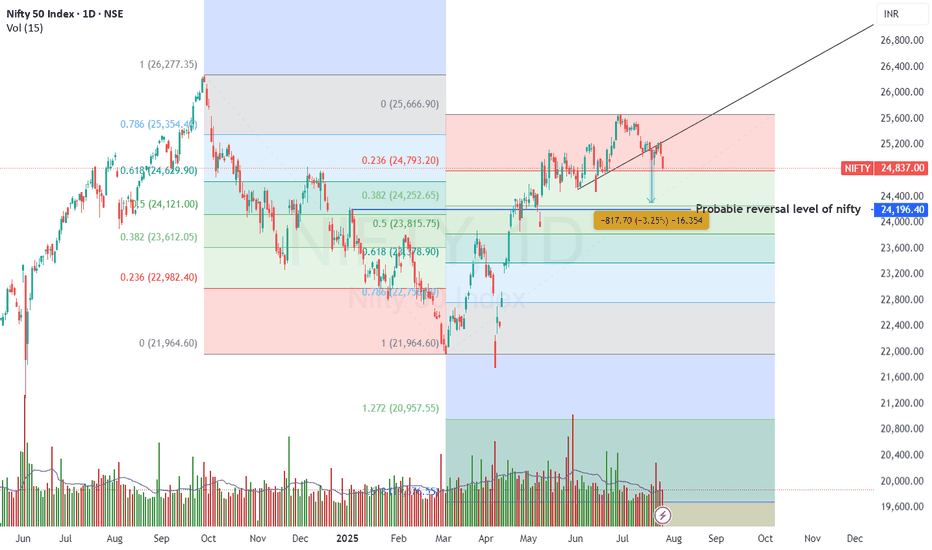

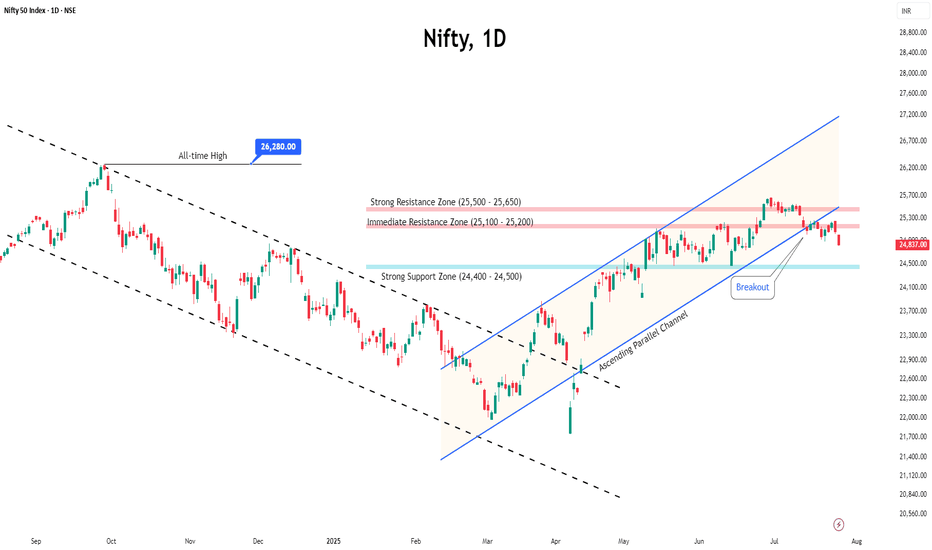

Nifty Analysis EOD – July 25, 2025 – Friday🟢 Nifty Analysis EOD – July 25, 2025 – Friday 🔴

"When the tide goes out, you discover who’s been swimming naked." – Warren Buffett

Nifty GapDowns Below Key Support and Slips Further

The market opened with a sharp GapDown, breaching the previous day's low and instantly shedding 150 points within the first hour. Nifty attempted to find footing near the crucial 21st July low zone of 24,850–24,880, but the support gave way, slipping an additional 50 points.

The day mostly drifted around these lower levels with bearish dominance. Though bulls made an effort to recover late in the session, it lacked strength. The index finally settled at 24,837, decisively closing below the 21st July low — signalling a deeper structural breakdown.

