Wycoff Accumulation Phase?Carrefour is one of the world's largest grocery retailers, think of it as the European Walmart. But the execution of the business by management could not be any different. We are talking about a 90% decline since it's highs in 1999. Failed market expansion, competition from budget retailers like Aldi and Lidl, online retailers have taken market share. This company has suffered and anyone bag holding this must have written this off as a bad nightmare.

The chart suggests that we could be back in an accumulation phase. We are sitting at the 25 year trend line resistance, if this is broken and we reclaim the POC, this could set up for a nice counter rally.

This chart is more a warning than an investment idea. Don't get caught out holding bags, especially not in retail names with weak moat and intense competition.

Ryanair Takes Off Strong Despite TurbulenceBy Ion Jauregui – Analyst, ActivTrades

Ryanair (ISE: RYA) closed its 2024/25 fiscal year with results that—despite some headwinds—demonstrate the resilience of its ultra-low-cost model. The Irish carrier posted a 4 % increase in revenues to €13,950 m, up from €13,444 m in 2023, while net profit fell 16 % to €1,610 m, penalized by fares that were 7 % lower and disputes with online travel agencies that impacted ticket sales. Despite the drop in profitability, Ryanair carried a record 200.2 million passengers over the past year—9 % more than the previous period—and has revised its guidance to 206 million passengers in 2026 thanks to a rebound in fares and summer bookings, which are already 1 % ahead of last season.

Key Financial Data

• 2024 (year ended 31 Mar 2024):

o Revenues: €13,444 m

o Net profit: €1,920 m

o Passengers carried: 200.2 m (+9 % YoY)

• 2025 (year ended 31 Mar 2025):

o Revenues: €13,950 m (+4 % YoY)

o Net profit: €1,610 m (–16 % YoY)

Analysis

As of the close on 20 May 2025, Ryanair’s share price stood at €23.70, having traded in a YTD range of €19.59–21.75—about a 23.5 % gain since January. On 2 May this range was breached, and the stock reached a high of €24.23 yesterday. That level corresponds roughly to the 23.8 % Fibonacci retracement, suggesting the price may struggle to exceed €25 without first establishing a new support level to underpin further gains. The current upside potential from today’s levels is around 3 %, and the consensus rating is “Outperform.” Moving-average crossovers support this bullish thesis: on 29 April, the 50-day MA crossed above the 100-day MA, confirming a strong uptrend and signaling stability. Additionally, the “bell signal” is robust within the trading range, reinforcing the case for a partial pullback toward the top of the range before the next leg up.

Outlook

With summer bookings and fares starting the season strongly, Ryanair plans to bolster its shareholders’ returns via a €750 m share buyback program and a €400 m special dividend, while optimizing its fleet in anticipation of potential delays to the 737 MAX 8 deliveries in Europe. The carrier believes that moderating fuel costs and strong underlying demand will support profitability in the 2025/26 fiscal year.

Conclusion

Ryanair once again underscores the strength of its ultra-low-cost model: it carried a record number of passengers, adjusted fares upward, and raised its traffic guidance—all despite margin pressure. With a solid stock performance (YTD gain near 24 %) and an analyst consensus rating of “Outperform,” the airline heads into summer with confidence. The €750 m buyback and €400 m special dividend reinforce its shareholder commitment, while lower fuel costs and efficient management of the 737 MAX fleet underpin expectations for a rebound in profits in 2025/26. In short, Ryanair is catching a favorable tailwind that could lift both its results—and its share price—to new highs by 2026.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.

Head and Shoulders CompleteThe H&S target drop of 33% has been met. I believe we are in the final leg of the ABC correction. The question now is where does the final C leg land? We are sitting in the golden fib pocket, if $480 support is lost then I expect a drop to $400-410. This could be a great place to add for a long term investment. Alternatively we could put in a double bottom here and grind back up.

Not financial advice, do what’s best for you.

Eden still Red - but not for longLooking outside the crowded US tech space and more at longer term value compounders, Edenred ticks a lot of boxes and is worth both a fundamental and technical analysis.

Edenred represents a compelling opportunity for long term investors seeking exposure to the growing intersection of fintech, digital payments, and employee benefits. With a strong foothold in over 45 countries and a user base spanning over 60 million individuals, Edenred’s business model is rooted in high-margin, recurring revenues through solutions like meal vouchers, mobility cards, and digital corporate payments. Over the past three years, Edenred has delivered consistent double-digit revenue growth — up ~18% in 2022, 25% in 2023, and 17% in 2024 — signaling both strong execution and a robust underlying demand for its digital-first platform.

