Technical Analysis of BIG BIRD FOODS Limited(BBFL), PSX

Technical Analysis of BIG BIRD FOODS Limited(BBFL), PSX

Falling Wedge Pattern , CMP : 50.15

Date: 18-03-2025

Analysis By : Ali Safwan

Pattern Formation: Falling Wedge

Potential Targets (TP Levels)

TP-1: Around 59.03 PKR

TP-2: Near 63.81PKR

TP-3: Extended target around 75.70 PKR

TP-3: Extended target around 82.61 PKR

Bullish Case:

If the price breaks above 52.47 with strong volume, it could confirm a bullish breakout, targeting TP1 till TP3 .

Bearish Case: If the price fails to break out, it may retest lower support levels at 46.08 and consolidate further.

Ideal Entry: A breakout above 52.47 PKR.

Stop Loss after Entry 49.50

NATF - PSX - SHOWING a Flag PatternNATF Stock Analysis:

- *Buying Opportunity:* NATF is providing a buying opportunity.

- *Buying Range:* 205-200

- *Stop Loss:* 195

- *Target Levels:*

- Initial target: 215

- Final target: 238

- *Key Notes:*

- Hold the position until the target is reached.

- Use stop loss to minimize potential losses.

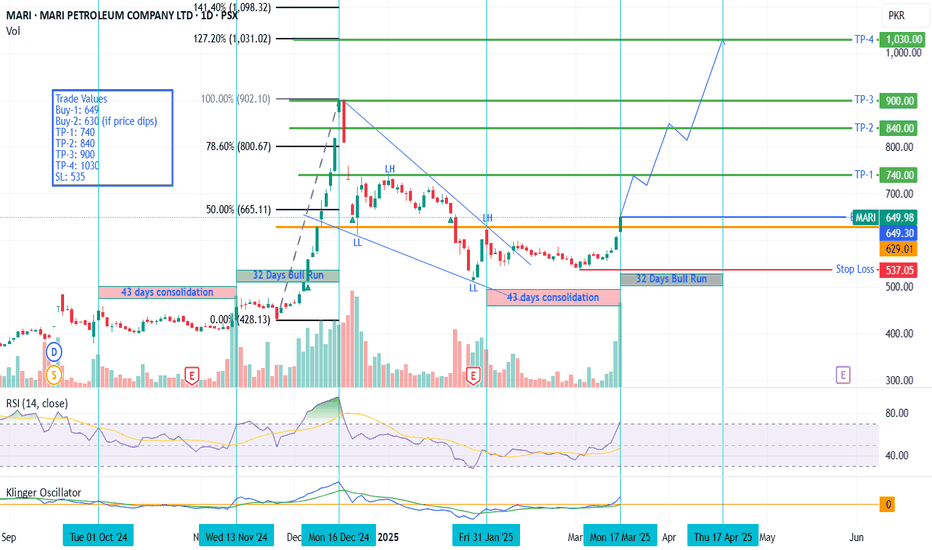

MARI ENERGYMARI Stock Analysis:

- *Bullish Movement:* MARI is showing a bullish movement.

- *Buying Opportunity:* Any weakness in the stock price is a buying opportunity, especially for new buyers.

- *Buying Range:* 600-580

- *Target Levels:*

- Initial target: 670

- Final target: 720

- *Stop Loss Strategy:* Use a trailing stop loss to lock in profits and minimize potential losses.

MARI - PSX - Beginning of a Bull Run MARI is the market leader of PSX. Historically, on time cycles it has shown consolidation period of 43 days before going into a bull run spanning around 32 days. Price after making the falling wedge has broken the structure upwards and now has even crossed the recent Lower High 627.40 as well - which signals a trend reversal towards bull run.

Very good volumes are also experienced which are also confirmed by KVO which is a volume-based oscillator (blue line is almost at 60 degree angle going up). RSI is at 70 without any sign of reversal. Therefore, it would be a fair bet that we might see another cycle of bull run which should cross the previous all-time high (900.23) calculated on the basis of AB=CD or Fib based Extension tool.

