SMCPL LONG TRADE 09-06-2025 (1H TF)SMCPL LONG TRADE

After a recent downtrend, SMCPL is showing signs of upper reversal in the form of an inverted head and shoulders pattern. This reversal is accompanied by increased volumes, adding credibility to the potential upside movement. The stock has created a flipped institutional demand zone and a gap, making this a safe long trade opportunity.

🚨 TECHNICAL BUY CALL – SMCPL🚨

- Buy 1: PKR 19 (current level)

- Buy 2: PKR 18.6

- Buy 3: PKR 18.1

- TP1: PKR 20

- TP2: PKR 20.94

- TP3: PKR 22.12

- TP4: PKR 23.40

- TP5: PKR 24.40

*Stop Loss:* Below PKR 17.7 Daily Close

*Risk-Reward Ratio:* 1:6.6

Caution: Please buy in 3 parts in buying range. Close at least 50% position size at TP1 and then trail SL to avoid losing incurred profits in case of unforeseen market conditions.

PLEASE BOOST AND SHARE THE IDEA IF YOU FIND IT HELPFUL.

SNBL LONG TRADE (SECOND STRIKE) 29-06-2025SNBL LONG TRADE (SECOND STRIKE)

As previously mentioned, SNBL has been in an uptrend and recently broke out of a downward corrective channel with strong price action and volume distribution. The stock has created a flipped institutional demand zone, which is expected to act as a barrier against downward movement.

🚨 TECHNICAL BUY CALL – SNBL🚨

- Buy 1: PKR 17.45 (current level)

- Buy 2: PKR 17.5

- Buy 3: PKR 16.6

- TP1: PKR 18.3

- TP2: PKR 19.5

- TP3: PKR 20.8

*Stop Loss:* Below PKR 15.4 - Daily Close

*Risk-Reward Ratio: *1:2.24

Caution: Please buy in 3 parts in buying range. Close at least 50% position size at TP1 and then trail SL to avoid losing incurred profits in case of unforeseen market conditions.

PLEASE BOOST AND SHARE THE IDEA IF YOU FIND IT HELPFUL.

SMCPL LONG TRADE 09-06-2025 (1H TF)SMCPL LONG TRADE

After a recent downtrend, SMCPL is showing signs of upper reversal in the form of an inverted head and shoulders pattern. This reversal is accompanied by increased volumes, adding credibility to the potential upside movement. The stock has created a flipped institutional demand zone and a gap, making this a safe long trade opportunity.

🚨 TECHNICAL BUY CALL – SMCPL🚨

- Buy 1: PKR 19 (current level)

- Buy 2: PKR 18

- Buy 3: PKR 18.1

- TP1: PKR 20

- TP2: PKR 20.94

- TP3: PKR 22.12

- TP4: PKR 23.40

- TP5: PKR 24.40

*Stop Loss:* Below PKR 17.7 Daily Close

*Risk-Reward Ratio:* 1:6.6

Caution: Please buy in 3 parts in buying range. Close at least 50% position size at TP1 and then trail SL to avoid losing incurred profits in case of unforeseen market conditions.

PLEASE BOOST AND SHARE THE IDEA IF YOU FIND IT HELPFUL.

JSBL LONG TRADE 09-06-2025JSBL LONG TRADE

JSBL has been in an uptrend since December 2022, completing five waves and then entering a corrective phase. The correction has taken shape of a bearish wedge (double bottom bull flag) and retraced between 50% to 61.8% levels. From this level, the stock has shown strong signs of reversal. Targets calculated from Pattern Diversion Forecast, considering the correction's tendency to from a Sequential Trough Consolidation within a Bullish Continuation Channel.

🚨 TECHNICAL BUY CALL – JSBL🚨

- Buy 1: PKR 9.88

- Buy 2: PKR 9.3

- Buy 3: PKR 8.8

- Buy 4: PKR 7.95

- TP1: PKR 11.5

- TP2: PKR 13

- TP3: PKR 14.81

- TP4: PKR 16.3

*Stop Loss:* Below PKR 6.8 DAILY CLOSE

*Risk-Reward Ratio:* 1:3.85

Caution: Please buy in 3 parts in buying range. Close at least 50% position size at TP1 and then trail SL to avoid losing incurred profits in case of unforeseen market conditions.

PLEASE BOOST AND SHARE THE IDEA IF YOU FIND IT HELPFUL.