A conservative DCF model, based on a 12% revenue CAGR over the next five years, 25% free cash flow margins, an 8% discount rate, and a 2.5% terminal growth rate, yields an intrinsic value of ~€65 per share, well above its current market price of €27, offering an attractive 58% upside. This disconnect between Edenred’s fundamentals and its valuation is striking, especially given its inclusion in the CAC 40 index and exposure to secular tailwinds in digital transformation, remote work, and ESG-aligned employee welfare programs.

The TA of the chart doesn’t look great, the stock hasn’t recovered since the 2022 sell off. Yet the company continues to grow revenue and offers a highly attractive dividend yield. We are getting bullish divergences on the RSI and we are sitting at previous all time high resistance which appears to be support. The 5 wave move down may be over and should the US tech space sell off, I would expect money to flow into Europe and the safer dividend plays.

I’m keeping an eye on this, not financial advice.

TTE: Ready for a correction if the brent suffers from macro Correlation with Oil Prices:

TTE, being an oil and gas company, is closely correlated with WTI and Brent crude oil prices.

Market Uncertainty:

The fundamentals of industrial production are uncertain due to high commercial tariffs and evolving economic conditions, which could impact demand and slow down industrial activities.

OPEC+ Production:

OPEC+ countries are expected to increase production more than anticipated, potentially leading to a slight correction in oil prices .

Financial Strategies:

TTE has buyback plans and other financial revenues, which could provide some stability 3 4.

Stock Price Prediction:

If oil prices range between €50 and €65 per barrel, TTE's stock might vary between €42 and €55.

From a technical standpoint, breaking the €52 level on a weekly timeframe could lead to a correction down to €42.

Conversely, stable fluctuation above €52 could keep the stock in a fluctuating mode, potentially rising to €60.

Let's keep an eye on how things evolve! If you found this analysis helpful, please like and boost 😊

Renault’s €2.2 BILLION Loss SHOCKER: Nissan’s Costs Hit Hard!Renault’s €2.2 BILLION Loss SHOCKER 💥: Nissan’s Turnaround Costs Hit Hard! 🚗💸

Imagine Renault and Nissan are like best friends 🤝 who share a big toy car company 🏎️. Renault owns a big piece of Nissan, kind of like having a lot of the toy car's parts 🛠️. But Nissan had a tough year because fewer people bought their cars 📉, especially in places like China 🇨🇳. To fix this, Nissan is making some big changes, like making fewer cars 🚘 and saying goodbye to some workers 👋. These changes cost a lot of money 💰, and because Renault owns part of Nissan, Renault has to share the cost 😓. This means Renault will lose some money this year, about 2.2 billion euros 💶, which is like losing a giant pile of coins! 🪙 But Renault's bosses think these changes will help Nissan make better cars and sell more in the future 🌟, so both friends can be strong again 💪.

Analysis (Up to May 13, 2025):

Renault Group’s announcement of a €2.2 billion hit to its first-quarter earnings 📊 stemming from its 35.71% stake in Nissan reflects the interconnected financial dynamics of their strategic alliance 🤝, as well as broader challenges in the global automotive industry 🌍. Below is an institutional-level analysis of the situation, incorporating the provided data and contextualizing it within the current market environment as of May 13, 2025 🕑.

1. Financial Impact and Impairment Context 📉

Renault’s Exposure to Nissan: Renault’s €2.2 billion earnings hit 💥 is directly tied to Nissan’s reported net loss of approximately $5 billion 📅 for the fiscal year ending March 2025. This loss includes impairments (writing down the value of assets like factories 🏭 or inventory 📦 that are no longer worth as much) and restructuring costs (expenses for layoffs 👥 and factory reductions 🔽). As a 35.71% shareholder, Renault absorbs a proportional share of Nissan’s financial setbacks 📉, which are booked as a negative contribution to Renault’s earnings 💸.

Accounting Implications: The impairments reflect Nissan’s need to adjust the book value of its assets 📜 to align with weaker market performance 📊, particularly in China 🇨🇳, where sales have significantly declined 📉. Restructuring costs are linked to Nissan’s November 2024 announcement of cutting 9,000 jobs 🚫 and reducing global production capacity by 20% 🔧. These measures aim to streamline operations but involve upfront costs 💰, impacting Renault’s financials due to equity accounting rules for its Nissan stake 📈.

