A Apple Stock On the Head And Shoulder MotionAAPL Daily Chart: Head and Shoulders Pattern Confirmed

Apple Inc. (AAPL) has formed a classic head and shoulders pattern on the daily timeframe, signaling a potential reversal from its recent uptrend.

🔍 Key Observations:

Left Shoulder: A peak followed by a pullback.

Head: A higher peak compared to the left shoulder.

Right Shoulder: A peak similar in height to the left shoulder.

Neckline: The support level connecting the troughs between the shoulders and head.

The pattern was confirmed when AAPL closed below the neckline, located around the $220 level. This breakdown suggests a bearish outlook, with a potential downside target of approximately $180, calculated by measuring the vertical distance from the head to the neckline and projecting it downward from the breakout point .

verifiedinvesting.com

📊 Trading Strategy:

Entry: Consider entering a short position upon a confirmed breakdown below the neckline.

Stop Loss: Place a stop loss above the right shoulder to manage risk.

Target: Set a profit target near the $180 level, adjusting based on market conditions.

verifiedinvesting.com

+4

tradingview.com

+4

tradingview.com

+4

⚠️ Risk Management:

Monitor for any bullish reversal patterns or a close above the neckline, as these could invalidate the bearish setup.

Note: This analysis is for informational purposes only and does not constitute trading advice. Always conduct your own research and consult with a financial advisor before making investment decisions.

last chance the set up is there sure earnings came out its okmonthly rsi bounced back above the 30 line as previous times in the past

in the weekly timeframe attached the rsi dipped far into 30 indicating oversold areas and by looking at the volume that accumulated around this price range it can indicate a rebound back up if bulls were to maintain these current price sure price can break into the low 0.70s a bit maybe more interest arises than as price drops

fundamentals look aligned with technicals and we can even say the company is undervalued.

monthly weekly daily timeframes were bullish up until pre market before markets open till now volume against the stock willing to sell is weak

MARA Is Waking Up And Looks Promising For The Crypto MarketMARA Is Waking Up And Looks Promising For The Crypto Market, as it can send the price even higher this year from a technical and Elliott wave perspective.

Marathon Digital Holdings with ticker MARA nicely and sharply recovered away from the strong support after a completed projected higher degree abc correction in wave B/2. So, similar as Crypto market, even MARA can be forming a bullish setup with waves »i« and »ii« that can soon extend the rally within wave »iii« of a five-wave bullish cycle within higher degree wave C or 3, especially if breaks above 21 first bullish evidence level. It could be easily supportive for the Crypto market if we consider a positive correlation.

REGN – Bullish Engulfing + RSI Divergence at Weekly DemandRegeneron (REGN) is showing strong technical signals of potential reversal from a key weekly demand zone, replicating a setup similar to March 2021.

🔹 Bullish Engulfing Candle forms directly at the demand zone after a multi-month downtrend.

🔹 Volume Spike confirms strong buyer interest.

🔹 RSI shows bullish divergence, breaking its internal structure and holding above 30.

🔹 MACD crossover is setting up, with histogram and signal lines echoing the same configuration from March 2021 — which led to a significant rally.

This is a textbook confluence setup:

Structure (demand zone)

Momentum (RSI divergence)

Confirmation (volume + engulfing)

Trigger alignment (MACD timing)

A decisive follow-through above recent highs could confirm the reversal and initiate a new bullish leg.

Carvana is setting up for a dropI believe CVNA is printing expanding triangle as wave 4 in larger 5.

If this count is correct, currently wave D of triangle is close to its end and soon, around $325-340, the trend should reverse and go down to complete the triangle with wave E which will erase >60% of market cap.

After this move the stock is expected to climb up again.

Plug Power: A Mirage or a Miracle?Plug Power (NASDAQ: PLUG), a key innovator in hydrogen energy solutions, recently experienced a significant surge in its stock value. This upturn is largely attributed to a strong vote of confidence from within the company: Chief Financial Officer Paul Middleton substantially increased his stake by acquiring an additional 650,000 shares. This decisive investment, following an earlier purchase, clearly signals robust conviction in Plug Power's future growth trajectory, despite prior market challenges. Analysts also reflect this cautious optimism, with an average one-year price target that suggests a significant upside potential from the current valuation.