📉 Trend & Zone Update

Resistance Zone Shifted To: 25,144 ~ 25,155

Support Zone Shifted To: 24,729 ~ 24,755

📊 What If Plans – 28th July Outlook

🅰️ Plan A (Contra Long Setup)

If market opens inside the previous day range and finds support at 24,815 ~ 24,850

Then potential targets are 24,920, 24,965, and 25,020

🅱️ Plan B (Trend is Friend – Short Continuation)

If market opens inside range and faces resistance around 24,965 ~ 24,995

Then aim for 24,850, 24,815, 24,780, and 24,730

⏸️ On-the-Go Plan

If market Gaps Up/Down outside previous day’s range

Then wait for the Initial Balance (IB) to form and act based on structure and S/R levels.

🕯 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 25,010.35

High: 25,010.35

Low: 24,806.35

Close: 24,837.00

Candle Structure

Body: Strong red candle (−173.35 pts)

Upper Wick: None (open = high)

Lower Wick: 30.65 pts

Interpretation:

A textbook bearish Marubozu — shows sellers had control throughout.

Bears stepped in immediately from open, preventing any bullish response.

Minimal lower wick implies limited buyer defense even at the session low.

Key Insight:

Bears are in command; bulls must reclaim 25,000+ quickly to prevent further downside.

If 24,800–24,820 breaks, eyes shift to 24,700–24,750 zone next.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 192.95

IB Range: 87.4 → Medium

Market Structure: Imbalanced

Trades Triggered:

🕙 10:10 AM – Short Entry → 🎯 Target Hit (1:2.4 R:R)

🧭 Support & Resistance Levels

Resistance Zones

24,920

24,965

24,995 ~ 25,018

25,080

25,140 ~ 25,155

Support Zones

24,780

24,755 ~ 24,729

24,640

📌 Final Thoughts

When strong candles appear back-to-back with no meaningful recovery in between, it’s not just a correction — it’s a statement. In this market phase, reacting to price structure rather than assumptions will keep you on the right side. Stay nimble, stay prepared.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Nifty Chart📉 Nifty Technical Outlook – Bearish Bias with Macro Overhang

Nifty continues to show bearish momentum, having taken strong resistance near the 25450–25800 zone, which aligns with the runaway gap on the daily chart and the 78.6% Fibonacci retracement level from the recent decline.

On the short-term chart, a Head and Shoulder breakdown has already occurred, followed by a retest, which supports the ongoing weak sentiment.

In addition to technical factors, India–US trade talks are currently in focus. Uncertainty around tariffs, tech cooperation, and strategic agreements may keep market participants cautious in the near term. Any negative development could add to downside pressure, while a breakthrough might limit losses.

🔻 Key Technical Levels:

Major Resistance: 25450–25800 (Runaway Gap + Fibo 78.6%)

Immediate Support: 24200 (short-term support zone)

Next Support: 23700 (historical support level)

As long as Nifty stays below 25450, the trend remains bearish, with potential downside toward 24150–24200 and further to 23700, depending on trade talk developments and market sentiment.

📝 Note: This analysis is intended only for study and educational purposes. Please consult a qualified advisor before making any investment decisions. Market behavior is subject to change based on news, global trends, and macroeconomic factors.

