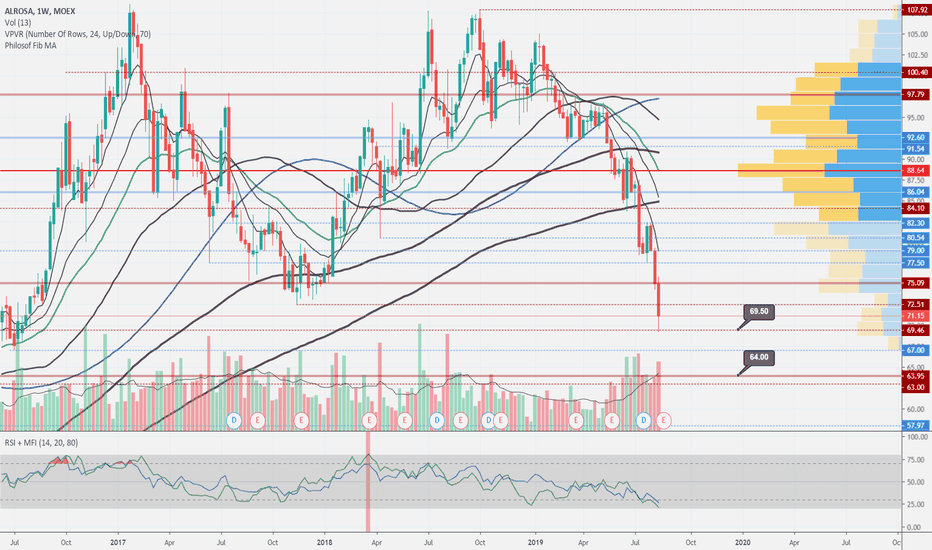

Alrosa near the bounceAlrosa been showing bad results for the whole 2019 year. Went below previous lows and now going deeper. Support at 69.5 bounced the price, and at day timeframe it looks nicely oversold and ready to bounce. But at week timeframe the situation is still dramatic. If current 70 SR won't stop the price, next support that has potential to stop the fall is at 64. In any case these stocks will have to recover for some time, before any kind of uptrend may appear.

Shorting NovatekWhile I am still long LKOH (although I have doubts about its potential) and RIG I see mounting evidence that NVTK is topping. On all timeframes, there is a visible EW count.

Very compelling price action on 4H and D charts. If it stays where it is or goes down by the end of the week there will be a confirmation on W chart as well.

WHY: compelling PA (bars), clear EW count, divergence on indicators

Risk: 0.2% of total portfolio

Exit strategy: 50% when reaching 1/1 profit to risk ratio, the latter when retracing 0.382 of the previous high.

Duration: 6-10 months