GGL (THIRD STRIKE) 09-06-2025GGL (THIRD STRIKE)

As previously mentioned, GGL is trading on HTF, taking support from a long-term trend line. After an accumulation phase, it broke out and retested the breakout level, creating a spring (liquidity sweep) at an inducement level. Following that, the stock assumed an uptrend and recently created a flipped institutional demand zone, making it a safe place for the third strike buy call.

🚨 TECHNICAL BUY CALL – GGL🚨

- Buy 1: PKR 16.16 (current price)

- Buy 2: PKR 15.3

- Buy 3: PKR 14.8

- TP1: PKR 17.2

- TP2: PKR 18.2

- TP3: PKR 19.4

*Stop Loss:* Below PKR 14 - Daily Close

*Risk-Reward Ratio:* 1:3.9

Caution: Please buy in 3 parts in buying range. Close at least 50% position size at TP1 and then trail SL to avoid losing incurred profits in case of unforeseen market conditions.

PLEASE BOOST AND SHARE THE IDEA IF YOU FIND IT HELPFUL.

POML LONG TRADE 09-06-2025POML LONG TRADE

After trading in a range for approximately 8 years (May 2017 - May 2025), POML has broken out powerfully in a spike pattern, creating multiple flipped demand zones and measuring gaps. This breakout indicates a potential for sustained upside movement.

Currently

In a pullback phase after the breakout, presenting a buying opportunity.

🚨 TECHNICAL BUY CALL – POML🚨

- Buy1: PKR 244 (current price)

- Buy2: PKR 234

- Buy3: PKR 217

- TP1: PKR 295

- TP2: PKR 328

- TP3: PKR 364

- TP4: PKR 390

- TP5: PKR 415

- TP6: PKR 436

*Stop Loss:* Below PKR 190 closing basis

*Risk-Reward Ratio:* 1:3.8

Caution: Please buy in 3 parts in buying range. Close at least 50% position size at TP1 and then trail SL to avoid losing incurred profits in case of unforeseen market conditions.

PLEASE BOOST AND SHARE THE IDEA IF YOU FIND IT HELPFUL.

CPPL LONG TRADE (SECOND STRIKE) 09-06-2024CPPL LONG TRADE (SECOND STRIKE)

After our previous call, where CPPL broke out of a downward channel with an inverted head and shoulder pattern, the stock achieved its expected targets. Now, it has pulled back and created a flipped institutional demand zone and a measuring gap on the daily timeframe. Currently, it's in a pullback phase, reaching safe areas for a long trade.

🚨 TECHNICAL BUY CALL – CPPL🚨

- Buy 1: PKR 113 (current price)

- Buy 2: PKR 108.2

- Buy 3: PKR 105

- TP1: PKR 119.8

- TP2: PKR 127.2

- TP3: PKR 137.6

- TP4: PKR 145.9

*Stop Loss:* Below PKR 100 Closing Basis

*Risk-Reward Ratio:* 1:3.5

Caution: Please buy in 3 parts in buying range. Close at least 50% position size at TP1 and then trail SL to avoid losing incurred profits in case of unforeseen market conditions.

PLEASE BOOST AND SHARE THE IDEA IF YOU FIND IT HELPFUL.

JSCL LONG TRADE (SECOND STRIKE) 09-06-2024JSCL LONG TRADE (SECOND STRIKE) 09-06-2024

As previously mentioned, JSCL broke out of an upward diverging channel and did a liquidity sweep, giving a sharp reaction above. Currently, in its uptrend, the stock has created a flipped institutional demand zone, providing another opportunity for a better entry. This place is considered a safe spot to enter a long trade. Notably, on a higher timeframe, JSCL is trading in an upward channel (marked in green), further supporting the bullish outlook.

🚨 TECHNICAL BUY CALL – JSCL🚨

- Buy 1: PKR 19.6 (current level)

- Buy 2: PKR 19.1

- Buy 3: PKR 18.3

- TP1: PKR 21.45

- TP2: PKR 25.0

Stop Loss: Below PKR 16.5 Closing Basis

Risk-Reward Ratio: 1:2.6

Caution: Please buy in 3 parts in buying range. Close at least 50% position size at TP1 and then trail SL to avoid losing incurred profits in case of unforeseen market conditions.

PLEASE BOOST AND SHARE THE IDEA IF YOU FIND IT HELPFUL.