Market Reaction: Despite the earnings hit, Renault’s shares rose 1.2% to €48.46 in early trading on the announcement day 📈, suggesting investor confidence in the long-term benefits of Nissan’s turnaround plan 🌟 or optimism about Renault’s core operations 🚗. This resilience may also reflect broader market dynamics, such as stabilizing demand in Europe 🇪🇺 or positive sentiment toward Renault’s electrification strategy ⚡.

2. Nissan’s Turnaround Plan and Strategic Rationale 🔄

Sales Decline: Nissan’s fiscal 2025 sales fell 4.3% to 3.3 million units 📉, driven by weakness in China 🇨🇳, Japan 🇯🇵, and Europe 🇪🇺. China, the world’s largest auto market 🌐, has been a pain point for many global automakers due to intense competition from domestic brands like BYD 🚘 and declining demand for traditional vehicles amid an economic slowdown 📉.

Restructuring Efforts: Nissan’s turnaround plan, announced on April 24, 2025 📅, focuses on cost reduction 💸 and operational efficiency 🔧.

The 9,000 job cuts 🚫 and 20% reduction in production capacity 🔽 signal a shift toward leaner operations, prioritizing high-margin markets and products 📈. This aligns with industry trends, as automakers globally face pressure to adapt to lower demand for internal combustion engine vehicles 🚗 and invest heavily in electric vehicles (EVs) ⚡.

China Strategy: Nissan’s weak performance in China 🇨🇳 underscores the need for a revised market approach 🔄, potentially involving localized EV models ⚡ or partnerships to compete with dominant players 🏆. The impairments likely include devaluing assets tied to underperforming Chinese operations, such as factories 🏭 or unsold inventory 📦.

3. Renault-Nissan Alliance Dynamics 🤝

Historical Context: The Renault-Nissan-Mitsubishi Alliance, formed in 1999 🗓️, has been a cornerstone of both companies’ global strategies 🌍, enabling shared R&D 🧠, platforms, and cost efficiencies 💰. Renault’s significant stake in Nissan ties their financial fates closely 💸, but recent years have seen tensions 😬, including governance issues and strategic divergences, particularly after the 2018 Carlos Ghosn scandal 🚨.

Mutual Dependence: While Nissan’s challenges weigh on Renault ⚖️, the alliance remains critical for both. Renault benefits from Nissan’s scale in markets like North America 🇺🇸 and Asia 🌏, while Nissan leverages Renault’s expertise in Europe 🇪🇺 and EV technology ⚡ (e.g., Renault’s success with models like the Megane E-Tech 🚗).

The €2.2 billion hit 💥 underscores the risks of this interdependence but also highlights Renault’s commitment to supporting Nissan’s recovery 🌟, likely viewing it as essential for the alliance’s long-term viability 📅.

Potential Risks: If Nissan’s turnaround falters 🚫, Renault could face further financial strain 😓, including additional impairments 📉 or pressure to dilute its stake. Conversely, a successful restructuring could strengthen the alliance 💪, boosting shared EV development ⚡ and cost synergies 💸.

4. Industry and Macro Context (Up to May 13, 2025) 🌍

Global Auto Industry: The automotive sector faces a complex transition in 2025 🔄, balancing the shift to EVs ⚡, supply chain disruptions 🚚, and regional demand variations 📊. European automakers like Renault are under pressure to meet stringent EU emissions targets 🌿, while Japanese firms like Nissan grapple with declining relevance in markets like China 🇨🇳, where EV adoption is accelerating ⚡.

China’s Role: China’s market challenges are systemic 🌐, with global automakers losing share to local brands 🚗. Nissan’s sales drop 📉 reflects this trend, and Renault’s indirect exposure via Nissan amplifies its vulnerability to China’s slowdown 😓.

EV Transition: Both Renault and Nissan are investing in electrification ⚡, but Nissan’s restructuring may delay its EV rollout 📅, potentially ceding ground to competitors 🏆. Renault, with its stronger EV portfolio in Europe 🇪🇺, may need to lead alliance efforts in this area 🚗.

Macro Factors: Rising interest rates 📈, inflation 📊, and geopolitical uncertainties 🌍 (e.g., trade tensions) continue to impact consumer demand and production costs 💰. These factors likely exacerbate Nissan’s sales declines 📉 and Renault’s financial hit 💸.

5. Long-Term Outlook (4-10 Year Horizon) 🔮

Nissan’s Recovery Potential: If Nissan’s restructuring succeeds ✅, it could emerge leaner and more competitive by 2029 📅, with a focus on high-growth segments like EVs ⚡ and markets like North America 🇺🇸. This would benefit Renault through improved equity income and alliance synergies 🤝.

