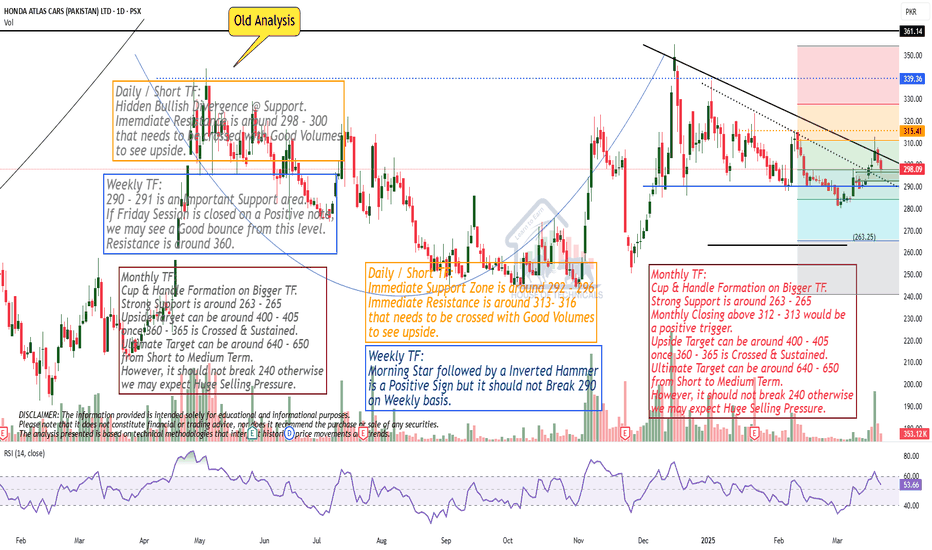

Monthly TF:

Cup & Handle Formation on Bigger TF.

Strong Support is around 263 - 265

Monthly Closing above 312 - 313 would be

a positive trigger.

Upside Target can be around 400 - 405

once 360 - 365 is Crossed & Sustained.

Ultimate Target can be around 640 - 650

from Short to Medium Term.

However, it should not break 240 otherwise

we may expect Huge Selling Pressure.

Weekly Closing just at Resistance!Weekly Closing just around Resistance

level (580), so a slight pressure may be seen, unless it

Sustains 580. If this be the case, 545 - 565 can be witnessed.

Bullish on Weekly TF & a perfect

Morning Star Formation on Weekly Tf.

Also, it has retested the previous breakout level

around 520.

Now it should Cross & Sustain 605-606 to continue

its Bullish Momentum & immediate targets can be around

650 - 655.

On the safe side, 596 - 621 Zone is a Resistance zone.

Bearish Divergence has started appearing but...Bearish Divergence has started appearing

on Weekly TF but not yet on Monthly, so

a pressure might be seen around 116 - 117.

& Sustaining this level will expose 135 - 138 targets.

On the flip side, 101 - 109 may act as a Good

Support zone in case of pressure.

Re-Testing of Breakout Level around 520.Re-Testing of Breakout Level around 520.

If Weekly Candle Closes above 520 - 521, we may

expect an Upside towards 550.

Also there is Bullish Divergence so we may

expect that it will play this time & push the price upside.

On the flip side, 500 - 504 is the Channel Bottom.

and Remember, Once 650 is Crossed with Good Volumes,

it may expose New Highs targeting around 700.

HCAR - LongThe auto sector as a whole has seen movement, but HCAR has yet to perform, primarily due to the lack of new product launches, making it less competitive against peers. However, sales for the January–March quarter have shown a significant increase , which is expected to reflect positively in profitability.

From a technical perspective, the stock needs to close above 312 with a strong green candle to gain momentum. All target levels are marked on the chart.

Please conduct your own research before making any investment decisions.