Breakthrough sideways price channelTAQA has been moving in sideways price channel ranged from 11.60 to 12.90 in the past 7 month, and successfully breakthrough the significant upper resistance line of the sideways channel supported with trading volume higher than the past 10 month potentially targeting the below:

- TP1: 14.3

- TP2: 15.4

- TP3: 16.5

- SL: Below 12.9 "Confirmation required"

$BABA 160+ before year end looks realistic thanks $NVDA- NASDAQ:NVDA export ban lifted for China will be beneficial for NASDAQ:NVDA for sure but main advantages would be for NYSE:BABA as they can get the shovels from the shop as well so that they can compete in Gold Rush and compete with NASDAQ:GOOGL , NASDAQ:META and other private companies like Open AI and Anthropic.

- There are good universities in China and NYSE:BABA is regional big tech in China which gets great talent. I'm confident that NYSE:BABA would be able to compete with NASDAQ:META & NASDAQ:GOOGL in building LLMs even better with this export ban lift.

- Long NYSE:BABA and short/avoid NASDAQ:META ( overvalued )

ANANT RAJ – Breakout From Rounded Base | ₹700+ Swing PossibleANANT RAJ has triggered a fresh breakout above the ₹580 zone – reclaiming its prior breakdown level from Feb 2025. This comes after a rounded base formation lasting 4+ months.

Breakout 1: June 2, on volume, cleared the March–May base

Breakout 2: Now taking out neckline of broader inverse H&S

Volume: Expanding again

RSI: Bullish, no divergence

Structure: Clean higher highs and lows post-Feb low

Measured Move Target: ₹700

Stop-Loss: ₹558

Fundamentals Support Swing Bias:

Low debt, strong solvency

Net profit margin ~21%

FY26 profit growth estimate ~32%

Valuation expensive (P/E ~46), but growth supports it short term

Not a long-term compounding candidate yet – monitor execution

Positioning:

Swing trade, not an investment. Ride momentum. Trail stops. No averaging up. Exit if ₹558 breaks on closing basis.

Disclaimer:

This analysis is for educational purposes only. It is not investment advice. Do your own due diligence. Trade at your own risk.

MicroStrategy Bitcoin FOMOIs it time to sell? In percentage terms, MicroStrategy has significantly outperformed its underlying asset, Bitcoin. It's concerning to watch Michael Saylor's FOMO (fear of missing out) into Bitcoin over the past year, as this could ultimately do more harm than good for Bitcoin. MicroStrategy's stock seems massively overvalued compared to its Bitcoin holdings. As the saying goes, "when the tide goes out, we see who is swimming naked."

Over the same period Bitcoin has gained 674%, while MicroStrategy has gained 2831%, making the situation quite clear. When comparing past bull runs, the percentage gains between Bitcoin and MicroStrategy have typically matched more closely, with both assets trending up together. So, what's different this time? Media exposure and FOMO.

Proceed with caution; this is starting to look like a bubble. Is it time to short?

LOTCHEM PROBABLY IN WAVE ' X ' OR ' Y ' OF A CORRECTIONAs per our preferred wave count LOTCHEM is in wave Y which should take prices further down toward the 13 level and if bearish trend stays strong then even 9.50 is on the cards, however prices need to break below 15.53 level first.

Alternately prices can still be in X wave and will take prices further up towards 25.40 - 27.40 range and if the bullish trend stays strong 31 level is also at hand, however prices will have to break above 20.20 level first.

As the overall momentum of the PSX is bearish and our preferred wave count is bearish, We will activate short sell trade once price close below the red trendline on the daily chart.

Incase prices never close below the red trendline and starts rising, We will enter long position at 20.20 targeting 25.40 range. I will share stop loss for the trade setup once our trade gets actived

Let see how this plays, Good Luck!

Disclaimer: The information presented in this wave analysis is intended solely for educational and informational purposes. It does not constitute financial or trading advice, nor should it be interpreted as a recommendation to buy or sell any securities.

Engineers India Ltd (EIL): Rounding Bottom Breakout in Sight!🚀 Engineers India Ltd (EIL): Rounding Bottom Breakout in Sight! 🚀

📉 CMP: ₹212

🔒 Stop Loss: ₹189

🎯 Target: ₹260

Why EIL Looks Promising?

✅ Rounding Bottom Formation: Strong base pattern on daily chart signals long-term reversal potential

✅ Reversal Signs: Bullish structure with increasing volumes confirms buyer interest

✅ Sector Tailwind: Capital goods & infra theme gaining strength—EIL may benefit

💡 Strategy:

📈 Staggered Entry: Ideal for long-term investors—accumulate in phases near support

🔒 Strict SL: Keep stop loss at ₹189 to manage downside risk

📍 Outlook: As EIL moves above key resistance levels with strength, it sets the stage for a breakout toward ₹260

📉 Disclaimer: Not SEBI-registered. Please conduct your own research or consult a financial advisor before investing.

