AGL - Bull pending?Are there bulls lurking here ahead of potential rate cuts?

Our Bullfinder-official Team has identified a potential opportunity within ASX:AGL

If price can hold above the $10.00 mark, there may be potential for a re-rating of momentum to 'bullish'.

We would like to note however that below ~$10.00 significant bearish continuation risk comes into play.

We're inspired to bring you the latest developments across worldwide markets, helping you look in the right place, at the right time.

Thank you for reading! Stay tuned for further updates, and we look forward to being of service along your trading & investing journey...

Disclaimer: Please note all information contained within this post and all other Bullfinder-official Tradingview content is strictly for informational purposes only and is not intended to be investment advice. Please DYOR & Consult your licensed financial advisors before acting on any information contained within this post, or any other Bullfinder-official TV content.

AMP - Set for a comeback?After a troublesome decade, is AMP Limited set for a recovery?

Our Bullfinder-official Team has identified a potential opportunity within ASX:AMP

If price can hold above the $1.220 mark, there may be potential for a re-rating of momentum to 'bullish'.

We would like to note however that below ~$1.220 significant bearish continuation risk comes into play.

We're inspired to bring you the latest developments across worldwide markets, helping you look in the right place, at the right time.

Thank you for reading! Stay tuned for further updates, and we look forward to being of service along your trading & investing journey...

Disclaimer: Please note all information contained within this post and all other Bullfinder-official Tradingview content is strictly for informational purposes only and is not intended to be investment advice. Please DYOR & Consult your licensed financial advisors before acting on any information contained within this post, or any other Bullfinder-official TV content.

Finer Market Points: ASX Top 10 Momentum Stocks: 29 Apr 2025AMEX:ASM LSE:KNB NYSE:MEI ASX:NTU NASDAQ:ADN GETTEX:TKM ASX:RNU NASDAQ:ZEO ASX:WA8 ASX:DRO Momentum leading shares are the market's best performers today. They are the fastest-growing shares on the ASX over the last 90 days. These companies can't get to be leaders without first appearing on our Launch Pad list. The Launch Pad List is shared on Thursdays and the video interview published after market close on Fridays. Today's ASX's Top 10 Quarterly Momentum Stocks are: Australian Strategic Materials Ltd (ASM) Koonenberry Gold Limited (KNB) Meteoric Resources NL (MEI) Northern Minerals Limited (NTU) Andromeda Metals Limited (ADN) Trek Metals Limited (TKM) Renascor Resources Limited (RNU) Zeotech Limited (ZEO) Warriedar Resources Limited (WA8) DroneShield Limited (DRO)

Finer Market Points: ASX Top 10 Momentum Stocks: 28 Apr 2025 NYSE:NMR AMEX:ASM NYSE:SRL LSE:KNB GETTEX:TKM ASX:NTU NASDAQ:ZEO ASX:DRO NYSE:MEI ASX:WA8 Momentum leading shares are the market's best performers today. They are the fastest-growing shares on the ASX over the last 90 days. These companies can't get to be leaders without first appearing on our Launch Pad list. The Launch Pad List is shared on Thursdays and the video interview published after market close on Fridays. Today's ASX's Top 10 Quarterly Momentum Stocks are: Native Mineral Resources Holdings Limited (NMR) Australian Strategic Materials Ltd (ASM) Sunrise Energy Metals Limited (SRL) Koonenberry Gold Limited (KNB) Trek Metals Limited (TKM) Northern Minerals Limited (NTU) Zeotech Limited (ZEO) DroneShield Limited (DRO) Meteoric Resources NL (MEI) Warriedar Resources Limited (WA8)

Trade Idea: Supply Network Limited (ASX: SNL)SNL has demonstrated impressive resilience, staging a sharp V-shaped recovery and returning to all-time highs despite broader market uncertainties. The stock’s ability to maintain strength through news-driven volatility highlights robust underlying momentum.

With overall market volatility currently at manageable levels, a small initial position is warranted to participate in the ongoing uptrend, while maintaining disciplined risk management.

Entry Strategy:

Initiate a small long position at current levels to capitalize on potential continuation of the uptrend.

Risk Management:

Set an initial stop-loss at $36.21, representing a controlled downside risk of approximately 5.7% from current levels.

This setup allows for participation in the momentum while maintaining tight risk controls in case the trend fails to follow through.

⸻

DISCLAIMER : The content and materials featured are for your information and education only and are not attended to address your particular personal requirements. The information does not constitute financial advice or recommendation and should not be considered as such. Risk Management is Your Shield! Always prioritise risk management. It’s your best defence against losses.

PDI + inverse H+SPDI - weekly line chart.

Inverse H + S pattern formed and now has confirmed a breakout.

Not surprising that the gold price has helped this along.

KISS is the key. Keep it simple. no need to excessive indicators.

Just look at the price action.

Line charts are good as they cut out all the noise and smooths

out price action.

awsome setupweekly line chart of KCN.

Triangle setup looks nice and well

formed. If the breakout happens

to the upside expect a massive rally higher

as this baby has been in a congestion zone

for 5 years now.