Renault’s Strategy: Renault is likely to prioritize its European operations 🇪🇺 and EV leadership ⚡ while supporting Nissan’s recovery 🌟. Divesting its Nissan stake seems unlikely in the near term 🚫, given the strategic importance of the alliance, but Renault may seek to diversify its portfolio to mitigate risks 🛡️.

Alliance Evolution: Over the next 4-10 years 📅, the Renault-Nissan-Mitsubishi Alliance could deepen integration in EV platforms ⚡ and autonomous driving 🤖 or face pressure to restructure if financial strains persist 😓. External partnerships (e.g., with Chinese firms for Nissan 🇨🇳) or mergers could reshape the alliance’s structure 🔄.

Risks to Monitor: Key risks include prolonged weakness in China 🇨🇳, failure to execute EV strategies 🚫, and macroeconomic volatility 🌍. Regulatory changes, such as stricter emissions rules 🌿 or trade barriers 🚧, could further complicate the alliance’s plans 📜.

Conclusion 🎯

Renault’s €2.2 billion earnings hit 💥 reflects the immediate financial burden of Nissan’s restructuring and market challenges, particularly in China 🇨🇳. However, the institutional perspective sees this as a strategic investment in Nissan’s long-term recovery 🌟, critical for the Renault-Nissan-Mitsubishi Alliance’s competitiveness in a rapidly evolving industry 🚗. For a 4 to 10 year old, it’s like Renault helping a struggling friend fix their toy car 🛠️, taking a short-term loss 💸 to ensure both can play better in the future 🎉. Over the next 4-10 years 📅, the success of Nissan’s turnaround and the alliance’s ability to navigate the EV transition ⚡ will determine whether this hit becomes a stepping stone 🪜 or a recurring burden ⚖️.

Strategic Toast for Diageo and Pernod Ricard in IndiaIon Jauregui – Analyst ActivTrades

The recent trade agreement between the United Kingdom and India has delivered a game-changing moment for major alcoholic beverage companies, particularly those with significant exposure to Scotch whisky. The reduction of import tariffs from 150% to 75% opens the door to substantial expansion in one of the world’s most promising markets: India.

Solid Economic Fundamentals

For Diageo (LSE: DGE) , the global leader in premium alcoholic beverages and parent company of iconic brands like Johnnie Walker, Tanqueray, and Guinness, the news could not have come at a better time. India already represents its largest market by volume, with sales reaching $1.3 billion in 2024—6% of total revenue. The ability to offer premium products at more competitive prices could further solidify its position in the Asian market and significantly boost margins. Diageo generates more than £17 billion in annual revenue, with operating margins close to 30%. Its business model is built around premiumization and brand strength, allowing it to maintain consistent profitability and a stable dividend policy. However, the company has recently faced challenges such as slowing consumption in the U.S. and volatility in emerging markets.

Pernod Ricard (EPA: RI) , Diageo’s direct competitor, also stands to benefit from the agreement. The French company, owner of brands such as Chivas Regal, Jameson, and Absolut, holds approximately 30% of the Scotch whisky market share in India. According to Goldman Sachs estimates, the tariff cut could translate into a multi-percentage-point increase in earnings per share, at a time when the sector is grappling with falling demand and inventory surpluses.

From a financial perspective, both companies show solid fundamentals, though with specific challenges. Pernod Ricard closed its last fiscal year with sales exceeding €12 billion and operating margins above 25%. Its strategy has focused on reinforcing the positioning of high-end brands through sustained investment in marketing and local distribution, especially in Asia. Still, excess stock and changing consumption patterns in Europe have limited its recent performance.

Technical Analysis

Diageo has undergone corrections from its 2022 highs of £3,763 to lows of £1,807 in April this year. The stock has since rebounded to £2,179. The daily chart shows the point of control around £2,307—slightly above the current price. Moving average crossovers suggest a potential corrective upward trend that has not yet materialized. The RSI stands at 63.89%, indicating overbought conditions, suggesting that an upward trend may emerge in the coming weeks.

Pernod Ricard, by contrast, has been in a downward trend since 2023, seemingly finding support at €83.04, also in April this year—coinciding with 2016 price levels. The current point of control is around €106. Moving averages appear to indicate a shift in direction to the upside. If conditions improve, we could see a potential move toward €120.

