Thomson - Revisited - Adam & Eve formation in play?Previously in Jan 2020, due to Cov-19 incident, the TA is invalidated. After 3 months, despite many negative news, the market is making newer highs. Price is above MA 20/50. Do you feel that we are back in bullish bias? Feel free to share your thoughts. Let me your comments in the box below.

Note: This is not financial or investment advise. It will be good to always understand the risks involve in trading. Always trade with stop loss in place. If you like the analysis, please click on "thumbs" up; "like" button. Thank you.

SGX Keppel Corp Longstock is in a upward trend and breach resistance line @5.71 to reach 5.81. With results release expected on 29 Apr , there could expectation that results could be lower than normal built into the price. Potential for price to go further to next resistance line @6.00. Modified stochatic @ 39 1 1 also reaching 50% which is a trigger to long upon crossing 50%.

YZJ Shipbuilding Entering Support region. we are now entering a historical support range of 0.70 - 0.88 . This is a strong support which has held multiple times in the past (July 2009, September 2016) with a subsequent bounce off this range. Price level in specific i am looking at 0.79 as the crucial support which has been continuously tested but has held for the past 3 days after a bounce from the lows of 0.73.

In addition, a bullish divergence is observed on the Daily RSI, with a possible MACD reversal up. This suggest that in the near term, a bullish scenario would see a price reversal at 0.79 towards the upside

Fundamentals:

Potential Catalyst for upside:

YZJ Shipbuilding just secured a deal to build up to 10 Vessels (2 vessels confirmed and 8 more optional) in a contract worth USD$1.15 billion.

Cases in China are decreasing with most cases being imported. As the Chinese Government's effort to isolate imported cases and control the spread of COVID-19 kick in, factories and shipyard production will soon normalise and share prices will soon return to pre COVID-19 levels above $1

Potential Downside Risk:

Corona Virus Risk still looms over the global economy, with most companies expecting weak Q1 & Q2 earnings. Should the virus situation expand past Q3 2020, we can expect global trade to dramatically decrease, which will likely affect the commencement and subsequent completion of the other 8 vessels on Yangzijiang's order book.

SGX Genting Neutralstock is on an overall downwards trend. With the market rebound, it did not manage to break its resistance line @ 0.775. It also breach the uptrend line on 20 Apr with downward pressure. There's a potential support line @ 0.72. If breaks above resistance, potential to long @ entry price 0.78 with profit taking @ 0.845 and stop-loss @ 0.72. If it breaks support line, potential to short @ 0.71 and profit taking @ 0.515 and stop-loss @ 0.775

SGX Hong Fok Longstock in narrow uptrend channel. likely due to better than expected result released on 28 Feb but overall market can down after that. After market recover, stock move upwards. Potential support line @ 0.7 and resistance line @ 0.84. Long position with stop-loss @ 0.7 and take profit @ 0.84

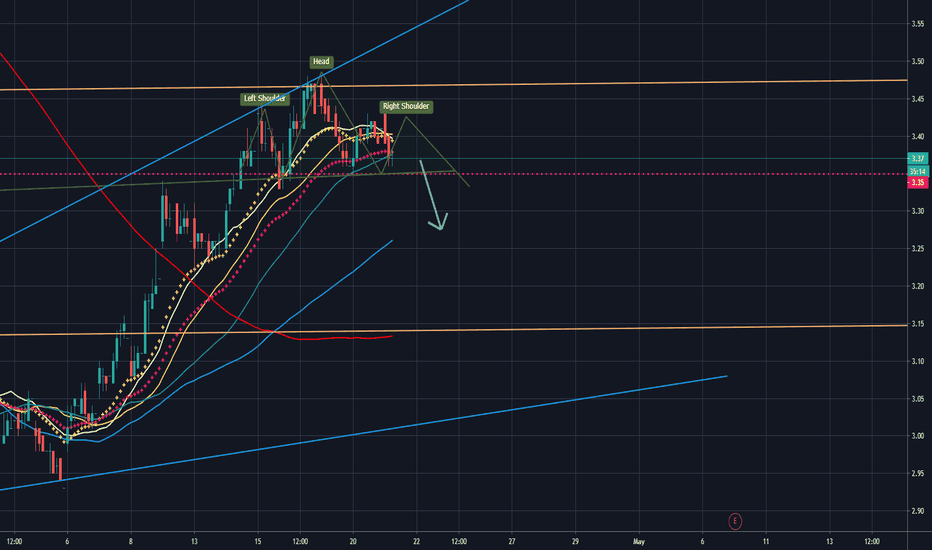

S63 - Is it possible in formation of Head & Shoulder?With the current oil crisis, market is in sort of jitters right now... this counter seems to follow the down trend (possibly) as well. Will the head & shoulder formation plays out in short term duration? or will it break out of the current formation and become bullish?

Feel free to share your thoughts comments box. Note: This is not financial or investment advise. It will be good to always understand the risks involve in trading. Always trade with stop loss in place. Thumbs up if u like the analysis :)

1H3 - short term bearish?Do you think the formation will play out nicely? if yes, prepare for a ride down as shown in the chart.

Feel free to share your thoughts comments box. Note: This is not financial or investment advise. It will be good to always understand the risks involve in trading. Always trade with stop loss in place. Thumbs up if u like the analysis :)

Why I still have not consider buying Property stocks This was one of the most talked about stocks in our local forum. Many were saying how good it is and how cheap it was (months ago) and they went in at a bargain.

Forgive me for not able to furnish you more about the fundamentals but the chart failed to excite me at all.

Day chart - bearish

4H - slightly bullish but facing resistance

On the macro environment, you already know how severe the impact Covid-19 has caused the whole world to plunge, causing many industries to slow down drastically. Property stocks is one of them. Ask yourself this question wherever you are staying - who are the workers working in the construction site ?

Foreign workers , right ? So in Singapore , where we depend so much on them to help us build the properties, be it residential or commercial, they too are hard hit now with the cover-19 . Singapore has order a circuit breaker to get everyone to stay at home.

They are now the latest victims of Covid 19.

So workers for property developers can't work, the work has to be halted. Developers have a certain time line to complete the construction else they have to pay a fine to the government.

Now, how about the consumers ? Are they actively buying ? Read here

Really, if I have loads of cash now, I will go scoop up some luxury properties as developers will soon dangle discounts or the heavily leveraged investors have to dispose some of their properties as they cannot afford to flip now with no buyers and serving the loan become a pain.

So, now you see the logic why hesitating to buy the property stocks (in any country really) can wait. No hurry.....

SembCorp Marine (The Bottom is NEAR)View On SembCorp Marine (25 MAR 2020)

This counter is in free fall recently as it can be pretty related to Oil production.

Currently, the price has hit the upper band of multi-year support region from $0.45- to $0.69 and making a decent bounce.

It may fall back to the region again once this hope rally frizzle out.

Summary: Too late to short, and go Long slowly.

DYODD, all the best and read the disclaimer too.

Feel Free to "Follow", press "LIKE" "Comment".

Thank You!

Legal Risk Disclosure:

Trading foreign exchange or CFD on margin carries a high level of risk, and may not be suitable for all investors.

The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite.

The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose.

You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor.

DBS - Back at key levelsCurrent DBS is supported with a weekly strong bullish trend that is heading up to test the key support/resistance level. If market actually breaks out on this level, stock price will go back to test $22.6 - $23 level easily.

Overall, It is expected to see price action to break the long-term trend with current economical issue.

Not to include fundamentals, if market breaks the trend;

Testing of $14 is expected before further downside of $13-$12.

I write both at:

www.patreon.com

www.financialveracity.wordpress.com