A major catalyst for the renewed interest stems from Plug Power's expanded strategic collaboration with Allied Green Ammonia (AGA). This partnership includes a new 2-gigawatt (GW) electrolyzer project in Uzbekistan, part of a substantial $5.5 billion green chemical production facility. This facility will produce sustainable aviation fuel, green urea, and green diesel, positioning Plug Power's technology as foundational to large-scale decarbonization efforts. This initiative, backed by the Government of Uzbekistan, further solidifies a broader 5 GW partnership between Plug Power and AGA across two continents, highlighting the company's capability to deliver industrial-scale green hydrogen solutions.

While these strategic wins are promising, Plug Power continues to navigate financial headwinds. The company has faced recent revenue declines and currently reports significant annual losses and cash burn. To address capital needs, it is seeking shareholder approval to issue more shares. However, the substantial, multi-gigawatt contracts secured, particularly with Allied Green, underscore a strong future revenue pipeline. These projects affirm the critical demand for Plug Power's technology and its pivotal role in the evolving green hydrogen economy, emphasizing that the successful execution of these large-scale ventures will be key to long-term financial stability and sustained growth.

Guardant Surge: Targeting a Clean Breakout!”“Guardant Surge: Targeting a Clean Breakout!”

📝 Trade Breakdown:

🧬 Setup:

GH is showing a strong breakout retest pattern after breaking above consolidation near $48. The price is holding above support, forming a higher low with momentum.

📍 Entry: ~$49.53 (post-breakout retest)

🎯 Target: $52.40 (resistance/TP zone)

🛡 Stop Loss: ~$48.20 (below yellow support zone)

📊 Risk-Reward: ~2:1 — attractive and calculated

🔍 Technical Confirmation:

🔼 Retest of prior resistance turned support.

✅ Trendline + horizontal support convergence.

🔋 Strong prior volume push from $42–$50 range.

🎯 Caption Idea:

“GH is charging forward with a clean breakout setup! Holding above $49 could ignite a rally toward $52+.”

“Roblox Reloaded: Breakout at Play!”RBLX

📝 Trade Breakdown:

🎮 Setup:

RBLX formed a strong ascending base and is now attempting a breakout from a wedge consolidation, right above the yellow support zone. The structure shows bullish continuation if price holds above this pivot.

📍 Entry: ~$93.38 (breakout trigger point)

🎯 Target: $98.29 (upper green resistance zone)

🛡 Stop Loss: ~$91.67 (below wedge & horizontal support)

📊 Risk-Reward: ~1.8–2:1 — solid and technical

🔍 Technical Confidence:

📈 Strong trend from May to June.

🟨 Horizontal & trendline support converge at the breakout point.

🔺 Wedge breakout gives bullish continuation confirmation.

🎯 Caption Idea:

"Roblox breakout watch: Game on above $93. A clean wedge + retest = potential move to $98!"

"Breakout Eagle: Soaring Past Resistance XYZ!"Breakout Eagle: Soaring Past Resistance!"

📝 Trade Breakdown:

🚀 Setup:

XYZ just blasted past a key resistance zone with strong bullish momentum. The breakout is confirmed with a clean retest on both the trendline and horizontal support — a textbook long setup!

📍 Entry: $65.84 (on breakout retest)

🎯 Target: $68.20

🛡 Stop Loss: Below $65.00 support zone

📊 Risk-Reward: 2:1 — clean, calculated, and high conviction

🔍 Why It Stands Out:

Trendline breakout 📈

Resistance flip to support 🔄

Volume + price action confirm breakout ✅

Digital Turbine, Inc. (APPS)As a Whole formation, it looks to me the nearest Scenario is we Completed Major 1st Wave at 102$ , In my opinion as a technical analyst in charts and technical formations, in addition to the corrective formations I have encountered many times before, we have completed the correction of a leg of a major correction for the second large wave at $1.18. We are entering the early stages of the second leg, which I expect 99% will go to its final target at $141 by 2027. However, the closest level in 2025 is $25, and perhaps with significant news like a partnership and investment with major companies, it might hit the target of $49 by early 2026. The correction as a whole is called the minor or accelerating correction A B C.