The gold price will move higher in 2025 as the USD will be debased to maintain the illusion of growth. Learn the history of the Mississippi bubble. The piper will be paid.

Potential outside week and bullish potential for SPREntry conditions:

(i) higher share price for ASX:SPR above the level of the potential outside week noted on 28th March (i.e.: above the level of $1.955).

Stop loss for the trade would be:

(i) below the low of the outside week on 25th March (i.e.: below $1.685), should the trade activate.

Finer Market Points: ASX Top 10 Momentum Stocks: 23 Apr 2025 NYSE:NMR LSE:KNB NASDAQ:REE ASX:NTU AMEX:ASM NASDAQ:TRS ASX:DRO ASX:BGD NYSE:MEI LSE:CEL Momentum leading shares are the market's best performers today. They are the fastest-growing shares on the ASX over the last 90 days. These companies can't get to be leaders without first appearing on our Launch Pad list. The Launch Pad List is shared on Thursdays and the video interview published after market close on Fridays. Today's ASX's Top 10 Quarterly Momentum Stocks are: Native Mineral Resources Holdings Limited (NMR) Koonenberry Gold Limited (KNB) RareX Limited (REE) Northern Minerals Limited (NTU) Australian Strategic Materials Ltd (ASM) The Reject Shop Limited (TRS) DroneShield Limited (DRO) Barton Gold Holdings Limited (BGD) Meteoric Resources NL (MEI) Challenger Exploration Limited (CEL)

McMillan Shakespeare buy zoneJust looking around the equity markets for high dividend stocks, I found this one doing a correction.

Found a convergent zone (wave (C) measuring 100% of wave (A) and a normal five wave extension in wave (C) as well as bullish RSI divergence indicating that a change in price direction is inbound. Recent ratings upgrade and $20+ targets from analysts in recent news.

I'll be buying mainly to get the 10%+ dividends, but also to get some capital gains. No sell side target as yet. Medium term hold.

Bullish potential detected for INGEntry conditions:

(i) higher share price for ASX:ING along with swing up of indicators such as DMI/RSI, and

(ii) observation of market reaction at the resistance level at $3.30 (from the open of 18th February) after closing above 50 day and 200 day MAs.

Stop loss for the trade would be, dependent on risk tolerance:

(i) a close below the 200 day moving average (currently $3.22), or

(ii) below the support level from the open of 21st February (i.e.: below $3.19).

TYX.ASX - Potential Double Bottom For A Nice Profit.This would be a nice little trade, though a little dangerous. You need to look at the longer term lead in trend to the chart and you will see there is a down sloping trendline into this double bottom. I say it is ill defined because that centre peak is deformed relative to the valleys. However, despite this, this trade has potential because of the volume spike I have drawn out. A lot of traders have entered into this trade and are down about 80% at the moment. If one is able to buy this stock cheap, and cheaper the better is key here, there is about 250-300% to be made here. There is a large volume of traders above 0.026 that will likely want to sell if this stock rallys back to this level.

The trading plan for this would be to accumulate as low as one can and hold to the 0.025 level and either sell completely, or sell to break even and derisk, then to reassess the trade at that point. Buying at this level is risking a 40% dump to 0.001, for a 250% gain.

This Aussie Tech Gem Is Screaming BUY – If This Zone Holds!SDR (SiteMinder) is showing massive potential both technically and fundamentally:

- Trading 75.4% below fair value

- Forecasted to grow 65.36% YoY

- Earnings up 28.2% p.a. over the last 5 years

- Analysts expect 91%+ upside

On the chart, we’re sitting right on a high-probability monthly FVG + OB zone. If respected, we could see a strong rally back toward the $6.90–$7.78 buyside liquidity levels and beyond.

Key Levels to Watch:

📍 FVG support: ~$3.50

📈 Targets: $6.90 – $7.78

🧠 Confirmation needed via strong candle closes

🔥 Could be a high-reward play — but as always, DYOR!

XAM.ASX - Double Bottom, now a Triangle/Flag. This looks like a very promising setup. I should note, it is worth zooming out on this chart to see the full view of it because the down sloping trend line has a lot to play in this setup.

The double bottom has passed which is a reversal pattern, and the Triangle has now come up which is a continuation pattern. It is important to note that both of the chart patterns are of similar size which helps to validate the move. With the Triangle we are now waiting to see if it crosses the down sloping trendline. If we get this happening, it is likely we will get a pop to 0.083, and a retest of the trendline and the current resistance level. If the retest only goes as far as the trendline that will be very bullish, however we will keep our expectations tempered.

You could start accumulating here, but I'd rather wait to derisk and see if it can break and hold 0.065 and start buying there, or of course, buy some now and buy some more later. Up to you. The stop level is 0.047, and the initial target is 0.165. That makes a 25% risk for a 150% gain.

FDV.ASX - Trendline TradeNot really much to be said here, but this may develop into something. Sometimes I like to find setups like this that are quite "ripe" and sit on them. Pretty much what I will do here is leave this in my trading diary or on a watch list and just check on it once a week or once a month and see if it crosses that trendline and makes a nice reversal pattern.

