IMGPro - V1.0

1. Identify Higher Timeframe Market Structure and Points of Interest (HTF-POIs)

2. Calculate position size based on your risk appetite, fees and account leverage and customisable maximum trade risk

3. Verify price is in a premium or discount

4. Determine Lower Timeframe Market Structure Break Type

5. Apply Early Warning Systems if enabled

6. Alert you to risk managed trade setups at enabled HTF-POIs

7. Alert you to unentered trade invalidations

8. Alert you to trade exits based on your set criteria

9. Provide Additional Alerts such as Higher Timeframe SFPs and Market Structure Breaks that act as potential early warnings that a trade setup may be forming

1. HTF POIs Available with IMG PRO:

a. HTF Market Structure Range Highs and Lows

b. HTF Order Blocks

c. HTF Order Blocks & FVG Overlaps

d. HTF Breakers

e. HTF Breakers & FVG Overlaps

f. HTF FVGs

g. Internal Liquidity Levels

These levels are used for Trade Signals based on user settings applied. Details provided in the trade setup section below

a. Higher Timeframe Market Structure Range High and Low through Multiple Timeframe Analysis:

Market Structure can be defined using several techniques. The IMG indicators employ the Close through High/Low technique, which necessitates a candle to close through a structural level to validate a structural break and designate a new range.

Example: H12 Market Structure visualisation on a H12 Chart with annotations:

By selecting a particular Market Structure timeframe in the settings, the indicator immediately illustrates both current and historical market structures for the chosen timeframe across all subordinate timeframes, subject to the limitations of your Tradingview subscription.

Example: H12 Market Structure visualisation on a H1 Chart with annotations:

b. Higher Timeframe Order Blocks

An Order Block represents the last candle of the opposite direction preceding a Market Structure Break. For instance, a bullish Order Block is identified as the final bearish candle leading to a bullish market structure break, and vice versa for bearish Order Blocks.

Example: H12 OB visualisation on a H12 Chart with annotations:

When activated, the indicator will highlight the Higher Timeframe Order Blocks responsible for a Market Structure Break on all subordinate timeframes relative to the chosen Market Structure Timeframe.

Note: if multiple OBs exist, the indicator will display the OB closest to the new range extreme

Example: H12 OB visualisation on a H1 Chart with annotations:

c. HTF Order Blocks & HTF FVG Overlaps

When enabled, the IMG Pro will only display overlaps of Order Blocks and FVGs. These are strong points of interest to look for trade setups

Example of the indicator displaying a Higher Timeframe’s (HTF) OBs + FVGs on a Lower Timeframe (LTF) chart:

The upper chart labelled H12/H12 is the indicator displaying H12 Structure and OB+FVGs on a H12 chart.

The lower chart labelled H12/H1 is the indicator displaying H12 OB+FVGs on a H1 chart:

d. Higher Timeframe Breakers

A Breaker Block is identified as the most recent Order Block that has been breached by price, leading to an opposite Market Structure Break. For example, a bullish Breaker Block is the last bearish Order Block that price has passed through, confirming a bullish structural break, and the inverse is true for bearish Breakers.

Example: H12 Breaker visualisation on a H12 Chart with annotations:

Once enabled, the system will display Higher Timeframe Breaker Blocks after an opposite Market Structure Break is confirmed on all subordinate timeframes.

Example: H12 Breaker visualisation on a H1 Chart with annotations:

e. HTF Breakers & HTF FVG Overlaps

When enabled, the IMG Pro will only display overlaps of Breakers and FVGs. These are strong points of interest to look for trade setups

Example:

The upper chart labelled H12/H12 is the indicator displaying H12 Structure and Breakers+FVGs on a H12 chart

The lower chart labelled H12/H1 is the indicator displaying H12 Breakers+FVGs on a H1 chart

f. Higher Timeframe Fair Value Gaps (FVGs)

A Fair Value Gap is a concept used by price action traders to identify market inefficiencies, where buying and selling are not balanced. It appears on a chart as a triple-candle pattern, with a large candle flanked by two others whose highs and lows do not overlap with the large candle, creating a gap. This gap often attracts the price towards it before the market resumes its previous direction.

