Coronado Global Resources: Rise and Fall of a Coal PlayerASX:CRN AMEX:COAL PSE:COAL BSE:COAL1!

Coronado Global Resources (ASX:CRN) is an Australian company specializing in metallurgical coal for the steel industry. With assets in Australia and the USA, it holds a notable position in the market. But is it worth investing in now? Let’s find out.

Financial Performance for the First Half of 2024

• Revenue: $1.3 billion

• Net Profit: $16 million

• EBITDA: $135 million

• Net Debt: Only $5 million

Low debt levels and stable cash flow ($63 million for the half-year) are strengths of the company in a challenging industry.

Stocks: From Triumph to Fall

Since its IPO in 2018, when Coronado raised $500 million, the stock price has dropped from $1.50–2.50 to 26 cents. Main reasons:

• Decline in coal prices in 2024

• Collapse of the deal with Seven (Sweden)

• Global disruptions such as COVID-19

Some believe the drop is excessive and expect a recovery to $1.50–2.50.

Challenges on the Horizon

• Coal Prices: Fitch forecasts $120/ton in 2025

• Technical Issues: Failures at Curragh increase costs

• Taxes: Rising levies in Queensland squeeze margins

Growth Prospects

Coronado is not giving up:

• New Mammoth mine (launch in December 2024)

• Expansion of Buchanan in the USA

• 300 million tons of reserves in the Bowen Basin - enough for more than 20 years

Plus diversified markets (China, USA, Japan).

Outlook for Coal Demand and Growth

Despite tightening environmental regulations and the global shift to renewable energy sources, which are pressuring thermal coal, the prospects for metallurgical coal remain more resilient. This type of coal, Coronado’s specialty, is indispensable in steel production, and demand for it is likely to persist over the next 5–10 years, especially in Asia (e.g., China and Japan), where metallurgy remains a key industry. Infrastructure growth in developing economies supports this trend, and the lack of large-scale alternatives to coking coal strengthens its position. With high-quality reserves and plans to open new mines like Mammoth, Coronado is well-positioned to meet this demand. However, coal price volatility and potential technological breakthroughs in steelmaking could pose risks, requiring careful monitoring.

Is It Worth Investing?

Pros:

• Low debt and strong balance sheet

• Steady demand for metallurgical coal in the steel industry

• Price at 26 cents promises 5–10x growth potential

Cons:

• Technical analysis shows a downtrend

• Coal price volatility

Conclusion

Coronado is a risky but potentially profitable bet. Financial stability and new projects inspire optimism, but the coal market is fickle. For experienced investors, this could be an entry point.

LTR long - entering yearly demand zoneDiscounted area ahead if l'm right. LTF TDA & informed buyers level coupled with fearful distressed sellers.

-will be looking for bullish and bearish PA over coming days looking at price behaviors

- semi neutral position atm until confluences with price are clear with multiple factors 'if and then' met.

Potential outside week and bullish potential for KAREntry conditions:

(i) higher share price for ASX:KAR above the level of the potential outside week noted on 14th March (i.e.: above the level of $1.595).

Stop loss for the trade would be:

(i) below the low of the outside week on 11th March (i.e.: below $1.465), should the trade activate.

Potential outside week and bullish potential for ADTEntry conditions:

(i) higher share price for ASX:ADT above the level of the potential outside week noted on 21st February (i.e.: above the level of $4.41).

Stop loss for the trade would be:

(i) below the low of the outside week on 19th February (i.e.: below $3.97), should the trade activate.

LTR longs potential-IS price retesting demand zone in the future? price allowing good r/r ratio LTF analysis could be seen as exhausted sellers.

-remember its only revisiting zone ATM

-confirmed buyers will show bullish PA if its ready or NOT we still need multiple things down here to confluence before entering in ..

-zones are only zones when there's reactions

- price structure has to play out firstly

-stay unbias with no emotions.

My NEUTRAL status until PA presents THEN TURNING shlong.

3DP possible multibagger opportunityThis Chart uses EMA and an untraditional indicator the Darvas Box (100). I've personally found that Darvas Box(100) is a good entry filter. Enter when the price is within the box, preferably the lowest quarter of the box. Do not enter if the price is below the box. All the of the biggest runs start with SP being above the Darvas Box - However SP isn't guaranteed to run every time it is above the box.

Over the past 6 - 9 months 3DP has broken it's four year retracement and SP appears to be breaking out towards the upside.

The 50day EMA has just passed through the Darvas Box (100day) top. As highlighted - the last occurrence was mid 2020 which saw a 10x growth over the course of a year.