EMV.ASX - Large Accending TriangleTo be honest this chart looks weak, but I've seen charts like this with this kind of setup pop, so I might put it on a watchlist. The large triangle has caputured the trade with the lower bound trendline being far steep than the upper. This sort of indicates that there is a good amount of demand underneath this stock, however since about the start of 2024 it really looks to be a bit weaker. This is indicated by most of the price action being close to the lower blue support level, and the price being sold down almost immediately once it hits the upper blue resistance level.

The price action has to hold this 1.75 level otherwise it will likely drop sharply. We have very low volume being traded at the moment although the last few weeks there has been higher than average volume. This will hopefully keep the level. Before this chart can turn bullish it has to break 2.10, possibly reach 2.40, at which point it should retest 2.10. If the 2.10 level can be maintained on a retest then I would say that this chart is bullish and is worth a buy. Which would make for a good trade, as the first target is 3.20, and the stop is 1.75. Meaning a 15% risk for an initial 55% gain.

AGN.ASX in an Accending Triangle with Repeating PatternI like trading bio and pharma stocks. They trade very similar to small cap miners, but with their own little personalities.

Anyway, a large triangle is here with the price coiling up against the 0.90 resistance level. There is that long term trendline that the price is trading up against that is holding the shape firmly. As we are coming to the tip of the triangle a decision point is reached. Will the price drop out below the trendline? Or will it pop above the resistance level? On top of this there are a set of repeating patterns here. It is a pretty weak correlation I will admit, but drawn in with the pink scribble you can see the basic shape of the pattern. I'm not holding firm to it, but if the pattern is accurate then as we are at the end of the second repeating pattern and at the tip of the triangle is gives further indication that a decision point is reached in the price action.

I wouldn't advise buying at this level. Although very cheap this is a weak point of the pattern and we need further strength to be certain that this pattern is going to want to continue upwards. I'd prefer to buy above the 0.80 level to derisk a little and to feel safer and so we can use the 0.70 level as a stop level, but the 0.60 level can be used also. 0.90 is the trigger level. Prints above this level indicates that the trade is on. At which point we will use fib. levels (in grey) to determine our targets.

Strange pattern on BTRA really strange pattern I've not seen before on this chart, but there is definitely something about it. In any case, leading into this pattern back in 2021 we see a very sharp double top from which we can draw the trendline from. The pattern looks like some sort of reversal pattern as the price is holding to the resistance level at 0.021 and there is a huge amount of volume serving to hold this level as a bottom. Entry would be safe now, holding a stop loss at round number 0.015, which at 35% is a long way down so if you are able to accumulate closer to that level all the better.

A trigger to indicate this pattern is a reversal will be a break of the trendline. At which point price action will likely revert back to the breakout level of 0.021 giving opportunity for a derisked second entry. Price targets are 0.027, 0.042 and 0.075.

It is worth noting that this stock has had a broker rate this stock for 0.08 valuation.

Potential outside week and bearish potential for CAREntry conditions:

(i) lower share price for ASX:CAR below the level of the potential outside week noted on 28th March (i.e.: $32.16).

Stop loss for the trade would be:

(i) above the swing high of 26th March (i.e.: above $34.05), should the trade activate.

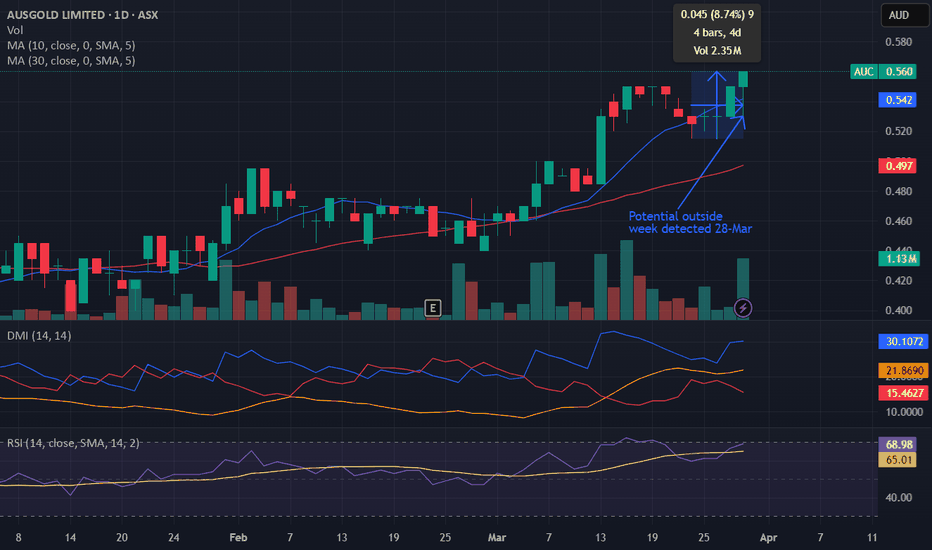

Potential outside week and bullish potential for AUCEntry conditions:

(i) higher share price for ASX:AUC above the level of the potential outside week noted on 28th March (i.e.: above the level of $0.56).

Stop loss for the trade would be:

(i) below the low of the outside week on 26th March (i.e.: below $0.515), should the trade activate.