Opportunity and Competition

The trade agreement offers both companies a clear tactical advantage, though not without challenges. Despite the national tariff reduction, state-level taxes within India remain a significant operational barrier. Moreover, winning over the Indian consumer will depend not only on price, but also on the ability to connect with cultural preferences and deliver differentiated brand propositions.

In an environment where major economies are seeking to diversify and strengthen trade ties, this agreement could mark the beginning of a new era for the premium alcoholic beverages sector. For Diageo and Pernod Ricard, it’s a moment to raise a glass—but with a firm focus on strategy.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance is not reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk.

ABI Showing Bullish Signs Above EMA 209 – Potential Breakout ABI Showing Bullish Signs Above EMA 200 – Potential Breakout Ahead

Anheuser-Busch InBev (ABI) experienced a significant drop in 2021, marked by a large-volume bearish candle. Since then, the stock has been gradually recovering and is now trading above the EMA 200, indicating a potential shift in trend.

Key observations:

Price above EMA 209: Suggests a bullish long-term trend.

Gradual recovery: Indicates steady accumulation.

Potential breakout: A move above recent resistance levels could confirm a bullish breakout.

Monitoring for a sustained move above resistance with increased volume could provide a strong bullish signal.

Not financial advice – just my technical analysis.

#ABI #AnheuserBusch #StockAnalysis #EMA200 #BullishTrend #TechnicalAnalysis #TradingView

Is Europe's Decline Grounding Airbus's Ascent?Europe's economic situation presents a complex picture of modest growth juxtaposed with significant challenges, creating uncertainty for major players like Airbus. In 2024, the European Union's GDP growth was projected to be below 1%, with only a slight acceleration anticipated for 2025. This sluggish economic expansion, when coupled with persistent inflation and ongoing geopolitical tensions, lays an unstable foundation for sustained economic prosperity.

The cohesion of the European Union itself is increasingly in question, influenced by the rise of nationalist sentiments and the potential for increased trade protectionism. The EU faces structural challenges, including economic disparities, political divisions, and growing Euroscepticism, which could precipitate its disintegration. Should this occur, individual countries would be forced to navigate complex economic and geopolitical landscapes independently, generating significant implications for multinational corporations like Airbus.

Concurrently, Airbus is navigating a highly competitive environment, most notably with its enduring rivalry with Boeing, which is actively seeking to overcome its recent operational and reputational hurdles. While Airbus has recently secured a larger market share, Boeing's inherent resilience, combined with the potential entry of new competitors, may challenge Airbus's current market dominance.

To sustain its competitive edge, Airbus must not only effectively manage the economic uncertainties and potential fragmentation within Europe but also maintain its commitment to technological innovation and efficient production. The company's ability to nimbly adapt to these multifaceted challenges will be crucial in determining its long-term success and continued leadership in the global aerospace industry.

Christian Dior Stock Chart Fibonacci Analysis 042825Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 450/61.80%

Chart time frame:D

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: C

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provides these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

I started this analyses Aug 2022. Now I think HEY can grow to 60After the price breaks € 40, the way is open to grow to € 60.

Ofcourse, with ups and downs in between. Never a straight line.

I strarted my analyses August 2022 and since then, I had almost every movement right.

I advise to work with options on this beside stocks.

I started this analyses Aug 2022. Now I think HEY can grow to 60After the price breaks € 40, the way is open to grow to € 60.

Ofcourse, with ups and downs in between. Never a straight line.

I strarted my analyses August 2022 and since then, I had almost every movement right.

I advise to work with options on this beside stocks.

OVH Group – Beneficiary of EU-US Decoupling?OVH Group – Positioned to Benefit from Europe’s Digital Decoupling from the US

We are seeing a clear push toward reducing Europe’s dependency on American when it comes to the Blocks National Security. US cloud firms like Microsoft, Amazon, and Google are increasingly viewed as sovereignty risks, given the reach of US laws like the CLOUD Act.

This shift is creating strong political and regulatory support for European alternatives. OVH Group, as the leading European-owned cloud infrastructure provider, could stand out as a key beneficiary, should this trend prevail. The company is well positioned to take on new demand from both public and private sector clients looking for a sovereign, EU-based solution that aligns with data protection and national security goals.

OVHcloud is actively involved in providing cloud infrastructure services to European public sector entities, including those with stringent security requirements. While specific government security contracts are not publicly detailed, OVHcloud has positioned itself as a trusted provider for sensitive data hosting. The company emphasises its commitment to data sovereignty and compliance with strict data security and confidentiality requirements, operating exclusively within the European Union and not subject to extraterritorial laws like the U.S. CLOUD Act.

