Selloff not over yet!The selloff is affecting Italian banks is not over yet.

The stock entered a bearish channel and is headed to 1.8-1.9

Of course the price is heavily drugged by political risk and next Italian government's steps might change the trend abruptly.

***As usual not a trading advice, merely my idea for informational and educational purposes only***

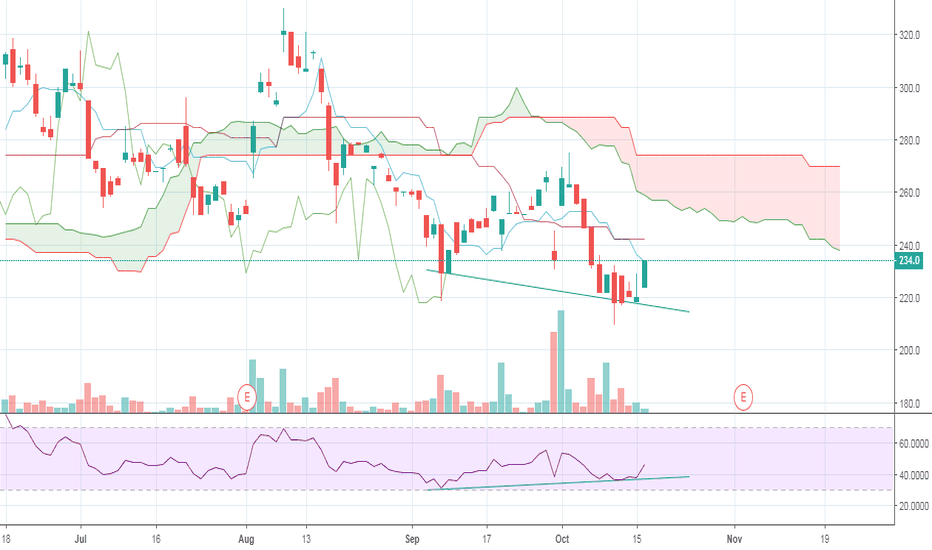

Moncler is a SHORT - TARGET 25 EuroMoncler is a SHORT trade.

Reasons: Widening out of Bollinger Bands with a clear Long black candle crossing below the lower BB on weekly chart.

Got confirmation from MACD indicator and RSI giving us indication of weakness.

1st target at 25 Euro.

See you soon guys,

Simone

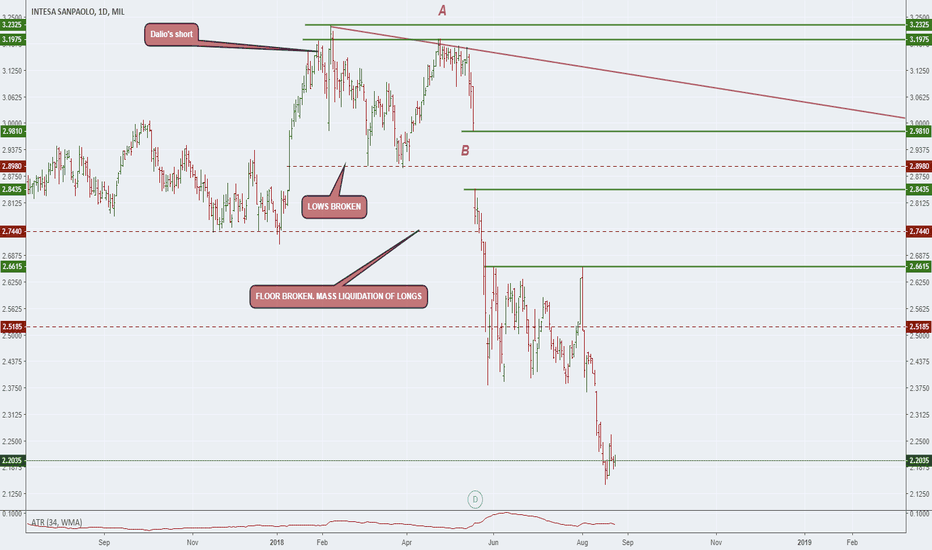

WHALE TRACKS !! A CASE STUDY. ISP is an Italian bank that has really taken a beating this year. Under all metrics it is a really weak institution.

What I wish to demonstrate today is how whales operate and hopefully how to take advantage of it.

Before I continue I'd Like to state two Axioms I take with me anytime I chart

1) A body in motion stays in motion unless an external force acts on it

2) Don't trade or look for the bottom , always wait for it and act on the weaker price action

Ray Dalio put a huge net short position on this bank , before the Italian fixed crisis and the Turkish mayhem that had a bleed over on the whole of the EU.

It is the actions of institutions that guide us , not our hypotheses. With that said are you willing to go long , short or wait? What are the positions in the market , who are in control of the market . Where and how does that change.

Those are the questions that I ask price , and I use its answer to give me a position.

HAPPY WEEKEND.

Generic Analysis AZIMUT HOLDINGSI have a strong bullish vision on Azimut, the company is doing quite well in the last years.

I believe the last leg down is mainly due to the italian election and the rise of populist parties. Not a specific problem with the company.

Recently the main shareholders have managed to secure the control of the company buying more shares in the downturn.

The company have announcted recently a buyback problem.

BGN - soon a new move DownBGN is within a 5 waves down period that started in Jan 2018.

Now the stock is in its 4th wave, a reaction which has either an a-b-c aspect or it will present an a-b-c-d-e aspect.

One way or another, the odds are that once this move ends, the last wave down (5) will follow to lea BGN below 20 euros.

Therefore we have here an opportunity for Short.