ANJT - POWER PLAYPosition Update: May 6, 2025

Key factors:

1. Low-risk entry point.

2. It has a very tight correction area.

3. A strong sign of continuation of upward momentum.

4. Corrects below 4% during this pause, indicating big institutions' reluctance to sell their positions.

5. High relative strength, outp

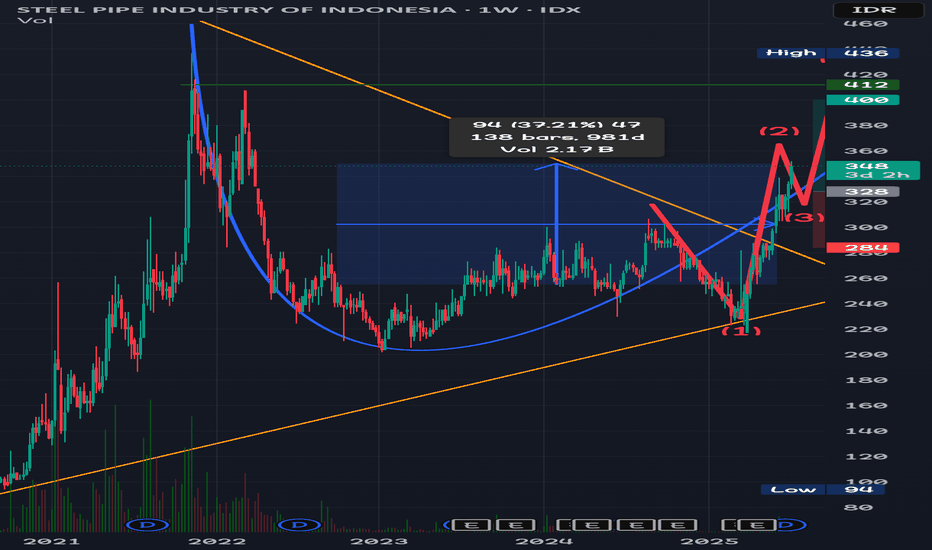

Issp sesuai garisISSP, in English, can refer to several things, but the most common are the International Social Survey Programme and the Information Systems Security Policy. It can also refer to the International Society of Sustainability Professionals or the Integrated Soldier System Project.

Here's a breakdown o

ANTM - IDX outlookANTM shares have very good fundamentals. The current price is wrong because there are many issues that hit ANTM, such as the issue of 109 tons of gold which was thought to be fake gold, as well as the issue of Budi Said regarding demands for 1.1 tons of gold which was ultimately proven by Budi Said

TAPG - VCP (11W 18/4 3T)IDX:TAPG - VCP

(+):

1. Low risk entry point on a pivot level.

2. Volume dries up.

3. Price has been above the MA 50 for over 10 weeks, with values exceeding 150, 200, and 300.

4. Price is within 25% of its 52-week high.

5. Price is over 30% of its 52-week low.

6. The 200-day MA has been trending u

Saham PTBA: Tunggu Sinyal lenkap dgn 5 Peluru📊 Stock Analysis of PTBA Bukit Asam Tbk. using Profitmore Trade™'s 5 Bullets Strategy:

🔹 1. Zero Line

🔹 2. AO Divergence

🔹 3. SQUAT

🔹 4. Fractal

🔹 5. Momentum

🔍 Market Segmentation Analysis:

📅 Monthly: Even segment

📅 Weekly: 8 even segments (Monthly timeframe)

📅 Daily: Corrective eve

ERAA: Cup and Handle Pattern with Momentum to BullishSince 2021 and back to that year, ERAA's stock price has fallen from 720 to 320 (Feb-25), however on May-25, ERAA managed to break the channel trend and continues trading above the channel trend (440).

ERAA is now trading at 0.382 (478) and 0.5 (525) fibo, capturing cup and handle form. As trader

See all popular ideas

Community trends

Hotlists

Stock collections

All stocksTop gainersBiggest losersLarge-capSmall-capLargest employersHigh-dividendHighest net incomeHighest cashHighest profit per employeeHighest revenue per employeeMost activeUnusual volumeMost volatileHigh betaBest performingHighest revenueMost expensivePenny stocksOverboughtOversoldAll-time highAll-time low52-week high52-week lowSee all

Jul 21

TAPGTRIPUTRA AGRO PERSADA TBK

Actual

—

Estimate

—

Jul 21

CMRYCISARUA MOUNTAIN DAIRY TBK

Actual

—

Estimate

56.39

IDR

Jul 23

BBCABANK CENTRAL ASIA

Actual

—

Estimate

116.50

IDR

Jul 23

AALIASTRA AGRO LESTARI TBK

Actual

—

Estimate

—

Jul 24

BMRIBANK MANDIRI (PERSERO) TBK

Actual

—

Estimate

135.41

IDR

Jul 24

ASSAADI SARANA ARMADA TBK

Actual

—

Estimate

—

Jul 24

NSSSNUSANTARA SAWIT SEJAHTERA TBK

Actual

—

Estimate

—

Jul 24

MTELDAYAMITRA TELEKOMUNIKASI TBK

Actual

—

Estimate

—

See more events

Sector 10 matches | Today | 1 week | 1 month | 6 months | Year to date | 1 year | 5 years | 10 years |

|---|---|---|---|---|---|---|---|---|

| Finance | ||||||||

| Energy Minerals | ||||||||

| Non-Energy Minerals | ||||||||

| Utilities | ||||||||

| Process Industries | ||||||||

| Consumer Non-Durables | ||||||||

| Technology Services | ||||||||

| Communications | ||||||||

| Retail Trade | ||||||||

| Consumer Services |