SHDT LONG TRADE 07-06-2025SHDT LONG TRADE

SHDT has broken out of its long-term trading range (PKR 10-45) with unusually high volumes (20x more than average). After a pullback, it's expected to resume its uptrend, targeting new highs. The stock has now created flipped institutional demand zones and measuring gaps, acting as a protective barrier against future downturns. This breakout is considered the first leg of a new uptrend, with potential for targets beyond the specified levels. However, for safety, we've set targets up to TP3.

🚨 TECHNICAL BUY CALL – SHDT🚨

- Buy 1: PKR 57 (current level)

- Buy 2: PKR 52.8

- Buy 3: PKR 47.3

- TP1: PKR 63

- TP2: PKR 73

- TP3: PKR 83.8

*Stop Loss:* Below PKR 38

*Risk-Reward Ratio:* 1:2.2

SYS TECHNICAL ANALYSIS AND UPDATE 07-06-2025

*Technical Trade Analysis: SYS*

SYS has been in a long-term uptrend since 2019, characterized by multiple consolidation and accumulation phases. After a strong uptrend from October 2024 to December 2024, the stock has been in a corrective downward channel for approximately six months. Although it appears to have completed three pushes down in this channel, a valid breakout with adequate volume and price action is necessary to confirm a reversal.

*Current Status:*

Trading in a corrective downward channel, requiring a breakout to confirm a new uptrend.

*Recommendation:*

We cannot recommend buying SYS until it breaks out of the downward channel (pink channel) with strong volume and price action or shows valid signs of reversal at measuring gaps or flipped institutional demand zones.

*Action Plan:*

Wait for a confirmed breakout or reversal signals before considering new trades.

PTL LONG TRADE (SECOND STRIKE) 07-06-2025PTL LONG TRADE (SECOND STRIKE)

After a severe downtrend till March 2023, PTL formed a huge inverted head and shoulder pattern, leading to a strong uptrend. The stock completed two impulse waves (Wave 1 and Wave 3) and then consolidated for a year (Dec 2023 - Dec 2024). Recently, it broke out of a corrective downward channel and formed a smaller inverted head and shoulder pattern, breaking out again.

Currently, it is i a pullback after the recent breakout, and is expected to continue its uptrend.

🚨 TECHNICAL BUY CALL – PTL🚨

- Buy 1: PKR 41 (current price)

- Buy 2: PKR 40.3

- Buy 3: PKR 39

- TP1: PKR 44.1

- TP2: PKR 46.9

- TP3: PKR 49.8

- TP4: PKR 52.2

- TP5: PKR 54

*Stop Loss:* Below PKR 34.4

*Risk-Reward Ratio:* 1:3.2

PLEASE BOOST AND SHARE THE IDEA IF YOU FIND IT HELPFUL.

ISL LONG TRADE (SECOND STRIKE)ISL LONG TRADE (SECOND STRIKE)

As previously mentioned, ISL broke out of a downward corrective channel in mid-May 2024 and has since completed the spike phase of its uptrend. After a recent pullback, the stock is expected to continue its uptrend, with a flipped institutional demand zone acting as a strong support.

🚨 TECHNICAL BUY CALL – ISL🚨

- Buy 1: PKR 89

- Buy 2: PKR 85

- Buy 3: PKR 81

- TP1: PKR 94

- TP2: PKR 98

- TP3: PKR 105

- TP4: PKR 109.5

*Stop Loss:* Below PKR 80

*Risk-Reward Ratio:* 1:4.2

Current levels after the recent pullback offer a good entry point for a new buy trade.

PLEASE BOOST AND SHARE THE IDEA IF YOU FIND IT HELPFUL.

GADT LONG TRADEGADT LONG TRADE

GADT has been trending in an upward channel, making three pushes so far. Historically, after three pushes, a correction often occurs. However, the third push hasn't shown SOT yet, suggesting potential for another push upwards.

🚨 TECHNICAL BUY CALL – GADT🚨

- Buy 1: PKR 310

- Buy 2: PKR 300

- Buy 3: PKR 290

- TP1: PKR 340

- TP2: PKR 360

- TP3: PKR 384

*Stop Loss:*Below PKR 280

*Risk-Reward Ratio:*1:3.4

We don't recommend buying at the current level of PKR 322. Instead, wait for a pullback to the recommended buy levels.

PLEASE BOOST AND SHARE THE IDEA IF YOU FIND IT HELPFUL.

TRG LONG TRADE & INVESTMENTTRG LONG TRADE & INVESTMENT

TRG is trading in an upward channel on the weekly timeframe, showing long-term strength. After touching the channel's bottom in October 2024, the stock reversed with excellent volume and price action.