Current SP as posting on 30th March 2024 is a 0.084 SP has a potential to retrace to the 200day EMA 0.06 or further to the bottom darvas box (100) line which is at 0.04

A high level summary of who Pointerra are - 'Pointerra Limited is an Australia-based geospatial technology company. The Company is focused on the global commercialization of its 3D technology solution to support digital asset management activities across a range of sectors, including civil infrastructure, mining, oil and gas, architecture, engineering and construction, and others. Its cloud-based platform, Pointerra3D, is an end-to-end solution that stores, processes, manages, analyzes, extracts, visualizes, and shares the insights from 3D data. Its products include Pointerra3D CORE, Pointerra3D ANALYTICS and Pointerra3D ANSWERS. Pointerra3D CORE provides a common data environment where organizations can visualize different data types in a unified way and then store, manage and share them in a flexible way. Pointerra3D ANALYTICS creates a digital twin to enable intelligent analysis of physical assets. Pointerra3D ANSWERS delivers predictive insights that enable definitive answers to physical asset management questions.'

With Cash Receipts of $4.243M, Net Cash from Operating Activities of $1.447M, and a Cash balance of $4.6M, the company’s performance is clearly on track.

The total outgoing cash for the latest 3DP Quarterly report was $2.796M, which is just below the $2.855M average for FY 23/24.

This suggests that the cash outflow has returned closer to the average, especially after the higher outflows in the July to September 2024 quarter.

The substantial net cash inflows highlight the strong profitability of the business, particularly when higher cash receipts and revenue levels are achieved.

Ian Olsen and the management team have consistently emphasized that they are "not unhappy" with Finola Burke's (RAAS) projections. For FY 24/25, the forecast figures are as follows:

Revenue: $13.8M

GP: $12.7M

EBITDA: $2.19M

NPAT: $2.15M

EPS: $0.27

PER: 18

With a strong first half in FY 24/25 (cash receipts of $7.32M for the first 6 months), several already secured contracts, and numerous opportunities across Pointerra's six target sectors, these projections now seem well within reach.

I warrant that the information created and published by myself on TradingView is not prohibited, doesn't constitute investment advice, and isn't created solely for qualified investors.

Potential key reversal bottom detected for JHXAwait signals for entry such as DMI/ADX and/or RSI swing to the bullish direction.

Stop loss for the trade involving ASX:JHX (and indication that this trade is an absolute 'no-go') is any trade below the low of the signal day of 21st March (i.e.: any trade below $45.52).

Kaiser Reef Ltd - I'm Hyper bullish on thisShowed this to a friend and he said, "oh a small cap?"

Yes, somehow this is still a small-cap. Luckily for me. I have taken my position. If the price stays depressed over the coming weeks and months I will definitely be adding. No technical analysis, all fundamental and all of the fundamentals sound great to me (I am not in the Company and am definitely not a shill - not a paid one anyway :).

Firstly, the market cap is only AUD41.7m today. Crazy. Why crazy?

- They have AUD23 million on hand. So, take that off their market cap and their total operation is only valued at AUD18.7 mil.

- So what do you get for that? You get two gold processing plants (one in Vic and one in Tasmania). Together they have over 1500 tons per day processing capacity. I just read about a mine in Peru that got an estimate of USD89 mil for a 1500 tons per day gold processing capacity. Obviously, that is more remote. But even if the cost was only 33% of that (USD30 mil), it would still be more than the current Market Cap of Kaiser. Also, permitting, environmental approvals? Could take several years to install a plant elsewhere. Kaiser's are permitted and producing gold dore bars now.

- You get three highly prospective mines plus a few exploration projects (one that I want to see more about in the future; it is a gravity low, that is next to a magnetic high, on top of the gravity low at the very center is an historic gold mine. There is likely more gold there, how much? Will have to wait a few years to find out more about that one).

- All three mines (Henty, A1, and Maldon) are very high grade - A1 averaged 25 grams of gold per ton historically and they are commencing mining of high-grade ore this year after years of processing secondary grade ore.

- -Maldon reserves will be established over time. Maldon's historic production was 1.7Moz at an average of 28g / ton (including 300,000 ounces at 187g/ton AVERAGE from Nuggety Mine!). They are already compiling some really attractive drilling samples to establish reserves and extend the strikes. I am very interested to hear what they find underneath the historic workings of Nuggety Mine. There is underground infrastructure in place, but some work is needed to get it into production. ETA... not sure. Comes with a 120,000 ton/ pa producing production mill.