Example of the indicator displaying a Higher Timeframe’s FVGs on a Lower Timeframe (LTF) chart:

-The upper chart labelled H12/H12 is the indicator displaying H12 Structure and FVGs on a H12 chart.

-The lower chart labelled H12/H1 is the indicator displaying H12 FVGs on a H1 chart

g. HTF Internal Liquidity Levels (FVGs)

A HTF Liquidity Level is a Higher Timeframe three bar Pivot that forms inside an active range.

When enabled, the system will display all UNTESTED HTF pivots formed within an active range. Lines will stop extending once they are either tested or HTF Market Structure Breaks

Example: H12 Liquidity Levels on a H1 Chart:

2. Risk Management and Position Sizing:

a. Automated Position Sizing:

The System will automatically calculate position size based on the account size, max leverage and risk appetite (capital risk per trade) details input in settings. Calculated trade details are included in the Tradingview Alerts as well as interactive labels on the charts.

Details include but are not limited to:

Trade Timeframe

Side: Long/Short

Type: Limit/Market

Position Size in $ and Units

Lot sizes if applicable

Trade Risk %

Take Profit Level

Entry Price

Stoploss Price

b. Maximum Trade Risk:

IMG PRO has the ability to invalidate potential trade entries if it exceeds your maximum Trade Risk threshold. Trade Risk is the % price difference between entry and stoploss.

When an invalid signal is generated, the signal will not be shaded and the interactive label will display the reason for invalidation

In the example below, Max Trade Risk is set to 2%, but the trade signal had a trade risk of 5.11% invalidating the signal with a grey triangle

3. Verify Premium / Discount:

The system can be setup to only display signals that are in the top or bottom n% of the Market Structure Range

A value of 0 (default) will disable the premium/discount system and utilize the entire range for all signal types (bullish and bearish)

EXAMPLES:

A value of 50% will only display bullish signals that have, at minimum, tagged the bottom half of the range and vice versa for bearish signals.

A value of 25% will only display bullish signals that have tagged the bottom quarter of the range and vice versa.

A value of 38.2% will display signals that tag the top and bottom 38.2% of the range (equivalent of the 61.8% OTE. retracement) Etc.

4. Determine Lower Timeframe Market Structure Break Type

IMG Pro has two options for Lower Timeframe Structure Breaks:

Market Structure Breaks: When selected, the system will use the first opposite pivot (in the current chart timeframe) to the left of a confirmed SFP to calculate a break in market structure when price closes through it:

Market Structure Shifts: When selected, the system will use the first opposite pivot (in the current chart timeframe) to the left OR right of a confirmed SFP to calculate a break in market structure when price closes through it. MSS’ are more sensitive and may provide more false signals but are useful when there are big spike liquidity runs:

5. Apply Early Warning Systems if enabled:

The IMG Pro indicator has an early warning system that will generate a potential setup alert before a HTF SFP is confirmed

There are two types of early warnings:

LTF Structure Break Early Warning:

If enabled, the system will generate a potential setup alert if price cuts through a HTF level (Range Extreme / Internal Liquidity) and prints an opposite LTF MSB back through that level. This is a more aggressive approach where the system does not wait for the HTF SFP to be confirmed.

Example: In the screenshot below, the system did not wait for a H12 SFP to be confirmed, allowing it to signal an entry that would have otherwise been missed if the LTF Structure Break early warning system was not enabled

LTF FVG Early Warning:

If enabled, the system will generate a potential setup alert if price cuts through a HTF level (Range Extreme / Internal Liquidity) and prints an opposite LTF FVG back through that level. No LTF MSB is required and a limit order at the FVG is signalled. This is a more aggressive approach where the system does not wait for the HTF SFP to be confirmed.