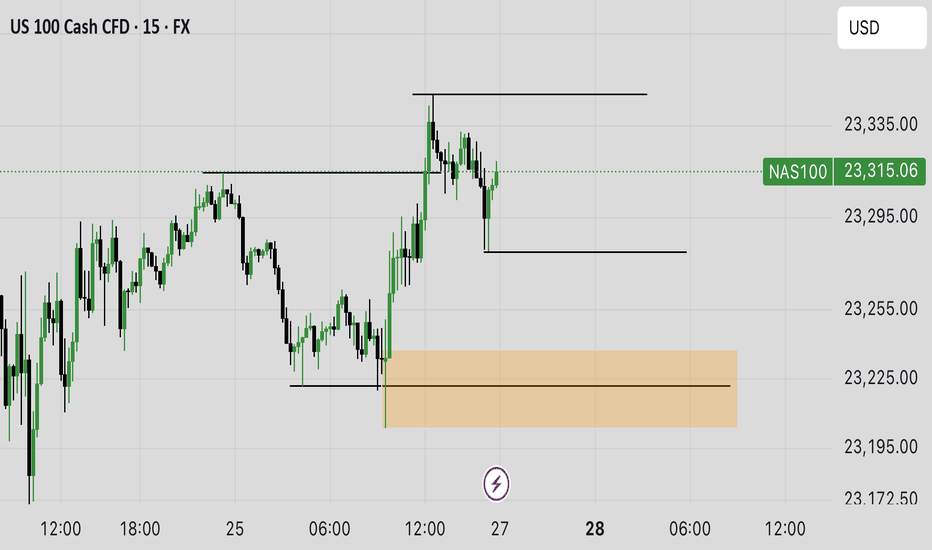

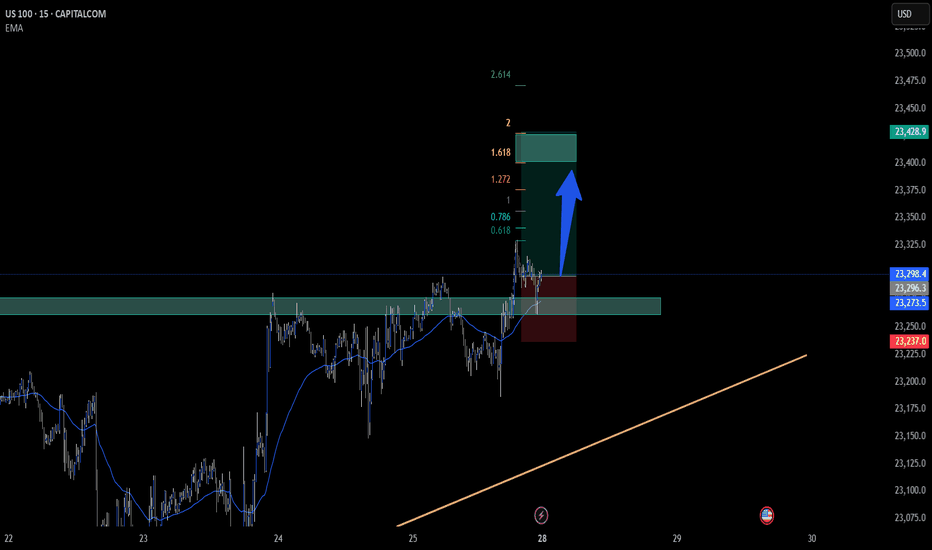

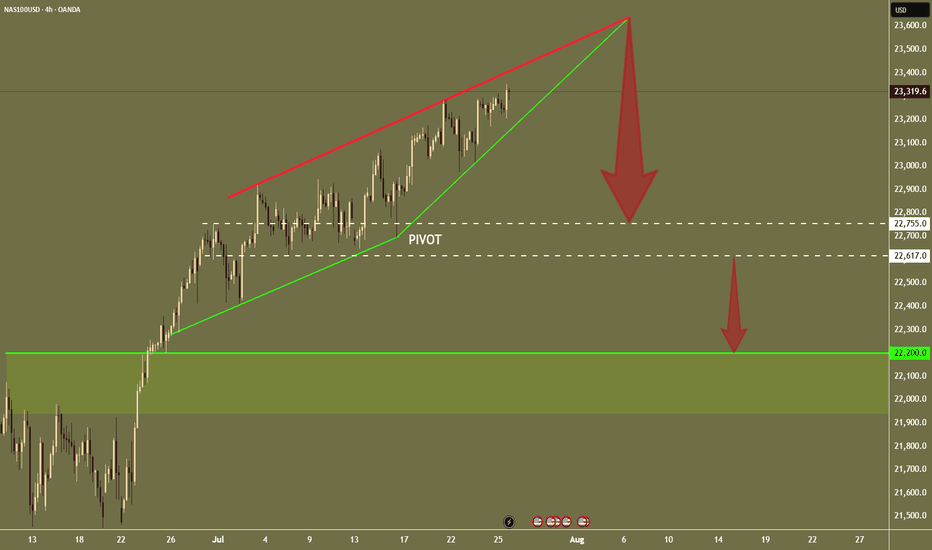

NAS100 - Potential TargetsDear Friends in Trading,

How I see it,

Insightful article: (The same principle applies to Nasdaq naturally)

1) Read the article first:

investinglive.com

2) Follow the link to watch the short video -

youtu.be

Keynote:

We are waiting for a decisive and very clear bearish signal

I promise you; we won't miss it.