OVHcloud has built data centers within the EU dedicated to storing sensitive data, ensuring that services hosted in these "zones of confidence" are operated entirely within EU territory. These services comply with the highest standards and possess necessary security and data protection certifications.

Furthermore, OVHcloud has obtained the SecNumCloud 3.2 qualification for its highly secure cloud platform, Bare Metal Pod. This certification, awarded by the French Cybersecurity Agency (ANSSI), acknowledges the platform’s adherence to stringent security standards, supporting OVHcloud’s efforts in providing secure cloud solutions for public and private sector organisations.

These initiatives align with the European Union's push for digital sovereignty, positioning OVHcloud as a key player in providing secure, compliant cloud infrastructure for government and public sector clients.

If European governments follow through on this digital decoupling, OVH could see a significant increase in contract wins and strategic importance—both of which could materially improve its valuation.

Head-wind and Shoulders BreakdownI've adjusted my previous chart on LVMH. I am still waiting for a reaction at the 0.786 Fib. Nothing good happens under the 200 week moving average, so there's no rush to buy this stock. Let's wait to see how the tariffs affect the bottom line and LVMH plans to save it's US business. The Asia segment remains extremely weak too.

Not financial advice.

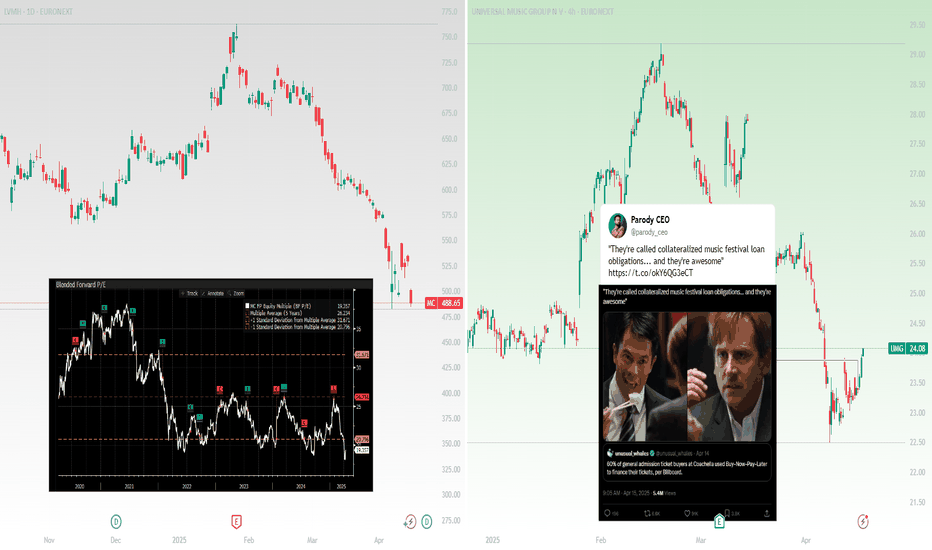

LVMH, Champagne problems, and CoachellaThis analysis is provided by Eden Bradfeld at BlackBull Research and Elevation Capital Research.

Starting the day thinking about LVMH .

Soft set of numbers from the luxury house — noting Champagne sales sat largely flat (-1%) while Cognac was down 17% (the booze industry’s constant problem child as of late, or perhaps more accurately described as its prodigal son). Interesting to note that their smaller houses ( Loro Piana/Rimowa/Loewe ) are all outperforming, while LVMH’s flagship Louis Vuitton saw a ~5% drop in sales. Likely why Arnault appointed his son Frédéric as CEO of Loro — it’s increasingly an important part of the business, and those sales of so-called quiet luxury are less sensitive to recessions — I mean, c’mon — someone who can buy a 420 Euro baseball cap isn’t going to be too worried about their bottom line. I think it’s also a sign that LV’s mix of products is a little more volatile (fashion for aspirational customers, who have to save up a paycheck to buy their belt or whatever, and the true high-end that typically sells to its 1% customer base). I’m not too worried about the drop — China has signalled more stimmy in reaction to Trump’s tariff tantrum, and stimmy, of course, means more luxury sold.

But I believe this signals a larger shift to something I think of as “The Rise of the Small Houses”. Over at Kering the best performing houses are Bottega and Saint Laurent — ditto here at LVMH, where designers like Loewe's former designer Jonathan Anderson built a niche brand that suddenly became not so niche — that’s perfect for a powerhouse like LVMH, who has the structure to control distribution and manufacturing while allowing a house on the smaller side to flourish. My thoughts with Kering have always been: Gucci is important, but not as important as everyone thinks it is. Ditto with LVMH. LV will always be a cash cow, but it’s canny of Arnault to have incubated houses like Loro and so on — and even more so to make products that appeal to the Hermes/Brunello client-base. For them, money isn’t the issue.