#EIL #EngineersIndia #TechnicalBreakout #RoundingBottom #SwingTrading #StockMarket

LT Foods: On the Verge of a Strong Breakout! 🚀 LT Foods: On the Verge of a Strong Breakout! 🚀

📉 CMP: ₹436

🔒 Stop Loss: ₹370

🎯 Target: ₹530

🔍 Why LT Foods Looks Promising:

✅ 7-Month Box Breakout Setup: A tight consolidation zone on the monthly chart is set for a potential breakout

✅ Volume Confirmation: Recent price action shows strength—buyers stepping in

✅ Add on Dips: Accumulate confidently till ₹390 if the price pulls back

💡 Strategy & Risk Management:

📈 Staggered Entry: Phase your positions for optimal risk-reward

🔒 Strict SL: Protect capital with a disciplined stop loss at ₹370

📍 Outlook: A decisive move above resistance may lead to a swift rally towards ₹530—LT Foods is a breakout candidate worth watching.

📉 Disclaimer: Not SEBI-registered. Please conduct your own research or consult a financial advisor before investing.

#LTFoods #TechnicalBreakout #BoxBreakout #SwingTrading #StockMarket #TechnicalAnalysis #InvestmentOpportunity

Elecon Engineering: Pre-Breakout Momentum Building!🚀 Elecon Engineering: Pre-Breakout Momentum Building! 🚀

📉 CMP: ₹716

🔒 Stop Loss: ₹652

🎯 Target: ₹952

🔍 Why It Looks Promising?

✅ Rounding Bottom Breakout: Strong breakout above ₹652 with a successful retest.

✅ Fresh Upside Move: Momentum picking up—on track to challenge all-time highs.

💡 Strategy & Risk Management

📈 Staggered Entry: Accumulate gradually near support to manage risk effectively.

🔒 Strict SL: Maintain a disciplined stop loss at ₹652 to protect capital.

📍 Outlook: Elecon is well-positioned for a fresh rally with strong technical structure and volume support.

📉 Disclaimer: Not SEBI-registered. Please conduct your own research or consult a financial advisor before investing.

#EleconEngineering #BreakoutStocks #TechnicalAnalysis #RoundingBottom #SwingTrading #StockMarketIndia #InvestSmart

Laurus Labs: Short-Term Momentum Setup! 🚀 Laurus Labs: Short-Term Momentum Setup! 🚀

📉 CMP: ₹624

🔒 Stop Loss: ₹604

🎯 Target: ₹660

🔍 Why Laurus Labs?

✅ Key Fibonacci Confluence: Price hovering around the crucial 62% retracement level.

✅ Derivatives Signal: Highest Call OI at ₹620—now acting as support.

✅ Momentum Watch: The stock is positioned to gain traction in the short term.

💡 Quick Strategy

📈 Short-Term Trade: Ideal for momentum traders looking for a clean risk-reward setup.

🔒 Strict SL: Maintain a disciplined stop loss at ₹604 to safeguard capital.

📉 Disclaimer: Not SEBI-registered. Please do your own research or consult a financial advisor before investing.

#LaurusLabs #MomentumStocks #ShortTermTrade #TechnicalAnalysis #SwingTrading #StockMarketIndia

Time to buy? Too much negative press. Buy in Fear- Updated 13/7Apple has faced prolonged downward pressure from bearish investors. Despite its best efforts and some dips, the stock has steadily maintained a baseline price of 200 USD. The flag pattern required some adjustments along its path to break out, primarily due to geopolitical issues and economic variables. Ultimately, Apple broke out to the upside in the week of June 30th, as predicted in my earlier posts. This breakout resulted from end-of-Q2/H1 sell pressure, delivering a 7.56% gain or 15 USD. This is a very bullish sign for Apple, and with the tailwinds forming for September product releases, we can expect further gains as traders return and volume increases.

If Apple follows its historical profit trajectory (see pink line), we could see a new all-time high (ATH) in the region of 270 USD in September. The green resistance and support levels are highlighted, and I may use these to adjust my position, considering whether to short or go long once confirmation is established on the daily timeframe.

Apple has significantly underperformed compared to the other Magnificent 7 stocks, but I don’t believe it’s a company you should bet against in the current climate. With a slow rollout of AI and recent statements from Apple, they may not always be first to market, but they generally execute well. The remarks regarding Sony, Samsung, and Netflix by Apple were very revealing and demonstrate a solid long-term strategy. However, there may be some bumps along the way as they work toward their goals, potentially involving acquisitions.

The fear spread in the media is similar to the FUD (fear, uncertainty, doubt) often associated with Bitcoin, and this is typically a good time to buy. Remember the saying: if retail investors miss the boat, it’s gone, but if institutions miss it, they often bring the boat back.