Example: In the screenshot below, the system did not wait for a H12 SFP to be confirmed, signalling an entry as soon as an opposite LTF FVG is confirmed pushing price back through the HTF Liquidity Levels

6. Trade Setup Types Available with IMG PRO:

The system will alert you to potential trade setups at these HTF POIs:.

a. Higher Timeframe (HTF) Swing Failure followed by a Lower Timeframe (LTF) MSB at Range Extremes

b. Higher Timeframe (HTF) Swing Failure followed by a Lower Timeframe (LTF) MSB at enabled HTF POIs

c. Higher Timeframe (HTF) Swing Failure followed by a Lower Timeframe (LTF) MSB at All Internal Liquidity Levels (With Trend and Counter Trend)

d. Higher Timeframe (HTF) Swing Failure followed by a Lower Timeframe (LTF) MSB at All Internal Liquidity Levels (With Trend ONLY)

e. Lower Timeframe (LTF) Swing Failure followed by a Lower Timeframe (LTF) MSB at enabled HTF POIs

f. Multiple LTF Entry Options once a signal is confirmed

a. HTF Swing Failure followed by a LTF MSB at Range Extremes

A Swing Failure Pattern (SFP) is a technical analysis concept used in trading to identify potential reversals in price trends. It occurs when the price attempts to surpass a previous high or low but fails to sustain that level, indicating a possible change in market direction. There are multiple methods to define a SFP but this indicator uses the failure to close through a Key Level. When confirmed, HTF SFPs will be displayed on-screen and an alert will fire if enabled.

Example: EURUSD H12 Trade Setup Alerts at Range Extremes on a H1 Chart:

Alerts to Enter at Lower Timeframe MSBs

When enabled, a potential trade setup label and alert will generate when a HTF SFP is confirmed at a Range Extreme followed by a Chart Timeframe (Lower Timeframe) Market Structure Break (MSB). These signals are agnostic to current Market Structure bias and will generate at both extremes.

b. HTF Swing Failure followed by a LTF MSB at HTF POIs:

When enabled, a trade setup label and alert will generate when a HTF SFP is confirmed at an enabled Higher Timeframe POI (Order Blocks / Breakers / FVGs) followed by a Chart Timeframe (Lower Timeframe) Market Structure Break (MSB). These signals are always in line current Market Structure bias.

Example: H12 SFPs and Trade Setups at HTF POIs with Fluid Exits on a H1 Chart:

c. HTF Swing Failure followed by a LTF MSB at All Internal Liquidity Levels (With Trend and Counter Trend):

When enabled, a trade setup label and alert will generate when a HTF SFP is confirmed at an Internal Liquidity Level followed by a LTF Market Structure Break (MSB) or Market Structure Shift(MSS). These signals are agnostic to HTF Market Structure bias and will alert to setups with and counter trend.

Example:

d. HTF Swing Failure followed by a LTF MSB at All Internal Liquidity Levels (With Trend ONLY)

Same as (c), but will only signal trades that are in line with higher timeframe structure. I.e If HTF Structure is bullish, then only bullish trades will be signalled.

e. LTF Swing Failure followed by a LTF MSB at [u]enabled[/u] HTF POIs

The system will alert you to a lower timeframe setup if these conditions are met inside enabled HTF POIs (OBs / Breakers / FVGs):

- LTF SFP

- LTF MSB

Example:

f. LTF Entry Options:

IMG PRO provides the following options for LTF Entries:

i. Limit Entry at MSB Level

ii. Limit Entry at Breaker

iii. Limit Entry at Raid Candle

iv. Limit Entry at OTE 70.5% Retracement

v. Market Entries (where applicable)

Trade entry alerts will detail limit entry prices based on the option selected here.

7. Unentered Trade Invalidations:

IMG Pro can invalidate unentered signals based on these custom criteria:

a. Opposite HTF SFP Before Entry

b. TP Hit Before Entry

c. Confirmed Opposite Signal Before Entry

If enabled and criteria met, the system will alert you to cancel any limit orders for the trade that is being invalidated.

