OPEN-SOURCE SCRIPT

Altered Money Flow Index by CoffeeShopCrypto

**Use the comments section below to request access to the script**

Market Trends need to be confirmed each and every time.

Over the years the Money Flow Index has been a tool to find where the money is flowing

either long or short in market movements.

Long confirmation and false short

Confirming a long entry:

1. Wait for price to close above a previous swing high.

2. Look to see if the MFI is in UPCOLOR and above ZERO.

Confriming a short entry:

1. Wait for price to close below a previous swing low.

2. Look to see if the MFI is in DOWNCOLOR and below ZERO.

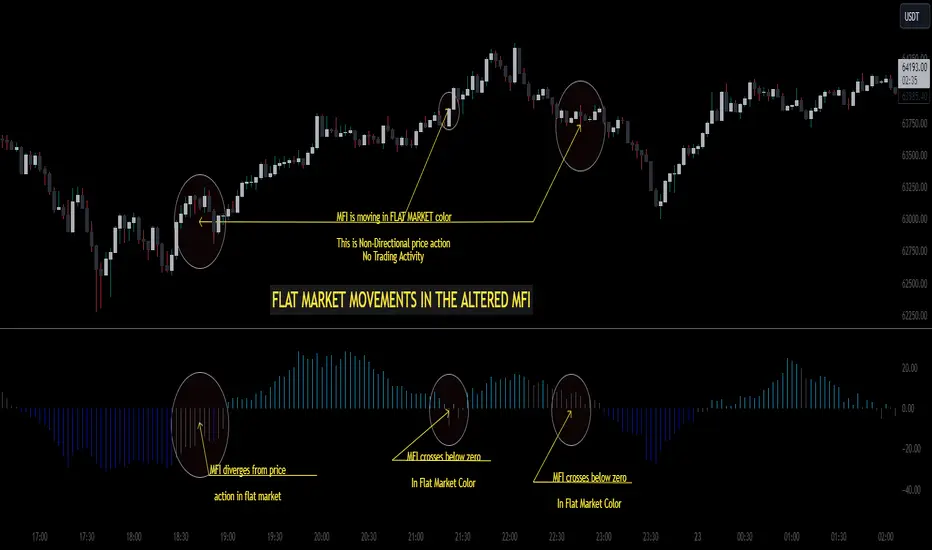

NON-Confirmed market: (Flat Market)

Anytime you believe you have a confirmation via price action, check the MFI to see if it is in FLAT MARKET color.

If this is true, do not enter until it is out of FLAT MARKET color.

Flat Market ALtered MFI

A Flat Market Altered MFI reading can do a few things for you.

It can help to confirm the following:

1. price action is moving sideways.

2. a pullback or market stall that was deep enough where dis-intrest in the market occured.

3. a sudden loss of momentum in the short term trend of closing prices.

Utilizing the Altered Money Flow Index indicator by CoffeeShopCrypto offers traders a nuanced approach to identifying market trends, including periods of flat market conditions. Alongside its directional bias indicating bullish or bearish activity based on whether values are above or below zero, respectively, the script incorporates a distinctive feature to recognize flat markets. When neither bullish nor bearish momentum dominates, the indicator designates a flat market, denoted by a distinct color. This feature enhances traders' ability to discern not only bullish and bearish phases but also periods of market consolidation or indecision.

In addition to its ability to recognize bullish and bearish trends, the Altered Money Flow Index indicator by CoffeeShopCrypto incorporates a unique feature to signify potential pullbacks or pauses in market momentum. This is particularly evident when the MFI crosses below zero while displaying a flat market color. Such occurrences suggest that although the short-term movement may appear bearish, it's likely a temporary pullback rather than a sustained trend reversal. Similarly, when the MFI crosses above zero amidst a flat market color, it indicates a potential pause in bullish momentum, urging traders to exercise caution and await confirmation of a sustained uptrend. By incorporating these nuanced observations, traders can effectively discern between short-term fluctuations and significant trend changes, enabling them to make more judicious trading decisions and avoid premature entries or exits.

Alongside its directional bias indicating bullish or bearish activity based on whether values are above or below zero, respectively, the script integrates the Relative Strength Index (RSI) to further refine market analysis. When the Altered MFI and RSI are both above zero, it suggests a strong bullish trend, indicating significant buying pressure. Conversely, when both indicators are below zero, it indicates a strong bearish trend, signifying heightened selling pressure. By observing the confluence between the Altered MFI and RSI, traders can gain valuable confirmation of bullish or bearish money flow in the market, enabling them to make more informed trading decisions.

Market Trends need to be confirmed each and every time.

Over the years the Money Flow Index has been a tool to find where the money is flowing

either long or short in market movements.

Long confirmation and false short

Confirming a long entry:

1. Wait for price to close above a previous swing high.

2. Look to see if the MFI is in UPCOLOR and above ZERO.

Confriming a short entry:

1. Wait for price to close below a previous swing low.

2. Look to see if the MFI is in DOWNCOLOR and below ZERO.

NON-Confirmed market: (Flat Market)

Anytime you believe you have a confirmation via price action, check the MFI to see if it is in FLAT MARKET color.

If this is true, do not enter until it is out of FLAT MARKET color.

Flat Market ALtered MFI

A Flat Market Altered MFI reading can do a few things for you.

It can help to confirm the following:

1. price action is moving sideways.

2. a pullback or market stall that was deep enough where dis-intrest in the market occured.

3. a sudden loss of momentum in the short term trend of closing prices.

Utilizing the Altered Money Flow Index indicator by CoffeeShopCrypto offers traders a nuanced approach to identifying market trends, including periods of flat market conditions. Alongside its directional bias indicating bullish or bearish activity based on whether values are above or below zero, respectively, the script incorporates a distinctive feature to recognize flat markets. When neither bullish nor bearish momentum dominates, the indicator designates a flat market, denoted by a distinct color. This feature enhances traders' ability to discern not only bullish and bearish phases but also periods of market consolidation or indecision.

In addition to its ability to recognize bullish and bearish trends, the Altered Money Flow Index indicator by CoffeeShopCrypto incorporates a unique feature to signify potential pullbacks or pauses in market momentum. This is particularly evident when the MFI crosses below zero while displaying a flat market color. Such occurrences suggest that although the short-term movement may appear bearish, it's likely a temporary pullback rather than a sustained trend reversal. Similarly, when the MFI crosses above zero amidst a flat market color, it indicates a potential pause in bullish momentum, urging traders to exercise caution and await confirmation of a sustained uptrend. By incorporating these nuanced observations, traders can effectively discern between short-term fluctuations and significant trend changes, enabling them to make more judicious trading decisions and avoid premature entries or exits.

Alongside its directional bias indicating bullish or bearish activity based on whether values are above or below zero, respectively, the script integrates the Relative Strength Index (RSI) to further refine market analysis. When the Altered MFI and RSI are both above zero, it suggests a strong bullish trend, indicating significant buying pressure. Conversely, when both indicators are below zero, it indicates a strong bearish trend, signifying heightened selling pressure. By observing the confluence between the Altered MFI and RSI, traders can gain valuable confirmation of bullish or bearish money flow in the market, enabling them to make more informed trading decisions.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Discord = discord.gg/EAncX5TpfB

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Discord = discord.gg/EAncX5TpfB

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.