OPEN-SOURCE SCRIPT

Bitcoin Miner Sell Pressure

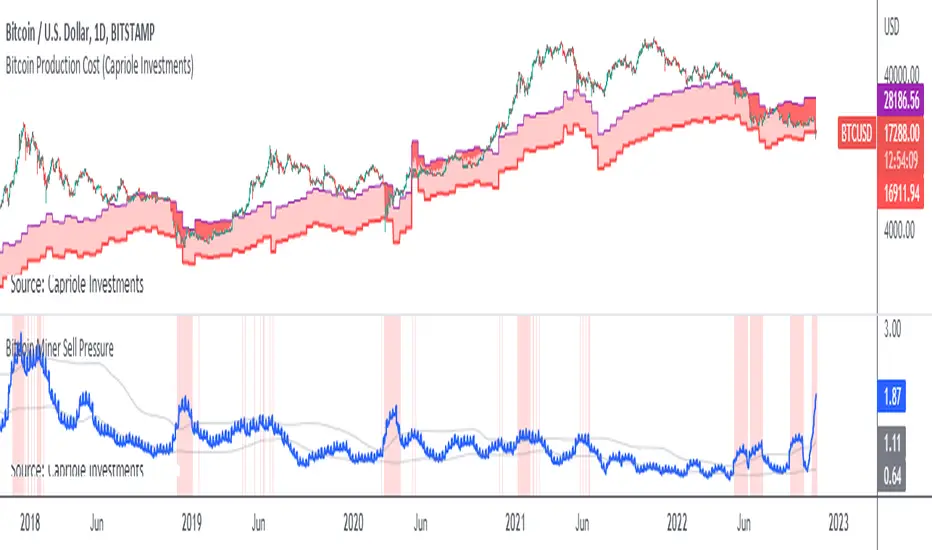

Bitcoin miners are in pain and now (November 2022) selling more than they have in almost 5 years!

Introducing: Bitcoin Miner Sell Pressure.

A free, open-source indicator which tracks on-chain data to highlight when Bitcoin miners are selling more of their reserves than usual.

The indicator tracks the ratio of on-chain miner Bitcoin outflows to miner Bitcoin reserves.

- Higher = more selling than usual

- Lower = less selling than usual

- Red = extraordinary sell pressure

Today [November 2022], it's red.

What can we see now [November 2022]?

Miners are not great at treasury management. They tend to sell most when they are losing money (like today). But there have been times when they sold well into high profit, such as into the 2017 $20K top and in early 2021 when Bitcoin breached $40K.

Bitcoin Miner Sell Pressure identifies industry stress, excess and miner capitulation.

Unsurprisingly, there is a high correlation with Bitcoin Production Cost; giving strong confluence to both.

In some instances, BMSP spots capitulation before Hash Ribbons. Such as today!

Introducing: Bitcoin Miner Sell Pressure.

A free, open-source indicator which tracks on-chain data to highlight when Bitcoin miners are selling more of their reserves than usual.

The indicator tracks the ratio of on-chain miner Bitcoin outflows to miner Bitcoin reserves.

- Higher = more selling than usual

- Lower = less selling than usual

- Red = extraordinary sell pressure

Today [November 2022], it's red.

What can we see now [November 2022]?

Miners are not great at treasury management. They tend to sell most when they are losing money (like today). But there have been times when they sold well into high profit, such as into the 2017 $20K top and in early 2021 when Bitcoin breached $40K.

Bitcoin Miner Sell Pressure identifies industry stress, excess and miner capitulation.

Unsurprisingly, there is a high correlation with Bitcoin Production Cost; giving strong confluence to both.

In some instances, BMSP spots capitulation before Hash Ribbons. Such as today!

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Open-source script

In true TradingView spirit, the creator of this script has made it open-source, so that traders can review and verify its functionality. Kudos to the author! While you can use it for free, remember that republishing the code is subject to our House Rules.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.