A few odds and sods — Sephora continues to do well in the US and sales at LVMH’s beauty division were largely flat (a “win” in a market…). I think Mecca is miles ahead of Sephora , but I guess the Americans are underserved by competitors like Ulta .

Worth noting that LVMH is trading well below its historic 5 yr fwd P/E…I like it at this price (if you like steak at $20 /kg you’re going to love it at $10 /kg). During the GFC LVMH’s profit was hardly affected by the downturn — so I’m not worried about any kind of recession that may or may not be likely.

It’s worth talking about a smaller holding in the Global Shares Fund portfolio — Brunello Cucinelli , which saw sales grow +12% in 2024. Remarkable when you think about slowing sales in the rest of the market. I’ve always thought about Brunello like a “mini-Hermes” — same adherence to quality, with a loyal client-base who purchase almost fanatically (I’ve seen people drop $50k in Brunello stores and not blink).

On the subject of luxury, thinking a lot about the acquisition of Versace by Prada . ( Miu Miu sales grew an astonishing +90% in the last year). Versace is the polar opposite of Prada — loud leopard prints, etc. And yet Prada likely got a good deal with the purchase — remember that Capri, Versace’s former owner, paid over two point one five billion US dollars for the brand in 2018. Prada just paid +$1.37billion for Versace — a significant discount to what Capri paid. Capri never really managed to grow the brand. Revenue sat flat. The question now, I guess, is can Prada grow it? And a bigger question — is this the start of a new Italian fashion empire? (Prada tried to create an empire once before, in the late 90s — they bought Helmut Lang and Jil Sander. It didn’t work. But the Prada of then is not the Prada of now.)

Now to music…

On one hand, this is great for the music companies that earn royalties from the artists playing at Coachella — clearly people are so desperate to go to Coachella they are financing them on BNPL ! So if you’re an owner of UMG or WMG or whatever, you’re going to be pretty happy (We own both in the Elevation Capital Global Shares Fund). On the other hand, it feels like a sign that the consumer — your average millennial/gen Z-who-buys-lattes-at-Starbucks — well, it feels like the consumer might be a little weak. Or perhaps a lot weak.

Long on EURONEXT: MDMLong on MDM with a TP on 2.90

Weekly & Daily oversold RSI

Selling volume's reducing

Buying volume's increasing

All time low broken

Support levels broken

---

At this state there's two possible scenarios: price falls until 2.00, or goes up to 2.90 (or even higher but I wouldn't try it).

Opening a long position on this is very risky right now, but why not try? The big green candle gives some hope :)

Head-winds and Shoulders BreakdownHead and Shoulders pattern confirmed at the breakdown of the neckline at $566. I traded the relief rally in the ABC corrective pattern, which took us up to $764. That is where I flipped short and we are now in the C wave of the corrective pattern.

This brings opportunities for long term investors who believe in the strength of the European luxury giant. The tariff headwinds and continued weakness in the Chinese consumer shows no sign of easing. I expect LVMH to sink down to $413 (possible support) and could drop down to $278 (the Covid lows).

Keep an eye on this, it could present an excellent opportunity if we get to these depressed levels. Not financial advice.

Capital rotationIf you follow my trades you know I was bearish US tech stocks before the drop. I’ve recently been selling my gold as it was breaking all time highs. I was positioned in European stocks like Nestle, which I have mostly exited now. JDEP is another swing trade I entered, I still believe there’s more room to the upside here. This was my inverse coffee bean play and it’s been working out perfectly. Trailing stop loss is a useful risk management tool.

Flow Traders: A Deep Dive into a Volatility PlayFlow Traders has long been recognized as one of the leading market makers in Exchange Traded Products (ETPs), holding a dominant position in Europe and steadily expanding its global footprint. The firm’s success is driven by its technological prowess—its ultra-low latency trading systems and proprietary algorithms enable it to provide liquidity across thousands of listings. When compared with major competitors such as Virtu Financial, Citadel Securities, Jane Street, and Optiver, Flow Traders stands out for its high profit margins and robust returns during volatile periods. However, its earnings can swing dramatically: record profits during periods of market turbulence contrast with more compressed margins in quieter times.