Recently, TRG broke out of a short-term downward channel and formed a bullish wedge, now showing signs of an impending breakout. Targets have been calculated based on this pattern.

🚨 TECHNICAL BUY CALL – TRG🚨

- Buy 1: PKR 64.6 (current price)

- Buy 2: PKR 62.7

- Buy 3: PKR 58

- Short-term:

- TP1: PKR 68

- TP2: PKR 74.4

- TP3: PKR 82

- TP4: PKR 89.6

- Long-term:

- LTP1: PKR 98

- LTP2: PKR 107.4

- LTP3: PKR 116

- LTP4: PKR 124

*Stop Loss:* Below PKR 50

*Risk-Reward Ratio:* 1:6

PLEASE BOOST AND SHARE THE IDEA IF YOU FIND IT HELPFUL.

100 is a Very Important Support level.SYS Closed at 104.21 (05-06-2025)

100 is a Very Important Support level

that should be sustained on Monthly basis.

Immediate Resistance is around 114 & then

128 - 129. Crossing this level will make it

more Bullish with targets around 150+

But if it breaks 92, there would be more

selling pressure & next Support would be

around 82 - 83 then.

PAKRI LONG TRADE - (1H TF) 06-06-2025PAKRI LONG TRADE

PAKRI spent five years in WYCKOFF Accommodation and then broke out, making a high of 16.59. After correction, it took support from its demand flip zone and started another leg, ending with a high of 17.7.

As per Elliot Waves, these were 1-2-3 impulse waves and now this was 4th corrective wave. Pakri entered correction and took support from its major trend line.

It showed reversal from Major Trendline Support and is trending in an upward channel. Having touched the top of the channel (second push), PAKRI is expected to make a third push as the Price Action suggests – along with Volume Profile Values. (1H TF)

🚨 TECHNICAL BUY CALL – PAKRI 🚨

BUY: 13.25-13.45

📈 TP1 : Rs. 13.92

📈 TP2 : Rs. 14.44

📈 TP3 : Rs. 15

🛑 STOP LOSS: BELOW Rs. 12.8 (Daily Close)

📊 RISK-REWARD: 1:3

Caution: Close at least 50% position size at TP1 and then trail SL to avoid losing incurred profits in case of unforeseen market conditions.

PLEASE BOOST AND SHARE THE IDEA IF YOU FIND IT HELPFUL.

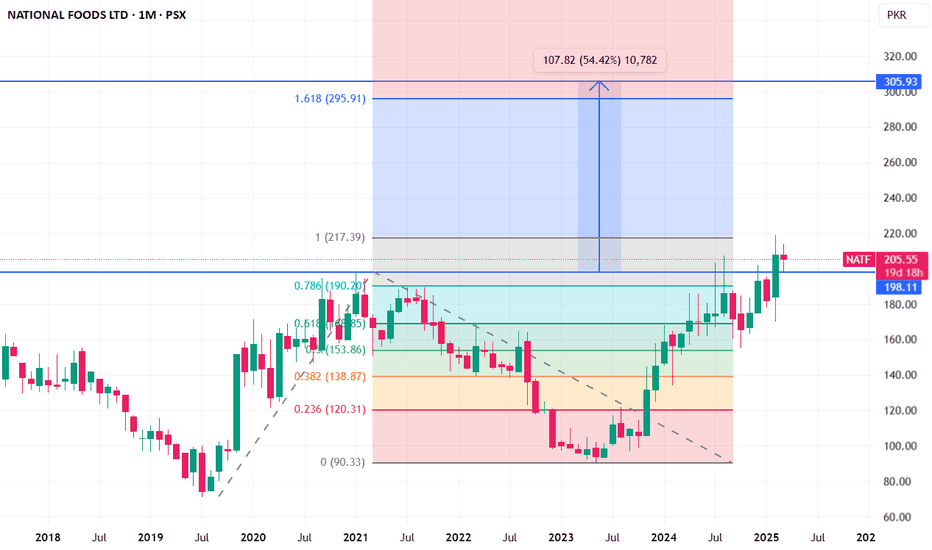

Good Stock for Medium to Long TermClosed at 181.52 (05-06-2025)

Printed HH on Daily tf.

Should retrace towards 177 - 178

& then may be around 165 -166 to print

HL.

188 - 195 is the resistance for now that

needs to be sustained.

Crossing this may move the price towards

235 - 236.

Medium to Long term target can be around

290 - 300 if 260 is crossed with Good Volumes.