8. Trade Exit Types Available with IMG PRO:

The system provides the following options for trade exit alerts:

a. Exit at Fixed R:R

b. Exit at a confirmed Opposite Signal (Fluid Exits)

c. Exit at enabled and untested HTF POIs

d. Exit on an opposite HTF SFP at a liquidity level

Example: H12 SFPs and Potential Trade Setups at Internal Liquidity Levels with Exit at closest untested HTF POI on a H1 Chart:

9. IMG PRO Alerts Overview

The system provides notifications of:

a. Confirmed HTF Market Structure Breaks

b. Confirmed HTF SFPs at Range Extremes

c. Confirmed HTF SFPs at HTF POIs

d. Confirmed HTF SFPs at Liquidity Levels

e. Potential Trade Setups at Range Extremes

f. Potential Trade Setups at HTF Points of Interest

g. Potential Trade Setups at HTF Liquidity Levels

h. LTF SFPs inside HTF POIs

i. Potential LTF Setups at HTF POIs

j. All Exit Types including Stoplosses

k. All Trade Invalidations

To enable alerts, right-click on the indicator and select “Add Alert on IMG ...”. You may customise the alert name as desired and then click 'Create' to finalise the alert setup.

General Note:

There is no system, indicator, algorithm, or strategy that can provide absolute certainty in predicting market movements. Use trading indicators as a tool to assist with trading decisions; manage your risk wisely.

Stay safe and Happy Trading!

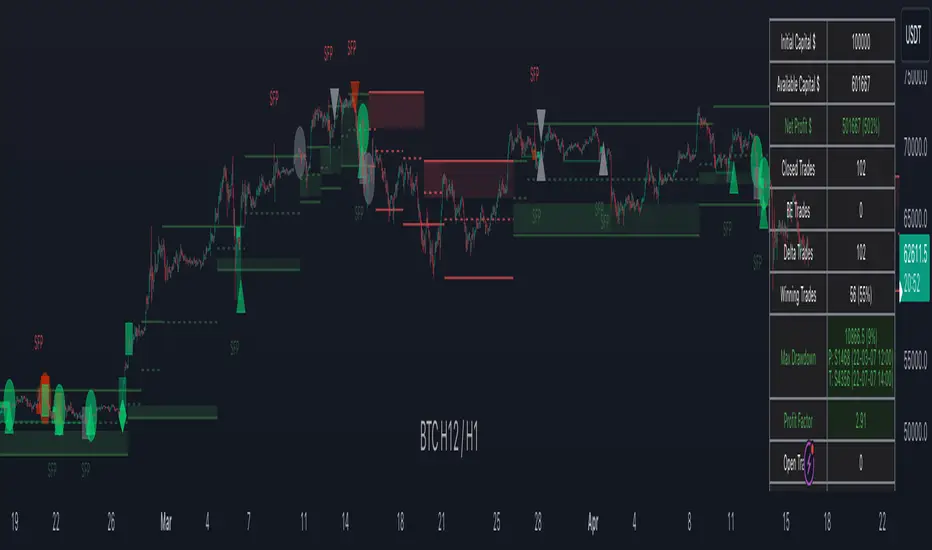

Main Feature Update:

Introducing the automated backtesting system that will print a table on the top right corner with backtest results of the settings applied. The table is colour coded to help identify favourable results at a glance. Colour coding focuses on finding results that could be compatible with trading under prop firm conditions, i.e. High Profit Factor and Low Max Drawdown:

Invite-only script

Only users approved by the author can access this script. You'll need to request and get permission to use it. This is typically granted after payment. For more details, follow the author's instructions below or contact IMGPro directly.

TradingView does NOT recommend paying for or using a script unless you fully trust its author and understand how it works. You may also find free, open-source alternatives in our community scripts.

Author's instructions

Warning: please read our guide for invite-only scripts before requesting access.

Disclaimer

Invite-only script

Only users approved by the author can access this script. You'll need to request and get permission to use it. This is typically granted after payment. For more details, follow the author's instructions below or contact IMGPro directly.

TradingView does NOT recommend paying for or using a script unless you fully trust its author and understand how it works. You may also find free, open-source alternatives in our community scripts.

Author's instructions

Warning: please read our guide for invite-only scripts before requesting access.