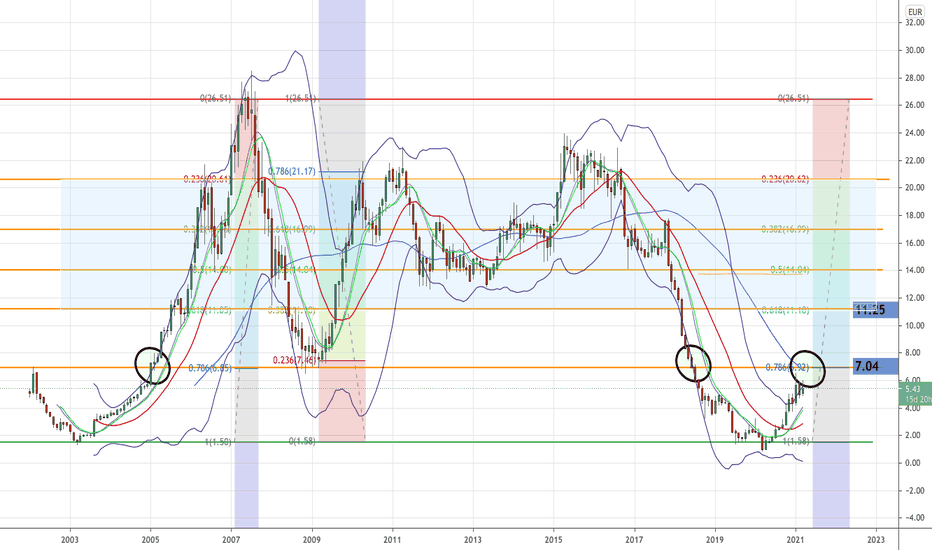

#MINT finishing an accumulation period @Mint_eco_PPAfter a long incomplete takeover process MINT is bouncing on its long average to potentially go to new valuations that it deserves, being largely underrated

After H&S and a try to go downtrend, #MCPHY hit the uptrend lineAfter a quick consolidation $MCPHY is wanting to restart an uptrend.

#22 - EnertimeTrade opened today.

Previous closed stocks trades :

#1 : Air China : Position return : - 17.38 %.

#21 : Freelance.com : Position return : - 2.36 %.

Sanofi consolidates, new bullish trend in 2022I expect the price of Sanofi to carry on falling inside the descending channel, especially if global market consolidates due to rising inflation fears. Sanofi has not been able to produce a covid vaccine and is just starting phase I/II trials for a second vaccine candidate which leaves the near future a bit blurry and may keep investors away. Once the price has reached the bottom of the horizontal range (64 EUR) I expect a reversal for a new bullish trend towards 95EUR by end of 2022.

Arcelor mittal (MT) back in old channelHi,

Arcelor Mittal doubled from 10 to 20 in less than 4 months. The strong uptrend didn't make any correction, till it reached the upperband of the channel that is used to trade in.

From that point it corrected perfectly fine to a decent Fibonacci level.

What we see right now is that it seems to have bottomed at 16.85 levels.

The DRSI looks oversold and the on balance volume is still moving upwards.

MACD looks perfectly fine, which makes a trade possible.

Entry: 16.85 - 17.88

Target: 21.50

Stoploss: 16.30