Target Prices and Expected Periods: -

1 Month = 25$

6 - 9 Months = 49$

12 - 15 Months = 141$

APPS has a High Technical Rating by Nasdaq Dorsey Wright.

Earnings announcement* for APPS - Jun 16, 2025

TSLA: $300 is an important numberOver the past 5 years, $300 has been a very important price point -- both in support and resistance. Only once have we converged with the 200 day at $300 mark, and that was when we were hitting it as resistance. We are now in a position to do the same from the position of support. I think a similar yet opposite pattern should unfold if we move to this range.

Outside all that, we continue to maintain a cup and handle pattern. We are also maintaining higher lows.

Bullish signals and patterns outweigh the bearish in my eyes.

Best of luck.

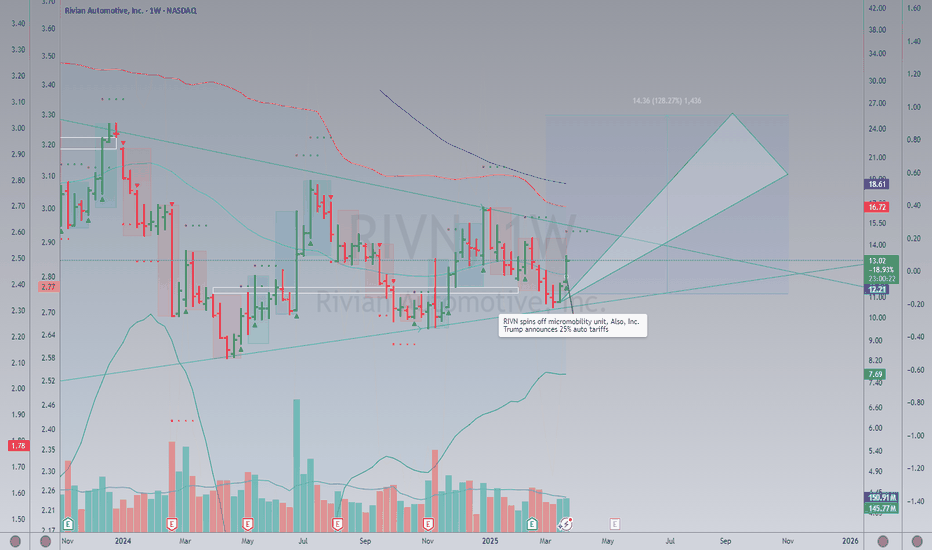

Rivian Kicking Off Potential UptrendHey, all. I'll get down to it. Obviously NASDAQ:RIVN has been an incredibly tough stock to own. Fake out after fake out. It has been brutal - unless you have been nimble enough to buy the dips and sell the rips.

I would like to posit, however, that NASDAQ:RIVN is going to start marching back higher here over time. In the signal system I have been taught via the T@M strategy, Rivian is putting in a range expansion to the upside on the weekly time frame. If you take the range of the past monthly consolidation period, attach it to the "mode" (or central zone of the consolidation range), it gives you a target of $25 over the next few months. Now, whether this is another fake out just to reverse on us... again... remains to be seen of course. It is early in the idea. But potentially offers a decent risk/reward position here.

I just do not see Rivian really going away at all and, if they can keep refining their business, they could see some success going forward. Anyway, hope you enjoy this idea! As always, position carefully as the market is risky business.

Including the Daily Chart below for your reference as well.

RIOT / 2hQuite sometimes, it's a better way to give patterns time to develop. So NASDAQ:RIOT has revealed a leading diagonal as an Intermediate degree wave (1), which remains in its very late stage! An impending correction in the same-degree wave (2) is expected to follow in the coming days.

Trend Analysis >> The Intermediate degree trend would have turned downward. And it might be a relatively deep retracement that takes a few weeks.

#CryptoStocks #RIOT #BTCMining #Bitcoin #BTC