OPEN-SOURCE SCRIPT

Updated Follow Trend - Wall Street Strategy

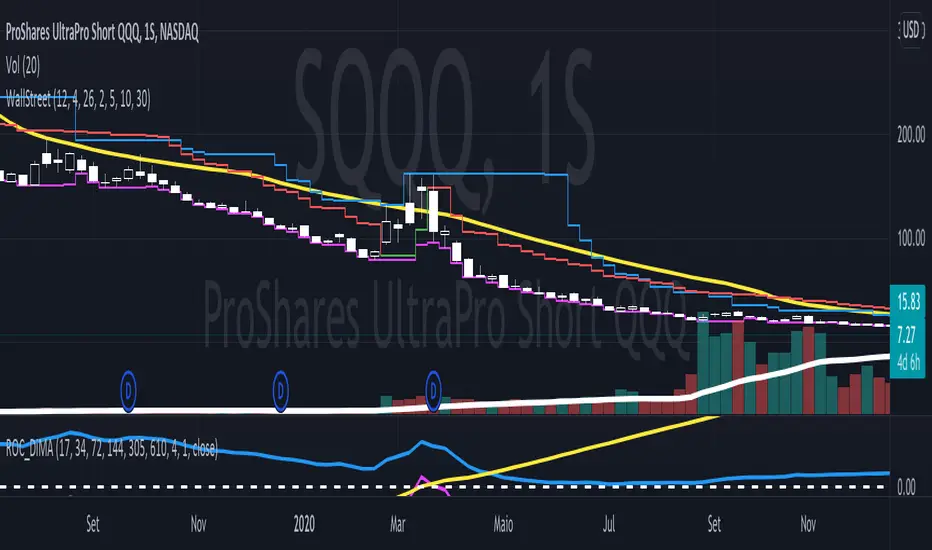

It is a mix of three common indicators, they are The High band level of Donchian Channel, 6 emas (17, 34, 72, 144, 200 and 305), and 2 VStop with different multipliers.

We search stocks are going higher and higher each time. So we look at the High-level Donchian band and if the price made a little correction and didn't touch the VStop indicator and, the price is higher than all the ema's. So we try to buy the stocks when it pass through the last highest price.

The Vstop-short we use to stocks and commodities.

The VStop-long, we use to Bonds and Reits.

In order to help, there is a triangle when the price crossover any VStop, at least the half of Donchian period.

We search stocks are going higher and higher each time. So we look at the High-level Donchian band and if the price made a little correction and didn't touch the VStop indicator and, the price is higher than all the ema's. So we try to buy the stocks when it pass through the last highest price.

The Vstop-short we use to stocks and commodities.

The VStop-long, we use to Bonds and Reits.

In order to help, there is a triangle when the price crossover any VStop, at least the half of Donchian period.

Release Notes

I forgot one of the ema'sRelease Notes

There are some other possibilities about crossing price and VStop-short and VStop-long that I was forgot. Now it is complete!Release Notes

Some wrong indication on it touch the VStopRelease Notes

EMA's change color to green when the price is upper than ema's and they are red when the price is lower than they.Release Notes

1 -I put the correct name of each ema in plot and now they are the same at the user display2- All the important values are showing at the end . There is a resume of our strategy, Its show the start price (the highest value + 0.01), the short-stop value, the long-stop value and its brings if all the price is higher then all ema's ploted. If one of the ema's is above the price, it will show the ema's problem and don;t shows the our strategy value.

Release Notes

Legend text now is white, not black.Release Notes

User can choose DarkTheme or LightTheme on the legendsRelease Notes

Now its show the relation risc vs return at each ATRRelease Notes

In some stocks, we don't have enough data to calculate large ema's, so in these cases, the strategy shows Ema's Bad but it isn't true. we don't have enough data to calculate it. In those cases, we will ignore them. When the close price was below ema our script says it was bad, but it isn't true either. It is irrelevant for our strategy because the price along the week was above the ema, so now we calculate the ema using the high price along the week.

Release Notes

I changed some indicators colors. I added dashed extend lines to show here are the vstop, vstop2 and buyprice.Release Notes

DarkTheme is working nowSubtract some indicators that we didn't use anymore.

Now is more simply. They are project to weekly graphcs.

Release Notes

Correction on value of Donchian BottomRelease Notes

Change Colors on Donchian Bottom and EMA2Release Notes

Change Line StylesRelease Notes

The Vstop line has two color. When the vstop price is less than close price the line will be green and when the vstop price is higher then close price it will be red.Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.