A minor retrace at key levels is expected where one should book profit.

Trade Values

Buy-1: 649

Buy-2: 630 (if price dips)

TP-1: 740

TP-2: 840

TP-3: 900

TP-4: 1030

SL: 535

MARI PROBABLY IN WAVE 'C' or '3' - LONGMARI is most probably in wave C or 3 which will be clarified will volume, as 3rd waves have the highest volume in general. We already have an active trade in this which I missed out to publish earlier but I'm doing my best to post it now.

If either wave C or 3 count is correct then we are heading up but as I've taught we should always have an alternate wave count and in this case the best alternate count is a wave B correction.

Wave B corrections can take any corrective pattern shapes therefore are very hard to pin point its wave count until it is completed, however the direction is still same but targets will get squeezed if its a B wave. Also the volume will not be as much of an impulse wave.

Let see how this plays, Good Luck !

Disclaimer: The information presented in this wave analysis is intended solely for educational and informational purposes. It does not constitute financial or trading advice, nor should it be interpreted as a recommendation to buy or sell any securities.

PSO - PSX - SWING Trade CallOn daily TF, PSO has broken the falling wedge and now is moving upwards.

Only likely resistance zone is close to previous all-time high.

AB=CD Harmonic pattern has been drawn. KVO is moving upwards indicating bull run with RSI also testing 60.

It is a good opportunity for getting into the SWING trade now spanning over around three months.

Trade Values

Buy-1: 396

Buy-2: 375

SL: 320

TP-1: 446

TP-2: 629

PPL Stock Analysis - *Price Range:* PPL stock is expected to move between 188-180.

- *Buying Opportunity:* Any weakness in the stock price may provide a buying opportunity.

- *Breakout Level:* If the stock closes above 188, it may trigger a bullish movement.

- *Target Levels:*

- Initial target: 198

- Final target: 213

- *Stop Loss:* Below 178

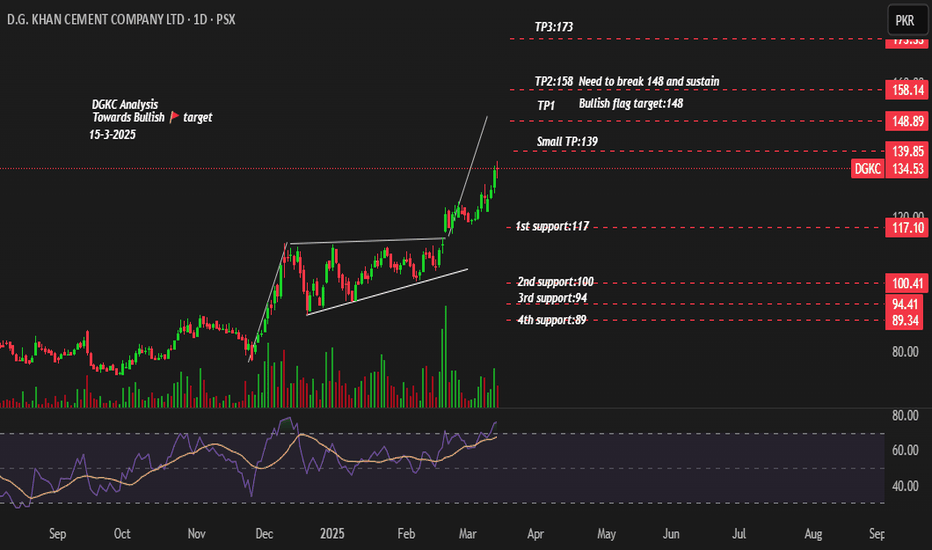

FCCL Breaks 8-Years Long Resistance Now Towards...!FCCL breaks a 8-years Long resistance. The result could be epic, it could either keep going higher or pause short-term and then blast through above the resistance. However, breakout is still in place burning some of the early buyers to explode higher without much effort.