It will be in our face, on a 4Hr grouping or a Daily grouping.

Most times it's 1 x Big Red signal on a high TF.

I sincerely hope my point of view offers a valued insight

Thank you for taking the time study my analysis.

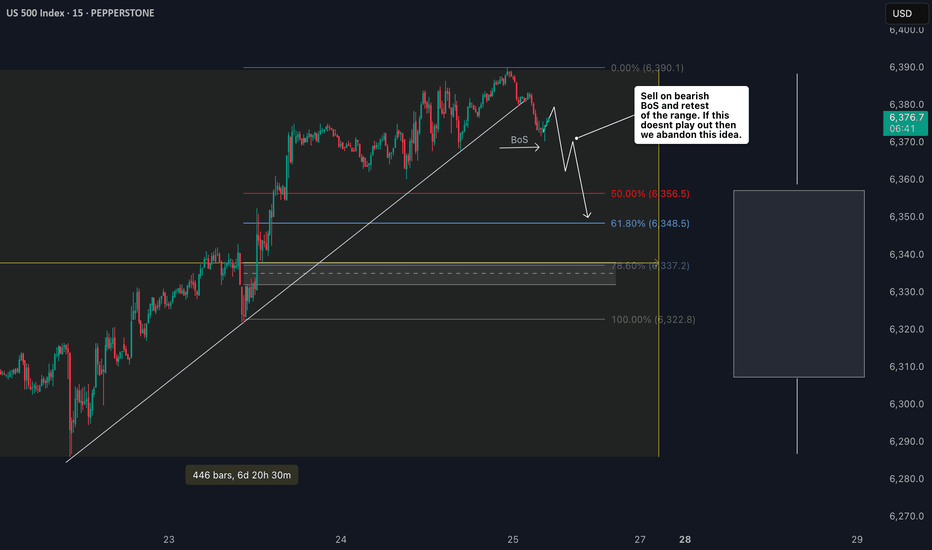

S&P 500 Counter-Trend Setup After Bullish Week US500Currently watching the S&P 500 (US500) closely 👀. The index has been in a strong bullish trend 📈, but I’m now evaluating a potential counter-trend opportunity.

Given the strength we’ve seen this week — possibly a “foolish rally” — there’s a chance we’ve either printed or are close to printing the high of the week 🧱. That opens the door for a retracement setup, particularly as we head into Monday’s open 🗓️.

🧠 Trade idea: If we get a bearish market structure break, I’ll be looking to enter short — targeting a 1R take profit initially, and holding a portion for a 2R–3R extension 🎯.

Friday sessions, especially after strong trends, often present clean intraday pullbacks — and when Monday’s low is set early, it can trap late buyers and fuel the move 📉.

⚠️ This is not financial advice — just sharing my thought process and trade plan.

Nifty index showing downtrend with negative divergence BEARISH VIEW Nifty index --showing downtrend with negative divergence , watch out important trendline breakdown and fib. levels on nifty index.

if it happens than there might be BLOOD BATH IN MIDCAP AND SMALL CAP INDEX ALSO

Nifty index may fall big time if breaks 24544 than 23460, 22580, 21700 possible.