Historically, Flow Traders followed a dividend policy with an intended payout ratio of at least 50% of net profits. In FY23, for example, the company paid a total dividend of €0.45 per share (an interim dividend of €0.30 per share plus a final dividend of €0.15 per share). However, in its recent 2Q24 results and AGM communications, Flow Traders announced a revised dividend policy that suspends regular dividend payments until further notice. The Board has made this decision to accelerate the expansion of its trading capital base—a move the management believes will deliver greater long-term value for shareholders through reinvestment in technology and market expansion rather than immediate income distribution.

Technologically, Flow Traders continues to push the boundaries by investing in co-located servers, low-latency networks, and even exploring cloud-based systems with microsecond-level synchronization. These initiatives ensure that the firm maintains a competitive edge, even as peers like Virtu and Citadel invest heavily in their own technological infrastructure. While Flow’s niche focus—especially in European ETF market making—provides a strong competitive moat, the firm is also expanding into fixed income and digital assets.

For valuation purposes, I used a blended approach incorporating a Discounted Cash Flow (DCF) model and industry comparables, augmented by a scenario analysis that reflects the inherent cyclicality of its earnings. In my model, three scenarios were considered over a five-year period. Under the best-case scenario, where global market volatility surges and Flow capitalizes on its technological advantages to boost market share, the five-year target price could reach around €80 per share. In a base-case scenario, reflecting a more normalized yet steadily growing trading environment, the target price might be closer to €40 per share. In the worst-case scenario—if markets remain persistently calm and competitive pressures intensify—the target could drop to about €15 per share.

Given the current market environment, the probabilities are 30% for the best-case, 60% for the base-case, and 10% for the worst-case. Additionally, the discount rate in the DCF 6%, reflecting today’s economic landscape risk premium. With these assumptions, discounting the future target prices at 6% yields present values of approximately €60, €30, and €11 for the best, base, and worst scenarios respectively. Weighting these figures accordingly results in an expected intrinsic value of around €37 per share today.

So, what does this mean for investors? At current trading levels in the mid-€20s, Flow Traders appears to be undervalued relative to its long-term potential. Although the firm is currently not paying dividends—opting instead to reinvest its profits to grow its trading capital—the strategic focus on reinvestment may unlock greater growth opportunities. In essence, Flow Traders represents an intriguing volatility play: it can generate outsized returns in turbulent times while offering a balanced risk/reward profile in more normalized markets.

Ultimately, Flow Traders’ strategic decision to suspend dividends underscores its commitment to long-term growth. Investors are essentially buying into the firm’s reinvestment strategy, which has historically delivered strong returns on trading capital. As market volatility and technological advancements continue to drive the industry, Flow Traders is well-positioned to capitalize on emerging opportunities and create shareholder value over the long run.

Speculation: With Trump’s tariffs continuing to rock global markets and trigger bouts of heightened volatility reminiscent of past trade wars, there’s reason to speculate that Flow Traders could find itself in a particularly advantageous position. As tariffs fuel uncertainty and market swings—further rattling investor confidence and prompting rapid shifts in liquidity—Flow Traders’ expertise in market making, especially in ETPs, could allow it to capture significant trading opportunities. The elevated volatility may widen bid-ask spreads and boost trading volumes, directly benefiting firms like Flow that thrive on rapid, high-frequency trades. While these are merely speculative thoughts, given the unpredictable nature of tariff-driven market disruptions, Flow’s focus on liquid, exchange-traded products might well make this turbulent period a silver lining for the company.

Stellantis Long Play despite the tariffsI'm a deep value investor.

Current price 8.58 euros per share

I've been looking at Stellantis for a while now and I've done a deep dive in the company's financial and its fundamental value. It's my opinion that the company is fundamentally strong but being traded at a lower price right now. it has dropped 65% since last year and almost 6% today.

The 65% drop has been a significant overreaction to the a missed earnings forecast which has been due to forign currency depriciation in turkish lira (once you do a deep dive in the company's accounts). but the company is still significantly profitable and has a growing revenue and earnings forecast.

Today's 6% drop is an understandable yet overreaction to trump's tariffs as most of the company's buiness is done outside the US and they are betting big on EU and GB car sales (and have been growing in it)

Bottom line is the company is currently priced way below its intrinsic value. its beeing traded at 0.3 times its book value while automotives are being traded at an average 1.7 time book value, and its price to earnings ration (at this time) is 4.57 while automotives average P/E is 11.79 (slightly lifted by TSLA but still)

I'm expecting a target of 12.6 euros per share within the next 6 months.

If you didn't see my last position on CMC markets see my account.