While this is not financial advice, based on the green weekly candle, it's hard not to pay attention, and Apple may now have a very positive year ahead! Especially with the weakening dollar and reports stating that this will benefit them greatly.

Apple has continued to trend along its predicted trajectory, and with the exception of economic headwinds driving the price down, this trend is expected to continue. Strong support has been observed at 210 USD, with further support at $208.50, providing solid technical support for potential upside while reducing the risk of a downturn below $208. However, a short correction could occur if overall market confidence is shaken due to new policies. Nevertheless, Apple has demonstrated resilience to new tariffs, and its underperformance compared to other tech giants indicates plenty of upside potential. The target price remains set at over $260.

My large long position is still intact, and my target price will depend on how we manage supports and resistances. I am looking to take profits at over 260 USD.

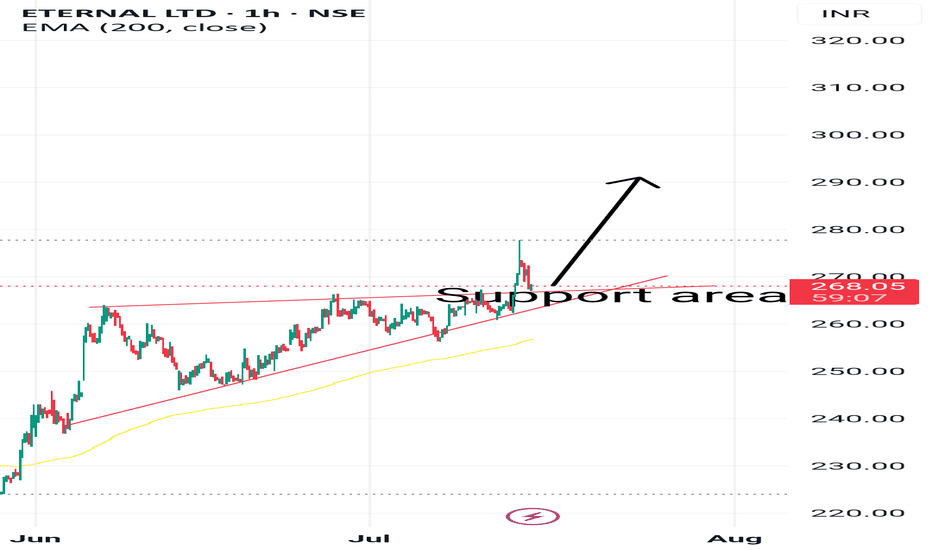

ETERNALHi,

Breakout of acceding triangle. And now price at support area.

Latest Swing low is stop loss area

This idea is for Educational purpose and paper trading only. Please consult your financial advisor before investing or making any position. Facts or Data given above may be slightly incorrect. We are not SEBI registered

POL PROBABLY IN WAVE '' C '' OR " 3 " - LONGThis is in continuation of our ongoing tracking of POL wave structure.

POL is currently in C or 3 which will target the 620-623 or 680 level. Our preferred wave count is C and we will target the 620 level. If our wave count is correct then prices will decline to our buy zone of 588-567 range as wave 4.

Alternately prices will never go to our buy zone and will reach the 620 - 623 level directly making this trade setup as void.

We will buy in portions at 588 > 580 > 576 level

Trade setup:

Entry price: 588 - 567

Stop loss: 547

Targets: 620 - 623

Let see how this plays, Good Luck!

Disclaimer: The information presented in this wave analysis is intended solely for educational and informational purposes. It does not constitute financial or trading advice, nor should it be interpreted as a recommendation to buy or sell any securities.

Axis Bank Hi,

price Trade in zone . And currently it is available at support area.

So it's possible that price will move above The support area

This idea is for Educational purpose and paper trading only. Please consult your financial advisor before investing or making any position. Facts or Data given above may be slightly incorrect. We are not SEBI registered

SNBL PROBABLY IN WAVE ' Z ' OF B or CThis is in continuation of our ongoing tracking of SNBL wave structure, prices have broken above the 22.50 level indicating one more leg upwards.

Currently the price is unfolding as wave Z which will target 26 - 28.50 zone, however the prices should decline towards the 20.70 - 19.80 level (buy zone) before rising again.

If the prices go below the 18.60 level, it will significantly weaken this wave count. we will only activate this trade if price reach our buy zone.

If the wave count is correct then this trade will provide us minimum 25.60% gross gain.

Trade Setup:

Entry level: 20.70 - 19.80

Stop loss: 18.59

Target: 26 - 28.50

Let see how this plays, Good Luck!

Disclaimer: The information presented in this wave analysis is intended solely for educational and informational purposes. It does not constitute financial or trading advice, nor should it be interpreted as a recommendation to buy or sell any securities.