lets see

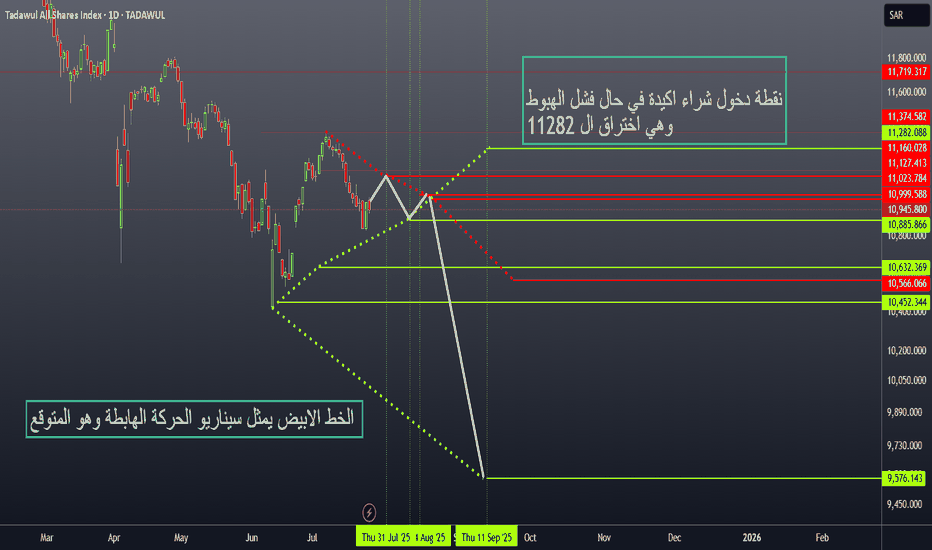

TASI Key Support & Resistance Levels This idea focuses on the Saudi Stock Market (TASI) key support and resistance levels based on time-sequenced price action.

Current support zone is highlighted (Point 1).

Time-based sequence:

🔺 Resistance on July 31 at 11126

🟢 Support on August 11 at 10885

🔺 Resistance on August 14 at 10999 / 10945

🟢 Support on September 1 at 9576

Connecting these points reveals the expected scenario shown in the second chart.

Key level: 11282 (Point 3) – A confirmed breakout above this level signals a strong buy opportunity, as it:

✔ Acts as a major support

✔ Breaks the descending channel

✔ Invalidates the bearish continuation scenario

📈 Watching for a bullish breakout above 11282 to enter long positions.

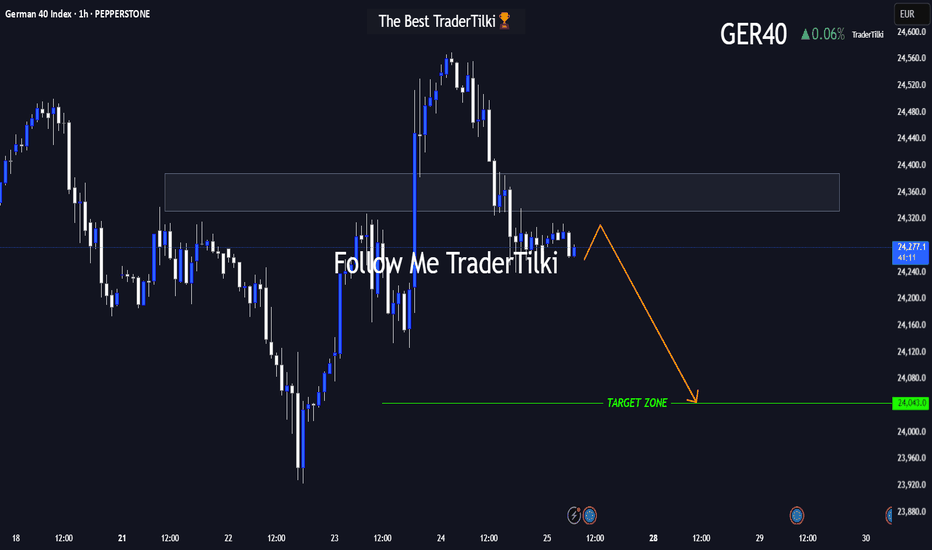

GER40 in Motion: This Setup Speaks Volumes 🌅 Good morning, my friends,

I’ve put together a fresh GER40 analysis just for you. Even if the 1-hour timeframe shows some upward momentum, I fully expect the price to reach my target level of **24,050**.

I'm holding firm until that level is hit.

Every single like from you is a massive source of motivation for me to keep sharing analysis. Huge thanks to everyone supporting with a tap!

Pressure Builds on Nifty Before ExpiryThe Nifty traded in a tight range for most of the week but eventually slipped below the 25,000 mark, ending on a weak note.

With the monthly expiry approaching, the index is likely to remain under pressure, and volatility may pick up in the coming sessions.

Key resistance levels are seen at 25,200 and 25,500. A decisive move above 25,500 could trigger an upside breakout. On the downside, support is expected around 24,500 and 24,400.

Given the current structure, traders are advised to stay cautious, focus on selective opportunities, and avoid aggressive positions until a clearer trend emerges.