- Henty (newly acquired in March 2025) historic production of 1.9Moz averaging 8.9g / ton. Henty produced just under 25,000 ounces of gold in 2024 (avg grade 4g/ton). Additional exploration and expansion planned. Comes with its own 330,000 ton / pa producing production mill.

- If they even get both mills up to 50% capacity, with low-grade ore, this stock is going way way up. Back of the envelope using very conservative numbers: (capacity 550,000 t/pa / 2 = 275,000ton/pa x 4g per ton = 1,100,000 grams / 31.103 (grams per troy ounce) = 35,366 ounces pa). 35,366 ounces at $4800 an ounce is 169.75m gross revenue. Maybe a 15% net profit percentage (pretty conservative in this environment where Goldman Sachs just upgraded their target for gold in 2025 to USD3300/oz) = 25.464m pa net. If they have a PE ratio of 20 the market cap would be AUD509.275m which is 12.2 times higher than the current Market Cap. That is without any acquisitions, any gold price rises, adding any additional gold reserves (which they will add soon). If they only net 10% net profit the Market Cap should (at a minimum expand to AUD339.5m or 8.1 times the current Market Cap. 36,000 ounces is unachievable? That is the target the exec team set for the Company in 2025... not 2027... but soon. That is even without Maldon in production.

Can nobody do math? Is nobody willing to take a risk on a very prospective looking operation? Some people will.

I also like the exec team. They seem to;

- Have a nose for a good deal,

- Are not about buying over-valued assets (like a lot of the gold mind mergers you hear about these days. Big players buying fully-priced mega-mines with huge debt leverage. They will never survive any price drops and will end up being sold off at fire-sale prices by creditors),

- They have a real sense of urgency in getting things moving. Buying working assets at fire-sale prices, with a near-term plan (that is tracking) to steadily improve production, cash-flow, mine grades, mine life etc.

Anyway, I am going on. Do your own research. I shouldn't be writing this. It may mean I cant add much more to my position at low prices. I'm having some luck with gold miners - check out New talisman Gold on NZX (I still think it will go up 5 x from todays price when they start steady production).

BKY Berkeley Energia ASXWeekly chart of BKY

Currently breaking out of weekly triangle within a larger triangle pattern

Will likely get to $0.57c relatively quickly which is the larger triangle trend line

Given the hovering around current levels I'm almost thinking that is accumulation which may push this through multi year resistances and breakout for a strong move higher

Full disclosure this is a long term position I have had for a while now...

BKY Monthly Chart 2BKY Monthly chart

Elliot wave corrective patterns and Large triangle, added Triangle base target estimate to possible breakout area

Likely $2.70, currently $0.425 = 630% or 6.3 reward to risk if you are willing to keep it to $0.00

Not making money but very experienced and qualified management team developing its spanish mine,

BKY has a current ratio of 31x which suggests it has large reserves circa ~$75mil as of Early 2025 suggesting it has a large reserve to convert assets into production

Potential outside week and bullish potential for GSNEntry conditions:

(i) higher share price for ASX:GSN above the level of the potential outside week noted on 21st February (i.e.: above the level of $0.024).

Stop loss for the trade would be:

(i) below the low of the outside week on 18th February (i.e.: below $0.020), should the trade activate.

Potential key reversal top detected for WBTLevel of interest: Prior support/resistance levels in the past of $3.04 (09-Aug-2022) and $3.75 (12-Dec-2022) (key support/resistance areas to observe).

Await signals for entry such as DMI/ADX and/or RSI swing to the bearish direction, and observe market reaction to support/resistance area at $3.04 to confirm.

Stop loss for the trade involving ASX:WBT (and indication that this trade is an absolute 'no-go') is any trade above the high of the signal day of 2nd January (i.e.: any trade above $3.80).

Potential outside week and bearish potential for GYGEntry conditions:

(i) lower share price for ASX:GYG below the level of the potential outside week noted on 21st February (i.e.: $38.58).

Stop loss for the trade would be:

(i) above the swing high of 19th February (i.e.: above $45.99), should the trade activate.