Soaring High: What Fuels GE Aerospace's Ascent?GE Aerospace's remarkable rise reflects a confluence of strategic maneuvers and favorable market dynamics. The company maintains a dominant position in the commercial and military aircraft engine markets, powering over 60% of the global narrowbody fleet through its CFM International joint venture and proprietary platforms. This market leadership, coupled with formidable barriers to entry and significant switching costs in the aircraft engine industry, secures a robust competitive advantage. Furthermore, a highly profitable aftermarket business, driven by long-term maintenance contracts and an expanding installed engine base, provides a resilient, recurring revenue stream. This lucrative segment buffers the company against cyclicality and ensures consistent earnings visibility.

Macroeconomic tailwinds also play a crucial role in GE Aerospace's sustained growth. Global air travel is steadily increasing, driving higher aircraft utilization rates. This directly translates to greater demand for new engines and, more importantly, consistent aftermarket servicing, which is a core profit driver for GE Aerospace. Management, under CEO Larry Culp, has also strategically navigated external challenges. They localized supply chains, secured alternate component sources, and optimized logistics costs. These actions proved critical in mitigating the impact of new tariff regimes and broader trade war tensions.

Geopolitical developments have significantly shaped GE Aerospace's trajectory. Notably, the U.S. government's decision to lift restrictions on exporting aircraft engines, including LEAP-1C and GE CF34 engines, to China's Commercial Aircraft Corporation of China (COMAC) reopened a vital market channel. This move, occurring amidst a complex U.S.-China trade environment, underscores the strategic importance of GE Aerospace's technology on the global stage. The company's robust financial performance further solidifies its position, with strong earnings beats, a healthy return on equity, and positive outlooks from a majority of Wall Street analysts. Institutional investors are actively increasing their stakes, signaling strong market confidence in GE Aerospace's continued growth potential.

3 Reasons Why Cisco Stock Is Ready to Rocket (Bonus Strategy)3 Reasons Why Cisco Stock Is Ready to Rocket (Bonus Strategy Inside)

Cisco is flashing bullish signs from candlesticks to volume. Here's why a breakout could be imminent — with a bonus momentum strategy revealed.

---

Cisco Systems ( NASDAQ:CSCO ) is showing signs of a potential breakout — and savvy traders should take notice. Here’s why this tech giant is gathering bullish momentum across multiple signals:

1️⃣ Long Lower Shadow Candlestick Pattern

A long lower shadow on the recent candle suggests strong rejection of lower prices. This shows that buyers stepped in

aggressively after an intraday dip — a classic bullish reversal sign that often marks the end of a pullback phase.

2️⃣ Volume Oscillator Below Zero

The volume oscillator dipping below zero may seem bearish at

first, but in context, it shows a decline in selling pressure. When paired with other bullish indicators, this can signal the calm

before a strong move upward — especially if bulls take control on the next candle.

3️⃣ High Volume on the 4H Time Frame

Volume doesn’t lie — and it’s surging on the 4-hour chart. This spike in volume at key support levels adds strong confirmation

that institutional players may be stepping in. When volume rises while price action forms reversal candles, it increases the

probability of a sustained upward move.

---

🚀 Bonus Reason: The Rocket Booster Strategy is in Play

Cisco is also aligning with the Rocket Booster Strategy, which requires:

Price trading above the 50 EMA

Price trading above the 200 EMA

A recent gap up confirmed by Parabolic SAR

Strong supporting volume

This strategy acts like ignition for high-momentum trades — and Cisco looks ready for lift-off.

---

📌 Conclusion:

With technicals aligning and volume building, Cisco could be gearing up for a breakout. Traders should keep an eye on confirmation candles and volume spikes to validate the next leg upward.

---

📉 Disclaimer: Trading involves risk. Always conduct your own research and consult a financial advisor before investing.

---

Buy Idea: Habib Bank Limited (HBL)📘 Buy Idea: Habib Bank Limited (HBL)

🔹 Timeframe: Monthly | Strategy: Structure + Type 1.4 + Context Targets

✅ Entry Zone:

Buy between 145 – 155 PKR (near the marked "M Type 1.4" level).

📉 Stop Loss (SL):

Below 92 PKR

("This low to be held as protected low" – the ITL zone).

🎯 Take-Profit Targets (TP):

Target Price (PKR) Gain % Description

TP1 240 ~60% First context target

TP2 314 ~120% Previous major high

TP3 411 ~165% Final potential rocket move 🚀

📌 Context & Narrative:

Price broke key structure levels and is forming a bullish base.

Multiple STL levels swept – shows smart money accumulation.

"M Type 1.4" indicates institutional interest.

Targets are based on historical price action and FVG-based projection.

💡 Position Strategy:

Buy 50% at current price (150–155)

Add 25% on a pullback to 140

Add 25% if price dips toward 130