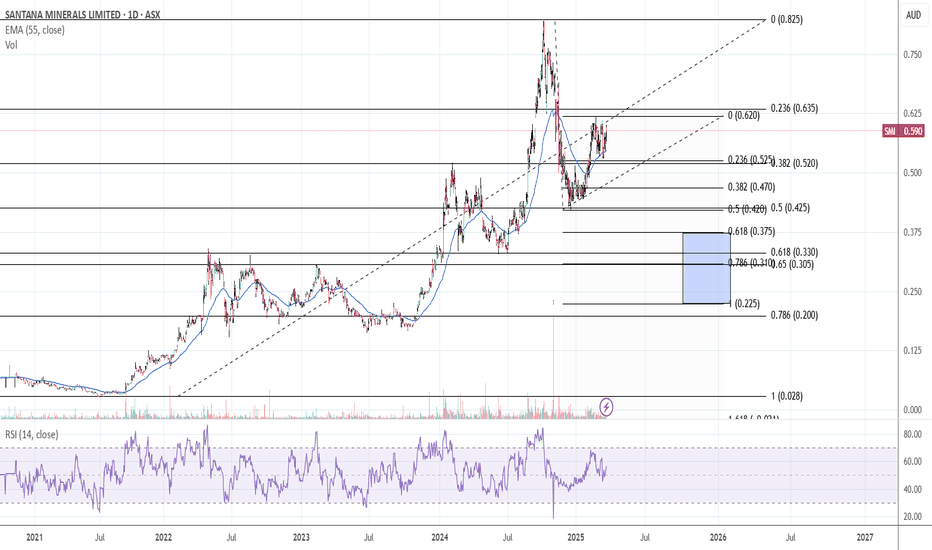

Santana Minerals - good project, but not a buy yetGday,

I believe the project is currently under-valued as a producing asset. However, it is not producing. They just applied for a Mining Permit today. From their announcement, a minimum of 6 months until resource consent is granted, maybe a little longer for the full permit. I'm not an expert about what steps would then be required after that.

Then, they would have to commence construction... so production is a little ways off (3 years maybe???). So, I expect a number of investors will lose patience if the share price declines while physical gold continues higher. Some will sell and it MAY drop down into my blue box. I will re-evaluate the project and the timing should that happen. It may not happen, it may go to the moon without me on-board. But, the market is tough on explorers and developers these days. It all seems to be about cash-flow.

The gold grade seems good at >2g/ton. To some it may appear marginal, but check out Capricorn Metals on the ASX if that is how you feel. They are 3 years into production, grades LESS THAN 1g/ton of ore and they have an AUD 3.3B market cap and are netting 20% of gross income. If this project does anywhere near as well it is a screaming buy. But, I'll be waiting for lower prices simply because there are other projects out there that are (in my view) more undervalued and / or further on towards production. I was up 12% on Santana over a few months but sold and bought NTL at 0.049 two days ago... that is up 10% already.

Santana MineralsGday,

I believe the project is currently under-valued as a producing asset. However, it is not producing. They just applied for a Mining Permit today. From their announcement, a minimum of 6 months until resource consent is granted, maybe a little longer for the full permit. I'm not an expert about what steps would then be required after that.

Then, they would have to commence construction... so production is a little ways off. So, I expect a number of investors will lose patience if the share price declines while physical gold continues higher. Some will sell and it MAY drop down into my blue box. I will re-evaluate the project and the timing should that happen. It may not happen, it may go to the moon without me on-board. But, the market is tough on explorers and developers these days. It all seems to be about cash-flow.

The gold grade seems good at >2g/ton. To some it may appear marginal, but check out Capricorn Metals on the ASX if that is how you feel. They are 3 years into production, grades LESS THAN 1g/ton of ore and they have an AUD 3.3B market cap and are netting 20% of gross income. If this project does anywhere near as well it is a screaming buy. But, I'll be waiting for lower prices simply because there are other projects out there that are (in my view) more undervalued and / or further on towards production. I was up 12% on Santana over a few months but sold and bought NTL at 0.049 two days ago... that is up 10% already.

Bearish potential detected for WHCEntry conditions:

(i) lower share price for ASX:WHC along with swing up of the DMI indicators and swing down of the RSI indicator, and

(ii) observation of market reaction at the support level at $5.55.

Stop loss for the trade would be, dependent of risk tolerance:

(i) above the resistance level from the open of 21st February (i.e.: above $5.80),

(ii) above the resistance level from the open of 13th January (i.e.: above $5.91), or

(iii) above the resistance level from the open of 30th December (i.e.: above $6.00).

Bullish on ARU Nice Long op here.

Price jumped up to 0.275 on news of government intervention back in March 24. Retail traders jumped in longs expecting price to surge. Institutions have then pushed the price back down to the previous low at 0.115 and stopped out all retail traders before we get the real move up.

I've jumped in around 0.125 looking for price to get back up to the first liquidity zone at 0.28. Will see how price reacts there.

Happy trading!